By Tammy Smulders

There is much talk in the fashion and luxury industry of the multitude of discounts and sales that the luxury consumer is growing to expect. This culture of discounting, which initially emanated from United States department stores, is rapidly spreading to Europe and Asia, thanks to the globalization of ecommerce in recent years.

Post-Black Friday and into the holiday season, retailers are evaluating their discounting policies. The question is, are these really discounts?

Bagging rights

The juxtaposition of the inflation of luxury goods versus discounting shows a direct relationship between discounting and price rise. This demonstrates that, in fact, luxury goods are actually on sale for the regular price.

Luxury and fashion brands are increasing their suggested retail prices, and then re-aligning prices to the righteous price via discounting.

Over the past decade, the basket Recommended Retail Prices (RRPs) for designer fashion shows an inflation rate of designer fashion of nearly 60 percent, according to the U.S. Bureau of Labor Statistics.

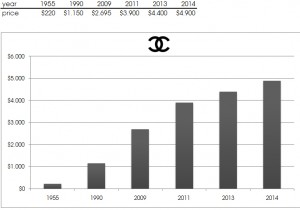

BragMyBag, a handbag blog, has mapped the price of the Chanel Reissue 2.55 with the equivalent Chanel Medium Classic Flap Bag over the years. In just the last five years alone, the price has increased by 52 percent from $2,695 to $4,900.

Chanel price increase chart Source: BragMyBag

Chanel price increase chart Source: BragMyBag

By comparison, the U.S. Consumer Price Index (CPI) has risen by approximately 33 percent over the last decade – a substantial increase, but a far cry from the 60 percent seen in the thriving luxury goods market.

Thus, the price of designer fashion and accessories has increased substantially above the CPI. That is where discounting comes in.

Luxury retailers have increased the price of products by approximately 20 percent more than the CPI, and are compensating by discounting about half of their products sold by between 20 percent and 60 percent, thus making up this gap.

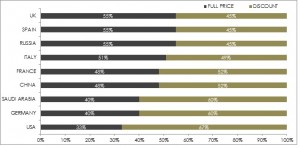

The Havas LuxHub Luxury Survey, released earlier this year, shows that in the United Kingdom, only 55 percent of designer goods are purchased at full retail price, whereas, in the U.S., only 33 percent of luxury and designer goods are purchased at full price.

Across the nine markets included in the survey, only 45 percent of luxury goods are purchased at the full retail price.

Percentage of luxury goods purchased at full price vs. discount

LuxHub Luxury Survey chart

LuxHub Luxury Survey chart

While there is an emergent culture of discounting, the shorter lifespan of the fashion collection, and the focus on mid-season collections including cruise and resort, has forced retailers to take markdowns deeper and more frequently.

Making cents

Discounting is taking many forms.

Ecommerce has certainly enabled price comparison and enabled consumers to hunt for discounts on a global basis.

In recent years, the upshot in popularity of discount designer destinations, both online (The Outnet and Gilt) and offline (Woodbury Outlets in the U.S. and Bicester Village in the U.K.), have whetted the consumer’s appetite for luxury shopping at a discount as brands and retailers use them to clear stock on the merry-go-round of collections.

While some luxury brands such as Louis Vuitton and Hermès have steadfastly resisted any form of discounting or outlet presence, consumers can always count on the likes of Ralph Lauren, Prada and Coach to offer attractive deals year-round at these alternative shopping venues.

In November 2015, retail analytics company Edited estimated that in the U.K.’s online luxury shopping market, 36 percent of products online were discounted.

Consumers today are savvy – they shop around for the best deals and scour the net for online coupon codes.

Several luxury shoppers also have no qualms purchasing past season luxury goods at a discount by waiting for a product to go on its end-of-season sale, or purchasing off-price at the brand’s sample sale at department stores such as Saks Off 5th or online at one of numerous sites.

One may go so far as to argue that consumers today are conditioned to shop only when they feel like they are getting a “deal.” But is that deal-finding phenomenon really playing out?

LUXURY BRANDS may well have latched onto consumers’ behavior astutely and devised a nifty solution that simultaneously maintains their brand image and fills their coffers: by raising the prices of their products to a premium now to provide a “cushion” for discounting later.

In other words, this cushion is the difference between the increase in the CPI and the increase in the RRPs of designer fashion.

