China is rapidly becoming one of the most important luxury markets in the world, with more than $7.4 billion in luxury goods being bought in the country per year, according to a new report from McKinsey.

This data comes from McKinsey, which looked at shopping habits and economic growth in China to determine where the country's luxury market is headed in the next few years. McKinsey's report found was that China will soon have more millionaires than any other country in the world and some of the most affluent households anywhere, making it an extremely important area for luxury brands internationally.

Global growth

Any retailer, especially in the luxury sector, could tell you that China is becoming massively important to any business’ global strategy.

The country is undergoing rapid growth and will soon be one of the wealthiest nations in the world, with a large percentage of that wealth being held by a group of ultra-rich consumers.

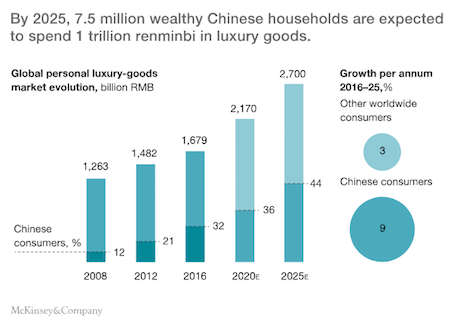

In 2008, China accounted for only 12 percent of luxury spending worldwide. Now, McKinsey estimates that 75 percent of global luxury growth is attributable to China and more than $65 billion in luxury spending comes from the country in total.

Chinese luxury spend. Image credit: McKinsey

The rise in luxury spending in China is the result of symbiotic efforts from Chinese consumers and luxury brands.

More Chinese millionaires are coming to existence, leading to more interest from luxury brands, which causes them to have more of a presence in China. This in turn means more Chinese consumers purchase luxury goods.

From 2008 to 2014, the number of Chinese luxury buyers doubled, showcasing just how quickly the country is emerging onto the stage of global luxury.

By 2025, McKinsey estimates that global luxury will reach RMB 2.7 trillion, or about $400 billion at current exchange, with 44 percent of that coming from China alone.

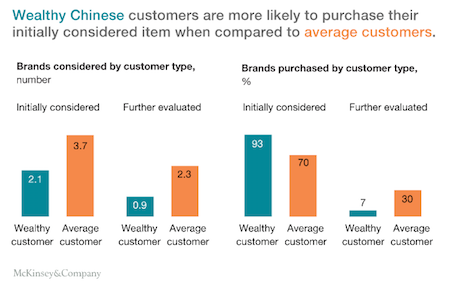

One interesting trend that has emerged from this research is that wealthy Chinese buyers are far more impulsive than the average customer, meaning that they are more likely to buy a product within a short time after encountering it or without evaluating it compared to other products.

This provides an ample opportunity for luxury brands to have a more physical presence in China in the future to capture this impulse buying segment.

Gold rush

Luxury brands from around the world have been scrambling to get more of a foothold in China, with many seeing positive results.

While Italian luxury group Tod’s reported a 2.9 percent decline in revenue for the first half of 2017, sales from China increased 1.4 percent for the first half, year-over-year.

Even though China is placed third by region share, right after Italy and Europe, it is the only region that experienced positive growth, which means Tod’s next task could be to figure out how to discover the full potential of this market (see story).

Others have been taking a more active approach.

Impulse buys. Image credit: McKinsey

Kering-owned label Saint Laurent is enhancing its Chinese ecommerce capabilities with help from online retailer Farfetch.

Saint Laurent will be the first brand to leverage the newly formed partnership between Farfetch and JD.com, which allows the former to benefit from JD’s logistics, marketing and service capabilities designed to cater to local clientele. Farfetch’s Shanghai-based team will tap into the company’s relationships with both JD and WeChat to better market and sell to the Chinese consumer, particularly millennials (see story).

These efforts show that China is turning into a major hotbed for luxury involvement and smart brands will understand the massive importance both China and the surrounding regions have for the future of global luxury development.

{"ct":"91PZJ4wslZX4Jm5S5BSXZlQch+8Asf1xyg1+FXmCWHsmMNN2pp454DwHLz1bgR2E5hEHEQHlbV8s79hT1K\/5syZqnQ0NgCgCAVCez49UtoxHlwGe2H+fGbSrQ5zRhH6U8pxOI9wISNj1nHYejj2FuMqceQwhiynEEx8fBibzQxeF6\/Mc6anJst2MbnYbt6lrZxMfwYaAyVaq3RVdJEwovzmmKC9mBiZeBYAMM2+6phHNBe0agHKbaowCOOjX1uMSm14yz9TtbZZV7CkXuNEcbxsTS\/yC54KlwQ5uDjfttnJlGqKPAWJyI02zaMz+eaHxWotn4D74ki+5pxsMoDXQ1Pp2AimzObLT187oxBu0q3ADJtQf8tJt2Z+wzSmws9mO5g7Fsp9gWV0m3NEl18+88oVeGXaSRDuTCTbHT40ZqzpH3TmePHK9mByU8Hg170y35XJk1P+xRmWVEzIEdrspPZ7RpgBpC8nnyfKNnNOHMMj\/r8AFv7XZVzlBtXF7Y8lEBfE8\/3pOPRFet4MpumSCZTnnY7qRs3FxHd2p6wRiWiCmZQ\/lRoWg48bIyoyfgrNS4rvcyuq9YVWlOm4nR6hhm\/\/Csln8siZm9g6SmSy2E\/XqZuXKzknqBXaIgHgF0jZSHwSUmbfeB83L6MocjXre3QvN0on8sRp57Y5uoSCFVro3ak8zMJ6\/U0whK5dnxaFdHtZ9LP+UWC4f4SH55J55NZ5CxreKZEHWV6Yi+Fr3Q+IPioetTNP7uETscKngRDpPZEEN2EBUZNKvVjGHkDRvQKdM5TrHsVlkQDRU8p+AZ4lsZ3iN6HAopkOerZPxjj1fQPnj\/Dn\/Mjmbv4fp7OU7WpI\/ODZPul8sVAiidZxMNu4D\/mU1msnGfm0j0olvZeV87+8MViOA88UZ4NxldDRohuF+TiZa1dtRbq1BqlrX2JLRL+PpnidaYKsUV6QNfAaX9mOTukpgtsFwPY10C3lOhLeArKmTENeOig\/QlRaqlze6RAC63T8ycC2JrU+1ehQCFluUL7J\/PmGPjpbqrEK04nO\/U1Ho8NMuonyATrqmVbCxnuags6s3ws\/WA0BwK2nXrqIV3n5y8dJvAJv8dpNhHf7HisYjEA4wykZCD2BOAfLly93fLJO6kAkKMMprGmwunb2fiQoYDDhqLrJ3JTi4rseoRX8kvFCKM1mGx49yVNBhEiNzMSlTmMl30+Cme3iw3kBXalqXb+zR5vhfQ4TavKScVjTAWTOaFGTbMFrOgHVGPp0JBC03pOYI1uS154FqwRWEbAJ7Nl\/mmRaqcvppCHTi6HM944j0l3nWmDszZCLctrE4TqTvlHEHKCfeKB9AtPnz74rR9cs0kkVWu7jYtSEu8t0jf5VdSYE7apxci5ZEpiuqJ4Nrpx4ZmP5IIZcftP6E1zlbN8nS3KX2hGuqNnTHDuDKJXFqaxXYSixZrqOo8tmstZG08kVSfDKQOv1DFyUEkF50VAHSuwEmdr7B8mSxtw\/DVAEhEh9G0tvhJX7PNsVBmw97qRknHJqWWXbn6CVXTAakzoTaUs\/dDGTeERktoqFWCbFDgkzHhXPNvT8RZrZkZabhBJ3Q2Vj8GeCRCA6zA4zC\/GlqbjiUQLUPMNBhhMAL92TIdsLVoN4y7Ucp1AzrTFbjrVPVW9g98xL4CdvFpyBt7TmCl8uZ7kVq2uam99LgoiDOWKYII6ozDzHJOp\/odi5ybG3BfQAaLOSwRTXMYlw0gKexZbWySAVlg\/24Tm