- About

- Subscribe Now

- New York,

June 27, 2023

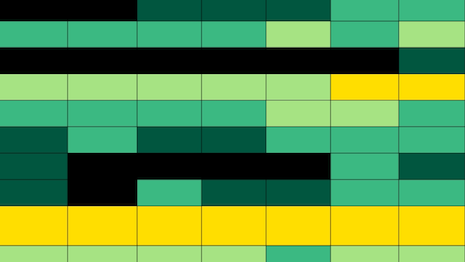

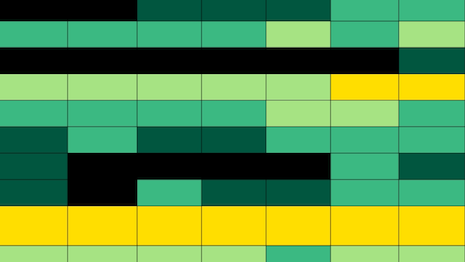

Finding a product or service error or seeing a company saying or doing something that appears to contradict values that it or the consumer stands for leads Asian consumers to act. Respondents in the United States, Canada, Germany and Australia are more likely to say that they will do nothing if an issue arises than those in metro China, Hong Kong and metro India. Source: Forrester Research

Finding a product or service error or seeing a company saying or doing something that appears to contradict values that it or the consumer stands for leads Asian consumers to act. Respondents in the United States, Canada, Germany and Australia are more likely to say that they will do nothing if an issue arises than those in metro China, Hong Kong and metro India. Source: Forrester Research

Trust is not abstract – it is specific and measurable. That is the chief conclusion of a new study on the state of global consumer trust from Forrester Research.

Business leaders who apply a systematic and scientific approach to cultivating trust drive revenue by building unbreakable bonds with customers, attracting the most dedicated talent and creating inimitable engagement with partners — all while minimizing risk, per the report.

“An individual’s level of trust in a company drives revenue-generating consumer behaviors such as the likelihood to purchase from a company again, prefer a company over its competitors, try unrelated products and services, and share personal data,” the report’s authors said.

“Trust is the confidence, developed through repeated positive engagements, that something that we think is very likely to happen will actually happen and have a positive outcome.

“Low trust today is a harbinger of serious issues in the future. While your company may be profitable now, lack of trust jeopardizes any future success resulting from introducing new products, entering adjacent markets or experimenting with novel digital engagement models.”

Forrester analysts Audrey Chee-Read and Melissa Bongarzone wrote the report in conjunction with Mike Proulx, Stephanie Balaouras and Bruna Venicio.

Consumer trust relatively consistent during volatile year

As the report explains, the past year has been volatile due to the war in Ukraine, post- COVID-19 economic turmoil and ongoing news developments about data privacy.

“Understanding consumer trust is key to developing strategies that improve it – which affects business decisions such as where to expand geographically, whom to partner with, what level of service to offer, and how much risk to take with a minimum viable product,” the report said.

A few key findings emerged from Forrester’s Consumer Trust Imperative Survey 2023. Among them:

Consumers in Europe are more guarded than those in Asia or the United States. With the exception of the United Kingdom, the European consumers that Forrester surveyed are less likely than their counterparts in Asia or the U.S. to believe that most people have good intentions.

Respondents in France (36 percent) were least likely to agree, compared with 52 percent in the U.S. and 80 percent in metro China.

It was a different scenario in India.

While trust in most countries was consistent from 2022 to 2023, the belief that most people have good intentions among respondents in metro India rose from 61 percent in 2022 to 75 percent in 2023.

Trust in new brands and organizations is similar across geographies. Respondents in metro India were most likely to agree that they are slow to trust new companies or brands that they encounter (65 percent), per the Forrester study. This contrasts with respondents in metro China who were least likely to be cautious (22 percent).

Personal networks reign supreme as the most trustworthy information source. In all of the geographies that Forrester surveyed, the largest share of respondents trust family members to follow through on their promises. In most cases, family was followed closely by friends.

That said, respondents in metro India and Singapore were more likely to trust companies that have existed for a long time or their employer than their friends.

