Hublot's official World Cup timepiece in gold

Hublot's official World Cup timepiece in gold

As its economy is plateauing, Brazil has decreased its spending on luxury goods, trading for necessities, according to new research from Boston Consulting Group.

Brazil was once considered one of the prime emerging markets for luxury brands to focus on, with a decade of economic stability that resulted in more consumer purchasing. These changing consumer spending habits call for a retooled strategy for luxury brands.

"The combination of a weakened economy with inflationary pressures has created a difficult environment for luxury brands in Brazil," said Gustavo Gomez, director of research and methodology at Envirosell, New York.

"What should luxury brands consider as they go forward?"he said. "Brands should understand that Brazil has experienced a growing middle class in the last decade and this slowdown in the economy is the first for this new generation of upwardly mobile individual. During this slowdown unemployment has decreased and wages have not decreased. This suggests that the decreased spending we are seeing is very psychological with the function of protecting against expected future slowdown.

"Brands need to expand cautiously and understand that Brazil has many micro markets and segments. In other words, while Rio might be struggling, São Paulo might be booming. Luxury brands need to look at results at the city, neighborhood and even store level to make strategic growth decision. There is still a wealthy segment; growth just needs to be targeted."

Mr. Gomez is not affiliated with BCG, but agreed to comment as an industry expert.

BCG was unable to comment directly. For the study, BCG surveyed 2,000 people from Brazil who reflect census data.

Consumer caution

Brazil had a very stable economy for the past 10 years, during which there was high employment, use of credit and a strong consumer market.

Compared to previous years, Brazil’s economic growth is becoming stagnant, growing just 0.17 percent in the first quarter of 2014, with the projected growth for the year being 1 percent.

Rolls-Royce opened its first Latin American showroom in Brazil

Despite having minimal effect on salaries or employment rates, this weakening economy has changed how consumers are spending.

Seventy-two percent of those surveyed say they plan to reduce their spending of discretionary items, up from 66 percent in 2013. The main reasons given were wanting to save money and a worry that their salaries would decrease soon.

Also taking precaution, Brazilian consumers are reducing their debt, decreasing their borrowing on everything except for cars between 2013 and 2014. Spending is down in general 10 percent on apparel and shoes, as consumers use less credit to make purchases in the category.

Rolls-Royce opened its first Latin American showroom in Brazil

Despite having minimal effect on salaries or employment rates, this weakening economy has changed how consumers are spending.

Seventy-two percent of those surveyed say they plan to reduce their spending of discretionary items, up from 66 percent in 2013. The main reasons given were wanting to save money and a worry that their salaries would decrease soon.

Also taking precaution, Brazilian consumers are reducing their debt, decreasing their borrowing on everything except for cars between 2013 and 2014. Spending is down in general 10 percent on apparel and shoes, as consumers use less credit to make purchases in the category.

Fendi store in Sao Paulo, Brazil

Consumers’ monetary priorities have also changed, as they spend less on luxury goods and more on child care, children's clothing, travel and hospitality and home goods.

Where a consumer lives within Brazil changes their spending habits dramatically. Those in cities with higher incomes are much more likely to trade up to premium products and spend money on fine dining.

BCG tells brands that they will need to rethink their pricing strategies, as well as gain a better understanding of the specific places where the salaries are picking up.

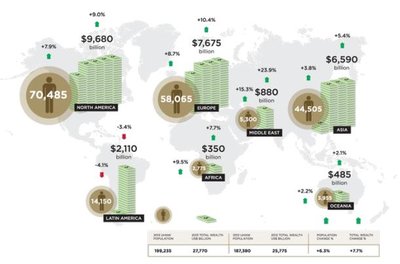

The combined wealth of global ultra-high-net-worth individuals has grown to a record high, although the ultra-high-net-worth population has dropped in Brazil and China, according to a 2013 report by Wealth-X and UBS.

The “Wealth-X and UBS World Ultra Wealth Report 2013” explores the global population of ultra-high-net-worth individuals and their income on both a global and local market scale (see story).

Fendi store in Sao Paulo, Brazil

Consumers’ monetary priorities have also changed, as they spend less on luxury goods and more on child care, children's clothing, travel and hospitality and home goods.

