Michael Kors campaign image for Duracell Powermat kit

Michael Kors campaign image for Duracell Powermat kit

While Twitter performs well for fashion brands, with generally high follower counts, the platform has now fallen behind Instagram in adoption rates within the sector as well as usage among U.S. adults, according to a new report by L2.

A number of fashion labels, such as Brioni and Hermès, have bypassed more established platforms such as Facebook and Twitter, choosing instead to expand their social presence to Instagram, a platform with high organic engagement levels. Different social platforms come with their own unique opportunities and challenges, as well as audiences, calling for a diversified mix of accounts to reach consumers with branded content.

"Brand adoption of Instagram has grown so quickly because they can take advantage of Instagram's high organic reach without having to advertise," said Eleanor Powers, director, Insight Reports, at L2, New York.

"Instagram also offers much higher engagement rates than Twitter (.63 percent versus .02 percent)," she said. "In addition, Instagram reaches an attractive demographic; 70 percent of Instagram's 300 million-plus users are 16-34."

L2's Insight Report Fashion: Social Media, shares findings from 79 brands studied between the second quarter of 2014 and the same period in 2015.

Creating content

Facebook is still the most widely used platform for fashion brands, with a 99 percent adoption rate. The platform is the most commonly used by consumers and brands typically have the largest community of followers on Facebook, with about 2 million to Instagram’s 1 million.

Facebook post from Gucci

However, recent changes to its News Feed algorithm have made it harder for brands to reach consumers organically. With more content being shared and created, brands now typically have to pay for promoted posts to be noticed when a consumer browses.

A number of luxury fashion brands with large communities above 10 million, including Burberry, have scaled back their Facebook media spend, choosing to use the funds to advertise online elsewhere.

It is still less common for brands to use Facebook to create an open dialogue with consumers, with only 19 percent responding to wall posts from followers and less than half responding to comments left. Prompts for user-generated content are also rare.

Facebook post from Gucci

However, recent changes to its News Feed algorithm have made it harder for brands to reach consumers organically. With more content being shared and created, brands now typically have to pay for promoted posts to be noticed when a consumer browses.

A number of luxury fashion brands with large communities above 10 million, including Burberry, have scaled back their Facebook media spend, choosing to use the funds to advertise online elsewhere.

It is still less common for brands to use Facebook to create an open dialogue with consumers, with only 19 percent responding to wall posts from followers and less than half responding to comments left. Prompts for user-generated content are also rare.

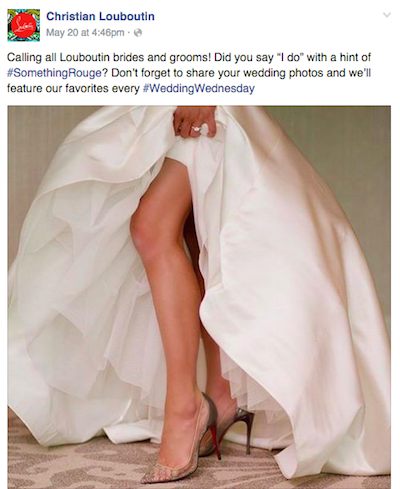

Facebook post from Christian Louboutin

Between 2011 and 2014, nearly 3 million teens in the U.S. abandoned Facebook in favor of Instagram, further cementing the image-sharing platform as “the most important” social network.

Findings in L2’s “Intelligence Report: Instagram 2015” show Instagram to be the “moisturizer” of parent company Facebook that has allowed the latter social network to maintain relevance despite its dwindling “cool factor” and aging user base. With the introduction of sponsored content on Instagram, Facebook has leveraged data-sharing practices to connect consumers with brands and products, resulting in what L2 calls “the marketing world’s nuclear fusion” (see story).

With Facebook often still the largest community for a particular brand, more than half of the brands studied use the platform's custom tabs feature to display another social media account, often Instagram.

Fashion brands within L2's index have seen a 160 percent increase in average community size on Instagram this past year. Enjoying the higher organic engagement rates due to limited advertising, brands have raised their post frequency by 36 percent.

Facebook post from Christian Louboutin

Between 2011 and 2014, nearly 3 million teens in the U.S. abandoned Facebook in favor of Instagram, further cementing the image-sharing platform as “the most important” social network.

Findings in L2’s “Intelligence Report: Instagram 2015” show Instagram to be the “moisturizer” of parent company Facebook that has allowed the latter social network to maintain relevance despite its dwindling “cool factor” and aging user base. With the introduction of sponsored content on Instagram, Facebook has leveraged data-sharing practices to connect consumers with brands and products, resulting in what L2 calls “the marketing world’s nuclear fusion” (see story).

With Facebook often still the largest community for a particular brand, more than half of the brands studied use the platform's custom tabs feature to display another social media account, often Instagram.

Fashion brands within L2's index have seen a 160 percent increase in average community size on Instagram this past year. Enjoying the higher organic engagement rates due to limited advertising, brands have raised their post frequency by 36 percent.

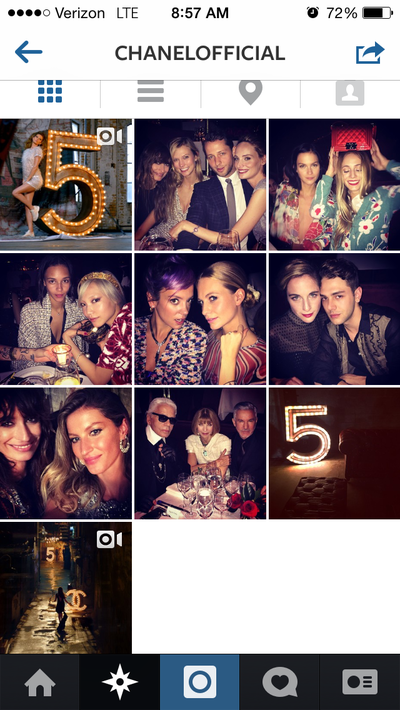

Chanel's Instagram gained 1.8 million followers overnight when it launched in October

Brands are also finding ways to monetize Instagram, speaking to their most engaged audience. For instance, Michael Kors' #InstaKors asks consumers to sign up, linking their Instagram handle with an email address, and then sends them an email when they like a shoppable image on the brand’s Instagram feed (see story).

