Since 1999, the retail industry has faced declining sales in the wake of falling foot traffic brought about by ecommerce.

Rather than fighting against the ecommerce wave, a new report form L2 suggests that retailers need to embrace the possibilities of having both a physical and digital presence to strengthen both entities. This is especially true for high-end department stores, who tend to be less digital-focused than mass retailers.

"Luxury departments stores have a few nuanced issues that are specific to the fact that they sell luxury products," said Aydan Sarikaya, client strategy associated of luxury at L2, New York. "Specifically, distribution between department stores and some of their luxury brand offerings does not allow for direct to consumer e-commerce.

"When these specialized boutiques do not offer products online, luxury department stores, and the brands themselves, are facing a lack of visibility within the digital ecosystem, especially on Google in terms of product listing ads (PLAs)," she said.

"L2 has observed that these product listing ads are then being targeted by resale players, especially for luxury brands, whom are encroaching on the visibility of the brands themselves and the department stores where distributed."

Off-price outlets

The retail world is difficult terrain. From competition from ecommerce giants such as Amazon to the threat posed by counterfeit goods on shady online sites, luxury retail in particular faces obstacles from all angles.

L2’s latest report outlines a few of the ways that department stores have responded to these challenges, and they tend to fall along three lines.

"Department Stores have been faced with declining annual sales year over year, which can be attributed to declining foot traffic and the expansion of pure play e-tailers and resale sites," L2's Ms. Sarikaya said. "To recapture marketshare, department stores have deployed a three-pronged approach comprise of discounting, improved omnichannel offerings, and leveraging off-price subsidiaries to acquire new, value-oriented customers."

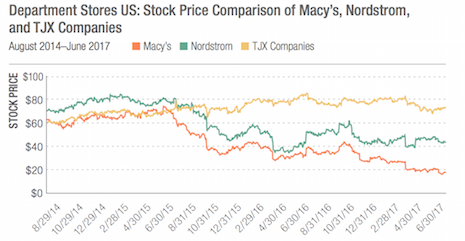

Luxury retailers have held strong in the past few years, but have taken a hit. Image credit: L2

Among these three, it is the last one that presents the most difficulties for high-end department stores and brands. Off-price subsidiaries refer to discount or outlet versions of full-price stores that are owned by the store in question.

When dealing with off-price subsidiaries, L2 suggests that retailers try to keep the experience between them and the full-price retailer as unified as possible. For example, a combined loyalty program that rewards customers on the same account for shopping full-price and off-price is essential to keeping this parity.

On the brand side, off-price retailers present an excellent opportunity to defend brands from resellers, who have the advantage of being one of the first search results when customers go looking for cheaper luxury goods.

Omnichannel future

Resale has become increasingly important in the retail world. As luxury becomes more visible thanks to digital tools and social media, the number of people clamoring for luxury goods at a lower price is rising.

The fashion market category that relies on consigning high-end apparel and accessories is witnessing a period of enormous growth, outpacing the full-price segment of its industry by 20 percent, according to a new report from Fung Global Retail & Technology.

The entire resale industry is expected to grow from $18 billion in 2016 to $33 billion by 2021. This data comes from retail think tank Fung Global Retail & Technology, which released the "Fashion Re-Commerce Update" report to dig into exactly how and why this sector has been taking off (see story).

Additionally, omnichannel and discounting will serve as valuable tools in the support of luxury retail. Omnichannel in particular is one of the best ways the modern retailer can engage with a digital-savvy audience.

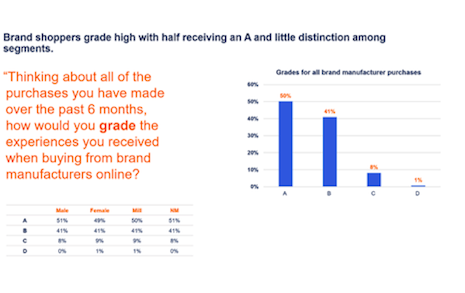

While digital is a vital aspect of retail, in-store associates are not useless and are proving to be an essential part of the customer experience, according to consumers.

