China's Yuan has stabilized after falling last year

China's Yuan has stabilized after falling last year

While China’s major cities are continuing to grow in terms of price rate, Knight Frank’s Global Cities Index predicts this will slow due to restrictions on loan-to-value ratios and tighter lending on an individual's second or third properties.

The growth of China’s cities has supported strong investment into the luxury property sector worldwide. While the rest of the world’s properties have seen instability in price rates, investment into the luxury market has been strong this year.

“The strong rate of price growth in China’s key cities despite cooling measures aimed at lowering price inflation,” said Kate Everett-Allen, partner of international residential research at Knight Frank, London. “However, we expect the rate of growth to slow in coming months as rules on loan-to-value ratios and tighter lending on second or third properties start to deter speculative investments.”

City growth rate

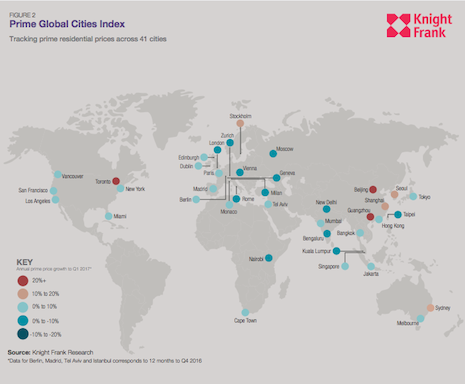

Guangzhou, China has been a driver for the luxury sector with prices in this market rising 36.2 percent in the first quarter of this year.

Overall, prices have grown 4.3 percent in 2017 up until March.

Areas that are known as technology hubs are now outperforming financial districts in terms of luxury pricing.

Knight Frank's map for global cities in Q1 2017

Hong Kong and Singapore are seeing growth of 5.3 percent and 4 percent, respectively, prompting them to rise in rankings of Knight Frank’s Index. Toronto is also seeing strong growth, which has spurred greater market restrictions.

The Canadian city saw luxury prices grow to 22 percent higher in the first quarter of 2017. Toronto beat out Vancouver by a 7.9 percent higher margin.

A new 15 percent foreign buyer tax has now been put in place in Toronto, which makes it Vancouver’s equal.

Seoul, South Korea, Stockholm, Berlin and Melbourne, Australia have all also seen significant growth. The cities grew 17, 10.7, 8.7 and 8.6 percent, respectively.

Knight Frank's map for global cities in Q1 2017

Hong Kong and Singapore are seeing growth of 5.3 percent and 4 percent, respectively, prompting them to rise in rankings of Knight Frank’s Index. Toronto is also seeing strong growth, which has spurred greater market restrictions.

The Canadian city saw luxury prices grow to 22 percent higher in the first quarter of 2017. Toronto beat out Vancouver by a 7.9 percent higher margin.

A new 15 percent foreign buyer tax has now been put in place in Toronto, which makes it Vancouver’s equal.

Seoul, South Korea, Stockholm, Berlin and Melbourne, Australia have all also seen significant growth. The cities grew 17, 10.7, 8.7 and 8.6 percent, respectively.

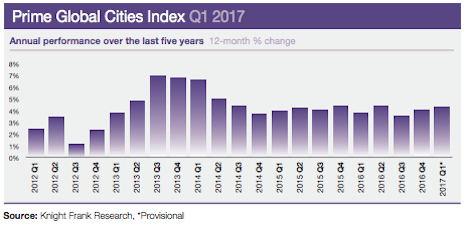

Knight Frank's research for last five year's performance

Prices in London have been falling until March throughout this year, but the city is likely to stabilize as quarterly growth reached its highest rate since May of last year.

Additional insight

The significant gains that followed a stagnant 2016 that these luxury properties are seeing have come after United States President Trump’s promises of tax relief have given wealthy consumers expectations for positive economic growth.

Property prices are up 4.2 percent from last year, likely supported by the new White House administration, according to other research from Redfin. The administration has also pushed price points in luxury home sales in Washington after President Trump’s appointees have purchased extravagant properties (see more).

Also, after a three-quarter-long price drop in United Kingdom country properties, the market is stabilizing and experiencing a comeback with increasing prices during the first quarter of 2017, according to a Knight Frank report.

Knight Frank’s Prime Country House Index Q1 2017 showed a 0.6 percent increase in prices within the first quarter, after three consecutive quarters of price declines. However, while the market is very active, there is a persistent shortage of stock (see more).

As these factors continue to push various markets prices, the price growth of tech hubs is continuing to surprise experts.

“The strength of price growth in some of the world’s emerging tech hubs – for example, Seoul, South Korea, Toronto, Stockholm, Melbourne, Australia [are surprising],” Ms. Everett-Allen said. “Price growth in the established financial markets such as Hong Kong, New York and London are muted by comparison.”

Knight Frank's research for last five year's performance

Prices in London have been falling until March throughout this year, but the city is likely to stabilize as quarterly growth reached its highest rate since May of last year.

Additional insight

The significant gains that followed a stagnant 2016 that these luxury properties are seeing have come after United States President Trump’s promises of tax relief have given wealthy consumers expectations for positive economic growth.

Property prices are up 4.2 percent from last year, likely supported by the new White House administration, according to other research from Redfin. The administration has also pushed price points in luxury home sales in Washington after President Trump’s appointees have purchased extravagant properties (see more).

Also, after a three-quarter-long price drop in United Kingdom country properties, the market is stabilizing and experiencing a comeback with increasing prices during the first quarter of 2017, according to a Knight Frank report.

Knight Frank’s Prime Country House Index Q1 2017 showed a 0.6 percent increase in prices within the first quarter, after three consecutive quarters of price declines. However, while the market is very active, there is a persistent shortage of stock (see more).

As these factors continue to push various markets prices, the price growth of tech hubs is continuing to surprise experts.

“The strength of price growth in some of the world’s emerging tech hubs – for example, Seoul, South Korea, Toronto, Stockholm, Melbourne, Australia [are surprising],” Ms. Everett-Allen said. “Price growth in the established financial markets such as Hong Kong, New York and London are muted by comparison.”