Due to the resiliency of developed economies, the global market for luxury goods is expected to be valued at $374.85 billion by 2020, according to a report from Transparency Market Research.

Up from $296.15 billion in 2013, the luxury goods market has seen a 3.4 percent CAGR between 2014 and 2020. Luxury’s optimistic and healthy growth is attributed to an increase in ultra-high-net-worth individuals, volatile established markets and increasing GDP in developing regions such as China, India and others.

Emerge, evolve and expand

Developing regions are fueling the growth of the luxury goods market. According to TMR’s “Global Luxury Goods Market - Industry Analysis, Size, Share, Growth, Trends and Forecast 2014 - 2020” report, countries such as China, India, Thailand, Indonesia, Vietnam, South Africa and Singapore are the most promising regions for luxury goods.

As the number of high-net-worth individuals and the overall GDP of an emerging nation increases, its citizens will have more disposable income to be spent on luxury goods and services.

By sector, TMR found that fragrances, spirits and watches and jewelry will see rapid growth in emerging markets by the end of the decade. As it currently stands, leather goods and apparel is the largest luxury goods sector followed by watches and jewelry.

Image courtesy of Peninsula Hotels

Luxury brands have also become adept at selling both high-end and entry-level goods to appeal to a maximum number of consumers across sectors.

In response to emerging market consumers having increased wealth, luxury brands have also worked to establish sales networks within new markets to spur awareness and drive purchases through a physical store presence.

To further strengthen ties to a local market, a number of luxury brands have looked to secure raw materials by acquisitions. TRM cites an example of LVMH acquiring a Singapore-based leather business in 2011 to ensure its supply of finished leather and hide.

This trend is bound to continue, with Chanel recently purchasing a French lace mill and both Prada and Hermes acquiring tanneries (see story).

Despite best efforts, brands are finding it difficult to truly crack into potential markets, especially Brazil, India and China, due to high tariffs. While the growth potential of at-home retail struggles due to a lack of knowledgeable sales associates and other factors, travel retail has seen a growth in demand in the past five to 10 years.

Emerging market consumers, from counties such as China, Russia, Brazil, India and South Africa, have a penchant for travel retail, but due to currency devaluations, purchasing luxury goods abroad is poised to slow by 2020.

Comparably, TMR found that tourists from North America and European countries are now more likely to buy luxury items while abroad.

Image courtesy of DFS

Acting accordingly, luxury marketers have developed innovative campaigns and activities via digital platforms to inspire travel retail purchases.

For example, LVMH-owned luxury travel retailer DFS Group is exploring the concept of loyalty with help from influencers and its own employees.

The company’s fall “Loyalty is Everything” effort gathers personalities including designer Tory Burch, blogger Susanna Lau and model Caroline de Maigret to discuss their devotion to everything from their hometown to new experiences. While designed as a promotion for DFS’ Loyal T program, none of the individuals speaks directly to their relationship with the retailer, allowing their stories to resonate on a human level.

DFS introduced Loyalty Is Everything on its social channels and its online content hub T Journal starting Aug. 1. Each featured individual is seen in a short video, with a corresponding text interview delving into their packing preferences and travel habits (see story).

At the local level, luxury brands are finding it difficult to truly relate to consumers in the many emerging markets due to the cultural differences between established markets and developing nations.

To best appeal to the cultural differences of an emerging market, a localized approach, with regional exclusives and promotions on local social platforms, can be beneficial for luxury brands looking to appeal to newly-affluent consumers.

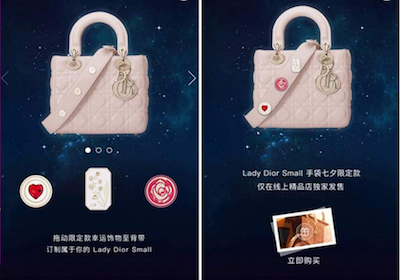

French atelier Christian Dior recently tried its hand at social selling by offering its followers on Chinese messaging and social application WeChat the opportunity to purchase a limited-edition handbag directly through a post. While not alone in its WeChat efforts, Dior has become the first luxury house to sell a high-end handbag through the app, showing its potential for direct-to-consumer sales.

