Gucci fall/winter 2015 campaign

Gucci fall/winter 2015 campaign

In the first half of 2015 luxury brands achieved a 4 percent rise in digital performance, but there is still room to grow, according to a new report from ContactLab and Exane BNP Paribas. Brands are boosting their ecommerce efforts, creating a better shopping experience for consumers or expanding their consumer base online through initiatives that court an international customer base. While in general the luxury industry is making improvements online, the growth is uneven, with some players moving ahead while others remain “immature” as a result of where they focus their resources.

"Up to now digital competence has been a scarce resource in luxury goods companies, often organizationally segregated, and top management rarely is digitally native," said Marco Pozzi, senior advisor of ContactLab, Milan. "But things now are starting to move, I am positive, in an acceleration.

"The industry slowdown and the struggle for maintaining profitability will force even digitally cautious brands to become digital embracers," he said. "If not, management shareholders and industry analyst will anyway force it."

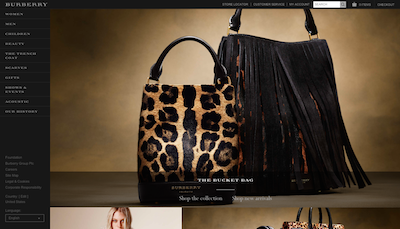

The third edition of ContactLab’s Digital Competitive Map report looked at both the strategic reach and digital customer experience of 30 brands, creating a graph that compares the two areas. Among the 17 criteria are the number of languages available, product presentation, delivery and cross-channel services. Measuring up Burberry tops the rankings for strategic reach, owed largely to its Web site and marketing communications, accessible in 11 different languages, making entire product array available online and creating an digital storefront accessible from many different countries. One example is its concession in T mall for Chinese consumers. Only one-third of the index brands have an online store for China. However, Burberry is not one of the six index brands shipping to India, a largely underserved market. Yoox, which powers the ecommerce sites of brands such as Armani, Valentino and Balenciaga, helps them achieve a global reach, but does not offer too much of a boost in service, according to the report. This may change once the retailer’s merger with service-oriented Net-A-Porter comes to fruition. Valentino store in Rome

While it takes home top prize on the strategic side, Burberry is number seven on the digital customer experience axis, outpaced by Gucci and Louis Vuitton, which took home the top spots. Gucci was ranked first for its improvements within personal services such as made to order and personal shopping, speedy delivery including same-day service in New York, Saturday delivery and streamlined path to purchase involving few clicks.

Brands are collectively reaching 86 percent of their potential on display visualization, a growth of 10 percent since fall/winter 2014. One improvement is a reduction in the number of brands requiring flash plug-ins for video.

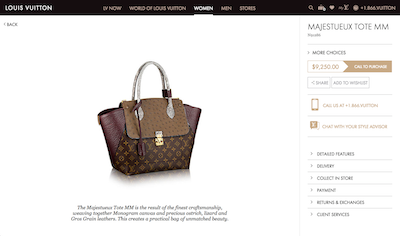

The areas where they have the most room to advance are in cross-channel services, where they are at 28 percent toward the goal, and personal services, where they are only at one quarter of their potential. Few studied brands include a phone or email assistance option, and only Louis Vuitton enables online chat.

Valentino store in Rome

While it takes home top prize on the strategic side, Burberry is number seven on the digital customer experience axis, outpaced by Gucci and Louis Vuitton, which took home the top spots. Gucci was ranked first for its improvements within personal services such as made to order and personal shopping, speedy delivery including same-day service in New York, Saturday delivery and streamlined path to purchase involving few clicks.

Brands are collectively reaching 86 percent of their potential on display visualization, a growth of 10 percent since fall/winter 2014. One improvement is a reduction in the number of brands requiring flash plug-ins for video.

The areas where they have the most room to advance are in cross-channel services, where they are at 28 percent toward the goal, and personal services, where they are only at one quarter of their potential. Few studied brands include a phone or email assistance option, and only Louis Vuitton enables online chat.

Louis Vuitton ecommerce site

In cross-channel, a number of brands have boosted the visibility of their store finder, but services that bridge online and offline are still infrequent. Only a handful of brands offer click-and-collect, about half offer in-store returns for online purchases and Zegna is the only brand to allow online ordering in-store.

Ralph Lauren, Loro Piana and Givenchy made the most improvement since the end of 2014, showing growth in both strategic reach and online customer experience. Loro Piana, along with Fendi, were the only two index brands to update their Web site design this half (see story).

