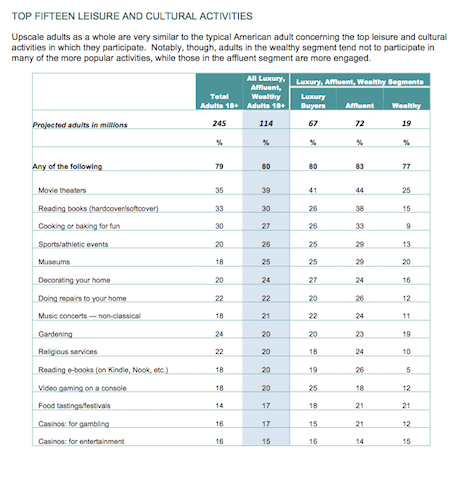

While affluent consumers have relatively similar interests to the average consumer such as seeing a film or cooking, the truly wealthy tend to be far less involved in the same sorts of activities, according to a new report from the Shullman Research Center.

Understanding the interests and habits of the top earners is vital for luxury brands, for whom these customers make up their target demographic. The latest Shullman Research Center report looked into what activities were the most popular between luxury buyers, affluent consumers, with a household income of more than $100,000, and wealthy consumers, with more than $1 million HHI, to determine where they overlap and where they differ.

"Notably the wealthy segment is much less inclined to participate in most of the top 15 sporting events measured in The Pulse, except for tennis regarding which the wealthy is the most involved upscale segment," said Bob Shullman, founder and CEO of the Shullman Research Center, Greenwich, CT.

"As far as the top 15 leisure and cultural activities are concerned, again the wealthy are materially less involved except for visiting museums, gardening, attending food tastings/festivals and going to casinos for the entertainment they provide," he said.

Cultural divides

Among the top earning consumers in the United States, there still exists a divide between the affluent and the truly wealthy.

While affluent consumers certainly make far more than the average customer, wealthy consumers are on another level, and their habits are subsequently quite different.

For example, between average consumers and affluent consumers, activities such as going to the movies, reading books, attending sports games and cooking for fun are all quite popular. These more mundane tasks still hold their appeal for affluents.

However, moving up to wealthy consumers, many of these familiar activities fall off. While an average 44 million affluent consumers regularly go to the movies, only 25 million wealthy customers do.

Some statistics are even more striking. Thirty-three million affluents on average enjoy cooking at home for fun, but for wealthy consumers, for whom meals can be purchased whenever, this number is only 9 million.

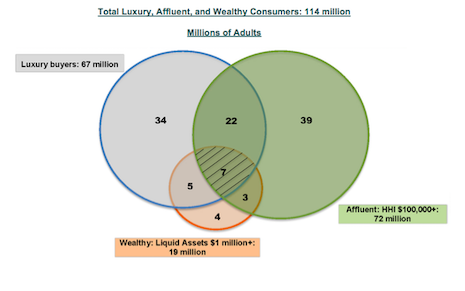

Total luxury, affluent and wealthy consumers. Image credit: Shullman Research Center

For luxury brands this presents a clear path for marketing to different segments of consumers.

For example, enjoyment of sports is very low among the wealthy compared to the affluent, with the exception of tennis.

Luxury brands aiming for affluent customers might deem it worth the cost to advertise during sports events, while brands marketing products for only the extremely wealthy would be wasting time advertising during a football game.

"As more luxury brands start incorporating experiences into their marketing and advertising efforts, they need to include context and backgrounds that match their customers' and targets' lifestyles and interests," Mr. Shullman said.

"That’s what this data provides for those brands that are interested in looking at their customers' and targets' interests," he said.

Affluent and wealthy

Mapping these interests and activities can be a bit complicated, given the overlapping nature of the categories.

An earlier report from Shullman Research Center showed that 47 percent of consumers in the U.S. are considered in the upscale demographic, classified as either a luxury buyer, affluent or wealthy. Sixty percent of the wealthy and 41 percent of the affluent are also considered luxury buyers (see story).

The crux of the report is that not all luxury buyers are the same. Some subgroups have not just different interests, but different shopping habits entirely.

The top leisure activities by wealth segment. Image credit: Shullman Research Center

For example, U.S. Trust surveyed 800 high-net-worth families and noted some stark changes and disagreements between young wealthy individuals and older ones.

These conflicts mainly took the form of what kind of investments they are interested in, their attitudes toward charitable giving and the new problem of multiple generations competing for the same jobs (see story).