YouTube, which only has an 87 percent adoption rate among the fashion brands studied, holds a lot of potential for fashion brands, since it exceeds other platforms at both the top and bottom of the purchase funnel. However, while the index brands saw a 44 percent growth in views year-over-year, many boasting a video surpassing 1 million views, they are not always optimizing their accounts to take full advantage of the purchasing potential.

Dior J'adore "The future is gold" has the largest view count of all branded videos studied

About 80 percent of brand channels appear in the first page of search results, but often branded content does not place in the top few results. Other opportunities lie in paid advertising, growing subscribers and including links to product information.

For instance, Burberry's 2014 holiday campaign used YouTube's Info Cards feature, which enabled it to link to other social media content, enabling them to view other facets of the campaign (see story).

In the moment

Snapchat saw the highest growth in user adoption this past year, with 57 percent more consumers using the mobile application. Fashion brands are still slowly entering Snapchat, with only six of 58 brands in the study with an account as of April 2015.

Fashion brands began to embrace Snapchat for the fall/winter 2015 season to give their consumers secret insider content, providing more access to the inner workings of putting on a runway show.

Michael Kors and Valentino were among the brands that took advantage of the application’s ability to share fleeting glimpses of personal moments, inviting them into a form of community. Snapchat users tend to skew younger, opening up labels to a new generation of consumers (see story).

Social media and live-streaming have become a necessary part of a fashion brand’s runway show strategy as consumers increasingly look for insider access.

Across platforms, brands have found ways to bring their show to life in new ways, whether incorporating a photo trend or speaking directly to consumers during the show. With so many platforms to consider, brands have to choose what content to publish where to achieve the best results (see story).

From runway shows to online content, deciding where to publish and creating a presence across platforms can help brands reach audiences in varied ways.

"The different social media platforms offer brands different opportunities," Ms. Powers said. "For instance, Instagram has high organic reach, high engagement rates and a high concentration of millennials, all of which are available without the requirement for a high media spend.

"Snapchat is particularly attractive for its younger and more affluent audience demographic," she said. "While Facebook has evolved into more of a pay to play media strategy for brands, and has a lower engagement rate, it reaches more 18-24 year-olds than the Big Four TV networks daily and robust targeting capabilities.

"YouTube, and now Facebook, offer opportunities to reach consumers at scale through native video."

Final Take

Sarah Jones, staff reporter on Luxury Daily, New York

Chanel's Instagram gained 1.8 million followers overnight when it launched in October

Brands are also finding ways to monetize Instagram, speaking to their most engaged audience. For instance, Michael Kors' #InstaKors asks consumers to sign up, linking their Instagram handle with an email address, and then sends them an email when they like a shoppable image on the brand’s Instagram feed (see story).

YouTube, which only has an 87 percent adoption rate among the fashion brands studied, holds a lot of potential for fashion brands, since it exceeds other platforms at both the top and bottom of the purchase funnel. However, while the index brands saw a 44 percent growth in views year-over-year, many boasting a video surpassing 1 million views, they are not always optimizing their accounts to take full advantage of the purchasing potential.

Dior J'adore "The future is gold" has the largest view count of all branded videos studied

About 80 percent of brand channels appear in the first page of search results, but often branded content does not place in the top few results. Other opportunities lie in paid advertising, growing subscribers and including links to product information.

For instance, Burberry's 2014 holiday campaign used YouTube's Info Cards feature, which enabled it to link to other social media content, enabling them to view other facets of the campaign (see story).

In the moment

Snapchat saw the highest growth in user adoption this past year, with 57 percent more consumers using the mobile application. Fashion brands are still slowly entering Snapchat, with only six of 58 brands in the study with an account as of April 2015.

Fashion brands began to embrace Snapchat for the fall/winter 2015 season to give their consumers secret insider content, providing more access to the inner workings of putting on a runway show.

Michael Kors and Valentino were among the brands that took advantage of the application’s ability to share fleeting glimpses of personal moments, inviting them into a form of community. Snapchat users tend to skew younger, opening up labels to a new generation of consumers (see story).

Social media and live-streaming have become a necessary part of a fashion brand’s runway show strategy as consumers increasingly look for insider access.

Across platforms, brands have found ways to bring their show to life in new ways, whether incorporating a photo trend or speaking directly to consumers during the show. With so many platforms to consider, brands have to choose what content to publish where to achieve the best results (see story).

From runway shows to online content, deciding where to publish and creating a presence across platforms can help brands reach audiences in varied ways.

"The different social media platforms offer brands different opportunities," Ms. Powers said. "For instance, Instagram has high organic reach, high engagement rates and a high concentration of millennials, all of which are available without the requirement for a high media spend.

"Snapchat is particularly attractive for its younger and more affluent audience demographic," she said. "While Facebook has evolved into more of a pay to play media strategy for brands, and has a lower engagement rate, it reaches more 18-24 year-olds than the Big Four TV networks daily and robust targeting capabilities.

"YouTube, and now Facebook, offer opportunities to reach consumers at scale through native video."

Final Take

Sarah Jones, staff reporter on Luxury Daily, New York