Beauty is an especially successful ecommerce category with distribution, online reviews and search visibility on retail sites being the most important factors when it comes to giving some brands an edge over others, according to L2’s latest report.

The "Insight Report: Prestige Retailer Ecommerce" details the digital IQ of beauty brands in today’s market and found that those that focused on both online reviews and search visibility were more successful than their competitors. The study’s statistics revealed that brands such as Estée Lauder and Christian Dior have been especially savvy in these departments.

"The report highlights the importance of ecommerce with traditional brick and mortar retailers as well as pure play etailers for beauty brands," said Eleanor Powers, director, Insight Reports, at L2, New York, "even as beauty brands develop their own direct-to-consumer sales."

L2′s Insight Report: Prestige Retailer Ecommerce focused on ecommerce data from Nordstom, Macy's and Sephora.

Now you see me

Distribution is also an important element, with increased distribution leading to boosted sales, and Nordstrom currently has the largest brand selection of prestige beauty products when compared to other department stores or etailers. Additionally, Nordstrom had the number one Digital IQ for department stores in 2014.

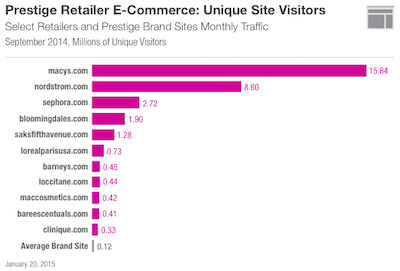

L2 graph showing number of unique site visitors

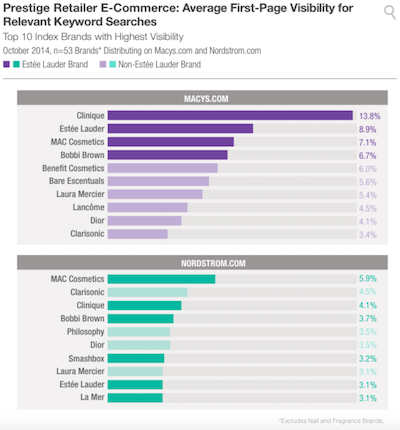

Search visibility is a key factor in improving a brand’s ecommerce, and Estée Lauder is currently the forerunning in this arena. The Estée Lauder Company owns six of the top 10 most visible brands on Nordstrom.com, as measured by the average first-page visibility for relevant key-word searches.

Other brands in the top 10 on Nordstrom.com included Dior and La Mer. Both Dior, an LVMH-owned company, and Estée Lauder were consistently among the most visible brands in other department store searches as well.

Dior and La Mer are among the most visible brands on Nordstrom.com

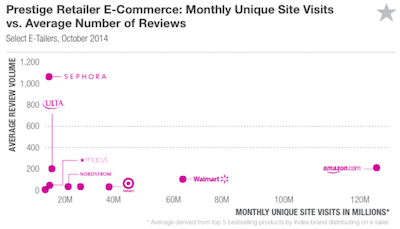

Online reviews are a factor in 90 percent of purchases, and products with reviews have a 12.5 greater conversation rate than other products. The L2 study found that review volume did not correlate with site traffic, as measured by monthly unique site visits.

Number of visits does not correspond with number of reviews

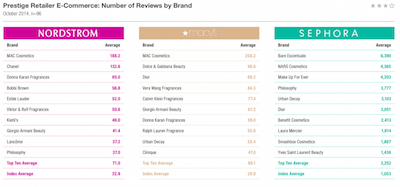

Additionally, the study found that the average number of reviews per brand was heavily skewed, with the top 10 most reviewed brands indexing three times as high as the average for all brands. On Nordstrom.com Chanel was the second most reviewed brand with an average of 132.6, Estée Lauder was the fifth with an average of 52 and Lancôme was ninth with 37.2.

Chanel, Estée Lauder and Lancôme are among the most reviewed on Nordstrom.com

Digital dilemmas

While beauty ecommerce is currently flourishing, L2 has previously identified other areas of marketing that could use improvement.

