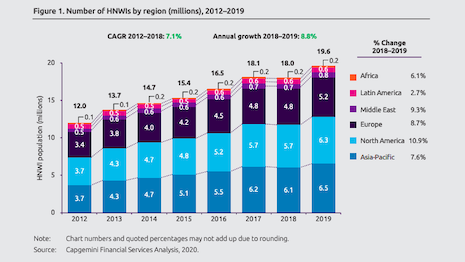

Number of high-net-worth individuals (millions), 2012-19. Source: Capgemini

Number of high-net-worth individuals (millions), 2012-19. Source: Capgemini

North America in 2019 overtook Asia Pacific in high-net-worth individual wealth growth for the first time in eight years. And then the COVID-19 coronavirus struck, traveling from the central Chinese city of Wuhan to the rest of the world, injecting uncertainty and instability.

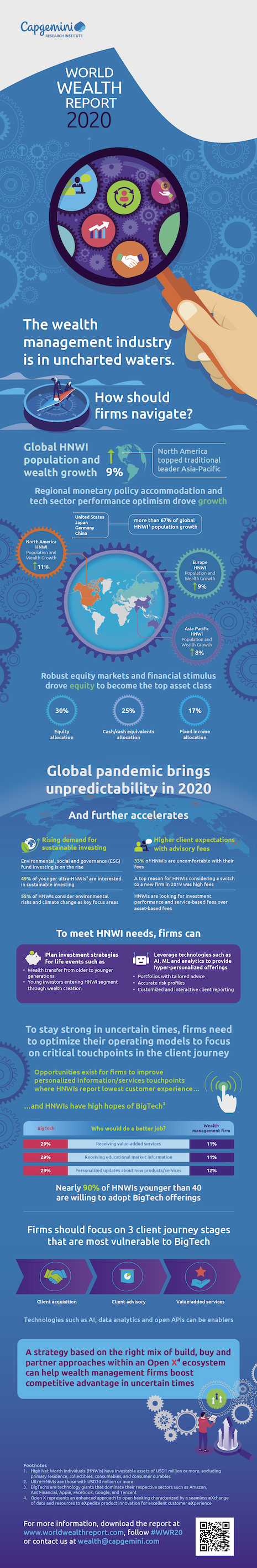

Capgemini, while acknowledging the current reality, pointed out in its newly released 2020 World Wealth Report that HNWI wealth and population last year grew worldwide by almost 9 percent despite a global economic slowdown, international trade wars and geopolitical tensions. North America and Europe took the lead, with around 11 percent and 9 percent growth, respectively, surpassing Asia Pacific’s 8 percent for the first time since 2012. All bets are off for this year, though.

“With increasing volatility, the wealth generation will be more uncertain,” said Chirag Thakral, deputy head of market intelligence and financial services at Capgemini, New York. “With consumers looking to save more and spend less on luxury items, it might dampen the wealth generation, but it is difficult to predict the extent of it.

“From a HNWI behavior and wealth firm perspective, in line with the trend for shift towards ESG [environmental, social and governance] investing, in a volatile and uncertain future, investors could see this as an important criterion closely tied to business performance of firms,” he said.

Smart money on ...

Indeed, the boom of 2019 has been overshadowed by COVID-19-induced uncertainty, causing the International Monetary Fund to project a 4.9 percent drop in global wealth this year.

According to reports from the World Federation of Exchanges, COVID-19 erased more than $18 trillion from global markets in February and March, before a slight recovery in April.

Capgemini, in its new report, forecasted a decline of between 6 percent and 8 percent in global wealth until the end of April, compared with last December.

More importantly, investment priorities have also shifted. Sustainable investments that uphold environmental and social priorities are gaining significant prominence post-pandemic, the consultancy said.

Capgemini's World Wealth Report 2020 highlights. Source: Capgemini

Capgemini's World Wealth Report 2020 highlights. Source: Capgemini

Here, in this in-depth interview, Capgemini’s Mr. Thakral discusses how high-net-worth individuals worldwide are evolving their attitudes to wealth generation, effect of COVID-19 on wealth management, how sustainable investing may be here to stay and what all of this means for wealth managers as BigTech encroaches on their turf. Please read on:

What accounted for North America and Europe taking the lead from Asia Pacific after eight years?

Equities in North America made robust Q4 2019 gains as trade uncertainty faded in December when the United States and China rolled out their Phase One trade deal.

The markets benefited from measures taken by the U.S. Federal Reserve to pump billions of dollars into the financial system after tumult in mid-September. They also were aided by optimism surrounding technology companies.

In Europe, European central banks supported Eurozone stock markets by stepping back from tighter monetary policy.

Economically sensitive sectors such as manufacturing and information technology performed well, but safe-haven consumer staples and real estate sectors were also top performers.

At the same time, despite robust market performance from key Asian markets – Hong Kong, China and Taiwan – some major Asian markets of India, South Korea and Singapore recorded weak progress in 2019, which led to sub-par growth in HNWI population and wealth for the entire region.

This was the result of economic slowdown and weakening local currencies in these markets.

Obviously, much has happened in the past few months, with the COVID-19 coronavirus devastating lives and livelihoods. How will this reshape high-net-worth individuals' investment priorities?

As 2020 unfolds, there has been unprecedented impact of humanitarian crisis leading to severe social and economic impact.

With respect to high-net-worth individuals (HNWIs) and their investment, two key shifts have happened/expected to happen.

First is the investment behavior is in terms of asset allocation.

