Michael Kors fall/winter 2014 ad campaign

Michael Kors fall/winter 2014 ad campaign

NEW YORK - Brands need to stop focusing on wallet share and instead look at potential spending power to successfully find the right audience, said an executive from Wealth-X at Luxury FirstLook: Strategy 2015 on Jan. 13.

Everyone thinks that they know their top clients, but their next top client might be walking in and out of their store passing under the radar, since they are hidden in the database around previous purchases. Brands can use research to find the right affluent individuals that will be a good fit for their merchandise, regardless of former interactions.

“The paradigm shift is away from spending and towards capacity, and the mindset you need to use is what the financial services industry uses, which is called wallet share,” said David Friedman, president of Wealth-X.

"What is your wallet share of what they spend?" he said. "Not what they spend on competitive from watches and jewelry, but on everything.

"Unless you know their capacity, and unless you know liquid what they have, it’s hard to think about it. It’s mind share leads to market share leads to wallet share."

Luxury Daily organized Luxury FirstLook: Strategy 2015.

Hidden potential

Mr. Friedman gave the example of one of Wealth-X’s clients, for whom the consultancy was doing a database screening. There were ultra-high net worth individuals, defined as having $30 million net worth, within their customer list, but they were not listed as key buyers, since they hadn’t spent as much with this particular company.

Since they were lumped in with the other lower spenders, they were receiving email newsletters offering promotions such as a discount for spending $50. These consumers have the potential to reach the key buyer level, and should instead be given messages about joining an event at the Fifth Avenue salon, for instance.

David Friedman

One of the other “deadly sins” of marketing to ultra-high-net worth individuals is a lack of communication between different branches of the business, since these consumers are global.

A diamond company has a top client that lives in Hong Kong, but always buys in Paris or New York. The Hong Kong retail location had an event and didn’t invite this customer, since the retail stores don’t share databases, and they missed out on an opportunity to reward and further the relationship with this individual.

David Friedman

One of the other “deadly sins” of marketing to ultra-high-net worth individuals is a lack of communication between different branches of the business, since these consumers are global.

A diamond company has a top client that lives in Hong Kong, but always buys in Paris or New York. The Hong Kong retail location had an event and didn’t invite this customer, since the retail stores don’t share databases, and they missed out on an opportunity to reward and further the relationship with this individual.

Affluent consumers are global

Mr. Friedman gave another example, in which a watch collector walks in and out of watch stores to have pieces repaired, and the retailers miss an opportunity to show off a vintage piece and sell to him since he is not in their existing database of clients.

Brands also need to understand how much spending power a consumer realistically has. A salary of $1 million can quickly be taken up with private school tuition for children and other household expenses, leaving only about $480,000.

Mr. Friedman gave the example that if you are Ralph Lauren trying to market a $90,000 crocodile jacket, you likely want to aim higher than that particular customer, because that would eat up a quarter of that individual’s liquid assets.

Affluent consumers are global

Mr. Friedman gave another example, in which a watch collector walks in and out of watch stores to have pieces repaired, and the retailers miss an opportunity to show off a vintage piece and sell to him since he is not in their existing database of clients.

Brands also need to understand how much spending power a consumer realistically has. A salary of $1 million can quickly be taken up with private school tuition for children and other household expenses, leaving only about $480,000.

Mr. Friedman gave the example that if you are Ralph Lauren trying to market a $90,000 crocodile jacket, you likely want to aim higher than that particular customer, because that would eat up a quarter of that individual’s liquid assets.

Model wearing Ralph Lauren Purple Label

One example of a successful alignment of spending power and interested individuals was a private jet company’s bespoke marketing event during a conference in New York. Using their data, Wealth-X screened the attendee list and identified 50 ultra-affluent individuals, who were all invited.

Of those 50, 40 attended the dinner, which included a partnership with Brioni and a speech by a leader at Seal Team Six. From those 40, nine decided to partake in a flight demo and a few months later, five planes were sold.

