By Kelsey Ricard

Customer retention often takes a backseat to acquisition, despite the facts that it costs more to acquire customers than to keep them and existing customers spend 33 percent more.

This is abundantly true in the mobile world where marketing strategies, budgets and metrics are all geared toward signing up more application users. The tally of app store downloads can easily become a transfixing data point and the foremost measure of success.

As fun as they are to follow, app download numbers and even app user numbers are deceptive.

Fickle users tend to download and delete apps at breakneck speeds, so those statistics are not providing the entire picture.

The guiding question for most mobile app strategies should be: How many of my users are engaging with the app on a daily, weekly and monthly basis?

High cost of acquisition and churn

The cost of gaining app users reached an all time high in March, when Fiksu’s Cost Per Loyal User Index data showed that the cost of acquiring a single loyal iOS app user surpassed the $3 mark, a 113 percent rise over the previous year.

At the same time, Mark Flavelle from Tapstream revealed the results of a yearlong detailed study that shows the depths the market has reached when it comes to app retention.

Mr. Flavelle’s data indicates that only 14 percent of users stuck around after one day of downloading an app, 10 percent after a week, and just 2.3 percent after a month. That is a startling 97.7 percent app drop-off rate within 30 days of download.

For mobile startups, it is a constant battle to determine how to strategically spend money to attain new users and reduce app abandonment.

There is so much pressure to attract new users month after month, yet even incremental increases in retention can produce big gains.

Maintaining an app’s longevity means pivoting an acquisition strategy to create retention-driven processes that sustain a consistent user community for years to come.

Making sense of acquisition and retention rates

The best way to clearly understand the financial impact of acquisition and retention rates is through a simple math exercise.

Consider a scenario involving a fictional company called appX. Last month, appX was able to attract 100,000 new users via paid acquisition channels such as Facebook and Twitter.

Applying the current industry standards, this would mean that appX spent $123,000 to acquire those users, and after 30 days had transpired, only 2,300 of them remained active users.

The net result is that appX spent approximately $53 per retained user.

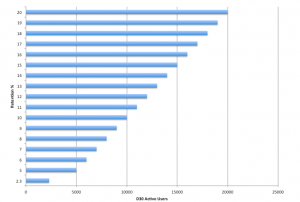

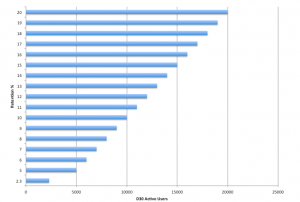

Graph A shows how appX could grow its 30-day user-base with cost efficiency by increasing its retention rate.

Following this calculation, if appX were to achieve a 20 percent retention rate, it would have kept 20,000 of those new users after 30 days and only spent approximately $6 per retained user – a $47-per-user savings.

Graph A: Number of active users given varying retention rates

Graph A: Number of active users given varying retention rates. Please click on image to expand

Graph A: Number of active users given varying retention rates. Please click on image to expand

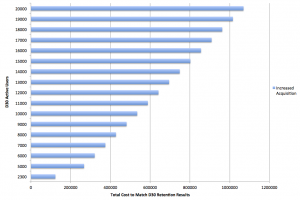

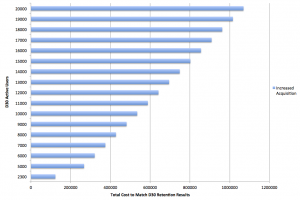

AppX could have alternately put its efforts toward driving acquisition rates to keep filling the top of the funnel.

At the end of the day, it would have increased active end-users without putting forth a heavy retention effort.

However, as shown in Graph B, it would end up requiring a much larger investment to realize these rate increases.

Graph B: Total cost to achieve given user levels with a 2.3 percent retention rate

Graph B: Total cost to achieve given user levels with a 2.3 percent retention rate. Please click on image to expand

Graph B: Total cost to achieve given user levels with a 2.3 percent retention rate. Please click on image to expand

Taking a retention-first stance

These examples clearly illustrate that acquisition and retention need to be partners to drive mobile app growth.

By neglecting to focus on both or by always prioritizing acquisition, app providers will quickly burn through money trying to increase their user-base or fail to maximize their customers’ lifetime value (CLV).

SECURING AN app download from a user is no longer the end of the game.

Hitting 50,000 users a month is a sign that the app is being embraced. But even companies reaching this level can still falter by not properly managing their user-base or sparking re-engagement.