The result of this little bit of ingenuity: a neat, clean and win-win solution for both brand and consumer.

The brand attracts the consumer and her resulting spend, while the consumer gives herself a solid pat on the back for scoring a deal.

Tammy Smulders is managing partner of Havas LuxHub and SCB Partners, London. Reach her at [email protected].

{"ct":"7TYkDW6l0MhSW8WkSqirNfoWpm01ohvudtuDz7DxCIinOPccJyuRqKj6w2bmgSLCv5VEjhDWCF805p\/AKbooFYju1uS85ytvt1BZQmPooTUZZy1uhnTGAjb+M+f31kZXwzYvezz5t2O+dL\/\/wKy7N6tCdWj9ukxxrFZWnC2D1Cr1f6RUnGDawul3R9C\/C5GUcj1SD4pnRrCPXESc446K5k0L9cxVDwonteN7GBDuXoKluuZsqvUoFcsmk171yY84ohkgGnBAcrlGZeB8FKseF3w7ernWPC1WgpPAEsvyzT2w+f3X2K87m89sz9vGOT4n6DdPYfZWFvuQN2jHL5yFzdC6lKf2IkooQPpInmcGrJy3wj0UTrvz\/hb2c2a5q\/7oOIVokwYabeiaO\/YMcUy\/YkforhSiZy4RUw+aOBj2qQIdCkpR0O332LuN8ZDTEON5\/Z6IW3cegtTneydypq0cRK85zeAn8YreQECkZi86ZuD7QX\/KHdI\/u0hILWTGOSv3ID1CVpHOHQyZ\/eIKJpMgQeJCq+wj95JibRdkjIwJ7eS2YusT5cVVsHiVqrQ8gjxhdFCKD4iciw\/xx0Opf8iLOlLNx+G4JMwplrWk8Yq4viGRuwut8PjEUxQ175FAmw7ug0pC8M3OTWyTqzN04zBhmZF\/NYUpsWw3rlGkw\/gJEKZL5TEYJIgutf3woydGmqnxVpm6faxwb4eSyezChjFwVAUg1RGrsoQReZUEOM3TWZRFTEDrXe2knvRgnl+gT2VgwwFncDjK++LsxOdg5Zm0H2j176AfY8s3lHcb47MHgEx2oVk0bgzC+q\/eSMk\/6N6JZhqdBa+qqhDcG5PXdLjoneVCOAxusGJGvWs+oKekvXgR7fA7UtJKHvepQh4Gu8NI\/evvebxR7MB1VrT5FVJm2yBz4\/Sem+vGaI09tNNPxQ7VAcVeIbD5klmn8Va7Lt1sjQkYjKU31AavAqJhlEsymQznlud0iGaGSLU8rwOrP10yscHkb\/ttsfllf82EZ\/QCHwtKGtJ5tX8kil\/roFxL3tbzSH2UaemeJ2g1W4BMRgDuJFVjUUO7GnYakwLhj7ateLeQ\/0Ad0THon6GLouHAYneP9jZTZ3PP+iB5YBNrwcluS0F5DZLoPjutWfTkdoum+XWnNrZPAbpkWFhj5\/oFAJfX3bKjoc4VdZp1yybpvn2X9NctbB5RivGZM6TfHWJtnGEbp41\/qO5slWwYNdYfqpyTjAdNhtkqr3iEp8LcM1NVgOXoquiEnOBM75Durx7rCW2UvBbqFdsWxrnxrWBwPLb+L2QAN1G4P5LnizvKg41fIQ80biFJbeOIwlykxsrRF9ivVfZYVRMPxxjtzk9uWXIjQhViCjVhxIgN5tmGFnpGrGE01DBYhlkRqjfRlyNU2eBi0FGjUWRUEesCJqMZPoAB8mbwXfimygFWy8CEOHa2zb\/RH1eRebJ8