Our analysis of asset allocation trends over the last few years showed that HNWIs tend to invest more in equities after a year of wealth growth and shift to less risky assets such as cash and cash equivalents or fixed income after a year of wealth decline.

For example, when the wealth declined in 2018, HNWIs moved to cash and cash equivalents as the top asset class in Q1 2019.

With 2020 being a volatile year, wealth management firms can prepare for potential asset allocation shifts next year too.

Another trend coming out of the most recent COVID-19 crisis is a further impetus to the already rising interest in sustainable investing [also known as ESG – environment, social and governance investing, or ESG].

Since the beginning of last year, UBS' 100 percent sustainable investment portfolio in Asia more than doubled its assets to $1 billion and demand has been up since the COVID-19 outbreak.

ESG-based [environmental, social and governance] equity strategies have been beating broader benchmarks in 2020, boosting HNWIs’ faith in sustainable investing products.

In some ways, ESG scoring has also helped highlight firms who have more robust governance and other business policies to weather disruptions such as the present crisis.

Asia Pacific seems to have handled the pandemic better than the United States and Europe. Will the pendulum swing back this year?

This is something that is becoming more difficult to predict in today’s age of real-time information and hyper-connectivity where markets are showing unusual trends.

2019 is a great example – despite unfavorable economic conditions, HNWI population and wealth increased robustly in 2019 due to optimistic stock markets.

From our analysis of the stock market performance of key countries in the first half of the year, the markets in Asia Pacific seem to have revived better, but anything is possible in the rest of the year depending how the other macroeconomic variables evolve.

What long-term impact will the pandemic have on wealth generation globally?

With increasing volatility, the wealth generation will be more uncertain.

With consumers looking to save more and spend less on luxury items, it might dampen the wealth generation, but it is difficult to predict the extent of it.

From a HNWI behavior and wealth firm perspective, in line with the trend for shift towards ESG investing, in a volatile and uncertain future, investors could see this as an important criterion closely tied to business performance of firms.

Thus, ESG considerations could become more central to investment decisions and will become a key offering from wealth management firms.

It is also likely to increase HNWIs’ scrutiny around advisory fees.

Our report revealed that HNWIs were already expecting more value delivered for the fees charged and preferred more performance-based fee structures.

How should wealth managers advise their clients in this environment?

Wealth management was, is, and will remain a relationship business, and it is all the more important in this volatile scenario that wealth managers work with their clients to help them navigate this uncertainty.

The key is to be in constant touch with the clients while providing value-add services beyond just wealth management in these times of need.

Sustainability seems to be the general direction where everyone is heading: manufacturers, consumers and investors. Will the move last, or the emphasis change once the health and economic climates stabilize or even normalize?

Even before the crisis started, our survey which was conducted just before the crisis in March showed that HNWIs will commit more assets to sustainable investing, with 41 percent of HNWIs planning to allocate 41 percent of their portfolio to sustainable investing options/products by the end of 2020, and 46 percent by the end of 2021.

While the pandemic accelerated this trend, it is expected to continue post the stabilization also.

What do high-net-worth individuals perceive as the biggest threat to their wealth?

We have not analyzed this angle in this year’s report, but based on past reports we know that uncertain and volatile economic environment is one of the most pressing threats keeping HNWIs up at night.

Are the world's wealthy looking at alternative ways to grow their wealth?

There has generally been a trend towards alternative investments such as private equity, hedge funds, etc., which becomes more prominent in volatile times as that provides a hedge against the traditional asset classes.

At the same time, one key finding we uncovered from the report is that 40 percent of the HNWIs investing in ESG or social impact investments do it for higher returns and hence that is also an avenue that many HNWIs are exploring.

Big technology firms may encroach on wealth managers' turf. What is their edge over the traditional way of managing client wealth and how can they potentially offer services that are equally alluring to the affluent?

HNWIs expect BigTechs to deliver personalized information or services better than incumbent firms.

As per the report, the top five touch points in which HNWIs believe BigTechs can outperform incumbent firms relate to information access or value-added services.

This is not surprising, when you consider that more and more digitally savvy HNWIs seek and prefer to receive information via online channels.

Self-service through Web site emerged as the top channel of preference for HNWIs when it came to firm or product research, receiving updates and executing transactions.

HNWIs’ warm and fuzzy perception of BigTechs is especially concern-inducing when reflected in tandem with their openness to wealth management offerings from BigTech firms.

While 74 percent of HNWIs said they are willing to consider BigTech wealth management offerings, the number jumps to 94 percent among those who say they may switch their primary wealth management firm in the next 12 months.

So what should wealth managers do going forward to retain clients and also grow their wealth in the midst of uncertainty?

In the face of today’s unprecedented uncertainty, wealth firms that revisit their cost and clients’ fees structure and distribution channels can build more resilient and agile business and operating models.

To do this, firms can maximize the impact of their investments through a laser focus on capability building to identify the critical 20 percent of the value chain that impacts 80 percent of CX [customer experience] and profitability (80/20 principle).

As per our analysis, acquisition, advisory and value-added services emerge as the critical 20 percent for clients and majority of firms’ future growth as emerging technologies enhance internal capabilities in these areas.

However, each firm will need to dig deeper to decide on their critical 20 percent.

Finally, embracing firms can prioritize capability building in critical focus areas by leveraging collaboration with wealth management ecosystem players such as BigTech and Wealthtech firms to quickly and cost-effectively fill gaps.

Please click here to download the PDF of Capgemini’s World Wealth Report 2020