9xLTjrNoruMN+MWvjWQbJc9258+VcifQF8ceb8FVR26Ymbt66MgUgXeRh5+su+SmF2uK5PcUJcHqNtZ780ycIQBf31H21o1FmWxrhhn19DIb5CJX7f1WdNO0KWIpuS+XfuJ6bLGce3mE8TQJSSXTZU5HhKMWBZGAlKslZESeAk03O23bNf90YPuvESwbiH5VJ\/E5OwUKRCS4bBZiLp1PS9RHiS9NrwZoODLAGSNoNmKcqOcxFvtdX41QB5Q3eIhs5hlC5UQtG0\/FmKz\/K9JUwLf8LAFmGWYS4Vpd1KADAV9AEG\/55ECJAnlGykJyAVPneuGEDZsWOleHiAZch8leWxU5RtG+c6Hicf8\/oEtGn0VhGfiXtRHXoaKv4J0YFFyqRkGI+cDKSqP5uM4RJXhEV3wJqVdsBPsE9v+t9E1nySzedotebsSwCX7B8p005\/b8jkbheLnzoiwjXwHV0PpHz+Ak1FM4qbXrEiX2jmyf0hirRW1hcsoGj\/OmKHv+JBqStfmSTBQucbyuXWKao7ruIuldmJfYuEUr5oXViGMygOmFM+G8ea6rrHAsrfl4J527LUMZkX2uRjFyaxrEZ9kBAvGYMdzE++AVLwmCeUaeQoz61EElEalJXSn9na+R4281FSPQBpMwIlXcI\/r1rRWfUcedAUHPiDFpIvK6SmDTQI521qR5dLsFMoUPOXqmGJjAF+xsh7KFOO+9CzbGf1IYebkYx6xD6erVZEU7c3o2tHYegA5DrkyS2clBaUCi4x9bkA2Hp18PXgAhWcXqRqyjPitYcCVPqe7AevzqVojRyyNHjv2rTyoVaGonCqXSNOchETD4oXPFFFhVWQH7udy\/Qp+EEr9cqkIAmQGDe+\/Sujb8pogAHcXwaCQS46CWF1FS+uUSGu4+t2AEfz5HGGnfHO3Nf0B76qD\/v84Dj9B0OWVWV7myTJsdICAoPAzRy6w9qK5blMRQP4M9aegEHE1IV5JmF5rgyMSitiGq+0LxoVBmcMFJiPN4ZlJK27R7jM51EZvp5oHcSRL8yVrxey13O+1HIN\/KfxZLENJgUZb8YBYJgd\/FwY67jClscafWSaAYYavL4dG8Gf\/a49EZ6NdJZMANFCWMxFuvwokpLOjCAbCuEBuNJNi3ndNkg+JK+MtURzVVb8ZdcWJSFLS2KLrwA\/tBk\/Fm2yk058pzvDLa60ay8t2EOOS4Sp5aV4BBJoTah70uSorFp0oCv75F\/Nfhsgnyk+p1iN4KMp\/+k+jPBjUeYUNjS+SDVKXWBijsx76KhokqQN2QdWJVUbrwhFgbOWk54ozgms8mh6BBngungiMBKG8wgRVnyE7YZGu6RJ0FNU3q35vzj36ttYoI8ib9510KYrd1JpeXkkp\/FMmC0lxfMbzUy1VOzzVR8R9cKkas5aTRCOKGpvL1cQ75ogJY2rIiEuwJJ\/FWwDsRKjckF3uCI9og6L+hFeVpYgBDbhqr0hx6nLeSzVf5NBV3Rwd\/1VnZaSEx9NmuCTnwC5Uml2UG6uKudSO4VcRhDp3YKFpLkki+Jz6FUN6hn4VTFqBzz8SH19odEDAWXLaYsM1VKRWU7N7QUkQSeH0VfrX92DvpPfQti0zW0XCEM4tjUB38yBeRvzzwWMlWs34N4ykEKhdqhC5BCuTDa+9F70c4ozJQoMR7JFvYb5Q26JDcLrGrrDyabmtQMrRgc9zH+fS6w8VFbxvTa8DIfMgfBLYm07xL+jJVv83PFCaszrIp9xmPH3ect9soKnXSULz3