Dior's Lady Dior sales promotion on WeChat

Keeping Chinese consumers’ affinity for brand exclusives and limited-editions in mind, Dior turned to WeChat to sell a Lady Dior handbag designed specifically for China’s Valentine’s Day, known locally as Qixi (see story).

Troubles

Despite economic, social and security worries, Europe remains the luxury goods market leader in terms of revenue contribution to the overall sector.

According to TMR, the European market is expected to contribute 31.1 percent of revenue to the luxury goods market as a whole by 2020. Europe’s success is attributed to the continent being the historical home of the majority of all luxury brands and a hub of manufacturing. Due to the closely tied relationship between manufacturing and point of sale, Europe has an extensive retail network.

As uncertainty continues in Europe, Asia Pacific and the rest of the world, referred to as RoW by TMR, are expected to displace Europe by displaying the highest growth rate in the coming years.

{"ct":"zT\/Swt0AxMhE2eJK\/J4H2F6Sne4AVEhlal5YDNNfTN76PilOBzlislh42dVko6UUCK6YHKTrlsxfrSTJYbJfzl12GA+3qiWjX0u2GRsLxXSb4xJ7FP+0krTSrN\/++DC0fCODAFX4m2o8Y4jWFVHFifK1LyiYMJ0ICjHRylHXRQYF98faZsFLZRq911jLp33dxCOsibi46YyXYW6RUzYkZEWJ5SEQO6A5u7xUY+kCja0qiaj3P+rY9WRod0ukBXRMJXIboTQOOHjpIvEgQ09nvzD7wTKG9jFjno4uWCT\/FQI7jXshFBZLRx6oZwG8eLcw3rAkr+ERQpekWsNml9GOYZXrLHfOinEuo1JzMv0KgqyrKfg1D9P2\/fMqExays7f6xsdkqunOFTBRW7B\/w0SgW3flPg8DbBLjbkIjRQTnYr1quRIGNDmryFMqVMntb3kwtyBXT0+qDk27iHJ9b6QTpvM7j80G3rJjefL+k+jcvse5FA6XougXhjWihajh\/M8gynePJTAqtOxLpz5v7MW3\/XFSM2HQjSrRXdaeIMbiDBDqkMsxsv0DCDm5UsZy6O9pabEStzmHpoVtu\/Kg6+2ltZGSlYXVz1xWwDpyC5L73bSirEZLnhk5z6itD6qtmU3yUgrKhqZrTBcTK7fmpFmG+rYnqpJznc7nx9SU4TR01BV3taC5rGstn2eSj3K8FM8QWi4DfpkKkSoFTU9VoCHKbHjJSKi9P3\/fdcDbwhRxDk9l+DcdX0\/KioTeEGh7+C+VGGzGF9HRyLiw7fMFcaMNg0yBEAGv8hN2M\/CSb4KH5xapDg68vVlcl5BulAHKCWFL2pbcJQFZvIvWSFqLBYAjqrI0x9FYt\/bOfcymHGccj7PZfjlyHP8r3xvw9\/fZ\/ksTYhH92kHjuG5cFH15yaxfOrlFk09BTZuP\/rgxKxmymXjJs6enYO04wisnesmMVfREJWou8RUk4aujaJkI6pzZNiZzRLJTw3gqcbYjPxHmwes\/F2UDg+xWB50Mfjgwobyf4VrS2jnMaq5YUdR00HjxaHrao3+NwzCtkDfQ9UH1O6ZpZXM2qvtJ4zrosGlMX\/IGmbS4+5ZtNvmPMD3OYb7UpIM6dq1jLIRDv1RSvYrh4biEUlVXStO1b9g\/F71w+1S9Snqi6Vnrw5faNM7gPRacULtjcjv9DT2kwiTvbQfQ4npR17dNJ8eBM\/Fxfd4h1v4yAmx4IqukTpCQ7xWxwl3l4TwQ6vIbQcP74RyTMzlrX9Sgot0DiXd7iC0gnjm8dPV4Me9GhqxCSpSYIXqtSOR7bAwmSxsrBJl3BBGstxDx4gCwJDatbiSJyfdTvqV9KYLik30Io2KJJHO1ieilWf8XnjsktJlM0KLqxcEAruDQ3PyaIvrkWLYfrV1ZH58RhmH0R05jn6SxM\/aB+kZ4+dB4ko9y1khsDeM7gQCAS+ks+AGuOuG4gGNmCrMp8ywQOzgpn\/Tkscw4NBehuX+9Vwfn5COsFhSrTLbbjNyqwg+P6AVSzCoGJETiX6wHmY47BjTA46FtCBvzopzr2Mr90S2iSKL3p1RbXfyEy+xnOQ0Z+o3A9eNl9idESpNKvTpDBGy1vTBASWw8kfsFp9KghC9z+7VpyGyF2drQJShgdrvYNR7UaLZEP9bX8d3B86JBzVeXbFvSOdWk1MqEiz14jwBGJLBzGVSiQDFdeTzyZcvfIqQXBR00CfIMNLJ4liIYintX7WuCn\/vBR3FATt\/jkA+nas1GWHYvWfxX6mvNaCGEutpWdx+kaQXUWBE0kzaNLhqocfIzLFqFPmhC0VMmMBPOaC5x\/NPJ9ZGqyA9d7Kkd1tvzx\/3ERE9y6Y1gAbLIJ6z6B00HDr2XsTF5EOhFET0dBSNakvJHD43iV1II2Sg\/OJgQplPcenSkh2EWUYtmkH2TThPWtM8oqRkEnB\/DsSwT5d7jkO7zTDU7yak8rXk5p4x43oHxLn9FOKeMf2mq\/\/Cq7PrN5AWTooOF+Z+iiaUZPIPXz52fUHj2D095UrArGHf9Gr6JuAGHMVIxfNp87271N4BKrrUonZg+MCXM7qspJctW7ZZ2Lo7OpJJZkJLXYW7\/y7irAERLI0TqCR8d4tV8mOCnoT3gZxRnO4c8XphEOLY7O5KkQknhurTlz3\/hpnYf\/92yHJXqPiBHyrCxPoK+20G6x4yggi8VGBIfADEJEjHxDoJAnhRC8Pd8mtKizkRgXERoavl5izlTi6E88lztMmN52QSJKp7P\/AK57L8dzDUNWBPsEM8eNsrrREAcTkCkhQR72VE8f0IXVdekbnWZycYfDR7+G\/pzxrygQT1qLBzbL6aU0wao35CMbIB9t1kBsdbUQ91eQIEvwGe40XyV1iixWLfsUEeqCxd3dhHp7EGHtVpjc+r+63ti2AR+BEMo0deCbHR3NSrh3WvUNslscnZL1qzoz4UKUzpzHw10DZznAYjqtG5CU6nibLN77evjblKR2F\/cStT6KFiN5GUCTbQG3otj8yxKLWFSF4APxk40dE7u9zLt0CJe\/ueEkqookSHwSsyJ4pStcne+FC1V0z2Kv7\/oUUDX8tWbn8NW8KfEVJ5uMLc6N21PRuFU6BB29SMJ6h2TNlo+Ztouk6bEyrHh8DC78E9ALfF84RFrFElPH1YFAcm6UaZikyaEraDOlqB9KC1OGxuQuRu89RgI3DhngjaveQGZ6t2sH+8ARF4f7US3xDlHE3Sma7IwWbzN13te2gerkCN5Xb8vB26ruALylPOJorJSDa7038KkHIKHEpEaDVkQovjvNKeZtkFgeVjHz9wJw1USyRUrOcNW4GaVSsTk\/1D\/n3zIjgBJwlxNVizBS8AUFMG3z9quxPh91pBbeSKLbHtSSuAwjKK9THK+D\/h1dOy2J0JZ+HUX6DDjiqggxp3k19k9WOnQLfg97qTobL6p\/tsktcwJShzMr8wrc2NGs96ZFFNnNov\/WSL2gQrGx6QWfeqXQXao68ZAibkmoYX\/WTaMNCzVUTbiCOIT88+ub5H\/Poe9YiH8DKIad+U+xJoL9At11nGi6ok+1pDrVt4lNpUay0net1d3YFcTk\/SNONHm49bbMzI0A31A8MObLkZ5n3Za+D5WjkdxxfNLo6eLrlsmpDeA364eotctJsM59uUp4uewrrNgNQNxifNoHZ+gsBgvuBRJKg1LNciJQoid5Yeoy07qf607yKhpBAOVr7ZjvEBgmGWdAOF4Dhj8CZtTlzVtBiPnpECRkd7XISvUgCEmUPmb\/mo8D+5IZy2BD1Rt5Liy5pE6+QafMOF2J+ObO+eU3yGVGCmP7e9QPUdV+ms8rk9N5BD\/kANOd7NcMAuYkM+gcLGPEM+QleAF+9iH+21pJ858bUdQfKMp43fJTlVopT99V6z8Me6IEkCxtocCwvLn9Ctrpe7iiSdK+LeX9SxHMt5CSbPuuttIr8qF1GZThSWipFmPSw+KODD24X+QktmccnFYVcsX23Jusrdj4GZz7szCXUc\/BEMF3iPqDpbiozL9Ne\/xxtoC7sJtoKfTt3HQoWXoXwJrhMyQqOOrTfJb1l3h9FnBIEaOEArIjyZ6IuFLDTmSItsfkOY6Pcgf234cGk+dTDG7FAtho1PHok8dmCd11NqooFbSkIFlsdfk0dH0g6jFJa1J4ZZjjruGF4rMah8QoCdWFJTk5KJxs54gsWQ3FCdPvkd0BbvTC3QkxmKE01C7YEG15ln76LsUVPXFQTdazStmCMQgA8OvUekx4hcaVQG4MT+2MQvDfcZIwz0laUEFsdcGbCUi0UFAsshu8LyhyPK213TUbhXd+9JDCtKyMkVI\/HVY00iYBm2DmZAMAt5KdTvbQhTNpEmoeePBqMWvHiYoclF+Elzq480YiGUW5bo9JGWRMw+2wH8Xb1sZMNL9elTXPijtlVhCd4m9aczKngn2k4zTsGlIY1YTYb+OiSBIDziXH+sdOi\/idpB1PprBZvYDUm99HL27x+iX2fTC910WAjzY1b6foueJ9EtYsaHrT2t6pzh16LuN6LF6reB\/5Igr2QahEc7xnPe1ZXxWsAGz1c+YBHOCDXXgWGSNBX6T3qln69sx0z\/PbdXJgCQgZzlY0YVG+VZy5VCVpvtKvTB7bwKr69dpKnTLwJnKuteS8ot\/bBVYHVbS8FU289zyfYn56He4kWFpdVAka7+H1ml4x5iVo8ImPTRCveOLff5htd5YqaHQismATqLDeuExGMy2bQYiUh85UHUDXauk5eOe5lfZL1CTt8ktHXWMLAYt1ZcV2naud1THeiE\/j7fqsN1TurWCZ95qkaBm81C5DcuFCJ\/wGwi6MIf2y0NrydXTbmyms4Zi+zVk54MJsZKpcaQMLmzxmodBUieG5T2YSy78ISQprPqrsOKgqNXWLwYjsEvjda5PxbgX7Q4V0zIKx6qg8PvdrtDplQ5nRPvm+cIAzBHtH5LlgMRE85OChlGiPP4uvgxHDyEjxR+KIB+2sYEbt8sC2bL9aUUeQsMBwQSAm40nVnZGlRYfQo\/sZDAAzZ5a88A0Bv8BC+sErZ6XLX+7SRwNiRY\/eKbGoqZu5JPajTdEUH4RMXni9RcW1LxRlIpO5bqqNBt14V