A new report from Astound Commerce shows that 52 percent of consumers think it is vital for store associates to be able to place an order and 46 percent believe they should have access to inventory information. However, online shoppers are having extremely positive experiences as well, with 86 percent claim their customer service interactions were great, and 42 percent saying excellent (see story).

Cusotmers embrace luxury shopping online. Image credit: Astound Commerce

"By deploying off-price subsidiaries as a point of entry into the department store ecosystem, department stores and enterprises are able to acquire and retain bargain-oriented customers and provide a point of entry into the department store shopping experience with competitive digital offerings, such as enterprise-wide loyalty campaigns and omnichannel services," L2's Ms. Sarikaya said.

"The coordination of loyalty programs between department stores and their off-price subsidiaries can not only assist with bringing customers into the fold of the enterprise shopping experience, but also can further drive repeat visits to the off-price subsidiary, as off-price customers are inclined toward frequent store visits and buying a wide variety of product," she said.

{"ct":"5bVubkq2+2BYwakCfYgAxBNOeJ6+FIVIE3T1tpLy0SxbjBOXAxSR5hBMWj0zdSOfBBa+MLyOeyEeqUkmKJDK0\/hvhA3ZuMRd9vRr6XdT2F7ZoQyIVb8\/uJGOjnZj8dLo6dnrQkJtDzpi6GdDP7fUmVn86M8\/vamhD9KJXSiNlFARpDMVkAUgvb2clTOQxxE7Ge\/i6j\/++nYTvJGkkp0ekC9YS4\/jr4V9LS1ao2K12RdEMbmEt7VNCZmJINnurch4vN70JGwfmoHZwKm0kGl3zYabKlNudmhxvVWYBUGk+NaGlT4hKkrJH9iORd9nV6bu4KjuOfesrHiOH9Bi\/gdJzMTnJhUkDDfCOZEj6v4NMHNAgQ20iIVgl0UEJyEb5rWFk8aU1+9\/msT6LijWbUWKAu4GwIeDnUFJC9+QtRA4Xv4JLX1YuDg8Hp0b4U5Qj+ehLDhZC+X4tgHqDts5Li+Aztpnzesn0SHqQudWoHX1jnpyt8Yokn2yQ5F9h2OsNlol+W0Kr3IDMEsKoXVPgSE\/