For example, in 2014, 56 percent of beauty brands received challenged or feeble rankings for their digital performance in France, indicating that attention given to other markets saps commitment to the studied country, according to L2’s report.

The Digital IQ Index: Beauty France investigated why digital innovation has lagged in France even though ecommerce sales are rising. As evidence of the disproportionate attention paid to other markets, 48 percent of brands surveyed have mobile optimized Web sites in France, versus 75 percent in the United States (see story).

Additionally, L2 has reported on the importance of digital awareness, arguing that the digital presence of a luxury brand is increasingly important for the consumer’s purchasing decision, but that among luxury watch and jewelry brands 90 percent do not offer clear pricing information online.

Changes in the Chinese economy and the emergence of the Apple Watch are forcing watch and jewelry brands to reprioritize jewelry within their brands. These changes, especially those in digital, can reshape brands into a more relatable and enticing brand for digital-savvy consumers to interact with and purchase from (see story).

These reports can help brands learn more about their ecommerce and digital performance. They can potentially use this information to transform marketing strategies and improve sales.

"Brands need to invest in distribution partnerships to optimize their performance, for instance through optimizing content for additional visibility in search," Ms. Powers said.

Final Take

Kay Sorin, editorial assistant on Luxury Daily, New York

{"ct":"6emYtmuBQPGSYy1fJe3yz9+3RrzM6HTv+rL9Zl1SC1h+U1\/MYT20vo98yUbJ\/f+DM7yDJBIqVisIat43I0E1T3tKTPWNNogWSqGfSD3o7ZeeCppJWwx+ZHqYAKP2faZDBuJEkd12mq\/WYnNo+54NyHweL8f4jtQOSqL4S5J65Sx8wJpueK\/fD0SEvSPfVDe\/FMl4FdlDrZvuDDSOZgcMoHy3G5yTEfYx61bndvM9lphhWgiLyspLz9pIfrnmNpqOdbWQWYSZzWe7+qt2RI5Pomg54I1bbJwS7xeVNkrnkCnavQ3x45xReJTe1Gx1u1au\/2be7W9ts+lZ9DyXBrtcg6on4OvYwtJS72ITILgtt0jRX1dqXYjYcwypTMTB7hE\/Ha\/oaSTYbkDuARyAyMUe9zRu031z1J4b6w1ZP8HGXXr8vaRrjrCzYyT9qd6CyRhP6byy4PL3+MQQ7nnglRgiYinwRsvHvErC4Jt2WVjBJhrCZtzto8ztt3oyfbECnvH4LlzFQZmm8vOFF8f\/B6FhIOBvqN\/8\/nBUcdh5JJQlqsllFZw4s5xkUV1dxxcI\/MxHwpIhzwB7qr8DYRDpdqtsFtZ6yWTw6pfCftkLShYJ9cMniNspwsEEIUpk2SG3\/pnBzjPuiHOtKZ7WCI9v9jkQIwAjDJyRESs8FyniLdWvg3D+DWxDL1\/fWy3Bpc6h+rE0Kxv+2yIY6puCOnWQ\/Na9KqPVMW3fnlzkybr4cePwnnYX2NPy\/bTkWyoXHka2eF6+2Kru8BQt784yvLqc8nT17XLfBIDrJ3OrrDaanLdtKs5DCqlYMr3A2AEML7TWx4DhhwlvWeuobsbshTH5WOs1JcpGuFBZEQOyBKmUZ4gtnyeAsaVb8pDXWqj5LUNUN2fXWJ2C+uncuXLjlA0Cd7LOqMs2jbUVegOdvJVu60Avd+KBsLE+9IT0CWlDpubaWjgn4GeE8prPVMAbipNSLCY3X4af\/yr+MEF4GpI62X\/O8LvO2Re4xiuAbbsiPhrGUMzYp1+YUOYdKtEE0ZYC0LMG63+oTgKT59jnDAj7HqX1ojC+\/4fs4efVdrTO\/cPz3po5oIalw+TafQEH9oGz9nVAF3RwWvYUfPSQcg4egWrP5x+\/ZCJZE5jWPPlc7Njvsne2Tq+eYpIYN5r6zXtr6j45Oli\/3v0WXL9Oo3r\/ofUp2sP\/96iIErPTkNsrRyud7mqiFo5U0FeJA1\/RCFRVbEhKs3SkNWsT3CzYXIr5kUhqsGlAcdjqcqnLct17y\/qdu9UvsN98g+dzT3U6o\/GftidBmmD56MWSygfMwKkUv+hnkPZFN5H9SLoBT0RSBxm6gCohOuPZTY68Iw3uqXsu4psQj25NNOiUxr5rImxcbn3mmUiB4MoQuyJH0IN4DmyZP69nsZeuoVEejLbQ1rtCNfdzOmIH86NAK7iJ6GEcrLJ1TreMF+UIhOcLdiXNI4Csv5yvYXFFGlLqfGpiuyrMaHL7oEurJnbbXLb4H+CTxcmOWVlIVbwl8VtJHBJpHexbvQxDEaPGrnaDu6nAKwPbCKBZuP\/z\/o3Uvid9Dw28i51Vg2gIbsRapNlyOwGskNWdnRP3WE7S7Xq1kBmAptDfViJ33A5SFmX1nupJdqsOMJupUex7VK\/HJUlMR515XCPnxCxMGiN4pZ0sEAgTzCX3OpeuMeOsCC3bLv7bYE6GV9VcFcaJ\/XKqtBfV8xOPDZ4F0O+5EiKrPMtpvlJjDJGrsCA5BuUk7aOZRYAxYhQsCthoz\/ErjtHAU\/EEO6B1Bph\/DMSLxOzfmBBa\/Fsm96hbiaQUuUiSVc2g+LlEBjCJvXnQzDLYTaSM7NshAtpQL0h8M00vPtXjAayJAQDnL705fap4YW9EJr6aTL\/nlh6qsPnD3kaChul5HbHhEzC6Zj0\/AsIiOrpbFJwb0dEuqvIDPSQtSBZBmH3nrri\/INCI4iez34ohruaylCrE1s916