Gucci, like its luxury peers, has put on an enormous show of solidarity and altruism to help health authorities combating the spread of the COVID-19 coronavirus. Image credit: Gucci

By Mickey Alam Khan

That percentage drop of 22 percent to 25 percent is the combined revenue of what the two largest players in global luxury generated last year: $59.1 billion for LVMH and $17.4 billion for Kering.

This dire projection is based on management consultancy Bain & Co.’s one-of-three scenarios for a coronavirus-ravaged luxury ecosystem whose key markets of the United States, United Kingdom, France, Italy and China – where the COVID-19 coronavirus originated – have ground to a halt due to national lockdowns.

“Profitability will be disproportionately hit,” Bain said in its brief. “Yet there is an emerging bright spot: The Chinese market already appears to be on its way to recovery.

“As luxury leadership teams plan their next moves, prioritizing action in three areas will help companies mitigate the worst of today’s turbulence and accelerate into an eventual recovery.

“Those three pillars are ‘Govern through a new leadership framework,’ ‘Act to maximize short-term financial, operational and brand resilience’ and ‘Transform the value proposition and business model for the future.’

“In spite of the short- and medium-term impact, luxury brands can emerge from the crisis stronger, more innovative and more purposeful.”

Claudia D’Arpizio, Federica Levato, Stefano Fenili, Fabio Colacchio and Filippo Prete, all out of Bain’s Milan office, put together the brief.

The COVID-19 coronavirus cell. Image credit: U.S. Centers for Disease Control

The COVID-19 coronavirus cell. Image credit: U.S. Centers for Disease Control

Spirited response

As evidenced by

Luxury Daily’s rolling coverage, the luxury business been tuned in to the spread of COVID-19 and its effect on the economics of the sector.

The first threat came with the virus’ spread in China, a market whose consumers accounted for 90 percent of global luxury growth last year.

As the virus traveled to Italy – starting in the northern part of the country where many Chinese immigrants contribute to manufacturing luxury goods – it hit hard the brands and suppliers headquartered there struggling to operate. Then the lockdown just stopped activities in their tracks.

Now, COVID-19 is as global as the luxury business. Luxury brands and retailers have switched focus to ensuring the health and well being of their employees and customers via store closures and other measures.

Bulgari has diverted production from its partner's fragrance-making factory in Italy to manufacturing hand-sanitizing gels for Italian hospitals and research institutes battling the spread of the COVID-19 coronavirus. Image credit: Bulgari

Bulgari has diverted production from its partner's fragrance-making factory in Italy to manufacturing hand-sanitizing gels for Italian hospitals and research institutes battling the spread of the COVID-19 coronavirus. Image credit: Bulgari

The altruistic spirit is evident everywhere, with LVMH and Kering brands including Gucci, Givenchy, Bulgari, Saint Laurent and Guerlain as well as U.S. icons such as Ralph Lauren and Estée Lauder Companies contributing cash, masks, hand-sanitizing gels and nonsurgical gear to medical personnel on the frontlines of the virus outbreak.

These brands and many others have diverted production, where possible, to help their national governments, hospitals, health authorities and the World Health Organization.

“Beyond the public health crisis, the pandemic poses a serious threat to the sector,” Bain said.

“Gross domestic product, employment – and therefore spending power – and financial markets are under severe strain, with a consequent plunge in consumer confidence and willingness to spend.

“In addition, purchases of luxury goods and services by tourists will continue to be disrupted by travel restrictions and a lingering fear of possible contagion on planes and cruise ships.

“With the pandemic still developing, it is difficult to predict accurately its full impact on the broader economy and the luxury industry specifically; its evolution and duration will depend on the response of individual governments and populations. However, we can at least start to assess the immediate economic impact of the crisis.”

