More HNW investors are looking into cryptocurrencies. Image credit: Maserati

More HNW investors are looking into cryptocurrencies. Image credit: Maserati

Wealthy investors are beginning to embrace cryptocurrencies, as digital assets such as bitcoin gain more acceptance.

More than two-thirds of high-net-worth individuals will invest in cryptocurrencies in the next three years, according to new research from the deVere Group. Major financial institutions and retailers are also beginning to explore how to use cryptocurrencies.

“The research shows that wealthy individuals are increasingly seeking exposure to cryptocurrencies,” said Nigel Green, founder and CEO of deVere Group.

“There is growing, universal acceptance that cryptocurrencies are the future of money – and the future is now,” he said. “High-net-worth individuals are not prepared to miss out on this and are rebalancing their investment portfolios towards these digital assets.”

The findings are based on a survey of more than 700 deVere Group clients from around the globe, including the U.S., U.K., Hong Kong and France. All the respondents had a minimum of $1.3 million in investable assets, or $1 million pounds at current exchange.

Cryptocurrency boom?

By 2022, 68 percent of HNWIs are expected to have investments in cryptocurrencies.

The most popular cryptocurrencies among respondents were bitcoin, ethereum and XRP.

Bitcoin is one of the most common cryptocurrencies. Image credit: RYB

Bitcoin reached its highest value of the year on May 3, and is approaching $6,000 per bitcoin. According to Forbes, the overall cryptocurrency market has experienced growth in recent weeks while the bitcoin market alone is now worth $100 billion.

“There has been a realization that cryptocurrency and blockchain are not a fad but are here to stay,” said Elizabeth White, founder and CEO at the White Company, New York. “Cryptocurrency has clearly become an important asset class that HNW individuals have added, and will be increasing exposure to, in their portfolios.”

Consumers are not the only ones investing in cryptocurrencies, as large corporations also take an interest in digital assets.

Institutional investors are cited by deVere Group as one reason why affluents are becoming more receptive towards cryptocurrencies.

New research from Fidelity Investments shows that almost half of the institutional investors surveyed view cryptocurrencies as having a place in their portfolios. Twenty-two percent of those surveyed already have some exposure to digital assets, with most investments having been made within the last three years.

Banking giant J.P. Morgan Chase is testing its own cryptocurrency, reversing its previous stance on digital tokens. J.P. Morgan was one of three lenders that prohibited its credit card customers from purchasing bitcoins in 2018.

Unlike other existing cryptocurrencies, JPM Coin will not be available to the public and was developed with business-to-business transactions in mind. Only large clients that have undergone regulatory checks such as corporations, banks and broker-dealers will have access to the tokens (see story).

Bitcoin is one of the most common cryptocurrencies. Image credit: RYB

Bitcoin reached its highest value of the year on May 3, and is approaching $6,000 per bitcoin. According to Forbes, the overall cryptocurrency market has experienced growth in recent weeks while the bitcoin market alone is now worth $100 billion.

“There has been a realization that cryptocurrency and blockchain are not a fad but are here to stay,” said Elizabeth White, founder and CEO at the White Company, New York. “Cryptocurrency has clearly become an important asset class that HNW individuals have added, and will be increasing exposure to, in their portfolios.”

Consumers are not the only ones investing in cryptocurrencies, as large corporations also take an interest in digital assets.

Institutional investors are cited by deVere Group as one reason why affluents are becoming more receptive towards cryptocurrencies.

New research from Fidelity Investments shows that almost half of the institutional investors surveyed view cryptocurrencies as having a place in their portfolios. Twenty-two percent of those surveyed already have some exposure to digital assets, with most investments having been made within the last three years.

Banking giant J.P. Morgan Chase is testing its own cryptocurrency, reversing its previous stance on digital tokens. J.P. Morgan was one of three lenders that prohibited its credit card customers from purchasing bitcoins in 2018.

Unlike other existing cryptocurrencies, JPM Coin will not be available to the public and was developed with business-to-business transactions in mind. Only large clients that have undergone regulatory checks such as corporations, banks and broker-dealers will have access to the tokens (see story).

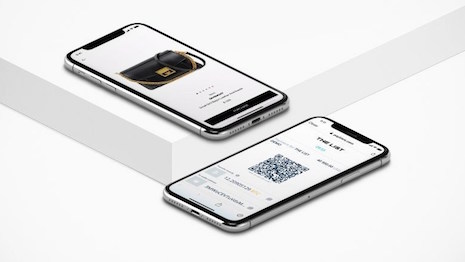

The List claims to be the first luxury fashion mobile platform globally offering cryptocurrency payment. Image credit: The List

The List claims to be the first luxury fashion mobile platform globally offering cryptocurrency payment. Image credit: The List