Among 11 groups and conglomerates, LVMH brands have the lowest average digital IQ, according to a new report by L2.

Benefit and Sephora were the only LVMH-owned brands to achieve the highest “Genius” level, with the average score being in the “Challenged” tier. Despite LVMH’s struggles, luxury brands as a whole had an acceptable showing in the study, neither dominating the genius ranks nor being underrepresented.

"Geniuses aren’t afraid to try new things and I think what we see quite characteristically is geniuses aren’t trying to be fast followers," said Maureen Mullen, head of research and co-founder at L2 during the firm's webinar on Dec. 16. "They’re looking to move first."

“In The Company of Genius 2015” looks at the “Genius” level brands, as defined by the 1,801 total brands examined across 24 of L2’s previous digital IQ Index reports, and looks for commonalities among them. It also includes brief profiles of each brand’s digital efforts.

Keeping good company

Of the 66 brands that achieved the Genius distinction, eight are luxury brands: Burberry, Cartier, Estée Lauder, Lancôme (counted twice, as it falls under both “Beauty” and “Beauty: China” indices), Michael Kors, Nordstrom and Tiffany & Co. Although the makeup of luxury brands appears small, it is comparable to the percentage of luxury brands among the 1,801 total brands studied.

Genius brands experienced ecommerce growth of 31 percent in 2014, but resources were allocated more generally to omnichannel integration than purely to ecommerce. They focus on new revenue streams in general, whether that is the brand's ecommerce site or somewhere else, and reallocate capital from traditional channels.

Image from Lancome "Making Revolution" video

Nordstrom and L’Oréal Group, which had six brands achieve the Genius distinction, including Lancôme, have been particularly aggressive. Nordstrom has dedicated $1.2 billion to digital and omnichannel projects, while L’Oréal allocated 20 percent of its media spend in the first half of 2015 to digital channels.

Mobile commerce is also a point of focus for Genius brands. Growth of 33 percent is projected for 2016 and 2017, and around two-thirds of Genius brands have mobile apps.

Many brands are understandably wary of opting to improve a mobile app instead of a Web site because the former discourages first-time customers and may be seen by the consumer as clogging up the phone. On the other hand, the high level of omnichannel integration by Genius brands likely helps foster loyalty and lends itself more naturally to an app.

Search-engine marketing is another significant part of mobile success, and all Genius brands own their first mobile branded search result. Burberry is particularly notable for its SEM; it is most visible across category keywords such as “scarf” and leverages search results to drive traffic into stores.

Tiffany has seen similar success with its SEM.

"Of the 104 jewelry category search terms, Tiffany is coming up in 31 percent of search queries," Ms. Mullen said. "The next closest manufacturer is Pandora, coming up in just 11 percent. Tiffany is getting a ton of incremental search traffic and is competing with retailers in that space."

Social media is also a large player for Genius brands. Their Instagram communities are more than twice the size of non-Genius brands’ and those followers are more likely to engage. Around one-third are on Snapchat, one-third make use of user-generated content on sites and product pages and two-thirds are on WeChat, recognizing the necessity of tapping into large consumer markets on the consumer’s preferred platforms.

"One of the areas geniuses disproportionately invest in is user-generated content," Ms. Mullen said. "It provides significant more authenticity and allows them to cut down on expensive photography costs.”

Nordstrom’s social media practices exemplify the impact the platform can have. The retailer combines paid promotions and viral strategies such as #NSale and “pop-ins” that it pushes heavily on social platforms.

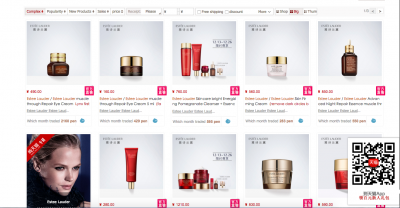

Meanwhile, Estée Lauder has taken a number of steps to ensure it is reaching a global consumer base. The brand owns every first-page organic search result on Chinese B2C site TMall, thereby eliminating gray market disruption.

TMall results for "Estee Lauder" search

Although gray market sales are a major concern for brands operating in China, more attention needs to also be paid to counterfeiting all around the globe.

Almost a quarter of online shoppers have been duped into buying counterfeit goods, according to a new report by MarkMonitor.

A third of shopping is done online, with that number rising toward two-fifths during the holiday season, and the numbers are projected to accelerate upward in the coming years. As the growth of online shopping coincides with increased access to 3D printing, brands will have to take measures to cut down on counterfeit distribution channels (see story).

Rise to the challenge

Interestingly, Genius brands tend to be high-performing, publicly-traded companies. Eighty-eight percent are publicly traded and annual revenue grows at an average rate of 4.8 percent. Publicly traded companies often have access to financial resources that allow for increasingly effective advertising, but pressure from stockholders also likely plays a part in innovation.

As online and mobile commerce grow, brands will need to keep innovating to overcome the challenges that accompany new platforms.

For example, mobile commerce creates myriad opportunities for retailers, but they must first accommodate consumers’ concerns, according to a report by Boston Retail Partners from earlier this month.

