Image from Hermesistible microsite

Image from Hermesistible microsite

NEW YORK – Luxury will continue to be a growth category for the next decade, but the driving forces behind that growth are evolving, according to a partner at BCG at Luxury FirstLook: Strategy 2016 on Jan. 20.

Compared to the simple growth strategy of the past 10 years, which relied heavily on expanding in emerging markets, the growth for the foreseeable future is more organic and therefore more complex. Millennials continue to gain more disposable income and digital channels are also forcing change, requiring brands to change their tactics in order to retain relevancy.

"Luxury is not dead, but it is changing," said Luke Pototschnik, partner and managing director at Boston Consulting Group. "And where the growth is coming from is going to change, and it’s going to drive changes in how things go to market, and you see winners out there experimenting and already going after some of these trends."

Luxury FirstLook: Strategy 2016 was organized by Luxury Daily.

Climate change

Emerging markets such as Russia and China are challenged, but China is going to continue to be a key market for luxury for the next few years. While China’s stock market has seen turbulence, it is unlikely to impact the luxury market.

Much of the growth over the next 10 years is going to come from new products. One area of opportunity that has been largely untapped by luxury is localized merchandise, such as Dolce & Gabbana’s abayas for Muslim clientele (see story).

Dolce & Gabbana abaya collection

Another opportunity for brands going forward is the rise of the millennial generation.

Millennials do tend to participate in luxury on the aspirational side today, but once they buy houses and have children, their buying behavior begins to more closely resemble that of previous generations. However, these consumers are less loyal than their older counterparts and generally prioritize experiences over things.

Experiential luxury, such as travel and hospitality and fine wine, is going to be the main growth driver in the United States for the next seven years. For those selling personal luxury goods, such as watches or fashion items, finding a way to incorporate an experience into a brand will help capture sales.

In markets like the U.S., a product’s craftsmanship or quality is more important than external values such as logos. In contrast, the relatively unsophisticated Chinese consumer of today values status symbols.

This difference in values is also reflected in consumers’ preferences for experiential or personal luxury. Those in emerging markets value the ownership of personal luxury more, while more established markets are leaning toward the often non-visible experiential luxury.

Dolce & Gabbana abaya collection

Another opportunity for brands going forward is the rise of the millennial generation.

Millennials do tend to participate in luxury on the aspirational side today, but once they buy houses and have children, their buying behavior begins to more closely resemble that of previous generations. However, these consumers are less loyal than their older counterparts and generally prioritize experiences over things.

Experiential luxury, such as travel and hospitality and fine wine, is going to be the main growth driver in the United States for the next seven years. For those selling personal luxury goods, such as watches or fashion items, finding a way to incorporate an experience into a brand will help capture sales.

In markets like the U.S., a product’s craftsmanship or quality is more important than external values such as logos. In contrast, the relatively unsophisticated Chinese consumer of today values status symbols.

This difference in values is also reflected in consumers’ preferences for experiential or personal luxury. Those in emerging markets value the ownership of personal luxury more, while more established markets are leaning toward the often non-visible experiential luxury.

La Mer spa at Park Hyatt

The key will be to balance both hard luxury and experiential luxury across global markets.

La Mer spa at Park Hyatt

The key will be to balance both hard luxury and experiential luxury across global markets.

Now in the “turbulent teens” of the 21st century, luxury consumers are changing their mindset, forcing brands to evolve along with them, according to an executive from The Future Laboratory at the U.S. Retail & Luxury Futures Forum on Oct. 21.

Presenting the results of a survey of United Kingdom and U.S. consumers it conducted this summer, The Future Laboratory found that “luxurians” in these countries are generally seeking out experiences over goods, craving a meaningful human connection from the brands they interact with. Brands need to respond with interactions that play to consumers’ intangible desires that exist outside of material ownership (see story).

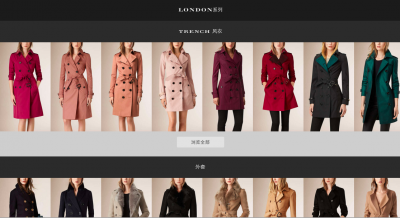

Channel surfing Along with growth channels, purchase drivers are evolving. In 2013, traditional channels such as magazines still carried a lot of weight in the purchase decision. By 2014, word of mouth, including social media, had overtaken magazines and risen to the top position. Consumers are looking toward different outlets to build their opinions, but brands’ media spending is not reflecting this shift. Going forward, those that are successful are going to be the ones who experiment and test, mining data to figure out a new marketing mix. Part of this testing revolves around metrics, and finding ways to connect social media engagement results to sales. Beyond digital media, online channels are changing the retail landscape. Ecommerce has grown, but brands are still struggling to find the best online store model, continuing to test different merchandising tactics. Apparel in particular is performing well online, but the addition of ecommerce to traditional business models necessitates a balance act between merchandising teams. Burberry ecommerce site

Consumer behavior also calls for an omnichannel presence, allowing shoppers to connect and shop anywhere. Aside from providing a service, being accessible across channels can have an impact on a brand’s bottom line, as those shoppers who buy both online and in bricks-and-mortar tend to spend 2.5 times that of those who purchase in only one.

With the rise in online purchasing, brands may want to revisit their retail footprint to get the best ROI, particularly in established markets.

Some brands may continue to eschew ecommerce, but they may be doing so to their own detriment.

Burberry ecommerce site

Consumer behavior also calls for an omnichannel presence, allowing shoppers to connect and shop anywhere. Aside from providing a service, being accessible across channels can have an impact on a brand’s bottom line, as those shoppers who buy both online and in bricks-and-mortar tend to spend 2.5 times that of those who purchase in only one.

With the rise in online purchasing, brands may want to revisit their retail footprint to get the best ROI, particularly in established markets.

Some brands may continue to eschew ecommerce, but they may be doing so to their own detriment.

Only the United States and China will account for more sales in the luxury industry than collective ecommerce by 2025, according to a McKinsey analyst at the Financial Times’ Business of Luxury Summit June 8.

Back in 2009, McKinsey had capped its ecommerce prediction at 2 percent of sales, or $4 billion, for 2015. The actual figure is around 6 percent, or $14 billion, and the research firm has accordingly reassessed its view of digital channels, anticipating robust growth for the next decade and beyond (see story).

"I think that ultimately there will be growth restraints [for brands that refuse to sell online]," Mr. Pototschnik said. "It depends a little bit on your consumer, if the consumer is willing to seek you out," he said. "I think it’s something where really understanding particularly the millennial consumer, and is there a segment of the millennial consumer, the up-and-coming luxury consumer, that is still willing to buy that way? Or you become viewed as sort of an anachronism. "So I think you are cutting off a large growth channel, so it’s a choice that you’re going to have to make."