Gucci parent company Kering was one of luxury’s sustainability leaders. Image courtesy of Gucci

Gucci parent company Kering was one of luxury’s sustainability leaders. Image courtesy of Gucci

Sustainability is Luxury Daily's 2019 Luxury Word of the Year for its vast influence on luxury brands’ strategies and philosophies, spanning sectors and supply chains.

Along with themes of inclusivity and transparency, sustainability has shaped the luxury business as brands cater to values-based consumers ahead of a new decade. Sustainable business practices have become an expectation for younger affluents, and luxury brands must highlight their commitment to corporate responsibility to remain relevant.

“Luxury brands don’t promote product; they match values,” said Chris Ramey, president of Affluent Insights, Miami, FL. “And in 2019, sustainability evolved from a trend to a movement.”

“Sustainability resonates with true luxury brands because they’ve always led with authenticity and sustainability,” he said. “Coupled with a newfound transparency, it was good business to accept and promote the leadership position it had already earned. “

Sustainability: The new S-word

Tenants of sustainability, encompassing any environmentally-friendly effort from carbon neutrality to curtailing use of animal products or plastics, have guided luxury brands throughout 2019.

Luxury fashion brands and conglomerates, including Kering and LVMH Moët Hennessy Louis Vuitton, need to balance their upscale identities as they move in a more eco-conscious direction.

Overall, the fashion industry is one of the world’s largest contributors of pollution, including textile waste and water pollution. Animal-based materials including cashmere, wool, silk and leather also have a large environmental footprint.

In May, Kering introduced new guidelines regarding animal welfare. The open-source standards cover all of the species that are included throughout its supply chain, such as cattle, sheep and goats (see story).

LVMH followed by rolling out a new charter on animal-based sourcing, committing to improving conditions along its supply chain. The group’s Animal-based Raw Materials Sourcing Charter covers areas such as husbandry and trapping, traceability and a respect for people, the environment and biodiversity (see story).

Perhaps most notably, a coalition of 32 fashion companies are joining forces to tackle environmental issues such as climate change, biodiversity restoration and ocean protection, seeking to scale up their individual efforts with common objectives.

Led by Kering, under the mandate of France’s President Emmanuel Macron, the Fashion Pact launched during the G7 meeting in August. While each of the pact participants has their own environmental initiatives, the project aims to leverage strength in numbers to enact change through the private sector.

Other pact participants include Burberry, Capri Holdings, Chanel, Ermenegildo Zegna, Galeries Lafayette, Giorgio Armani, Hermès, Karl Lagerfeld, Matchesfashion.com, Moncler, Nordstrom, Prada, Ralph Lauren, Salvatore Ferragamo, Selfridges, Stella McCartney and Tapestry. Pact participants are also pledging to switch to entirely renewable energy by 2030, including across their supply chains and manufacturing (see story).

Additionally, a growing number of luxury firms are launching carbon-neutral initiatives in an effort to boost their green goals.

This involves calculating the environmental impact of activities such as production, transportation and packaging. The carbon footprint that is generated is assigned a financial figure, which is then donated to ecological causes.

For instance, Gabriela Hearst staged what was said to be the first carbon-neutral fashion show during New York Fashion Week. After fashion house Gucci announced its own carbon offset program earlier this month, its parent company Kering has rolled out its own initiative (see story).

Gucci will increase its use of renewable energy to reduce carbon emissions. Image credit: Gucci

Gucci will increase its use of renewable energy to reduce carbon emissions. Image credit: Gucci

Brands have also used carbon offsets in an effort to get consumers involved.

German automaker Porsche helps drivers in the United States, Germany, the United Kingdom and Poland negate the environmental impact of driving through carbon offsetting through a Web-based program (see story). Meanwhile, Britain’s Bentley Motors is taking another step towards becoming a more sustainable luxury automaker by receiving a carbon neutral certification for its Crewe, England factory (see story).

Other sustainability pushes are more consumer-facing.

In February, British department store chain Selfridges announced its plans to stop selling items made with exotic skins within the next year, hinting at a larger sustainability push within luxury retail and fashion.

As more luxury brands commit to going fur-free, exotic leathers such as crocodile, alligator, lizard and python appear to be the next materials to be evaluated (see story).