Sixty-one percent of Internet usage in the United States is on mobile devices, and mobile commerce, already one-third of ecommerce sales, is set to grow over two-and-a-half times as fast as total online sales. Although mobile commerce has been seen as a lagging point for retailers, most are focusing resources on improving mobile sites and implementing other mobile-based strategies over the next few years (see story).

Nordstrom Pop-In promotion

Likewise, the influence of social media and growth of omnichannel marketing have impacted consumer buying habits, but a lack of overarching departmental communication means there is still room to improve.

Social media has become an integral aspect of fashion marketing, with the 56 percent of consumers following branded accounts likely to spend more on purchases than those who do not, according to December report by Fashionbi.

A social media presence is just one aspect of an omnichannel strategy, a consumer journey that bridges online and offline interactions ripe with content, experience and high-end service to spur purchase decisions. Omnichannel has become a signifier for “exceptional” brands, but Fashionbi’s “Mystery Shopping: Are the brands really able to omni-market, as they claim?” report looks to determine the actuality of the practice (see story).

Although innovation and curve setting is part of being a "Genius," brands shouldn't get lost in big aspirations.

"Geniuses still get the fundamentals right," Ms. Mullen said. "It’s not all about these sexy investments and what’s the new platform, but investments in back-end infrastructure as well.

"What geniuses do better than anyone is have that direct relationship with that end consumer."

