As the global economy continues to grow, more cities are experiencing booms in luxury real estate, according to a new report by Coldwell Banker NRT.

In the United States metropolitan areas like Seattle, Atlanta, Houston and Dallas, TX, are emerging as affluent hubs, as are resort towns like Vail, CO and, in the international arena, Monaco. In addition to international economic expansion, the rise of new markets can be partially attributed to young affluents who have a greater degree of freedom in choosing where to live.

“We profiled Atlanta in our spring report because we saw big sales increases in areas like Buckhead, GA, so the jump was not a tremendous surprise,” said Ginette Wright, vice president of luxury marketing at Coldwell Banker NRT. “Atlanta is an area that moved out of the last downturn more slowly than bigger markets like Los Angeles or New York.

“Los Angeles is another story. The jump is in part due to organic price appreciation - the home that may have been $750,000 two years ago is $1.2 million today,” she said.

“Luxury Market Report: Fall 2015” looks at sales and listings of homes across the United States, finding growth in many established markets as well as big jumps in emerging, secondary markets. To examine the latter, the report compares Seattle with New York in more detail and also turns its eye afar to Monaco.

Over the rainbow

Listings of $1 million homes skyrocketed in Atlanta to 981, making it the second largest market for such homes behind New York but ahead of Los Angeles, which has also experienced growth. The $5 million and $10 million benchmarks continue to be dominated by mainstays, including New York and Los Angeles but also Aspen, CO, Miami Beach, FL and Greenwich, CT. Atlanta was also the biggest grower in sales of $1 million-plus homes, surging 70 percent.

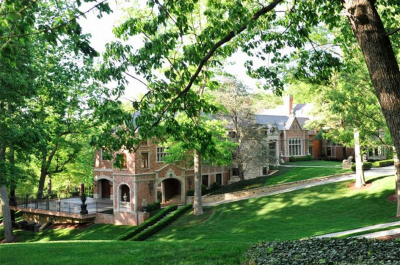

Coldwell Banker Atlanta listing

Seattle has again experienced a boost as a result of the business and stock market success of local companies, Microsoft and Amazon chief among them, with Adobe Systems and Tableau Software also of note. The city has also benefited from Facebook and Google’s new offices, as well as from Asian buyers, although one should not be quick to attribute this to trouble in the Shanghai Stock Exchange or peg the purchases as investment homes.

“There is no hard reporting on [the role of foreign buyers and investment homes] because the information is not required in a real estate transaction," Ms. Wright said. “Anecdotally, foreign buyers play a significant role at the top of the market ($20+ million) on both coasts - but this is no way discounts the role and wealth of U.S. ultra-high-net-worth buyer pool.”

Despite a lack of data, a realtor quoted in the report notes the impact that overseas buyers have had in the market.

“The typical Chinese buyer is an all-cash buyer,” said Bill Riss, owener and CEO of Pacific Northwest-based real estate company CB Bain|Seal, for the report. “We have a group of 16 families and 15 business people from China coming over in two weeks, and they’re looking for single-family homes above $1 million. I see a number of buyers from India, too, since Microsoft hires a lot of highly paid Indian nationals.”

Coldwell Banker Bellevue, WA real estate listing

The Seattle boom includes cities further from downtown, most notably Bellevue and Gig Harbor, whose sales over the past year have more than doubled and more quadrupled, respectively.

In New York, by contrast, demand is insatiable, and flurries of new units have done nothing to depress prices. Despite a slight dip in the quarter, year-over-year prices continue to increase in the city (see story).

Construction along the Hudson River on New York's West Side, as well as in Brooklyn along the East River, will lead to an increase in supply, but no slowdown has been seen so far. As the report notes, China’s market turmoil may lead to an influx of Chinese investors.

Monaco, meanwhile, has experienced jumps in both sales – by 37 percent from 2013 to 2014 – and in price – up 20 percent over the past three years – as well as a weakened euro, which makes the property look like a better deal to U.S., UK and Swiss buyers.

Coldwell Banker Apsen, CO real estate listing

In the report, Laurent Demeure, CEO of Coldwell Banker France and Monaco, is quoted, “If Monaco has lost its position to Hong Kong as the world’s most expensive housing market, this is only due to the exchange rate effect. And Monaco is more than twice as expensive as London and three times as expensive as Paris.”

The city’s status as a playground of millionaires and its low supply mean that there is little chance of that changing soon.

