2017 saw a massive explosion in global growth of billionaires, with China seeing an average of four new billionaires a week.

This growth is not limited to China alone however, with the entire world seeing 437 new billionaires over the course of 2017 alone. This data comes from Hurun’s annual Global Rich List report, which found that China was increasingly pulling away from its nearest competitors in terms of total wealth.

“China is going through an amazing period of entrepreneurship, adding 210 billionaires in the past year,” said Rupert Hoogewerf, founder of Hurun, Shanghai, China.

China's growth

The world is in a unique position at the moment. According to Hurun, total wealth increased around the world by 31 percent and the wealth of global billionaires is higher than it ever has been before.

“Never has so much wealth been concentrated in the hands of so few,” Mr. Hoogewerf said.

One of the biggest stories in global wealth from last year was the explosive growth of Chinese billionaires.

From 2016 to 2017 the number of billionaires in the United States grew from 535 to 571. In the same period, the number of Chinese billionaires grew from 534 to 819, massively dwarfing the U.S.

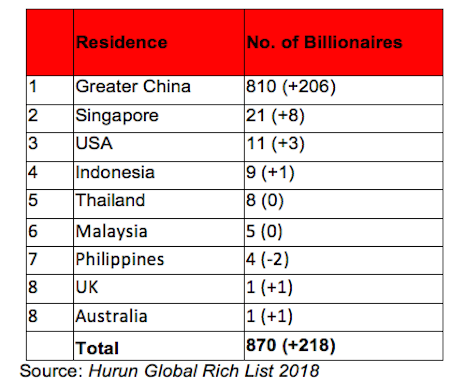

Global billionaires. Image credit: Hurun

China’s billionaire wealth has also been bolstered by huge earnings from Chinese affluents such as Tencent’s Pony Ma. Overall, China created $4.3 trillion in wealth in 2017 compared to $3.3 trillion in wealth from the U.S.

India has also continued its impressive growth, adding 31 billionaires over the course of the last year.

Europe has a slightly less successful year, although notably Bernard Arnault, CEO of LVMH, made his way into the top five global billionaires with a 105 percent increase in wealth.

The massive growth of Chinese affluents remains one of the most important stories in the luxury world today.

Global wealth

China is poised to be a vital market for real estate now that the country is home to the fastest-growing prices in the world.

According to the Hurun "Global House Price Index for 2017," Wuxi is the fastest growing city in China, along with Zhengzhou, Changsha, Guangzhou and Shijiazhuang holding top 10 positions. While China saw the fastest rising prices, the United States saw the highest ROI on properties in the world (see story).

“Global asset allocation is one of the biggest trends now for China’s high-net-worth individuals, led by real estate,” Mr. Hoogewerf said.

The price of luxury goods increased 16 percent in China this year, an increase from the 13 percent they rose in 2016, according to another report from Hurun Research.

Where billionaires live. Image credit: Hurun

The majority of the price increase can be attributed to three categories: yachts and aircrafts, high-grade tobacco and alcohol and leisure activities such as golf. This data comes from Hurun Research, which released its "2017 Luxury Consumer Price Index" to gauge the current state of luxury spending in China (see story).

As China becomes an increasingly vital portion of retail, the British Fashion Council is strengthening its ties in the market.

The council has entered a partnership with popular Chinese ecommerce platform Vip.com as well as the Hong Kong Trade Development Council. Chinese consumers’ interest in luxury goods and fashion has grown exponentially recently, and the BFC is making strides to leverage this (see story).