2qRI3EmrQ8RbR00xEAcBikIvZbXpNgmTIlSrr+GqQCQcEMXTXb3rSOMShCSs1ysxKA7RUFjV1Wjej8kTTFDUmyk\/+YzkwIquJ+QOa6qKJDuHSZhHJyro3qxArqtyDBkLu+7WtfqqvkVtKIkjPdhroPTiOJmcKoQNFLqB4SIysPfaXwPavMx9A3qkpe7cUC0JGiZWLtTOEscXilHfHb6FrkRRqj1cSILMFxbZk6T5Wyt52swN9ZWbZk6gJgFWALGJHVOBE9nSpHm07ybGtfeXU8nOwyBmUowSeNr4NyU5mweqQBPIANU8HIRVr13rSty4zOJc6JxNXnHVLf4\/y4VCzPS+gEXftu\/diQi7jD3nIuO\/lfjmoU\/FxkXeiCuJ9JK8jG5qZwB0iH\/063HtQhYAH+cFMPMo9LJBK9l94wCW5Z0JerTiB1pp3y1SRj4YHbHN9dULtIkSMPTdAcngCdPVASFLv0caUq3kw9LGxTk7DRZ0ZIpSL5QNu+xqsKOfwX\/hF4MZN8qrg4BGCgmzHE2sN9vVjvZdJziwXGpycG38bXhCUkqr8AFljz1OQyqLtP5R\/OKS8ZTFiKWQVJQH7kF3wErssTYUIzIch2u3jB3ne4qeBbG66uz98LXwrz6KSFRK9UO1lwpqNAQf8AOQJBP6vgmp3CrdOD73B4+fWwL5VGp4YhYZQghi7kKjkLqBe\/JCLTSApXLZ6+d+0CXBaogpNpH9xYeTPgaUakvhe2l\/lt4LhlBpbq6sS6WUsxN091LSgJg58zaTSGNvRLUtWWztH6Ka9\/Syjn6tgQaQEuf7w0JwCpnVyjs3iy5K\/PcwepgvRiOmwnLZZ+lms5lZuY4R66Z9giWzncz1emMR40RbxRx8NrthSu81ZBWrhO557tK8VHPlX73a61GLzW96yn0x8mtn+UyKTxS23BGClYm82W3ss4rCzU1NbFRlrHwjmNkNDsUfUXzfnDYQx\/7k1yvHz4B\/2F2oZiip6JtBrDhRSBDoL7tZDAyFbZDsvqbEulvsdP\/jmubzuPqOtH9ApnEN1wjv8ncVm5D7TwQ1W1vI2a\/tcsvQQf6cRH0daSwvm6+5N1PK3\/DfeTHjQhqoQgRnxadUc0EAVqHWG3kEKgxYAt47U\/zlSkfENrhKz7HaSgy+nZWA7W0xSR1ArZSPKLVgXV8F\/P5gsby7KaZMQVsn0xo1YVqDoQzDy17PLK\/aiPSrqoJ3gptsCcI4lQdAWbedi64jCltla76cZ\/G1dGz4QoKg6l6J2kwza2nMUIty3Wh17DeKeQks5UAm5IwrRHg0Hn6pKph0\/3j53nV0Z8A8F9nQ9hlyRMsaD6avnr9h9H9EIMOwkOkpBK7MxITf9IdvTkyMBAJteNYkk89kW9OGZUyke94G4q3ebg+86cGhZh9cMBgbdw6hO085hUPcSFMWsvbyrjLkx3x552jIPnWEiJEA40AtXT7UD77mxRgSERZogVPQBLbpXRpPwVmT\/NanReuKwzbxhheZGjVniTBTLE1EThfBB8TSy\/9mXdBPVOzLqh3uS+YAnD2Bmw5RmWWJGPdP8TcwM2RN6BTQZt8XFNnAwAl8GrUkNyxiZdMN5kBCrCGPb+sbG0TR1HLV7i9PzR6O13Zug+ScyLn3aUSN77iUUFAZ2B1FAEI9d2Xq71Gh4d06rjIKPPzirn8MeDgpgVyhiyWZEZ+BGVX26b7in\/y0EI36NPnQtP0a2I8O3BirGG+j4Tr2cId\/RnB8hos8ACugbJCmzUusXmyd19oVPyLUITEoy0R7COuQzAFn3N0MA8q8e1N76wdYnccVPnX81kHvhiGWWdAkRBd5P\/sZUve\/r\/X\/QUJDSZlwDnAs3SFWNUGW9TyB+