Consumption in India is set to reach $4 trillion by 2025, according to a new report from the Boston Consulting Group, suggesting that luxury brands may do well to invest more resources in marketing and selling in the market.

Within the next few years, India is set to become the third largest consumer economy in the world. With the lion’s share of this growth being pushed by a newly wealthy affluent consumer class, luxury appetites could soar in India by 2025.

“A set of emerging social trends could reshape consumption patterns significantly,” said Abheek Singhi, a BCG senior partner and report coauthor, Mumbai, India. “These include more — and better educated — women taking their rightful place in society, greater pride in being Indian and increasing time compression, each of which will drive exponential growth in various categories differently.”

A growing economy

Luxury has always been traditionally focused in wealthier western nations, but in the 21st century, with commerce and retail becoming more global, luxury brands need to pay attention to what else is going on in the world.

Countries traditionally considered “developing” are beginning to sprout up their own class of consumers with an appetite for luxury goods. India is going through such as transformation now, and by 2025 will have one of the largest consumer economies in the world.

India's affluent class is growing

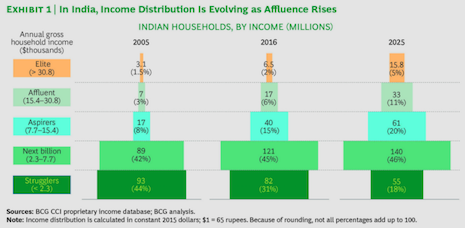

BCG took a look at India’s growing economy to analyze exactly where this money was being concentrated. What its analysts found was that the elite and affluent segments of society will be driving around 40 percent of the growth that will push India to its large consumer economy.

This concentration of wealth among the most affluent segments means that luxury brands will have a much bigger audience than before in India.

“India’s consumer market is poised for fundamental change,” said Nimisha Jain, a BCG partner and report coauthor, New Delhi, India. “As the consumer market continues to grow and evolve, companies will need to shed conventional wisdom, try multiple business models simultaneously and be prepared for rapid change internally to adapt to changing consumer needs and behaviors.”

New opportunities

The growth of a new affluent consumer class in a traditionally undervalued part of the world for luxury marks the arrival of an entirely new market for luxury brands to invest in.

But luxury brands are not unheard of in India currently. Just last month Audi began a campaign to bring luxury vehicles to the country through a partnership with Zoomcar.

Consumers are now able to book an Audi Q3 through Zoomcar’s mobile application and Web site, which offers hourly, daily, weekly and monthly reservations. As consumers increasingly turn to alternatives to car ownership, automakers are finding new ways to remain part of consumers’ lives (see story).

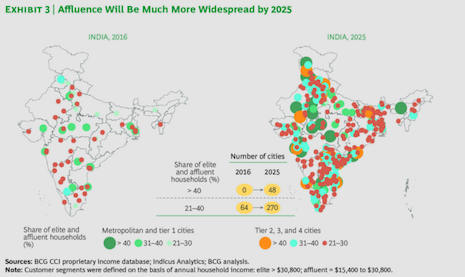

India's affluent consumer class will be more widespread geographically in 2025

Additionally, the Indian luxury market has been steadily growing over the last few years.

Estimates reveal that the number of high-net-worth (HNI) households have grown at a CAGR of 16 percent from 81,000 in 2011-12 to 146,600 in 2015-16 in India. This is further expected to increase to 294,000, representing a total net with of $4.7 trillion, or 319 trillion rupees (see story)

Finally, a major driving force for this growth will be thanks to the influence of digital channels on commerce.

BCG found that digital will influence 35 percent of all retail by 2025 and that between 8 and 10 percent of retail spending will be online in India.

“Already, a rising number of consumers in all segments are using the Internet as their first port of call in framing and driving their purchase decisions,” said Kanika Sanghi, a BCG principal and report coauthor, Mumbai, India.

“Our research found that about 70 percent of those who have access to the Internet go online to make informed purchase decisions," she said. "As consumers get more comfortable with digital capabilities, their usage patterns exhibit growth that belies age and other demographic variables.”