{"ct":"H\/mhuqYMZmgPwnKNdGJzuAHwYQGGS0YUc6LxrI94mF5UavEuPmC2RImDUaML7U0dK3tpX2coWjky8jPpI7Mhu7Mua\/OTGSNHh\/1J+FP1oW1SrOwBrecik6TiuG9a3k0PbwaFZAHSC\/2ThH1W66247clWufP6+AXIZTH3O2kmo+\/inXRiljLhJ2rKrlkcpW34LaykbEtdiZ\/kbz4OgSsyz5jrCNYuJYJwJkz9e7eARzBi\/IFKRfH27JPVarHeh5YgOyO3cksm7Mpt+Myx2o02H8s1nguHVESV2\/+pJ6BRc7P0JxwakIoBRL2wlxjTIVvDBdYFUEAuppF6mdQzDJ3XliElBrDvCxFBD0BboOooIkxzoYpJtmjXT98boFUkQPH4u5tkz7CTOkxd09ZstXsAqodIjb8YMVPOQZPvdLCCAx+v0BJjhT2otFAdAJyK2aETM4Ozx36+nmD9VRhP1UUZ+eGCv7beLfKX6eK\/zQKmP0BfIlC3jN8ePMF2PpRp5W\/0I5\/LXq0QhnhlN+TlFDELTDMuGWGKuXScTGklVGSRSZucLvTMGGg0CQLjtvs1gTGBWjcMxybUeoOXyppIVDH32Lnl2Ki4hLOy\/VIyW1mMVrwwuVq938chxRiXw+MfTLdiVgmGSWGGIVXQV7CXObNzVQYYVmTSHseC1jFz4mCbscidaNVtzmOWRZ5Ykurxuv4wrw8buH98s06wz6AhVGvI\/TOBraAFcrScANtn7aifkyfdL5tmmyHgCUU8xObYHG31oP36oAzcxC6+0eJXTwlmL+hswhsBIzesMtNB2+PR+zRZqH3G1BzmaxppcP9Rdbr7xHfsxQEMyGIFc1xtB\/i6jlmD6XMVTW32fsqQpEcmeV+37VAnyI5N9ehfWnEMyRbi\/ugGCIU1lYuN7SGIz5x9jA2a6bzz3Rz6mGuKFkn4g6Q\/d27THjuwz6MVWcinvpDWoArAYVN5LRF56YtDouWDBDQKjtRA\/vTnbx5zdOFZM59o4fA+GcTqyMi7I+faIHw2miXnLjDrypxUtgPuEIIduqxhTZGbfHZs4M4h18P7K7iyYkPu8ufOBiOn0rcIdluU7j41damZYxjg\/Hc9dU+7qFm7b8Ru67QVUCkJIFgtL\/l8M5qsFWvGEV2zHVIyq2e6+gGxeJI+imRa1u2iuhIn1EPOnYyEf9qCmYUfy7cH82eh5N4CltlIRHoSpk+xLUb\/TK7nW0r2MBgXdk1N4fftKrU0DnLBOtDAgqaSzjIRVrudvMnmwIaH4YogA7qEFM9pt+UJn6MZ9+t0lc6YCZNKt9LgSUF4kmz0EprBEVQ44qXJmE8llyFj7akvgl3yW6ggcHIVeTHbrRN92oA8pSOi38zNLUe3hX2NRN3HdCgZORMEG63Z82NJst2aiyanrRc4aFLwaYRavFKvCaEx1dk4mWIIgQRy0i87WE0yqB4svaZsV2DWLZNi5XymeKCW+KsPbZ0aXcWCbh\/+9VvZoZ9sTIU1dSP+cRzagTchpeR+doOZtpPStRoH9AtCMiStioTzIp\/ywLSEBkz1DU3ha\/Bvp5maaZ4vOgR0YpexR\/XD+VpjRWY7xOERjK7fyBIv6jZ3KwZEMxJA6eL5zcJrlN+Ohksfht5H75LJuMvcyYGnEXYhFXhUwstqsLjWDW2W4NHLwW5\/UTtWF7yxTWcgH7JlJwP4PGIu9xemzHgW3KR0yn6nyXwsOddBv5DC3apTOFkAUTCxAdgFHFjwaHKIMGU3rl+A5Lc\/0f4IqSh2se2BhMbaXg2Dfr2KpFWMUcogvtLsaYoH0C1IygXEEypV8vtnMtWOYp8ABsHGr6VRFx5lNO2xpOcZexTLXhbGaTDJYJ5a0xnrS+ofOcX\/JH8pa77wxjSBkjp37LcHnjbKwhPeyNMYjdH4G6kPAL66ahk2lGZUZ3LOK6l\/j5Nx4JUyz6xEdahR8xNWa8ZeHeSxWqq9b2NU022xYccDT9m\/IyZ42MgxFOIdndk4cA5Vui\/9SOyCM5pDpyjGyNrUYklV3w1pX6yIzYr9yPTg1ikngP69qvF0dU7CHg13eVzJllFeE\/6uTOuJdcqxLqMtrnVRykwkmEXVzyEzwJz+TY\/bX91hmKrgzwD5ynm4fvbPNaunzsw6JdQ279+k5McUTND0RD7bAADLIBlaogF735x7wfowYQGbWztmqYTclX4v\/xx\/IfQawTH5r4cYIp8+dQuvd3l6kdMnv5RnxsUNg7UgcjwpxyjEnckS5gYhCaPZxnsAg15Ufy6GvoiKd5iZZxNzCSV11eD77dwiHZJY6HmgM1Vv296yYejZZ1WqdUenmCDltbRvroQbecmoC4BA9a2T7zdq37kgzXmWTeQAcSayQn7dZP4BO9jn\/Rzbm\/FHWHjLRTqpI86LrWPpYbIkUY+oj5oYN7d1uXeoAQWIBb92l+PdPQUUWXVmn8JluKRIy62KVa200A53UE8+DWypdISYjTHElLR5lOiNgRR2qxooobL+xI8RBIEhKT4KQq2xdegvKTo5kRihz0yv\/c2OWIIbIjUWsecM17z419Oap48pPUdg87hDInd2RzXaUhYg5LSI82GofRX71ZE4q6rlBvrStr\/aQPPtgx8N4kC17VsJnziBmRWn6j20\/6bvu4MgyxT1chfM2HlF+4tJs84\/Y0kAM9bPf2yqBpC1g\/1MhKIpYWr24GwJjkf+JSz3rnU39YVSet\/bkw\/gepanWL3+JpnGdsoYds+o8gswg1TBJB2Y0Qc\/pUyCYtzVwr9IPUHYlL1UHf3RVpqYj+Bg3bb8Y6epaNEAJz50AMh6n3zZRVTxuYsJ6xYoB5t1y2A9Q0Xd9\/l091EEtBe+\/XnJRU70Q142Rd+FdrUCVUGdmNc+3JzPXS8sYNg5ZVpEAPwxv4SS4\/qecTc1gpyScv4haRGRmbkXP9M9lKxWawiFtBNTVSU0FdaeI2SCcJnCgcWgYMwMtTrIYiuySZK1F+kiD\/SGOBxKbhlno+PGFMWRjyJfSVPdKQytWE\/LzDDqDW5KgThh6ga02ViYcw2YkdVtJy2vE\/QekRF6GPAe+pg0fQEMDhzArNI0ks+cHRocVivVtnq8c89iQlbcgN3OzBn4qKyeYQEepuJHPSceuEQbQ5egNX61R3g0q99IwQY227KsRLnYQitkO0TQHW9bx5CgjCsj2I1YqSoThUUt2q6J1M25drBuHi0I8\/LXyJ3puBPKCaowWSIOZF0jE2KcZypp0nD9vU4b1S195XjdRWJ7gG5ACbF6IknHZM1C2zcB2kZfbzZG2FFN+zNjT7WXF127cL1z6JVb\/5CLjKj1OgbCaefygXIVuldfGdgi0a8PouaOmnxKDXhQIMmDFSQw6D8GofnbrDCZuJKAkqgeXkXmqCmqvZ\/g5XKMUlbintmz+hh069o5tdIfj2TCzbpeBjcxXsiEMQ+\/3