China's consumers lean heavily on social media to discover new products. Image credit: Knight Frank

China's consumers lean heavily on social media to discover new products. Image credit: Knight Frank

NEW YORK – As Chinese and Chinese-Americans continue to develop into the world’s largest luxury-buying demographic, understanding the social aspect of how this segment shops is key to marketing to them in the future.

Speaking at Luxury Interactive 2017, one of the co-founders of Dealmoon, a Chinese shopping recommendation and social network, explained some of the ways that Chinese consumers can be a huge asset to luxury brands in the future.

"The new Chinese luxury shopper is comfortable doing a wide range of shopping discovery via mobile," said Jennifer Wang, co-founder of Dealmoon. "When it comes to luxury, they like things that can be seen by others."

Digital word-of-mouth

China has emerged as one of the biggest luxury consumers in the world in recent years.

By 2025, 7.6 million Chinese households will represent RMB 1 trillion, or $151.7 billion at current exchange rate, in luxury goods sales. This astonishing figure is more than the combined luxury consumption from France, Italy, Japan, the United Kingdom and the United States.

“You’re looking at a lot of new consumers in China," Ms. Wang said. "This will be your audience in the next 10 years.”

In light of these figures, luxury brands need to understand the best way to reach these Chinese consumers.

For Dealmoon, often this is through word-of-mouth and social media. Chinese consumers rely heavily on social media and showing off products to their friends or asking for feedback and recommendations.

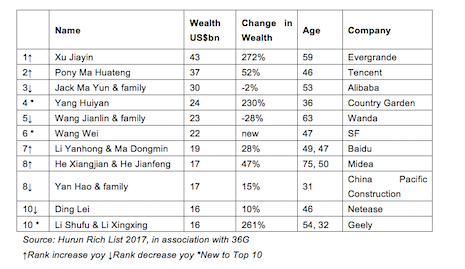

China's 10 wealthiest. Image credit: Hurun Research

“You have to find the best suitable product to the Chinese market through user experience," Ms. Wang said. "Referrals should be your best source for Chinese customers."

Additionally, delivery is one of the biggest difference between the Chinese market and elsewhere.

In China, consumers are used to getting same-day delivery and other high-quality delivery services.

“Here are things you need: super fast shipping, great packaging, same day response from customer service and international shipping," Ms. Wang said. "If you are selling something over $500, you should give them a luxury delivery experience as well."

Chinese luxury

The population of affluent consumers in China is continuing to grow at an impressive rate, with the collective wealth of the top 100 consumers in China growing 60 percent year-over-year.

This data comes from Hurun’s annual “Richest People in China Index” which categorizes and ranks the ultra-wealthy in China as well as analyzing the state of affluent consumers in the country. This report shows that China is continuing to be a hub for newly affluent consumers who will be a valuable customer base for luxury brands (see story).

By 2020, Chinese social media use is estimated to hit 647 million active users, making a presence on local platforms essential for luxury brands aiming to speak to China's affluent and aspirational consumers.

Dealmoon's Web site. Image credit: Dealmoon

According to Fashionbi’s latest trend report, China’s social media use has reconfigured how consumers in the Chinese market shop, with most opting for social commerce facilitated through platforms such as Weibo and WeChat. Developing a localized voice is a vital strategy for brands looking to make headway with consumers located outside the West, and in China, without social media it is nearly impossible to build awareness or conversions (see story).

The focus on mobile is another key aspect of accommodating Chinese consumers, according to Dealmoon's Ms. Wang. Chinese customers rely heavily on mobile and brands need to be able to offer them a robust mobile experience that can serve multiple purposes.

"Chinese customers use mobile heavily and it needs to be fast to accommodate the volume of browsing that they do," Ms. Wang said.