Post-acquisition, the priority should be on tracking how users interact with the app, and then capitalizing on that knowledge by creating experiences that keep them coming back for more.

The beauty is that app providers can connect more meaningfully and intimately with their existing users because they have learned more about their behavior and preferences. That makes the money spent attracting them worth every penny.

Kelsey Ricard is growth lead for Taplytics, a San Francisco-based mobile optimization provider. Reach her at [email protected].

{"ct":"uR2Fi+33fK1POXz+elTZKzavqnQKzvMWRxcxFXYmD+B\/HHx\/wCi1xGAOgciRUOTAooJ2Dpe3\/X8HrmslQO+e3251tIabZ5RNwKFSZroZ4nJcQVnUPRlg5pgWiVdSritl\/jZaspNpBb99a4P0XLQ+x+SUzfRU7J8Pry8PobmJnDDq7umgHZoE4ZPlTWQtZvxP\/0sc2mVK9VFD\/\/kO9HUpcVq9bgtxRurV2Phi0d9PJEDUlwYwn9CpOU0Q0R4lvcx2AFLx\/4NgS0HFVLx2uhNeLEeGJJDzMRqnd7559Su0p90BaqTTGM4JU5n2YxPV98sDvvjfpFF0qmNefquoD7VKwXTths7q8i0j3vplbL+S9tpDqPAv7RIMcZEhc85X2Ce6fPxy1n3tDaX\/H2FRwsEZcvTfBr7fhZwIwcXWnuNiegRjvsXiIIJkIz\/XpZMyre5NBAX943ixSOVT\/kTv99FCGwieINKomS4DY3sLc9IV6vsAwIkVLNWu6itL+77jlpFuaV6nCqRSCmMo2z5zAE4m38qSbsR8SN8RUzkHoBXa12GHYkjL5aR4Qyu1kkRlT2gbthRpm3tROy6QrYFKUaNIeJd8j5Em2qiVUvmKhCKhvbj5Ur23q+3\/OWEX6AJ+Bs18kzNMRgBZkmebCSDjoQvw1CHoodqhQZlOfd81GhndE8Bdc5Vq+joOBLw16l0o6nQum7Tc9x9oleVBECZWNEV0T9nDWbS3pGpva3QSiBXLKi8v0BlSl\/JOeocokBvVC2HbioghSr\/Q1v5bhHsR\/+sLodyriiST06aocpQBiBmuzkI2UbgQWtFU4AKbkvdGUaq9kxND8N7XFVcXyN8y3+TLNkX6VUkVOgoBAM3zOTorbUzafTu5ohU3LW+RFJJz6MHdNNhBYcLNIomRaw4sti6uDu3t+0PR86TBOvrk3R9DcWdmVD1yjSgKnHFccBl+xbVGdCK885KbKIvkszlr2pJfGjLltpRYV9N5JQeDmJBLmkA7SCuIn9NHvr4PhSqSRAUFlNRLM4LgNL+Gd9vWFTa4eDmI1gco6IIF0vyyre0DDRtvydASrdbRYa6Pv\/9vwAI9iTyWnV1ZzB6cbzKfF3AysCXRx2gDjJvF4zozH9Kzl2jxxlQUWgSNKfMB3LRpn5bs09E\/KoG\/FqlvQZsj6Ncwffxmc5wyyEIznaqiFtewdGJMM70IpQgQ0ffPs2n+nOli0D+aw4\/9Vv7BESpOoP7eIpuLNwULHgpsTyTyrr3sN0jDue81Tc2PbmiIpT3id56Tt63jV737ShKJDjPah1WYy2LGIXOF27Qo8orrU45G1x8ZfpMz6dvCOO9ahKbtkMLOydufoLnfYkkVMPT9IpM5WTA20SskuvoIE1cBzEEQbO6JbbhU6