Burberry's runway show in February 2016

Burberry's runway show in February 2016

Technological innovations including ecommerce and social media have created a domino effect of consumerism, creating fertile ground for the see-now, buy-now movement. A new report from Fashionbi, "See-Now, Buy-Now: How Is The Industry Adapting To Fashion's Newest Movement?" lays out the various solutions that designers and luxury labels have settled on to appeal to consumers who have become tired of waiting five months between seeing an item walk down a runway and being able to buy it. The industry agrees on the potential benefits of a realigned timeline, but apparel labels are divided in their approaches to the problem, which may lead to a fragmented fashion calendar.

"[A potentially divided fashion calendar] would only persuade the brands to innovate and fall away from the traditional bounds that some industry ancestors have set," said Ambika Zutshi, CEO of Fashionbi, Milan.

"Brands have analyzed the big defects in the traditional system - in today's digital era when a consumer may get to know the collection before a buyer and, is immediately simulated and falls in love with that one exotic handbag for which she is ready to pay any price - making her wait five months till she can find the bag in the retail stores and without a guarantee that it wont be sold out even before she gets to know of its arrival is a big turn off," she said.

"This has already made the brands realize that the time to make a change is now - to revamp the whole production and promotion process, otherwise it is only going to be harder and more expensive. And so many are doing."

Divided designers The traditional fashion calendar allots a year from the time a collection is designed to when it arrives in-stores. In this approach, the apparel is designed and samples are made for runway shows and buyer appointments, but the actual manufacturing comes afterwards, allowing designers to get feedback from retailers and media before they produce on a greater scale.

Fashionbi lays out an alternative timeline, which would include a small trunk show specifically for buyers earlier in the process. Based on their orders, the manufacturing and lending to fashion magazines would occur before the runway show in order to be ready for the main event. Armarium showroom

Then, once the fashion show happens, the collection will be available to be purchased, and print placements will be ready to run at the same time.

A number of positives are convincing brands to change their existing approaches. For one, having a commerce-enhanced runway show may lead to impulse buys as consumers fall in love with an item seen during a live stream or on social media.

Also, encouraging consumers to buy right away may also lead to more full-price sales. Furthermore, as luxury and designer fashion fights to retain its exclusivity, shortening the time between runway and store availability may prevent fast fashion from knocking off designs.

Fashionbi identifies four main strategies brands are implementing.

“Seasonal Buy Now” is perhaps the most needed, since it would align product availability with when consumers actually need it, promoting fur coats in the fall rather than July. When starting up her namesake label, Tamara Mellon took this approach, allowing consumers to buy what they needed when they needed it.

“Consumer-Driven Buy Now” follows the idea that runway shows are no longer trade events, but rather should be for the consumer, with commerce incorporated.

Armarium showroom

Then, once the fashion show happens, the collection will be available to be purchased, and print placements will be ready to run at the same time.

A number of positives are convincing brands to change their existing approaches. For one, having a commerce-enhanced runway show may lead to impulse buys as consumers fall in love with an item seen during a live stream or on social media.

Also, encouraging consumers to buy right away may also lead to more full-price sales. Furthermore, as luxury and designer fashion fights to retain its exclusivity, shortening the time between runway and store availability may prevent fast fashion from knocking off designs.

Fashionbi identifies four main strategies brands are implementing.

“Seasonal Buy Now” is perhaps the most needed, since it would align product availability with when consumers actually need it, promoting fur coats in the fall rather than July. When starting up her namesake label, Tamara Mellon took this approach, allowing consumers to buy what they needed when they needed it.

“Consumer-Driven Buy Now” follows the idea that runway shows are no longer trade events, but rather should be for the consumer, with commerce incorporated.

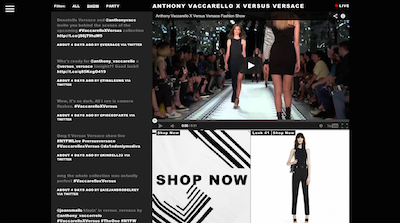

Versus Versace show live stream with ecommerce feature

In the vein of online trunk show retailer Moda Operandi is “Disintermediated Buy Now,” in which consumers can pre-order at the time of the runway show, allowing them to stake their claim on a favorite item and receive it months later. This helps the client know that she will not miss out, while enabling brands to take time after the show to deliver.

Thom Browne does this, taking orders from interested consumers after its runway shows and then producing made-to-order garments for them that arrive about 12 weeks later.

With the rise of social shopping, “Digital Buy Now” is the strategy of using platforms’ buying buttons to drive sales.

Burberry is a brand that has taken all four approaches, shifting its show schedule to the appropriate season, opening up collections for purchase directly after the show and leveraging Twitter’s buy buttons for runway-inspired makeup purchases. Before switching to buy now, wear now, Burberry was an early adopter of pre-orders, allowing consumers to purchase some items immediately after they appeared on the runway and have them shipped in a number of weeks.

Dipping a toe into immediate runway commerce, some brands have chosen to bridge both worlds, creating a selection of items for immediate purchase while keeping most of the collection for later. For instance, Prada made two handbag styles available in-stores right after its fall/winter 2016 show earlier this year.

Some brands, including Vetements and Alexander Wang, have chosen not to embrace see-now, buy-now, but to move their fashion shows to limit the time between a consumer’s first sight of an item and its availability. A similar solution is to hold events solely for press and buyers, embargoing images of the collection until closer to its release date.

