Mercedes-Benz, Lexus and BMW received top scores in L2's latest report, while Bugatti, Bentley Motors and Rolls-Royce floundered at the bottom.

Perhaps more so than other product categories, digital is reshaping the consumer journey to a new car. Consumers spend hours watching video, reading consumer reviews, learning technical features and taking all sorts of virtual tours before making a decision and heading to a pre-determined dealer.

"If we had to limit it to just one observation, I would stress the year-over-year change with regards to tablet support," said Colin Gilbert, research director of the report, New York.

"Last year, we detected only one auto brand supporting unique user interface/user experience for tablets," he said. "This year, nearly a quarter of the Index has invested in tablet optimization—driving major changes to the site profiles of Porsche, Ferrari, Lexus and Volkswagen.

"These brands demonstrate a firm grasp on user behavior, recognizing that tablet usage is now challenging smartphone usage among new car buyers. While select brands are moving quickly to 'patch' this deficiency, others are falling behind."

L2's "Digital IQ Index: Auto" assessed the digital proficiency of 42 automotive brands. Rankings were devised according to the following criteria: 30 percent Web site and ecommerce, 30 percent digital marketing, 20 percent social media and 20 percent mobile.

Clearing the way for digital

Although automakers will sell more cars this year than at any time since 2007, sales will likely be more modest in the years to come.

A generational divide continues to grow among prospective buyers. More than half of millennials regard car ownership as too onerous, compared to 35 percent of older generations, according to Co.Exist Fast Company.

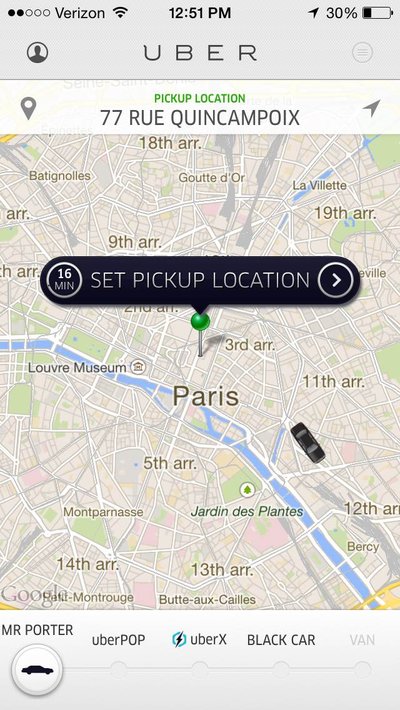

Also, millennials are more likely to embrace transportation applications like Uber and Lyft that prioritize sharing over ownership and public transportation ridership has reached its highest level in 57 years.

Mr Porter teamed up with Uber for Paris Fashion Week

Accompanying this philosophical shift, Autotrader determined that 73 percent of the consumer journey now occurs online, where consumers are far more malleable. In fact, more than half of consumers are open to any brand when first considering a new car, but this neutrality diminishes when offline and consumers enter tunnel-vision mode, visiting on average 1.6 dealerships.

However, auto brands recognize that, because of digital, a competitor can abscond with a consumer at any point of the buying process. Even when researching in dealersips, consumers are vulnerable to information from other brands.

Places to win

Although it is important for brands to make an impression early on in the purchase funnel, only 20 percent of consumers end up going with the first car they research.

Nonetheless, search engines, which come in as the sixth most influential source of in-market research, can shape the consumer journey.

Fifty-two percent of traffic to brand Web sites comes from search portals, according to SimilarWeb.

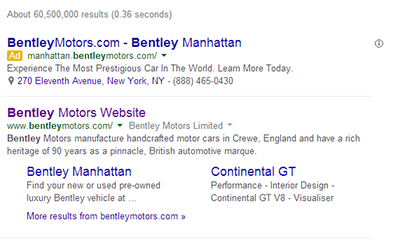

Brands dominate organic first-page Google search with 44 percent of the results, while auto dealers generate 1 percent of results. However, only 38 percent of brand results offer the ability to track dealership locations, forcing consumers to rely on Google Maps or the paid search efforts of particular dealers.

Bentley and Tesla both provide links to showrooms that react to consumer location.