Ct7cyLlM3oQSHZmD8cdTechlVqWGZgSvYpC1whdllfM7aCePZoBLmcJfSs+zmh75B5WcOZVQIc0j6dbhwhef9RgQahXWuEtCIdtYyiC2E7qUQFcgSssmKH2U1RLKaxXF9yqpSczLHBRDMrAmyGo0NWW\/WtcLAEeAlLvMKORHz55Nk2hJbfvqJPrdUOXeBTxnGFNUzaWagTMfOKUgjqWlH48HMY8m41RH7+12mUy4PZw4vJTEmpVRBYCnUf6UlUWhkMZdWGfibeH\/HMcIOCbZDiXssDjAuY5g7elQcMFy6YRgDR40\/E6flOcUhqQGhVlh3TYzAFhVGqxkEwMapepSj19fhLqV+8MCVACKQMoazv6+lNBAZ9\/QjOVw0VTTb8YDfYmYbyzluuNiBPKFz+pjgCcrA4+b0J35qAvoAIEfb55S9WywFM3iPw+A5vpYp4vYKbXynrZcc1SAOUI4fnaJOj0yttxkJFl7XeamDY9hoJrXP+SKmV0wcjhv4k4TJcO+rUxh6FxZlkJEAWsBYRJg7t4m7Fo8Lb+5e\/E7CcbVZx\/sZuVNEMj8nhtZSi1mzYoLWO+odRaic6jVULITMyf8Mmsqv3SqH+fzzBgNbdL4H4yQ+9k6frSL9IJGovPmbT86mkCIXc56dqvi0c4JxMUu2Az5iC\/itxguXxGzg5JD1ILRweZfk9eDUGNa3lED7lffyjP\/XOrVj4qdSt7V5g8IPjVMwVidXCxoTvft+8w0FlN0BqRQHrlYoW6sK+de4A2gYlKCjBL3Xh3bF+AOb1Le7CQGkx7a5PhFKsNDxxXz595y7AsGxr0Jo6BblnBwvOMOToEvMFOpzt1XYCDundINjrr0pL+0QVFnEIquM7rGIS7Ps9skhViXtoC8iO3zXqXWUJ0K2PKtSpADIpHydWui4dL6qYTl03uqsGZT2oPoOeN45aMqAeimlRDggBfzbG1vS9MxPD0PUFQxQPr4te+LaVyOGL50hmL1+13wg9ezXmpDCJRQ4Bz0hGmOYL1pfy4A+4QUy2HJF079fU5G4CaD5NMtJreP0jcd2KNiBXYSCB9iP2NlX0JldK5p0QyfgDulDeb8tYnx7CsQLVKJuGChsUD\/+Ha7hWsqsXLIEawfWfZ7LJKkrbaIYIapzwLXes5FRuZ\/zwUfIf\/Cxq+k74cm6rD1uv1kdgtexxQQAYULgOkxZrO8ndWZ4w1gHQ09LkRVQ1P7bO9uSzxF0Hv9dL4e2c3zmrV5d0fif1DirWPBgKgZOKrKeBG6+2We0x88yS41pBThr3ecs9v2juez8o3SLtFnRu+Ux2oclh42D8Vk2o0Qa2DLpUVgwg+A503RrToe2ZePY6VRHyGhd0NJTJcUlD8o6sniatjdGHES9tkm15sEtXxjbTDKoourrjuSmWhoUGYAGAHv1hlkLBm7TPnDlapHO7AP26O49Q+9rtVP28v+uV5Rugtn21k1zZNjij8NGOpDVpj1VkChYaZTTC7\/0J8+PN0UJ+DHZ7w++s+wLf3O3Exa6QjMuuO5ocnfpbwRPBf0MH48Y0WDN9YWTtQnN46EmFMmRhNIYel31WXnqwXWZSuodZK8TnaKRB+sNbvdq2QURxska6wpE5XSpTx9c6q\/KD7bMCZCwk3oKRr0rhELHjuikoH0O8O3tuzezvaTe33mtoDKNUjJrNUNfNrjRj9iFKdlD+5jiJQE9LrZfwnKLMtEyoHiBiKSF49SdDo\/rv0TNhBqvu\/3URgB0DQkXculgU72rnJG9XIs\/AlxKgsPKH7ABRTeX0T7PQuz7L4g\/RJ8qI0Onb98iFaBkcqSNWbwPHoB4tmwa4RltuFoyGNPCLRtvLFOr+LeBx0Gx58uqAKx6k4fO9L67lI7T\/LOuq+TeDDx0dtJZxPCkZPAxYCT5mZdM\/wMiX7pgbBHrEjpXyFk\/R5hXzmkvOeGgzQMotH+wZSdECWym