By Eric Stein

The mobile advertising market is booming. The IAB Internet advertising revenue report shows that mobile ad revenues have been growing at 100 percent CAGR [compound annual growth rate] since 2010. By some accounts, the mobile sector will account for almost all the growth in the worldwide advertising market in the coming years.

Of course, what is fueling this growth is consumers’ rapid shift in their media consumption habits to mobile, driving marketers to follow.

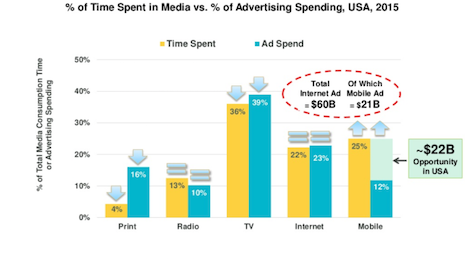

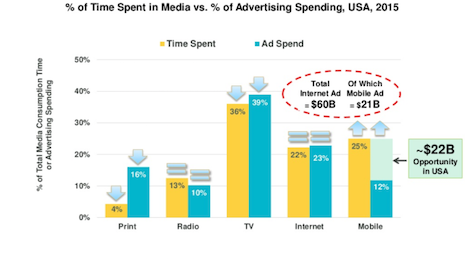

As she has done since the early days of Internet advertising, Kleiner Perkins Caufield & Byers partner Mary Meeker looks at the disparity between consumers’ media consumption time and marketers’ media buying share.

In the 2016 report (slide 45), desktop/Internet advertising, like most other channels (television, radio), has notably reached equilibrium (print has a long way still to fall). The biggest disparity now exists in the mobile channel, creating a $22 billion opportunity for the United States market.

Yet, if the mobile ad market is going to reach its full potential and fill that gap, it will have to address a unique set of challenges and obstacles first.

Compared to desktop advertising, which not too long ago had a similar gap in unfulfilled market opportunity, mobile advertising needs to address a multiplicity of standards that the Internet does not have.

Advertisers increasingly want to see a justified return from their ad dollars before further investment. That return is a combined effect of the ad dollar spend, the number of transactions driven by that spend, and advertisers’ ability to measure it – captured through return on ad spend (ROAS).

Depress the number of conversions or lose some of them in faulty attribution, and the appetite to spend will largely be diminished.

Unfortunately, today’s ad industry is doing just that by not adequately addressing the following issues.

1. Suboptimal ad experience for mobile users

In the digital era, many businesses tend to find their best customers to be their mobile application users, rather than mobile Web visitors.

For the ecommerce industry specifically, studies have shown that apps outperform mobile web by 3x conversion and 2x retention.

Ad campaigns to these customers, however, most likely drive them to visit the mobile Web, which takes longer to load, crashes frequently, and is generally a sub-optimal experience when compared with the app.

A bad user experience resulting from a click on an ad will not only hurt conversion, but also reduce that user’s likelihood to respond to an ad from the brand in the future.

2. Outdated advertising technology

The technology stack that advertisers use for their mobile ad campaigns were built for the desktop world, but not well suited to today’s mobile environment.*

Take linking for example. Some demand-side platforms (DSP) wrap destination URL links with click-tracking tags that break those links on mobile.

To be more specific, none of them allow for a click on the link to open an app directly from an ad click across all operating system platforms. This should be standard practice given the higher conversion performance in the app.

As Criteo noted in its first-half 2016 mobile commerce report: In-app conversion rates are three times higher than that of the mobile browser, and AOV in app was $127 compared with $91 in mobile browser.

These metrics all speak to the need for a smooth click-to-app experience, leading to better campaign results and higher return on spend in mobile.

* I recently spoke with a large agency trading desk that conducted an RFP for a mobile DSP that included 26 independent companies. Rather than going with their incumbent, they chose a purely mobile DSP because of the requirements they had for mobile could not be met by the “traditional” players.

3. Ineffective mobile ad measurement across platforms

As ad dollars have flowed into mobile, they have come from a growing breadth of advertisers with different measurement needs.

These advertisers are increasingly challenged to attribute downstream ROI activities back to the source campaign on mobile, especially when that activity happens on a different platform than the original campaign platform.

Got a click on a mobile Web ad that resulted in a purchase two days later in the app? You are lost to the advertiser, or, at least, the campaign. Same issue in the reverse scenario.

Without the ability to accurately attribute downstream activity to a campaign across platforms, the results of that campaign will be artificially depressed and advertisers will be less likely to increase spend going forward.

4. Need of more mobile-friendly ad types

The way people interact with their mobile devices is dramatically different from how they interact with Web sites on desktop. This different behavior calls for new ad types that can provide a better mobile user experience.

The industry is still in its infancy when it comes to being mobile-first for ad serving.

Companies such as Facebook have been experimenting with new ad formats including Dynamic Product Ads and Canvas ads that better fit the user behavior and are already seeing positive results.

Marrying these new creative formats with better post-click user experience and measurement will help ensure advertisers maximize results.

Grow the market together

In a world where all the above challenges are being addressed, the total market value will grow as a direct result.