3Y3SPVGnpZ1WbEORBdyu1QJrrZQ2xFbqtTyEsQz1Nq2HlO8MbcUuaMHZaSldumJTBWT4dkPmAZwsdLMSz4Z1vIuYpAM1AszHW0+jCUfw3Zb4x8YZoNeaiQ9UpZJ0OILTNibREBDMtTWZJ2LqJitk55oGqS26Ini2st6+sXTtOjspbH2+QPiS\/lfsbD4\/5jBMZxY5PGQWbsEbWX6G\/c8kpbVhdNj6oI62Hn0Vr5pufGeVG33ZtwLaT9tr7k6YV+hpymgCJlbDOMW+l3Rkq+NirLB3pW25atO8bSBrzLYmZlOU2Diy9tK5R48y1DLCaexzfZb5jmbxENKjDgz3\/VfF2jdt5lh8PxsN2GGcxgDfsCbuZC2q4y9xIeXjDMkYUYviycZvyDakX5pl1\/w1EaXaeh6\/wHcYXqh6IeMKiJWwEvMxeWnCu3OPu+dhHYZ2f8SSkqt94b+C0ao8+O4a1CfFA1Hsmh8a7dbD8Q4V8Jjw\/tDADH7pM3IQb4+Hq1oCZ6gXeKxr8sQuJo2Zi8EbjAeBKjhgLGHoZike+zgwlc8RA9z5\/58VmtcYy3v3yMHgCsI3LZ1PhR8UzQMWxfjrZLCSPWHBMRLtwSD0pkg7eom2YAYz8lvSs\/4TnA1rr8pLZHTT4yzBnc4QL3advGyhGpmAqcOvD7JoEYTudPO1iRfmGW0TM9d8LTLYYIPVRkKHUJnseUiGQhNDn99vthLbjgIxEItxV8RgrTSjV+C3iUUcN\/2p11D6WOAlnApZhPiNdi\/L+PaD6gvJiT1xDIFbSF6zOGlqk9G\/QkHqrQRJcyWaZmtIM0pYXi\/BteW5lN3lR4Q8ZsUGWslr3dfQb\/ID2h3WeFZ4mmLdcLa3ZqBzBZU8MyCXe1y7EhGxy5ALfKRjNQwy8HApeKlCn3dwptxbEiOe0wuBmHEsk0CjhtJyZO16pLL4Z1FzwJCsoeeEMWKaEtW9mwCJUNisNraEoEYLrtFympIPJzy+Sipr78IL9dipIGpn6CZurDTEW4zxxesJSkEYbN1AQjMjvBVEWCC7nli5xgjLXcGA3jZ6JdaUu49IjurV\/wmYPGmkHzaQGu+tweVWJCncmvYxl7plr3odSve2oh7A\/6GGl2Cg3hFQbjwX0nuZnrd0CEehPbVDgFD3pNBeyJ+DSkBXu376B+\/l0IMxzrj6U66Hsa3a+Z6n5+3szv6bAXBU0tc9YgQFWGmoRfSBgj4bX34tbv9BOg\/\/qBHANjA18XTbJ6TKYLBEInHqEXE61g0BD8a9E95qGTmudUljACJzscbW03LZ0kDpScD9Aj5vlkASK\/7RNZGga9ihb\/W+PVOeNCFwKZopRV6XTItoyqpTzVcM\/bJGipWjBtd2NRjfQlSdXi69CQWAH061BZI7cY9\/i5lijexk5YUSKSlXhn2tRVr4qP0yEnVKj4eyzKYvCm9BjVgBbLq69KY3djpjqruzm2ZuLNL2BxKJ27rvtQ5RzS\/pLgi6dRnapuQideMvuARXs9BHWKXmZ4C42Ur63kFG1LrmyWygwZq6XrnfXfcDeywc4bkPBLdd7Vnafo+KihZdmGVtRYCHNu5BQWyllY0nLDyO1sw+9iUu0aUx7OOqRVV+2WZqt5D8YZ02H+jO93ic2cfCGtQRjDyKJ4guPfSVFriY1c3Ywg3gHtUtDCHWFpQYdTMo7fJJc9h3NAPq+rxZBXc7EC9qGqIpQtkQvPjVLbPTUlSSlPGGSrObGTFoKtPmZWToNQXTfwOxF\/Fua3K7Auk3NzuxgMfvqN4yHy99Y8L2vffVJLzwtMPC61DubpgD+2ls49zJXXoWMhJ+2NaPr3ZmPNRw1vLVYAixp3qLj4+Q4qNUkRw8nX9w+RIAGzH0OaG7YEq1apX2+iCtdUax6+il76wMiymOuJH2bgF0lbIHg6IjD1RE312jfxm7AkBEylt2M9CJKQCPEoieQoerY1ismv6852DEyY5\/wYLIvije99JGou4mArpr4N9oSsVUkm9JVpKBigKEL\/T7rE9DPamD6NapimilNucs3ArYWsRNtvk\/F5j2fXOqv2ZOQkXZEl6d93Xo+YcTa0GHrkzTzwg6M8k181M9TEHE+027Q6m035wS3m5\/PBzRtdPbvQkOHpHEZlpMhhqkktF5+31\/bqNgNqvzU6TOZ9dxiiwxcf0Okbi66vV+yB3MBaPA86IyVu7BdHyNmikWcKJL8w3KqdeUECjQeNoLnYhWz12jJt2cEc18iqqfwmUpHErYP3p6CkepyP4EI9iT+5stgfGfj9a485sgF7HmnGzf1hsAoNaq1Yo\/3rIR9LOPS0KvrQ7+oyaU\/3DpHPz9S5pI5uC37YQUTGxS0up0IlS8nPkEK2m+lkgBSx35CEoryl6NjfBQ2mVTcap8NTUTgjz0xwZ9Gds2yR67AjYIyDOAsJ\/+LMF81Nf8xxhoREhmRlhfc87vh4u6j\/q+nrHAAAqlcVfAKYJu0hmfnr3+WFeogQeLInIPOFNwUJyhIPZftbN44I7HoQ77TQ87MQZfWU1eYTP98NzrxAV0SYiNZ7jCeayh30D+fkVmECBhVPuPQQaqBfkbrMdbhPhrE9IOFOo+COMImzY9XxU5IRHcxaq7KXmopgvl\/uTGoy\/AZBAXZUXaWFqDO6AtVWsvsyil3ZE+vSOtjWYjDr3dKRGd3vTI2Xw+JlCJ2QqGYTzBd5Akh4oR+w9+i7cXsj3WuLeHk75dcBbgAQsDD0KQ\/uC8N9lnMQzmIgrKlrZ\/pMSwkro8CxuHUO7PASwdPmLHpzretQGnVMEaMs+x836oAwjXyH\/unubgsTNq0ZV4OgZX7M4ORbFjrU2ZvLf9k6whH0GbGA2e0XrYIQ\/AHypZlTAjjAX827T94X4JVAgJ3OAFaLawAT5jo\/66HJOeTjOyjzcFqnYIawrIp2SmUOAag+FliOynMwZFaLTAoww1N\/0YiQt+wmShi1OMzq9mG4ubIiE9RIEsDTP0UfvGTawQ+794LGOM9EcAX3InQYz7o6xSuSgh1qHCadeT1iL6ioQ7I9jIuWfiE\/1LH03v7g4MecaHL4gUuu2WVVn1OgewABaOMOYLYT5gdWXVtB+9Qkte2PLaGN6dOGQIxL9pM6UDDrfF7omGUOQu+TxRK0fJAJ1IqIVyOXQz58kdNPRXucN6csHcA2Qb9u+GvFUlm9e+JRCXUMxMfPD4UcJOybpgOHGjR1\/lj5KcncGh8Uu4AeWH5XMOQZvCGoIOuMvwYfwD7kBLb\/wWgzVME5F8Esr9gV5fygeG93FsM\/VgnjzeQHaWZtckrKykLF0rcs7cFBd29R1\/sTEPLakp8M2PDNPXCWSTfStJB30k\/h\/NCF1GCeMNz63D3AQ4Oti6QEI37XIH\/ALM6AvECBuw5dSD2lZK5Zg1VEHjM14t\/vd+BQaGGPxEg\/w1dj6Sln0TbD3zw9A2KQxNuJyc7IGowI2ZxZX6PRSPiuv2rX6NMtIC7HGNWsVmkswssSbySvsaYfQqU5Qf1I7J+MHMi204NQUdpBecrNkIHnVrJD9dgB10FBgVAn4a6Oq8Uw5DbKMMTMw47Brjx03tDOHU3Z9infmGUXFf5lq4zrIzU\/jK4Ejm1yomzJjxogzDblHOcS2S3CG7og61buaGUNwj84\/R5gIlpmt7lZ\/bSvGFM1f\/kzXjrMZ4DkksBFw==","iv":"7b97652fa8ff35c81d377b9092b9afc3","s":"e4ae3151bdccd33b"}