Where a consumer lives within Brazil changes their spending habits dramatically. Those in cities with higher incomes are much more likely to trade up to premium products and spend money on fine dining.

BCG tells brands that they will need to rethink their pricing strategies, as well as gain a better understanding of the specific places where the salaries are picking up.

The combined wealth of global ultra-high-net-worth individuals has grown to a record high, although the ultra-high-net-worth population has dropped in Brazil and China, according to a 2013 report by Wealth-X and UBS.

The “Wealth-X and UBS World Ultra Wealth Report 2013” explores the global population of ultra-high-net-worth individuals and their income on both a global and local market scale (see story).

Infographic from Wealth-X

"Given the slowdown in spending, companies must be prepared for more intense competition,” said Olavo Cunha, a partner in BCG's São Paulo office and leader of the research team, in a branded statement. “They'll have to adjust their cost structures, improve their innovation capabilities, rethink the value they deliver, and focus on the product categories with the greatest growth potential.”

New territory

A report published earlier this year by BCG argues that Brazil’s interior market, the cities outside of major metropolitan areas, are underserved by companies across sectors and consumers there have nearly 20 percent more disposable income on average than their primary city counterparts.

Sixty of the 98 interior cities with more than 5,000 affluent families were found to have no luxury car dealership. Lack of awareness and accessibility of automakers among many other categories leads to undercultivated markets that will continue to grow well into the next decade (see story).

Brands remain positive about the opportunities in Brazil.

While some economists may argue that Brazil missed the window of opportunity, the rise of the middle, or C Class, is evidence of the country’s potential in the global economy, according to a panel session at the 2014 FT Business of Luxury Summit.

Of the country’s ultra-high-net-worth population, 70 percent consume in Brazil’s three main cities, Belo Horizonte, Rio de Janeiro and Sao Paulo. Brazil has also seen an increase of consumer activity in its smaller, tier 2 cities as its middle class begins to consume at a higher rate (see story).

For brands to reach consumers, they will have to reinforce their message of quality.

"Luxury brands need to reinforce their quality," Mr. Gomez said. "In slow economic times, consumers want items that last. They are seeking value and not necessarily price reductions.

"Focusing the marketing message on quality can demonstrate to consumers that luxury brands are durable brands that can become family items to be passed down."

Final Take

Sarah Jones, editorial assistant on Luxury Daily, New York

Infographic from Wealth-X

"Given the slowdown in spending, companies must be prepared for more intense competition,” said Olavo Cunha, a partner in BCG's São Paulo office and leader of the research team, in a branded statement. “They'll have to adjust their cost structures, improve their innovation capabilities, rethink the value they deliver, and focus on the product categories with the greatest growth potential.”

New territory

A report published earlier this year by BCG argues that Brazil’s interior market, the cities outside of major metropolitan areas, are underserved by companies across sectors and consumers there have nearly 20 percent more disposable income on average than their primary city counterparts.

Sixty of the 98 interior cities with more than 5,000 affluent families were found to have no luxury car dealership. Lack of awareness and accessibility of automakers among many other categories leads to undercultivated markets that will continue to grow well into the next decade (see story).

Brands remain positive about the opportunities in Brazil.

While some economists may argue that Brazil missed the window of opportunity, the rise of the middle, or C Class, is evidence of the country’s potential in the global economy, according to a panel session at the 2014 FT Business of Luxury Summit.

Of the country’s ultra-high-net-worth population, 70 percent consume in Brazil’s three main cities, Belo Horizonte, Rio de Janeiro and Sao Paulo. Brazil has also seen an increase of consumer activity in its smaller, tier 2 cities as its middle class begins to consume at a higher rate (see story).

For brands to reach consumers, they will have to reinforce their message of quality.

"Luxury brands need to reinforce their quality," Mr. Gomez said. "In slow economic times, consumers want items that last. They are seeking value and not necessarily price reductions.

"Focusing the marketing message on quality can demonstrate to consumers that luxury brands are durable brands that can become family items to be passed down."

Final Take

Sarah Jones, editorial assistant on Luxury Daily, New York