Luxury brands need to self disrupt to thrive. Image credit: Balenciaga

Luxury brands need to self disrupt to thrive. Image credit: Balenciaga

In 2019 the global fashion business’ growth is projected to slow to between 3.5 and 4.5 percent, with much of the increase driven by luxury and emerging markets. Against a backdrop of political and economic uncertainty, about four in 10 fashion executives are anticipating worsening conditions. The State of Fashion Report, coproduced by McKinsey and Business of Fashion, notes that the industry is facing changes that require brands to throw out the old rules to succeed, calling for organizations that are able to rapidly adapt.

"Optimism in the luxury [segment] is aided by their strong performance in 2018 and is fueled by fast-growing Asia-Pacific economies and the continuing boom in global travel," said Achim Berg, senior partner, leader of the apparel, fashion and luxury group at McKinsey and coauthor of The State of Fashion report, Oxfordshire, Britain.

Self disruption plan The fashion market has exceeded expectations for growth in 2018, with McKinsey anticipating a 4 to 5 percent bump. However, most of this growth is centered at the top, with the 20 biggest brands accounting for 97 percent of total profits. While fashion remains a growing industry, leaders overall are pessimistic. The report notes that most of those showing optimism were from North America and at luxury houses, with 56 percent of luxury and premium executives expecting conditions to get better. In 2019, growth is expected to fall from 2018, and a number of economic conditions point to a more challenging environment. Meanwhile, companies are facing greater costs, and economic challenges were the third largest trend mentioned by executive respondents. Among the causes of uncertainty for fashion businesses is the impending trade war between the United States and China and the ongoing Brexit negotiations. Fashion relies on the ability to move raw materials, talent and completed goods across borders, making potential further disruptions a hindrance to business. Another trend driving change in fashion is brands adopting sustainability and social causes. Driven in part by demand from consumers, companies are taking vocal sides on controversial debates and supporting initiatives through collections and donations. For instance, Gucci donated to gun control rally, while Balenciaga has created lines that support Bernie Sanders and the World Food Programme. Tamara Mellon aligned itself with the Women's March. Image credit: Tamara Mellon

Tamara Mellon aligned itself with the Women's March. Image credit: Tamara Mellon

"Sustainability is an increasingly important priority for the fashion industry, reflecting rising concerns on the part of consumers and companies about how to alleviate their impact on the environment," Mr. Berg said. "Sustainability for the first time breaks into our survey respondents’ list of the most important challenges, and is evolving from a tick-box exercise into a transformational feature that is ingrained in the business model and ethos of many recent success stories.

"The growing consumer desire for sustainability also drives the shift to new ownership models," he said.

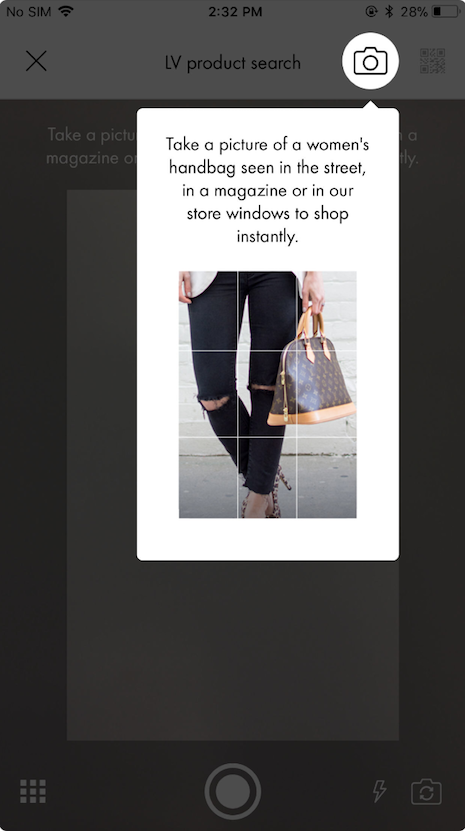

Along with being sustainable, consumers are prompting brands to be more transparent throughout the supply chain, helping to earn back the trust of shoppers who are skeptical. A number of luxury brands were recently called out by a report for their lack of transparency about their environmental and social policies (see story). About half of millennials say they research brands before buying, making readily available details about production and sourcing key. Consumer behavior is also changing the typical path to purchase and how shoppers interact with brands. Today, consumers are more apt to get their style inspiration from external sources rather than a brand itself. Coupled with a need for instant gratification, creating a link between idea and transaction can prove a challenge. Some brands are turning to technology to solve the issue, such as Louis Vuitton’s visual search function that allows a consumer to snap a photo of a look to pull up catalog offerings that match (see story). Louis Vuitton's visual search. Image credit: Louis Vuitton

Louis Vuitton's visual search. Image credit: Louis Vuitton

"Far-sighted companies will have to make bold moves in automation and AI, and will disrupt themselves before others do it for them," Mr. Berg said. "Fashion players now need to be nimble, think digital-first and achieve ever-faster speed to market.

"They need to take an active stance on social issues, satisfy consumer demands for ultra-transparency and sustainability and, most importantly, have the courage to 'self-disrupt' their own identity and the sources of their old success in order to realize these changes and win new generations of customers," he said.