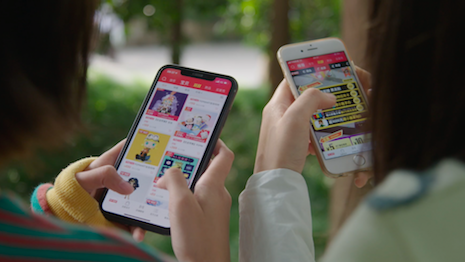

Chinese ecommerce is helping sustain luxury brands during the pandemic. Image credit: Alibaba

Chinese ecommerce is helping sustain luxury brands during the pandemic. Image credit: Alibaba

NEW YORK – Chinese consumers have helped buoy luxury brands as many face months of falling sales due to the coronavirus pandemic and global lockdowns.

In a fireside chat at the Future of Luxury eConference on Sept. 23, one of the founders of China Luxury Advisors shared what the market’s recovery can teach brands and marketers. Although the pandemic did change some consumer behaviors, it has mostly expedited trends in luxury.

“China is largely back to normal from a virus standpoint,” said Renee Hartmann, cofounder of China Luxury Advisors, Los Angeles. “People are having events, they're having parties — it’s a different world.

“It is providing us a model of what things are going to look like in the rest of the world when everybody else kind of comes out from the virus,” she said. “What is a post-virus world going to look like? China is probably the closest example we have for that.”

Future of Luxury eConference was produced by Luxury Daily

Luxury interests

While a significant number of Chinese consumers buy luxury goods while they’re traveling, in 2019 the market’s luxury consumption was still growing, albeit slowly, both domestically and abroad.

In early 2020, China was the first country to be impacted by the pandemic in the lead up to the Lunar New Year. However, it has also been the first to emerge from lockdowns, well ahead of other major economies.

Brands have resumed their offline initiatives such as pop-up stores and launch parties in China to celebrate this year's Qixi Festival. Image courtesy of Prada

Brands have resumed their offline initiatives such as pop-up stores and launch parties in China to celebrate this year's Qixi Festival. Image courtesy of Prada

China Luxury Advisors has been tracking Chinese consumer sentiment over the course of the pandemic, and has seen attitudes shift from concerns about wellness and stress management to a slow “reversion back to normal.”

“From an attitude standpoint, still a majority of people do want to reduce stress, they still do want to work on meditation and self care, but that’s going down over time,” Ms. Hartmann said. “What we're seeing come up is, I want to explore, I want to be successful, I want to try new things.”

The lockdowns did not wipe out demand for luxury goods, with beauty products, handbags and jewelry among the strongest categories. The largest luxury brands, such as Chanel, Gucci and Louis Vuitton, have also built momentum since the onset of the pandemic.

While international travel remains restricted, Chinese consumers are still relying on daigou to import luxury goods into the country — particularly as many brands discount products to move inventory.

“I think there's still some cachet to buying overseas, whether it's you know on the beauty side — maybe it's a different makeup formulation — or maybe there are different perceptions in quality overseas or different types of products than you can get in China,” Ms. Hartmann said. “So there’s always going to be some demand for buying products outside of China, even when you can't travel.”

Ecommerce shopping has grown while Chinese shoppers are unable to travel abroad. Image credit: Alibaba

Ecommerce shopping has grown while Chinese shoppers are unable to travel abroad. Image credit: Alibaba

Outbound travel from China had exponentially increased in recent years. Luxury retailers have catered to affluent Chinese, who aim to purchase luxury goods while traveling abroad, but increasingly tense relationship between the U.S. and China has already had an influence on tourism in the States (see story).

With the U.S. still struggling to contain the virus, Ms. Hartmann predicts Chinese tourists will first return to other Asian countries and then Europe with a slower recovery in the U.S.

Digital in China

Luxury brands are also heavily relying on ecommerce, particularly marketplaces Tmall and JD.com, to reach Chinese shoppers. Gen Z consumers in particularly are looking to interact more directly with brands.

“Everything in China has always been brand-first, product-second,” Ms. Hartmann said. “It’s always a brand-first experience.”

Ms. Hartmann predicts this year’s Singles’ Day, held annually on Nov. 11, will see record sales.

Last year, Singles’ Day generated sales of $58 billion, up 31 percent from 2018. With sales surpassing those of Black Friday weekend, luxury brands can look towards Singles’ Day for inspiration at cutting through the noise to reach Chinese shoppers.

Live streaming and virtual voice assistants are two of the digital tactics brands used to engage Chinese consumers leading up to the shopping holiday (see story).

“Even before COVID, the Chinese retail market was so much more digitally advanced than the rest of the world,” Ms. Hartmann said. “It's going to accelerate that digital acceptance even more.

"China can become a playground for people to look at and ask what worked in China, how can we bring that globally and how can we use that as a way to drive these accelerations happening on the digital front,” she said.

“You still have to adjust for the local market, but to use that for the idea generator and see what works and what doesn't work and how you can bring that to life outside of China I think really will change things.”