iJeZH9Yjs7glHLye\/y+EWhFrfmEwsjmp446Xj0FSxvc7o73Vx9Y+IRftW3FmsLTEtXXzLBLtSG3UWxLR0q8Qk9WLs9tDb+eHZSmpr9a70yK9oeVGVdHL0sqraNCDFb8c4LsvvyQeml7huaJ7gnm3xiTgKMOsj80T3Cq9z8YFuukNWDwTkKTeNvNosWoVBs\/bc5Oob1wbiUxAaFLmnS7sfxUhyM8Iuhsfbhu3QUn0tgALmZqiX79Q6NjIiAONeoP0zfle7geQ92prscgvyAOBylwpC+qdwJxz52O96qRV40XfkaKmDHDk9MaLiO7SctP8sOPjRd4ohBrAF7cyrZNoHeH8mtnNzBUH7qkVrEZF5y9YKU6b1po\/XnRa8a39VVSp2g5UhHEEe2kREv+X0lc7lrkiz6BjqKEBMyCYcbNe0UwNFrAn0YdeNFo4BC1sRF3YqmygQhKh4IchWS\/SKf8ZqmXsd+71YuKhPIDelfbGhA6Y1I2XJge0G+nQHOx8Gu02zXUKftZ82s29eAzS3YXPeeSMx5+hWg6CVp4C0P4cUTsvs5Nd35wZmr1k6aMCfj\/nlHHiUUm7Mk+8f7yoO\/qAcpHT1gLSofGpjKLeo5cir\/gQ7dLH\/9tIKjDS9zzh5PX35LH\/p\/DmwpvMnA80omDOtgBgNn\/\/3XIYNACPsEmjlWz\/VAhfLY0WhTNFlzeLhRpypES4MUahhiF2t8MUXGgF1lmW5gbD84ZUWb6egW9WGEI0N6Y5HV5YR8hwKmCFt9Ow9I\/ZxrMns8tCeB4G3BVh9kAvlqYL00fBbRqZddt9FPn9SCw7Q5rZJZM39E2HAAclLhQ\/M9M1vgpE9v7Lbydr3onJuVN7aRq4+bbORVfq5YniCBJK63zfHV4W\/Qy9GMkI+Yw3jM65QZaqh\/Urse8yLxXZLRI38q6JO9FKVp\/8RwMJ3AaV8Z1wyJddZw5APGO+qahjddtb8Nn\/EEFtupEIZ3QeXIHcBkr\/Z10X2ls8gFsD96Gszgt\/ATJHZEggrzH\/r3YZT4nHx1lH5\/dnBJluTsEO0NtfI\/tcdDAQmvHndb4Kf27KZQFm+ostK80lMi6pVjYgJ81Avh+b8xWO66cAmPrVQwadThwGItsFw3N3vTfZqGWGfzJAj4vwYejzqo0h7zo2nEchSnx72Lg74IRJuF\/kqc3e9hN07O0m++IR5DMUQYqvfkE4Tg8VbAfmOWL1Q6R1a6kBodtG+JX0Ydj2ExFXPowY8KAS5fuXTLBN44bsyhkeNsPte7Ns0ZQl2XOFSXeqJ+RRPs3jh+YtVnhdNjEGgJ9jtuoqT+ztxYCr\/V1wkRb3zToZ0\/HQ46V8tj6bAZ\/Sdj0yujZr+YpUe8paIlVt4ChIx8Gkohse2HIUZYDOQW7W0MOPDUaLHQfXIlsEVVv2a\/W8Oz8I5lnI8a9xt6s5gxEYCpB2FdX1Oy1qpxDDVWu19r3xw10iTJ4XXC9X1OR3a71OUAsJ52yp6371LbYmlAuYprRUckBPQH0B3MHZt9p+ZNUOsrCUVbvVXauzxRpaB528Eh1nVYwMQ5BH76leQOF\/39IF6ducWLKyERbnda3szL8b\/VUGIviw6NSyjr0Hlf5asrl26wFPbzYVvuML+spDOAaCeeIebGMxbRDnQQqqZRN4KQAWAz4SvECTnc4N+ynAjQuIMj3Tybnta8xx7VzrGFvTlAibPfqPM0XTKV70ml+IxJLevf5kWJKAqqRegdjHhmzDpBbijm+P13BYTeBsB\/Xkqc9onwohXfISCOIIX6hPTglfQHri1LtGxzU1j0onejiaQsqHtk46iw2i0ZhpSFO8hkKI62YXLSfG\/u2AL8eIz1bUST68vjfDkQscVU5C5rk24EauPmnSAM3YECsKJde9\/uitN5w84CKKiCfB8ebds9iLoX86wouJC58QM7lsALM2PJiSAi9zK\/ELOP46MRRG8dM5QD5KTfTci1RZhH5m3wi8gRldjn32ICfG\/kJ3YsJE75xLTUBT5aIB2EkW2Rxf2SvVUD5KiEsL794QMJIKtpGcfCOh1yfVy\/wh8I0h4sXZA8crEN21yXX2K46G1xX8ksBdPK4mC8gaqitlcq0ZrT3kRWXjw55Kse+BmUuRVYQxQ3okr6zZ6pSmH\/jR1kIyz0VHkeN43wTK9wFEhFrbMnU8ks1LfJ9djudU+9h7Bawf4pOi8\/VnHHLyNKZuG5wdeFTsvGELhcamfdKPEPeXbP5CBeOCTRNV2IYK8gp3Gz7dNR8lwGDkFiOezfuaBPrkaRvLhDzSAhpsy+ACh9C1AoqmsWrlbFkOqX4pY67J3bQg10+M\/cAQEKDUWSrUbA74AYD+x+EdpU9mpjAgyUxZmr0OLVYqzFnAYgcORWGSsB60M2jT+3GyRuPE5N4jNj7opzQLuTWmyrjuoIhYejm3dyW4v82r3m3ViclvBy34vDFGipMYPLguIEDW0eMik78NSuVKicmozrcixiitkm+ecHhEftkJnkRzPpSi2VCvrkMH4CqW2nCX7CaOzEaAfybdAzvr0rfbgBpLqVEQKo3rW4+9lmfyYDhb\/bCkA62bq6ol3z0815PUd1aVLebmP1zkCSiRAoUhzuxMENGEe945IRz9CKJ2Qv1pWMfGV5mx6uzgpu+OnJlRmfdqzr9qWijmMAJ+hUbIoT4DKMawc4QXsDUZxWZmnPg7ORpt7xej1GYxiz8kWWqczJwlWk18AkqS+aVBXZ7ZYg9RCHD9FLbc1OE7W10AzYIg18i8sOp\/Yi6e+P8CHhmTrx3tLZjBPTsJZ2QhH6O5ia5Wkrln40tnP2aTnL+Wdv6B\/V6Xmu6DGVlcQI+dWaNIAWZYjnnAtsMcR93KnMJpea1POawT\/kfW7EhK36X8tBTxvj3GD9WZ7Zm+yI0wDakOw4Dw9TRpRqXX0vpEKmgu\/FPDXclYG4YlulzCbVUKxsPKzdsek4t+CJA4oZp1qqGkqT35N0IuuOfzPDcZVdxkQ7hRTvNL2xFfEhNmbf7OpqRFKZuxlGcxaSPtLLq3YxEFh3Ko811+04L1p1C8WpVO9lcgMaQCk4+5Kpgd4I9FE\/kTLzF8LWJsv7piv\/1JrK1lMZI0lRzXtcYBauN3M3dzboPYDWqQBP3GsunsESqvZDS6f9Lhgr9A07yZLMuC1+DIYlFA86sxH9i7OGEm0AXTqY\/SNUuyXOaPolXqJ8hJk5fCcg8octdnzIiz+mJkJNP3cMz8Wr4cxbRMQeVtfsbaPp6cff88DiMgiFbwLCwHcNM54h","iv":"7c5bb3e11dee391637df615edc3355d1","s":"361c95beaba74810"}

China will soon have more millionaires than any other country on earth. Image credit: McKinsey

China will soon have more millionaires than any other country on earth. Image credit: McKinsey