Despite being one of the most popular advertising mediums in the world, retailers and brands routinely miss the mark on YouTube advertising, leaving large swaths of potential audience neglected.

The average retail view rate for YouTube ads is 76 percent lower than the average for all industries, signifying that retailers have a lot of work to do to catch up to other sectors when it comes to targeting customers through the video platform. This data comes from Strike Social, which examined a year’s worth of YouTube campaigns from across 25 industries.

"Retailers typically stay rather niche with their targeting around luxury brands and then go broader for more mid-level brands," said Jason Nesbitt, vice president of media and agency operations, Strike Social, Chicago. "Still, within the targeting groups for either a luxury or non-luxury brand, there is always room for testing.

"Luxury retailers should consider testing broader markets as well to see if there is room to expand their brands to discover new audiences," he said. "At Strike Social, we’ve seen impressive results around cost-per-view, view rate and view click-through rate with younger age groups and more general targeting for luxury brands.

"But it’s really a case-by-case basis — you need to dive deeper into any YouTube campaign results to see if there is an actual tangible impact on the brands and products themselves (i.e., purchase intent)."

YouTube engagement

YouTube is undeniably the absolute largest platform for viewing video content. Every day, users consume more than one billion hours of video content through YouTube.

This adds up to almost $80 billion in revenue for Google and a huge potential for brands to influence their target customers.

The video platform is especially helpful for reaching the valuable 18-34 age group, who are the most affected by YouTube advertising.

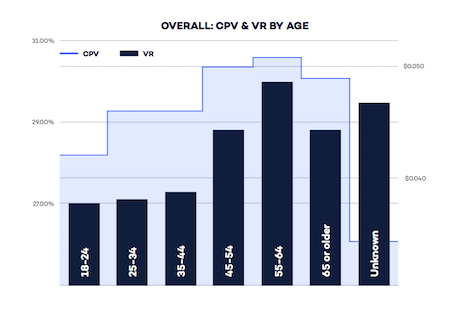

Cost-per-view and view rates by age. Image credit: Strike Social

Older consumers are also viable targets for YouTube ads but with some tradeoffs. Strike Social's report found that older consumers had higher view rates but also higher cost-per-view, meaning that they had the greater attention span for consuming branded content but at a higher cost to the advertiser.

As for men and women, their viewing habits tend to be roughly equal.

For luxury brands, short films and video marketing can be a powerful tool, and yet even the most globally recognized brands can have highly produced videos with only a few thousand views.

It is imperative that those brands use data analytics to create better and more engaging video content and promote it accordingly.

Video marketing

Many luxury brands rely heavily on videos to support the brand and attract more customers.

Some brands are even going so far as to make videos a part of the shoppable experience.

Fore example, British menswear and leather goods brand Alfred Dunhill celebrated the city of its birth, London, with four short films chronicling the lives of four local men.

Each short film delves into the men’s lives and how dunhill fits in with their aesthetic. Customers can then shop the looks seen in the videos for an easy connection between advertising and commerce (see story).

Other brands have been hosting entire series on YouTube, such as Chanel’s recurring Gabrielle video campaign, which sees a different celebrity starring in a short film showcasing the Gabrielle bag in each one.

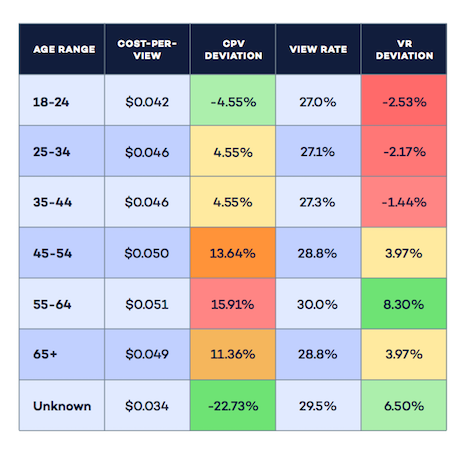

Another look at the data. Image credit: Strike Social

The latest Gabrielle video bridges the gap between East and West in its ongoing Gabrielle handbag campaign with a new short film starring South Korea's G-Dragon.

Previous Gabrielle short films have drawn on stars from a variety of disciplines and countries, all united around the concept of the Gabrielle bag, named for Chanel founder Gabrielle “Coco” Chanel. Previous videos have drawn on prominent Chinese icons for starring roles, and now Chanel is recruiting a Korean singer, rapper and fashion icon (see story).