FBpazPb2BcaXWdcxTLDTNyyAK6\/IH0jEG6iYqukzQzfkFKc0pBQN\/c84nSBvuvIfMF7eLrp0+n48i54gpO+XkVdMBuTlX2XzVqiIKQ6Z9pUFgbUFGsVhMoFIz187wXbIC0tnSt+xLcNMmoPfG7eRazKbxNsaZO4L4O\/YKGZBVzRgzwcT5QVCTvQTfF\/B44NThesDJLaMvCZQojnJ9\/YLdC9k3PeouPqNSUIP1zZXK8hqd9PXI7312dq0rU09JVuqac8eQwZ9PvUck2Aj8acnDXrJav8x+v2FsZoNguIirZXfD6BsUsKxsODQXQod1Amt\/mH5YCgQg0NeYFCI+6XAg4mC\/E\/9c\/IGH01qMH71iIMg8AvUKWKtJh+dySqg4sau7XszhuIUfMsux8cjiy2jtEGGQwZ53HEw9IMjkcgGQfAF008jAvtVV\/NqHR6cPUhLz803mnXqo5Pus9+oKZdvdGwOPhW4jIrSl3kZpwVjB1pAiLuqauzedmy7HYspq\/cmng3G+KHe+t\/rrC79U03rOnFpDTKJfkQwz2zja6X5DIYqo3GtcLiQ86bu7\/wFS6G+PbySV12bByPXdebTho2cOLFzbbmaFOVXbOcj+3DhDR17I41nCXLOxezn5UivaJOuKsdmYsQdut8LuI+FZmPSi\/+3QpbKj52fg9ZpNL+2vugHqgIdIcpNyIhJU4rhDwY1oqNxfHJ7j4RkPAkj1CcULiyZlJwoXr4NIM3t7HVqW9LDhM2uhbfWiR+W6SwR5pK7PNqlaL\/CzRit\/hkaExkjaW5uvYiYnSMJxXJBPNnA2isB2LG5R2\/s4xncRw8GYnfvfLuTeG0DkmG2MHajDCiRFOuDyLe1A46Tzhzf57OCQ3RvQ3jeFygvAN00xL++AlNkjYlTiqW5SaMwG+ZSQ0igXMhrGIl32PWziYLRnJoKg3WJLUvNOAjcJKCtZ2N2rwCyVI9rnZUiAAicV+gwRbMIPJjUsZI9JINz4GW+YlGT0Z+uVVoYaHAU0tPs\/oJZIAYMwu\/tWgEWDcyp+g70v9bL9K7Z\/K\/mj0ITINinrlDGowT1x6LQg2uyLD2zv7QMQIaV6ob1soGIPE\/\/ey2620as6ZumnP3y6ktqzpmQG0EhegRku6A3ETbnNHA8l4hRTapNu6Hx+cwkH1DScszcNk7nNZZrYO1UCnzUtwU70zo7Zwz72dIcMJExKxDjY6oogyblvFvFRoVRC6Bs+ygz9zEBVTyhA\/jLGe0cZAzRi1xJb66SKdsBfDU1j0gmSkePuCGkllpShjuDVs3UNK4LLhEA4fV6MwEe0KAifRGu0kM\/OMIVCLsn34xE\/WHvvT69eZPd+lOuj5ekZDcaXmZnq2jkkfGRoP6\/uc+sYu3BJ0qD9UnWk9Z14KUg3P3OqW42Cw6AK9drFfyU0AZ3SMsZFDhXP+fuInITNEhOnETCl3rg2xAIiDNh28OFvpg8VyWYjQd4rSssDeYekt5OkkrMJq3ZQeZFDJC9xn7ticaX0Vv8CABZyWmlPpYe53vKR996oMu2cCB7fVzE9yXwbkniQqpOCl22wjXXYa1DS0CGH\/hV2a8siyN6E1MtNkti3yBUNZGPxY61dqaUT+k6+ZmMRYsLylEbgGSnESBtCANVlaYHpSHk71a61ZH4aOfBrTmj8qRfnSPtTtdduIWFA+Z1FmABx5CPZNLVeX7EiI+ujFg4f5TqvaOlqDFD+brNm55WtuYx2Sw9qQohzfjmj38LFJlzILeQCRgxOLMjuVwUcQIR\/AUyrPhuQk7bD7r96Rg77i7sb321xHwnIqQw\/oYnrQsFE9vtHd\/ueeD5SnNO5JhG2pZFWDnHSz2oPdMZhwSMVdBXRiuEx6STKnBnuCKJWoYMCBcCREy6eU\/Omu\/Vd9Ew9vOf07LUt\/Y97lwjQD\/6Vl3SoNJSWJVqOAFAUYmwBihlgDOc6c3\/38GYoCCkfoahAGA9pSj3AN9ZQitCBKuKxRaewNfnwwOkW1cnuLhAR2SFEXhm3Kl36gXqY\/y9Vf2sjDAebiAIFT9dFHUn5N2JDTj\/jZ0tURwndnl3IAeW\/0uN+LIo4glm1K7dCTF71EMulf9Tq3V0QkdpXo7GL4nFW6Mei6oduWOzFBe7kZc3JfwIS5s+Q2GvVhH3I+6+al+CXyMS5zFUDF\/vjJqfGJ\/gIv\/nx\/2YY3yI2w4wqBRVi1yrd9FvqdJGH0D\/HOFOY5j+IW11cAjkqtDbwqmeckIgSufmJOcrjORWl6gfMVgh1GjmIlBWrKlt92P0zZFra\/JlfrudynGdEe21xVFaTxvh8FfQfwwM299bpkvcT25ttqp0GYMhyyPcdljdSEBeS1D3I0Nm0kBHFmNlUG7dMHnCtbuNNKaCLnQnfVkynFUWFZlCFXoZeX5ItfF09ESudmoRGUBae8my6JhY5XuQ2zv+fDdoelEJvc14cS9hwkr2f7Ko\/gVcdHMxX31GDoozjAsq7SkK8U3w4Vchp9DycTz1Dqf12L5VjbNWh7E+gdtp9+S57a5Ry22izLfjjGksw9STt7eZptnVCNtwA8n5uBbfMMIeaOKCluLODE7XRkitwV6Uzc7VDcaUZsJvYGt5\/1XbenWBoboCNv9YH9WcoXyyeoBCMx3mpKX9yxotiHz78wcpYU9fRqm3wihLc64fRhWIPNNCajTx50YSdx\/mkp3AYPyPGT389ofRri5bnpFcbLSCyYzUcj+tlLE8n6p7TkD3lPybFQL9D+PdjnJvtLViWCgaJso4idtYT86S7muLDejcHIwf8u4094nR3pWt0cGX1eg6tRXzkyU3pEIllF7ns3VQTePIBriVI9SCWMP9S8hceWG9RG2UAANU+MEcKX\/xRWHiLCvbg+Zk9i85iXinvnrcnSxLIonr2H91uAW6T+0CyXshi6sEGRYKhjs04iBmXJE2CqgizK1srg0PRAdUjod4nJYlrtgr8NzclXCO7Wgt3OlVxV1R2YGJAjqXagHORPDFvDW+PLVrOBukZmTXWJBoS6HiwCDLbVIVjP7GJpME5DpU5DH3GMbetEkm4oztZ8h+zFspnwU9qzR0nyTnUMUm9rZHFKSt+lZaWIHxcDZ5sBCyBjBXQUsG4MoCCbSpISdO9fp9se0+Lrhya4D9qmy\/5KOubytOW6jh\/K4732Tak9fPZi6iU5aw39tI+HnekhbnOzBuq\/\/4SuiaKC\/k8vLkpVCS7t7mVJK1WWn9lIO375EKTM7\/zA9B1magEQTf87ycgMEdKC+47QvLYiKOHlenAw4ikrB3uY9DH5TIfx1quIOyNE2zZUyC2iq92nCD6vLom5JRDR\/\/nqLFHoIJPa8gMPpWychRNUawuzwUNIdIwUTyRGuWQPIYhacmKazOz4PKNRY9UvZGgy9+lopIAOvElhQLfPIhgKCdulpViwMX+w9JOLHYrd\/6nW6BrQuhp1oyFP2LijlvWJh2ffpA4lVs6pXhR5ASekj4yzcAw6+F5BSOKp6wwcSxfETkkKHZcFkj6llInAkzdEHEEicqWZ+7kN7QNZafe8\/OmUOuHrB1zO+n3TNfLALAKDL7M9VsgBeJNQ\/KHOCvLTMPWGG8HrhjDHXjH+4T36