Young money

Other cities, such as Vail, CO may be experiencing boom as a result of millennial wealth.

Those 34-and-under consumers are most likely to purchase another home in the next year and, more than that, will not limit themselves by location, a shift that could also affect what markets consumers are looking at for second homes, with resorts and homes in areas associated with vacation or retirement increasing while those in business hubs dropping (see story).

Millennial consumers have radically different preferences compared to their Boomer parents when it comes to purchasing luxury real estate, according to a June 2014 report by Unity Marketing.

The market for high-end real estate has changed drastically over the past decade, and differences between boomers and millennials play a considerable role in influencing current trends. After a brief post-recession rebound in recent years, the luxury real estate market is now settling into steadier pace that will require professionals to cater to millennials’ new preferences (see story).

It must be noted that booming markets should not be generalized.

“[Booming cities like Vail, CO, Delray, FL, and Montecito, CA] all are very different markets,” Coldwell Banker NRT’s Ms. Wright says. “I hear Vail is getting a lot of buyer activity from Mexico and Delray is a beautiful coastal community just outside Fort Lauderdale and Miami that is benefitting from adjacency. Sunny isles is another area in South Florida just outside Bal Harbour that has shown up on our $1 million-plus list for active listings.

“I would also point to the mobility trend. Montecito, for instance is an area that many Angelenos think of wistfully because it offers the fabulous climate of Southern California without the congestion and generally you get a more substantial property than what your dollar may buy in areas like Beverly Hills.”