Bentley search results from New York

While dealers are rarely seen through organic results, more than 70 percent of brand searches produce paid ads from specific dealers. Consumers are much more likely to search for brand terms than car models.

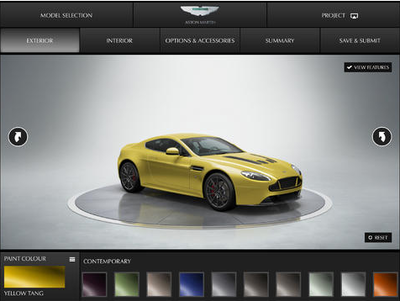

Manufacturer Web sites are the second most powerful tool, behind dealer Web sites, in the research process. Luxury brands tend to focus on car customizers and promoting test drives, while ultra-luxury brands tend to invest in video.

Aston Martin customizer app

Ultra-luxury brand Web sites are dismal in many aspects. On these sites, consumers are unlikely to find options to compare model, live chat, schedule a test drive, access 360-degree views, access maintenance guides and schedule services.

The report spotlights Lexus' and Ferrari's Web sites as stand-outs.

As Mr. Gilbert noted, tablets are another source of differentiation. A consumer researching a car is now more likely to be using a tablet than smartphone, and around 20 percent of brands have responded with tablet-optimized Web sites.

L2 Auto video

Stratified field

Mercedes-Benz climbed 20 percent to the number one spot in this year's report. Other luxury brands in the top 10 include Lexus and BMW.

From Mercedes-Benz CLA Instagram contest

Bugatti received the worst ranking in the report, and Rolls-Royce and Bentley also received feeble scores. The majority of brands fell in the gifted and average categories.

"Mercedes-Benz is an exciting story because its digital investments parallel a new phase in the battle with BMW for best-selling luxury brand in the United States," Mr. Gilbert said.

"MBUSA definitely demonstrates ROI on tactical investments," he said. "They offer one of the best examples of a mobile-optimized site that focuses on shopping tools and local inventory. They prove aggressive when it comes to competitive purchasing, especially on YouTube search. And they were among the first brands to announce support for and demo Apple's highly anticipated CarPlay.

"But Mercedes's 'x-factor' is their ability to define a digital platform's primary appeal and design content that will resonate with their intended audience. A lot has already been written about last year's 'Take the Wheel' photo contest on Instagram. Recognizing the success of that program, the brand just launched #GLAPacked—iterating on concepts that work. Few auto brands are as proficient in executing distinct digital programs that still prove highly complementary to offline marketing efforts."

