The controversial United States tax bill passed by Congress last month has given the country’s luxury business a serious boost, according to Savigny Partners.

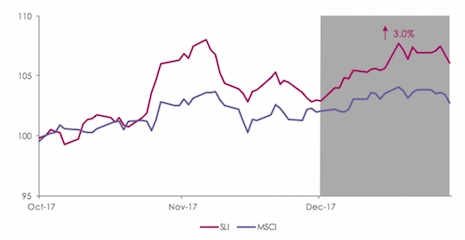

The Savigny Luxury Index saw a 3 percent bump in December following the passage of the new tax bill, which critics feel has been designed to give more money to the wealthiest U.S. citizens. With more money and lower taxes, luxury investors are celebrating and the U.S. luxury industry felt the effects.

"Luxury is a long-term game, there are no quick wins," said Pierre Mallevays, managing partner at Savigny Partners LLP, London. "You need to invest in your brand, not milk it.

"The new corporate tax breaks will not only leave the U.S. luxury consumers feeling better off, but it will give U.S. luxury brands more resources to reinvest in their brand and business," he said.

Tax break

The tax bill that passed through Congress in the U.S. in December 2017 was hotly controversial. One of the indisputable effects of the law is that the wealthiest individuals in the country, those that are most likely to purchase luxury goods, will be able to keep a much larger portion of their money.

Because of that, the U.S. luxury industry received a significant boost in the Savigny Luxury Index.

The other immediate effect is that luxury investing has increased in the past month. Fashion designer Victoria Beckham and ecommerce retailer Moda Operandi both secured big investments and jeweler Tiffany & Co. increased its share price by 10 percent.

The SLI had a 3 percent boost in December. Image credit: Savigny Partners

The three big luxury groups took the top spot in the index this month, with LVMH at the top followed by Richemont and Kering.

One major mark of the celebration in the U.S. is its surpassing of the United Kingdom as the world’s top consumer of Champagne.

Real estate effects

Not every area of luxury will be affected by the tax bill, however.

New York sales transactions priced more than $5 million are primarily settled in cash, which will make the upcoming cap on mortgage interest deduction in the United States' new tax law almost irrelevant to luxury real estate.

Dictated in Douglas Elliman Real Estate’s Q4 2017 Manhattan Sales Market Report the average price fell below $2 million for the first time in almost two years and real estate activity in general has stalled, alluding to a nervous energy from buyers worried about the tax bill. Amongst the average price, apartment sales and price per square foot dropped as well (see story).

Douglas Elliman listing in New York. Image credit: Douglas Elliman

The French luxury industry may be in for a less celebratory change in light of a newly proposed tax reform bill there as well.

French President Emmanuel Macron has proposed a tax on hard luxury goods for the upcoming budgetary year.

President Macron and lawmakers from his political party will propose an amendment to France’s 2018 budget that would apply a tax to the purchase of yachts, supercars and precious metals such as gold. Left-wing opponents of President Macron have accused him of being a “president of the rich,” but this recent tax proposal begs to differ as the wealthy would have to pay higher prices for hard luxury goods (see story).

The report also had advice for brands looking to have success marketing to lucrative affluent Chinese conusmers.

"Chinese consumers want to see that a brand has a legitimate presence in its home market before they will believe in them," Savigny's Mr. Mallevays said. "To be successful in China, US brands have to be seen to have a visible and prestigious retail presence in New York and other key cities – before they can really tackle China."