PY1ipqkC2y+TqZUjsLJwkHz\/vHCzzUaPl1cVQvojVxqYcbyj7uOg7TR76Vjy1\/T2OTA2Lt6bGvvIUDWrQ3sjFYtXpwDSYF51n28lMn4qIfdbEQTYTebaQw01VWSEZW2n4r00GSoDHWc+fxCX+ZAbHFj223yggY88HTmBc2VTeh0qERgK9mhTZKA4XeJjZ0zmvixYxn9FhD3\/U8JSWbm7Jp9+A\/4r4VRXq7TpK5tudl+FrVLIKAhTJr1KPd7St\/HLnVbxip34R4OyCj6aCLPu4LDzr84JfkqqQLYZoudjA77LPZavbGc7rM0BsJuZrVrOg3FZ3ABRE2siE+CjBFCi8F4DMDdXMzR+lXLMiDKJXtC4SFIabtoSRRP5lDzbiNmRguef7xExlbTnf2Z50EeR9AsNlm6gQ\/UKnLkvSXNR1Q433G011vScAX0Q\/e3drISWlu17dE3somlp\/P5GGLQy8ifrogV52ChZW6g3qIA4XmzI867mAU++viNh8YKqOcaVzrLWBpLMSw\/YG1tgomKq2hjuJM\/k\/ST51Ga1jqEzLgivr8JRH713oA\/eEor7I8Mb1RvZZIWGrCUKmXRkObLqb3BE4JYiBFaXWI+Fktgff7fLNvxnvRyl2tCv27U1Z1BeuwNlPtAlPxWvEcBngd08LFuU\/WAqR6o60lOS146H3SiL4sbvdJIKUQg0LrpEbQzxIpIOC6MlQLOzdI\/Ik1JhSLha44dNHaZfaKB6xYvkID6cZUnGz\/NtPIyr4aSjvtiLy\/qKe6xpsUvAZLmRW3P9Hh\/Pdn37\/aosH9Rz0oec2yBAyylul69KnfWKP0E05dbAs0PFZhiEvbWra6gzbJPELna+s4BRUAmGVir9U0Jzi+Azvpnl+8dMg2QwBx340MoxR1IpS9Ao8TY49bv13XaEpwYYFQnVxRcKOXOy9tXAtqzkhk\/iO8nyuovJ+5tYDl47Fc53BI9erUnm5DIWwgAiJ02O4bbRVOVcc6B+pV8uaeJLAwXAYsrQiYvuuyivek+5hjaiNK15WLgH9i700t7wV\/MljjnR9stonmcFNjZYWoPcMF0INDpotqX3kFm0AY45yZ4tyGIpn9OTv4UmoPkVM7n6SuxlY8hKxJHzTQrcJnj3RfL6cl3O+r2\/1wXswG22cUfiBEFy8HH9W016+ZS1Y90pPjXInoYISZEF0bkmu\/TT6pQqOcmlhRyhq+L2vAJjwYaoIaqy9PRIWOpeLiU3Rzehbj63w0vdifURk1xQ2cwMAWS7gVb1uwgfIUUYKzxqZ12QsvNPBHwiWW8Y+9xYHWzznsPACQLoX18XspOJfmii83l7YorQcZMZEQjoB1\/qq3vOYdLGzAjfHOjQ9qt+9DaHHlELMLv7l9sRE6HZNglYf1WMw1yYOS0UZoE606WPKgPwzxRJYjaWr6\/7p3sfvEdtCrIGds7ek4jc1kYWfMoitHDT8a5ogEqsE9Pq7FWLDpUPjVs6jbzCMtylK4M59KDk+WBfqcG0Z7gJqXLFG72PB4rxFRym1aCa40k9lVfFSDBsaKf+AWUPUe2OoGEjVOfEx4jeCUmblfA0dPp3mP8pes0LN4e+QTFMbLNU4hTlemxtav9trT5FSllvD0MM\/DxVmboN6uASNkuW1Cao2mok4ymQ3iPHdayqgYfc+UpP\/VFql2YIXisI0M3+MRmyaDoujhSdc0iGgft2LqtKFcWHkdAzbAhOsAtHj+py4yQUBc6j\/B49MSew\/AUtMqy6inYd53Iyo7Ewoka3PgSsXNfgAxce1Ld+cn0EGXnUCxi\/zysL