cP33IsBPd7dPBNQdaxMzEN9Ca7W3G+YGXsXhy4U4QSQgOhhdflSVC8N6JZRai5tIEFzTM8TP6bwQM+KoALKX1ANPbw+Brr3YbJGQSSD5iosOBPnlCKA8pGxFisWq47d1v0L+aKy8lztFpmx7catHoM\/qYDsKZ\/PCcsio6v2XnOUu6bu8vRHu\/IAKZhxAyfdZ9xO4bmT4jZB\/84hP8q73Ls\/H6pH+e\/5aeJ2RFfWEoknz2nUWUpzno4UC9nZp6ZJXDEVbHS5w8Of9A79i+Lxi2PUs60RmQAN+S1RPDbyPoUfBvc17tE2griM1SLYLta+iEQuH0VMnFr9CH3gLZHU8+W4FHLob3w0PUYYn2sg+T9fUngdl5K9z7dFWs\/S4qol4zDkYKZU36oe6USwK4\/h6SOD3BxuonhH3FAzYCRr9+mxIV4L6ER3BasILou90vthoxRzy7r+HnTY7UEu7XdjxlF98d+yVUiRmyrNGukGFTTPl6nlIjuNeAY5u4UOc6CpOziKmtUap4NrqpB5K93Muvq1Hz7f6n+UppL\/7KFg1g9TlI1berrL5RqUp4QpWAZQXTRMwzE8AwIWzs8KAVWzev1YhuLDO6rSnfmElYVhwqdV39i0kuTIJc+\/I22WDFNX7ELz1rrDJKSo0W\/j37yVpPu0b\/cmfsDJfb4F\/d5JnMbo2eSXx8mgyQU8PDb4S2niatUed9S2YYAqNMzm763TKw+xPqARBhJca9FDOlCzETj+\/ObQ9QRJLRvftXzHE6NQjIG3PVtxCJHtYd10KYHiQJhbaYzO5am8xuiKYfxftsZ1rrw5ppEkDpFR0PKr2sEkVQwTEgOudvYDOw2GeDOBYhbhRU\/p5ywcU1f0nTh2d7lrUnvZ6VTqVO19as0jO+DUb0\/9SM8tOqJFSh3fRLOi6nPREGuZSbmzWpIUJNyA5ygitgTgH8wNa+jYlQq6TE54Jvn7+VT\/D+HEfkojch6SbE1x2avnjMTqeHwUBe3TsaSgzsl6DzeFtmRqc8ZDJGoymsORHMmA7hTdARO+jzeJODX6arVaHXccU56nS+Urnt4w4r3ltXoyGqjm5\/65JmhsHFiK893Dt20pJU4LrSwY8cbZeV5kWSuzbHTkF5o1rwguOVfzRLbIdjxulF6v6NtCndJuvzngIvvFL3S8NHDWrQAZi1oxMNVTWKtQrWGAKIncYo1SbSmMtx1I+VI4\/7Sg3CVbzmOdRPzGcrdZXK8EK15hPKtWPKMm+Wh10j4trl4f+O\/KIH+p76YB3HTEU+J4erG43MeVr9vPHMemGInkgYcd2h5YKUjd+XbOInCpDo+ogfTMYNTQTKm3XClNT7CCbfxHsKlx1TeCQGMpUUliYv8YbiGaFshHcyfEg5EzA2B2Lfun+7SWHWAsDnsWTzZX4m+px11PaiA4csbEAE\/+kp2zSS0uHTP5AGJChzIp6j1ymGZk9XE6NFr9vaXxCuPOHWx1X44vKngttYkS+nC\/\/IdGxDGHSCrlm1lMiswz4gKVORZKU+jqnjsZ1Jjf+KIazq4QSwr8iBcIf0doHa9Mpm11qXM4omWkjTf++b7AVPdKXtb5HdiZFibz3hxSvXrF9YKAEK7Jr0fEu58imJqOsHoHsB3zqwAAK3idUmCox3HCt91vKdXc3av\/QsoYtmtRx\/e4OHFMu1xdMFAV3W40ap3SggN2B2PVaOTLRvMvDIBGU6lHJRT7Gj4qdK2nIhMtS1DDZrmKHTU9sGqwJz663WLvvoOw4Yi\/Vhac8XxlL76+QcfVR6GZTOXUwfINYF4Vr8YlzBjMgRZ\/t3G\/5BPBw5BToxxqA871