Audi City in Berlin

Audi City in Berlin

Multichannel retailing is the future of the automotive industry, with 50 to 60 percent of sales leads expected to come through digital means by 2016, compared to 15 percent in 2014, according to a new report by Frost & Sullivan.

New store formats, such as digital showrooms and pop-ups, offer original equipment manufacturers (OEMs) a cost-effective way to reach consumers and generate sales, but this change in retail strategy requires investment from brands. As automakers alter the way in which consumers interact with their brand during the purchase path and post-purchase, the challenge will be to retain a sense of consistency and loyalty.

"The digital age has simplified the process of buying a car, allowing customers to research car models, compare prices and even avoid the hassle of dealing with pushy car retailers," said Neelam Barua, automotive & transportation team leader at Frost & Sullivan. "It is expected all that is required is to visit a shopping center and choose your new car digitally as you shop for food, apparel and gadgets.

"In the future, buying a car at home using a virtual car showroom or remotely connecting to service centers and authorizing repair work on your car is expected to become a reality," he said. "Car ownership has become a lifestyle element with a technology-assisted environment deriving brand awareness and experience involving customers at all phases of the digital cycle.

"Automakers should certainly be looking out for increased digitization and use of advanced technology, especially modern IT systems that bring together mobile platforms, computing power, and interactive solutions in all phases of a car buying lifecycle. The disruptive influence of connectivity will be changing the way business is being conducted in the automotive industry.

"High real-estate costs, expensive resources, global presence and the need for innovation to stay afloat will compel many automotive dealerships to shrink store space and resort to digitization for interactivity with the customer. As bricks-and-mortar gives way to a bricks-and-clicks sales model, automotive retail has to become a revolution by offering an experiential-based approach at all levels of the customers’ journey toward a new car purchase."

For its “Executive Outlook on the Future of Automotive Retail” Frost & Sullivan interviewed automotive OEMs including the groups that own Lexus, BMW, Mercedes-Benz, Porsche, Audi, Bentley, Lamborghini and Rolls-Royce, among others.

Virtual retail

By 2016, 20 to 30 percent of the space in a traditional dealership is expected to be allocated for technology. Automakers in Europe and the United States are preparing for this shift toward in-store technology with investments planned for 2016 worth anywhere from $500 million to $5 billion.

Audi is one of the brands making moves in digitization. In 2012, the brand opened its first Audi City virtual showroom in London (see story).

Within Audi City locations, the automaker’s entire line is displayed on screens that respond based on consumer movement, enabling the brand to bring the dealership experience to the heart of major cities, where retail space is typically compact. This has helped Audi boost its sales volumes and grow its retail footprint, with 16 locations opened in 2014 and upcoming outposts planned for Shanghai, Paris, Rome, Barcelona, Moscow and New York.

Audi City store

The automaker has also designed software for a virtual reality headset that enables consumers to configure any of its cars and then experience them in a lifelike manner. This technology, which claims to be the first of its kind for an auto manufacturer, is planned to roll out in Audi dealerships by the end of 2015.

As part of its Mercedes-Benz 2020 growth plan, the automaker has opened three brand experience stores in Hamburg, Germany, Milan and Tokyo. These Mercedes me stores immerse consumers in all facets of the brand, allowing them to purchase from its lifestyle collection, explore models through conversations with sales associates or interaction with digital touchpoints or enjoy treats at an in-store bistro.

Audi City store

The automaker has also designed software for a virtual reality headset that enables consumers to configure any of its cars and then experience them in a lifelike manner. This technology, which claims to be the first of its kind for an auto manufacturer, is planned to roll out in Audi dealerships by the end of 2015.

As part of its Mercedes-Benz 2020 growth plan, the automaker has opened three brand experience stores in Hamburg, Germany, Milan and Tokyo. These Mercedes me stores immerse consumers in all facets of the brand, allowing them to purchase from its lifestyle collection, explore models through conversations with sales associates or interaction with digital touchpoints or enjoy treats at an in-store bistro.

Mercedes me store in Hamburg

Three more of these stores are set to open in 2015 in Moscow, Hong Kong and Beijing.