lW\/2L1inAcHFPjZTE0wxlUhfDbLGrOuYGGM\/WR39uGR9KnJh3eGv12C+5yJSCpgXHMauHKkFr\/JiuqScLofN54urtpqmpcbp6da8+\/s9bCHrRjrCLY6KMEaE8U5eIUPTsQofRm1yhV7s5GxYkKvKGREcM2JJGUrA7xeeB2o7vk\/8f+vK4wrEmNu5oKn8gcMplUnuPIT+la3MmLtJm57YVAxo2hpFr4WvRbvTAYwCrxvzOwz2TpVwxKgc1hG82Ed+a1+B5mz4byT5JXF21MFDqpi7nimYEwoy\/4zSON6MqIyH3iyVUM6c3f+MogruFyQeZ5L0tASR+dnBaHCj5n8rCs6GlbMITx9bGsonyIbvFh7zYd4t8w\/YxwhszxWUSzxdua01s2Cjm6HHX1Z3M1cJz1wLZXksEtO9U6lcmOb+B8wiVSDqES7IMdhvE9UfSbabbi3bkludL3iHfnlTOzLB8Ycth8QQvH9AJYsM7OvMRNoYnsOTVa1VPJ8In+qPkw9S0m6Pp+DU5nzFy5YBmJIEdCMssAb7fo5veWTLAHCtRQNacYVkIE6o5ki4tqieTguqUd65SrmRsg3Nb3NtQ7W1VVk4vlSM0ONNO\/eL8p36hlhlggI7E5xyy8lZ+dS2y+0oYdONCFYP1vTOGZdw8Um6ekHXgvG7EzsCOC1JryyRP7XhDJAIUpjbtJSuk2nlERIpaakXVnBNlbD+Ewa0t\/4UXUoMoErjVNHiPKv2RvH7W\/eHh5ZrPiInGkj+0NaghY17LJMtBQrUBxUT0xSKjtY2q6URdlVXOHBLEnOWzfqAnbhT9\/06CfHrFmZ4A141JonmGYIIIYVTISxyWUnOFGHiU48By9e5iKBT+HAC0k9ch39dtpnLtbZFGZWBQ3bNNAO+7zWnYPPtM4\/HzkyoqQ929ztLwVWh2+NTEJovInpgMl6nY3+ij8gCZvBIanBTqOB+GIJDICdLbSFOpZuGxIGRRe+MJB463RfIXhjB1UInpsiAbrnIAmqEP8\/s2j46JB7+RSqoE099UzCi3+YVry1xxCTDKFMOuHCvL6MVBH4PDT6kDXNSnjzyvuof3HcSyUhYBP8aLqO+Fg2G6g+nXAiuci7XjYFicO\/cyO7VpOuBAN3Pes7odEiFVphM1kcVZB\/gD2pr19ZHi5LeHw4z0zUZ7a4iTkzwb\/Noks36b5A96hgakzKohbY8zvyHFzNAQYsfp4o+HCfxM4XVZnKopRY7AljrvHjnmFBN6sm+Q\/v2q9o\/t\/sWNxS7w+X2\/l+4tILyJSGe0va4EeEAbisVFa9vPdjKInUfO1djKvn8Y1VKgrHbk2\/WVqtzrnalSjCMCgxXlTyFz7I+UGxr+1qRMsztn3zmTgmJIS0Efb1onNM1QnhRLdlnelLWmNCWiUWrUlDG7JbtlAEZQxh238FzttWz+jSnm\/YS+CwjSerrIvTHy9MzMW1dxVFboAFrWqK6AmW7s06zOd5xJH4CFmXIPVhpuOONDhZr5AAoWSFUTFW3EletYLoxNQA4HefYwfcXugHHOFmu3WNa6n6YqDahrigSDkYoGZ3RRWZXqlepX8jn4RtKjpozyg2WKId\/UqQM64nooBhzLhdp7WLtCtOi+OJhwSneurlJyjwfXzpjuR7DDhyiKSAzxxH\/VWBjdlIiDX9Mw4CYDlkIfr2lfMGauThbFcXs+MzwIChJPfelNwCOYxhE\/m4H3MRvMUxUvj5s\/ofFWNzRiwJwVXbW6T7qrxfkVGE+cQZ1X0SHjyAYEhsIlaXe\/HVFdDHN458WlNSc26SsUO03jOjgy8Bb4pbmBjEasQnYnc1ABSd9ni\/GQ1+vRxZEEmBgRCs2MW2nL8xyZ135IB2FvxeCH\/GAB6sY0DSJNayP\/aNzzw+j2VRHaAcYdDthhqbQYJuOwcJVH9f2hEgufuyU5pF928k39SPWW2wmF1sQ7PhJ7PfXQvPkqqDUxAalXtmhsLmxDGssQNP2pgu6P+luHCZz6Nz+yVzWCO7F7h6s5jUrK+\/ea1AZ\/vJqASaU0xor8PMsvN3LtoCI9jWJ61DNe0c9zFLlJFbwPF0oNJxWj1bujFjJPcamzfnORDQd\/MNTV4f588Epr1xUS0ghQpKJdOGCCGwUcSfVAhSjoZ7Y46L4XvmKBCtWRCVTMPLYUpZYm\/tT29uGUVuYhLtcIe1Z4\/BFY4EENq0lspqn7YLtiFicoGPK4GJlanvD\/uccFV+QRRACHRDEsn20dXP8ittcLPcXonT6MZ1hDemLwRgIdh3UKlf5ticomUaqL1IDdqhrY+j1dpcF4O+ykP7Cw9SZBVCELQskB46DokCuj4gjVJxDhmt+ZCIt8E6m5AGsJwGrqSj+1xSswqxm9lHzXkVvkVrSLAeCimwXzzJDrOIaSAicy36gK82kki3OS97ygMNKZRGcD80C5M7dL8wce2lw+i\/CPJ67hQBTwJgxkouzsSz3eznqD\/K3piSH2Gta4ppfzCpZwgu3WEbc1S3UgK4Y\/mM1pJEGdrI3\/QWryCvijE9GH0+UYS1\/MTEQUMqt66BHbchMaDDUt9ytMUVL7seqSnsOg9S5Ce3QxXIT\/CrI1hIKNEnvKGMS8pz9sehspN7G2L1T1IfyEOiLv6\/bb0xiUtX7qbx17AEuszzQdGD3vqQIhdoA8FnsAPG2TYAG3LisRLUztYZkgjaEMoyYwd+8mTyC\/jCuqRFi2\/9\/fDk9YlADdihA1V6Q8nNjOhsjCvJRjkQ6fWlNEr0rHDnnrPXHP+SxMjhKH8dQjW2VbXsK96D3FeBUnsc\/7jPEyYPGHhk+eGDCMlj9mu1dCblHDldxfaLFIAbtyAMrLB1AjXTw8TyWabnpvDmz3kCiZjyEJBtCtoAZXqg0JAwsKzQUg\/IA2jWlluMFbbAquF8fJN8lQ17dX8L9EhLRakFMBynXJTwC\/dtXKvyOUoD1\/\/WZAiwRJpqEuAVzk5Wt9cHpzK1lAkyFhsnk1DzxyQ0ZicIvlAzVhs+FouyNGhYuoclupCiSx89cF6Vl8Su4domlLc+f9cHlKBUIuIhYxxmWGl3j7adkD2cHJNwt\/l7FHcpqLSNBx31DPJGzL6tzccRVfRjO7n3Wkb\/XE7YAuZZLq++6JWgPUOCu3iCF2UC+YfIhHYeIy2RaHilQC1pJfhMsvh+t97sxNQnrMhaToG10vu8otsajrRc+iuH9ca7fovRb9A9NMtd733rCgyL6CW6Qyi40\/Ak\/FXuYpkUO4\/gRp+Z0HlSPAKTHichhyPl+Ggue2QtoHvfBaK9\/S5JNi8ejgv9dYZ5s8AbTho+cR\/zWCByJgGWWiDkpL68qp+mApkRvnAMrU3FQw0vWwkyhj18u3+0FIuEfEiP7RXIOoxUI7xmWjAehgjOe7F7JTv\/sr8QfwBzBtMHhvkYgu1MIXPX5CBUFZEFwi5iiicyw2LwbzBFJeiB+rwA2DBL9U\/i8czp0KvGC8isZb\/440hOmu7HXdX8oSIcL7YofIjDeiU7qyPaF4wr09I4fwptZw6BSWTFHn66\/+mFKM4uf\/SBR2vsjqdhuGXum9EXi74ZyRE4tf2lLgGKktTs3aUV8XslCUXcI7tWf6ReXDUdIfXam+xdX7Y4pWrEdkYEfzgtW9QI4X8m0clb+i4nYzYFTiSeLVooYkcYoIuuYJ1D7zw91OApV1PqWTGmGvTzOsH3AizRn2GYewxu0wdjYx8UbGVIhiRIyio5tk6nJmfqXTpFtNmpVbaS9Mx1lEp60HreDhy769L9y37hscZN5ppZsyy3frMTDFi+B+G2vHg9Mu4PAgt7MZsjDgSoY8xSj3SvlEAy90APnPwVZnHmiHywwFStzzqjwLWhcjZmbcvyoaMMvTQjkp4EIac2GpQqy4i0uhW2pxpzngHczMsM\/mxmQsggA+rRp5HJmK+d6x3GPhhB+JdZGEmcLvS3kzRgUBGoN9ddmI2SyO4jojeDZJvFhia3GI\/kOFirormsNJ4R2KcjuuEGXtBmT+2bXX+RCFjjw09\/1aTQ6CuNKls6xvAgXsBzaBr0uthAbHazgCfRCjOOVC3E4hqoxUMImrfBSN1lCPUu8+dpwuu2hYHyseWVbL1ZTgH5GJYT+fvYOfCwrEW25YneMGBqoFqvLQcwTzPghDBGj5Haj3ojiJYF8cGscP3JLihfAS5+sSuyqPWTmQYjAPQHf6ljIeclE2dQwINpmbHN0qrHUaOyYHV\/fH\/WDvyTrZoC6zAA8Va2tKvPM6xOYCEmItXcE670FJsZppTqqpZwdpWuxNlmW1CgkS\/FayAGBXo7nhmtoRTSc+q6VBifx65cM1a8WMy3j32bCVIwFYOXMbEppoQHkCbKfHnJIoxAlIyWuQXR+pUeXvEMjp\/vdshwOPMK8NHzWl9S3u0IeBfflmRLbCa1R1Ff9BdQyoVzgptJ8IDychLW4LNEGsQRS1aPz2GbgKqWYokHY78b84RJ5wfRyi8t6zL0MH6jxJk86jc6NazNNbwFuHd2x\/tydZMmMBQ2Ve9sfu1AaSChqqikLSg1JMGWmO1VIfPv8Mp5nZPiMQDXLhYnnXvqX4p9sY\/BJY0PV4dGHwnYXF5iTWTDKSowWGW7gPrEVJW7EyJRHpMKummt\/EQZ6j3PMLRYkUAbCdHTVzpQ+PjhhEpf1Q2hSIj073f4sQUCd+0nHbFTKmqMtZISfDyZZqmC1NT36RyVTNzyWH1bP2iRaNa8yw5qo14k2dVKAdXYAl0rWIta602aKrKpxBANr9+aJdcBrnjwBvZ\/Tslz7SsM2pQFOGoPRXgHKKTqfmmShRorNGymbv2EMp9xesi5C3zXoLrhpyzFJA9RUYnqgOtttQWvVnJ9i65ar8Q36zx0hrLxVq9rPVW\/xSDAlLp1TY75Hu7EAjuTalOjnDIADTfJZItElOMFraUCEPeuy+kg+wYJITFCbldU5g61opSOLIFxOX93tfMrSrjXv2ABO+\/gqS3Ze+B25g3ZL2lr5jEd8fm1+OgX7clZJn0xOOFRE8fH8pGKf6fdRBqqf6gP\/6v5Ne03u1y+D63dux7RbQRGTafQ+D190Jre1DKg+BwRef+qbWzt8tqlRcgprfqWII5OCHcaHI63sAUakwX44bid+4GJ0VewbAEPFe+ys3g1NKK9MbBK+UcW0OVCymfWBnon7S5bV4SSLxVEitx8Ns9MlBKIrt7p3zUq0VEk9gpKogTqm0aNSttt3K48Tkroc\/oOFGoVEmDGzIDyW+Hi\/gb+YQsyrWtzK9zs6tWfv5QpK0qPjHLDRRyflOW4iUtjB6JVq4+SJzdjMQzQYUP1k\/IVNGMboMDYhUHO+\/z4raJrSY4ikKeQZb\/+Ht0WK6k9hxTqr7dMjzMnG1yewGrLMgnuDLXFmXxTv4xao46tQ4fmTUh3wBqzfn45ajVj8plFdwPki3+4Z3TQmzG7BUllaAhF3O4ZcnCFX6X2XE9NA3SmT3XIgI5E6uzXPhZKbVBAzdHsxDxameW4IOlBQngouf0WoGlT5N2kKRvXyZVaz52+g3v1HPncBFC8rtYr+Rlm1U0CyIRbw7bR2V8sYlbDXAqIdBvAunih6SDpMBLqT9fBOEkf6etmwtCn8SrwU0ZrhZjidrOKmsCagc1FVJPHxxrMSn4KsQn6onYUntFety4EIvS1zgd\/XAMQKRBmp+1plgTtk\/S1gZ0+4IyQZA6OpJOGw+BWvsGAA2FNbsVBWJmNCyxK4w6JQv1l6LLKH5eU3FJRnc3tCCg5nm8CvXwFGOV\/yTF+X0acShvazbXhIgNs\/Xn9COM19Dn7tDkzJcOWIuSzoMyCdWpbnRGXgg6oAJ\/D+gidzyn3iL+syZaIirhkD+9o+tzUSlmG2ezo3B4DwLBmPyJ00tiYaEntUm\/5B5eElY696mSKwOFWrREkk12GVGnSHdrejv2eL1u8jsETa3dOOuylU2bgySGTf2wz0+hhuvrAdgbgoQVZ\/Ey56a0I\/F0q3eOLBMAmo3zdttN4BPAQAjuqwomsBFJMvCzPOjlk8kHXj0OQOeoXBXyE7j9uKQpBynwpdRafhLF8+pB0TmkWEfRQ5gOT9fPw0kYTbuRPy5+vYdcEU2tydedS+DFf4oJLjqvNzZg\/oSQb+XaRqml9a4XJEBDQB4g2UOvXhDj6b2oG54wD2rHzszF81csT1w38EI5hKy4neRgNLORjir3LDcaXL3Of4Rd0S1CRQozPmau7gfMGGkGmTlMhT6JkUQhX0IvzKBvBYume+inDuQurBPahy+gKE8+1BJopV2MDwCcOifR\/OeKVDpeBo2+cmkHpiGaKD+Gp7Ngty\/SRqB6mp4MbpKiytPVfJQfeitlxTZTI4XWubwIk84kqY5T8ceoRps7t40tLwZaKM\/wjZbjnAwfz4MVLKRnuSCMpW\/slVO98g0mwkBlDwpLyNE7g+\/MmcNniuULCWRm3JpP1+nXK06TUXNIJPM9dJ36HPcIsgd14JeFMW5kNsdmbKaqAsZu1fzjZDnVK7p\/GDbQE4Okn90ntUyFwQr05Z9TJoq84Wtmb6Z7J0EnB6Cry8QeFfv7o5LSme2LYglh7VYer3HelIWyeA3um0VWsPQZqqdWrDmFf7DW7yQePbp\/R0aoCBecb1+\/uVVaF1rdGBmwog2Fnlih802OXZEh2p9COGyr79NxsA5arfLPUQv7CZ9p2ftiYjL\/TylOfIfzhBpiZ6O4mmtxLdC1rFSwHTELD45qSxVg1x5BM7\/ZJxn2IDDAnDSeu9pXsEc2E8yjjVsleBCBVar1yqWmttwxTIheGKfy61\/hxgeC2Ak9wNMeYU4dlbjYTpK2ZFZYf+mm1BbC8ZEAIs+js7qHsQ33jIPIB2WvEiO9Rnb1h+awPPVQAmjU2CQKJrD8ZPbqgYz+rkY2OOTJWZ\/ftTe7\/bWB6pvE6dqj91tV7072+Oq9LtwhRIsa3ApkBmS3grWt4nahYi3StPXMmhuMyPPAu4LvF3Bp7hAt+95ti\/Uya3wwIt25oLVEEoU5f8BoGvHnGoomIHt3HZBczqkbk57S9Qj8yrB9lMeD1DVaup4ed9S0lOhxoMbvmslnl5Chiw5TzmXYuDQXgU9NjiUCnrQ8zw29QRIi6cF3YLB1WZ2GlG9SlFVAObYxtM0lS\/DaPT4dNHqv9eIOUQrbaF7hPZQcsgwNP5hID6JqdBqCpo4Z3D7UDTf3+rdGQWs1\/L\/InasJH1dFddtyxaHDWSi684jUkoDif73t1M8ms2oFhIpHBqeylDGwuhjqSf0anoorogopBuqLYdAyuzLsDVyqxaHpCqkSh4eVHVT\/NiHVdF8eeckv0LPA1UDkFXXSHThS5S5KZpCZI9jvaxeYivRYuY1p8kLzuJ68734D7\/AQGOyODKpaeLOgsvPIilhL+ZmtMLyAmCmYWAYY+KWMnWcPr\/5jEb5S\/G5LipBXIlXdxwsJOx9h\/l9XF\/A2Wg5ZjiQnTNoa8gHeJzpQmOtNPNayimqayxQ80j8VdPllYsVvp9tagrnJEuPK622CtII0xoEWF5PIUe8dV1DEzhSBgMw5r82UNRSdVdQ6O9IBQ9Upk670RsFdaKk\/p33xccYzvECXEGKYXF0Yg0PsTl\/5vvrGuIPv\/jsgbS63q6GVI6+YApw3kPZXP8R\/UFQrrWhTeVuNnGQ4JupdxrLLf1zwqt2kQ8GA35n+fpy3KBpLM7Cee7JLKhGmCqRel6dTbN6ZDvHvJ+m2ErLmEPd+b5rL5YELxaGCGHMc6HLOEN0t9fsGJ5luBrYrqoJilHu95\/QHVbtXtg+HP9IHXWXDQllh5u4pQCiPo69ycFnrgahZQl4QEevryQ8DTeWrsXIiQd9LCjDitY\/WrYdiYyNLB0DgaPyjzY3KdSDiTEZqKxwyjpgHwBetgFpHy87Tjc7wtQLuLkkM9jL5MTVr8seNfssSTQ6fvpJ92NtiiXTtGcK6fvoatkNXpGE7Q62HYJNIf1HxCbxqR+pzz1MA8LjxNfWe1aMqH6rndpHrUktp+CSw\/yGedbjPaEwH2CaV43h364xdSomUagmCHlkgr0z2eA7J7wiQAnIhrbz07XbqK2Z3RbjoKaOLluE+Vc\/6OMELlYZ5AiCPp\/IG\/Jv5AY+M3lA\/Q74mVQ7wBTRCgMGospIrglsLbA3uIS+Yfgv5PSqvUM6+8a9Jv1vs+UoJsDSbqhi6gMbUfc5NfYTd23XYKISMUf8+xL059YMq31BwiyG3GXJO0DWQ8KlDs8giNH92AJVRbtOwv7MAFUqIqiUiphYUcF6MJ36XmAQqKoyaZhrAVqaW27H9aEe+MhfaydyrGqr4MGVCBWuS\/m7iS+hRY3v1GY0L\/0RgzenrvifLk3dili34rRBK6qqZwhL1wxEmiqM4JOQhtPfYSHlFEGgIMDcdgsKjw8pEnv5DND0ZBpW4oOo+JVaXqJjeuRyJeXdoyAQUrMqTjWg2tMjxPZWzovYb0C0+97ojCc4Cqu9B8dB80kfmdzmCUUFd5M8lNSeOeaVZzWX8yy1aYZENIr","iv":"ceb52f28f4082d4c844d4b9d7b532353","s":"c95fb9bf7efae12b"}

Department stores are turning to discounting, omnichannel and off-price subsidiaries to regain customers. Image credit: Neiman Marcus Last Call

Department stores are turning to discounting, omnichannel and off-price subsidiaries to regain customers. Image credit: Neiman Marcus Last Call