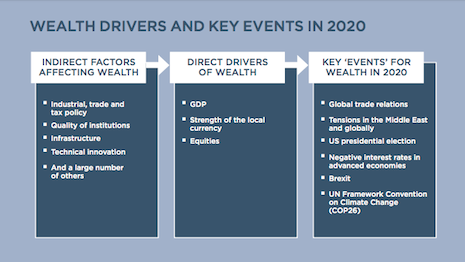

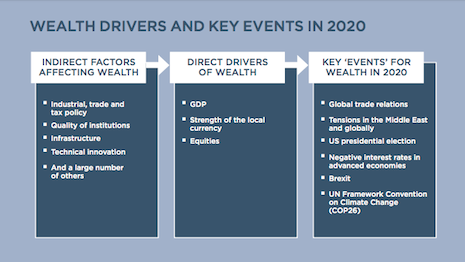

Wealth drivers and key events in 2020. Source: Wealth-X

By Mickey Alam Khan

This year looks to be one of solid expansion in the global wealthy population and their respective wealth, according to an optimistic outlook from Wealth-X.

This growth follows a very strong, but somewhat unanticipated performance in 2019, largely on the back of substantial gains in the equities market.

“The outlook for the wealthy improved over the last few months of 2019, yet worries remain over febrile global economic growth, including ongoing trade tensions, geopolitical uncertainty and unpredictable policymaking,” Wealth-X said in its report.

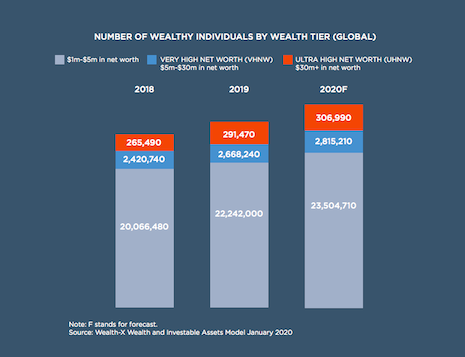

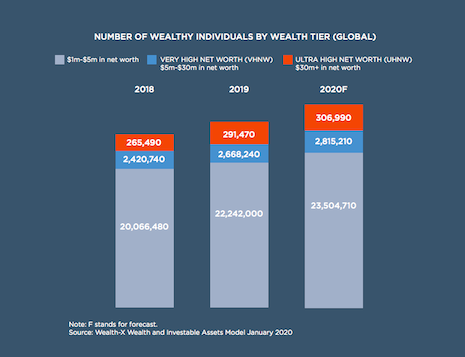

Number of wealthy individuals by wealth tier (global). Source: Wealth-X

Number of wealthy individuals by wealth tier (global). Source: Wealth-X

Numbers gain

Wealth-X expects the number of high-net-worth individuals to grow by 5.7 percent to total 26.6 million in 2020, with such individuals accounting for combined wealth of more than $110 trillion.

The data insights provider found that like the general population, wealth is distributed unevenly among the wealthy, with exclusivity rising quickly above the $5 million threshold and even more so among those with more than $30 million in net worth.

That said, growth in the number of such individuals this year is expected to be around 5 percent to 6 percent across all three major wealth tiers.

Drivers of wealth growth

Many factors influence the size of a country’s wealthy population, their respective wealth, and how that wealth is distributed over time.

Per the report, these range from the quality of institutions, to tax and trade policy and the level of entrepreneurship, among a host of others.

These factors play out to shape the size of a country’s economy, the value of its stock markets and the strength of its exchange rate. All these factors are leveraged in Wealth-X’s Wealth and Investable Assets Model to measure wealth by country on a year-on-year basis.

“Looking ahead in 2020, a variety of one-of events and trends will influence the trajectory of these wealth drivers, from geopolitics to the U.S. presidential election and how central bankers navigate a world of negative interest rates,” the report said.

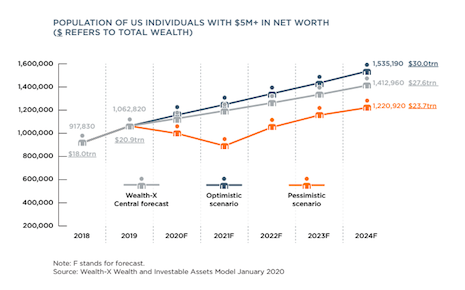

Five-year outlook for U.S. wealth

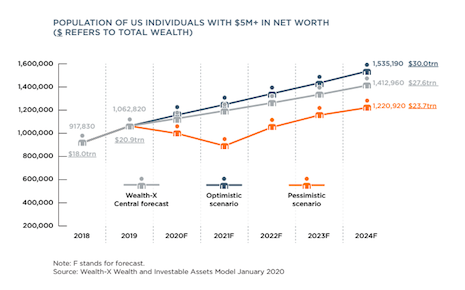

Scenario modeling shows that even a recession is unlikely to constrain wealth growth in the longer term, speaking to the resilience of the wealthy market, according to Wealth-X.

“Our central view over the next five years is for continued, if modest, growth of the wealthy in the U.S., the world’s largest wealth market,” Wealth-X said in its report.

“Nevertheless, there remains considerable uncertainty to the

U.S. outlook. Global geopolitical and trade tensions remain, alongside others such as a leveraged corporate debt market and inflationary pressures. And yet, wealth growth can perform better than expected on occasion, as it did it 2019.”

So, how would wealth in the United States be affected by a recession, or on the upside, by a better economic performance than expected?

“We have forecasted the number and combined wealth of individuals with $5 million-plus in net worth under a range of theoretical scenarios,” Wealth-X said in its report.

“Integrating such scenarios into an organization’s business planning can help ensure it remains prepared should one of these scenarios materialize.”

An optimistic scenario is that the U.S. economy performs better than Wealth-X’s current projections, alongside continued growth in the equities market.

The pessimistic scenario is of a U.S. recession similar in vein to the dot-com bubble of the early 2000s, which markedly hit the stock market but whose impact on the real economy was more moderate.

Population of U.S. individuals with $5M-plus in net worth. Source: Wealth-X

Population of U.S. individuals with $5M-plus in net worth. Source: Wealth-X

OVERALL, THE bounce-back factor is key.

“The good news is that even with a recession, our model predicts the total wealth and the number of wealthy individuals to grow over a five-year period,” Wealth-X said in the report.

“In the recessionary scenario, wealth would be impacted negatively during the recession and the following year. But once economic recovery gets underway, businesses, the stock market and other asset prices recover, pushing both wealth and the number of wealthy individuals up.”

Wealth drivers and key events in 2020. Source: Wealth-X

Wealth drivers and key events in 2020. Source: Wealth-X

Number of wealthy individuals by wealth tier (global). Source: Wealth-X

Number of wealthy individuals by wealth tier (global). Source: Wealth-X Population of U.S. individuals with $5M-plus in net worth. Source: Wealth-X

Population of U.S. individuals with $5M-plus in net worth. Source: Wealth-X