“The importance of word of mouth and personalized recommendations to building trust cannot be understated,” the report stated.

Established businesses trusted over startups

While respondents in every geography that Forrester surveyed were most likely to trust their family members, they have preferences in terms of which industries and company tenures that they trust. The study’s findings in this area were interesting.

Most people trust business more than government to keep promises. Trust in government varies by geography, the study revealed.

Respondents in Asia were more likely to trust their government than those in North America, Europe or Australia.

Seventy-three percent of respondents in metro India trust government to follow through on its promises, compared with just 21 percent in Spain.

“Trust in governments fluctuates depending on whether there is an ongoing crisis and how they are handling it,” the report stated. “In contrast, trust in most types of businesses is much higher.

“As the turbulent 2020s continue, businesses have an opportunity to solidify their role as trust anchors that provide stability and positive long-term relationships.”

Trust in employers remains high amid news of layoffs or mismanagement. In 12 of the 13 geographies that Forrester surveyed with Spain as the exception, more respondents said that they trust their employer than their colleagues. This gap was particularly large in Australia, metro China, Germany, Hong Kong, metro India, Italy and Singapore.

“Companies have begun to notice the importance of the employee experience, and most now vet and fact-check any news and announcements they release,” the report said.

“Thus, maintaining a high level of employee trust with employees is key to not only retention, but also employees’ capacity to manage change and embrace and facilitate innovation.”

Digital-only and startup companies are at a trust disadvantage. Forrester data shows that nascent brands have to do more to earn trust.

Far more consumers across age groups in all of the 13 geographies that the market researcher surveyed trust legacy companies than digital-only firms or startups.

This gap was largest in Sweden, where 61 percent trust established firms versus 30 percent for digital-only firms and 21 percent for startups and smallest firms. Contrast that with metro India, where 81 percent trust established firms versus 70 percent for digital-only firms and 64 percent for startups.

“This requires startups and digital-only firms to more diligently manage risks to the brand,” the report pointed out.

Indeed, mental health service provider KoKo in January 2022 faced consumer and public backlash for not informing patients that, as part of an experiment, they were communicating with a chatbot and not a human with genuine empathy, the report’s authors highlighted.

Social media companies’ trust deficit underscores misinformation’s global threat. With the exception of metro China, metro India and Singapore, respondents in all of the geographies surveyed were least likely to trust social networking firms to follow through on their promises.

“The age of widespread misinformation, filters and online predators demonstrates that user trust and safety is a constant battle for social media companies,” per the study.

Continually build trust or risk backlash when crisis hits

Consumers can react differently when they lose trust in a company, the Forrester study found out.

Consumers in Asian geographies such as Singapore, Malaysia, metro India, Hong Kong and metro China are more likely to punish companies in which they lose trust.

Per the report, consumers tend to react similarly to both a functional loss of trust (e.g., a product or service error) and a values-driven source of trust (e.g., a company saying or doing something that is opposite to the values a consumer holds). The study found this manifests itself in many ways.

Reactions to breaches of trust are swift and detrimental. Respondents who find a product or service error from a company that they have been doing business with for a long time typically react by warning friends or family to avoid the company, not doing business with it temporarily or permanently, and preferring its competitors.

For example, Balenciaga, a luxury label prominently supported by Kim Kardashian, challenged consumer trust with its 2022 holiday campaign that featured children with bondage-themed teddy bears. Sales fell in December, which is a key holiday shopping month.

“It’s critical for companies to proactively address trust challenges that arise,” the study said.

Consumers in Asia are more likely to act on a breach of trust. Finding a product or service error or seeing a company saying or doing something that appears to contradict values that it or the consumer stands for leads Asian consumers to act.

Respondents in the U.S., Canada, Germany and Australia are more likely to say that they will do nothing if an issue arises than those in metro China, Hong Kong and metro India.

“Asian consumers will punish firms by buying fewer products or services from them, warning friends or family to avoid them, or temporarily not doing business with them,” the report cautions.