Not all advertising is conversion focused and advertisers do not have unlimited budgets. But if we look at the entire market as if this were true then the market would grow in relation to marketers’ ability to drive returns.

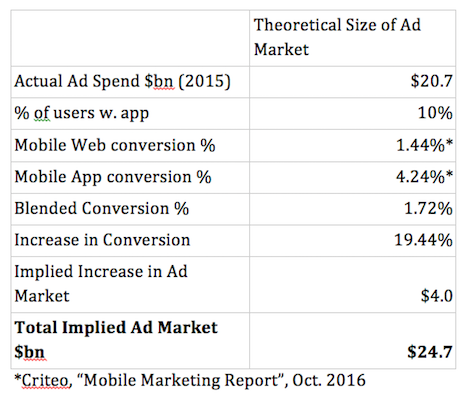

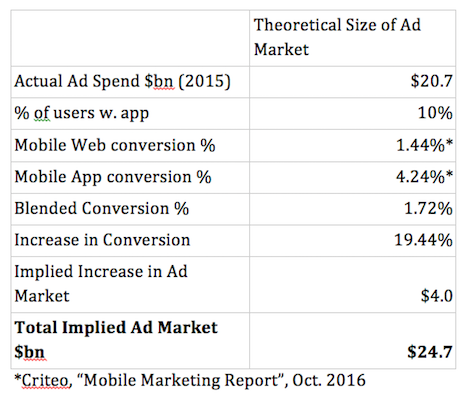

Let us assume there is a 10 percent app adoption rate across the board. Given the positive impact this would have on conversion rates based on the Criteo study discussed above, this would increase conversion rates for the market overall to 19.4 percent (see breakdown below).

Applying this to the $20.7 billion mobile ad market, then the mobile ad market would have been 19.4 percent bigger in 2015, or $24.7 billion* -- and I did not even take into account the increase in average order value reported by Criteo.

Now, of course, this would only apply to a portion of the market, but the point is clear: the market will grow as a function of its ability to produce more effective mobile results for advertisers.

Here is how I arrived at that conclusion:

Criteo mobile marketing report, October 2016

Criteo mobile marketing report, October 2016

There is no doubt that consumers will continue to migrate to mobile. A growing percentage of them will prefer to engage with mobile apps on their smartphones and marketers will continue to demand solutions that can solve these issues in order to better engage and convert them.

One simple thing for marketers to do is to conduct an audit of their own mobile ad campaigns across channels and ad types.

A couple key issues to look into are: do they link to the app when it is installed? If it is not installed what is the strategy to get your best customers to adopt your app?

These questions are critical for ad campaign marketers, but also worth contemplating for the rest of the industry.

It is a $22 billion opportunity in mobile advertising that will attract lots of innovative, mobile-native solutions to help the industry get there.

JUST LIKE Brian O'Kelley raised concerns about the dominance of Facebook and Google and posited in his recent post: We are on the brink of an “ad tech renaissance” that will help bring the fruits of a rising tide to more players.

While Facebook and Google are able to take much of the complexity out of the advertising ecosystem within their own walled gardens, these are challenges that the rest of the market can also work together to solve. Doing so will not only improve the state of ad tech for mobile, but will be critical to the mobile advertising market reaching its full potential.

Eric Stein is chief revenue officer of Branch

Eric Stein is chief revenue officer of Branch

Eric Stein is chief revenue officer of Branch, Palo Alto, CA. Reach him at [email protected].