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York

{"ct":"xbMeXFdYNp4O1zCrgYWdQgYOJY4Yu\/ErQz8elsSodzi8V9IGD0+VQyoYraRBAAKmM3BCA3nmczyuuUUTQJnTOUEjDui\/n\/jiOUVNCg3iYBgo3bJDahk8kKhB2QLTjoz\/akTLYvtiytx6nEAK21+V\/f4if5ZWNEzQeAcstSrwer4IuqhUx7dIn2FG\/abps2lk5Wy0wrj+5Ms4mcEGi0dumxXBRG9Ozi6AtpjkoVMt\/x5jcEbizdiJkhA34\/aGnw6\/oy6MV6P7SJKgLsrJslOHFibVZHorLynEGhBy35eHnDa4UIXlOQpwVLD8Or+8a7x\/FOEZ8PXMkdjNMpjT\/MwfGeuljI5xbwP8XjuTpr7EP5VRiNi+qEDgzpLb4JrMs2IQB4DydG9R\/fZ5jvS86Jha3a3ynRlltPeg6jOrtNbh6aK1IZU63PQJeI0\/ZS6H5iFtzEURkUy9x5FCqS7rGMajT41uCwQic5TcXx0yBPNm+pyHW3CpTRwcQL6hSyp5AA\/AUbWkoPfH+morSv36fx5pnHNeq27FKGKZOlhFQu1dcCrkJo57Hz01UNMrOHNNnKqt9NRKP5j1LliUmwTJTA5fdG\/BDN46BlJfqJp\/nxBonwSxs9BPdjoSZ29WeVDeuQt+FjSUQZ6zU3sjx1M0XMv+a+zXYYS\/v17i3tp5GoFK1reEesAxS8IKpBrrEo2wwxsUujGTwbLhe25qWFfrW3WnYCOJSy1+Wo9hZJk8SVLJzzt\/muO\/+uQFLdx+En472MVRjHfDRKd3VoGyIg5OpMHZWr3h1SB26ovzk9\/tkWwyzmLYWZqzFYVpcl2thavcXosWypTN6ZoovGz5iN1fuSIPPUCzpizY++6Hdhif+0n\/SJ44toNVKHJQ4i9wY5vkkFGVLwTzHn05rAqWYnD\/ta7SbjxmPwwMhpc6OBqNMvI8zfitotcJaDqzFJfJFKnUQ3ckp9R6e0djHkGqIAmKE1I9TYwDnyfypKs4etHVxveiS9l61HSRBLaN5q0ffFs90wP\/HFFEpWCa6GtcDY\/hUGj6m4ZP2Es17oSnqTS8cIcO+3XWoE4slG4+6sDnZDlpIHEMCwS7\/Its2qiOzT3Jj38Fv43nfngKtL7zvmoBJ6oXmnJxiOKRmqTwqmyENhIe6wxEmyJz5RI7ZFaj1t6kVwe0X9x9inOlwlq\/0eLlzPXMva04Cl17yzSIULoh6LPDgbn7AnPMry5EKWNux4LUAFDxJlLXzpiGWFrb6oASp8jFRZ0YIFrjanFlpwzQukBvSRA4s7uTVim5VWQ368zg448cAbyDrHU2lduF2kwR6+4P+aChVUd5ycaA5p2BfShio0gdozZ3qj\/fXTQvrIj5zUKk7JnC2UXMkUj5GWy2n3IjVOhRNSK51JBXr+RpwJ40lEYPk0E4opjLEE6QCWAEb+R0gZ9OmgxaewHxY+PzKZqrwBeanRnYWbHuijXQWf1UpwKPZ1e6GqrPCPCW4cq59SuqbsoZ4mGB4mzqdMxsoctkOsWxBXVFaxbn7w6lysPSRvrLfxh7crYDExgDqToRenKVkilZerQq\/2kt5ixD+Bos7MM4WNMlTALqM+g\/JGqzNL4CgxkDE9RVd3vRMyHR0teYESKTd\/FAC0h\/pxyFVAI4GlxttYwb3vzWWkzJ8oStY+Ji6Yo6\/XJGy18irzHaG0BKr59cgie5\/zRPMpKehWGXllBQSCoR68o3JVMVBWal560E\/C1RxUGtNE3ccbblTpCt17dy9FptxRmRb8PfW3cH+QqLzMgiW3XIiiquprpj9nGjjm6hkpgfRhisXsQ0gHnLQfGeAhdtVkeRbLyAsJvDhaHdkKt+4LfWwp9W7nBGYzKN1kdnB\/Y2t5iMuVGH2ZO3V3JFwY9Kfxl2hIPlDCJH2I0eTpzLeLasiauXL0+aJWuIRSs8c4Y5VvANmlYtSYcXdcSqz9psv8jm0WpE6no3+j5+JFDVSmhBlHcxGo43QVjPJ20rKq24WNZdbJNIkFSt2IRTbzy7PEoGa4\/aj7odRrwBORa5CWLF1EVWTjhXUijP0aYPimjCYmxA+WdwdoMacgSzNqNYQlW6zhG+yOlOnA+EwT1M2bZK8LglJ2kjDUphu38CtUsJW6ogkkz5Mq3RXNy6yNNXdSP22FZWgVqfHS53LFi6JMTDjGyJlb\/cEwUnokmz\/KJ7ENQ98A8J+4\/6tlW9yvPPr2x+uXF31SGFaKxqh1sILUyZrKppJrFo5DZJv6jDlp6dTM+yPwPHbGScqc5qEv5+G1xS7sEIAhB+EzCxqpODYIf7SnYj2n8d1NYdJNqL+fT42UOMEzxii305Qk3dcIC8wn7D8f+GMdTbYT6uTRJdO2lyyF4w7\/QXBXQ0q6A1r1sFTLCURPVSPK\/5\/XrL6O4dnFlsd59t8ZBHWvYKpm+Cp8i22EerW72I\/Zj9RVhh6ga25FKnhcOB15+BHrYyh9u38jlXO8GEuLTkhsaKVrqijVI4yqdKpNvWQNTzJhxdtQNxd32i3tuONP6qfjvXRHbB2cTE07oWKmMS55pXmqiFhBGfCuTTmGMFicDUMgCtmekA+ezb8Z\/Y4hpO9AW+w4nCALzXNOcGLDce8n359XdjjGL\/W8FGOmqJPhQL2+LbCVGcUmZiU0qHtM1BcyosLT9guOs27kOImtWVMJs0lcE5IWi\/j0ZbUw+i1pc3Hpo+KuCCR6hg34CRGP8+gmI94dAzKZlvuBmijvk0JAESdRSyDyD3nlLre19uzXvogTyWgdv9P2XSeZAx4yUMQly0sGhzxBaIOFqtOrDrKZ11\/eb\/e2zoeEHHALw0RHw82DTRelTQ9blvnpCxWyZyEQyqQRNp\/NUMQpjKuvfPn5gnTnxcVyXy6J45hEF9DhOy\/SN+6RoELcdp+s5uSueTsCJ58JyRzbkoHpBbO0Iy8Oc\/rGCspTtPCGxyTVcVmzkZDlM34brj0F4Gr2kD5b1MQpEgl4+u66ZO247kvEaCemdeodH3p4ZxmwQniMRYMMdVgy2U9yoZX1mo3Qmxg5tKbK0g6m85lqd5NcrTOC8eubP2ijfU5PAZEkWLF1k9+huwp5WCpbtfsM84s6yGjbHVACvKtE9hHvoMVaS753sn7C8LhbygY4gHNelDuC24lwncRfv6a+OInIJDtXp9RS\/R7RhvS\/RhGLwEpFVGKa\/PK+s9ecbHM6obAo570F6Hok3hvS2g4V9D0JHLeR\/ISx9hD9p6KOAI1zzAwnXZdm3hMvVzZSuT2YhOM6lQr6jfRBHdAm+WDA2jRDx5F9Hp6DK6GY3G4W3DH5Oe3qkYkkI8QrRPQ5m1LMyKGh+wUVbj3h+x\/9ej6CeKSfIvZrqaAOnO15t9TufW4t0ZN3hKLAUX2cv3gmB3o0uoPxOC5Kcjh7njgcHPBd4xNAM\/9TpfTI\/qLE8h1deRKCubXA4mqFvTlBvyUFjTtLNjPoEnXhPDvMKc4Z88kqQgfyliIwM7SB52P3sITLzbSp4qhpQ3ellBorGIgdLa8\/NzSOsIpC3pJo+MhhHWU1OJNBw8lzLbYg8kHxH91hr4TWD\/QUrJz78i03tpfl7tk47c2y4xBQMCFnYOzRETO8B\/bwxJunyQ2UJt1\/leUeJe+UkbdUZ1Xut0EaHBraq\/3Tuh+nn6flnIy4zUY7B\/3jNmdSZIE7siSOLOWce8rxyN6sPQm0fKLNbynROE3Ad+9qrHAmeqMzktWy6KZwlsQLr4QMG\/Y8S7jTq+snP2b826s3lpLh9JlJon4AHJjRW1PlLs+7v6yKf3z0aCDZs+TwH3ASvfpgO81rMZ7RTO7Ny8KdiwKx\/17KtHFxmULp\/zJTR7DolvhzqB0BJJ9TqxEShjQvKN9IEQdYORTY\/bllug2pGUAPkkcfnLTK6jLejT+MG0cEIJWxW8dSelS+5mB4Puk4Z13EVKmuxgY5pebK94MFfBWbi\/bThLIkdnvzya5nPR2LYm8YD4XWmtjPJ6U5mzy+U+ZuGxPzZkCAZuw1o42MiG0IKQmXi3nqacwlyViPRgpzpwfPBwKyQ6+G0Fl4TKQPo0EgyelQ+\/P9dJOYfEpX+uLhrzq9i14MZhI60uifS\/9OfhLJEqee7\/2UfQN3XAFMR8LmdNS3sZaufda\/+UruPhEbayT19uMIDfK4pnMY5ZrDVRoQ3h600cPd+hjggmgbr7+We6y8mpDRhZK1ozL\/zJWUd80GMfFHxYCjie4bBOeaPeZQpdTYTWbeY\/T+egaUngPoo+IMzlccbwoocTB9qDpt4jUvqp\/YTK5Iusu+53p136b6Zu\/EfwGW5aBXg\/dbC++a5f7oaXyGQB\/dzbB+E4kqmZhZhgHhVA0YUBDy3uxnPJaPfzSjOHq67f8mM9XLHETIbDgC5CGHfDhltNQfs\/Bl1CVUGwknZcAc4hl\/Ial7nw+a9Ud\/kt6RK5RWaMPAWCCddplrQBic+\/fXseW1GcBemyqHVmUOFtGt6Lt3T\/sxC6JTFSipgZyIYMwOAnovxt5gQ9r7aqNX3Qk9627+zhUiF229ey5P79JZpbvpeFhPOZhZMTMYxa1Qfs6g9rmT07aL8TyisdqK3PewXY3bQZNtCrLdmg4ShDg8G0kShAaoTrA+MDHCIDrnX\/7GtKwE48h5n7z2ZLHyTxyi+5cw+7qJFpWypXcZ7I\/O7IfCJSyKvSuyN2zqg5poR\/YeO\/Bg6lsT6KVxIFjiCgHVr96I30S6R1lxruBCAu\/2jmo70eobAAr33WGewZXi4BiYa+Qi8HtyCwNU+UPp5BxGQI3fDY2vb1R1Xh6L4NiDzTcgXWmvz0wUSL9SgzeeaHtH0Ux+IT+zf6VDLj9pOv8PkRl11j4OjWH+nL8JvTuV9mW5Ucrbtn5xa\/L5Ce7WwFv9ZSlKHyJnyaAxYnCUr5SP10DjHraG67xWTY+rPyNy6NwrlsZrXbFLuPTs+iuAsrUBQeSzmEqV9L\/PNAZOhcK55JKyArnfVeN\/5ado1Tqc0vDy2Cji\/XIzKfzqnlI1Tf5APY1Wk65LT0X\/SxJW1uU\/HIWqPytt2XMRWKIBXmynBeWJxDVnjF6NUfHcn7JuV5L\/QCWbgihK6\/G5oaqT800nFz\/UNBGkNLHAkWOeXu5a2ietKzmJ6TwnIzy0meZQpJ5pDV\/B+ebi2V6kVeGJmyJQczP1WO40Isid8u2RV5ryg27RndJamrEFwwe9lAF4Ae+FaamZNyFgYHVYh6YlkRlZnvNIwAUh2uGNAqQAQOqntFq5Mc5kfeGaWa2Hv2s42xn6saExwDjU+zxvhEm5jVznqdwbADdmmF4bkCUYviUg\/9NOUWwFZ1L5MgKaqlTkC+HDibqMGLfbJI4y2swQk+c6Rm5TqmQn7c8RYiu2vmrJmthAQRR2MTA\/VIu5rQxen6nYM3ySsb7u0v39982pHFGrSpa51XZJw4FMhW8CW4GfhCgUDnhkKqjz0tpfxcGAPTthMJjbJ\/IWaEpU6XsaPYse\/CFHcO3L77O4CVcC6Kh1V9DUlWMytJ1Cb+SBPV5HopP1IEcfPJoOckJknz93WHA8orjSkrNWOH7bVhyJqOQJgSxi6TzpytPM1kwLZrBxwBzbnCtF4aZi6s6pgJbJ\/sgtYgk4rtYddfIzZwzardrHk9nKYD3GxKcJUa7AnB3smddQs3RNNGP\/tT7zPK3lhGHUbtObfuerk1\/74MsDwvnUoVCQVfWCIiN5epQhlISjPnzp1SkiKAcDkZL5LnN5p1AChQL02OGiaD+JOWruPY7AoU64PYNJvIdLmqlVd2Fy3cSlBeO3SlsRH7E2J6AamYG6PSNohb1BaHsIeWOfPF01LHjZnAQRWaFWXtzxD4MGlQWW+LplMiXkeex\/zEjf+H9ykdnbknfnFkWtNsJbEbZ5l9JEhBYS7R4r4SqicDY549CGyJNR0cOe0PDov5QJxlI1KhoELNC4yf\/WUUfxZ9NJu3fTu7OyZKP9KroFF\/wRGgPxyV9aWmnB64cT5u8WRgkEGMikKRpuPSklcVcaY8E1Hdi3\/zu4l6tRwYpqgymiOJbi+e9EbxlI3BGqStCU+oQsI217FniMEzZJRk5d6cDeUZMbLtVcJEwtPAc6KtCkya8AOKQFGCjgonat7eTem9\/X1\/HhCToCCjVA+T8lakIn2BjqnIvc0cqM\/h8pOc+kzx5zMtrxegBKZfufNFy9\/uSn9ncWLTHrFFa\/p4gHMrApMjCTcSThvkU3BAubI8Ceyp0FFdH5iV6Ea88sCBKXG+gywW\/NBbvxbQXG8txtHnaKEQgYVWmWzWIbov8K+veZ3HUtwSOApCETNy5KgEqbLLcTGcvOlLtAuiIvHMfImVylPJQTXagB7tQGWG4Y5YKF9fU4vpSe8zjY9aVp+rZgJCmdsk40n2UOg2Q7hOaXdtKy7XVe1vY1ovF42MxU7w+3Ov04czc20kXEJ3SThGDtH0aNG+nbH7efQSSq1ymiQUCuUVtTPV49a2T0KZYZNBzO4YfLkw1ObN1ZdDXusfJPoeShvVDby5oEoAzrrS7EHThHZL4ZYskuCTKeS0oZwa3VIcFnNev14PGPrz3r71D7tpQUw2OfM\/4sB1GeJLcYtbb3UwnMbIPoS9+JT7FLQshMeYbfZXIpUXm6g6tRekRoik7zkRqPauP7j3od3A+bB95Ob1sr+H1i78eORKQdPZ9jo8BSwJobtask9CS\/C2fJHnoNzU5yStzjQO2y+fX28SdXQ8mpRGsfHOX9K6dE3XMq+oRN+8WtWf4miRDRKsa1guyA+NnfBY0kYdP2dnTsIp1R4U0Rp+c2Qk9XRtBsoiWY3mVWZ+ZEzT42SVZz6oFLhn2KomYUDBUDr9Q1j76fOU3HQ3579n9hd9oVMWSdrW5OOxfjY1XsuGlZudY7Df9xg1FZzVFwAEIXPf\/TVpyCn5fnAoO2bwCgJV9h70Us0z0zG6LXdJ5mKVDh9pN1lQ8v+xGgj5l0ySzOhXm63XYJcfKh9rvxUKSbUkGs3RbxYSZXKBwk\/EYRL4+qeO2fmItNpwyGoQVkD\/4tNjIg\/3mlyftCRe3xIeBzfaaeI0IBkFeZouJsCpkgqm9zTAieer24vzAl4jzynOXK3k1h2mPEPCfCrGmwu3WKGdrbarkrfMtxXzNTFy2HewK2bzF5JHKt+aIKX4PnK6KEA+x3CaEBA8NKMILcyGHSC\/3HuOd2QgNXSFdgdKNg9g0K7LsLC9LFB+3z8yEfDj06d\/gKy8U1gpCAX9oUmJ6HHYw3mj3wvJ9+Iiobzd1zLZGHPz6xg2+93vRFRfDwmEFn25lOm5ca+kq5eqmYRpDRy7ntk\/b7UiBA0cs0DA8AAxKedPcc7tN\/tx8gmyvO7jc2P5sJ0X7FxMqNrglIeJgjkbBhUT7HeoV\/NbMn66Xkuk2osQ+OgPB2kCPWN+81MDlj1VkewHkWgBYnkUkMPtgEhOXSGDOHYzjx