Final Take

Forrest Cardamenis, editorial assistant on Luxury Daily, New York

{"ct":"5Qp5if51Td\/hpWBA41hMy07Z8zm+abZiYZdbaYI5YC7ZJXnfveES6ID\/tfX5W7h6mt8vbbL2qZ5hi1+smGP\/uXdBWXOrzSpsjtU3gpOnquoz0mxUlzjhOQwJxE0CZwrEFzSyn5vNUXzxkBC2L1+hlA9NjTLP6SPa3P9g+G2+6azbzy4c87jZQiFlAyK1j\/oganbT\/6+KJP5Me8dqEODRiip6kbAzAneVrKUQD+DEJPIBL40lkMcbueBb0fSdN0YFihtC0HM7HiKyPSNSBGMDK3gJPVLuyieOp3RvOMy9NGjdxknugMxGwGxdN5l9dFN1H7VRqXEb1o4hAn5AWytMIVx76Q9N+DF\/9spJWdoPN1+OcfauaqCJzTWtgXjVtutGMu9A25oCm5NIKL3X606o2BQ5yWrqgjAAzMf8uXx1G0vpBLpmaeUHDFiwGnPdNDSuBeJK2h\/0zEXxYBGEup5\/6SBY9\/Hpt3xKQP5uzIuR8Ixv+lRF1nI6KoLCxL+BW\/bmSqtv0Zv\/ufSKH4vZg1Nz03dDKRRuhPH4fS7mIXl8KMoqcCwd0EQbhlV7GadlMU6QHG+POBhEqyOJrAvrNq\/0n7epDmhw12O5tazVhDjyLt8vpJ4C5mQvIgqRkzJT9L2qrXT1hq5b0aqF6GELI+FrxjsConuelhEcG56biSNrhgbcgwNTrjgoDukW1AJpYh5H+RDEdFeW5XymxRc0xJdB69uAs\/FpQAP\/9MItyvl7WHNGxlJn\/Nkw9Zd8KXdEF4XLbY+JEAjUVt+OrRF7ebXwNLq4PpawEJXeOGubP2qWnpbaXhS3adcKyBLyXGh4Fcyx31g2040HJ\/fX7aIiTq3PDgBPahG843hc1Kgp8tFfqVeBk7etmg5XtZLb1xKeTu6B6E9k6CwIT8AVwYa3gPdi7JiVPa4WTXpDVVLfWP1bh2F8Li5rDNqxwyuHUprdTOlPLfPiPOxYNrLt0jlVQSQ4U1ywB1hdoIzk6HHE\/AFlrrLnDngskjFF4apClyyJmXeyu7CRi3BVboSjJIriXlpmZmkaKkOOQXrP26Wgvys5a5Nekt1LDGv8CrWOI1DRYXwRKiT\/U72enqrGbB59M+krS58lrGVFQuyVtcwGCZ6qRM8Mi7ipCyb5jqI\/H5OZxdZ3ImLVj2sOAdiXr0d9JFDd8+nj9D+l2yPMe2fA\/eJEaWZW\/gMk3dMNd4q8pBLzCCjtJl8dUO9U6bF+e9scy167n8sQBxyZ\/jAbaor9FDmm0P+ki6z3q4rPBvzkiNP9xwmpjXjazNeBEuWL0M4Ggx+0Ms8ahf7vl6bZZgs9zkd9OD9hbxWXmVw8Mzx7ZC+s+vZsup735CCQqYJdngQIgAuD1\/VMLzguMmvIO8hH9WfqRuF1DPlLdTm9yhdQEILnKssrqFScHIk5eMqwGv0dZ\/OPBiJVeFJGaUA6xt5HJdtobZFe6XMPHEd0llJOf6ih3hXha0Jwfwiay2PjoJogNduCBiPPGwlqJlNVvNqQJyU1BWyIObfh0LmVtuKx6c+p5QiOG40\/i0vQcy8m0lI2D3j7vnBurg\/uIZJiQB3hZFLC1xfQB0uQqz213fXIfQbDbs+csVCyNFnSS0KRYSjaYD1xWZ6P5ZdoFV2011JkCSrhAaGq8m5a5aiP2w+2p0TY6DaDpEhX7qu0WuLNmjXQnHkRoKRlif1gnq5WyRCzjvf1iT796\/y\/4TUWB2b0Dsp9CCGJp+\/OCQImkVJPqw2muqTMth6d+z9WOAETHOgD\/u5\/WAvmnYfImC28pHM864R4O3wnG3aeNit2E7IglpSb4CsE7T9GfLhhnk2VxOT\/KYFl7S4hDtxeGlMszxHQN+MyvKA8TFsfnW0RJZUTZ13PATTBhuabq4wlXGh243uJe1c8LZe6OPKyH7YwX5y6KBvAkTwJozAVSt7sEP37FryrnBaMOw60+dunnO7tbVf4ZCVTRHMIIOQZq8gDM0zLNwtfJIOeutpW1Ha1iXMSZRAwNA5hCDTEKyYu3kXBrw6RvpDsMCByiEdWfYYTE\/3ay9pehXvZA2zj\/JXmqW7LAcjD6EZkGON4asUcalSakxspTw5ShGbyH53i4VbiafCF9frb1Jwi9K2977D\/+JPAFvO57kaLzodBQgZxVd+Movts9IHRKWmmGUiK8iVmgs+jR+pDFsmYAUTJjQH4Nltqm3dymaEcgEa7sS5IeDQl1hrYDoCXtWk36FZqhHppNht\/EYKSHfzkcEzJUtIf\/g0a1gQecDDfk\/aa27ayQALaC19a\/QxeTBWYqEyevNho46OhchZeu\/1HQXvKoxVX8fHQ3Twt76Hk3qhBUNsQh75BQpI1oOuSvgfMCBygD4kh+wROS0Hf191dnKwVlukHavhkwM5vXfqqXNHet1Bmxst388huE19cfeR516myDgB2WN2x4\/ObooAPswfQhGnvK+8WPPadOVj+tUf4VdW+uOWm57+GAq15Oy9yu3d93+bJCOhFuE0ZDKdcllF8pe75nLKtHa68Sun1ceMWyf9D541blAVz\/ArTBuS6j2r5rABuqCqhfMz2+hrkcPnOG58hzbBA+4KfaRuWr2xkDoHSjFpxVQBbIBcit0zMJxWurjaZZgXBC2ESpTFpdteBmNyk\/60q6OyyDWsMzbMDXMf9yyvcYOGLN8Ae\/wm6SQOYRGOOghLeGmtGyLU4jR0L0kPbkz0wEv8AQyHwKSSrRAcDF0LCM0X8100scLVddwST\/2VV+cdIPTjDDiiafbYxLw\/BBJUpC4Wzjg13x5lERr6NObzRZDASUGDA2kM98N7enKJn3sec9z7yP9gqqSFxOGsvmatrNND7uj\/W1SnFF63Rx4p1yivVIkkpsOJI5Q+HrT9gbiab\/vev0SjCgBLwXIkWKFE3yk8VFdvoDaLA6Oz48w1aqeXn\/571FOwNkWljnlr4rlWyQ6eS2Qiqzv56AVN6r23PIN2DOSAM3TTUk72mNgBHv+hzbAfO54f+bX5WnaWtdlq8KURrzogp1uNmg2IZGGZiUlZUph42zqAap5thYpWkczUteLG7b6ct4XWq91P4EJxgkh390x9z4GrQcRNe4Flkpa8ByMAbjl9M3jfq+KatbPhZILL8m6Ztj\/Ch1MtUwkQ5xGoWMKLvf8aIPnFBXJKVgjAoxV5jO0OPmCaYSujTHFYlC6Ywe8LTWxGIcarJDQQR\/g9uQYkgfkzs9nllCmoed6QszcpiBVe8Kqxr32uD7OlsX7VgNv4S3ZvRI0ov5CmO7GNEJzBdzlI6DDDqKpQoAHF+RUkRG1jG7GD9fBwol0CU92+JV8+AOOgDpqskYu8ZyWGmpRo9m39p\/oMF0eXyfZOjvbJvrVdooh0E50p4wBHSs9fObEMAVj2d0NSYhQRZq\/7nSRyyDAPswWxjKbiC1eU36gAyRS8Ep8YlRqWC46vosint6dATHhat5W+lOAVtgTsIjuvKiH5480vkl9w1R\/dliqMogg3Goydve0JDjS3cb71wDsAvnOGzC+xaoAOGXhd5WO7QveeD56KQSChp+UVUlcyvPj4ZXM5O8n9ph7Ntl+9mNT0lPzHvObKuqj2Rc5BSdYBuXXW5583JjNtzoN03Mg5BowKd0zojQblyXhLuOwNC2ETB5P5jQyW6pphvKLVlM+0QkDJx+SeAP5mErzcv7yLi9MD5PmovvoAhh2or1gKgC9Kw1dyjK0IfGRV8oKesxdAJ1QPDNjq2\/v7LeoYnbKQmcfOHuv5yOsvivp0Rq4NgF2IYvu2NiXeb6tykk4kqKdp1lVWJ3LcN9wsFJ8dn8KWj0Qsvkg\/wUY709NGskwBmesEtA\/IUzMC9WmAd9neJZHturujMDA4RZtzuyl0YajZK1crbRi83QuBshWHXlh\/q8hnZ7uRSO0eDi8vzP6OsOJj5rgpRX0maEKV2GDVQx5YRHPTPtJLah5IRAogztJGpx38beKjq\/lBUZEx13KaTYUmVRYy9WKxbITCtB1YPjFnStyuAufgn\/T\/3n9+1O3bdJ3fx6duPukU3TDtCZss7QiGCQiby8Vzfr0v0uvwOjCx7MW2fHvBh\/YiZyOz+5RxrBx3PnaRTEZkb1dzi3m0TqmAPVi3PpGkXgLoYXXEbpKvlfex34Lst7hHQ2a+xBMvfCW9m0tGeY7vkZwX+VyyGen5r05+g1xriUZ5pzHVPZx9XjAk7+zYaVrxob5AAs+pQM07MXyv2RpsBHV6BmHb1bByYYHSmLvXf37ueBFxwZnFFpFHDilvfzrjhrMSIFFdjeorqbIhW+pCAlE6ckFyt9ii3MDnLggPA4ENmfTU1peVJdJPcMK4PI68L00ubgUOGTUizqTt7imDaa2a8VQHpUgUDSZZzLZBaSwoclVZQ2bH92HBHLzxfQw0NcPhaMY5dQSGW4bcHde9HPfXJa9acD9ob91mPqxtTdFGVlOrBgs7UjanlHF7XCO9ERakupiDgAgyLFP\/snmBPeRvOgbdzUmVn1wHEXdZx6cRD073tDyjhqOelCCX2\/tVNPxKrwHe\/Yt0t7ht\/SaHtY7\/3bymGEqrgXYxT\/k5tU+0aowlmT0NL1idX3Ls10auBNx2TGcO34ATkjZAw7i08YrYhgySjtOQSJwG5mCGV7YYquH8LxD8cZ29gHZ2PHFH21kfwj+xjkXDDADozj