China’s spectacular growth in luxury consumption recently is primarily driven by Chinese women buying ready-to-wear fashion, jewelry and cosmetics, according to Bain & Company.

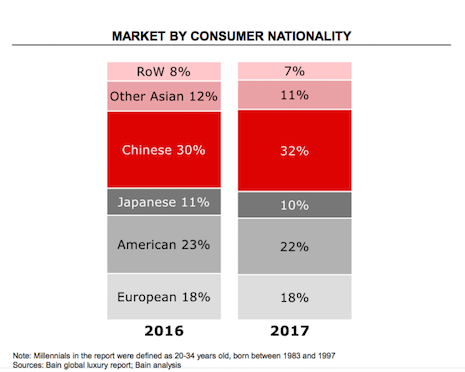

Per Bain’s "2017 China Luxury Market Study," China’s luxury consumption is outstanding and outpaces much of the world. In addition to the value of Chinese consumers traveling outside of Asia, Bain's report also notes that Chinese domestic spending has outpaced overseas purchases in the last year.

Spectacular growth

China’s centrality in the global luxury market has been a hot topic for over a year now, but Bain’s latest report introduces some interesting new wrinkles into popular understanding of luxury in China.

For one, much has been made of Chinese travelers purchasing luxury outside of China while on trips to other countries. While this is undoubtedly still quite popular, Bain’s report shows that domestic luxury purchases have actually outgrown overseas purchases in 2017.

China's luxury dominance. Image credit: Bain & Company

Chinese luxury consumption is primarily driven by two demographics: Chinese millennials and Chinese women. In China, millennials purchased an average of eight luxury goods per year while non-millennials purchased an average of only five.

Additionally, 93 percent of Chinese millennials either agreed or strongly agreed that they would spend more on luxury and fashion goods in the next three years with only 7 percent disagreeing.

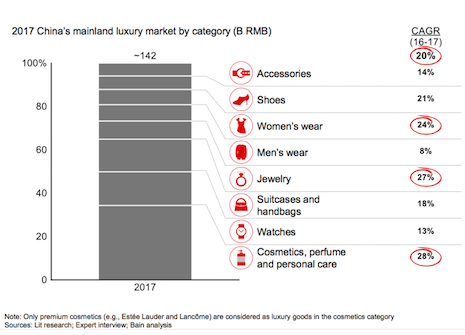

Similarly, China’s three top growing luxury sectors were women’s cosmetics at 28 percent, jewelry at 27 percent and women’s wear at 24 percent, showing that women are clearly a driving factor in bringing China up to 32 percent of all global luxury consumers.

Chinese investment

In just the past few years, China has evolved from being the “factory of the world” to the consumer of the world, according to an executive from Chinese ecommerce giant Alibaba.

Speaking at the National Retail Federation’s Big Show on Jan. 16, Alibaba’s North American vice president Lee McCabe laid out some of the impressive data on China’s massive growth as a global importer, and not just exporter, of goods. The thesis of his talk was that, for any retailer, and especially luxury retailers, there is no reason not to sell in China on a large scale (see story).

A number of luxury brands have already begun expanding deeper into China with a number of new expansions.

For example, L’Oreal-owned Giorgio Armani Beauty launched on Chinese shopping platform Tmall as part of its efforts to capture China’s fast growing appetite for high-end cosmetics.

In the weeks leading up the Jan. 16 launch, Armani Beauty held a series of pre-sale events on Tmall, Alibaba B2C shopping platform. Similar to fashion, the cosmetics and skincare sector has steered away from online selling in China due to counterfeit concerns, but recently, brands have begun warming to the idea as Chinese sellers establish a sense of trust (see story).

Women's wear, cosmetics and jewelry dominate in China. Image credit: Bain & Company

The brands that have begun selling in China have begun reaping the rewards. U.S. jeweler Tiffany & Co.’s worldwide net sales increased 3 percent to $976 million thanks to sales growth in China during the third quarter of 2017.

Ended Oct. 31, Tiffany’s third-quarter sales increase was attributed to its fashion jewelry and high, fine and solitaire jewelry categories, during a time when the brand is working to further diversify its product offering. As for its nine-month year-to-date results, also ended Oct. 31, Tiffany’s worldwide net sales totaled $2.8 billion, 2 percent above the year prior, and comparable store sales declined by 2 percent (see story).

It is clear that luxury fashion brands aiming to cash in on China's massive growth should keep an eye on millennials and women.