Social network

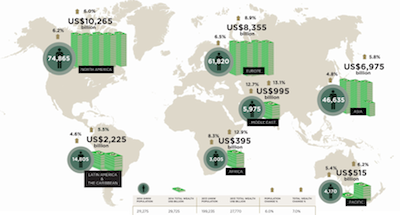

In total, there are 211,275 ultra-high-net worth individuals, who reside in the top .004 percent and hold 13 percent of the world’s wealth. Their average net worth is $141 million, and their general liquidity is $35 million.

The United States boasts the most UHNW consumers, with 74,865. Europe follows with 61,820.

Model wearing Ralph Lauren Purple Label

One example of a successful alignment of spending power and interested individuals was a private jet company’s bespoke marketing event during a conference in New York. Using their data, Wealth-X screened the attendee list and identified 50 ultra-affluent individuals, who were all invited.

Of those 50, 40 attended the dinner, which included a partnership with Brioni and a speech by a leader at Seal Team Six. From those 40, nine decided to partake in a flight demo and a few months later, five planes were sold.

Social network

In total, there are 211,275 ultra-high-net worth individuals, who reside in the top .004 percent and hold 13 percent of the world’s wealth. Their average net worth is $141 million, and their general liquidity is $35 million.

The United States boasts the most UHNW consumers, with 74,865. Europe follows with 61,820.

Map of UHNW individuals

In the ranking of cities, New York leads, followed by London, Tokyo, San Francisco and Los Angeles. Chicago also made the top 10, and it is an “emerging market” for luxury brands.

Seventy-five percent of the ultra-high net worth population is over the age of 50, and over the next three decades, $16 trillion is expected to be passed down to younger generations. When wealth moves to new generations, the inheritors tend to do active things with the money.

In general, each billionaire knows three other billionaires, representing $16 billion in net wealth within a first degree of separation. These individuals look to referrals and word of mouth more than anything to decide what brands to give business to.

Sixty-eight percent of luxury industry insiders believe digital marketing is not an effective method to reach ultra-high net worth individuals, according to a new report by Wealth-X.

While social media accounts and content rich Web sites can bolster brand awareness, they do not lead directly to sales or client acquisition for the wealthiest clients. To reach these important clients, providing unique experiences to the right people is still the best approach (see story).

“These guys, we call them 'LinkedOut," Mr. Friedman said. "They do consume media, but they’re not on LinkedIn and they’re not on Facebook. Their wives are and their children are, but they’re not.

"So they’re just not going to respond to any digital campaign."

Final Take

Sarah Jones, editorial assistant on Luxury Daily, New York

Map of UHNW individuals

In the ranking of cities, New York leads, followed by London, Tokyo, San Francisco and Los Angeles. Chicago also made the top 10, and it is an “emerging market” for luxury brands.

Seventy-five percent of the ultra-high net worth population is over the age of 50, and over the next three decades, $16 trillion is expected to be passed down to younger generations. When wealth moves to new generations, the inheritors tend to do active things with the money.

In general, each billionaire knows three other billionaires, representing $16 billion in net wealth within a first degree of separation. These individuals look to referrals and word of mouth more than anything to decide what brands to give business to.

Sixty-eight percent of luxury industry insiders believe digital marketing is not an effective method to reach ultra-high net worth individuals, according to a new report by Wealth-X.

While social media accounts and content rich Web sites can bolster brand awareness, they do not lead directly to sales or client acquisition for the wealthiest clients. To reach these important clients, providing unique experiences to the right people is still the best approach (see story).

“These guys, we call them 'LinkedOut," Mr. Friedman said. "They do consume media, but they’re not on LinkedIn and they’re not on Facebook. Their wives are and their children are, but they’re not.

"So they’re just not going to respond to any digital campaign."

Final Take

Sarah Jones, editorial assistant on Luxury Daily, New York