Land Rover classic models

Land Rover classic models

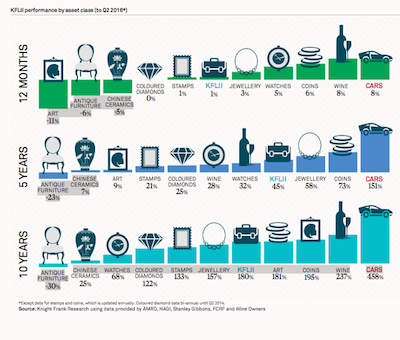

Classic cars are being dethroned as the number one avenue for luxury investments, as high-quality wine makes its comeback, according to Knight Frank’s Luxury Investment Index.

While classic cars have risen in value by more than 500 percent within the past 10 years and 8 percent year over year, vintage wines are surpassing old-time vehicles in terms of popularity with consumers. A drop in the value of Bordeaux wines caused slow growth for the wine sector, but its recent price boom has caused a growth increase while at the same time the classic car market slipped below 10 percent growth for the first time in five years.

“For the first time in several years cars are no longer the outright top-performing asset in our Luxury Investment Index,” said Andrew Shirley, editor of The Wealth Report and head of rural research at Knight Frank. “After a bumpy period when the Chinese bubble for fine French wines burst spectacularly, the market for top-quality wine has now found its feet again and is performing strongly and going head to head with classic cars in terms of performance.”

Classic cars versus wine

While wine has bounced back and took classic automotive as the top investment, that does not mean that classic cars are taking a back seat. The sector is still right up there at the top, just not in the lead.

For instance, within this past year, four of the most expensive vehicles to ever be restored have been sold. A Shelby Cobra was sold at auction for more than $13 million, the highest price paid for a vehicle at auction.

The sale of the Cobra by RM Sotheby’s beat out the previous highest auction sale, which was the sale of a Ford GT40 for $11 million. The $13 million auction sale makes the Cobra the twentieth most expensive vehicle publicly sold overall.

Best selling models from auction courtesy of Knight Frank

Back in March, panelists from Douglas Elliman and Knight Frank’s previous The Wealth Report 2016 noted that despite stock market volatility, geopolitical instability and new regulations, prime residential real estate still has a good outlook.

Oil prices have plummeted, governments and the IMF are tracking the flow and origin of incoming money and many assets have had negligible appreciation in the past year. Nevertheless, a look at recent history and wealth projections show that a bet on long-term growth and on real estate, as well as classic cars, is a safe one (see more).

As wine continues to grow as a major investment avenue, many digital tools are emerging to tap into that. For instance, Vincast, a digital tool for wine lovers, helped connoisseurs maintain their collections through investment-grade analytics.

Whether a consumer is looking to begin collecting or uphold an established collection, being privy to insights regarding various types of wines and their worth can be essential to profitability. The Vincast by Auction Forecast platform tracks data points such as auction prices, collectability scores, market indices and return-on-investment forecasts to ensure the collector that they are making a sound purchase or fair sale (see more).

Other sectors

As wine and automobiles continue to dominate, others are slipping in the ranks. For instance, Chinese ceramics, antique furniture and art have all had a percentage drop in growth over the past year.

Art saw a growth decrease of 11 percent in the past year, but within the past five years saw a growth of 9 percent. Antique furniture saw a drop of 6 percent within this year, 23 percent within five years and 30 percent in the last 10.

Best selling models from auction courtesy of Knight Frank

Back in March, panelists from Douglas Elliman and Knight Frank’s previous The Wealth Report 2016 noted that despite stock market volatility, geopolitical instability and new regulations, prime residential real estate still has a good outlook.

Oil prices have plummeted, governments and the IMF are tracking the flow and origin of incoming money and many assets have had negligible appreciation in the past year. Nevertheless, a look at recent history and wealth projections show that a bet on long-term growth and on real estate, as well as classic cars, is a safe one (see more).

As wine continues to grow as a major investment avenue, many digital tools are emerging to tap into that. For instance, Vincast, a digital tool for wine lovers, helped connoisseurs maintain their collections through investment-grade analytics.

Whether a consumer is looking to begin collecting or uphold an established collection, being privy to insights regarding various types of wines and their worth can be essential to profitability. The Vincast by Auction Forecast platform tracks data points such as auction prices, collectability scores, market indices and return-on-investment forecasts to ensure the collector that they are making a sound purchase or fair sale (see more).

Other sectors

As wine and automobiles continue to dominate, others are slipping in the ranks. For instance, Chinese ceramics, antique furniture and art have all had a percentage drop in growth over the past year.

Art saw a growth decrease of 11 percent in the past year, but within the past five years saw a growth of 9 percent. Antique furniture saw a drop of 6 percent within this year, 23 percent within five years and 30 percent in the last 10.

Knight Frank's chart regarding investment sector growth

Chinese ceramics only saw a drop within the last year at 5 percent, and had 7 percent growth over the last five and 25 percent growth in 10 years.

While many individual colored-diamonds broke records for their high prices this year, the market as a whole did not see an increase in any growth, but there was no decrease either.

“Given the record-breaking prices paid for some individual diamonds this year it is slightly surprising that the overall market for colored diamonds has not shown stronger growth,” Mr. Shirley said. “It just goes to show that rare and best-in-class assets will always find a ready buyer, even when the wider market is more subdued.”

Knight Frank's chart regarding investment sector growth

Chinese ceramics only saw a drop within the last year at 5 percent, and had 7 percent growth over the last five and 25 percent growth in 10 years.

While many individual colored-diamonds broke records for their high prices this year, the market as a whole did not see an increase in any growth, but there was no decrease either.

“Given the record-breaking prices paid for some individual diamonds this year it is slightly surprising that the overall market for colored diamonds has not shown stronger growth,” Mr. Shirley said. “It just goes to show that rare and best-in-class assets will always find a ready buyer, even when the wider market is more subdued.”