Consumers are likely to give second chances to firms that stay true to their values. On average, consumers are more willing to give second chances to marketers that both talk the talk and walk the walk if they make an unintentional mistake, or to view them as leaders.

However, brand values do not equal trust when it comes to data privacy.

“In most geographies surveyed, consumers are reluctant to share personal data with companies – even those that stand for issues they believe in,” the study revealed, highlighting a key issue for marketers.

Data privacy a global concern

Not that naïve, the overwhelming majority of consumers worldwide are aware of the data economy.

“In our survey, at least two-thirds of the respondents in each geography are aware that companies collect their information when they use websites and applications,” the Forrester report said.

“A country’s privacy rights and regulations have a big impact on how consumers act upon and feel about their privacy.”

Such a reaction varies by geography.

Geographies with more privacy protection are more strongly against tracking. Europe has some of the world’s most strict privacy legislation, so it is no surprise that Europeans are strongly anti-surveillance.

Per the report, just 23 percent of respondents in Sweden, 26 percent in Spain and 27 percent in France said that they feel comfortable with companies selling their personal data and information about their online activities. This was far lower than those in metro India (67 percent) and metro China (48 percent) where government protection is less extensive.

Geographies with less privacy protection do more to preserve their privacy. Respondents in countries with fewer privacy protections have to be more proactive about protecting their data.

In metro India and metro China, more than two-thirds of respondents say they actively limit the collection of their personal data by apps and websites, compared with 50 percent in Germany, 48 percent in Spain and 37 percent in Sweden.

“Consumers in Asia also use the most tools to thwart third-party tracking, such as enabling a browser’s ‘do not track’ settings and using ad blockers and browser incognito modes,” according to the report.

“European consumers focus more on account protection methods, like having multiple passwords, adjusting site permissions and enabling parental controls.”

Geographies with less privacy protection are more flexible about data sharing. Consumers in geographies with more privacy protections ideally should feel safer exchanging their data for added benefits. But the opposite is also true, as Forrester found out.

Respondents in areas with fewer protections – particularly in metro China and metro India – are the most willing to barter their data for cash rewards, loyalty program points or even better customer service.

Meanwhile, respondents in Germany, Canada, United Kingdom and the U.S. are more likely to say that nothing would motivate them to share more information. That is indeed a stern finding.

Trust drives positive business outcomes

Forrester analyzed data from its survey by company types, including trust and rewards mentioned by respondents, to determine the relationship between trust and consumer behavior.

From this data, the firm identified regional and cultural patterns for the likeliest and most expedient outcome of trust that a marketer may capture due to strong performance on the corresponding trust levers. Three patterns emerged.

Trust is harder to earn in North America and Europe. In general, consumers in Asia are more trusting than their counterparts in North America and Europe. But when North Americans and Europeans trust brands, they reward them accordingly.

For instance, when a luxury brand makes a product or service error, just 33 percent of respondents in Canada and 36 percent in France will forgive this mistake, versus 53 percent in metro China and 66 percent in metro India.

That said, when Canadian and French respondents actually trust the luxury brand, 67 percent will forgive the error, which is almost on the same level as 64 percent in metro China and 74 percent in metro India.

Asian consumers demonstrate trust in a number of ways. Consumers in Asia signal their trust monetarily and perceptually and are more willing to lean into their relationships with brands, the study found.

For instance, of respondents who trust their bank, 52 percent in Singapore, 83 percent in metro India and 83 percent in metro China respondents follow their primary bank on social media, whereas those in the U.S., U.K., France, Germany, Spain and Sweden say this is the reward that they are least likely to offer.

Asian consumers are also more likely to work for brands that they trust, per Forrester: 57 percent of respondents in Singapore, 68 percent in metro China and 75 percent in metro India would seek to work for a convenience brand, compared with 28 percent in Sweden and 36 percent in Canada.

Globally, consumers most frequently reward trusted companies with their wallets. Doing business with a brand is largely the most popular way that consumers will honor trusted brands.

“Our data shows that when respondents trust a brand, they are often more likely to buy another product from them,” the Forrester study’s authors concluded.

Share your thoughts. Click here