{"ct":"JMaM58Iymw3U9VanQeV14Ju0JBHDUQM9NfECV0Fyp7AZZYJrd5Y2MV2i8S+UrkFOASLGrt+ZgtNAMa+BEfXNDV2efrN7KVgCQfVXOxNlD5iBRbP98H5sPFp3KvxEn9SJkr4RIixydl0n4evdjvR5UnzgvpkDnyxvZeU+ZG+UPZ+74yZa1SOHnS\/4gwacSaxAUVGqEx7lsQMSYkH1uOxpaxb+RBjo8o1a67o7EREZT7oPvv6ILNBIjdN+JDguya6xULOwmrNxYMjwKBtZY7cJpWjg3O7dgRx\/SRmgtO9ugE9nXiDDpSe8\/gmbBsNYO4FRWh9kpRGEKTovxFJ+U5kyBo9+BLkEcqSoUDqoOWbtou5Q1qWZmR+4B2N32vYe1nI7qTYUrdG3HwAeuioJCVCxjCAixoFEid9eouH\/YM1D3RoX\/TBBzXu8Hmu2HLdTHPAX5G0usplWIQwMU6LjnLOvKoV6oLMZQBfyd0JCg+hrHVWhVxAhOK1rW2xEkMLCfJ3TfFd11a4jytzzAHhd5xDml15Kxgj2A51q+gB3LJo4u0bwoF5KE\/BffTeh\/uJlZ1cs6t9yL5YtOr525DC+\/TvA5j3ohkSRa4kY1XNknCX4CHcRKES20SmrP1kKxb+ZuJe9Iw\/1cIC6oXOV2I8JBmUMWdBtyiUJfMZHoikosDnf6etXd9vc1XGu66QPVgGLmKup7uDNv1ZbzbaYZRuS2E4zn3XPm81EhfkZK\/46Bh20O7zyxatHWoGyoUDWuNATvg7NCkjpHCFFu10oXg\/xf6vUzFX\/iGm75H4pLXFpTCR1qGsNw41hPLUkUJYhaig1+5p6b+DW3T3JVqtX5yh1Q7uDRzgKJbElmMT38DuHbdggWiX2cSdXJXuhv\/+tJETtWTLoIPfLfwjp9k\/TZRtpEgwuEa4omVW87xrNcCMmD5zzz06UQdSG5RtTDFCJwENI95dNamrrGfVN31En0ndFTSBbdYFkSppL9ySuJSq7vvWX8nasd4BhTI+U7adD7LgRR8bRQEYfhMgfB\/dRP4gLmhyncF\/CRrZtdRPdX5PR0Vcd5Dckvt5RmvaVjmh3VNBM0FtjVDpHpbfUCylvNX8BrXydYETYPjQwJujNDXDl0+jHvJfrblX7nFXIp66L8Q6bA\/lB4MuhXad\/8gcJ3TicJSS64gYoiTuemCjnsvVZ3hnmP6qthyzsiJX7Nj535jugTSAK5eW\/Mm6gquomsOST\/\/5ldZW2xbBDNHqQLSgvPr6hM18kW\/NR7ocmSU+87NONjXWlctbNxC9DSm+88yujj90IhPvC6GvVds2NJ+pmfs5WeCI7hq16jcFeyxJqt8lyNNJjLcc0f2AKm1ZP6Qsd4W\/MdIo+85G2Ltq+pyC+yXnGcNgvloHFisj5mEO3tCNyerPVJCTdgdBtJcigwaW7GIwjGqjrOOBx6\/1lBCbCX3rvU05l1tgfNLttA8lOdjAMssOCVL3hd+jiy\/8vDtBgExLQWh9bEW2\/RFKf\/rcdwe\/JhX2sN5nDmTcIxPftiVpAIqeKE9lxQ191gzLf2m1yXf+66Za6E\/AA6gFXkOM2ULuKGP1vxIIximmYBKDZvpC7c5j2OJh87Xh4zFh9eb85z9OVrSXZ1e\/KWlEXtyubx7AujGN27B5AAb2BfVaXa+AAbPvZc1uFljXuWUujLdWoCxtRK644r2+pUri2c+6ztJk9jwEwFyLAUkCQ80PgsPmidYEpZSmNdaiiSsGNKjJQGiC3PDPFUpWS1inpcfxusNLWGBmsIy7nf4LxCq\/JruQ5Ri2qwToz+5TOD2aq64DaZMhcNA7c\/vz7KI0F6OYDLMCzQPENAFgrCa2Qa6cBLxNN70zEHRReUpzZidIucjj8Pci3v+b6hKSrG3OtwqHBdcd6SOY5wwyppvE7Uy14SDjODpLUSPV7z4iwIbucFQ92q57ZT8oju0n1tgMqlSwdvLb+UwEmVj+kGPx9BN7J1DCDoqSCWaEi9xZ14pPZurJwOaRQXFV020jLZ0gbkVlLkS\/jTcgcAXCvMLCIobQxzQMYw6DHc8ibtm5SEusjpzUs2Kv+02h0SEx7DR1yLbqIKN0ygC8o4uqoxxD9mSr8ZcajKheWpf8JlFGzJCRVULCOQjL7dy451bguQRqxYF8iNlYgEagyN9Nne2PZhclas2jt\/lvNauJIFkzxioYRX5oxSuOU9MkOMH356ba9wqkbGRtX9YlFD3TUdth8HeHDB31PZbju3\/QFTA8C5LCX7rXceVzMJ3tShjKLloNtNiz+rqKD+CVOzgiFuiYHm7ADgv67Fr+KE4pqUfLn6A0lQE9r4ldW9iXk2vVbSQ1fG6\/sa+kuBkuxT2TRgmboGcejDBFWmwCf0Sf7Z1IajfntVU\/OVHbPfSktbC\/eu9iPW9oVmDn6WTfm4tpv3+EFysRdZc9kxZ483RaiRgAVGvu+pDkEHQsPwv0G64VqkLDiJPVSh0bvusS44cvvYLBFoSPPKffvJq+IEkQgq95+yzmwOj0SXwWmZizZTZIvYA+2Y9ltzBZtlsXQGlMALFc43PU8RG\/9tBKSG8ki2V\/1vh8radk8XUTdKZ9pyPCbMw+bF9Nvp3dn\/r1RhM\/xbaS6G4u8P+YDkVXBDcVIY8WcZvpUNdgrR+xCXOWddAvgVNJ1t7iQxngmXw+d8GtgAfHmRiYETWU4zsA5sJqBfbZv5BWju4x\/4Bxl3BEJewrxsv9lWAP3kkOBaSF0orFz6U43QJAJmdyW4JmzY01M3tuIlDldXk2yttTmfzXRfGn9qPr48E4Q3LApi0E6V9C0OoGExLvzMKFXNUgT23IXTL3T6OpsGk\/xjsUjUHPZda00QtZ\/TB5yHmk9K+1XIp4ycQws8QxT644yMOIS066dNmoqazavZdxBiPbV5ZO2TpZaumbjLnX2g762OtabxGiwSXAUWju+DBI9dr2joGoCojjRySjE1Kh0VlruUsLpfjMoEDs1bXjG+JIV8s+VG4kqS3hzFuR954abAkoU+sGBSwcVrKYbwymSkO2g1eq8atSZG0muAlRtO5UMlIPS+PoSliYcA90c6kbF6NdQR4nuIoZQtPJLYaMHgbGkT4tp7uC+LmS7htIzatWwQicouI6vJWpky9sSRBYwQJua4+BFf7X1b1kLBKwB1sAXsDu3+T41ZlW+y7DCMOu1mya11OVM4WPnj7a40aMrSHcPROV50\/DlicOq9osVWMceVOPEsawl9+8Ca1Cm8mPrIH52v23mrE1e7A\/ij5jGMKoJrS7KSofC0q4Z9hA4EgDyRWtfDOHvyHtqJrHAw1vPwkM\/ynTpNqs\/YJsBidEFIP+dii9tOzWuC8lZ6jWgFfEEJkjWv53ADUPTOoaEpx\/lG5FkaQTupl77cholR7mKrxsTJsVdU9whhKiUUNokZlFqXcsqBUkdkR34thQR0awoB3Z7e6ux\/LsVS2Kco254Hky0uDzLyo6GHagJJl9n2mOL5XVwZPsVp8oP2Dcum\/Mi8+aUb\/AbVFT5yDFdtqVc8\/ZBhbYaICUqRsZNmGxqIMxCMj0tGg8Dqf1Y5S\/BSC3YhxJxwhFXF+rX4pxJ5v\/QJ+9ClpbwKoGGFArLrG1RL85Yyblj75Ik6JfFmArJ5B8tUAcAYODeY\/oP35ruWScmAH6NTdkSpXUP+vwuyHR16WU4UpGTYDMDy0MCBAZchyFeRuLX4+hbCdjFxH79gfbBBqUdHDqBH\/LDkvQJuPmFqM\/N18JoZSbT9ZiZRCcd\/SGiZEdUbXK5cGfS6Vz0kzogY8ume+O990W18rPLCHhdgp4+siOkRB3a33Xn8EJERJCQfo9Pw0fEabtqB5NxZtvRJRT9Vq\/TaZp\/paalH\/FzJdkSBIMLnzuSXp9hW4ER2lAAPkA6pIMVAhaLFvoZx0LDSs7mCUjXZz2jH8PICCv7cZbMRxNqk45609hzlNqfLUoVVyaYmUK7OgIgKH3rWAWzv5cDYmyko6ZviNxhWp7siz5nPgIissPr9Tvyxp1o6xpbrfAi4ArGT2g630UgYlAOwQu9xeiAFyOsuQM7KLojPc\/F8AMKInfDGWDdHtRgQNDxxIi5QkNIE4nvV07A0ulz79nnGymlSSW31fptJKxXHmXCfRYgneWNpgv+19I3f0KWhxpdFNzjOI\/+FvYNPWv5p7qQ2FrNxxkhfxhBrvf437SdajZ7Z3aK4s68hQgo9lAkiUwDmjJNpcqfFHID8UXFBQghz1iESYf457qoA5PMpHZwsd8JdZrZebsvOFllq7Z0Arr4lIUeYRhNbckPIl3bfr1ED9k9fp32c0P4iBNkb+mON1zpuglOhBS43H8MhCQdcaEw3E8VmgbpWXsq+authjbb7k06hCnkJ+egS7U6IjnIORA9Xe9x3N6meEW4glxKMzyfdmubTPUJXjxRFomCQeh6ZTfUKAEDOslio6cN6p2XlYC7wS3N7VcaQWVgehyG\/bpc8u+zETqhypbh409EhNLgAAkSJ59Q2S7N9AU8CMhZJT6r0GaiymKTQsTmLKiO3JMyUvND5yUZw62HPNBdsPV+EEp1PYIjvZSufcGUxliLliDCnYsuKNCeLVmLbVJ\/dfDdPzJdA2Svy6Hk5C7sMIujSqnkH3kbl9jE1+yhLCQXEgcsIq\/h74MXUNfeXfXedcdjFkYjG09N4bmhODnTrvecSvypdzxofVxu4R7VqzR5Q4T5VI9vkqvg0I0g6MuISq60iqRtneI+P0nzvurX57zG+0QWRSh35aB5klrsykilWANj6NNyPyD6sM12tyeXdLUqR+9IHMNszCItmpZO82OuC1ICyW7KgiE\/3GdLUIAeuLKPkPmy439N9EtXuWZQ7bxtndazVhr9Dc3pTvvX1tdh+NN7OBau\/cwA8uWE0KJpI4VGFALVilLSKNaZk0L0fATdt23O+eNGncGlgltclV+TkIpjasg+4fpzjPf3rF\/5t+52mQ5K\/m\/1Dn59i5pMUGKOAeufCdTZ\/ZY0Yloh28OHakOV3Z7SXfChh5fuQyNm8G+l8TQdv1tUYw44G9RVig+8FvSaBLZrhfE1JzaRe8fRDRQLLSwZxctc1IyzmSbPHKI9e1Za3kBpEal\/OyYWMRJwNN3E6nCphKPA73WsYW7mZY8XfZLnuVk5FG3Fdi5QAXgzpj+jkAWya6hW2J8IJn0DN7fNIaApg6i6G8QbvkSZuHrFTR3z0g21DUGuk59fU\/sE\/dmKGoIxgeLedfEIRsgOLNuoToq2dvI7iPGzo\/XquUEzIjzr1Bs5eCYBLgVr6IshocXQFqD4zMggPLey9xBfu3LOee6L4fGLsDMCbMMP\/v2tglw88VSzngV2JsgtYrxAbhqPsdYbG+gmG676n9Ld+TgStOAB2C4jlv0K0jkQhFW7qjdAaNj+Wf1ymib+C1\/rLUZr9gYNX3z37clqw2L4+oEgexe3nHWiVSQe7LBBXgb5JisQUhRk\/ILFuBtKo377Ju6plb2EugJSUb+QkyHfnmWT6E0aJZiW8kMLslnEnt3wKcLnj18aHaoHFfTwyHGrGU79X2Hqn6OJmTRxWNavSnEBw1cbgjgtmCUIEXAu2H3+oWimKUL6nZZZkSAizY8SgUMo7UcTChBTliKBLAU7FXvZTdedlvKo\/NRJpLjAft6\/kVFmC0k5LzYymgS6\/ZZZXOnX7x\/tNUg7lgH44YKhOmEIYTGsNVpGQSUEhJ9jgIx02G5JMzJR8jVd91EdLZJmJSolhH8wSDteF4UDPBBh9umsode29avDCHy8J6YPby1pm+nGTKRXl+\/3TrC6sLn63umJ28hmIykfgMIEVGvzCgZYS61pBuvLbQTzuhqB72H5ZTPWvkiwOQH9a5UQKThjwwe+fwXVo5QsQR4iWWF0IwPsej8Y9FHUCjoe4JCU3gdiVTqrOjO8gB2IK+1jwwM+mFcfQQXyXLfWv41NWRfp+tv7K6kw55YwSnQbDgxNEqYNlu8QDMVdydDV3xDpKf4eZjubDtzZWZ7\/vpo7U\/f2bF4oWH5U3adpyfY99DxbZimEDTqD\/OzYg2P6pnt1oZ\/HDnOO5YTfWRYZngBMFMxRwOb3qoxTW8vK8nXS9IEaNO6oPv4ortXA0dWLxwVya+5TwtF6yZFcijsKNN6xZT2b17S5d0fpmsaOLJHP1dbjf42BH9foAN9kTOKh\/FeawNwurB+QFHppaTzDeUmydY7nR+Xpqa4VLIVLTQ0z04vddZl3isCn+nBTJ+QbczECCwITF7Z89eOhTj+x4JcwaGCzvYbAauy06uF\/mcwgWFWCBrBQsOJeTNUfhVkID6Fn2kKCyaSRwrgwZRMkZmgaO7ULccgSeNF2gSVFauoihD3Wb7kBi2y9zLMaTbKjtjoM9\/1l3QBzODko7hhEyfMS+fStFNrV4AS11w5rZzpGkYoic6TkPyMn9omMbWe21env3CooeWg+553XB6X\/pbtA8XeM11juW2+dO5LXuTDqr7K186M0lawKLChfK16U+rva233cUNoanjBhxq0xi7OmheCtHtvLV0gZQOWhYmtIcSs1ViFHnA1ACGevy+qNKjv16HTF1pmP474mSsy7ezME6KI7P4xf2RENERkQlsaNm6aojvHpHaijpCNQWEl5B0pMIf5rK7q6GXFKcQMZg4mKsi0UB5zJnlLLZXIhAadhiKtw\/feRHnFCgcv8B\/Eocg+yGBvif4gStzu+cZzJB5hJfd3Nsy\/QGKt8CoO0Zi4I7lcJmoPJGWUNrLBexSMOaNziOXshKw+BLgeN3PdlSDqWx66jvNZQKI5xsBuv0DWQlFcN0S4Z1owWIb7yAlOqF3XlmGamt8ERMZUtQHVUBZIYUAGfAi6p\/HTI8npA+NBd5W+S7NllGEYeTBqUjikuauDLt10ZLNLrAvQ+rKfkMTgOC9Kl9y3D2BGengPkWztZH9RzJYUXwRT3IjQOJGSYGeOfRs8TuAAKhZu+ffUSI8LEwh\/GdAEENVxFXNbOtF2jkoh4sPJwOabsHXeJ+C4\/U+AOZ\/ECSSpGIWwwsQ5LzROH\/nvkpi7CtL8nj3YUJKWiyNyj+OAHhjcQ259m2X8k9SpIACwGCdNT2rGSAN2woQHcqYJYxAwA63XcIB59jDtujDNP\/t67fVccM5Ic0TeGZ7Uz0SjauYoo5q1pPgf11fyGui2LZ+rI26IkrVe+P3riZtLWVEx1TSm2+Tww6ld2b62ky6hmloVp80jIHjkC9AQ13LvulSW88oPKf+GilLFRR5buJ0XB8GQs8G\/4Gyl1SZUiZFyI6jN9VpOCQGXfsT+9Ech6nkmF09xd\/nx\/LrwLYRWepGjr8uFZ6\/kRNo96e1h\/lkNXK3TsXDlT9Jo87JO1ZYqoWMMFRpxpiY70R30kbl0JFVpzMHfBtgTCpXiaW3Z8n48ByatkWwEaENRfTveAIt8zAryqNRYgdC5l54YpdZIBhaNxyOF4qVnhgEVTL6bzp6qjJaQul\/Fp5fdUNBapV+4XX3IeIuZ1t7vVshYE+cgSuuvd+E60LTI3OjZ8cKow8H5AHo6oMQ3wkVNKjY2onA5a2uf7Hkt9FHoPgGXQI9\/PqioCS2DXWw6vlUAWnZ7QskTCTcVQ1O2rR+YNMwMNo9tAHDm1U92b0HsH4s8aOfGozTDkXjyLcYd60vNyWqH46K2AFhHTTtVbFsFeUP5pkTRN46+uBdVwriu1v9TVFUYAwPrQwyASOKa2+4gpL56P3ylf8Jd06zpdCz8TfmeUXjGfLX8AZSeH+WZyIiBMWKcpRsWSb2gp64zGyBDbneZfu4RXrkqfSy1t\/B698lsNSQjZHA4Mq7YSDcgfojpUeHSjtAeYwmPu+1E0xc\/7GO\/utJheO6n5RaLLIU\/jVNfp3OurcA8y2rd\/5vzIcHKbkaWc6106yTqrL17YubKTY3zw4e04YApPdrlkA76KAV6lYVNhN8bpEMPZXb\/yFX7qvTfsN0YxGOEyBV0NjtTK0JLFrg76l2HAO3vjmTQf40\/t8URc5UlJ8ol8WGD0RBjWUhfVfwaCO3vyT9MhgNCwQXp1C8rkUSQU0ztVcaEHo9W1fUlk8fRibrZfZIvgZ85XAlBaChx9E05sWkI3SVsMd+D86a1u9X9RF2nYc5LwCReZUCBMH29+VMJYINOSHxoKxfO1oqf4Ytnh\/yqsCHolxZLLQBfZ9xF68YtjBkng4EBg9V1SZhgFAduQ2OFqAZlEvh6QU56ax39piK8YlNZ8+KePqv0b88qCF+hw8bdJOR+hV1bzAmrFzzbRc6H7Z4z1Y9RZgm2irCjiptTSOan8EY6NcKx58RzYTdpvWDWx\/2oOlJZrGk4WlN5rVi\/vDCCyAkIIP+ghT0pK\/N\/qh+yB7zvS5AoEVx4Nu7XmusUaKmWTY1YDPNfKduWHRitjqOQnTNvKkLL4USvoumylcCZvksP64E4Q+u8cQgHkhWxAuEM2Xiz43kLqumxs9\/Y2M05HV36TsitK0X8FWmunGaEjR6EYMpYUwNubzDFzgj8nZ6rOP+N6hBLxvH1JT1rxfFyW7oc+86kXlJhZoAMXwkRyyHw2QfxH1amH+UvLki5gV9PoIjBcea0A+Hl8\/D1pHw3QPE6VCVmCszmXu6HXvASrhVulxOFWyS9brgqnE5\/HGXTRYYqy3aezTeUUQvXIGf6eMYsdogx25avdIPK09s16cX6J0\/dCGi+Wm9KxN05Z6Xo1PJV8YgMR8tCPnCoe1JoSeHllfQGv7n3eg4nUcdKs0CDgoKtp\/3ps5wMfhFmgVgGjSGR4arD4Cw5MMAahlvd4AuT41\/hGLNV69+FZXHlvIupoJS6cKcu7xMoIbqVYB2AEId44fGnkAZunUxo7y9buD7VRU+oUS4zn3xLTPTAiY754BKU2P8pxwJ5ttWxp9Sepp6fKmZIoHLlfUoYWbdEqYLvTiqL08WAzq9nJnoOR3Tl7UjAzmtdWEKZolSU93MX2veQTy6oTtiGstiEBPd3r45B3kz6SiD3MbmMIlNUgUF