Fendi worked with Jackson Wang on a capsule collection. Image credit: Fendi

Fendi worked with Jackson Wang on a capsule collection. Image credit: Fendi

Streetwear brands such as Supreme and Off-White are taking off with Chinese millennials and Gen Zs, leading luxury brands to get in on the trend. While athletic brands such as Nike and Adidas still hold significance in casual fashion, luxury labels are increasingly associated with items such as sneakers. According to a report from Gartner L2, luxury brands are leveraging channels ranging from Weibo to Tmall to push hoodies and T-shirts to a digitally native audience.

"China’s millennial and Gen Z consumers are a significant force in the luxury industry, and many traditional brands are modernizing their styles to cater to the tastes of this demographic," said Liz Flora, editor of Asia Pacific research at Gartner L2, New York.

"The streetwear pivot has been a global phenomenon for luxury, but brands have also localized it for the China market with China-specific collaborations – for example, Montblanc’s special-edition backpack launched at China’s largest consumer-facing streetwear trade show YOHOOD this month and Fendi’s capsule collection with hip-hop artist Jackson Wang," she said.

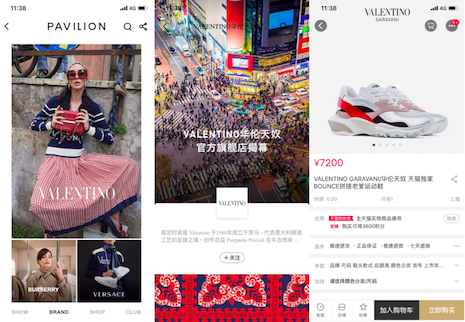

Seeking streetwear According to data from search engine Baidu, shoppers’ searches for streetwear brands grew 12 percent year-over-year. In comparison, activewear searches rose 6 percent and fashion queries increased 5 percent. While streetwear-centric brands are seeing success from the rise of casualization, so are luxury brands. On social network Red, the top five brands mentioned in relation to the “sneaker” hashtag were luxury labels. Nike ranked first, but Louis Vuitton, Chanel, Dior and Hermès followed. Gartner L2 also found that Gucci was the most commonly named brand alongside “little white shoe,” as consumers posted about its Ace sneaker. Due to the popularity of the Ace, Gucci placed ahead of Adidas. Luxury brands are more apt to use their stores on platforms such as Tmall to highlight casual clothing than they are to market streetwear categories on their direct-operated sites in China. While only 10 percent of brands showcase T-shirts, hoodies and sneakers on their direct-to-consumer sites, 27 percent have at least one athleisure category on their Tmall store. Valentino's store on Luxury Pavilion. Image credit: Alibaba

One of the key trends in streetwear is collaboration.

For instance, Montblanc worked with streetwear media and retail platform YOHO! to create a special-edition backpack, which was revealed at streetwear trade show YOHOOD.

Including Montblanc, almost one in five luxury brands have worked with YOHO! for collaborative Weibo promotions.

Valentino's store on Luxury Pavilion. Image credit: Alibaba

One of the key trends in streetwear is collaboration.

For instance, Montblanc worked with streetwear media and retail platform YOHO! to create a special-edition backpack, which was revealed at streetwear trade show YOHOOD.

Including Montblanc, almost one in five luxury brands have worked with YOHO! for collaborative Weibo promotions.

"Brands have been launching not only sponsored content created in partnership with YOHO!, but are also teaming up with the platform for product collaborations," Ms. Flora said. "This helps brands traditionally popular with more mature demographics modernize their image to reach the next generation of luxury consumers.

"Montblanc’s limited-edition backpack unveiled at YOHOOD was created in partnership with YOHO! and Chinese footwear brand Bing Xu, helping gain exposure with a streetwear audience through a strategy localized to the China market," she said.

Brands can also lean on established streetwear labels to reach a younger audience without letting go of their heritage and positioning. Rimowa teamed with Off-White on a co-branded suitcase collection. Of the luxury-streetwear partnerships studied, the Rimowa x Off-White alliance received the most engagement on Weibo. Rimowa x Off-White suitcase. Image credit: Rimowa

Along with collaborations with brands, some luxury labels have turned to celebrities to drive attention.

Italian fashion label Fendi collaborated with brand ambassador and Chinese musician Jackson Wang to merge music and design. Mr. Wang worked with Fendi creative director Silvia Venturini Fendi to create a capsule that blends his personal style with Fendi codes (see story).

Opportunity and outlook

Luxury opportunities in China cannot be overstated, with Chinese consumers expected to be responsible for more than 40 percent of true luxury purchases by 2025.

According to a joint report from Boston Consulting Group and Tencent Marketing Solution, 48 percent of true-luxury consumers in China are younger than 30. Not only are Chinese affluents still young, with the potential to build their earning power, but they are also digitally engaged at unprecedented levels (see story).

The rise of streetwear has blurred the lines between luxury and leisurewear, but the casualization of luxury may not thrive in the long-term, according to a report from Fashionbi.

Luxury labels including Balenciaga and Louis Vuitton have found success by diving into streetwear, while other brands have borrowed marketing and sales tactics such as social media drops. Expectations for streetwear remain high as luxury groups continue to invest millions of dollars into the trend (see story).

In China, there is still an appetite for streetwear collaborations.

Rimowa x Off-White suitcase. Image credit: Rimowa

Along with collaborations with brands, some luxury labels have turned to celebrities to drive attention.

Italian fashion label Fendi collaborated with brand ambassador and Chinese musician Jackson Wang to merge music and design. Mr. Wang worked with Fendi creative director Silvia Venturini Fendi to create a capsule that blends his personal style with Fendi codes (see story).

Opportunity and outlook

Luxury opportunities in China cannot be overstated, with Chinese consumers expected to be responsible for more than 40 percent of true luxury purchases by 2025.

According to a joint report from Boston Consulting Group and Tencent Marketing Solution, 48 percent of true-luxury consumers in China are younger than 30. Not only are Chinese affluents still young, with the potential to build their earning power, but they are also digitally engaged at unprecedented levels (see story).

The rise of streetwear has blurred the lines between luxury and leisurewear, but the casualization of luxury may not thrive in the long-term, according to a report from Fashionbi.

Luxury labels including Balenciaga and Louis Vuitton have found success by diving into streetwear, while other brands have borrowed marketing and sales tactics such as social media drops. Expectations for streetwear remain high as luxury groups continue to invest millions of dollars into the trend (see story).

In China, there is still an appetite for streetwear collaborations.

"Collaborations with these iconic global streetwear labels have proven to be massively popular in China," Ms. Flora said. "For the study period of May 2018 to March 2019, Gartner L2 found that the most popular luxury collaboration in terms of social engagement was Rimowa x Off-White, which received the most engagement even when compared to celebrity and non-streetwear collaborations.

"The report also finds that the collaboration also generated 94 percent of Rimowa’s total Weibo engagement for the period," she said.