{"ct":"zE7cvfT1ojoigAmSvzLcV7loFJ5IlKrhU7OOM0+AbsfiOlm\/tzPGR1N\/QbY9GZDgc5DeIAEpDqlQOpgnCRA69mSd\/cE\/Xe5KOLUCvu3209U2PCrKFbumdCl5TC4hfBmxj\/Ni1BgPrfX3s9NGjjtZzgKsz6GDWgglcJdjH\/1CLdN+kiWSvcjODD4vJ13s+huZIvNvRn7nZ7hn8tLQTnZG4qXatBz4Jw9PIqkEoi516R7ChIbMzjHoEuwIxWZCnbD0FZtEqs1U+lRHnDUVd5E7ak6OQv5zR6b3LLwSvsZ1w2iaL69vyIdvGQkgZ3QqNWDWJRIjmyOUhVs\/rq5sttWbVgN9dZRAtyEslFEpmuQmujgYXYYw6MEqxLdJRKxcLH5dTWkjRZmO4wPInOBo4JKBOV3glaBloqRtz9gwOAO3JQfCh4tTkB1lq3Xveyib3+\/TBqgC9TDeltcy4yIVmDjFYbXSGfAc2kMPKuv6zgF2z56T1YLCdQNpWT8dVTcxFj2WRRUUjYkAFusF7tpLnBGjY\/FSp8D4Oi9fhfpaVP6WuDcQ39h9Re7K\/XaLfgGbz9o\/35uE71vcz3t6QooCWPXMYJicA+pZzBHGsm178XuWjFNgL8MZSK5rfm5dzkWz7Ob9s5JhV4VR48xXUSRY02Wo5jN2GO\/9UUL5KUNt7zQSXBYm2\/73PpkE7LDkP2l3GmIPnL9XrMog0B9C6PRM4pljzyZfL10MXz4WNfqSKeRlf+g7PczNzy5Z97Y8aTIMSgt2Zxj4i5yvirTz+KMeyqhB51+0KEYb0o1c8llAbGGTLcJ3Hse7opJEPf2D\/+xJ\/A\/1EJPi3Mt5LiqtgYSLqT+KLwkhlugi81m60gpFUgEYUWx4lbLnrH0jU68VhMRfYk0dsXsTe3YpkuvR8QgJS+e8Wl3LsO5+KnAB5lNOpdtbhb8OEQNNBQTAXbC1AER9\/luxbhaX0gkZnJTayqpEeD+62+5I9U\/bdPxVgOMDfS0sBGEcflLuCyNPOwpiMsa05Cvj7aSy+8T8cikNAR1v2xJ3Gnc+FV2eqTGgt0bBoiM53BkG3VsAovAHqReCOd18CfdOhdwnejHbuURhV0S9DMUnYZJPQEnznwSk9tTxO9GqOpty0\/Mmj2+NrHbid1tFUDCVME0PSaNH8hNTmuisXW3P9PsKWSv5\/xu4tD5LntK0dCHuk+hkS2\/WEh7LoXc6DhP1OMupITSTi0oCbb4puNx3410KlITp4e5MMAQ7YNudV20HHe8dVVd+26mmBuDNQoMe\/QUl7YEpQ9eB6CWMaxP0ivfxB8eYYfDIBX1UcxuYeedEvec569agD3lfH7Wksgwz5DrJl1AU2lspXB6KbUZSr2eDuhMrjgLBNvsGcRqMDQo\/\/QCTQKrpyreOuvxRfjgs1a4vk0yfxPS+SlJCar1B\/qp8rZ+ipNnfIeLCymyJAVMDvbj0+aVMbbFcYlfQ6F7dhohoKC3wMcqjj\/dCwYOz0lD2f6LUp0abPaX9+yEwkv2Tmg38PZpMyHDo8b3cgsyNSjA3G77JjFPyotrRHXRL+xpSoxfmDr9W8gqg3GXSgqhXfW5q1RBpfO5Qz\/yLjT3InwUrlK9VIDFVJ5T4wD8semWRmwiiCPuXBaoMWXniSknOpVF7\/FN4oMM8PaHJY00DjhbnQgDbKzRMyd5XslrZM3yG82nvC6hYSul97UGXPFVpNrtULEKQDyqKCHMSpi78\/MMnHlg0t5OO4uj56HMs6V+ElJlV5X1jpz+AsnaZJ76dI7haFsuhhUSY8OaX5DThEr\/PiIIu9zBipspAfDlC+CBoG7Qhu9e2GRHfHDpdZ2kXW3Zoshti717Y5fSIdrr8V9y+GukqBj87q3PodwDtE4EY3Qv\/jenJCHZPYz5+WuLqJfBecCLXcI5vKS\/pGh\/t5447SwVEVwOhfNGF96TxCLWCXTRq0XPZ66y3zzgxaNjQksbH+\/HfcIIih2lJUt3aEnJqpHAxOGTyCxBxJt+wgRLMo9krPjHJbIyWRl1JZWYRDwXfjhoyKSIK5Y9a3E6G4vMCy38tiReAPruYZpEWcFoaeW4YsUiNvAhpoJTYFSHt6Ipz8rvlU0QU2eSRLEJpGSvyp96EnUoZd15WRo0T82sZH6rJnd98Bgl13gLcND3XB5VFAhf\/94qtfvHxzeBcm3vKzrtDTqT76ofk5au2LJOi0amO0MnUE4TdGraQIBsCqHc9V0su6EvCsHeQ7juyurXLaCfRRroBPiVJffakLWlduDsw7K6HXdk2Ix93TbNzuMC2MOjz8Qr405mHxCOS\/4DPI8fdlYpXdKFwbFJWwEt3udghoaKf6Wg+qGopnmle7Ma0Uri+jZoJEVMgX+KXTAyn7wGjXHEJYX2sCmp4ZMQdzNBmOtMkcKP0l8IlVyJXsLehHdJerfc9ybTVM00UyGJ8Fn3kjil8aI7VG1DcX0xzXopP3NL4jiEnZBGIeIe0mkAx50ddD82y50cnoPRm6fYjVptmPaK1scCgwD57iATSj2gGfV7pVkbLo0kRa42b5bUVaHcSLWQaF6hP2iCYQihEYkE3758Ao\/JM1NYx9VPBoD5S0ve3iqcUQnneEBDfYhp0og\/lIVOpQpw3EpZjtvlObDefOCTcsFWY2YJ6HRxe29ewhgXK+wBG0Uwm+X1QgSJtVk3wuVbgw7x\/itFKAOYg2MOhVBqAzGHwnB\/+TTOsr6PtFvyAG563pUkk0yS\/DQprI2PHkAu2OvyYOB+a+yWLsIGN3WL8W6qzgF2CkPsxAprg54TtexwfkiADoJ\/n39+Erb1q9+Li7mava8wuKFUJRQfRCrY8JUgKIKSQrOri5KOrnZkUinR2xShcNCKE4BSduqb5rzEtgd4eStX7\/YQAAga8EhseavGqOh\/eHsncGQNNeM1CSekkpZ3A7b\/IwzIUhiieFk3tlwbj5yCjhELkvCdoOxraEgSdHonQD8IL4lpKMGzPPV8RHx1GbVVAAVIu28ILwqUUmn2++NGenafINjIZSImmLK7+tR1c8QmgxF5wIRSjamOcaWG5g1Xu6zSbaxkt9Fc5yYMnHMYFEEsMIjRyoJ4qLmNpJgp2BoqU8fFLfjdNfJlAHnO04zmJ4P+qO4rbkulbTaJhY4teKIKtNYoMneiSc0yRXJ9El86fXvpIxp\/DqNlBALwVCAUGUgrkLM\/Fn\/glM5oiZoZhrYeEpeScop3m7sKS3eJxNTPYhPh7vRKF3bTnPlrJOikftPwGv7RoEeQj0f22DF\/bGifxSJQKy+x6tVknptPTmnY0Wu93t9slHXVudAUzwVILyQ5SVMsgEBRK1V7eQANeFCNGCsSPs2xtrX65tKXLxCyY1TMPmUws\/1iAlpUZPJpwyv9f+On583ssdWQVxa4Ds0Tlxl\/aguSAWN8+03qis9i3HjU2mfecV6y3qqeV3cjJEML69UgjYDXCpEHZyT3aJnNZ4bShF7YfPz1OoyeKvPBuvM\/HlRh6BX0BlIoXbdlUZPoICTgj5LGWLR0+9ff9J28ckS6v6roDcFepH8Y55RIjkvUrtZjatNCfeh6PUkQBoYfzp0SFJc\/TGYdIJGXMhTerVUiAfOAZ\/Rv2wfcB7UCsjfzTx+RY339U6BAz2SIYkHkZnobbujkEbzktRiXb0eNr3iUk7a7S0IbR3N\/QKT\/VBFQNodqDLcN+DC7PBUS\/te6sN1IeRdHu+1F72IDVD\/mqN8qbDk6kLqqlAvVKBqPcoL+X+SqQCC724ajsHV8ryxtXrMwMuLtAb3Qb7pBCyNp4YiKjwN7KoH3zgjvC3qMsHz6c2JdOUBP8rLiuBRciGCedOR8BdLTIkiASYUkQ0DDPf+