+ie7ETOVDOdzk+qjicaRsJhcYr6+mEOWyHeq8kPyXdk29C426YJnjsdp7VIn27Kugtq1CdA+lfrauAR+5QDi4G5vLpXFEJsH2DQjXXWn1WJR5EdTjT8ibnVPkHwC5gMzqNz2qll593m4EWOFdEJDzlLxKBUU4HqZx\/YuAGUA4uZ9wCQpybCDn9XVa4SZjmgtk8nZ4PrigwxaK9aB6AKbBqTdrUHNinM8Texesz+ULV1Jx\/R2QbvAe9PUQNb815Fri6cbN0SWogDq9BtAY7kgWNPz6KQmZrGiTRfC56+Wt\/b8aaxM\/d5qkaX2YbyCw3uWQtIMGgvLfyctDwPosWm5rZQUCy3yYmZW8ll\/2vkifF\/BxygS5dFIyiD90z495\/vSpyou0YvF0LblX8UAFCvZzcPohUWQryG4RGrcaNmwWiAwgqFao+qjW8bE5\/PT75ZYVyAcftDfGEq0Xox5JFfLLX26FApSr2AvK7bWR96N+k\/aLCPaq16ijYJmy98cc48cBjNBLNObfEpwYSjyyA2b2EMY3jANyWk9CarPVulAPV\/5uUAihAWcosn+izyxaKLG6DYWcJuROhZ4wVT23SlVoyumQc1ONX2NbYE+24IweLSRfK\/FoaU7YdntGiAlVoV0j6SvA+eH1eTQqrZzYcCbJibsnemVvguXl+K\/YlnW\/oHzh4D9DJ1HAHAn14ZaWxRN6p85qBHXwZOyGXaXNSppFrNQQN4nBOgewqB1N0Lbiwd7gF3rwz72pu5TOmbSOBjrMZD\/RPeZDYAaJVsDdSO05HRFC9P8fyx7Qc4xAUizMW5Ir0NHCw4vABjst+vbZ5hnOzHuNBdRHqgf8LDKng8ZpalbSA8e\/miNmYe9kBFpP5RkGaY+9Yg+YOYivdYp5x2XsvIrPM5jRcPOPzXfb8qtkWKsS1f+u5ojWlop3LLi6uw\/9mQj9fmyJ03c2gUEhw214PDegIERv\/RJ8ahVFwQUIZHtUCAbDv3r5rGC5zaN2Lxolx5M381txmxcq02iOaWs\/dafaVU8dBChBxuZmwPJ3m+\/fKiNn3zoDkekWi\/nSnkuUK\/4DkS80cyKljm\/as8KtpPCkNdmHFn43Z2\/SXUIuzHPWhSrQOKe7y4t0OTcmchk8ZL3CHyP3tqjOjP+B4qvn96mKAzSOlcNB6YvyJ3TbFxWdysEl9U1Y4CCDy2RODoXrgq8uZUQgn9E+knE4sXUA4DjckdefCCmlHTuakH3S6bptUmg5+NGVD09H+W79Vd4w\/5SC0WFKyhYmpDpkyk7m\/icW5L1GbzOsdxCQoiQ83CG+9Yy2V+T0Mg0\/hghhNBvrL27is85BqdqdYqmAo67kTfTFQ+mBK17PPY17hxivuQt67VfGdbmfmQOTb0dXZaOKrh9AldxTOatwiUU\/K71PJ8Qu\/4zCyyMHWX8no+NosuLfnERVYMW\/sY0gnlJF3hk0PNdXEdhfaJKMKNrBLTjeDUxvcqh61DKCf74cprKdSoLoX694FxQSIfq\/QLBZlPMKi4e6Mm5XmTEwJ9P0Xi37c5zpYwYxVgB7ZBnQG95GDzSzvBEKUev2OAePUAsE36Ba82J1ZeWlnDqfHXimEm8KS+blAMUPkW57oT1AO3AU8\/FFKLumEW3GkCWsQyOdVNElqKNqvzw8WvaMBAxjTN5SnePwuMGRlf3HyxDDSdSl0b4yk9bSsVTP9k\/8Wb4KNVHk37ABLIWPBtB4bnLprR2uzLBVS8h74ZpVQiYNed8Q1r0NiU+bgt1\/xlwiDwwmHW6AuQgX\/6QAZ6JsfCRm8OW8I5rarNf5E+SWYeA7Srg15B+ofz7eS9zqVp\/PBJNQyHAbOFzV22elkr7cPSszWHSzAcVZz03wt5pAO8gi21L+IkTzVM79sC1fcHaf+L5tKVOmmW4zX6Jp9wWUvbLqJBoydGmTeI6WVO\/30Ygc7mhgpm7MRiVZfsKGP75qJi8+X+\/sJSrsCXIbGBEDqsNvK1lyl\/tnh9PuIN\/tUgGpJ2\/6B67QegXbNqDqiU8KCFoKStxUInVX1JidMTtDoGsO5WtLBL3hHF2I48sR\/lD+h2BPsWhss2949o2UmfdczIsS50T1eYpXdbdl8vlz4\/+\/nCtEHGDwaH3WTlfsHXmEgCcrxwI+7f1w6znv5G3X5ZA5rw6JefxICsp8iBxVT2amkNUEX+fEHgMb9koq9Lr\/8cYt26pht8r31gBrjhiDwMzXg3axNjRt2urcOOAgDiUlPi5T24H+NfZjczMpSedTe7sl01865SKXlJ314mTSNvx7HJ2dCxES\/src\/lrNbVvJn77uNjj0DQZUIfLzRSr8b2B+GYuVE6xM4E4A0J6vQIQCeicIX8OM8h+LUeRXfMvCOjZUZH2DuzCOPxLJlBMrt9Hy4cPlXUtnWX0Dsauc2JJnDei0Or0OWQeL0e+y1SVkzWksPMeSlF+xO+gnP7cltXaBWiu7JLx9\/BbaAWLGcxvuau6mGbeF3UmkOrLsCNx57UXG\/YAIKAGm2quCyuaOZftVaFesP131Yt68plIwpudpoJ67tCnoXlgFAf6JWUwUimhYcgvxfZqJfKR6Jaqdz1W1eHOHLP87f8VFqGEIVLxpREWYUNzHm0w+mEIN5BcZKaqXysQ14GTuXY\/kClIcFyduSlXXTEiZZg8SgtNcqw4WCfEERfWBCRCCeXYL3h3oDndKddsS3nx+rXTaH6KtOe2dqiZdF+nTsf4Zb\/IpKbqZnyLLJ7hjxHrCjqgPjYdJPuFMgUMs9D2uf5374DQY70sXbr3bJEAX8FTMWUF92wY\/36yz\/jg6Z5UzItU+Dfidk9QB1J41WxF0vv5wBn1b5K8XL6k6zj\/0Cg3Agrk6j96timSImK91\/y+9O0yA4yh\/xeKyZWJR5za\/MCq7FwoBRMnftsRr2vFhP\/\/cEv94nKNRzvWJFKKBYHaCB207cvo6l3RL3yHEYDAYl4N\/u\/V5xRpvGsbMWvAdjfwJ5Z9Mw+qLMISZ9\/ckue3MX\/KaRV+9BL74kjkIL5l5CQhwFFajcgs\/W\/IxCDf8dp3qSF37Rm4nfzipTl3w05HriRV1KG5w+vdFNxbYvnNhaX8Zd2BNVfCx5ZWQogogx2q9Dl3dNWIS4Nb6hD2RCma5QvtwqB4RNP9t8mTJqjce5l+RxsZtSNFmHt5xtEL1Z9HwGJx7j6WQoyMc08ZutFwJ6gxeJ8V5ouRnNigVekQi4gbUaiH8m196o12D5chcAwRyiaATwg4R5uhtGlCQPz27XHoeL60OopcrMXxSX7LbsAo3tYkj93TE9VSMCMMDBmqxvtmE8kTjC9sSxXtqjd6u0bBmR\/+8uwiBSOQkkG\/+sU7Z1KN6eriBcneu4liGd8lCN+zNteoMW4RWMayWer9W8XWC8emNXzAY2qdgvoe2pIAZIoTT4ggNEiUep8c37KL28H\/l6MpVU5K66UFx3eQdSrNGchEXDjn49cACD4IK0t41pOZufp1ZEE8OFXrPmr0cgVstpy70m75drFa5QfD9xZQOAS5qYpgxRSqDjutjJGLtrHzVBjJVa0XXlX7x1gt8LPbh09KbUEM\/FEGfUTPyMy33UdQdfkJWNz00rmk7Vw9QwjuKdPJajD6IW4c1rVfnTEY4zU7tN4tbA8t+mk4B73Qfp9agyWtxiJQ4tCjJKhb9vuiFCFLcrk9CIp\/1FGfgLBpCCQRFPVTFfzQwTR\/VsMz0qzTMKjbv9YhRq0PAqGf0nPDNYDKprRLw3WwphSPIXVbck9HZlpCBI8XBnT4db89zGCQ4FbASNyWRGZTxdRn4IfPX1j+tFZapTRURwDaymSp1NQdljrFmTMnHM61IPFAy8ZS0j2ANCDYD\/vRipJfBovfjbYa0ccF6Fm5BZaAuDvjvXbIsHpfG9gZCOLI6Td1QvksEjC5mqB4jVkv\/+cS\/gHrS78+CNh\/K3vCgEewKo2sUARkmpak0tVSfqi2ss+Vwxk0U9dOIuKVdcj39tDvVtGkI+YSoXCGL3H104kCHBp\/fTAmqeyPMOP6oBl119qX\/FbtpiiDKRRn1hMLmKI8GOVu24Lv01MUTM3gpwREyZEzEB6DGIhB0e\/kvmAkVa3YH5hG17xoZleJ\/h4KmO44zeUPWscOjtVUnpzrAdxWXdoUs4RP6lZGILDeaVfQMN+Q7aCPE07fSdDttoa9nYSyTjZbj5stZtywj8zST8Z+JZND+eLVD7mrzL3odX12hvzxsvhRoubdnxiInLHkdF+guEIjIwsxpHTv63Sax2plZpQ6gzf6M7BmbKpfBePot1A0Bv+WzrXylr9O+GMQPdP4M2KI0ygKlZ+n01OuBxiDCWHnW1JadMM8JHVKdYJRGWt8a+l+ylYxwBhwEVKjqmfSzYLQFSzB5f9V8YWel16q3SC7YuFyJHF7vTPd8UK4euCHYKKHXRVhOmsca14JAO2gsSAj27YXoyrxH60azjzUOgG21syb2ns9nEgTg5jfYFENRqORKzRxfzVHtrwJotsYmcXniE6m+t\/xl8zzzlp5tEACwuKlxm\/WrAHW2ieR1rZc8Zg6BbzM9TmtDyF\/AUmQNA4ud+Pv3dzFATD72gfdNFaOFua\/uUm8\/TCkbOfu1iPi5BQsX+\/DPIdHcrqdMkUfPffkaYSLc\/WVdlVsiH1yj9W0PzJ9Y9fPoPhNicoEKLgsPPEUxGXPLKlh7rq6wWZHNodDzq1oNF\/tNsKEFOzQ8IYQ+Bcms+rR3KVDkH4IgCivLfwgZwJHA5EdC+hy7TTylnZZwWgrrgEew4lHDK8knJ5ZOU8uD1kQQrF4nc1LoRxolMoFgWI5mxU19Y4xXM4cnprs1jb+SrOuXzMOUGkotbWPORHcdELCS7ye\/kgpdIqfFDXv7IhiJTFHLFEJsd1U0OaYd+wuQ0wP9zE6d8hKGn9XuhhdXKxPdNDb\/zZF0fUxwvG0XsVVPiHaI5Kg0QihVZScZgIaOyXP\/2IJxRS56kDDokFuLEEuXo8Ao2bRUm7jhtrSmZsCw15Rl+qs6HdERVGiIRB2hYlsVoZulI\/0x\/8TF0AVn89cOTwEXtJ9ylyefMYhuOU+z1tiBDzZ6VLzspOX1ApFQgh4bQdVHKaaS\/tdnOfhIwwCAMOpPso0r3Cbkv4G4N9ASnm1wa\/2B6yzup9jDOFj7w\/DTeREN+lF8z52l\/NwtlZKxC8bOFIi7J1h+Rll2\/QLbkhhfw+5HPCN3ZrK3sEwD\/Et6Y565gaWXMXbceCQj5dHyFKTXlgh0MbgpeV8STyS4LXWbACareAcVGqxMbyQw1SM3x+HkC41\/vYJV7zGOhHVJHYnQj4REIMnHEBEgWaBesuv7GCuOH6KJuoCiBbTcj7\/fd84v1290AHTnuTJjNA5PpanhYo+1HziUtiaDQ97twoTJFJwtZj6mEItfgFZT5LcLzwy0WIzvy6Ttf\/UwK7Fini2\/UQv\/m6VeOs9t2+yGpP5Lr6mmL0\/facff8Q7jo556P5l09s0eeV8lsBqsGY0h0ehbWwVd9M6eEe+JlvIlP8ooTLA03QNouHEnq\/14FnPCBHD2RW8GUeRTRS5gKL+XGjLI3eQ34DucY79ZoWQlqZTt9jzfpk2knOM1R9L+0Q97fsc20JgIvyxuOtcEZWUV7mFkaYjDrFsn50N98Q713dncdqOTFE6o6xpG9dypHQT0G09hUkrqISUzY1MkYb37kkBLmQkzPbaB5QrKQGTHJYPdubNXxFWmjk0ZlRfXTvvutgotd35+QzGBQu2CeoKKG7xA1zqaOAhXxNmq7GS\/TElO8nze\/Duhx0UYEkTQEP\/xckBH00zw2pWTYdy2NU\/1zu2uJRzrnp3feHbwxbbJemU410QDB5UGwb43ek1cH47ZxYotRqLwwytEo63p1lk3LSh7t2cD66luS92hM\/QQHQFJ97\/Nz4C2\/fNzT3u7h91LwMvazDAPPmeqz556URIKDVsy2cTo3pJblM\/++H1fEwezvpiY2Ky0Qd7alDJNah0YcmqORF77pGDsFHzf0NH6q1VeytELhpvRecXAnp51W1z7KthCZhYWeMpOaaaP5DyxhCMgPwIyy6NDv8ijPIC6uiZyKEmGKoH8Uu4CakC2PiMSnbu8tyecSafKGOCibBrMnt1kYl352kRK5mLzXd1DS8No1QUG+gaBz4GuRIcImSu9ko0+CU3IqSjfpbW7WKWBprVgERmw060T772e0aq+nia6cA1Sl4lwUoVUN3RLb2H50c8ZBH3P+ojHz9ZoOJZVoI9\/phhK0ESZr9VekgD52t+pqrPK\/z0l9reyWQTRhrdy5KEwK98FzsLBVQjcPGiB65h5Qqj+OhmEPvhNicUdwR4p\/b2AxsVrAdcYwnn3CmUnI3f78WrpQ+Pp8CmNUDWHcIYtduDDw7DTDRr\/rm7K\/lnxnml6szTUWLOEys0Rt\/JEkC\/84gV2tiaA1WvEqXa\/x+poktanJSBHFA\/i04i2KbRpRZdBvbS1xjKPY9j39c9Llb9ueXYsnIH3YBSZXgzLNOcAohyZn\/a95brluJggrpM4Fa6svggveNwv0LiGkV8fxh3QzxCnZRcYybRwChb1tlaAezpi+Ka+1Gq+2JMmP6ZYDGiT0c8FPX0DVtqey0sDNJTLHKXrpGOJ2BIiw4LSJ2NUxsvxO5KeHkwksjDyN5+aSX6C4Kr\/pOvhF86kCrFT1rLJpmwvXFZw\/rugT4iYaV4zzHORruC1e+H\/WyFL8rDCqbc4nLMjvRByph4C8thkngd7vIzcPA8dD8BPggpmfoZ1H3scDy+N2xK6huvCNFCebEtP6eI6rGk7Sst0jD4VSx31NTNmls3MOHd2H\/D749GpGm\/4+JMgIylTOLeOHRA\/FFl6SxRPhjSd+gbK9jmb2bmNMhE2\/apTmfW5P+njwxN6Xff0KHxX\/sUQunyqYMUJsEREl0lBZ5yjuSpodSqu1aniA9UVDXbxiJj5p6HC2RKs9nb2WdiowJUvSSTj\/\/GPKdTSxrrR3\/tojX1nTgIZ2Y7XYw5uhmAlUrmgrYH95ixXaHkWeZPWWhafmQTYlOcm1z9MaxOteRSeaal8tmJnzyy+HLr\/nStSOdwqvYAm4h9SfHNQsXq41dcAZR