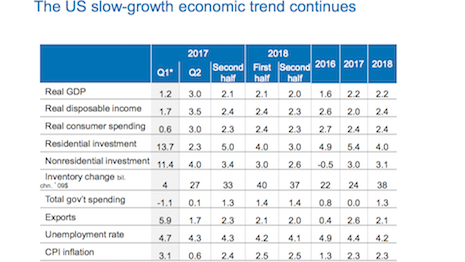

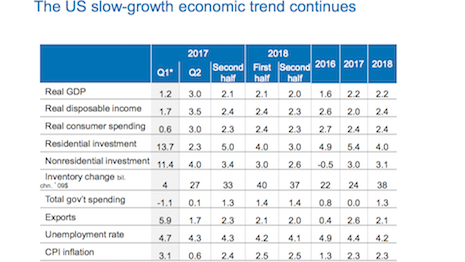

The U.S. slow-growth economic trend continues. Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, The Conference Board

By Mickey Alam Khan

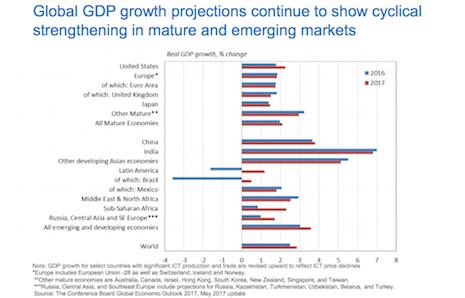

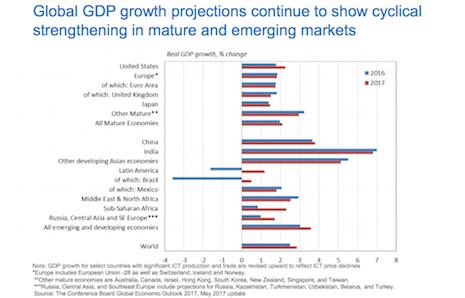

NEW YORK – The world seems to be getting more comfortable with a slower structural growth rate, although key challenges remain, according to the latest global outlook briefing by The Conference Board.

Despite the recent cyclical upswing, the global economy remains at a timid growth pace, Conference Board chief economist Bart van Ark said at a media briefing June 12.

“A volatile and unpredictable U.S. policy environment, clouded Brexit negotiations [and] the need for reform of European institutions keep uncertainty at elevated levels,” Mr. van Ark said.

In other trends:

Emerging markets are making massive medium-term adjustments that keep growth rates at bay

Monetary policy stays accommodative and sustains upward pressure on financial markets while supporting unequal distribution of gains

Unemployment keeps falling, but labor supply is under pressure with the aging of population and little improvement in labor market participation

Investment levels at global level, at best, slightly more positive

Productivity growth looks better, but it is too early to see structural gains

Global GDP growth projections continue to show cyclical strengthening in mature and emerging markets. Source: The Conference Board Global Economic Outlook 2017, May 2017 update

Global GDP growth projections continue to show cyclical strengthening in mature and emerging markets. Source: The Conference Board Global Economic Outlook 2017, May 2017 update

U.S. view

The growth trend of the United States economy continues at about 2 percent, based on the Conference Board’s half-yearly economics watch.

The service side of the economy is growing faster, while the cyclical uptick in manufacturing may be slowing.

Consumer confidence and housing demand in the U.S. remain favorable. But the outlook for non-mining business investment has not much changed.

“The consumer is pretty strong, still hanging in there,” Mr. van Ark said.

Inflation weakened Stateside, but a tightening labor market means inflation pressures are gradually building, keeping the U.S. Federal Reserve on course to raise rates this month.

Finally, chances of a near-term fiscal stimulus have diminished, leading to a downgrade of government and private investment in the Conference Board’s forecast.

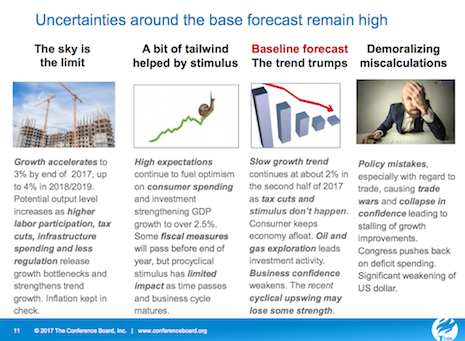

Different scenarios for U.S.

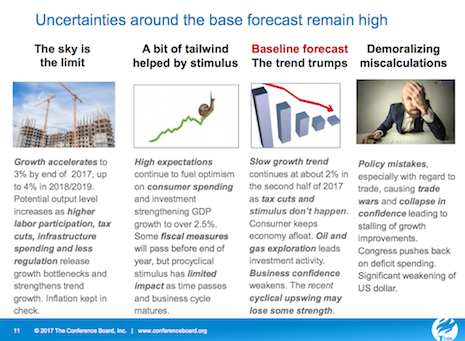

Uncertainties around the Conference Board’s base forecast for the U.S. remain high, according to Mr. van Ark. He outlined four scenarios.

In the first, called “The sky is the limit,” growth accelerates to 3 percent by the end of the year, inching up to 4 percent in 2018-19.

Potential output level increases as higher labor participation, tax cuts, infrastructure spending and less regulation release growth bottlenecks and strengthens trend growth. Inflation is kept in check.

Under the second scenario identified as “A bit of tailwind helped by stimulus,” high expectations continue to fuel optimism on consumer spending and investment, strengthening GDP growth to more than 2.5 percent.

Some fiscal measures are expected to pass before the end of the year, but pro-cyclical stimulus has limited effect as time passes and the business cycle matures.

The third scenario is the Conference Board’s baseline forecast, fetchingly named as “The trend trumps.” The slow growth trend continues at about 2 percent in the second half of this year since tax cuts and stimulus do not happen.

Indeed, the consumer keeps the economy afloat.

Under this forecast, oil and gas exploration leads investment activity. But business confidence weakens. The recent cyclical upswing may lose some strength.

Finally, there is the doomsday scenario, with a title tinged with understatement: “Demoralizing miscalculations.”

In this situation, policy mistakes, especially on trade, cause trade wars and collapse in confidence, leading to stalling of growth improvements. The U.S. Congress pushes back on deficit spending and the dollar weakens significantly.

Uncertainties around the base forecast remain high. Source: The Conference Board

Uncertainties around the base forecast remain high. Source: The Conference Board

Consequences of U.K. elections on Brexit

While a softer Brexit comes more within reach as a result of the recent British elections, it will not bring an outcome within reach sooner, according to the Conference Board.

The newly weakened Conservative government led by Prime Minister Theresa May faces three challenges.

First, it becomes harder to pass through Parliament key domestic bills related to Brexit, including tax, trade and customs regimes, as well as the repeal of the EC Act of 1972.

Next, the support of the Democratic Unionists Party will require clearer arrangements upfront on an open border between Northern Ireland and the Republic of Ireland.

Finally, the success of the Tories in Scotland has brought support for a softer Brexit stance into the Conservative Party.

As a result of these factors, negotiations may drag on, benefiting neither the United Kingdom nor the European Union.

The U.K. economy is already weakening, Mr. van Ark pointed out, so clarity on the way forward is important for business.

Europe also needs to speed up reforms of its institutions rather than be distracted by negotiations with a member leaving the union.

The Conference Board chief economist Bart van Ark (at lectern) leading the global outlook briefing in New York, June 12, 2017

The Conference Board chief economist Bart van Ark (at lectern) leading the global outlook briefing in New York, June 12, 2017

Risks ahead

So what are the other risks to anticipate worldwide for the rest of the year?

Global financial markets are rebalancing risks as cyclical strength has been factored in and medium-term growth prospects remain weak

Europe is challenged by changes in political dynamics in the U.K., France and Germany, even Italy, affecting Brexit and the reform of European institutions

China’s role globally, and Asia Pacific, in particular, depends on a range of internal and external factors, including debt and default risks

Middle East risks increase under political rifts and modest oil prices

Brazil’s recovery under pressure from renewed political instability

Key currencies may realign as U.S. dollar loses strength in relation to European and emerging market currencies

The U.S. slow-growth economic trend continues. Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, The Conference Board

The U.S. slow-growth economic trend continues. Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, The Conference Board

Global GDP growth projections continue to show cyclical strengthening in mature and emerging markets. Source: The Conference Board Global Economic Outlook 2017, May 2017 update

Global GDP growth projections continue to show cyclical strengthening in mature and emerging markets. Source: The Conference Board Global Economic Outlook 2017, May 2017 update Uncertainties around the base forecast remain high. Source: The Conference Board

Uncertainties around the base forecast remain high. Source: The Conference Board The Conference Board chief economist Bart van Ark (at lectern) leading the global outlook briefing in New York, June 12, 2017

The Conference Board chief economist Bart van Ark (at lectern) leading the global outlook briefing in New York, June 12, 2017