4Usx1ZNxDPbf7aHn8vee\/+2ZF6Lhq0U5UZzwpmMs7PZS+CeSfWZXEStOUqKgJCFCaaAb9yC5yNTp\/xLr+PFqJuFqz\/cDinIpGUeUI6jylxPn4vmLr2wgl9\/90xYuSaxyY3C+Oh\/koIEXV07g0iDfjfybXpQ9jWTgaSaOzVGQin4LY15Uax5geaGjGAsrLZ0iFP8qQm\/dT2JyDhgUyzFHrvLpCv2eGASABvJvP4jUZgDQR2o3D1VoLoYYSbvmwrZkrZkU\/qaNovD4c27nhSDrMgwGa\/9GOS5arivXiHR2Ep3YpA\/5fnlFNIfxysuNf143Ck3Es7NJGG5JLK5WZ+9mRGpMSkrP95LN13VcjRhXID+Pa6yBwzV01hgwQ782DcFIjRJdreIwsvV2bHlhuYXwd0IS7z76cBqs2c6w3H7IA5L+a0uovVbXkuUWkkXsFxN1uO2euz6hIFGTNVHfpEzoDzxKNlgLGzQV3OfBT8OmtSv25OIFBU9DvjQeAcCKMCPu6NqFmzMyjRl3VB3AQATNqogMEC1AeCTLdaipV8BNt+iq+M8kWO4xHzQ1Sl3OybkPrIfigyQK7HQM+v5IVM+Xt+EX\/CqsBJCf8j+Uhdt0+mp6hbSqdqx\/RRUj9klH88GRFzDhcIWPcXTTrjcShW9gs1RiWs6gnLAZEP5Qq2nOKZwVR7W84S5VgAAmxbJRqsq51uXFNLD9Kbvo6FlfUjZtxl1n1Sa6dPVmsPbTcAQxsZrUPpCFh8x92NzgIuMOeyFHHMpGuJRhYPejGh0M06Dj5yZecuA\/Wnru8ZlwiHsslZHRtTS5wdy\/H2rvNyXXWx\/tGPvgN1wh\/xdpSzm6QBx2UcjPdlbDbfJOPo4j8fhrlkul+XSELVvq7uMm+vXxPP7r1z74SzpL4twVA1\/Oypt+qaHaVIiDUyoyumuu+\/OHUvN2rDINTq+15WZe4BREU6ffHYpZqJqvwgBmWH+8UA7Cbn+HmByRjeBbBRfKoPv6XvbOoT8fgojoVNnsPILsLey7Ein+uk79XIheDG4T79mH+0hWnWXbcql3fHZ0MTwDCQVE501c7UMrOLp8xTJ3BxRA4QBKv6GmfigmAZsaF08znlTQcrLF+KbOTcKVrv5yA17ZmEbXxz7t3gmQwJiDtF13d9QuNboK2z7F8Vra+XtfPUPUbuellNia11L849pOUKa9awiLIMCbcQUNtjvIW6RFVrQwJE9yQPAbyjVSjRb7gvXMuwh+M\/ZmADcMEQqsrkMim7qikMbGeQ68t921lWGRDMpidtppcGiwd3p8xWtucAaMC+B6KHTAJEBIs2CqI5c6Uh6tduf5e3sYHOSvDKyX660M2svVAZpzEJlhxXqzptWgGhMFwDrYbCDrKoFjjKAqSbeH7BSRVfKnXQvpU+gnezOFepvaoFfflImlItkUIbFPnb+c0XItIgOcCIVNrNi8aXmE2yRwZG97aEhBslSowXX0SFXDkqujLZhNpZYznh9muZZctNWj7kuY4qx1wkWqlVLVFej67D+fC\/zbP0JbtM6ahr5R8R\/o3hnm3Tc2lbyYuIsnina5AcZx8zbgHKN7MUkUhiI4ycEDxEpQNJ2wuvJgXmaytLGHUTJkTaEm5TNeBPmz0z3swMHvIF86E3M5QfLZDevW8lRqKxr\/a13WWfR3Ov1yUSoaM\/kAwPrgBhEeoBIsTTsIEDBj9ARlEkatGRmWEkSJKA5dI0ZNTJ9RPivEcQRWwoR593dRwpSuVC8gAQ\/9PWEoeRy6ETmhzf5G5Z6wB+LeNOM4Re368xjJ9TRi1hCUoVrbtrW+XZDwi91Udbu4gkopsUhtg6a\/sD97xztfHitHI\/NcmVKzrZTWhatnIddzARAzcFmu3o7xXWXXP+E3bnugHQBZTNKEqON3XqOUYyCirApODn941P\/QIIC5Z7Y2PNH3lUa8UFIxi6k0Dh2euhFp6faOyAnP\/Oc+cuJ3MN9x66DhXcvA0qldYudLm909B+eN2r1AZLpGwXf9mo13CEQZK3MPygyXlpJFNCbFYVbNQfix4k6pSgb2QScBXnqktZypX+qO0NiHhnc8Ho7XTtzua9f\/VjWm6XHEpZrE+gFbrrl+nIH1Wi+\/wFUjP70ETJfC8BqKjhD8RFDZM3M+bminNYEsBNHOjIJXudGwc0PV1yH8e0S3WNkoJTvI4mM20LqiUY6KzREBY290zM5EpDllPY0ZJnFatZBPddo4dPS+IKaXEPf\/uMC1hMbGD7kla9IX6ZSW3CU9xLtcacJjl141Opmre1zrCUz1XLUM8Hb1Cw\/x6DbWiPDZMkGvSZBxgdUoj530RlC0WhInQu9JWmK3yarnog9dCpt4M9jcUF6qO9umE+zl67TsG2P1ecytkpgJOdkVrKmSWn4Tae32RPts0s92zSg6+HADdPmIsieavLHZaWWxqVoBv7otMbZMFNpnxs62nzPD+1A74FBhcU7PVRnHITWYUcehHzUms4IzxTPJ8+m3GWoVWX4OibcuT628MYQ7R74mO5kqG96MaT3BQ5nl2xpsDzkjmuMwhmPnm+DBHvyQQTbBsLsAWjP2vFg5eW7aQnBU8d8dNiHJ4Bn9QBoFI1W+Es3+nTUS5aWB5WOlbwpMrbh3VFHYy3uNbZJN1iyvq15azhucn+3qfLqvlQS1ZCySvdDQd0jCfBH7aWnY1kHZ7CuDGGi4tqRWsvQTQPOefb4GVYk9oLba4t06rZCv1\/gA7\/dd2xn4RSI0Xg\/Lq6KRmgROiWG0DX12OgDK2FB50TsNamu8h26ZQCxx5eTybymDtElZUcwLc5tOBTweayw5eATdqmhSnY0Qe76J1F4hvxxvhseghfR\/7DpmNcpfhPs3+8cxtyChznB\/pUFDi4m8rk3yhH3iG7uymRWBWRTbSeM5SfiNouoJLW3rdZjZOPRL+iRt584mTIlqAS7+4qefWs6VGmt\/u85kJTXb3fWvxQoeQ07xe+7H9yY+BVfrRbSp0iV8SrYxVTw7NvchIYKwSC29LSSXUX+CYotBJ6c3pOjBjp2tU7ztOgmdr6qCsJwTpsbgxBLVELYLU+Bs46Bh\/8w8pR+hl+y5CTA278ERFbBNgBnoCw+bqeThIVflp76p6+XCxBjKTdbB\/1hjB8eaKNGX6OL2nnSmY5v7GixUDmyo2Phfuh+lzjYxzGcUeIAr4ISr7cvjMh37ICpT8HUF\/5s24F6\/QCqIwjn+Q4Bz5cgeNZWympGZVnyQB0MhlR6Pq7wWZyvHGUhyTdF02lb9Y8hshlaeA93GjlevDdFU1q0Ez+fan\/6ozMqqk0mzMHMkewjyzOT95q5QTPVJ8imJqY+fcIUeGq\/QJMYFggvG1L5w2kFjgHXmTM1acZEO5HAVuetROaVcMc4GpOOJiBp4HyDAJErC5zA9YNtBtjqIAWC+TmI1EkTEs4n+4ktc0\/kkqBjoZyGl6rRe70lBHRh7zmyIDdyI5HK5UWq5HVx\/hDbdqJd+W1STbavrXROGmRZ\/a9YXNlLGF6LCqAXAXgfHTZiBNbGSRp\/gZl7JdIKnf6zprtHY7s5h02OzIYUOIZsZkjPATKL6fc+GkvYUzmWWvfihNqeGWQsFjxCAC96Un43ynpCrcIlaItiDLlh+2lhobwW3Tma9YfRaZji4RAYH7VTJNjtfy\/tyVsijJN40masD9PLy8iy6AVr0JVveHizQ2vZChanwdyKhkYcWebG1qbZQGZbBuQfn\/hw0bAEWl0T1OZ+AursGn\/k4hZHPm2nqJ7b3xVV6gI\/8Uw5ZMOd82K3xajduEruql0BcZ3fczgEhGtV53eu\/oQiLAkggI9EmUxdSp8i6BQ9e6s2Lk4AwwFU\/gEtagg24nFW2YUWp\/DRviwUVBnJFbJD2ID4WkLmHhErbgjiRh