One area where luxury brands can make the most of this research is through what channels are best for targeting affluent and wealthy consumers.

Television, Facebook and Web sites are all popular among upscale consumers, as they are for average ones, but mobile tends to perform much better among affluents.

"Luxury consumers are much more likely than the average American to indicate that they recall seeing advertising on their mobile devices as far as the top 15 communication platforms the Pulse measures are concerned," Mr. Shullman said.

"Equally as important and potentially more important is that luxury buyers indicated that mobile is the third most engaging communication platform on which they recall seeing advertising among the top 15 communication platforms they use," he said.

{"ct":"uwnr8BQSRVaSwkjAwmKh1OCM96XQiQtHK9NJP53vIGfzHoxJQQYqJmipWxJuq12fMFrM9e7MKej7+60mzT3R4qNQQceyYwRtCs8dQixhM7dTI+MFf7NR963uxwG0SD2RrdabEx6sq9GAj\/crILQDFt0w8WlvTEPTQ0H26tic0p8U\/cPw2m5QbTzE5kok2xavloQE\/SF4ofxQMkdqgcwZUwSesAwj\/feqQ5frPUZ0tA4xcd1S1K270sltA1N4OAJwJqQg27JTT4nq+rCKPYDjoVKwBcxDKQaQSKp5xoT9gXiXMHO3Y8aFGzWUOiy0JEtRQ0X\/outh1UavoQPlMqLg6IOXfcW7ZizuwJolHEX6QkLeBUJnM8Qz75WKmfLUDWg3ap0d70uZ9rv+SUjEEeiDTFCsiKvkRl9IyFOStxBViKKK3KIN5rIZb+afeiqrck0IXijDLvQacHPF\/YEsFcw6Q91uqwka8IqOrMWJcQ46rhRbOUHVeyF0rHcwJXQb8mPm91iTy+eaD+AoChqKSrSJGK7OSuSYLZXp3MhgxIL0vBd4\/nkg+BEgIFfpgJycrPPkwV3H7PzpMDgWftAVLK2FxxrEp2O5v0Yh6FPU\/PkEByXwkQE7PJSkGph0BZDAwZ9IcNVYVwjbkrrD2kSwcTT\/WuxYShHjPcML2Khw3QottX1zOJBUzMON8MCmPtnDUi24GEbaoGEBGjITAmMBlRpPGxCHKpiBwf53I\/5Qg1UJOJGL4woRN8IkU77aEbsDz8nONNaDOUcB+7fPzO4UgjvfA28x9kdQNfABg3CcPEtHfX0WtbUsi3jlOImAvfBroYoX3mwjiQtn6Q3eeu4kjYneVMYavPy2yaOJOis+FYcYwt6dI\/dxFOiK25jeWnq90SboM2i9SLc\/JzofvOpHn0NeqZE6wobG7ecTNXq1K3nF1Kzf7yhku2AXyVGx4BPkNov+fzDVqqrUnjCdOROCcGoj1LoXhjGROJhoOm8otFjAmZyQjOdlU1tiAYo1iJRHhEM1K9NfGZj9ouUg7wPZAaZn2L5Oes7M9qDBgrGHVWg4hdh6\/KwHhpitBwQB8\/\/nE1qyly6994D1O4PX8JEom7OZ93wRpdL8OTOMhqX0K1AqORHR5Tt6ARGxI5FAvukfk+rU\/CdvORgnYJJ5nChu8eSWMqdxnB8UiAYebKs8uR0w7JM0P6rDUpfh6Z4KTRAi9JOBcqBoDKXZx5d0f7VUKuq4EFZk0G7x9GqWoyU\/tJT4DOv\/E1XmcfqW3eG5A82AxbZUa2fetd8Fub4VaVLNtCNSfmxSt57tUQ4etXL5E7kflQdCfNJSEJeHQBhvWFiNr\/Ompup3XpD7y3QwZE5lIiiiAf0Tq\/v0s4OEFWhtw15N33nAVhMlfyO9lJ+m8q+Q82tvPBXKkrfv+Z5erUNgEMYmyIeNfEm+l\/NBv88BjHKzM4RcPMEKTo07iGouVGRxwx+hVczYRS5Y\/QssMKqoFghMmuGeQ7E6T+4c8YLAgYOoM\/8SW6KRCYN7cSNy82OLTDaWm\/6jk5xSUnzBPeaxe6EJbql00Sr5bmggPSfQU29gPz1AP8P6f1YMAMfvTIHmafGKwO+0EnD8hdD5NdFwsxTRzEf3wQhgax3IFvYX6nM5QmbWQpWYfzERbPcExOWc3AlLCSVD0ha19t9484Vqv51j6Eiy6PShX40DRyw018kaQg0yL\/iT0EMlQPq72H8eGJxPD5QULT6imBAdNKs1pYUFIOkdpek5FWqG27cYBOLOEMdpNA+2VtUaeVrbaWYiF4Og3+ufrn5kzEL7SdLhT1rlegeeP+rzrjj8OSs8lAZA94LW5jdizvrOQzMPgZp+UDTQiV2H2XHPhJsWaoudhNyCtHq1lco7\/c7h814v5PYWjrvMJd+25+wK8YeMTKxCUCPMmaq+U8V83nEH6PGvLiIDbRXdeRXmr7Px2ghkxH0J3uMzqjzrBEZwK1F6Ho5r8ZKFmyAkWOgqo2rBZO6xaRwSGpgFxjAjHDT13lzEfA\/rhBjp08iQ0NxR8h09TbZTn6U2FBEidiY8CW3j94fdSs0y7pne4Emei+EBIeKjdYuhmYA8X9nDsvuNoZNEJ1ELUsnMGHXSqSTzmyMxVoF0eFlxPzMFharwK5Z313obL\/EZeTvAEUHXEYJEis7n4vi+NpRwlfZjwPw88lCsIFz8aCddRJZnfpqskKuwutfnPCo75nX4DMMSlh21mk5NzNaj9P6rG+3W2F0CAM+VtNqsJ2a+KGHAU9sX8C74bnbKnjZDz7+tZe9Sche5w4GM\/8uOvtv48X16wcJ\/AGyx1BnUuBsiDnV6oMS9v0\/jCpbavJTLozPOMgsYodMswb771tUbMEhnHxC5LMMK\/6r2xZczYeyvhL+vduXbb1eaaT9RSFRyQUljGse0IP1Ge9xF8tZEoeim8SwMA7SYM6q4qyeLDdqmDPD5r5Wr8Sf2quSslZLSm+t9VtXTSrb7JrIgCgrZyeE8WAj\/IbpGvlwilBpc59t\/jQkf\/Qhx5B4Wr2MiDzvKjHigGgGjt8qJQiJ8uhsr1lFDjkuJ\/hicacCH7armC9K3uDN7MUbp22PwAEodGZbA4EFYfyfvIIg+e7BjfKZ40nSZvnUCed0C8K2wdfvq3kRdPcG5uRCarJQq5ing7i6WtPDr5wK\/daw0rzCM3xJIZK1nG7cVS7aGGDAt47kKMzFDlqwXLMPUwG5SGA9+a8r7WSsFiV\/\/dCLvPyuDy5vBpV+2fH960\/WnwY8BtbOCM6AzIOSW0wNTcOAPXMdOPb5dCuiycvqe8G1f9zRDa+\/Gz8QP5tEFr9u6bBKTZNs+4cxGrE6G6BiP17Lh4qlAGfKH2pr0P4gOcKt19lC3G4jn3eWPxLDpCVcdQYolszPAkHNsKYuAjGM0dkQa9VLaFrYKfjTpS0tYRjeH8e8pT4IS2AR2C7NDmSI2qH00GMiPSBGmgcgKoqfH4Hl+sRQUiS4J69+0siy+Kj9LDQNN\/68QEYqc0LGszj5B5VeB62H3qGvNsC1xMwyq72pk+ibD18YCltvIIIt84ru74yPs0pOFZHZBNDPv73Bl7FgGFD3v8eanHuvIB4dL+yildaSW05bRdq9ZZLFUafsu0sCdIzShgW8wePdflN8qQ6bf5V9rKr4oLaz9Qbsr2Og6nm9IesUKS29\/cWvTl1kSE7Uh1THPMUgdfLIbImXaPpkKqgkCKfgjEgFefkkG3+j4MQx010ZK7LHHKnyk2M8FxIXvnxM3f\/MMXzKNOwFgHgYsyjhq4nRoYGgOQrjf2ghRcPWt\/127dcQi32QNblb5kKEHE1Hi44kJsWq3uao9Gd6KOnqSPgpum4iy4BZO8odqZRN\/zW1jd\/M2gmRyvJsFnLOT60XLP9CClNckyAZi5B+w0xLQ7M9SU2UBZyUBucpyD\/rP6Xq9xmS0uQdcptF0ZjRfGJcrt+UmGOUXjvCwaJuzaK1gOc8LfMj5xiY9VJDP7r28YEePJ2\/fgLCrddf\/KOQg+LOqRAsOTGQnv8wnKEFj7baT6cmrt38P\/\/SGh14Wf6ZaUIaaED6V\/IeUPUk1H4pgpYhFvXQDkpRsnxh\/ugwiA\/Dajr58YgorL9zRN4cVebnJC8k862GjI2qhdexBKEyohn4PtDAYG2qTmo88EGPMFLvUWaJC1wy\/YLDZMJfq3GNd1UctNOAoz8D8cMTQaj4K5rFjwAaC5Qw4VyocQEfskDsv3hdmpt0duCpMA7PpxutNYs\/UDy6g4SXF2dkumKIkCZiWZd1EfKORF7eUoBUBnztz9BGIg8yK76MLVwFKBG3vb2qsmE6kkUTwmL4J3M6VEPD5gOEVNX4e8dQwlzs56bEa\/0sjEssRZV8v\/KutGoW7pO8eqFK3Z8DabE0HU2rqK84f9NkCzvnqJGsIlvESLkmxbTuGEG9AvEdyduvu\/tLvRyvErx3YO3OCX8\/lCDNrRGUaQR+p7n29RlPgFZunybiof9GiNapaQNmAlB7vR8\/JA2Tes4R0wZu7O5h4YnEl8Mju1H7W39FP\/K9Tk4wgnXvQPZiHBIyjHCRQxByz5ZT5NQpKc6Gw32zNsyEwr3ZPXJD0oAOyDy+5DFkumNNeRYDKqfe\/QGf20jZX245+LLSxHgCoQsuYUEY4obPPIRi0y\/mjRkxh22WTRuY90Q\/PCS15pAXVEhn9itlNIDxznGYDssFQtapQPyYodQSFsO1J\/FrGCYVeECoXemKYQhpcpcW5YNu0nlIIYVMb72eSmKge32elMcZiFL2oldmVjoEIVJqLZds3+DHLnxOdHP+OoXhsEa8mTzBcsaqyroqT7ItQpMSpSgMoADfk3A54W99IZwfCJ1E9qkc6JhWsU52OCBKdQAJK598\/3hAHSf6s8deACvkPl1jrIE\/m0tZanpuwf0CiuJYHPh1VvLLZfUmP0ePAIY+S27zh90A+JHgm7GtqUrg\/E+Iy2duQCZnyGxQZjsI5kgnjYX47RWFlPdwXe+ecQpAlVejUl3jM3FP5G15qY+HzOcIVxepRUmbXRXuA1RJJyvf8tnpufKPKFjL5f3w+iu\/7YUN+JxU6+pogfO0qWKREPO9GGkA8x7AocX3QnHDDHrDu0K5ocAr2u\/3Uw58a\/smmrf7zqP\/To+eRK5UmMl+M6ZDo+2BBEPbJa9YgBHyDNcg4evWadbwilXv3uV4SqSfsVZXD2WG0EoQVW8CCilrre16FGrzBretw7I9f+Ppr4\/96REMD8rMoC42dUN1E81PRCKhPyWDIepNhaehYjnHFAXUQRLKMxn54K8rvVBOMiym9tyb0PZNv2DNOr7Wyyoorxi\/m\/0075VQBYMbc\/UtAubGF0AE32RTUzJDyJ\/yPXEsRfCfzJo8Sc0vtkGqvj\/eZqm1A2iY7BKc4HOl2660fcoxfUC2N\/nOPkV1iG5TBLwGdAygks5ygULZFf2J+HERew4ba3FSwTfPxVtX2uChoW9cOxIu4RFw9KVmajSOZvxzVtdiG0lnjQnCvV3\/MZ4HhUpYZ7hykHUeWH0m70UtK0WflOaRC0f7MTxGwOWRSQB6Ig\/MN6c\/IEBIGf6\/eZYtDj\/njdgMKjeWic+Xcv9i9o+8ywy\/Nj6XpCsM9lcFckeWk41xlwKcoMnUR1Y2+1iq1vLkfjDybm6GSJG443mbN\/zNsErK7SVGl3LWEGeuaDQj+a+\/KyFwX5fLWBpQF3BcQNmwpSqylQjlJdSg2cv1rnMc+7TCLjX3QBnskgYxP1jRlYE1zTf5d4U2Dfthgi2fRKyV8u7h+JkyLgQBzmxELUJAFqBOW71mHu99RvuMEfdSaTWtkb2NjATdRzlKYMbvaI552MMls4rjgUG1HSL3rPekiKuaGjAyDW5Vd0Lgz9KeAsNjcCfiUK85SaRLyT4m3CPd7Ny9RK1EVuAk+YDIQrSlcJLrjBhlZVahiXqrnpkfL3nfHcB\/tPJ9AAliXstklixBeMen5QLGfyeSf5Zl4QXAfbSNTBrzPVMXKgwcNosG6Q5Rg\/F\/tF9WwW9h1+nQVgeZM1phuffm3vC8kRoU08TQewTjxNyQCz\/F1UgtnW9dBh2QrM1NdVsc\/FwR5eYjDxhHZQymRMwdvbPtTorcEkOIEoeVbmgejfnP41VdGK4K8KPS9\/lExv3sZnKU5cuW44\/5Y7ek1hnUPXHGMPZ4N\/obkWxdcdcBlFettN0gkBeR+zgPUzTzFONgwdximbnLvjE3Mfcww1fhti8\/OY+UE9P3gjRgL8w3AOtbADgSj6Q+4V5gs1A1+aissTC2F7X+NuIZZwG9JCOCf8Kn7IpcCm0nwINjzZV14kvWN57vrz3ESuejv0BrMdSpt8KfcEIoGOf7O\/xrWViCgDqKI1gB8zpN3HyltOmsa7TjWJ5Ft0ojUIbZV8gsqtTnuJqS3YJQ0Yr\/Me7NrAqWWpozBz+iXS9SvBFXMbvGYER78wifhn1ylAU5t6J5mXjX7GwrXDDMuO334+LyTbtBXrg\/ptpMvum32\/qc5BfAs54uIk4nDI7J6dLe+zWnwV6AardbG2Cq70nHVBQm2gFt0q+AevgiFo3\/MYysJsEvm9BDzJkCEe5+T7NTthBFUFfx0HhGQnElFK\/QY1HQax71KGIUVkTXIMs\/FMSyIx1v0U64sq8GxpA4NL4FsvjYr7IPrygMcnH1E0g6Ju\/guAvPw6z6Y7Q6+p54cCZKW3S\/o\/vPdtCiBk9FTB\/ZHTkKTqhq3XeQFdLQ535nZCRWxaAw48tHRAgdqGJn6xONgrMVKJtCGeMF4hQQSu5P68yILuRDkcWdAaTIxUWUjU2vba55hJB3Vp+y+l5im+UpC1GoH\/VvK1Ir1dIi3P5nh0jqz\/66opjJotqIKMG+5y38fw9Xy+js3nwvP3gdIPOKxWXqA0YJnVlCsEjfz4Vdb9kYsAumId2g2Q1sgmP9Cp0w4OWZVLCsVS4m1+3+DZZWNWAeT4BaE0C3ou\/WNLedLedzLwf7YZkNck5FJq2cDbZH4fHscba80WtegUzopF4SOFf5jKtJafG3Q7YfWd03GGX7ZWh2i2fbufZ\/SW720mm1mBVJ+rfM2Cgu1sak14Yi8WmQ54pGOFogLXVwYLIdlMDeceMl4vl0oI\/wgEBGb8r\/jUX5d\/ym3tC42PRlrMjzEwBirkrsK0jvullqCQ7x\/ywd6gEuzxfin9svnChHSCct7otBNqMAzmah6E\/Aw7rKLhwWi0U0zAlsDp9YkULYatn3YfkfQLohu6f5zxUhZ15Kgi5jtTx2DAaf\/YMYFYr6srhWtmeM\/R827YcQ\/xQqQ6XC0Gs\/UC\/zzgX2HbsDPjR4v5hiSWB\/m\/rfPXvf4R7Q1BDSSY8F0ZKMwOIm74A5cSVEkH1dKid4GU0h7CzhBRDNdAC6v9bfFZ4NZzp28ObdaWfw\/0GYErxjUpPPLAcQ1oqfEskwrMi04CNBQ3sJWrayun1yl1UPj8k\/Gi1oT4FqTK+Jd+4dIj6Od5\/IF3VGLRLd7RqnxEHSjq5ZxsbPRgLy1cUbKPgCU4\/crzQycYzQSh8nb6MSK+naZY\/DwIoco83QCmk6q39k\/9M1TzKROijW9dDufZGP3yqBGshpHZ0+AQv9sGkzepAZZPmD62A9T+LReIP9gKXquKfkqxVvsVMEkPaY7kMhThVjROEUueZJqIb++lmM3kU25fTZblC5Slm3oRA1Wi1kd7uKMHmgM2zpoWvHrQUXZTsKg+TVsScTsOHvRrI7diyTSC9LpUjD7o97OeAHm0+2wre+Ks0kLa62A\/2chMqwW+LTIP7jM\/HTYHY1+fhvRWNCK2ydFhvZiVQ2bgWb\/iD6gr8yFKnjHIezYXRUIPvFf9JyPQLKL7RvCEcFDC838NysULdWZAS8oYRC+Jyk6vhzOMz3Xvo2o4kjzE7leoasCXk2i2LGB8np++8t5pYIMXgY+e5B+q+WyQlinUKSLgGdZxvUAhNZsO8vhGtG0L2E\/r22YtEWjPLo2RilkwUcE64jTpQRWIbeMSqo2NahvvCZ\/eRkInmMFQnFNaifqLQvhuM2fVFnHaHT8zZavYQmnZkwrpvuA2cUWrbsy9372u3lgSCRkvJnXuvS\/Dk9mO0mc3fSHHgAnQRPL1MBpcai2Ve1XpYuS5wDQX+uPGcS\/XPvkPejErH\/tM1qaXStNHT3Cvndf+sYZXmKvd\/ossM6bs45WnwhIxXcHNGKxS9p5Vu6LP4dLQuZrB3u1bVdHLqeFs7EoqGqOhH9\/6JaamKOs7GVW0U4k8SyC8436v6brzPj+G\/r4y5r9WfDlCZ3I0FKx3Aesq+S6ToqgwUDqoANnvkrcKJchEpIUuGRIJcWfllPCo7H3RFuSWDC4n6uBLigeyP\/XSabXyYQ9HhT3dtmuBem0szGGNCGY1vOtXN4NmvdKkXoz9S4YlKqeAE6Z+HMHEQZKS4tJvoAml0X2XlNdRIZ8ZoIXE7Ix23t3WQcNdLQYasaTd7rjtDYCIbWu\/Yvo7Idhsien9soxgwDdWqQu4LRxXdmZoDJBnMW4zpxqwihvEN0eSqF9Am6zIYpWIk\/zenZT9P1flYgeZRIPK+oMSwYo1HcBx4lfFm8t2sNSbS73HSYrVLG3LVOUeAv0RsEPhU1WE+r1YP0MgQvnzG261zuCbAtGxwbF1aVBMnmfCVDefm8pKBoHFJ6nX4VmrDLJuVhggOdGXsEmS7wKrThSiZ9lPk3Cubl5DzHZOVkyZx4m9ZnIBSwsfjGE2oAl5K2hqg\/mNNQIIjfubcW1emc1VM3rIn89RfQ+fLRjfrEjE\/RTuJBQ7n1pCfP2r59MSI1jfEXe6Hy\/A4arYKN6L8txeIvgiV\/lgJdK31H7Yv\/87eTcyLRqhyS21eenTR7VVjOF2Hyj9G2kcVd6rRGwU9Q2vxZ7PPINp\/pj16Ev8ZIxK3MXy8oYYMrVyjnlfaLNsrqGm3fHTNvwJeee4GrXsI4T6pjuAr02F+qiHCLeX+8KrGyUjFjyQzcC8JhMo11kUHLsCdmEogpjFkA+juM+4jdWx\/XvWx231NDXxKmiqcEH4DsZf4Uz8MsbPKU2C7bmrMpKh2fXk3g9aPsIpWGvUu+ASGMqcgdLVQVYfu\/CXqVDgqJ339JVbg==","iv":"dd89cc2c73816030b1679d37b2b22deb","s":"f1cdcd72f7b4d742"}

Sports is a major area of division, with the wealthiest having far less interest than affluent consumers. Image credit: Tag Heuer for the Asian Football Confederation

Sports is a major area of division, with the wealthiest having far less interest than affluent consumers. Image credit: Tag Heuer for the Asian Football Confederation