a3obvbm+Z9P3zq5g\/vtDuhcd4E5fqreTiJ6KHsdPsuiCMxMFoz7PLjUJQYno0cLukyflWRKcrfQ2hnxLge0l8HgD1gwEwEXV2XO4VfSILF71PuYNJSV\/7AlAPOUtkMgBBSyInZGIj5Gdw6Ta8lEBrM59+IfWLfB9+psuzU4BmtJFd6r8BrzXvEYrsKqPuoyLg1GgMObr+wJUjf8LyIUH\/ISJkMB\/FctHAO3x9fVJCj6LvX6rJO2+0WrWiW+PsV9J1p5SHJ00Kbf6w1nzSIqVxSb2nbI\/63zLTmHEIJJGDcLfZzzwS5sRYHbr6R2cU6oAidRHo5jyUuuOWjyEK\/U\/y1t\/cGkZeTINRoU0JEblw95Md5lPwBUMFUqxgjCSle\/zlYf4hO\/Pre1kMC5cZL\/PZQQxnjSxUcl20XCxyQ3A0aCg\/3FW2C7JxA23d17uAv4QAigvkd89RkEseyPX4nKvXO9qgVq0RBQdh+e3oVZPxfl3hOPRB3bZtylyU7\/v8UaItVOD7nmdP9to7NhRWibBtESG23D+4Gu37bnOkgiUFczJBIFmJ6eULLxOFVaXJAKBYPOGA76xALIEVrMDgbJleoDPijcLUE3edue6t44kAuHH\/0DyXDn1D8qppWcYb0DvkZYwmLzqyRjiWN0\/fw+oaJqOWpWV\/fpeUbSPLw7L3vuIMXK3Pht\/HyG7sVAa8qoSkGAI4LN03Wkn+2XcUmcjQFxM94ddfzCUPiS3c2FxkIa4quixdJL2FYgXrslf\/pyia50\/cEDwu5xPBWOKQPE60VFtlG5JKCj14+E1pIRWjyWn88aw25zsqFcD5WMsiEpq4HRVcwO8f7e4pEIv8lO+lWx49D0xHpk\/klSwBWOm5hb0xbwygNexCBY5s8WdZ2FLw1OkQ6rCHfgh21YRZVRgohYOSf30aSPENsP+JQtagS9HJHp1nl+pBlCLnELNeQ\/ouGRFtxYD\/ndUNqyANXCCft5Ck0yoMHff466pdhCGwz+47Gg4\/IezaCgMc3obuGot3POLL1gMcGWIgCMY+8FHZufDfKXEruJW3VjGyAJHSbXNXvfWWCzoek+3vHx3aC0q8HH8h0jZKFFi7uyzVSd0jafHIgO4VtnDCQil+iTHP7c6lQRJjaco945A96HvRdWkOqHsBfg1OYIGft+4sRwIxNIUDlfbC2rvypDqxkz5mA0YG8lpWw0VYZ1INgSyl9qCoYLmuDeAmOksonfHHgj75MCYtvUxshr4R2MT0VehWzU13j\/QYF2y+gX5COnLDYZx6cN6S3bilroStX68p28DweQdaTenkcE9EJSX\/\/aLNFTbnSh+er7CxeVLQVRaleZIUvQJE9IQgO34vBQ2iYpRH0jIpdjsqs3ADd1oW1CnUt84H8zrT6IKw94TCjbzTxJIQkTGpDp5W4xjsOMQE4lPvTusD9spTnWzuGbNaIk\/wmk2jcGRtDvLiYbCVrEPM7iNk98IusU1OTqgnSyMEUPCeupdLMvkfM5jfSEn+RP9SZIcZXXMbNWYdtcZQWa8188wfeXB\/9+l2bjvZh9lUaJXAAURqdjEB7vjqSSqu2Q9bna7ZiHD\/kWQta0tVHZuqSOcLwFo1w0cfpfprzAbZirFZzQ8tU5DlpTxWM5dAQGYjMlOqSIWi98nyLhUQQJJaxXOP93QGUQat5aTbptLDzAFQslF9tJiCFXll\/nJgCVghGrOlN+KKcRAc3Xf5Snb8zJvSBQPNS4MNNv\/pdu+FpdXHqv1dRJuiOHwMCqdxA9u70mdvsEllvtSuGgc3hSR6ej5qOc5FooBdpdnw1oqirjLv9cDbC5cXC0Q+1W3vkR569rVk5rGADDLwyAGqxYTcU+sQpoe0diTU+54WILOt6nHQqTN11fNVefVZQ3lz6X2utS5P2YYlOqVSdlmoByD\/hhuXml\/ODdxmJef986l1AmWsaROI2lcJaGTrLK2Nlbm4RjV6JyOY4KOtv1eKdKihCDTsrq0q3cMuToWw5bdCGA5DGvwnsLP9mQjm\/TNrt1CHHysMH5yzDYiQTXyARPOmGjnUYUWX6DwiJm0PGycMOCTv2bvKq6ZY\/pPMUgWeoX56N4vVQZIx5BZB3eIKNkNbqPJ9AUFlNxJSWC31y4YopHS3lLC8R0PlNIXGcLvat7Yhm0T\/+Z0GJo6AKiHGp5S9Nu7DOixmyky8uXgjA4RFjzWzIXpYiwlGuvNJYpXdGsAOjYEo5O1rINxkoFbGiqFRsUIwzqPHt\/pGrUX6Sr1fUZRpw85vqMMvyfCqEbUocYojoQiXSl9sOD3sob1jKejVCO17KW7RVFJWRhj8jGV2rgJj1HE58KPUdpg8wcSkyY3e3VRlMrNHyd6uR0fkkx6ahZmzRLYysXm3pYk4xpDXtdNwJf6ahP5uKhkzZft1wACAX4rDdaeuPwZAb+\/BB\/R8OyI2z72q+9ywpecXQTEc\/JQSivGE4fSHdkkTy6C6Pb7Zwd46a7TxiQj8Ip8UT0YHroIgGGYgLaYW7QsVQrPnBAOUEpOJkXPZjU01o\/C5Ku8uu9r+swR5huPemVoeKxlzBzzE2Q+4XyEpw+JoixVMRIJ+HTRNP6uFm0g8oCsHbAIQxgFgo1oEXMzgk+ro1kWG1Yk0EyYV4mgt03z8crpw72enFlu6tyYesVueGcrGQxcnALCNZochijqiAJojiG5WDbbqf3Qffl4w6I4yVr+RlduuZ1hNzAbTOI3rTUSSNksy9jnIgmGZKdCBriG0BRlTychHanG\/w7O\/EBO3nfOxB8Gs7Je9oG7eDAOd7m+2IhLbTq8MLjnv8\/xj3IupqboxPDWpEzS7RWPKbS1Bc1W0ilHoTVs8N3ke4GpiswCE1LMilIsNUSzeabdiko9fUSzHqVerwnuCS3t7dPNTSzptigad9s3J42rlqFQ2jbD5UTBIdF2zfhZC7q6FgTLvf4vWb2SYxGJRh+FubbsZ14gXgH8jt5GjEntsvoTVznLxmVd6mTtMcOFXsxMrrNj5liZN9d+HK598nCD9SaGIxTPeTkwy5IDjj8AUUVxMqdRIgf85Uls4T0A9rW\/WaS1Syy34du0hJLj5EsVyVVS4nWOndYlg4Q+7CD8FgQQlvIZRIxVeBoHgKn9jaaQUVxJEg0HN8pmBQ2pmxhxUWU1gEeIeGFimyRGOu3ZH8hj4vcOF6kZUXs4wRml\/P3tVCU4viCuz1vVOgB+5emltwBlpoN3yyOhEjbroGMpERF4d51MhBWz2grsLa+hEKkLG6mDy\/bL16BT6F+p0J98LxfjvqGev\/fE5A2rDmJnlYa1DPATiLlrqxlJLfHqTbE\/lC4Vov\/JMIPdOzYvbcHuRylKr6pcvyoDjNY3xl37jqQuAIrEOaXAAPl9FCQlJ1Ik7ZT7Aiw0XpBQm8NRLRCMZMPE7e4xdJJbzDP+oPUgx63tLAzJGq1d45GgHpdGAvV97CDaxa7RYUQ+DLbvgsu6lVCYyuqgV7UTfU4G\/nBeAV\/Mbqq8g1+JnfgjcNiAGaeK\/DOS4jWt6Ildvx1JXlkd6xLvTA+FtDiJK93gjUDYD8En2YlhCIupkYyKTrQiULkLoDf57F3J1ysFsR9+xcM4l5cy\/NctwohJntG6ld6LhR0ruaI7e1Mqzn7hi5eatcGZVRyuWhC1mZWr