08yi6X6k+Wd5Yh+0X+WoaDuSTBfhvpc0A8TVznlgQ5iTQnGcGTiYQGL9IEE75OKZ\/Ms\/p9TFlndVO3E9kVnfy9ovzrfZmOhVw2OvypvFTJdaUqSNWbbHur7nYA8srICD7rb37Gh5Ao7Pdh8OhCJwUlKIf32D30qArHk6kHEdq5+HInkdgcR9qoeEU1mTMqCfZj61e+8HE+jcmzMnwWAvdBGAyH1RQxKRujX2gY5FZ+aSn3ACboI5rxrHy800skgJgbOzaaefHiZRcOjwzMaia97svpMwE4uD9Exw6G+Z7YOExNEWVjpG6AmQDDjDF6jO63jlWsjEwL97jXcOOvYw1E6Ql3wKUsTdC4eW45hTwvulUoLHaSFowBuJ2DCTfKIADhwT5RmCcg+t3Z26YsnPixrNXGm6\/FFxmyD5Ezjsdl47egmNgpIIPRGuBT0wo1H8uwo1ehs9KHqDsUAAaAomNHViwT2MCGnC8Mtd9Z2ToqYDpjzp0gjrm5dStawx9aZXn+8eHpY+FW4I3vKQJqoGl9Czg5Wdqci8Pu2xwxiieskd9Ch0tzyZfB8VUTL+la3p3Hr7V0m\/QaDTe\/NU3ta8m2WFbC90k4FwPuo5aP9HIUPT2ivApDtaGUquEmcQtwMFIYbHPJY3gfAd08CyWfrkfRe1hpSnZsNwEZsAUmBvqhl4kuL2MV2a+HABXmmHCkw8ejHyKMSgTc0oJInIBOvMEih0qxKVw38soj6eNqTfkM+hsiAyAbwO5GN1ucXfUslcmAASVStAsMjWOfrXAq5NEjxbfv45ndTq5IJAQ238X5XWyq1jWEV36Q93mZF9y2\/QOz2+FQa5UiEtYM8B\/d1ugQO79lvMBKACRmNvBfURcXxbUPLTkBYhIC\/4h+ll8Jebf\/L8wEHImpPTcH38ALEZAb7Stz8Oqzu7JrqRFxic\/TzPy\/o+2ZWlx94\/86\/frHbHVCRiydkxIbwHKrT6yqH0mxiD2Hw3jbM6tuWB4h6CxA\/YYHXQR7ZuZ\/993dx92UI0Kb09JK3Jlebl25TBDQXGdVsryCNXHDdh3g0bGBIdsWDDjPT7\/ICPghhpcydMaKnPNcOMreiheOXWaV6ZeHBQ586xztvxzyjAj9wLTvikysEDKgnlLvcjmjfMwZtFUPYokblNHc4c61DZQErVhwdFkgZWLP4sRSfyepnhhoVDAYjbWNuMOrkqbT\/kiaJPvyL+HRzkCiQHBne96F7dL7PDQCTNuepAe14fbfEktcG4m2ZT4SL7n0TBCiR8Hvpr9eIoRkYRJ0NgKNylPCLEQHGLQqBxmre7YTqbpsMiwqhIuTIRSXH2zdNkOU6cyAmOiwtna581C+EMX2C5XEz6tDTrXyw9g0VqrY3vaalNpuaKvQhRyWa4VfX8VZuOfSJBV412fQpF85UkQr7U8Xl4idtxghi8SRe2QxRRl\/iCwookku2IW1REokvx2WW4HqWowujARXgezktHmlOYpfJNTTnrVqtIQCFgQnDXiRQYHO4mm9QcSEc2goe3l6lZqi8jI\/51dWIl8L20fq55bIUe5aEeo2l2tluZpp1fS+F14OTXVhI4Mp2bx4vakbGt\/Y14WrM8pV0EiAT5cqZ6Pb12rQzOt87wdXm0mohZ7Kfmbon5mp4UZ9wFngjXVaS2ejzKZGFvXpIcsTZ98I3p8qAqgoUJ83I7z8Wsgkl+usmMNOQS5wL2wsKmBy8KfR0xyrT0VMB1c+9qts1IdSJit\/BCfeZM0iU1ejmy26NeIyrlwoQXWs1Hs5sTEmdcpGI4+XNsbhNGk\/RCJYwu11gPk7sCi3Cm\/LAgvEw+WPwJUm8QKVztRZHTQ+CRMsArNcZkbMHBD2ggwe07YhgxD+sKAJ2EWJyTmlLBqg4sqL4fa2ihzsS7TpurWZQx7Bq2yh8NkXHhR4Hz7iDeDjHLu1vjpx7+Qa2AMwFkLpjJ0tu3h22ZcNMPTtPrtW4TExofTnt8DYfi9froaTve3jLamNmsE7JhAWT7DhOmy3kte0ABIPEHfzff1mv0pd1uxr2lhYSqRWE7FnS3EK1aibBJ7luWBEN8U9jaohxxxM04T2eTwwK2DUc\/PulOnFFx1gcB02Hae7pueHEWxMGL9tal95JE6xTA0xz4LeRMOKSurKSiq9qUNemn1kXcD8uFMx\/8A2tZFq7P2nRNpRE\/9YynsJvoR\/tyJgipUBBROZtqzIgSvx\/rDOXsVdhxoqweZa+9xAZYorUoJo5dkjl716c4HIKrDycID3bRw4dQ3sbk3oBztiQdC6dg\/mM3jGWIYv9X+s4AysszlBuAvg88k0PYwEnFzIBxJ18IdV83oonyQcClqCf2tdmdTh5qkqb6P0rFneHH9NhVRAE5Q6nj12fxobb3JBwWCRXhHPBmH6GIqdHwot0WUYH1f8YSdZNC3np+3LgUXqGLJ4DB3ZFHqjw\/AJeqYz4q26qVz0eSp4JQQcqqhjHzy8EhvxqKI9o8FT5dqEAKU0OMJasBhdQA9MEuSyRHjXQ3P1sjZ6nQ+r1f0fc+aLz25sR4rqHYYejagCc+17LGjumhbTRCE1jW5wVTfKlQr3XQNTDNvcSiWQLbtXEHwb9NSO08E3kUeTi1K2lZ5XN1BliXVYyR0e85Wfk4maQqaKnycETDF7dpxHN\/NMIunbyf4brzudDYNOHo9twELQVzvks\/yEhX5pYjToTTNwx3cZQ0GZ\/uERvwiI7JjF8esHaG05qVHbzxWdnLSRJQTYo4UuR0iazheSV9uxrsHBr+DfZij50YepLWC2t\/eYPwajjgxGw5tQuua8bmRRYbii\/E\/v8OSIGY6\/aGkXtmGA+Mrwl1RFwxLonBCM0TlQhKvoR31OpWMkiK1p7tF19C+SUzIkItywy4NEC4ap8qvJD1LFWBjswDDzuefvDhVrcqYwookM4syQrQ48O3luD8S07jB38\/jpjeSdtNLqzX7Ht0A7\/fC0k5WpPdLDAjKAGZpcRFqxKqvR9DvJaOuouGQYI29gLVtiJU7OYttX+zXtRbAqk27TI\/wz0rurDyoWlkqesgeJT0dOOPQgXXMjcz\/CWC+rb9f3c2F5GRiqLlopyzuXLiL+MXyM5mSvvlvXIP2JK7EI8JZGxsUY9Hr4ZOVEJnZHabVb668K41RaHCtU3p2cZhrmJgbgc14RHRNh2R3fGOgZ8olu1pw+KsSzBSOPM\/CeBFiVnX5qxxN16EuePYKVRofys8qwH0KaWN+14Sw3IoEav423250sWaQXokUZB7wGrYFrKjEQ+KfYWZn4qQTRMRBIM4XvQqR3N0NIOhpk1ZVOOTp5njil3oOUZvCC4igrZTxpveYFRJhSsWlD6e4eHY+6vjyWtX+uVdK6GcfGI8+oTLLiRUgHwrW\/UtimR+b0APzkuWFS\/r88ohbx+EF9m79UJBXaq6V6joOjp8YHJpk6PDj8i1dbD\/4Q2NmLXmt0LG44u04O36chIj1UoSZ\/f+6xGTWcbMpnPXoDaxC6milqQE3kYTYRciaHUo4QWeOwZtGglh\/gV5tNRJ9AicflAEFSFqSsKJm8i+6hvPw2jwskYFtXsqdhjtqdVw9igsFgY9FaVOn\/8j\/eC+8cbQVQdBwQyPmwKSdc8Z2ZgB2e\/leli38fkCTre73xqhFzLzco4tMig3B5UjSVyjELYdgwww2oqzvD0uuXdVkb\/1bU1K228dI9MteFwAh529j2H8DJ04ec7N\/yAhTKxuUlel4PySv+9psrZRNIvq3L6QVsJVFWD2gI1okICM3\/CT8MmXHVd4jGQ3eVpI1TsL\/Ra7pXZ7TkxQE72jtssNTjXrvYw\/EOFQ5VByc\/1bFgHAAme1qk2czpGdTRqGheRjFx2KVywaQfHwYtSw7ZtdeFf6bKZ3OyT+DBOgrA0pgVbmrkWBECiHYAJAC0NOKCMhM\/rZMYBl2dTwNrJiI=","iv":"91cd9a83a1e1cba2e014d84c478aaa2a","s":"dc3aa8c46c39232c"}

Advertisers remain over-indexed to legacy media. Chart: Kleiner Perkins Caufield & Byers Internet Trends 2016 report presented at Code Conference June 1, 2016

Advertisers remain over-indexed to legacy media. Chart: Kleiner Perkins Caufield & Byers Internet Trends 2016 report presented at Code Conference June 1, 2016

Criteo mobile marketing report, October 2016

Criteo mobile marketing report, October 2016 Eric Stein is chief revenue officer of Branch

Eric Stein is chief revenue officer of Branch