Understanding how to make the best and most engaging videos is key to a luxury brand’s ability to attract younger consumers who are most active on the platform.

"The most important takeaway for any brand, luxury retailers included, is to listen to the data," Strike Social's Mr. Nesbitt said. "Most luxury brands tend to stick to what they know and target to the same sort of consumer over and over again.

"This can sometimes contradict who is actually engaging best with an ad," he said. "In testing, it may turn out that younger females are engaging really well with the ad when the brand tends to put their ad spend toward older women. At the very least, not testing limits reaching new audiences.

"That’s why multivariate testing is so imperative; it uncovers surprising insights into your audience. Let the data lead your ad-spending decisions, rather than tradition, and you'll truly see the best ad buy for your buck."

{"ct":"CFvI8uSfKWTAyGIOB6kzekAfq0YzRP81l42il6NPyj7cSlsrkvsZRQX1QiECcxbqMS2wPxRedBKyl3v0o2E9dxv2UkmuLTerSXf2+MzXrUs31pdIm\/VpgmQjp5LjdBhzfeJ+EEjuFrr4L8c1uExVkwJNg7xkZyr324e+J8UyLZ\/P+OvIoJPRfTUI2FFxxKR6\/oxxgo+fbc1QmxVWN0oS2GiMVavdWxwbanyf7o9yJNaRdMyVrrufCSANfgV0QXEPYmgRhsWWvG5+QrAIGWgiXLSOfibHl7ACAQ54gk97SrY4eSQUKKzCKatYTYmqu8F4ONSwgsftt03NR7VAxS4RejPptUjKxYu+7Kpu2o25M\/pI0uQBfI2pTRk+UT5o3YNbycXPuw2P2QCkcz+gyA22HajJAslJqN\/E2IwA9qrQMywjcTOOD+GQYpwu6s4erdf3g3o1nEkq0sHtnuNjYDFpwi65d6w2LuUPOIlBkVcQQHNWJGQ9MvkuHoK6Y0UvsF3bi6Qn0w1dh\/kWj\/KZPnhkyxgzNyynleiC+3SidNGaXNG9YycftJlYi4IDOG6EmJClt8b4w6d\/9ImlWIqyKhHVyadaMLwkvygJzMhobbl5BdM3236QtSSF4Oo3qUk6BNfu0bF2xBPHioj6BPz3uQLFjdFsmBgGf8UBA\/ZiCe3u\/2\/vnYmxhWRXmGSNDCGiJAi7SlAWhQio\/NMtflNiLO87hvu9RS9AoL7tPNzgcTk1lBJDWMej\/arKpB+fJtoiWz2ji85Kixy4sfjAQdrKubQZ6lZT9Xp1g9eT7gHty5boy\/PqlYLSLpWXdKCh+2l8jz+Vw89ATUq8M8TE7Id\/gyeNDmkdMj63pbUxUm+sj8Hkt2M1Rz2DyIwSHY9zYlrqr4uQV3K+BArzegmeKQbiCdpKl24TOLD2d8rNKROWHcKB9SJvw4NxXYlGL9W5O0vQMIni+RFxtcME7bykvPhm54aKPUuojkUUOU19SHTdWWy56\/ilD5kC1fh7aAib1V1lQkl\/3lw\/3+S9EllNm1TgfW6GamX9TEpwZ9N8\/V9NLxWs1CFMU7J01kVoq3SMSAm96CYZkB2bAS4yZaXWP+p0QbV7xPjBQG9mPUW8uGCkzU4r+7VJwEBtQGL35utSA2O\/QIcao+WflblAl\/3NDccnvgzCtCLnOXC0ZM\/LmxpO5jXKCozyuHW8Z9CrMwvZTqUrIk\/UnVc2lxFOs3eHa5xBO9nwRP53t9zr\/b1OTnRU95B133vGzeF2OncuaO\/WJPa6z3DwBijZxbt8\/wTHhcSBlcX6F\/CLrj64bnhKyEO7Do9Mp3u7fMMMqq4nLaVDfT3IzkianygNnc\/smvn6QMOLhH7cVO\/YehEz500BgMNc42dWVd6weYKgyye8mCH3zh9GcZjrkGL9gq9rqtWGZ3DRDVFKfTnHQp2MiCdhNK7tqgThHXmWYCc8V\/xjyeBLIsRvMGmAnz3IzhwcLgZTUwZs+1qd3Ktdkm3DZCW2NCYu36fOR+\/f67B3OlwGODwe804u9fLaKMEyNH1Orl7JosGBlg7lZEUTM67DvspSnATcYY\/5ZlquOCUFlHvhk5XNqSucBQo+cbjROqGe7hPiu7wsTpvrQOyUEO1x+6Otg8+cSEkA26cGg8EMhgAsT7fg1Ynb+copi4nbRY6NSXS\/D8sMha1rtaVyLyC9x9HPeTR6MM5bx5ZvGKQUPlrLY40jqwOPT76YQjYmnDwZZHW+OFfNd5nCLB7exe3NsNDplrw0AQ\/6YlyRFzq2TnNqGCOYnPy7MXQh6Rr+f8KjhsYpp3lIzV20I0BPdtjIxDgQ22AwBRQRt4rZb6B7x53SpxgG+EbUJ3R4uotDLw+uXEqRY9LmRkqVtoSuOis4JEpjqkHh+x8clTOusRiiWo36Hv+TyFIy4f0HlO89LHXGuLnZh2vMXhbcSA2FpcUL+ErL9Q1mXofS78t4XlnOsY0bSh2IHgiaGoCaiZ\/4QlJLqEbyyquIMr9ClWYSLVw5nkQs7FuH\/RY7ZXT4zVR\/h5GpSodvWZKQ7vfPsmxaYwXGpqMz7u+eUSG3AQbESgVnR8QDzgF0t6QVClNvIPR5q3JfSgBjZrxo785bTh6fRueQD\/LrVRvh+tDAJj0kSOPKVvKoB0oggs94iMa3s+hUoxWmTB23OSazVPFDJjE3Ci9wB+zhBJG1TJ8pfhZu+vxOYMstEzrkWERcKVSV5ScC4bsPqWk4E5s2672OwNcOuP7kCinermjpLhy\/qVUYq4kn6rw6AKerQiKJBMui\/0TLMmKBrbTaucPbzfIShIopsUWzK6Hah3SpDDBKMsav2LHYYTukWEQdu7CGoL7bsGH9r\/gL8hFzdL36ubqEcwoSwL\/1zEQC6YfetkD0RUnm\/VsInnfNNpCmdMIYNNALEROLKcvxaB11UOx9t7Mkz2fKgRfl6PW6xTiPFp9UST4i5NDfloMlapOZaCKiZv8xhEAN5rywLCxU29vqbF2+HYjYr9kEuLXHfV89\/8FYn7WAb2oxNYTUENIKj7yvLZTPOkYLUHKnqg\/Adi3qRWnqakNLN0QdMuI\/ssmWGDVfLiKwKDjHMseJrv35xPwHTNco2vXUaJ9hl4HvMom3\/nubt+zDj50L0KSM+POKwm+BKjztuoKQaiZFju26XOB9HWkv5fgKaqvCAmM70c0DoqwcdfPk9IC1kNcktlAz1HA09ov5gPMy8sjwlt76ysUK6ChFMKqb5CgckCSutdzdZIO1K6jYMcVBUCtqVaidyDIyqXCPoib9q6nUubBOgu18UQGxzbjQT9xbhE8+C2KBYflTcZP\/AJAgENTdUfhO0EohR1ZzwagUFFWRSXhGPtUCVJ+XfgnRm5Um6ztNmMMvkljSKO1EF30LzruJnHAVNqaYKauqBet7X8dMLbBoOzLYSYcjN1OXiMKsP2DoFyNFTfkPLeyl54t8adL06WU4Rv+FkZfL+ktebZ9uRmGjVqN4f4I7QkHwejPZf822xgCj6zyFVOcsf3kqfRKrw8opDjmxNjtEvUvEX\/FhzpYMlt9co0B0tt10n82MXC7\/+PgqcwEJO35DhAy6Od2akpmjYxigHsbQi5DgC8+cWAIUXKude45PI3\/iii4zKXN4x9ais76VMjop4Gh8+GMnb\/aFGbDFiK4kfKzwh7lKtPAqM6Bq1FPlmjQNChgCmmAnFwwNMtO2rA\/9vEuc0CyALLLWpBWCVYKWpA870ZzNQtPB5WeGsrxqeB3RXNSTSv+k7QAIgpDdqHsI5mEtnkV3MUa+Oibnm22wBmUTpwLrJBst3GgryOJHYILrvn\/WAPifOB9XZZYkxxF+O1sW4meST9BvlkSrS5cpb5e8Cucta0ErPcRPqaFS4+YhkpWiXDtDKsespH8mNlz03DET3wpcd\/fzspXNa9zy+E89ZjtTIAjwNxbwZz0MFosRV1o\/4FFIyihasGImI+D4rCi4AVrxAmibo0QkVFresBuA2E8TohF4OKhy+o9VygjB78XK4CSN8HOUTdIehXnCwCNEp15M03hjibk5gpxcATKg4mLQq9xZHKySqujPt92LGHkXwGVvUHWj5bDgYGsm4ECrt+hY\/tUQSP+KhHexE9afu5AlInsF9wmt17rWke1m4iGptatc5QDflrVa9mnoBAffDV6mYmnBtDhQsp86duJzgmYCdGwKIoxmAdQUZ\/R7jpOuehHD7A+j\/NYA3wFBLgNZU4RcKvCHTa+Z+1ZiQ455HrUewnRDGsL5DYNQfowxGMJ89wC\/5izx+NOfA+IUtg2enmnzYELsQmGBhKZR5bfoW7SliiosBEvs7JvazZcMEom1G9jZS6xe3E+8I0sZflabm78Juj2i06cvdSvi+\/rpz3OeNLhvljCwJAS2ckkDWZ2V1j\/lEk0ow2XC7reiaKSZkTUUFMUutHvQ22wkw3tmCTirXH+M37Hx1NGIPuhE7TmLr+uorSXWeo\/dzIuVn8SDJusXIMjnkqjq8\/3+iwj3zLdJes\/eoevSaId0aOcFngvwDW62MfOUf23miFpg43XQFk1wUJbzlGEGHMrhILQewmpuA7BqhFo0CWcK1X3B4GGT9dCoAJt3UsfC9foj74APjyJIutTNMsJvunYlHAsSK5nVLGQBhqNux1omsz6+HPUJ6a3Tb7rKu8X8bqZvDtR4bBWsxp1HxiSBzUBWQc4HK4jdpBmXzxbcTct9kz0ZL+qFYnrpizpxXJr\/Pv8iCoJJkNrgC3VUqJy14UKWiWvC5\/vmLsGZLHgTcK\/aZfo9lkaXxADtWJaV\/SMf2s71AqT7mgD5zMIFt87Kuc5EZmJcHJLuvIlJorJguE5FZhDS4znZEQizvSNPSrjp6CudWzyRuhRM8GH14oDSZtTUPdzA70TiZZxXsMqqVnNg9nd5ymOSRTRKsin2Le2Z+CZvGmjpyjd2ROcVPbuBIyHKW0da9EFgfj0QT036YBxux4Txf8LMMdfYcc9lUB+xnfUXd6vKxCCTx1PZNe7k5RnyPgvH4iNMmUQOzg5X\/Pwq4tepnH07duSfWWVYzR5pP8b3ElKdgch1cNGhKU\/TML5izdZY95pXta8bv578zO5tFz3AOz0vi5Kthv2+pYzkKi5faQMDehy+V6qhwbypYyHzQOrea5amDrDOc+RYCjdTDlwgFcAEYys+lZROoJyLsnGjYH1yO68Y5RX8iaMo6gWwFosEGdWPfV6QIWCvxODhar5SNOu37ZFX4E15stF8\/hem92A+vJyobVfPjAFlvTE0w5vOxfYVXR6WIFWxYzgppROCxszYaAtpvinRfEhuFx6E7IrhRmy5Yw+7GY3c+2tQ0isBlBsvui4uuGqtqPHdDWIqrm3rVK4KhXFONcIOhcLLWxO7ENIGY2gHi6cLHXCMiMQQlFJcghYHp\/2JWL6M9c2WWIk4aqvMaUXsVe87d8YujfKyxZdXmhubIpuSVbu7ChVYnsWfMvl0KWOhN0FbdQutYxDiVyIuj+z\/6kNDUkXlLX\/6YM65qGeRqdnLL6jasbqM7nGOWfmN\/j61PyEVaziMoE2xamQEpNygz1QMzYuDdX0ap52YcDQ5x+xTBUiSEc8AThTu\/Y8HH4LUN+qWGX2RxtQ\/7pD2xo\/Fft7ES6ObZGgO76rqi+Dc5PGuY7kj0Y2Vfq1nKyllZOaX1B18bo+li8\/TjMKbjnBd9Cm30NAHBGhhmwxLPYiuUZ+9TpTjXmIt5EyEXYJNGk2qWk\/+Xfmp4unLcrOr2+6VVjmgp5j3+sJqUpij9bwYBC+VsI7tFJZg+RJy1okMvmU8jLycdlGSOLQxhtTQMYbf2WFbnB2f6E+mMDYT018VCc8L6e+9cTGRd81khgyXnM\/h2w7k\/VCq+pNxllJk57Z1YJgBx5tTRmwsnyPnZByG40dT6yPwVzdJT1bgusDFJSWSHvLYa+5nCRjh0UevipCMvjaaVMuvF0S\/fnwWQI0jyRSnC6qIiPL9NxurxybaKVo+fBvp2pXJpefqFBvA0rknQIDxBHJi0taZF1LVtIjZvEkS4WV0+pM8hv6aLe2XzBbXNUQFT3a34f7FSI0rE2ozBf7NT+l4PBv5\/L2\/un2JBNergw92slHDX+ReuewnlRr3SL3jAzrWkUT3GThN0AuIUMnowsLhSywKzlLtMQqQ0f5fYTl7mmAwWPSGmd1vH28NGeqh1n2R45k6ornsgpLr7T9EchXUEgsVl832USPqSQWQOausgBh0ReGM\/a4ougblxw6aPrOxlzsuKimR\/o1O20RWOGAoPB7up5JeS3fgjykE5+CdKHyZA75u1F5LgAvqJDHtsMOt6HA9rk9znh3w\/9xwX\/P2aPlyl5beAHvOPisYzSdGK5BiTKeKwtOBPSAsQvfY+0DoXiKHxgV\/cffxK62tL1GlDN\/13xpt76f5IpBukYvNhxcQZT0i3Tsog+Igcbp6FkreEQDpRXgVAhTqfo45q\/EcfEdtP\/06SvvUgW2ArSi8UkoLng6g6C6nuFqZrhFEztPsrCgM61zXYGAub+aEpH\/sgP+fU3FuV2A6lqSKMnibEIF6W0b0pR3y6W3l8Tod\/JDXB4cEMF\/PVdd49moTiQ+AwEoeyx7sXltJd23oPaH38okr\/w3yIwdBEGKfUrSgZ74kWyDxKTfWODCdBdaYCEp4gnNWeausaz8rQBRUo4oK7Qv3EDyVZmsyXHv2xl2nX6NMbXIAESSTCsMrG\/fR1zt75pFZsD9ExH3+TsNjUWsuFB6q2UMINNk33kEqbz5wfQyEeohctxdw3w0wQ04LprdJkKNDaS+kKnDXRUapWt8OCgVMjiEGrwLHIy0K1DsbOZ+HdxTh+Adu0h6KuEiqY6oA\/fD9ue1YZ9YphS4mtJJ06fXK92VK\/z6iTYuuC7V7DN+lQZL+NkGA53usvjbtW+kiQl3\/HygyHkskOXZrhNlbEkPl2G9j7Y+psEOof\/skhrSpgG1cP8NLCa9SKKT8RfpDPYuxDPoKtGf5dXjPuQnxTuZEi79kyqVPKZJlB4\/VCNr\/FXEtelU3Xg\/epvH9w5Bki2i45phlHjaKK1jjfzJXa\/noTNAkQkiKbLrAyyehkutTwly6HfC4BW7SSFsEIDLdhqqAelZmXu0QbXVN1+NfkjaR08xqzWmBiaf3zREP310IvyUPgFKI8IWPe8PLTYE69IVuMnQLuU+OXO6cdnSkcrHTxiejTGycoj8IIf7fVesNZUKNhAX2nf91SZHtz0tNDUdJZkTtd1DJUS6oiaMb5V1DS4GaTBPOFZmNGbfG37\/vu+AhBCfDj04JjrvDzan2AQQ7DNzaxTXMABUjY4CvcxlZiNH\/eetI0pPvaxuh7GM2Scd6x7ApUrJss\/nNCpngmYAPBHvyqOSFsT20h6lKw4Gkh2UkMayfSyVJglOVzXi\/Uuru0sGJiiyMnY27rR\/thLv\/Si4sF0JozG1eNm3QpiX0NZussqNSlLcuN7EiIStKQI6rBtOWz\/OdxMgFOOE2LrD1WV9kO\/i0ccQ0rk\/72cSORpuUwOy0lKzozSHJ6SOjcK7xIMrxgLzdQC9EKusz7WHzM22eQX8TPqYW3JCUcrQkjhM3neRKyCn6JFO4+bKF2eLJyF001ckosckrba3AseIHXSxjy\/dMwjXY2rCCyw3OxF2Q9bhtCQwdgEMks7LA6Jl2JPffJUuKb2OIO1yICKEi+2TEyqkdDCZTjnlKPgQ\/YNYFqcwzku3EwJmYiy2JKNBA6Q3wMr81jwSZcHnTazIghv7CEsUgLcA+IaMHpiar6EYYHsr8Di8sRFJIU6nITkyGxMu\/symEz6xW1rl7auIeWqNs95fMO3AnKHI9ZDIbUTKB+HY94GKEIEotaBZTVwMX+k9F1e5DvJ37gpgR3OhPO3w1\/xo1KsnQpkNsOCOnI7PmmiAgNT27Athv9I9ibU2RVDDl\/tiWnU0s6QxpOoiCAYMMgSmbBmnAG90MpcnehhnevLFXCBBkwpdhFIDnwZe27aGzkQJE5mBsSLGfhFRVel+kSBiAjPS0Y1Od6H7OsCvpbjLHPMjswxLTLcaEik\/cffx3FQINp6repza4iMzaMadHxv\/e4cSz0FWNLELsocdpzK1mw318HINlWpXSQX\/fk6vN9yPENF8S0GuE+izolBmQuXI+rSKMP6vzjSxxRZeFA00I9dP5LaaAEGle5kzwVWLHSi9iSqQ5jqKKqiKJyLAdjRAXSl+XNdvj57dNDdPiw6\/u9zW7akpynkq\/cmfUxmAgw9jskbw428m5ni5N\/jii7Ecmf2Agub6o4V8IuW7BCSht28OCwedUuxDXo+XLcrqFAaophE6VxWzf2w5DZo8JmmixEifBkJJfnrkXARdPTcw+haK7wLHCL2\/go3zn6rkmm5EXBdKxawP6KNl82oRltvoqojO5bibmXilV4buATTAvV0vXQyDLU+aS50FptZf43Rd+zQ4lK6PaVkQ7DxIApEST9u75ivU\/qSC51dKZEuV\/uVf62MKhrzLbcFfFdvXTVuXI8fVlOLLF1V\/3m2RI515rnruTE13lxN\/Igt7MxgCtMC+JdQYQM6sA9PMFtOiuyseEfV7GRJ0Oo43NE72cViNoAldOJ1DLN7ogID9eVw2KMsZNp46D5Lc1DxShf5Q\/Ltn9Oa5ca3VpD9tK2nlLlb26tXaRXz2k6haVa1a11sDlahHq1z\/SPTU87z2VdpLAEOn5VJ7tE3sJa19BYdzdGlSOZLZ0JqrMiCjAbeHcBzv7bA4GJ0gfwcsUUtDzo5l3znQfRxE0bxFRKtaXFjURaVlbMd1HexaJFsaguyc6RFyDRf7Z\/vUAOFJe5FD4KbmNIiktKUn8YzRJE6w6NnJxFhHxeTBZ7xbw4jjcS2fOfldkFxoMUYq7t00yJY0hvTrmVYomHp8Uro\/nGnzWf6ok3y0PaWf2ISqvXgm1hXXGfA9Er3zurehttAdA5He+r6EPzC70mGMIyjJIl0t7uW9LsoZcuQtGH\/oZjxo58c7YTB4JuFscoLiNxqX6aCV4+qxaImvufKM9off\/K\/gHJuYq94KvTjvr5ErnGVJm9pgVaEXM4dAmqAMCNO5yTpayeWoW1mXSoVAGU5w3I2dHULqw3VcYA8zDDFXSAJUr+TJDq8DPf7a4VnE=","iv":"191d9df83ad78d5534f60d5e2fe2c9fa","s":"49520d785a73558a"}

Retail's average view rate is far below the all-industry average. Image credit: Strike Social

Retail's average view rate is far below the all-industry average. Image credit: Strike Social