{"ct":"vVX3+jeYBN52Z0ZSJj0\/epP4k3xBSdy6syDXGM3iNwXv3T0iw0j7GOiFWwfT6vkfwD+qwl1V2oN+Z1eFLADUxrCG0pzOCbiXExINeoIOYCV0920hKJWT1SUoroKsWgMt5zhy\/5WnjMY0mtLmaLkCgOhbCyGl6N1QdvWQnErwg2VDk+7ZcvSAjhQRqUw7ysqxbrSr4wWl+Dt9kzduDk1RPKZs1jVXBLL75dcMboULvSxkfl0u9m4qpXnukasJQamSVwMZrsntpWTay5QbEkjdT\/kKepfGSEK2mQXtUk745NHycsaKC3eZaxrEtMgwJGCVqM1R6WQ4X\/5CsGs9xcjm32H6lzynjenDBdtBdxO4\/zyfvrR09XPwmWW\/3WQ8+Jqh2HB3cwNB9cRRDuxQs5ebi5Y4O9x7hRrnEXxmtHQm730UmYX+lP0Iv5i4JfZQyEzIAHj1ZNg4sh7jNf3V0xjvnvkFEHQ9wLLrNrXIQTBAzIl4yofQCZAJsjIDLHl53Iixc0qm1dLvMChJHCAgSfeMMW4HBrFOwXqrUvAMKpitJHVMG8jz+XFUmw5d0mi6+Gl1EaG9qwgdp396JdicywcDxdy0yUXotz0VGzL7AZBz+LQ2VG4hACvL6Xt6XhlGoykp5jpt8lVS86oQqb0CQEoDdqkF0gsyQ9RDtKqzr8JpM5z7fuO\/Gd0XpmF1kky+oqa54u3AtPNDU5XJDeX4+Z0AhNNzFJIJ5bMreW7GyVxUBUhymbpTi8ypbsmgj6LxupOnLi5HwdkP7WgBAtTh+pOb6du\/z0B344H0ymVlobGcnF7TVRFpJSNM3ip9MRYyALTjyaDOng5vWEwRKSUWDq3+MBryFsmsUtG06LTc++7\/HfB2DwUonvlE+3PR4riRKeBdWSToOm\/MR7YK73kgq0uoyxVrFkYopaHs2mWvsUNfXysnckOtNft+pE5BYy4t9A\/Lp02zjEWLp5ecc38UEtF7DuV\/cXMcBMHd1WITnT1e\/yQYM4C8\/P3aVpbCzi7frFGtz+SwdoYVoIZHoA\/4MEZTVN\/MWuwe0wEBGy0Lm83ox82Uly35\/EpnVbMLkHPKLi9VobiD2XA3hRAq\/V\/tEuGWs5HoZpdOdlY4V5sznnkRsh0+2XT8ocoTjP5qtWT2LdoyXtM+ql71k9pAa1tMR0BwdEEM6tolCVWPVfQVH0ELubbtPik88WQ2OnIVkGgIv8xfRgoYLuew7L8cN809MUq2xDcgPmWZZavJrTAPENEjI8csIHffgS2N0h3XQq0KQb30YDD6x\/DoncfHD7wGfajY3RKGl8EEctzVX4GNZ0h3Tl3HL0YOlTDJTc7cOdJAwVbdHguXreDhzNcObGoDSK5nsNGd\/Rq2Arxp5ZVAhpdfMxVJ\/nSJb4iOrjhDyAnJRTG4QWpwJjr+Zea1GCYcvxlI6cy3OzkIWfXWn31avtBr6vVlAkop0fsqXyfn14UTH22N3QR0E9Lb8xY+1Y9rTwLpnhZH8VhNpggOf61hQ+kyBs6iKibKrmp1kjx65TNfwChfTp8uTUvbfr3ylg+KE1HFubtrBQ7Xvhl6KRXrtudioKbC6\/eh7JJrVoOjOhnkuKsu+PO3q11SvHp7XvbcXmtMHFkXhV0KIlbcQsMQb8ur35FRWs23UPXwtQctojZ3SMM56QTUI\/2QquXSFe\/aSlh6PZsK9kOVjlG8v18LULCir8rM70bm7dDjmqBUMXyGWjAN2P1CoKrXTX98BdmGB8MmkMIpJH44xUO4vnStI4\/k79sabDLKArh5+RXG8Leus18xyP6Q6Y1GlKcTVezL683LkKzAs1oWGGYr4\/LMD1RwCYvEWYwXUD5A46i7xh7SFP63ObyweJOqSJ7A1\/bgMABj3KO3V2c4pa5bhSqfUaHw+MP6wvU47u6jRUpkmMPAAKceFmKLV5bBCTatAeoJNPDsOCTjytrMQyzT7\/TO3Xa8Vs+FmKtGdBpDEo1Q0cjGwMbgQWW89EhOBK7XEhhzMluObFYN3l6MS2tItNxJUjl1aov7pvtwLKbMnUGF+cfuCE6GiKCaoBf2mclE1Qkc2oLO5xccYDchCP4hFV02Qgh7GdqS0peA\/epBSvVhPINl8LC\/eIgVjF3y0mCs85tW5aF7HqiPlanpkDbE5dD9WmV0CruvNYwXBZUTjCzK31c\/uRPnxMgeqmlzo6OG2twkC2\/SvGUk4yXIsyiaEWdy08VIczrMGSBKlDGU\/Vi9sYY1dlcuH8vFJucbS2r\/lBQS8wS6rmwyXM4SJ7q5Dbtgr\/DWLMT7xVtrNfXYwTuYP1q+VQJhIZEHNPti75gjlgZ7b6nQ6rORYTbuLS99aAqHYb9QlHe\/WhOV49ue+VHu\/AHoP3ncS1hOh8q7rYAnJ9wAFTK30LWLbq275CXLN0N5s159aNMonhuWcavpI4SSI4FtqoWxJL3UgFyRzP+XuC5SawF3PzmoRoigQb3NlhhDwcSMMKnNZRNX2amjAYjuCKhNGm2HGgMcWJ+9ckInYNME+e5kqdnFR9+i7QiZMrVAfsXfUnPyDiDz4EGdTVvOSkXMFCGXJPk27c3ZWCc7j+VnCQoTakPL37adrYRk2PaRyPaelG9GHR5dQfNv6otOk9rDmjKocCta19juGccqrV1PIw6zUtqrbTmQQGbmfdYCIMHjfS8xgAOTH0z0oD6guslNVuam193QEjNJxnLweN0DZTIp\/LISHojXs1wtdCWBR51CLuWP71jyFmbNfWuOkLoItN\/5B4MTTa03NOIlLdmXd+afz4OFdgbpOcSgI8nm2Ev+WjS0\/BU5un9eIb1kkSUjcJWEF3MMqBcdJ26n8UCGzxzRaFY\/Vp6iXQoaSol2RFitb8U6k3Zn\/yYSDP7tt\/WgI1feEoZrI1uqETkmdnIVvp05maFb2\/ScgAA9AFp3CxwQ\/E+scNXduVwzZjRJOc8CYZKxQog2+QERfAfpw2PE5yVp6tMmo7llm2TiQvjqUYO1QI3aQ8+\/ilQMmEdr+VhSG\/9cnSggnDc+2IKJFsZJgj1xuvs3rDpTZzItmoEcYBH5SdkJFNxh1NzIzdjAk\/nwxeyUNIm1uJXyU7EdH8zR1Ok5g3yuH7oxGeqlwA8mxYgf3W+Il8FrLPYrtaZrYnXiCfvGeZ1mdrOHtBHMDifFjJKD6KjRZQ+Hfen6JEOnsBTkrj95Isath6lKWvijL\/kQ6YpErFwzeE52r\/W4t29gDjiJIe+l0zCG85X\/pBiIrgk0MoL7J8DfOkwFz+UrQAAXjHtm3LyGhw7aSz6vI\/m6bENWzR\/bODM6occN1Xo6fwTTB97wRhpYO4EC+BeRsZbcuG7i5zbAJaecSC0QVbke09MvhHPZNO\/z9gMbDOgDF0zd3LrJcZo2Zq8qqeCWGeFierjtWjZ4IzRWKn7t5jRggq+pgymeyRg6SpvwVjLawDz53gD5hndxDxhXObeJCOVYU1ApJekdRDk9SmjIqGxBcfXn5p1L8buWA40zNURMBuz5y3HLc+95uJJNzJ9\/Sykq4jUTbpkWF0TfFIybyAITk9Lm5oDphQ2Ui1Q\/G2sJHpHdBwcQW95PA8qnMdyBJ9GqrHF\/CJcxIVJi06CygJiBtFvzRiSSRjSuYyYmVthCvmmUrVwbwqQjqj7gZ4Sih79WDroHovuRV4ss+wH\/LMDZvZTY5iCJxPTUKxIoijuPQKDlG5KJMHBeEOG+z9NlO\/Xf4KuTRlSKFt9oDKwv+MeBqm6Tqshy9dk9aU+8LH9dA0vueOg5GWuE3gGDCID7BAUF45z2AMymj+zV46e9gU5RBu5fAInUKMxehOEgxdOEyCtZxVjEc52Fn1eznb3s+ZaPbpv6NFY\/AHgSOqYXRvWL68qE6HIXtjKFZBz9hfI0FR\/IwFdyOYsmbe8PGbC7hotT094tQs7of0CwBu1JYza+botGHBCOqtJJMEwotiW9g53k6yt3ynz9rC1oxnjiUMTwgFrOW3sIHTGLmxnyr4QLIVfOmQ9s43hMiUW2Vp2+uX7zLIwzuiWUMdDyLU+6H9Qyh7YCcqYjCPOLFOJgLO2rBd6gA5wtDSjmU4ErTPwyXFiB+SMhfFlO5h\/7DwbR1LPxBs0M3HKj1A5Bvls2u1hZdIsy5CH9dHZk+WEAe8F+BP5vMaRbPMHlLmFPIxoKMLJpK6GxFFN1ksT1QOfDhU7zvza2JeUgR1EkfuU\/7DRYS7cGWdFaJdnAh1sUvK2Im0K0xK+574UypqC9j\/61dBGq5y\/JFTQvNnS4Tg2qQmDvw3Jx4KIeNrv3vhUEeeso98+9Awhqo6LhcoGbeEgcRyysqgDAp\/dc9e2MxV0\/5YcXORXDehuTEnnv1f\/2PVlczIRNajCRe4\/G6cT85CsEo6DxSgYkc8d\/s3OVg4rGit8wns7eAsmyJHn4w1P\/YauAeiUC8mLTLoONmglAqEDMbCQXZEnK8Aysacp0oezG7D+YZ4lqFguPI7kdhkda1rxQsQ4pP\/PprrOJJjBKbe2C4BAI42hFERtgvinOzPKDLx4\/K4J6MJeOxO4+Uy13kFUfy16A6uBbF0+cAlIHLHOlTlnVZpeJYR3aDNxnajM4lgMCAAgWnfY0I1q9QMAFAgNMfVjhEeKpUz+uoHoopVTXt5crBx6iFbbq8oc1mgr5QjaqaqYpyeCbF9InaYDcbZR9k15+hSxidiycxSHNVIeWU\/BuWspwWViJ0emjoBApJ4u1btbZjOSX6\/NA+eyj0GZhTY6RZKHAt6vN7c8L1KQz+uPzVkor8rrTp1h6bN6Mn7tblO1QflApD0xxjjY\/NVpXA0dc2L0mPkZmz6UNVELMoRLsoSnVJaIB2JS5j0mBiGIEEPIB7BUogbvJLWS0CcFRqTOBJn19nChJeRsLZEJI\/HgdCJX9lJwhKmUcMOEF4J4hW3G77kxI48SsDMQv0efWv1qhqmtiY5X+Xb7yW8FlKSRxXKAdBCrmYxPy0HIoG58\/KhXirDmhuSEvOv47IpBijnnMkTU1Gwwjx6qmdBz9ml215pJrbW6dPFhBuGYRaoTWlpf\/tbSd2uO09SjfIDW3dGtehdyKr4JVcsiAEwKfYo1HzRnOxchVhPiOPK5kCiZfBPMbKDHdQizaaynbYBr3dcLFExEu+9yxQNtnbiHEr7uBKQYwXXrGIsVdUhrKn3TYR8QKY9IYUYezKr1pdZKabdVmCksCD0IhEvn\/E2+fzz5+vYfcmLm9gixo3omvmCwNkW053fb6kkC27ctn9j2xYXmqbN5g2hIyU\/gC9A6gfpgIex6b+NS\/DLe7W\/tXojxN6PNqtqpm13fhaV4IFCxxDOg53J9foNnLAYIjqHBlTmRU09Gs329uHNnCta4wXzwXIRVrXOXlyjLzG+27pYYBRWP+\/uhyJ8JEB5pcL3TpTWCtExhLs+FAazJ5SX\/i+vT1bHOab2JyuvMYVjSKGaH\/WGdrHUCZox8vgTbrBBdhPdKuXpoC\/uYZKtvhV6PN2vCSC2vB1oQVT0XaZ7F1nf6RSlzHt3lGrrE5Z0FsC1PSs2+bgI3525bEQZxDn\/jbOm2rVdV6rcjy8nd4IvCXao2L2P2PUy+TyFR1O4DrCqdQ\