0zicptI2JwRXxSNjYaBkjy7d7SzbXUOFD9fHeJM4CYkf3zWn1a+CCNkMGScfQakcFOLhD1F6bP30afRAW3ctEAqV7hV8uU0YCI6TvJm7jMSCqguEc7WsdYsrD\/Gg9JFXiL2WKcwdS3J0E0PvC3NWOZ6AWKv6Bssz21wJg13fnNx+lfrCGHwkWUneEFO0qmDuw8Wt51rqC+brqX1MNhNGGHexvydbQnLWIrzhp\/xXmddPycSBmUwWuwbvV0G2EaIk7J8gM40KkJNUUWPdvO1ljWu2Iu49VI5UM5RBi7rZ6VR25SuDiPEhWa8L+6NIGSh2agt4eJYh6QElP0ZPUZP8l41HOPYHfjWtqLZhJXqZ42+h3cBRhEdgspdA+uFNUyD\/Lv\/zYwQxRc46csukKy76jMelIi\/ooyWjVMPrVUbvTMQT4yaVq3of6xMDUCqGP+JcO0z414LW+RKZgEXumupI93YBCTQFX3ulI3mqQq8NXqZ6aGzcC3mM5vVlaBlldzoTedCli125BlKo78rwTEsB4rZOlO7LmME+MycpksPdJKoPYKyexem15C2zCwqhosVgfRtSwLmdtGlT+iHPtPKn7X+9EE9+75QDxz+RlvwwxdsPj12wxfpQY6qbc0n6QMAR2hGHs9wDNM4Y+VrJ5nyNrNJ5yZJoDnoNgcQuIO1aZB1+ofQcFZZozVLifuKU1KwJfMHk\/HbgjNVGl35L3dfLKw\/BHxalvzX+EU2p18XHdhP43W0rxbHRSllyd50nnhVLO\/80UdJ9UMTnIrqFceKPhlePhcI5yn9cWsconp4uq6sgyy318Yh6R0OboV4y47Lhpaq1qtSspQV8gbcwaWqGFQhEW091ATKpZ4JB71EviNKWac6kv0VDLTVEaTMoA\/pMGK\/CyWH35J3c35C+LI3xByJOhZKhSkQuZqUESV24dSgqwcXMMxJHTEERUTWlKWJXDf34yGhKeaGuuCzkf1ZfBvW4FwuhmNMOkcsFfdvx5rVjhECeTQdEEbkd9hEKVoX1ztYOn2oSVHZz34k4M1HESyJW0eSYLO83rMh8JUfXhGc\/wBczVgvXv8nEw0vKyc1ggw2G0cvCoqhnYi8isgR0ifGhkNQMi9osSDXLvJ7OThyu2BHR9wDX5hDnxEFJGK+RVs3xKNfqQI9SJOrxbToWBlGNEXeTpry\/TOyK6PhQstZ+2Pi76MjUWJb1vhlVHuaofhP07g2ek0HQLuaKWFvMbQm4rN43wyj9OUoW1VQ6GufxQEy2ItSf8UEQvmlM3sM4s4bO56m01kqzUJaLTs5swTbWuxD5gn4zA88i6JGs4\/RUFkI3cC2ebzgPydkyed0QnpnrSDItzsI578gO51NamC3eB4yE+juY2fL3mpybcF4+Hlq6vd0mr3D4KD19aBxdTSis2TBnts9x4FUewocbg9HWLMzEkia82t1p1xsr3xD1qDqifmBiki6XhWYeb1RxihWxF+pHMhzhalgECV4bKoEnvF42KvMShLkRkTuM0OaM+VLj48o+67kF2p9GI+0qg9gqJ9o07W1tLRXaJ7h9kIjqinghusJWKykQw5wNx\/gHcGErd0SC1kBR16tPFVfICVd7NZOT5fmWlQwMG2jX1dCQu7Hvl\/ZYgyi5NFvI2ouZQDNJWnL4Zp90m3oUsQtwHf+KBwsfp6qixLQ==","iv":"fd4daf52e6de88106b9f28be5b31d12d","s":"25b1e7a0802b0169"}

Estée Lauder Fall 2012 campaign

Estée Lauder Fall 2012 campaign