\/6Frm8jvkSi3wtfaKWxa5oTkDPBfXCW70zUzlGMQTXEN4x4A4+eVWkr9FznXxjrgKjvEMQUqg3XU9ocFRmUft1lCZFdIBtN6zzFMfS0leBsX5zgGeOdjIhjKdsbjmaQ0\/KxwI1gkZE5\/N69cVtE9AFx68JYD+3OagJpxmt9z41Hk8rBk2oZGwQbDWfKwFi\/Pv9nPpf\/ab2npBcb\/VYx4eTfoSXhIUAr6tHT943MpHlcHsc1dNc\/gysRSZdw2meSIUfAdhAd1iPRw5gjvvQ\/iUnTj2E6SuLuUPoAQQNxMVEQAa4JovNa4kynTEoE82IkyWyJ7M3mhrhOjn7sgaTZrOXuXMooszzCHSEelk2jvusEGGom6SGiq\/80wc\/rG0LKzLWE3YVF837FcUmthpv+ha0gDynMiL6cTyyNUFt2pqG6TPxJWNXtlK1uWMqYhJlr35Td8U988Pj0qWeCAMGgg7qcHeFKmn2yQL\/JcnqkMWg0ATOLW0ulxlR20TE\/HaYifGSdYZxsw3BY3ZgFU\/xquxwgXnn7UCIV1wjlXdbV1UQTyJrElNRpDafWQcD3AdaYh7wz9ffYX0ftDWMFs9cuA6QNT\/pGFaY0fSdHZahGWCQ6pYcy3Pvy89zlHtKl5xRljVrOxBMqxJpkI477Vl2TlhdKEFdiB3s5vX\/+gSG08Yr2s3Q1j5NBIY91tTafWBiTxra+w9u0zxbLeLP1S734hMZyMyqtRwFmxhP0kij+qw5XUGgJC6yfwMjen+LUuQ7OAg6GHR1m9msJwqxFJ26pBzZUVRYOHeMzBkF6S+6f5mZhUyQNJ3j7\/+69EjuEN9ZBqMKpHpIObSI6rO13I+SIjjBlZy2kw5wOdqiA3Zbvk68vpWcb+7kJe\/LelMGd1wfaShlynkoNgnvXMP\/Gw4QxtEqVgNi8rX42\/gI4cHzj9RaJFljjumH+MgY4hLxE2JjYuZNQEz2IyCeWufLoQodl8EpL\/uZFSOSkCqcB01J6aoOhmHBdc+l9krx8xAMRpnhSNz96oVr7OEyag1YIRSBtu162VcGwZw3ecH4JYl4BPsXj7stEarxf5Q7JNOVWULk\/4EsOnn96lXQcAxBZ2YG0Rp7FBvYNLj4ziEI+EA88Da0pAo97h+dJk2ZzTqUaviDao5d2pQAQ8KtZes61Hk6SqfMUbVRWPQwAbAdv5CtY12D0hZSFixsHfMZ543D+I+gRzTX52tNfqi0B3j3NNlmSfNG\/760KcZqEl6Z\/PhYCJj4A9ENWHuaHCitYE6D4VFbJgBGh9T7Jg5VM2B5thncAjAe0T6\/tdz0uL90IoFaoa\/tT5\/ooi6UA\/McwBUdW\/EcBc4J5\/78oabXs7G9h3byw==","iv":"a8b41406b41aa01ea41355f1291c81d1","s":"f1656858b6daa7be"}

Kelsey Ricard is growth lead for Taplytics

Kelsey Ricard is growth lead for Taplytics

Graph A: Number of active users given varying retention rates. Please click on image to expand

Graph A: Number of active users given varying retention rates. Please click on image to expand Graph B: Total cost to achieve given user levels with a 2.3 percent retention rate. Please click on image to expand

Graph B: Total cost to achieve given user levels with a 2.3 percent retention rate. Please click on image to expand