Water Mill, NY home; listing via Knight Frank

Water Mill, NY home; listing via Knight Frank

While a fixer-upper home offers greater options of customization, affluent consumers are not interested in doing renovations and are looking for the convenience of a turnkey.

According to research from YouGov, only 6 percent of affluent homebuyers would be interested in a home that would need renovations. Those looking to sell higher priced homes are being pressured to put more funds into the properties to give them greater appeal.

“Fussy affluent homebuyers are putting a lot of pressure on sellers to update their homes prior to putting them on the market,” said Cara David, managing partner at YouGov, New York. “Only 6 percent of affluent home buyers are looking for a home that requires renovations or remodels.

“Time-starved millennials are driving the market – and they’re not interested in the role of ‘weekend warrior,’” she said. “What’s more, it seems the idea of a turnkey property – where a buyer could move in as-is – has taken on a whole new meaning; buyers now look for features such as energy efficiency, master bedroom suites, outdoor living and open floor plans.”

For the study YouGov questions affluents on the attitudes, lifestyles, values and shopping behaviors of the world’s most-successful households.

Affluent real estate

The YouGov Affluent Perspective 2017 Global Study shows that millennials are now a major driving force in the real estate market but they are uninterested in taking on a fixer upper role.

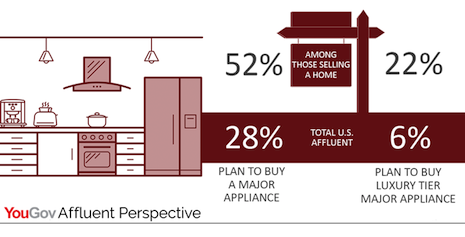

YouGov's chart looking at kitchen appliance purchases. Image credit: YouGov

Sellers rather than new homebuyers are spending a significant amount of time working on their homes, with 31 percent of those looking to sell their homes spend their weekends doing renovations.

Another major statistic that supports this notion is that only 28 percent of affluent homeowners in the United States are looking to purchase new kitchen appliances within the next year. However, 52 percent of Americans who are selling their homes are claiming to buy new appliances.

The ratio is very similar when it comes to high-end appliances with 22 percent of sellers looking to purchase luxury appliances and only 6 percent of general affluent consumers will.

YouGov's chart looking at kitchen appliance purchases. Image credit: YouGov

Sellers rather than new homebuyers are spending a significant amount of time working on their homes, with 31 percent of those looking to sell their homes spend their weekends doing renovations.

Another major statistic that supports this notion is that only 28 percent of affluent homeowners in the United States are looking to purchase new kitchen appliances within the next year. However, 52 percent of Americans who are selling their homes are claiming to buy new appliances.

The ratio is very similar when it comes to high-end appliances with 22 percent of sellers looking to purchase luxury appliances and only 6 percent of general affluent consumers will.

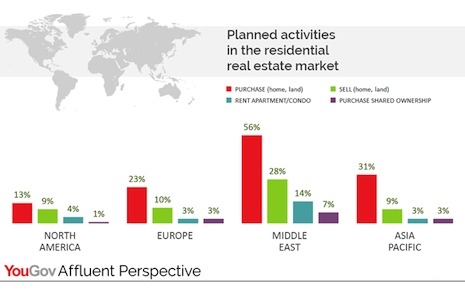

YouGov's chart on global real estate. Image credit: YouGov

Currently, the Middle East is the leading area for real estate activity with 56 percent of consumers looking to purchase a home and 28 percent looking to sell. In the U.S., only 13 percent are looking to purchase and 9 percent are looking to sell.

Also in the U.S., 4 percent are renting and 1 percent have a shared ownership.

The real estate market in Europe is slightly more active with 23 percent interesting in home buying and 10 percent selling.

Additional insight

While China’s major cities are continuing to grow in terms of price rate, Knight Frank’s Global Cities Index predicts this will slow due to restrictions on loan-to-value ratios and tighter lending on an individual's second or third properties.

The growth of China’s cities has supported strong investment into the luxury property sector worldwide. While the rest of the world’s properties have seen instability in price rates, investment into the luxury market has been strong this year (see more).

The number of homes sold for $1 million or more flattened in 2016, growing a mere 1 percent, according to new research from Christie’s International Real Estate.

According to the broker's Luxury Defined report, on average, sale prices for luxury residential properties rose only 2 percent, and homes spent 13 percent more time on the market than in 2015. Following economic and political uncertainties and fluctuations in 2016, the coming year in high-end real estate is looking up as consumers feel more confident (see more).

“How important it is for luxury appliance brands to target affluent home sellers,” YouGov's Ms. David said. “A high percentage of affluent home sellers are having to sink money into the homes they are trying to sell – 31 percent of those planning to sell their home agree that they spend most weekends working on their home, including updating their kitchen appliances.

“The stats speak for themselves,” she said. “While 28 percent of affluent Americans say they’re planning to buy a major kitchen appliance in the next year, this number jumps to 52 percent among those selling a home.

“The same is true for luxury tier appliances; 22 percent of affluent home sellers are looking to buy high-end appliances, compared to only 6 percent of the total U.S. affluent population.”

YouGov's chart on global real estate. Image credit: YouGov

Currently, the Middle East is the leading area for real estate activity with 56 percent of consumers looking to purchase a home and 28 percent looking to sell. In the U.S., only 13 percent are looking to purchase and 9 percent are looking to sell.

Also in the U.S., 4 percent are renting and 1 percent have a shared ownership.

The real estate market in Europe is slightly more active with 23 percent interesting in home buying and 10 percent selling.

Additional insight

While China’s major cities are continuing to grow in terms of price rate, Knight Frank’s Global Cities Index predicts this will slow due to restrictions on loan-to-value ratios and tighter lending on an individual's second or third properties.

The growth of China’s cities has supported strong investment into the luxury property sector worldwide. While the rest of the world’s properties have seen instability in price rates, investment into the luxury market has been strong this year (see more).

The number of homes sold for $1 million or more flattened in 2016, growing a mere 1 percent, according to new research from Christie’s International Real Estate.

According to the broker's Luxury Defined report, on average, sale prices for luxury residential properties rose only 2 percent, and homes spent 13 percent more time on the market than in 2015. Following economic and political uncertainties and fluctuations in 2016, the coming year in high-end real estate is looking up as consumers feel more confident (see more).

“How important it is for luxury appliance brands to target affluent home sellers,” YouGov's Ms. David said. “A high percentage of affluent home sellers are having to sink money into the homes they are trying to sell – 31 percent of those planning to sell their home agree that they spend most weekends working on their home, including updating their kitchen appliances.

“The stats speak for themselves,” she said. “While 28 percent of affluent Americans say they’re planning to buy a major kitchen appliance in the next year, this number jumps to 52 percent among those selling a home.

“The same is true for luxury tier appliances; 22 percent of affluent home sellers are looking to buy high-end appliances, compared to only 6 percent of the total U.S. affluent population.”