+A0BrlqpqMbGvtiDoGEEZbea\/uXYdLA+HQtN64W+DGDCOBjInxD5aIi9F3C\/ak\/2QVru6t47SU8It2asnEviAAczrTVmGwBocwUTxHGqB5jAxN27FVb\/xcMNu+yt+Y6sm7oe\/czp\/Jk1jGFu7a75t\/v2WiJ7CvEUEB0stylMs7S3BvM7KomoDk7ZaI787MHODgNn7mLPOxshVmmPN3ploeQ2\/HJ7+frvC0IUQbMlosUgbJCkI1rM+tYd5Dl5QGIzqpODuy\/c\/xskl3uTTHBTEG89pGFA0B3LkeZL4t\/BCRdw5k\/J1uQ3DzrMqJ1veyvnWxmMBIMsK152GEvR2sei770bTNG4Na\/GXdfscXDlWsGh0TYphBYWE6N7GYmntW04jZFxH7lADJENfqB2\/QXAzxEIqGI3wTIr0OhcWOcGhWiXwTGaCg9xbLK5FNNansKrQClPf1RRl6NlWJ7ClYYEp79eCv3QTHFuvK7M24CuePyDlxabIQtOJl2lhWW4neiC5KlK7eiN6jNqh42LhZZoPO2kyF3eUErMS6sFFAjMSNyYYjFUEjC6PD9O8GFGai8BE6iFeB6Qf4M7sbDPb9hDn+xpjQJgxrcDzcYuZAcOWETex2D26Yx3mdI0sBJYztTahY5JRwvGmCIKVkUuMd4vN4TM5EDv0Q4UKzHehyhemulTportkS7cEc\/oIo4jWXLnqD7LC97pwRZGHlwFXSA5FMTisdcNZ85bAjjk+GWGqXw\/LQ7LyLILBDY2AfNusQhZZ3STTB+7avHoehzHRbJAF8tVtgKG19Tk+pqBMuGbFyL2R60aGr\/9iEDXB9Fo\/xAyJCAzvAqlbL0mYM2mgm+TO+Lp5zXqwo1pfr70Sxu+GtC+9Jx484\/meijIdKyp2mwO4oytD8FamYFo5URQiZGiKkjSav59gjQNpbTxRcYlS6cGkDKsSfeU0rakrvP+vSNWcS3GQfDrxJb2MbtkVE4iGg1\/VR0pFb3Wb2RmE0nDxGi3taaFDxsHqK8PXpu7HDpALvhNFZCQALmqk0dq1+lV7TdURMDyNQjKat204jR4w51tulBhKFfoToWpt\/m2sxbzH+PZaoBbNhBgbhRbYOPFamPijvVMPDae5rSXGIb+Iuy0pgqt4o0HhX1+taVAejLI6Fy7dz\/2R+2OXa6lUlHbGkoX5YcuBjR3hJWp8j\/b1xHSQ78uoNg1Pgz\/z\/6kQXAy+vbeD7tQX08LksSa2XGiTsd4w6+30M2khu6kcuVLwy5qDtY6xzlko69xXcoePnivV9D\/dQwFxLQJT1Aegj6x439+21LmKMqEJbYZ7OLbVARiml9bNFEwmsjNsOAzLmPkVawalxJQO18Czjxu9gNFQkZzlfP+JXcDHfqlSBZp4NE7+ynU9GM7EXnDsKWwXUDEW6DKun2xLF7L+EDNl0dH8qt2Yq0aHlAHO6zvC3pr7QzXVZ5ZFj0IGLs+QEjedAq4TD6qmCdYYIL7otPQjy7DqLJ6uS6wSfxS4nfZ4E+MyybwERrkMKUrwreRc50TOUuAhDOPw1pGmM6GJTmnIcPk7P0cFvTqSfbTHP9TCIsr3t5+ISxbK4vbHBvLpNJXadgSxG8HV+qg5QS+E3RCb3M8y0jFJNBRa90kbBJLRtbt0r+vN5lj\/UigWMpeJt9TJvg==","iv":"154ef4928a9b6fcb5929d43f3c90f9c8","s":"cd85e0c2c0cc97bb"}

Chanel price increase chart Source: BragMyBag

Chanel price increase chart Source: BragMyBag