1nS7cSkdqScI7UX+4r65INEplCbWsOECBmxdG7UAXTEHxpC0tJ1eI441xKis9txkdtbo\/EtdLndcxnQDnCDpBKWXDthWOOG0VBCk6LdH5VZWThG57iMZpuPlrzinICnFNOaF6UATN2lpxkoOR1rnG1vuz0mOip6iQwncHwCtiQcTMjKk8Mgiyvl9xfs4vKDMxWVEV7ZM0FpsY1ExR2uFhufU88Wgni\/SuIdlKTVjb\/QtvG8jObPl44GsCwaUrkGAT9y6Ht3hXLky7RIv3YJ7h6tINTSyuWgDg6pWgy+MV4pyrN982yhbMMhCi8CC8ndGdzu8EKKMSNBej0HpNmd+bGAcZTeJpV1E\/7ibRLn5eorZerdzsFjZ8wdGad7xU5zAGwln5qEZmwYeT1jtt+vjPeO0fWZpQtOSgzuW+GpGbE507PsmG0Tw3nM3HRv0RmgrYV1cKXAO59rWoSp1qjxvX+65SiLBvVxJTlXTp7hFiWrK9HL9fa5qr7w83TMaEduNzDsaSu2dY8QPYQF6sHAlgjl0vKyQ3Y49KXauo7ygGAV2Y6Eb4qaAA2A1V2Hh348ZHkARQXF+01DsMVqSfYKEyyRhR+FD+Galtr7c\/dDwyqlfw9RgpqKgTSLnyJG6Y0kkiut\/Xk2EfchxqFf6WTgPULElkB8ePHh6pHz4IuM7jVkaMfFESoDBPt3qbt9lxXtjKyzTQddjfgkCl7pzTK67rf8tC9kYwzf1j4+v6GUCKyS0+3n7R\/ByHT2VTWav4ePFhZV9ct05mq0RAIV9oRJwRzKJg0RUhnVjoLycR2sLwx7zPtedhqkRdwhtMfUbsj0AQs+iaOvdAYp9PbuKAbBQ86kj5zcHFVr86Xrw3sL8ahHCOp4hWTml4MPkoKgLS78PKdhUzmtofAhsf+O6GT15l7\/thaRZDiaUgQNtCtZcKNo6FJv7+pocYhwoPSzkCMs\/4WI0c9dgeZkkl5R+07DuwEKQXpmN1OaQxop+NZn3vzwWpseUEzicNzM+TMv5IG1I1oEYQSLtOElEfb8rXkcUWvAD\/YAUfSZ\/Yn5UBsL60Fj729aOaHm7r2u7FiV5aGLsbYQLXSbvaFF8Z0qhHzEvFqwaHrem+eldTJKwK0AvsjNRnubu5Xa2ZWJIcJjSc2dRGgczxdrbAsVsmV81FKKhFBf37N8\/+IEu1Ro2mKufn0jJ4Aw1r8urOqHwKTFfN5scIZ6qzApcYHjBI6OLHClZ86luiC19+udHedN9bpy2\/FyA6EPa5ggM\/d2ZKPsyhWlpnmyXvn7nKhAeXsa+65iKMtO9gJ17abCD8ksy9ugipNkQLxLtFqLmXPOBX2EUgfpIaRy9MPxP7n3amZ2ssqHxls1m81k0X7GVcABcQ6fsHmHHjd6Uho77FKwvHNZH\/v+oeEgSQUPv\/sEAwEVzGvVqr0gTDTJ0ATwgvygxtIOGnfOJsWbo3zljXZBvXO+kp7lDMkvP0vDPcRzanjorLcgIAuF0XNBwAyWZP03yKhwlVGiK+9NL\/hHNbA0OriUH861bCZyp9lm1AKHIEhDv58ZtAZSe3oDUsxjpqcfBMJyadNVFGJ2Cqzw07ZFa\/Y3f6FipH7wDe1Eb09gQPTRaXEixY+kE0dbce5CQSCCj8BHrlH9fsscN1F0YSmvKqcugaucofsNqjn9cowHohigo1wPBZqSdAv\/nxug\/ySpViWb+ySMOztdez4BezyFAH\/HBFvKzoN245N1AIWfOmZaXI6FjbbBHaeQK67AE9\/ZYNJeBuCR4CPEPOIlbWr60hQfc3NdB1CjpZQdmbOqvI+at7\/HJ56ikcAswDjxhVuYQE4kgRx0sUTnZ+r4XDFB+kCBr63cUDfRxRP0YToLTotBRID\/biU53W4JPBNFrHEtV4qkxCw0GzDQP4UjUkwC5AOH26yLq1Wmy+1LLRX3