b0vEvc\/chy9j6R4uEfPZpzJsrCeNqDpFBzgUvzwr6jYd9HDaj+vw1PjHV\/6odtPLrvOXtl4SLpdFpEbrNv6BUsVpRIVs8tjzHbOBS5jgVeHPNOk0OoMj8dJ5pC2rUDfaKE1dtt6XjLz0pSr0wYjuMmACSArKgh\/PldaP9oeqVYAwgjhFv7dO5wQD0T7+WPT2xVrCxEWclfzdAr+ymePLEA5\/6Dmp39nG\/KCRxbgmKOlcFvtOEIMrFhg1yGt2fdgrOxVH0Q5\/jAEcyR9qWTLKrH1xcQa174dDTEiOXVWrcPuBAIlK\/R5ryZnltn4Vq+nik7RVlo2EjpOsK\/3Qg6C\/k2OAbg3LGhqeiXaGQ5mAkxI6m4pK4Zs6U0cNk4FnfUrlNCGxeHkP6nvBsDqIF1ufSrMpPyoW3jLg2+heynHD+volZQqXS\/XywE+1WJ3B0txAypvgiVsIdQ4RinUoLev\/1dtCat7uo2z\/smQbjnQPjQjDCS2ONhMOnIn8NisPT71qqO8Npfad9y\/IxYwDmiGHn3DK9V7ABHYap00m8K8iAcufDuXuLdQdGRT0Vp78QvSmnZjLgZqW3FxGsXlI3TirGvDiyzReqh5bRW7MI9IM8CVx6RdctSWKeB3QpL\/eOnig8kpvDCK7Q3lS+siCslPrC5jp8icfx69goZCQDt9zFCciC+tj6mUj3jB1SqvUFVZNa0zKmamKl8xq3zJdYuxQlpoGbJf+efxQbyEKOpUz0a6ISl5BdmhreyJFyLWPA7X41YLtBYEI4ViTD4I5jrqrnVNj5Z\/pkeXTK0TqItBr57HIIZ9d4\/CnnlYw1ySLCK+s3C8ymx\/SMQA6lEHpwuz5THn9F1ZyNdxxwr\/ahvWpnP2JIZnnGeKNjGDaHZ\/sLtfyWoJiqGBxwBCXp+P20HanisV8CnGOfUYo0O\/DTSqVNvkLE3FiPndNBPU1lrALCKEgMNXGvXgYaN2XbuN9qJj2tOnGn\/slaGwKPjR3cmR1Qk+lfN19BIrkM8TWAsr8e+eoYEtfkqUMCH584\/VR0GypvrhRtcAaiPWzvO64XDDYiqvO+UdtCEu9jPlTI59r8YFpbXcZF3QFrhfl67njZehPKrXUFMPRTLtVMVwGxrv4ziv8xhdo0Gkb2vUCT4UeMlZ2Pus+B9MBt5sQSvi2oya\/N1fLo5dJljC21onPVxXIYhym7UJyDAEKcom+cks\/cHYbnX92H2xdJv2dU11vEout6HLMlLWhc3SH\/sV1s27VWHbZIHcUmYz05zV0SgXYFxDlkeCk2UiLDDeRioqo1YH\/W1G3pY59vrfavZscwBmgbJMEiE9S4WwRXAhK9Iu80QxaNwSUqrRH3UPYl0vT5x\/KFfIGgnYaGS95Oq07dHhTfhHMJ+h1ltvcqUpspFOLZVtpApHl3jM50n8BPgS8RKAqSmSDOAswhghhZa2JEp\/9HKlE1o5Ijtquw5yZ6iZ2Xc7jXUbEj9LwzGqe9g8vPoFwG0PuGfLA1EAdyhejogf8J9tacqGl2YF9EmERQFpgzBO49x9I6C5y1mIUj8kPryn15qFomQfm2EZuKQxltlOQ77wlvvZzsnODFIUP4tMvz+fy9shcU8Q67gEwnBeeBtgLoqtqDc3x1Mxyx2aaHE0cXon8OPyGwBwq1oRT4GJN8VYsLziXGjIX2TBecYVIQJIeGPMub0Vc4YtoE8N9OD0dv9XewaYQZ2D5ilO\/\/IUKTt7Bvx0clxRambqDN32BIXnSxmsWom0PPIJmwDP\/tf60AdQ72AnRB3s67oJ+ndqZAi9Nr5es2jb36TP8TUcu5IA7UfexNcWOhDmSeOYFVVi1NQNispiZf8KDyG1CpWE\/iLT3k5Lecf9uMUJRwiWUrgShvTRyr2Wf5RCea0qxXbGiYI2w+CkqZrs0bViY2N1ka2fAZ3N5GwWPsv9QjVCsMaR55W594g54gW7a8Rveth\/fbTytDn8fOEF9WZQbndACqKOvzmYl13IBZHie6ErjCqBBxyXY0zhgC0HQ\/g8jp1i8V3cWKPG8RISaDhF+acAPrCmEl7bdUahguAdc+wJyVF87fnMX1cPnUB5RdL1n96zMLGOSr5NRazpkOfHFxdNDe6PzZuj0w2liprDV9WjQIKho7ZmWC5LsNyNacuHD3S8k4Sttx5OL5bUgJx1499SVaBJ\/zlmPZgWdytlVr8J8PddRCEtg7ziiYPR3zXxmjJojMrsI6sNAGDDDpk7bHmgwtMOoFV42wE8F3RmMNfbVwv+4hLCfgFZjKL+QhMK8Sy3Znb0lOltv0XqYDVOoluLPDup5FOdfZohZ5C6XIAyRVzUWpiCtS6OFW9VXyKwpcDH7Y9ilSocdPAWwXMdkIePiQLoxeqF5U08XFzYbSDsmirtacX0yfapoH\/ZPhIfGF2a3ABJNC+8qH97Uf\/4EiYBAr5slrzVREmYgBESGb7t7lWETCCc+R+wHGLp\/6BPpRpAxbYhP+3xS7JUoFENWjHB6al69BtRFmikOuP79Bn6Gk+T9jhBCAlHW\/d+1GEt8qikRie8YlVgeG6K09TR74jUBvahVdZ1ymxUJf8VrJp3vJxI+rNSuZAY930TmVbTRGWnuQiuJYtsw87DK0VsMMocfGek9Y0bjsH+7m+MdOt02eU8xvW9K3Qbbe3E9omLd9E2SHLATxmBeiY0ZArJ5pwODqfYEbe9M04RWt8BDYXGOu0NbWGoYsrSmYkVPNf541CzDNcS2YlBCQRuUT0pNK+OGKDCOv4kHgeNlAO5ZqbdNwkmKOS4dgbTbGAk\/EzvsQy2HXu\/sMS578rfJjrvDaknXOq6JN8TqJ3\/AazzUzcNgCeuAQKyQw+TV8L4zj4ingTlys13P2wq25Af7s5vhp\/bHVZm3c1OLTLsbQVWrZrTrKNa3NktALNSwbHeeKJSD6wpujBJYGEM9GwrFvDBWMYX9\/TqAyUBlsBwXWAXIYmXGHfojcEwy5DCWCFGyU9HOdsRl52+ZY5DlH2+wReycuXnhisZCqCak6NXyceHl0te662iNKTlxv+VkIv52bXaVBPylYWHscx4Ph4KnOp5Dqvv+ypIw8MTuiyjr+FVtHr2OEc3arRcTd\/KSPYiGx61PHbrWb7TRRFJuPkYa5mY4yrBmTXQ19DgU5JSCg+YFsPX0KURZmAoYms2ZYbV62h1OfCu0WLEKBSO8ehnxktozqogMb4pQxuXfhk=","iv":"1cb115f2b7f2814d2bc546c1a83a7d1d","s":"398ca2518f0590c1"}

Chinese billionaires are also spreading out around the world. Image credit: Sotheby's

Chinese billionaires are also spreading out around the world. Image credit: Sotheby's