Louis Vuitton ecommerce site

In cross-channel, a number of brands have boosted the visibility of their store finder, but services that bridge online and offline are still infrequent. Only a handful of brands offer click-and-collect, about half offer in-store returns for online purchases and Zegna is the only brand to allow online ordering in-store.

Ralph Lauren, Loro Piana and Givenchy made the most improvement since the end of 2014, showing growth in both strategic reach and online customer experience. Loro Piana, along with Fendi, were the only two index brands to update their Web site design this half (see story).

Fendi ecommerce site

Fendi rolled out four new features this half, including a wishlist, shop by look and size guide, probably to get ready for its ecommerce debut. Several other brands have added similar product selection tools.

While the provenance of luxury goods is often a selling point, only half of the brands regularly disclose the location items were made in on their ecommerce site.

Fendi ecommerce site

Fendi rolled out four new features this half, including a wishlist, shop by look and size guide, probably to get ready for its ecommerce debut. Several other brands have added similar product selection tools.

While the provenance of luxury goods is often a selling point, only half of the brands regularly disclose the location items were made in on their ecommerce site.

Luxury brands are generally expanding their offerings online, with between 5 and 6 percent more high-end items available via ecommerce in the spring/summer 2015 season than the fall fashion season, according to a recent report by ContactLab and BNP Paribas.

Ralph Lauren, Armani and Hermès boast the most products online, while Bulgari, Ferragamo and Prada showed the steepest growth of the sample as they work to increase online availability. As late adopters enter the online marketplace, early movers such as Burberry are going to have less of an inherent advantage, requiring them to amplify their efforts to remain competitive (see story).

Most brands now offer a mobile-optimized site, but only Moncler and Tory Burch host applications for all mobile platforms, including iOS, Android and Windows."During the last semester we have seen significant improvements on the following criteria of the map: display visualization (+10 percent), product selection support (+8 percent) and personal services (+ 9 percent, although in this case still very far from maximum potential)," Mr. Pozzi said.

"On the horizontal axis digital proficiency of the matrix we suggest that luxury brands continue to focus on personal services, in particular qualified phone assistance for supporting or closing a sale and booking an appointment in store," he said. "[They should also] seriously address cross channel services. For example, up to now only seven players offer a collect-in-store feature, only half of the panel allows return/exchange-in-store, only Zegna offers online order while in store.

"On the vertical axis strategic reach of the matrix, we suggest to be less reluctant in making the full product catalog shoppable, in particular for ready-to-wear, be more transparent in declaring the production origin on Web product pages, while only half of the panel does it. With products above $1,000, customers should be entitled to know where they are crafted.

"Also, address expanding ecommerce services to Far East, Russia, India, the Gulf and Brazil."

Direct approach ContactLab looked at how brands are using email and direct marketing to reach consumers. In these rankings, Balenciaga and Dior are top with their campaigns that are mobile responsive and specific to men and women. These two brands also excel at creating direct links from the email to a landing page. Tiffany also gets high marks for having a consistent navigation bar between email layout and its Web site. While the agency suggests one to two newsletter deployments per week, a number of brands go beyond this, particularly Michael Kors, which sends almost one per day.While 88 percent of marketers say they personalize their email communications, a new L2 report finds that about a quarter of brand emails are instead sent using a blast method that does not take into account individual preferences.

Customizing emails can help to boost conversion rates, since consumers are more likely to interact with a targeted message that is relevant to their wants and needs. Brands and retailers should be thinking of ways to bring a more personal touch to their digital marketing by using data and technology to create better relationships with their customers (see story).

With digital becoming an increasingly important aspect of luxury retail, brands are likely to make more moves going forward.

"Burberry has been the historical pioneer, and still leads on the strategic reach axis," Mr. Pozzi said. "Gucci and Louis Vuitton have started an interesting race to lead on the digital proficiency axis, but are strangely followers on the international expansion of ecommerce.

"U.S. brands Ralph Lauren, Tiffany, Tory Burch and Coach have all significantly improved their position compared to the first Digital Competitive Map of July 2014," he said. "European brands are trailing, but there are some interesting developments: new well-designed Web sites for Loro Piana and Fendi [and] powered by Yoox brands starting to move on the digital proficiency axis, in particular Balenciaga and Zegna."

Final Take Sarah Jones, staff reporter on Luxury Daily, New York