/k8aJlGUBQh33ajoMkuzTOn9bawY8pFOIJLMftQ\/1WpCid8z4SP7wVRovsOLXCrEtl6ZUjfLvrXZmiJhPmLmLhkD7IeMUKLlvmbs0N1RRTQd1zTTIk5zBnrqKgQx+B8qhCHVxDKdDlBrxzyGrgOpapM7TPHi4xmDn+1dDHb4pxXNVLpAgCUE8anVrmSqahGY7z+EJMVrfuyOLJzsIFbwPqfAvGdvQ4v0yFhQnAviWUBS42WhabDctFZaEhQH\/FDmlJnVDQseOf6uxj8eGzIpDNzeX+BKocsUEBQbeCVUBjCcPdZEaHeEUAQ5Xf1q1Afd6hWQsOSZynct19XFdvoELZBAV8IbvGLq2c+ldzXIfm260ST5jnqifJ9L5I6kJgzAFSWZa7q5OwdUh7VmouipmqNH8qYJDXGR8L4SQQiOYa8lcgzoh6oD\/fcQelWViIbdWoe4zrbrX5XKmCWu5BkmwQAWq0wPDT4upDnFiPAFN2QMTCUoKkHsFw+MRmOleA\/oWfltiunQUXgHVK58s9Y63IJHHjRJPC6K5cJ9XAEMeRCvvthqaOgUxIh1qiRDHRzVPa0Kx6LbDynMyT+1eCX2K4I4tUYAAZVgtYm3Br7fCMMwPRLeM4Le\/qihrRexlTLWmZP4pD8xxJKoxYHrqK31ED7KAd0zDUbXfF+6uEIEOklq4H3dMdj0VX7k9DzyQUKb0QkdSO1ZFTZlMx7Bn8EHhrYrsLniUVuVtkE8OsuYQYDjJeUa3V8xh1NwrIwojPNG0JgNpLeN+z31oB0sU3i7l63SxSovmExHFKScm69yDfMwVpZ2bmWFW1vcIExR2kTDk+XAxSvXq+zgilyFbb+J3oxmz5sVe+P927bw3ROh\/Bja5UQCp1ff7BXraU\/7UcVt0DMe73B5HtMTXw94pSR42e8JrBG+1jHe38B\/PdkcgIT19aTPqk0TPiyjuFxj0\/iBhvjgTYAerdE\/CZqTM+jPfhdbSqQjSL+wUE4zwZgH5h\/AGmWihns4bFdYObfazH0wgeLDC5OJMNNXqp4EHv0SGjizQWa2h062yCSwt5zbQ\/YDr34rPRhZQTWLLB8TsMys5J2Q4Qy5oalF00MvBTr60mYWoEhUQRsQjhO25I2WP\/L07M6baMgtCOWIHgsftgHFMuX+gp97upUuHRPB7NpM8JYfuYqcr3JnRdHxUUxcDrhirfo6LWPqdBMCQhGgczLdNxi6IAjKXOun30g1ysEUBymNfte081clc3XECilvZnmAe\/7gFIxJlE8wH4XDLyqwDE99jEYlpm60rtiS+1V0N0FivYlVFi3nhsRjcqqoxKtF11mzfZ2eIlw6Wq5zWNkcFOo2zQX\/Ks\/8JptojCIMxHDhin+0Gxd\/MtHcHrXAuSE9wZvT7wj94R4IBDH4kI5zRbC+76HEJ74B5iM54nMsnbohTjxmsjnqUBRpqSzofpSKZT8F1zrUdC\/gz963GP\/HisabWn7vm30IkhYR5JnS38koNoG71TXsQZ2S+uUvw8ehg8\/l5Y\/qN7a93+RrgESHszcw+UOJsExdNZPRCZxIKXUFArwlx+I=","iv":"851a3357b1318b71b8d91199b08e2b5c","s":"bf5897b99f83e226"}

The number of luxury brands with physical stores in China has ballooned in recent years. Image credit: Bain & Company

The number of luxury brands with physical stores in China has ballooned in recent years. Image credit: Bain & Company