Garment factories slowly resume production in China amidst the coronavirus outbreak. Image credit: Sheng Lu Fashion

Garment factories slowly resume production in China amidst the coronavirus outbreak. Image credit: Sheng Lu Fashion

Penny drops

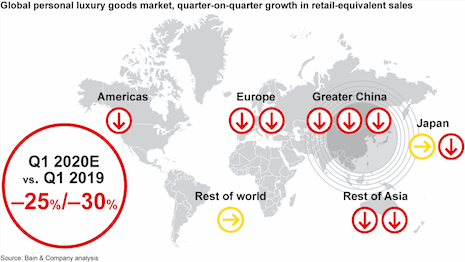

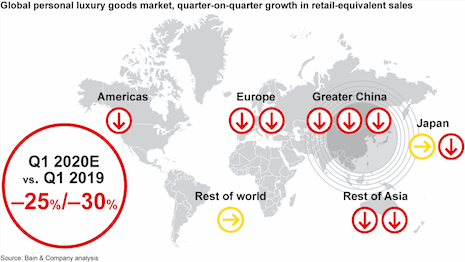

Bain forecasts a 25 percent to 30 percent market contraction in the first quarter of 2020 is based on information available March 25, including data on the spread of COVID-19, macroeconomic numbers, trading of leading luxury marketers and expert interviews conducted by the consultancy.

Given the rapid evolution of the situation – and the likely pace of future developments – there is a high degree of uncertainty about Bain’s forecast and related modeling for this year.

“That said, there’s no doubt that luxury is highly exposed to COVID-19,” the report’s authors said in the brief.

“Chinese consumers represent 35 percent of the global personal luxury goods market. And that’s to say nothing of the travel restrictions that are choking off tourism and travel retail, or the deteriorating economic outlook and its probable impact on spending power.

“With all these factors and more at play, the next few weeks are going to be critical for the sector.”

Viral creep

The luxury brand executives that Bain interviewed said that after an exceptionally positive start in January, the performance of the global market in the early part of 2020 closely mirrored the spread of COVID-19.

As expected, Asia suffered a significant sales decline, leading with China.

Nearly all luxury brands operating in China had to temporarily close stores or limit working hours, leading to steep double-digit year-over-year sales declines.

However, as widely reported here, elsewhere and evidenced by Bain, consumers are returning faster than expected to luxury stores that has reopened in China.

But the coronavirus has had a double impact on luxury consumption in other Asian countries such as Japan and South Korea, discouraging free-spending Chinese tourists from visiting and harming local consumer confidence, Bain found.

The luxury market is expected to decline by 25 percent to 30 percent in the first quarter of 2020. Source: Bain & Co.

The luxury market is expected to decline by 25 percent to 30 percent in the first quarter of 2020. Source: Bain & Co.

In Europe, the luxury market was stable for the first two-and-a-half months of the year, albeit varying vastly by country.

To wit: Italy suffered the worst as quarantines caused double-digit sales declines nationwide. Sales were up overall in France, Spain, Germany and the United Kingdom due to tourism from Russia and the Middle East and stable local demand during the early stages of the outbreak, the report said.

Not surprisingly, consumer confidence had already started to dip in those markets even before national governments instituted measures to curb the spread of the virus across Europe. Now, of course, the sentiment is deeply negative with store closures in many countries.

Across the pond, the Americas have begun to feel the full impact of the COVID-19 outbreak.

While a decline in predominantly Chinese tourist spending did not affect luxury sales through mid-March, the positive trend turned negative as most luxury marketers shut their stores in the United States and Canada.

As pointed out by Bain, the drop in air traffic from Asia was only partly offset by continued tourism within Europe and the Americas. Discounted and ecommerce saw a boost.

“Off-price sales of luxury goods grew, partly because full-price sales are still dominant in hard-hit Asian economies,” Bain said.

“Online sales experienced double-digit growth in Europe and the Americas, and only a limited slowdown in Asia.”

Ralph Lauren's call to arms as the world grapples with the COVID-19 coronavirus outbreak. Image credit: Ralph Lauren

Ralph Lauren's call to arms as the world grapples with the COVID-19 coronavirus outbreak. Image credit: Ralph Lauren

Three scenarios

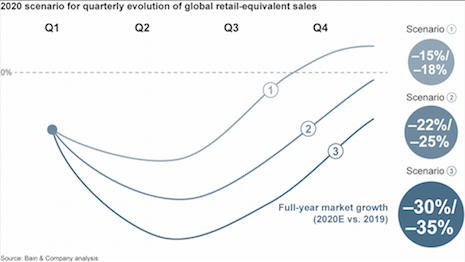

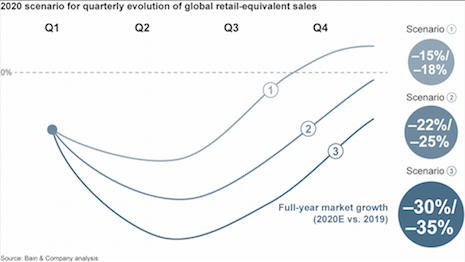

Bain sees three scenarios emerging for this year.