Net Sustain features eco-friendly fashion. Image courtesy of Net-A-Porter

Net Sustain features eco-friendly fashion. Image courtesy of Net-A-Porter

Online retailer Net-A-Porter is helping shoppers indulge in sustainable fashion with the June launch of a platform dedicated to environmentally conscious apparel and accessories.

Through Net Sustain, the retailer has designated 26 brands and more than 500 products that meet at least one of Net-A-Porter's sustainability criteria. To be included as part of Net Sustain, brands and products must meet at least one attribute, such as responsible sourcing or reducing waste (see story).

Luxury hotel brands are also ramping up their sustainability efforts with support from a growing number of environmentally-minded consumers, and many have pushed to reduce reliance on single-use plastics.

Due to the sheer number of guests that hotels welcome, the hospitality industry can have a large impact by reducing or eliminating use of single-use plastics, such as small toiletry bottles or straws. Marriott International and Peninsula Hotels are among the groups moving away from supplying guests with plastic straws and small toiletries (see story).

Marriott is ditching single-use toiletry bottles

Sustainability is even influencing the experiential side of luxury.

Contemporary luxury consumers are drawn to unique experiences rather than tangible “status symbols.” Travel is one of the fastest growing areas for luxury spending, and global outbound travel is expected to rise 25 percent from 2018 to 2023.

However, the growth of tourism can have a negative impact on the environment. Increased tourist traffic can damage natural habitats, and historic sites were not meant to withstand millions of visitors.

Many consumers, particularly millennials, now have a tendency to value both experiences and the environment, and must balance these concerns.

Sixty percent of global consumers are concerned about climate change, according to Euromonitor. More than half find that purchasing eco-friendly or environmentally-conscious products makes them feel positive, indicating there is a financial benefit for luxury brands to promote sustainable practices (see story).

“Sustainability is no longer an option,” Mr. Ramey said. “It’s cost of entry for every brand that serves high-net-worth clients.”

First runner’s up: Inclusivity

In 2019, corporate responsibility also went beyond sustainability as luxury brands embraced inclusivity in their product and service offerings, as well as company policies.

Luxury marketing focused on inclusion, individuality and diversity, as brands spoke to the Gen Z and millennial audience that craves tools for acceptance self-expression.

Italian fashion label Gucci, a favorite among younger affluents, focused on products for the entry-level luxury buyer that balanced inclusivity with accessibility.

This year, the brand launched its first unisex fragrance, Mémoire d’Une Odeur, with a campaign featuring an ensemble cast led by Harry Styles. The scent is meant to reflect the shifting identities among younger consumers (see story).

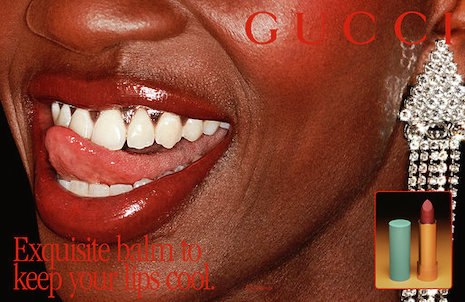

Gucci Beauty celebrated imperfections in its first campaign. Image courtesy of Gucci

Gucci Beauty celebrated imperfections in its first campaign. Image courtesy of Gucci

Taking inclusive beauty into cosmetics, Gucci also relaunched its beauty label with Coty. Marking creative director Alessandro Michele’s first beauty collection for the brand, the line debuted with a series of 58 lipsticks.

The initial campaign celebrated individuality, as a spokesmodel tells viewers to “Be bold, be bright, be beautiful.” Since the launch, Gucci Beauty has been promoted with imagery featuring diverse models (see story).

Similarly to Gucci, French fashion label Louis Vuitton also made moves towards inclusivity.

Louis Vuitton’s menswear artistic director Virgil Abloh’s true commitment to diversity allowed his first collection drop to see significant sales numbers, before it even reached the brand’s boutiques.

Mr. Abloh brought his unique approach to marketing with a new three-part campaign that focused on personally important themes that are also present in his designs. The Boyhood series ushered in the menswear collection by showcasing infancy, childhood and adolescence, stages of development in which society’s views of race and gender have not yet been imposed and kids dare to dream (see story).

Elsewhere, U.S. jeweler Tiffany & Co. expanded its offerings with the launch of new dedicated men’s collections. The Tiffany 1837 Makers and Diamond Point collections encompass jewelry, homeware, accessories, watches and more (see story).

