Luxury ecosystems continue to evolve. Image credit: Swarovski

Luxury ecosystems continue to evolve. Image credit: Swarovski

NEW YORK – With luxury becoming an even more heavily concentrated business, brands and retailers need to brace themselves for changing consumer demands and expectations.

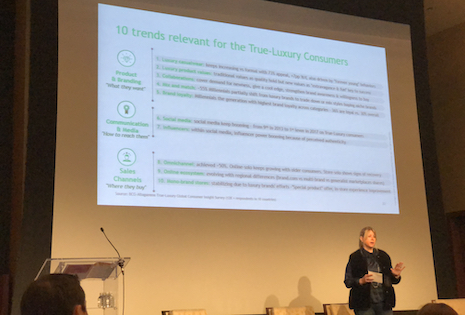

Presenting at Luxury FirstLook 2019: Digital Acceleration on Jan. 16, a partner from Boston Consulting Group discussed how generational differences continue to impact luxury brands. Ecommerce adoption is also driving the luxury ecosystem, both in-store and online.

“Consumers are looking for more engagement from the stores and less focus on the transaction,” said Christine Barton, senior partner and managing director at Boston Consulting Group.

Luxury Daily produced Luxury FirstLook 2019: Digital Acceleration

Luxury changes

Currently, between 4 and 5 percent of luxury consumers generate 30 percent of luxury sales, according to BCG.

Within the next five years, however, millennial and Chinese consumers will dominate luxury demographics. China is also expected to draw a significant sales volume from Europe.

Most luxury consumers will soon be either millennials or Chinese. Image credit: Vipshop

Younger affluents are embracing new luxury values, such as fun, creativity and personal expression.

This is reflected in the shift from heavy spend on luxury accessories towards ready-to-wear. Perhaps, older luxury shoppers are among those looking for more high-end casual wear as they transition out of the workplace.

Luxury consumers are also increasingly turning to digital channels for shopping and trend expertise.

Online, mobile purchases continue to prevail over personal computers, and mobile commerce is expected to grow. Smaller high-end brands, however, need to make more active efforts to optimize for mobile.

BCG's Christine Barton speaking at Luxury FirstLook 2019

Luxury brands are starting to catch onto the idea that bricks-and-mortar is not disappearing, but physical footprints are changing.

After a period of disinvestment, companies are putting capital back into their stores. The most innovative “stores of the future” are found in urban areas with large luxury populations, such as New York and San Francisco.

Millennial perspectives

Research from BCG also shows that millennials have the most brand loyalty compared to other generations, despite preconceived notions. This may be because younger affluents are drawn to different brands than their older counterparts.

Consumers today are faced with a plethora of choices, making brand loyalty and trust even more important for retailers.

According to a report from Euclid, four in 10 consumers would seek out a favorite retailer online or travel further to a physical store if their nearest location closed. Millennials are also more apt than their predecessors to follow a preferred brand to ecommerce if necessary, with this generation not as concerned about the convenience of a brand’s physical footprint (see story).

Millennials are also strongly influenced by social media, especially more visual platforms like Instagram and YouTube, which Ms. Barton is stabilizing.

Instagram is banking on the long-form vertical videos as a way of helping brands get even closer to their audiences, building engagement for the platform’s brand partners.

IGTV will also be heavily curated, with Instagram working directly with many of the influential creators on Instagram to help them adjust to the new parameters of IGTV. The move seems like an open challenge to YouTube for dominance in the world of digital video (see story).

“Consumers can at least rationally tell you what they think they were influenced by,” Ms. Barton said. “They can't always know subliminal influences.”