Consumption of luxury goods has held up in past crises. The 2002-03 SARS outbreak – again in China – was not damaging to most bottom lines since the luxury business was not that dependent on Chinese consumers at that point of time.

Even after the Great Recession of 2008-09 brought on by the U.S. housing market crash and resultant global financial crisis, increasingly wealthy Chinese consumers kept spending when Western demand lulled.

But there are key differences this time.

Chinese consumers are much more affected by COVID-19 than they were by the credit crunch in the last decade. They are not likely to ride to the rescue as they did the last time round, and there is no other emerging cohort of luxury customers to tap, as Bain pointed out.

The fear factor over COVID-19 is also greater than previous crises, hitting financial markets that yoyo up and down. The virus has hit the global economy hard with job losses – 3.3 million U.S. residents filed for unemployment in the past few days – and GDP declines worldwide.

Moreover, luxury shopping by travelers will take longer to recover as countries maintain restrictions on travel to curb further waves of the virus outbreak. Add to that the consumer nervousness over flying and cruising.

Based on these factors and the information available, Bain has modeled these scenarios for the luxury business globally this year.

In the first, a mounting recovery in demand in the second half of the year limits the overall market contraction to 15 percent to 18 percent for 2020.

The second scenario would see the market drop by 22 percent to 25 percent, staying in negative territory through the fourth quarter of this year.

In the final scenario, the luxury market would drop more precipitously between 30 percent and 35 percent due to a more prolonged period of depressed sales.

“In all three scenarios, profit would suffer a steeper decline than sales,” the Bain brief said.

The personal luxury goods market could contract 15 percent to 35 percent in 2020. Source: Bain & Co.

The personal luxury goods market could contract 15 percent to 35 percent in 2020. Source: Bain & Co.

Now, this modeling is based on the information available so far, reflecting assumptions for the duration, geographic depth and intensity of COVID-19, as well as other variables such as expectations for GDP, consumer confidence and macroeconomic indicators.

Additionally, Bain’s scenarios factor in immediate lost sales and the delayed effect of fewer wholesale orders from department stores and retailers.

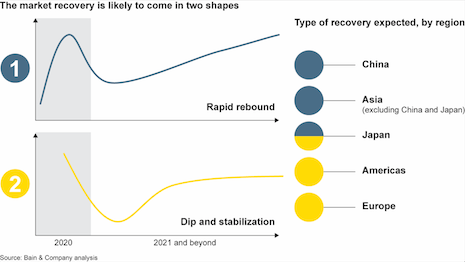

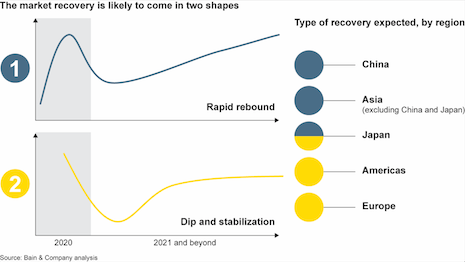

“We expect that the pandemic will continue to reverberate through the industry in 2021,” Bain said.

“Some countries will likely experience a rapid rebound while others will see more of a ‘dip and stabilization.’

“China and the broader Asian market could experience the strongest recovery; Japan, Europe and the Americas could feel a more prolonged impact, depending on how the real economy fares.

“Nevertheless, we think that medium-term market growth will be supported by demand from the Chinese middle class, an increased appetite for luxury goods among millennials and their younger counterparts in Generation Z, and the digital channel’s continued maturation.”

Not all sixes and sevens

Bain sees six consumer trends emerging or solidifying in response to the coronavirus-induced crisis. In its words:

- More China: Luxury shopping is likely to restart first in China if the virus remains under control there. Continued restrictions on travel will mean that many purchases that would have been made abroad will happen in China.