In addition to the Mercedes me stores, the brand is also launching pop-ups, online stores and creating new positions, such as mobile sales associates, to help create the “Best Customer Experience.”

Frost & Sullivan ranked the automakers it studied based on how wide their dealership revamps, such as tablets, virtual experiences or new customer journeys online, and new store formats reach, looking at whether they are in no regions, one location or more than one region. Audi, BMW and Mercedes came out on top, showing a more consistent, global approach to digital integration.

"Audi, BMW and Mercedes have consciously opened stores in high-traffic retail locations which provide opportunities to interact and educate potential customers in a less formal, more digitally experiential environment," Mr. Barua said. "Their approach using digital showrooms utilize state-of-the-art technology to deliver a variety of informative experiences in a relatively small space inviting customers and enthusiasts to spend time creating, modifying and saving their car configurations to be revisited on PCs and tablets.

"The key propositions are offering seamless experience across devices in connected stores, integrating retail shopping into a continuous, measurable service experience deriving high customer loyalty," he said.

The traditional dealership will work with digital touchpoints, reaching consumers at separate stages of the purchase funnel. Since about half of sales leads will come from digital sources, 70 percent of the marketing budget is expected to go towards digital efforts.

For instance, BMW recently joined the instant gratification application world by sponsoring CNN’s daily news updates in the new Discover feature on Snapchat.

CNN will deliver a new Discover edition which will publish five or more global news stories every 24 hours, and BMW will run video ads between the stories for its i3 vehicle. The stereotypically young audience of Snapchat will likely be intrigued to discover more from the advertising presence of the environmentally conscious BMW i3 within the latest feature of the app (see story).

Looking ahead

Frost & Sullivan predicts that by 2020, digital retail will improve conversion rates by 80 percent.

Traditional dealerships and franchised outlets will give way to direct retail from the OEMs and digital showrooms by 2022.

Digital will also change car financing and payment, with mobile commerce and online integration.

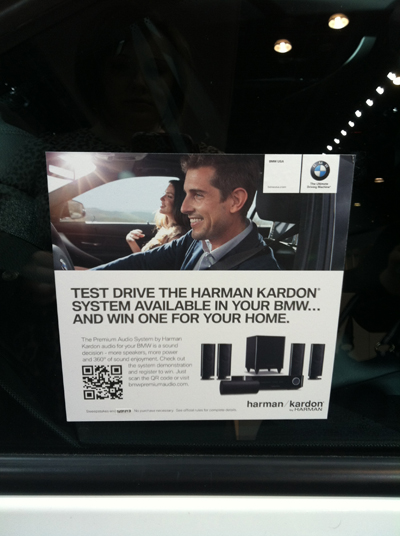

A shift from the television, radio and print campaigns seen today, car ads will be placed online or through other digital touchpoints, such as QR codes or holograms.

Mercedes me store in Hamburg

Three more of these stores are set to open in 2015 in Moscow, Hong Kong and Beijing.

In addition to the Mercedes me stores, the brand is also launching pop-ups, online stores and creating new positions, such as mobile sales associates, to help create the “Best Customer Experience.”

Frost & Sullivan ranked the automakers it studied based on how wide their dealership revamps, such as tablets, virtual experiences or new customer journeys online, and new store formats reach, looking at whether they are in no regions, one location or more than one region. Audi, BMW and Mercedes came out on top, showing a more consistent, global approach to digital integration.

"Audi, BMW and Mercedes have consciously opened stores in high-traffic retail locations which provide opportunities to interact and educate potential customers in a less formal, more digitally experiential environment," Mr. Barua said. "Their approach using digital showrooms utilize state-of-the-art technology to deliver a variety of informative experiences in a relatively small space inviting customers and enthusiasts to spend time creating, modifying and saving their car configurations to be revisited on PCs and tablets.

"The key propositions are offering seamless experience across devices in connected stores, integrating retail shopping into a continuous, measurable service experience deriving high customer loyalty," he said.

The traditional dealership will work with digital touchpoints, reaching consumers at separate stages of the purchase funnel. Since about half of sales leads will come from digital sources, 70 percent of the marketing budget is expected to go towards digital efforts.