Some designers, including Domenico Dolce and Stefano Gabbana, have said that adopting see-now, buy-now would hurt the creativity around producing a show. Often, pieces that appear on the runway are tweaked up until the last moment, which would be impossible in an immediate commerce strategy.

Versus Versace show live stream with ecommerce feature

In the vein of online trunk show retailer Moda Operandi is “Disintermediated Buy Now,” in which consumers can pre-order at the time of the runway show, allowing them to stake their claim on a favorite item and receive it months later. This helps the client know that she will not miss out, while enabling brands to take time after the show to deliver.

Thom Browne does this, taking orders from interested consumers after its runway shows and then producing made-to-order garments for them that arrive about 12 weeks later.

With the rise of social shopping, “Digital Buy Now” is the strategy of using platforms’ buying buttons to drive sales.

Burberry is a brand that has taken all four approaches, shifting its show schedule to the appropriate season, opening up collections for purchase directly after the show and leveraging Twitter’s buy buttons for runway-inspired makeup purchases. Before switching to buy now, wear now, Burberry was an early adopter of pre-orders, allowing consumers to purchase some items immediately after they appeared on the runway and have them shipped in a number of weeks.

Dipping a toe into immediate runway commerce, some brands have chosen to bridge both worlds, creating a selection of items for immediate purchase while keeping most of the collection for later. For instance, Prada made two handbag styles available in-stores right after its fall/winter 2016 show earlier this year.

Some brands, including Vetements and Alexander Wang, have chosen not to embrace see-now, buy-now, but to move their fashion shows to limit the time between a consumer’s first sight of an item and its availability. A similar solution is to hold events solely for press and buyers, embargoing images of the collection until closer to its release date.

Some designers, including Domenico Dolce and Stefano Gabbana, have said that adopting see-now, buy-now would hurt the creativity around producing a show. Often, pieces that appear on the runway are tweaked up until the last moment, which would be impossible in an immediate commerce strategy.

Burberry runway show

For luxury brands, they will need to decide whether it is best for them to retain their traditions, which may cause consumers to consider them out of date, or embrace innovation.

The Fédération Française de la Couture du Prêt-à-Porter des Couturiers et des Créateurs de Mode voiced its dissent for the see-now, buy-now movement, saying that French fashion houses would not be taking part in the shakeup (see story).

Another consideration is target audience. While the United States and Asia are really interested in see-now, buy-now, other regions, such as Europe and the Middle East, might not feel it is as necessary.

Burberry runway show

For luxury brands, they will need to decide whether it is best for them to retain their traditions, which may cause consumers to consider them out of date, or embrace innovation.

The Fédération Française de la Couture du Prêt-à-Porter des Couturiers et des Créateurs de Mode voiced its dissent for the see-now, buy-now movement, saying that French fashion houses would not be taking part in the shakeup (see story).

Another consideration is target audience. While the United States and Asia are really interested in see-now, buy-now, other regions, such as Europe and the Middle East, might not feel it is as necessary.

"There is always a solution," Ms. Zutshi said. "Many of the big luxury labels do offer additional non-iconic pieces as well, to reach a wider audience.

"Even if some traditional Italian and French houses are against the see-now, buy-now idea claiming that it is a death of creativity, they can still implement such an offering on their rather low-cost pieces," she said. "It is anyway always a better way to judge the audience, to see how are they perceiving such an initiative taken by their favorite label.

"Perhaps the millennials are only going to appreciate such fast-track acquisition. Hence, keeping the iconic pieces as they are and still showing concern for the quick customer needs is the right balance any premium or luxury label can surely implement."

Delayed gratification Picking up steam, immediate ecommerce has caught on with other sectors of the luxury industry. Colored-gemstone miner Gemfields has acted on the fashion industry’s most debated topic with the introduction of a see-now, buy-now jewelry collection. The collaboration brings together Gemfields’ sustainably mined Mozambican rubies and Zambian emeralds with New York-based fine jewelry showroom Muse, known for championing emerging designers. The Gemfields x Muse collection debuted at the Couture Show June 2-6, a jewelry industry event held annually at the Wynn Resort in Las Vegas (see story). The debate surrounding see-now, buy-now is ongoing, as brands experiment and industry insiders weigh in. As the fashion show faces disruption, there is no single right solution, with each brand having to decide for itself how to proceed. Panelists speaking during the “How Do You Solve a Problem Like Fashion Week” session at Fashion-Culture-Design on June 9 tackled the issues surrounding the existing fashion calendar, from the delay between runway and retail to fast fashion copycats. In an industry that thrives on creativity, is speeding up the timeframe from design to department store an attainable or on-brand goal (see story)? "It really depends brand by brand," Ms. Zutshi said. "If you are a cool consumer-centric brand such as Tom Ford or Burberry, always the first to innovate and implement the latest in market trend, your customers would rather expect you to keep them first for any offering and launch a plan convenient for them. "If you are a rather traditional label with years of heritage, it is important to test your audience at first," she said. "Offer a see-now, buy-now solution on small accessories or capsule collections to see the response of your target audience. If they are super excited with the idea and praise the brand for pushing limits, you can then extend such offering to the further signature pieces as well. "And, as suggested by Fashionbi specialists in our latest marketing research, see-now, buy-now, it is very important to take a step back and analyze the risks involved as well. "Do you have a full control over your supply chain? Will you be able to fasten up the entire production, exhibition, retail and editorial process? What does it mean as a cost and adjustment for the brand? Only then can a brand smoothly integrate such solutions."