- Accelerated shift to digital shopping: When safe, consumers will return to physical stores, possibly with a renewed passion for in-real-life experiences, but some digital shopping habits built during the outbreak will stick – especially if brands raise their game in online assortment, user experience and digital marketing.

- Heightened environmental and social consciousness: Consumer concern about sustainability and social issues is set to continue, consolidating the importance of environmental and social governance. Enlightened brands may rethink the end-to-end product life cycle, supply chain management and disposal of unsold stock.

- Rise of a post-aspirational mindset: Ethics will become as important as aesthetics as consumers prioritize purposeful brands.

- Strengthened local pride: Public opinion during the outbreak has sometimes stigmatized certain nations, triggering assertive displays of cultural pride in those territories. Brands need to avoid inflaming these local sensitivities.

- Expanding need for inclusion: Brands will need to use all their ingenuity to revamp their offer at accessible price points, reflecting the reduced spending power of many middle-class customers.

The luxury business will continue to feel the impact of COVID-19 in 2021 and beyond. Source: Bain & Co.

The luxury business will continue to feel the impact of COVID-19 in 2021 and beyond. Source: Bain & Co.

Bounce back

Regardless of the ongoing crisis, Bain is optimistic that the global nature of luxury again will work in its favor.

“The scale of the disruption caused by COVID-19 has little precedent – in peacetime, at least,” the report’s authors said.

“Unlike the 2008–2009 financial crisis, there is no new pool of luxury consumers to compensate for the drop in spending by established consumers.

“The worldwide scope of the outbreak is particularly bad for luxury, one of the most globalized industries on the planet. It has shut down several growth engines that had powered luxury brands to ever-increasing heights over the past two decades, most notably Chinese consumption, both in China and at tourist destinations throughout the world.

“We don’t think that will be a permanent state of affairs, though. Luxury’s global reach should become a strength once more when the current situation has stabilized.

“Brands can even emerge from the crisis stronger. Lessons in resilience learned in the dark days of 2020 can power a sustainable recovery in 2021 and beyond.

“This crisis may be transforming the luxury industry for good, but it could also be a transformation for the good.”

Gucci, like its luxury peers, has put on an enormous show of solidarity and altruism to help health authorities combating the spread of the COVID-19 coronavirus. Image credit: Gucci

Gucci, like its luxury peers, has put on an enormous show of solidarity and altruism to help health authorities combating the spread of the COVID-19 coronavirus. Image credit: Gucci

The COVID-19 coronavirus cell. Image credit: U.S. Centers for Disease Control

The COVID-19 coronavirus cell. Image credit: U.S. Centers for Disease Control Bulgari has diverted production from its partner's fragrance-making factory in Italy to manufacturing hand-sanitizing gels for Italian hospitals and research institutes battling the spread of the COVID-19 coronavirus. Image credit: Bulgari

Bulgari has diverted production from its partner's fragrance-making factory in Italy to manufacturing hand-sanitizing gels for Italian hospitals and research institutes battling the spread of the COVID-19 coronavirus. Image credit: Bulgari Garment factories slowly resume production in China amidst the coronavirus outbreak. Image credit: Sheng Lu Fashion

Garment factories slowly resume production in China amidst the coronavirus outbreak. Image credit: Sheng Lu Fashion The luxury market is expected to decline by 25 percent to 30 percent in the first quarter of 2020. Source: Bain & Co.

The luxury market is expected to decline by 25 percent to 30 percent in the first quarter of 2020. Source: Bain & Co. Ralph Lauren's call to arms as the world grapples with the COVID-19 coronavirus outbreak. Image credit: Ralph Lauren

Ralph Lauren's call to arms as the world grapples with the COVID-19 coronavirus outbreak. Image credit: Ralph Lauren The personal luxury goods market could contract 15 percent to 35 percent in 2020. Source: Bain & Co.

The personal luxury goods market could contract 15 percent to 35 percent in 2020. Source: Bain & Co. The luxury business will continue to feel the impact of COVID-19 in 2021 and beyond. Source: Bain & Co.

The luxury business will continue to feel the impact of COVID-19 in 2021 and beyond. Source: Bain & Co.