9uEKR60V1RJYFOjec4MrxdACFvvbTlev\/2z8AFZUxbzdVXAr7O+\/kbi9B+4OwSTMqBEpf4wdlM5RbPi5kU9GcyESbcFEl4ZWUEg9VffOjPHw5arr3mVI1+0+xWECZEztDtu8IUVBVoyx9McTR7BJ8K8HMV7LewqdfFRY9QjE2jUq2j3WgaqXcGY8HW7WjZGi+Q507BgQFBCTdzaYqXDmdYX0DTz58tDC3lBsLYIHvGyo8dpWmSOeULlYmcNn\/FzKVliGP2536s9bw6OiYVSp6v5iCefS1KgnwWP2cvj0CIy29j2Pz1UaOPNIO9d9EAo62Y4VTJ8IroKUE3AbGuwFTNmmMNdF1BzPfaUZ7Ez2AN7WRvXDJWyROqrrPb4\/ZyqZVccpRR\/gdrFs6llrVAn6dvE5LVS6PfxctfB8LgPYiQ7qdRVxA0ZEBERatCZz289CtX0W7WsNeUgn+2cfJwaIUWz\/b7wM7pQsXUvW5yBmCYte9dezUvPJBrg1KWHgMYHXrczyM17rnG88NReiTnAfAszaYCkx79b8OkluvGDILxyAK8goVHfbtjVd6ZIuk0CSWavND6TA+TcPrRrddGNABEuzGi2Xb1tA9kcfEDEiCmsCE4BXL4W7QdCC5wDCgh\/DrM5B8mlNabbrlaLRTbkwCLT8G4Gc03hhOe5JNSnjyZjd4oqAv0TOqR+wZlxuss5Gw1I7x39sKxEGCGkznX7CSL+Ix1pzKZezUHS5fdvgktSKzXJbtwiPCtw8oEpxCPpU77yep66tCHdz+fAdtmmF+M9rcE0xVfK1ww5B1ZtXMfvaFPSPNev386\/7O8svkPDRrLnpQ\/uXm+FkBW1iUZsjVFeQ1ll0DNwA1LEDvXeSWK29wmJhGvkNTha\/UeAfMGsnNcNGNgtxhoYdE7hUdQeVc4DtT5hzzOqfAXvTs7KNZy3pY0GNzheUXU\/EiUCeyKzmZczAZOi8DEm1iK1NoZ+lCaRto1g7BPWgF3sTBT9J6h+XM63MDcVdEZyoi\/0w1Uer04SHaSR78OjIy0y9e1h0okyVEEo77lNiAontao1Pd8iRnagnZG8Muo95BSKEnJfMqzuX6r1orlLcyuodOdCgScnHenQrNTb6x81pTYwXKQinetw8RyB+WrDXisPf3CMFa+bNTgL\/aBa3pJkdkpPGm4Wgz9EF0TzgcPe4xOfWXCcGvo086D80CZehWQzzQIOjvt\/z31iz7KJAjH1rlacUi4RIz8PaiH1GprxDc6ayim7uP6hVOdf1BbQPvrf5HHkJq1tdXOt\/sAUzZhAsSJpA0Ey\/ANqrtJlDF6RLYZKXxAzenJIFWkRwGkfctdvKXZBOKWhginJ7OezfrU6HyWEB7sOE3N60UoMkC4HoOy3C0nGNv0EcJIo08\/BE+zgCwHZuzfnBzdJx6x9nroiSt1NPmV9n\/2k18N+uiu89PF9oESMZ4TdG\/f3gRzIEXWtPbVbfY0N6iB9XNRpfU+l2\/BYPfNC+e7+IHNpeSif54D3q6ddSknz0ODowGOQ2nm6iTOIjINxAgwbbkjlfIYOWDCT5CkMQn9TNVptBthF6Vz55SIBOXdqpiVpOIF+RV13laC4woL7CLFfwYBoEpXNdvFYHUUYm0PtQ+LOZfwEBufAj96plRmi8F2Zd6Y8xuRw1mniMeZQ6wsmcdD8eJ86c+MPky8fn1HjL820IMO5TkgSe613zGJNfQE8qe8huZYkahbDG8EAZMQOHLXZWQ9F0eLGITPOgkYU6iAeexO3qGZaGyyb08s\/j3rCofwlSQoiK5HFMTFTC47s3KOIBSVZki2JofUViiC50As90nBWFGutijggi4wz3+Fb2BC2a69aXTAQ7hFt8drYV5l+ZKewUDSeAazbD06Ywof3tr2r16+FynEpGY4rF8zkoYYLdw8oW9TB37pDZ6e5PfFlGq9CZk6yS6DHJea2HaCVS4ylVWOf2iPSnm6wdRn4rsrkLdtbtdO2VYxTREmz0nBy1yWbuhCiDmS\/5+P1ziStC57kzq+tV3j5x0iTwQeoNvfUd\/i80BvMFgHNFzsarQGgZC9l1AK1WyKHc5zWvpPWWxW7Gp7GcSidSz8KbBeDO77J5Oic2Nq3O74Ib9xKZqZIdtthxtIRVhjjhylLdBeXQlIJ25f1HxmBlkkFcD8hhSLBjJpk\/P28xYzxiwrxl6swxXrOWjnLRWkv\/jK69gHrMT7euPqcJq\/oBw\/yFf49JZs+WKq8CBcbmjGGfEqhZgwfOzzx7W+3UJBJ8NbCciLMtrosFB0cj7Pyxq+9xX0gweiguGBqE50s2fm+jzvEXOqoMMyl1oM\/VG7NcSCAyo099kvYawfPdpqUh5TEwV2JT7WHyPDq3BsKLO5DZtueM07fn5eRBRAZ94leClTyHBWXAHFNRnQ9jYFPnS79DDxAavoUdd26kdlLhdbOqDX8a4Lu65KWsHsAWbTlorfmwaJ8oL7I\/k9yRgu3RdZmidewvcKcKC0N7XNkADaJ4sXPcg1OWF1UA4ZztMX66SerxyRpgkibsZtCR38r+1KXAoWY0cq5DsS4IMusckqEaMBITC\/MLqY9ed6clbIiFymCt4DehgaU0m+sDcI6rCdMRNu7fPg1QZ+0+3eyG7fz9oOUKySVD\/KviBcLM70Ww7cEMzZhnoXTjAaj2klTWuGYhDv5YrivDD+3e+E5D\/cz6owMwa\/xcqXZRqVVc3IrjCEo+Wu0DupSPWdhwKknOvWhdCNWSgEZIP0FRhE+8M2QNILLGJRzpFYyHm6Hjnj2z3RERCdzPrp4fiv1xpA5JUznlWW2BFzNujljSQo6OZL8XflNYWI934ZQCyJk+zEwJ+TtrF+Yt9nQSNlAlaGb7dpjr9ZWqxQXy8oQh3rOsqGy\/KGCm6YeiCbkza7PGfijtNs8\/uMeeylGLqFmOwCj4c9hi6\/r5mK0RxURfOvwXDYuS5k\/Owlaaz+HMezpZQVFOgAknr4CKRRzN78RckL41qnNtpqXf5NYAozPzAxVQ6uUIpiDnBSBuYfG\/7w6Tm\/R3Y6el0ljnRtns6whTWZDW87mpLj1SWNKpNZyz77LCVaBoaMKHFwE10gm7Cq6wYgz\/eoMDiidOp8CN7F4dZ\/l\/ke4zCXd0lAerHFJCe3atjnWJSYWnVhXR\/PJD6vHkeYpgf8YbUrxUWQ4h7dmgJB\/6V9vH45T05hwbDymZcDpJOy2Q09i1wlTTZWaMiwq6d+XcdT2oNxEy4MuDg7hFLwtgZV3DXp9nje09ei86Nd0m3OuX994atBlwV8Yuva6zABqZSftKEkBl2sgj8VXIX85sjfVfR4zxskNbNqxfYxcJedvPYPaABk2PIlodThPPBXwX42UDeO17fJhMmgs4mTaHX+b\/pXSBPwmPwzbRFriPwu6RZv4IUqDb65jOHHp5nOBxvxzts1DRalehJwTdWrgIgXXyumo5bKKDCHo6oCiguqo9IQVnIj+ChlW6xJGkCpDeFz18DjacJM8k3MiQzPI+BL\/+yNMDEE4tj0slQV+8jhT2XJt2JdsgKxfJKUX52nBfFYEjcZwdmPaTuWjVk13Kmnd2dI349pQ\/DkFmNRK8MSsyx8ZqpZlmXhl4gyxjkiX\/7L2oXSEZNyfF\/+fxE=","iv":"857d5929f928f7c958f9480b421bbcce","s":"c1e34d2ff3638713"}

Mercedes-Benz in Mario Kart Japan

Mercedes-Benz in Mario Kart Japan