Many luxury brands also enacted policies that support their commitment to inclusivity, some of which come after finding themselves embroiled in controversy.

Gucci is concentrating on diversity and inclusion on a grand scale by hiring a global head of diversity, equity and inclusion. The label is also launching a fellowship program in a number of schools to help become a staple in inclusion (see story).

The initiative followed a significant diversity issue. It became another luxury brand to be in hot water thanks to accusations of depicting blackface in its designs.

Gucci quickly pulled a sweater from its inventory in both stores and online, after it received backlash in its likeness to blackface. The black sweater was fitted with a rollup collar with a cutout for the mouth, outlined in red, much like a golliwog doll known to be a symbol of racism (see story).

Kering, Gucci’s parent company, is also investing in diversity by naming Kalpana Bagamane Denzel as its chief diversity, inclusion and talent officer. The hire comes amid Kering’s broader push for gender equality within its workforce and its initiatives to eradicate discrimination (see story).

The luxury group also extended its 14-week paid parental leave benefits beyond mothers, allowing fathers and partners to also take time off without losing income. Effective Jan. 1, 2020, the updated policy better promotes gender equality and work-life balance (see story).

Sephora focuses on diversity and inclusivity. Image credit: Sephora

Sephora focuses on diversity and inclusivity. Image credit: Sephora

This summer, LVMH’s Sephora also adopted a new manifesto committing to be more inclusive. The manifesto reads in part, “Sephora believes in championing all beauty living with courage and standing fearlessly together to celebrate our differences” (see story).

Another area of attention is promoting employment and access for individuals who are differently abled.

LVMH marked the International Day of Persons with Disabilities by highlighting what its various brands are doing to welcome people with disabilities (see story).

Second runner’s-up: Transparency

Encouraged by more inquisitive consumers and aided by advancements in technology, luxury brands in 2019 also became more open about their work — including sustainability and diversity efforts.

Tracing and sourcing is a major focus of transparency projects within luxury.

As consumer demand for sustainable fashion accelerates, apparel companies are ambitiously planning to significantly ramp up their offerings and transparency in the coming years.

According to a McKinsey study of chief purchasing officers, most executives foresee having half of their products fashioned from sustainable materials by 2025. The industry has a long way to go to reach this scale of sustainable sourcing, and companies will have to surpass hurdles including growing costs and material availability to reach this goal (see story).

Kering has partnered with Albini Group, Supima and Oritain to develop a more sustainable business model through 100 percent traceable organic cotton. With the help of forensic science and statistical analysis, the aim is to tackle traceability of plant- and animal-based raw material, which is a challenge for fashion’s complicated global supply chains (see story).

U.S. fashion marketer Ralph Lauren Corp. has stepped up its fight with fakes via the launch of unique digital identities that let smartphone-wielding consumers scan the apparel or accessory’s QR code for its authenticity (see story).

Southeast Asian luxury marketplace Reebonz is the latest high-end retailer to tap blockchain technology to make checkout easier for all consumers and heighten transparency. The retailer is hoping to become more transparent with its supply chain, using blockchain to ensure its products are not replicated (see story).

LVMH is also turning to blockchain to manage new requirements for its crocodilian leather sourcing (see story).

While the diamond industry is often opaque, Tiffany started the year by making a commitment to sharing details about its stones’ origins at point of sale. Tiffany’s Diamond Source Initiative will let customers know the country where their stones were mined, with plans to allow consumers to trace the production journey of the diamonds from mine to retail (see story).

Tiffany and Co. puts sustainability and sourcing under a magnifying glass. Image credit: Tiffany & Co.7

Tiffany and Co. puts sustainability and sourcing under a magnifying glass. Image credit: Tiffany & Co.7

As of May, Vacheron Constantin has been making blockchain identification available to owners of its Les Collectionneurs collection timepieces.

The digital identity enables clients to anonymously prove that they own a particular watch, helping with actions such as insuring the timepiece or reselling it. They can also use the blockchain to identify the watch as lost or stolen (see story).

“Inclusivity and traceability, among many social and moral issues have always been important in luxury,” Affluent Insights’ Mr. Ramey said. “Today’s technology is allowing luxury brands to manage it more granularly.”