+l4EnCTTmZanFUhSWJuXwHgvp9gUmp\/gOsY2ZY\/r0g6IenIMQK5y5DVBxLj0vD969ttUMtPOcRsyB1tSuFcqPRvrSrv8BMNgZHg2bNiEsXiaAUfpKk5o1OZfrOviqafY34qyJhDbKxK3vxhM37E+eAPth8jynlQL7GLzLT8bOy+fJbAxrdYkHfZutnHmK+ennrL8fwdRTgLpauOEE3Wkgi4XaNzOH54yfuNbv9Dr1x+o7Y8KlwsucMwTsG73eZZLYWf8P4QkudSfrYD86wZHpMNkvAUCOvpyKqD4vGQMVJo6M1nfwOmHY56gt3ggnoQmByxUyW5WPwQ+J5fmUMwB9wGXR8i3q\/fUn\/OI7PQvpzoGZ3AS0RUNgKF0Pyaa+dcwDP8BN+Jvi9KGsal1S3OumsJugYgNtClPku+\/sIe0L3fkTBd1iXneFBPzHjUt7gz7bGaLI5RxG\/AVSDzX65FmjjKW3pRfAv2Nniz2LXr3d5zUG4UEr9jcjlWodSzcz0ghPmBSRKnWyFBBtNhSNw23+tSOw5gnZ2x4FDvDt0GkKFAEqTo2g7tXHbzvfMZNOJBAU5LrS5jXPcyUX6pJHovo2ynXLaECr6v1HHw5u20ry68XAVAPa18NC7LLRYNK1AiTx8cbRild1BtHKfi5L4dU8UrgTKYanLJOsFHakVnsKmGZPeRzBBG\/HFsohi5tfLcSZuLYGcK2FAgT4+lgusZVZ6ne+CX0aVEy3Qj0oaZy66XL1JJOgMJz60gfQpIaCMK\/QQfgKZuODb\/y\/e3jDVFtzYUtSgQfh9j8mHlf+qnhvmmjgKeQ\/uTuo09LWT\/FwwkrEAULyDmoOih8KONwcBkOo0RxwU3ne99ZLYTKggx7InD5eHHcXwa3rs\/NDLtZ1W9b+mCmBSV9RbG4AHY3clCNOLDEbu8nexqNgtKj+zppf6B7Z0oX06AqF4k8Rq8Rf7+Mh0fw6I37zhgOF0N2ASpjCKmkVtHcB8UgJGmFIV5Xo7BSccmxp53BETKSE8JqUxqZwDDAcihOzRMUOz43WvjxoQtrC7HQK64ywKrdTlrMCOXoxaR8lRHwiId\/No9ylopB\/wuA6teBVExHNWwVEjSLZGzccSiGYTO2UkYjgh0MB\/KOSCvIxE6mqPIEf5n6PPK3FOG7wHPAQgrXZ2B5HohGaxzX3eQHMXgVroTEEs8g6zJW4eLZ7MPFEFEg+UE49q7wIoF9uPKNycbqJ197COD8LOmeqkqYUx48ImnJ7zBGt9657q2yO\/y1MvoE4dCX+15yHzewS0LCbWAw2bkBWwPEgw9rRZZx4VWDCBpIBxts54nobF\/tOBVnUQUqeQVS+nUPKHaABmZJvdi5JboMvoo8ztKW1Ows9wox1e8bq9X4mKi\/gGB4tK9Y5dd+BGInGEd5ruDCAYrTDdSAytIG4VIuAumbBNo89EfElsPZf3j5bx3LFBzH05Nblrg\/G4NKgHbWaoT6OL0JK124OtEP2os5SvC3uy3C8z1EcrsStPDojMgmE1GZEmIkf8\/u\/rcoISrNlsy9njaOEUjcQNYl5mD3B3CNoNetGGu2lL7N6CuquoLDVYi9EJ70stC2xkOfH2u5uBBdh9wVOifN5uU3ydZWHJNuYkbpKjF13pll68RmgReC5EOfniVrhkdvBq8ade8f6JykWA2gRqNZhgCExRgc1tWgJaxGg+pCBqC1gqHEwVRg+gxa4lnJnHJqD0mLW9kqiDfNYb3KGD9sk9iNtTxHvMQifJEpYZVhyAR9BcmexW1akj37DiLGQtCb2qySjuvYwTbhB90fMeN160wtCzsSEgpPcMsbd1Y3eoEMK2hML3LOsgfkM4zxfwj\/t0SsCsWDZ7uliQYwvkG3HEjpBe\/wb0flkcySuSXBIOFPbm4R7bwW32q18ewOXjw0iT\/giY4KvBR\/U9VGS2V4PMu3VxSse7b01M0lMa2fpJ4cE5FK3jQHfCreHKWIk9xOPVqRV92C09P3dBKZvHNe4hTMjFRi\/R3rQIbYhLLrWwnU2FqPczlKR1s8C4Gy2fGy1hszumaHHn\/us9DPYxK+ddPc06udMxbVSLgp\/C57uOd\/UCaRJR8tyfQQAQaNwInXSTP26W9rGTChd4TL\/A9LNfIjS08CsiWD4HG5Rnj1YGOGxZEzy1ys2vEhiHkoB3otimkGztaAK+RLJ+SGA\/gEzZxVaW96enMZaDwxCdNbre7q","iv":"7acba8bc3bc752664e38a6d6d715ef86","s":"dc41c8d4695de3e1"}

Promotional image for Burberry's Snapchat Show

Promotional image for Burberry's Snapchat Show