QqUOFw3+WCpcBzjeADmwKCx2SpZQJcMTNJKBFaLkqTaogiMbucHZa9VnMw6\/WTyVYJyGOmOV2ewoFdAATe5TPyZB5MIfG2vMbJxJv5qgtve5mC4+qouw1v8xFc3GC3GjVPXdatnItEqlpNcT0Q3MB5CbiS52wYvgQ5J+cCBO3iwOTmhvL0KVJOvEroneF8q3xMhAC8PoICMEEuhTdpBCvdREurT39bea6pzJDi17rDIafEs\/zRGDjvUqE6YMlS5A87ZHLsXJ3vyjkfUO5kwDyP\/Kjdwyt6H7ngx47ohkVRhsYB9cu827EN8UIweAUXHK9JdxGZE8z7v0LuaGXRjpA8TerKgZrR2X\/dgF+YdPmwUgrg4pEB\/7Xk4Tw68XDxoRnPO9uGZzfxWKrLNICTrhPD9lx4tKbELn1Yoag90b1F0juR5vLmibOIMdR7bE3r1+nZB+RDr6efsM8DAhONEubw6cGjzD1rk5sCPrdI2mKTFeXEAEVElFw4tismLl\/dD0MCXOeCANBX\/YWsMHaYT1pAxd1D5YDAvE7jdEUUpIJgnzm77ZEVMCfeepdSbXIb9TIktt2e7IQUb6RSbN3HFhVZIE6XCq1BYh1PB+LzL+4xW75ci1Pu1QXHYHTSv9qqIZrKfyd0NKwBG0t2iy2f+UnrZUiIOI0q8xyAs2MpuQz5MjsVBC59gDpcXRY7P9Nc2KZTmoX0DQfk3CcD\/IjzCxCqXJ3p7\/zaRtjG5t4+5nfMwyTHaE8mDxHRP7YR6lp10wto7JNR6vL\/kte5IRPXnXDykkTMgHURSjpjyS\/eB03tNcxNEUUdAU6g04OxZLuAB1U6wUOhmkvyJCKGjn7hnZFMEAC6ySfbmnJVw8Z7YvtIfPStbr3ZTiXrHfRzGc+QH2b3Y1aMoA\/A9A\/SSJ9qgTKLUECKhCetCnKcaq8sAhBfEI4pmwN5qPqXh49NpPHMvE\/0r797uvf+l\/uiTFo0gv9TcqugAiCmt7M4LJ7f7KRg+B0ePPllyuRje5naOSAE2I4kHZVPkObpkHyqWdD21a+A9OOum9H0MR3sc65RfRrMMVINb+JHUYAzQ6zvYXn3rqVGoTTDzXe7t5g9tmDhwj+GSrdqKtV6rrafOkMfOVPv1sT3Wq42UzHhLY1rb6Nm9MI9Jcvq0clAyNpv4eEO5yFYCFBjKqCKdgnQYngXFfjWU52kWvZsfUnatvy7pojJhXFEKI2eTxR5\/YNIMZSVpcKc\/62sr\/dJRvdLDDWkTyc7iVMcMXlMKpfyfHjI6QH7xT2bJufNr0LVJ0wQYzmkqEYkGcjsNpt+yEbVScC4OpLnP57Kyjy+91X5yhHd4ykADgXlwiOth5nQky2Cti6Zjy4TEYuDJvwYh0xGdWwyIXamx695A7TliIEBbsVcEgVbBohRujgLs6rIGu71IqB4AcnzCLvUi1yFID9bvAEiC21Ln5wLrupWfzfjhkx+F6ypr1QOtAL+nJsd9vHiWlxHT64Zzfu1WYNRhzJTQ\/HDSRwKEjx4NpPpFTJaMEkMkt\/QVbfLtBlaODaotlvuSiFDJE+tT+dpnB2OBooDw7dmsG47K0\/3FHyx9\/GLRHyfaLtM+deJPww==","iv":"b4892d8cd94661982913ff648be7e4e1","s":"7e2eb83bb8682fe7"}

Tarun Tahiliani is one of India's most storied luxury designer brands, known for its opulent ensembles and detailed craftsmanship

Tarun Tahiliani is one of India's most storied luxury designer brands, known for its opulent ensembles and detailed craftsmanship