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York

{"ct":"hZ1DPpjcl2Er7zxh9k0NbgiBZVzFSgxh3DtbglzEmwJxR5\/VVaRtPrkry1xskFBPtZiyoLnS9fraBNLWUPDiwLLPAdd9eWVX4tynZ9AYKExtZAI4U3y1fmw\/ZnPOUw4rXhOrOUQRv1oS96ecN52eEsOnrWXIGlblDLpzFd0V99kYUFgqyTMg6rLJPRj47o1e0KNBdT7X3gDoZxoaSdoh+Y76gdf+plqrDtngSw8t+jgJvYW\/jypBpoLS9UuNwGT+FBmGHpFXJ5GX\/LNX+vhCmyXYrrkycNKXTRNQUBqWBlxNAy9bpZvZFepiwscCvIgbOl1BE\/ASIOquGq+\/X02hDKGenlhOKjmdYHH6zRyVzUtL1PhP7m6WXqpDOlKIztmFNVowYaQf0hgIN3uwRyuIYaP2ah58JqZ6+6lX677TSBitLwAtJ6qM1iHpZ1cANkD0ohKJx2z8IBtpISVL0Gt24oF8YCS0M\/jJqR+e\/+sBubMg0\/BZMa6\/WOSFp1pefXWLqjgDk+smDNwwMZqiwvNmqaOKkKKBNHmhvh\/RhorAZQ\/yfenUpOh6sk9+hpXoR0Iu5ERf1rX9LL+YeF2eQzSoTV7HKFqSU9kMMUOcc2NR9ESOwizEPj7KaFmVzvrnvcIH2UReO2lG8AytWakg4vqRPrmgH4+EH8Vjo5HXRYgRjtnwu9nDmpVMULHj47FD6ZrHDIVTBIsdhaXZJsUP66r51iY60yHZxHvcZI9Brzro09p0C1us8xAA\/enQd4dQgOhcfGeUUZGjCcHiUJFsicGcdMojzGW+WdqzgzArzvWee8vOP9Bn5\/By26dolccwdnAEao1XyU9eiNrBqrcJWxuUaIGRS1z+8R0dDtwRo7pwveZs7XqaxqbdKQg+GaHQ\/lhLbo4zWclnt8g0Y3vL6aWOkztY3xIio8tvbg4uZxRRNGZNS9zzPAxWbH44w4dmWSL2e729qmwYNtraaf1NrviChUUXcqVa6zOil3F1rhK4Kf1DpgGRUsBr6\/GNP4CRNYR7n+gFNcDTSXKx+fBChtS094bumzN1BfjcU+NNyFagl\/ZbSdySj+P1gup1FBQ35c0W+mxTBVJgHBhKt4zIwhTUmQ487zVHc2AfduTHTdA88k4ZHXlMP\/rbwThqsDp6aPM0wYpGiW8B8hQMrgSx887EoyCzWT9yTI1iAri9k0d5Ryq1TnMAdNbP+\/ZoTuBvBckC5Sh5LJq260YhtB6NK3n3v6qOI\/Wmbn28zS2MyQleDCU4Lj42D+pMlcgw7Qe27aCltEasICf1hlwGYB5eqas8QAT99j5+IT2uiBv7nGDp+BpWSaNOb4i15CsP46xRRz5Q4a5IBZn4SxATAcEqt1hANlkuhkRsB9uKFLB1LwXg8lmPo8REmewy4i6fz1rLrwT3+du5G0ZrzJV0aCguNq9xgb0nS38jKe1bJrgmZD8b038vCX3gwnRzuoY8RhBiOGZcIJee8YF7GEsrlmpkaN8b1WyC5nJDvpcvZIHv01HvRIrk+MHwx1E4sY8Jy7nrkmFH5GQNnBEDro7JgZOA2ZXAfHl8P9xeHx+NCkzCa6Sw2yc4OCDu1NBeNX7dk9eNP2kUgH\/moDRquYhotESnX4s0o+\/5MGDk24\/Jdz8v\/P0T8roletD2Z8tM3s7wwFw948J7l4QwsJkWvEl6CZs4Yk3goxj3okTCfswpW1Rjbbwoerp2I46p+PymNUA\/AAlrQQtm02Ta9sw4GAXoXcPJ4s6GKhd3s+WksT7G4lmXuchKKzLuOS3z0Lh07RPMdMaH07wykIMip\/IVj4DYDk8ZAsKseK\/Xrsna81gRXB2fJwiwhentO2Mlaj8nGliZdFmVk3e4VwNruxpzwLNs+AMmEZVYJgWupnXHU+YQHiulNaEs+5BXk79cmNLngml8\/HPQfCyIh6yLlMPRkHF2pLbT5o0Je5rWI6abnJSRLnEa1\/B3Cl9HlxUvsVVmpKqacvjIKYORdyYIYZs7QYQrVX+y5vO5p26VInDXzQlz2FxzxtGzMTwIrUy+4KamJ7K0raHp+6BFR8TlvINYW4BVQ7rKBmSSh2HgiktjTxJe8MPH5dnSJ+pQ2hQFV\/HM3LFwo8GqUBCajqvA9yNHoRzFSojwz8ieLTHkwbOLPrZakTiCTcud1j0Qx0Z5EDEa6DBkwIF\/JPtHppeRJn+ESn\/GWcH5VM7GCxAtYTy8FylYz9FnwILr8OQbgEK1Ea3hH26o\/oroa3cifE0VlBuByvZb1jKtTg50GwW0IscU8V5XPcfKLMr48CPFw6Dat7g6nRgr2lXaaU6cM3DvonOGSiwxh4xiMOquee9purrBcO5jD2nS14J44qKUp\/DX6o95MnzF8V\/TH83SKKvrqrB1hK9vqqEaDdOdeSBb17xLRMc+yCoL6lX2dPke+n2Ot5JLMyaROKUcqGj+J0P36LwBVf8PvpP2EfY3WgfrcNBaW0L8mqH1Xkxw0Fw1rqgnW2GmAXHkvqRADA24LVb6mMM7Pn2q3Vb2NjDaldLi9WoiVXVRZqhIFhugFVKLPZWfhrwRvjX8HpI5AmyMufY0IcoM\/NJkh3pItqxdmvRWYEBntGgxmMM8AUSCcgQNaLjGC0CZjYHBsEWlYfhIf\/C8XffVCPGUgazmLeBErMXg+1yG4\/3qhk+UYDRfAO3avS4LS66az3BuxiRoh3lXIQN8MxZxC1IWQU1zM2W7FC4mOY7jnVgsCdXbzqHsPCT31\/Cs02M6XlemtehD9iRRi0L5cCuSWWZye3fHJZ\/DCpozq9tTcrcC7ZhVbhBrrgOZwOqRTNiFqzei+niosi8++qa+3H\/gGQTZtV03\/XF31F4RCeRLKlEuuqEOZyC5HR5Lasu4Od52JVos2yrl3jotlvfGqDS5aZPSki6\/LaSszYAemvtly+l\/YbAd32\/Bl5D5rH\/u5N3Hs\/CUBCYp3JX6XsMX59fEAp8hqWgtUToDXoqyvfcUGONIj9iki9ZbfKXS3ClIVre9LdUlM0hU5CJu1gchDZ6M4GqaoWxx\/Yc8PAk\/+iubNqpsm9VMFsy2gf2nKYUKkN8eLB9KNiYvsQQwPjgu\/ln7nRDEQDOsg8lGvZYOwa1ahey21ZL5ItMeB6l0wYSYZ5VJVp6I1qIDI+5pDUiyCswrI5iu71V1+YDBzlAvJwGjESm9teo6SF1oKK4eFqzXaiPIBoIWUdUbxmuAqEBHaQzQhrDTz\/YrlQifYKVBd0\/5bR8hMWmp75mycTDXSalzn1zvoNmx8dWJubt5DfVbY0OQ7A5BF1j6hADycN6JTQdzczG5SSpWZGdB4X5sa1RhBlAm+4QGvsZC9YHPHJ+xSTowcKSpLR4WBqWmOWr8qKYUeiijCcTIvZ6I6Zhrl\/yRuRgwuv43f8Qh4HuPyFlXrtDvJHPwMU8OPUELa69Cbvwe4o7V2R1iQYbjtIUlU4JyrQn7f49\/oQ5R4LDP00FtH8HAA8xBJUgKQ1IyIScy6agjR+tJ4EwN7Jp0f\/gdBhLNNJkXWP+2zQQyTJVLJMyGggmk+sXNBZhCOaoIgkIJBqIb9odC7D3woHCO5uC4zzQqF0y9xOgOwUGRWh6uK2BdHRjzrFW0UzKWfrCOaLgrsw+99VXTq49SZR6i3W9YmMEG54EXDGrDE7kMFDsXTlqJ+iuzu+yKP4d2Rzhd3JHIsAfpinFo9xq7AeR6bF5m4j2sWrAbZFI6KKVhZAPWjv8A\/q6SNJgxqEnG5kWREkCB7sZ2M+qlh0KeaeAvBExawMwpcoM1dOEIyszonMV\/gPvwLxSr48n\/tL+JL\/81j5AdfS\/gH1EVZK8LJyCysX6SVpJQ7l3YgtmDb0Y5rzmIaYQV2VxL76y1ph965QGPmrf7\/w7dmUKnabIDrtMhm9cimY3ovwxkhLINfv9qgeFIUVccKE1KyEvmjDjeRlSKaqKj64xi+3FrE9FTzJsX31NTLtWIzMMVVauTp18ClvYeAPTby52TiMuZ+CGB5Hh35uqpmvLPf1GK5JtbOkzPeE42VK8jVDj0SvQ\/Ud\/T497Bs1NUFP8dJkVNAtiGms0dXvxLnFD1yo2h1g7nHrcBF1RO1aEg7486P0zBoV4JHVIwyJA\/FL3ibl\/Q5WvBv5giA9YpZOmVAfCZIBLZgJST6i+7BIo2IXsWCVFA+cylcDhIaF9dx8EuR5bIpeS6tbeg4h+sEg93xigXdM7dhH8oEF5jwVp3dHLK+eiv2S1MwNl1D1WdpshftLTwoYAY8DrMe70af71AVXqZPrp7aAzUVrnde3DWURunmub12nUm9fv7XC4szE6SCiYF+mCPftgt\/Xe0ezWuC\/hPPMYemG2pLDqMFA4CdjyWxOhl6MLlSTMLMYc79F4O1da36PnX+w9V+fOkew0Vf\/h1n8Riapvqkfgx\/1QC+gJFjOoqdSwj5dU2X8h5w3uDwFsANtkeMl5iXxyWp9HFW0Hb3C\/OgSGVkG3juzaM0GRtjrzWRYhsOAQDHNIQmPRjFfc87HDVXXP8eLgFM0Rhv3N60U2mmJ7aTCU8iQR2sPgkQ2F7ozGsGhQ9stVM7Nj7lbnvfQJ3s7AWtmyBjy0yPf0Z\/Tu\/1yxStJ3y+izIgN876nSQb3q\/zgIbx6oCoUko6tn3\/4dwoIWMeB3nidT8fJxcdjP5r7+HLy1ApUgHLY2OiRlwidwWvCT5Px2Ewushpoi1QHo2Vnmkzhq333hkBkzh+ZYZVCaQmw+NR6MjA2HLvlhmBsVdOjadiOq+jFWMpjce87Vs+mNnhUp8gQAihitpZXsGxTfWVZk+GI0rDSxr3MQcKaCLQQoyPEn0bYuuIn\/QraWdw4f4cP\/5q0C1jgv1tqAoSfA0aPuXypDe+XItpe0NVyu3AzL8+f3Q65fEZBVXhcxc\/mK\/SrWEGSFjHeFmEGhGGOrENIaiS\/\/Q7b\/cMqopk\/0uXIPZbWKqd+AxhMf\/U8tB4oYa9Mm8KY7s0ZAwIhmTQPvc79HR4DctAUZ5mmCQvkS+R7NGkQSpC2YHhCZnLmQbc8TNMoS\/zzKaJSyHMUrFUA6Ed\/g5G+N53cSZO2FBEwPUlSWQ9c\/ZwtwrUt5pU0CgkUezbLWTwOeWWstr9sS5NVreoJjt8+pBC1e+P9R1feqnazMKYKHUuJvszw0i7cXPadchw2RGoTuIP3VXIxGrU+2csNa5r8PqkZCMKsKas97w7HhfJe8chZd03JTknfqPNJc732HjSN61C7o0Yva1M6owbwPvuqb09V\/DSTKyKB1wjeBRk04YhaMpiY3mvJY9Xd10oHIH4H3gNVx8T52Vix03r7p94a5B5xH1YTgWIIoQN9yJPp3rVaaVZxqqYQNJmQ3FhMi2o0dmZFQIZj0V0lnfMyQd\/2ivmCHqSJnlbs+5254XG9Vl7hW5cIkWth5nFncRI1UBvBzrxL\/QbzRnpbCHJPB2otmB7ohmFdy46gczWbrvewXnSTOaeFgBxSM+sxHQPOdO\/\/p4Qqzqm7FYqlx0rcWlLEo4sLl+KKURJ2m9AkzPtuJrGprCreVOGfJ1L9VqB6kK3dcX9xG+R0GqtQ8IZN7D2QBDd8Y46djKjeR33qcB\/cNFehcJz5G7s5i49H5eFnzeG9a87Z9ezjatULEhbFC\/UUQ+CLdPpVZgzs4t\/BV3uvUWR6opYCs8YWAsMYoMiQuwFBTDufObkHfAxZP5EAz55cFeQXo9JClymv177N7a355hZq\/IPht18ZxYc0QychuXrYZWatzQAaJMna0QDA0oLIyy7FJq3LmBBb5FDSZR3HChhnOL+\/dt8ptxdSmYkbPbTmPM+KCyll5ktN\/rCar6Y+W+wOMGl3uBZeeqgNxQY8+BhGCFBYHa1\/6B6ldyxaDcygtgCwIHHxVOA3wRGXDI3UtIkNFi3BkFugMtTwrwURgUEnR7xsvk76NZFf6l+PavMdKXrKq4u1cB3I6rfF81W1uZZqlVWLov42volnDmlz21hm6mLXtsFA+xC4uNdD5IxFb16HnuHwCkUeMFisZ2FyHvGyZCwkTftfQ3GKvEon76LEPmkeAr\/7Htka+BvRdJLI4pwK3jkBqqJgjTnlW2EfkIkgZFm0BzNZ\/nqteNAKyK7nXdrYhgEAX8rogk9x5YPRdYQxmu+2oe638o+TySSUhu8rzmKWFTV1VEkH4eafXL5JI4DU7JewTpsronOSJ900FvedYR3ZvgHZT3lMS1dFkMc3At8jgHlGyfEBxnJFZ3KFFzVFGq4m2y1+KUTcSHs0xEACFqwogOBPv8cK4o6\/PXuUTTKe2SHJeBUH6LkwY44QLXbvmKHAnQL9wGza4fvEiSWr69jAheYHc5EBKJObUHXrxpJ29WZ06jD3NdNhlHfiCvLOfXzmHE4waeYfWyEELbyXDH0Gey9W1DBbnNFQm6iYKK3tHC0b8DOQCjN5r3xfCmraiTACzTYiM0tr3emVopdeEZAeFWunDdLPa+Rx2aNOwgCgnimsesoD1rQDSNYNtC16xWZEXXKavezctULMMc0Oq0o\/W\/vcsxfmK3HQjrWf9uMVOHMou3A5SvRfojbaC5WGjMcbax5pVVI1bRCTdJ0SgHEJA6A9OHiPUEnfMK3tcqa2cs66rkzXoWwrk6VE0d7tfomrTCSXuHWAtScX5UKRM22u4uTSmU5tdcKgR9hhNjIN6v7gwgjYbx1vr29Cf1C654EaAuLs2VBUVH5Q4gIn2ix0Q259ddIY\/zynF+x0hRE9xWQp85bL6G6B01wR77Vdw5JkdI1c9ce+cTED5Y8dKiP3uxD2gpZ9b4o3\/KO3I6TmwkBJBHuephzbSzwGSRS\/woKcXj3MXjzyZOAw3y7n9WaGSmXKEs3X18AbAt6jmJWkfRLueZSRlPa8QoGTCTzrNtqwxyaGRs7I69VQvuC8YIxsTAkUyrn9HKyfTkZYMAm7na1bjHdjnK81\/4enV1hRxUM001rAYKCpcD7+Watv0uG8NI9IEXj9SlN7bzTLTvBYf8MX+ll+ZHG\/9L9Gt3qDwkVVkCxjSLH6vd6B+27XqNBYMeL8HypJVE+lM\/pEu92coJqxh9wDeJj+\/5KNFwjKU\/WHw1AsvGsdIWgSOaaUOl0fCaF+oSr7BVQnuDePjmpl0VRHMjuVetaDPXMx2+WraJjk7AMeGzOVXZPYiFswgM0ag3\/WFmW+W18A2WPZ4QJHXI+iU3woT3b7l230VnO2Qby\/PynCtY5xDQ6sXbWsuger9tq34oJhtH1C7m4g8i7sO5DworULC3E7RSH3lmVeb7WFELL6lUWfi1o+iynoqXK4pfkbIIEwfAqtD1YkiWw4D4J4StBEFntORctKlNSqSacCVDKVOzvTDAn7M4ZUXd8IPkdoPQs0qvcul2qfovl4EJC3UN8qaHBNmOBr5mtmazPQV0xUdEUTKsV8XL\/nCy93PCZIWu8+1v41+84cyvW2rVOtP5ZCGavRYF3uOQoGDtTgfPOp0Thh8kCh7VXdHU\/imrf1wVGBypIBxOCoffkiEf1NfOfNse4P+U7u54RW90M7qiQ75SStjrLiJuqs7smgYaNXlq\/03ZRfAutqW8\/wOPQ9+QexKmLMyw3TXFbs2mvFvUMblTLOevoJsPur\/5O11eJ1611K8tavZtNiWFjyr8+aQDq2qcQdJQltQBJtVgEXBm4hzJhsfvRsKaIyXGXE7UyB2pvuUmZJU5cBGTBDXbbYV3WArRHddstl\/DEBxVhzaH\/10HcnXqDkEa5JuHDBfx9XvCgYMUUn5hvHK4P4KkT2VTv+n0Ro+VuAXwZXgBiOF8HuF1J8b6+z\/\/j0F79qha9xgWKfhSOv9W9ZL2cI1xQcC\/u7IOIMuh0VlbzkdGGTnoyFLEmJ5rTm7CccfrQVbtJVlEgJbYUHFYmxbaqoetgWzFBQb6M1dgKdKVz3PRL22xmqukZ998w5ge6XRssoM54GZagYT+qka2K1fWeNKrFXDFdWiA8gqi7hPSf5pvWt1Z8Ii734KzEzMERVrs72D6UiRZKuR9mcF77XfSWrYDXVOExi2LUYRJoHTELuWcaKIoB3jnO6v\/XDdl0JK0eLo91pSy184dgZd0s8PEvu9KWOieQZhmETm6qFkQd48rmQyoooDS4LbaOrBVPiZYNSZcY\/GHQTZgkYgADCqlDTMKARpZO3\/\/ndJO4NkGMUVigyF865Xo3VXFq\/6zFizA60\/iq4WxMJ413Oh0nrTXjxhuxBYY8bzkKXAYRdfSML3sEva7b3FzQCl9\/O4tibG6M\/TaILF+MiCPlRp5jLcvzykoO6cYc7GvDwmWYauhIIfYRfBYR4BasleOrrSEBHhxuuQnTSDQQnMFqOdxYHHhR6PklBIzOnTDMn+bYScOrgdO1tRDdcjezqhQTzO52PywrkDIJvjdXa\/G8qg7kAmbF+1Pv2QOXDfP3b38bfya2DAOfjs8YFBwm+wd4FTMb4AH5Lcu7IhPSOlgv9a5FuQ34ajlKJ7uFLk3ctU5QbzP+91bgrHwF5H087EDLpZW4qHXJkBVL5d4iA03v52KHIh5ABL3DqnWkr7Ga58OaRRHN4\/B2Spw\/oF9+asK7rRKc4qcnDhqhjdLALfv2TE90412IFIfoBzZjc+kzbbKDKw5ET7I2gUr\/TSAGvrImmSw2G7Y\/5hRO1KKNJtqJ6sSAgicZEEGQVChOLWpA1oSyBn3hbqPdhmOrTcpCxtEHZR8UUaUxClmUb4RdTyJvqoE99nuEC0aWScikubnbj9e+a3LezkeMLcu9tFZPnb4vgQqfOTaohP7NdaR8PzMzo2+fmRhEZzPh0I7H5iExvOtv4bCC46yaKc6IKp\/ssGHPS\/y0rxEHr3E4OJkCGBaYDFZgfW6SKkoaTHaJSPvp5Y0RFKlggQc6lXJv0WPiFuY7I5br0IV5GvNEExT8KpmQovHUyFxLk4MfQE09t9xwfI\/8DVhQjIQaRxImSJyqxMU7no69k64S2JQQoOxKkBumpi3mRhGPRuycUfPAUm7qSjzMO5dcaUnkK+PXFtbmJ7ibWrURx1H6\/uQxcNqWBp87Pojw39H\/Ab4AdsOcJPeYp02NaHT9MI2f4QN1uvXaOmE9+O33FGfT6B7usw8ZPbwvwA0aP0jtgihpiHeI+YdnIR+naDHEDaoxsOuvhbHwJKHiUeHrQL\/N9\/SSXrkJKA9ZZvR6b6\/i055hse3ujzRr4bUE4dBKKHFwolLsHRvMHEXREaWua44a+nSS\/JeVAJUyX64P625MV11Rtlemx3HaeSK5PZy\/ny856Rfop0arrRdmJdHJO8eafafzCJVTW+EUPx1cqHsPLp9IHESGfJflu02psZ\/+u8zoureBvx1o0i4jQ3lRm5oEM0Px9pX8sCnZtokhycds36lHbOgrJlyp88nKLL4kCsOZZZ3XkXKN6kQafk3xgF4ojWzCNmL5yrGlzZcoVReX8hEhXfLgufdE8\/QJGr9FmBgjqwNtraBxCeuTp9jbDS3c800KTJX7Yx+orKy0Nz7cZmPoOWHO01ZnQu5PH8VdEWr7X4S2FVLsZxgUvfO\/8DIjpWXzUh2xpgNhNLYXbe5pii2MWEjruz7SJFPTSZTT1oL3izVUsKUF7TRfM6qt+cLBJurph1a4VnxtdtLqQAyyjhP3m+8Bv3d2F50CU+alUqGcKowKg09mL\/9H+BfYXqmdpf7hNKtGprIDae1g4a4taSqZUb+j+kpGErk\/jM0cnoggvXujgOpnxfDCGdJ5TH5qIipn\/WLtx1Cw2McTGvSaL0\/0d2LXyf4ATl+CXjeY3fTeqmCoMOXRKiiig8zAQFEsQu9BWEd3zxbNFIupD6zthfW09Ded+7zqgvUZ+LEhnF3hcgl\/146A4LGC9An49KGlSB\/DBIEkbePeXND9u6A9QrSoR\/Gakc0239l2mjJMEsBkUnkWc5TxQHIucsArQ4U0I2qqD3ddrYEFDM2wIY7hrAr0pBAE+1tS2RAuA08B2UG30xQXE2YYxyAjmcnFGPD3fHAY8fUy26eY1TUqW1EY79tVG9JwKIc6tZruqfDk+wH9YX7pCdKqG4FXC34qtvSWW+pGhaqvGoC+JX6v7FEcS6IGjwSnwdlzfcOLV4EY\/7M68wd4bdpEV5ps\/88nQT+dMMJzor7tkT1jUy9E\/xG0Jaw1j0mHSIHaSbX4caKvdXNgepF+YIzIUVFB\/xfcDB7w7zJlxLEplZ4xrldNb\/Ix6uvUQ\/oLIkgdFr\/rErtjACKyND32tchHdaHD5AhG+msMoAvG3mQGaq2EQU\/7SW8nZuAM9\/xAAxUoyli0FK7q7EEPU9\/iy5S5gK6ud2tu\/CZMLy1DTf3sKkzMustDyf4Ayr7KrRDkEumKBYjoLZnyMpjHzjS8O5IzXxzWLLVKGPvApIBnzX0K55nEGyiSuFJVNL8kf+BgBV1iZtZeYkkZm5pS293JGNdsN\/mIGrcaoJHswqkyt4L32oZbQbzvR1egS6P1bDif07iWRDohaEKwuBxA8ie7Z57xozjqOAo6CGN8Y9Do\/mjBwzgFjMoUP2vbNXvj6k7gl9phn0Hp\/dPv6xHykxYCSmpb0WL7BhuZhOuqmuhelpqofwygK+HaMmWqLyhGfx2EucyjEhlDHSuVc5X+qxaPGU3Afa6q7hJZj92\/4pS+EU9G7i0Fm0G2nvGvtVTaKhDApxd93ky5vFFqdLEksuIXtdu\/Dd3cpLuqeHGqThtsIZ5hfIHF3gMr4DXNu3IR1pAq\/H01qUo7fKNRRtX9WGLDKmhr5Sdkw7LjzSoar1E4\/Khb7Nue+XiZwKmBwICcUzrqrWFRDAcHn2yq5x2nInN77cPFyT7tlVbmou7swrSE0K4Vrps8xGXZyEYyZVXUi8B3XKmbgZYZiKSmNU3iZsacIx7lnE4DNKDlD1PIOa\/k4XMNGf++wq5HRM92h6Vc\/NdJNd8HQFAkr2obmiYRVWXTu\/cpjHc6Q\/EhUHnOyLUSB2cLG5HvAMrUn9lTEWitY1U+VDRiHebxMCZzkvEEWMEN7vtw78NaJ+CtJ5MvD6s2CLXHIMN2OGJQlJFbzNfQrUoXwT7MZyPzV+PEtLXOmXGUK5\/7URn6rH0bTcS20ZXa1aNtXvSuTiuY9VkA6S6FgVqAgi57iVDLvAa\/1GduvJKwR029KamBhWT46lPLscFMBs5UKotZE8efyMHZNqKCrq2C+B23PPOzMpmaSpScF2sitxA4D\/94BQmVPJOUtZIslN1D2Lbq8VWUeNwMPzJYLSTAdQvl2HVGmCeAr7XShqKrChstvqmSQwvtnB+7RzBiQt91azAc50jhb13CamfKk1LP1MCVnPmbvz5ji9SUpQNjxT81LNljTa01BKEF10pF\/NcnE1TOLvWkrfXHVSDKFQN3c2he3iexWhryI6xzbxLf+MGqPq+Cx2rKhnsPmmmTCNryU72xAhm0OfGnrRlaX01knkgqFoeh7zrQN+2jx0FzPoPqW3BRgAQn1KYj6m82KuCMLNuhd5oBt4MTruB+IybuEiCCtj2rfjC7JLK4FZp28EglUQ8bgZ+jCmXSEzXWC8dC4ku\/rLYkbUSm8iAdRQxDGsABGZWZPKFCT7RDl4PBEe5RKuUh\/yoK9Lblx17bamUKwWcz6dPgmeujCkJ1rVtVyz7jcz2oekqfhXZFGvfViSWYXgPrSrrlr5DFzhpTptCdGMMy28pgvnE8EIJUYolfLi\/sfZrIW9j7F0rhSWzTNVmnPSsnG\/fSTsBsoSf6nHW\/CAbbX\/EnA7vaNzKTcVHL+Ogo5bs8YcApPkKe1hLIKYsNqPbx5IQLgyXCuY7UU7OWWM+R+RbVJhvraiJ8Wwm8T67W0f\/wyOMOzZ0E+x\/W4Ac+bKDCHC4NsYAKfVWicxeGek=","iv":"cca628b7e03b305d87f3b31496431645","s":"92f97f874498249a"}

Photo of Seattle from National Geographic

Photo of Seattle from National Geographic