For instance, BMW recently joined the instant gratification application world by sponsoring CNN’s daily news updates in the new Discover feature on Snapchat.

CNN will deliver a new Discover edition which will publish five or more global news stories every 24 hours, and BMW will run video ads between the stories for its i3 vehicle. The stereotypically young audience of Snapchat will likely be intrigued to discover more from the advertising presence of the environmentally conscious BMW i3 within the latest feature of the app (see story).

Looking ahead

Frost & Sullivan predicts that by 2020, digital retail will improve conversion rates by 80 percent.

Traditional dealerships and franchised outlets will give way to direct retail from the OEMs and digital showrooms by 2022.

Digital will also change car financing and payment, with mobile commerce and online integration.

A shift from the television, radio and print campaigns seen today, car ads will be placed online or through other digital touchpoints, such as QR codes or holograms.

BMW sticker with QR code

Eighty percent of leads will originate from Web sites, apps or mobile by 2022, swapping places with today’s dominant telephone and traditional media.

Borrowing from retail tactics of technology companies, sales associates will be geniuses, similar to Apple’s store employees, or avatars.

Mobile now plays an integral role in every stage of the purchasing process for cars, according to a report by L2.

According to Nielsen, 63 percent of consumers also want in-car connectivity so that their mobile experience is never interrupted as they go about their day. Automakers that dismiss the power of mobile to guide purchases will no doubt suffer in the long term (see story).

Beyond the online storefront and digital retailing, consumers also connect with brands via social media.

Automotive brands have embraced social media at a higher rate than brands in other product categories, according to a report from L2.

Average community growth for auto brands on Instagram jumped 152 percent, and the platform generates an average engagement level of 2.68 percent. While communities on other platforms have grown at similar rates, the second highest average engagement level is .21 percent on Pinterest (see story).

"To stay afloat in the competition, automakers and dealers are embracing the retail revolution by considering the cost of new technology as an investment, not as an expense," Mr. Baura said.

"Global passenger car companies are being pushed to innovate and adopt a new retail model for the next generation of young car buyers," he said. "This is a generation that engages through collaborative consumption and targeted digital marketing campaigns.

"Increased incorporation of digital technology in car retail will drive more customer engagements, higher footfalls, more satisfaction index on products and future automotive technologies. New business strategies amalgamating 'bricks' and 'clicks' will allow car makers to sell vehicles online and associate with the dealer network for order fulfillment."

Final Take

Sarah Jones, staff reporter on Luxury Daily, New York

BMW sticker with QR code

Eighty percent of leads will originate from Web sites, apps or mobile by 2022, swapping places with today’s dominant telephone and traditional media.

Borrowing from retail tactics of technology companies, sales associates will be geniuses, similar to Apple’s store employees, or avatars.

Mobile now plays an integral role in every stage of the purchasing process for cars, according to a report by L2.

According to Nielsen, 63 percent of consumers also want in-car connectivity so that their mobile experience is never interrupted as they go about their day. Automakers that dismiss the power of mobile to guide purchases will no doubt suffer in the long term (see story).

Beyond the online storefront and digital retailing, consumers also connect with brands via social media.

Automotive brands have embraced social media at a higher rate than brands in other product categories, according to a report from L2.

Average community growth for auto brands on Instagram jumped 152 percent, and the platform generates an average engagement level of 2.68 percent. While communities on other platforms have grown at similar rates, the second highest average engagement level is .21 percent on Pinterest (see story).

"To stay afloat in the competition, automakers and dealers are embracing the retail revolution by considering the cost of new technology as an investment, not as an expense," Mr. Baura said.

"Global passenger car companies are being pushed to innovate and adopt a new retail model for the next generation of young car buyers," he said. "This is a generation that engages through collaborative consumption and targeted digital marketing campaigns.

"Increased incorporation of digital technology in car retail will drive more customer engagements, higher footfalls, more satisfaction index on products and future automotive technologies. New business strategies amalgamating 'bricks' and 'clicks' will allow car makers to sell vehicles online and associate with the dealer network for order fulfillment."

Final Take

Sarah Jones, staff reporter on Luxury Daily, New York