{"ct":"G3qLhlQAdMAB6qef5g+xia2DxAHtcXw1ba+ahDyfDZZId5tlQdtJUyJpeZMwHCi5PrlmWpn+i2JwythUpmrhikZoh8A0Ikl2D456GcQTNPnqmHPf6J60wzL4FtMO1Wdk+GUTc6TkNoi1kFGYfGYl5lp64Bf8n\/lbq0Lvo7J9RMlhldDhhQcIcuOl7L5IIhAplbrMM3TemRbb5eNmY6sKtYYQ1e7oaztRY0RZKy6JbbYi3FTIqq31iP18sdM6OOkoLJrmp0T2qGuutGmV5Q8wle1AhhRBsgPtDNPnUkdFpH1w2wfjNB94cDGNWFJCPMCpn5aluwMBsHnepTt3LDoslONJ\/Fa2wG3IRe3XuO12rgormlrXK4GszvO9YfHshD9icEZcNBRB6oLlYxsZ8w02XxiJp2N8zYbRAps4Vg0nQmWFmGlAAnKSq+lS9+AYzvW1gFqBceLPIPq\/GjrmGc+0PLFzWBTwXkFu0ROyyTlkUU8FYLYRi88Dh9oA6iZe1r1\/KY1d6JnRjkDaBzyLE55Vjaj9Y56yLjkjz5FushY4zD5LTKoP+toG16w9Q1LsDNFFW1fxdK\/dgzwUp6tCWszuoXTZD7TvqFQrdQnn\/89UMqn8fINODSEMSnIPLl+lNSrX\/lPhWbALlC6eTLUKbEH3dxtBpXAES1gpnNWEEwLdo2MPgH8az2f4MSXqQouXfh9Oe6ArE9LxbQpICkSbL6wcHQlPaQNOzwouH3OzmjRwyZrTL9LR5wHDjYk5YWFMRzjldqCy8vgRakM6WPSWgx1nNdWke3\/sXOX4zHqRa24QPlKZyM\/pwyoeStWqzmdamwzFGcib6sNNS4zqM88Gff8J8HHQho6YUZlMx2hElEem26\/UqqLC6iqGcjC7FXlobVLpGu+9Kb1QCDpxulMOAzZSvElK2E2dtw0oEcL\/cp53TxlavNzG2pRMyrq9Wq+JSjuny1LGrSoeuUAvVpIyvYCp6CTM8rLAJ4K4smGrDya0lvqoe+MVdMIlCZfmvM4wmD+Bgjfo5i5xmM3diz0CIoKOPfDXYeFX4u+sFcmZMY9Xsf38ORq1mAsZqSZZvAXOjeIsUZkmOAImOYbEitcMriGc21u38tTZuTvQjdtIwZE5OlrXP64dxBTlhFT2xwxWmEh15F0Y7UWfZBR5Nj2xYR5jxPMMqbIssjNgtvFw8lBn0Au4yWTCrJllwK3muEmBivGGb0I6eQf40aheY729IuM02+EB9+ol+KYKsrcq9sp4heW461KTtndECUrAt4Uj\/Hdfa\/7rz6iIfigvFKOjrmEZa8poEwi25asbQ3FcJClHwJlw+CvXtWrcexD4k3sHO8S72RJpKB9AGO2eXlKuydblzV3UW4PpXYxRP\/C18dp2cUmtSISn1KUGs3oUAtJOMn71U23zmQY5FntQ9vxPs9aaOw4wA65z7mNjVBZFj3pFhy1Uh5HZVDirC9UCzd9x7AXO\/2VDcQt06ClU+pwocRz5tNFRUoBD+ihoJa2CheF\/lW3Vxg6imYjW9waLh12Ps+6FlUT7SCiVDwnLL3Tn2OQT7WNqE\/nSf6qMu1w84ROD9iR+QRj5RtLPAv2dV7JXioUs5YfwSaDBC4xr56jSAMFz+M7r\/\/6mB1Le06IlJKiXNVo5mu4PIfxt4GdAnuWrWpJkqFe2AHCWvSqhPvzBpJiUQBM3t1y5vJniVBB212rT1RkjGjxMuabm5fzNroKwEeKj7T3AdawMEdB1sYabgoq1KDtBQy37XAdcmp794pTfAKQFE14rHmLVTzfCgVaq\/9xejbjnJ4zWLF8ch8136WHgbcBNuStDclxEYL\/Onz+xY1t4QMNCnd+htV0D2xwmW45jlh56Kq07OJOPqKKp9guNhtxe+WfojbGqpVsIQywdU4ZI3FE5qxrqoEtBHy5\/1IFtEeAHEclbz0X1U3d5iQaoG4cujAA9s\/IRhA+QavTx9Nd+Bipff48aH5ghrIhqmPQdXeiT3oBo6UIKDZh+BzQwYH7L0HUJbI8vpNl3fW\/Nh+djrOkmFNqAq0FHumQ0EskFMx9jrJpCWmIdVpx3NW09M8Mhrah7JTAjND63UG3y1P6d6s4cUSI4N+2HkLWxC2203ssaxIkSUoXZkJndPbDvt15qaUKmCdRGMRDDfendbQAeTja23vPL+zAd14CWM\/0MO0MfRyGgJMT6apkeEi5CwOQSNmziJxueCUMM5fOJ9IbowXy8geuECjFa0uukEM31qZkAhmajJ+k36xAF08kTrxuPeUkJGk8DuGqcZwEDHUnkxyOrevJtq\/58jUcf7JSNbj\/se6dbVhWF\/rOGSXG+p3sGGbeUSeFXG8kuWmF8iofvTs2yq1EbL7B\/XU+wCLE1FS36KQWf8pUA61gzc2oNGkTcufk+Xt4odVjkh9doYVcEVhGyHnhvzfF2tRwBXzRm95Vh\/V7MPOv00+04YowIecbLH5+q5aM539feq9B\/+6Sfr93fnoVF0AxE+iGOpsIxugTOiwTkmek4f4jmYanmeMMjP9ocqISDgXUQgtJdq642C\/m1y9wcOANooUZ9+shkTaAAHDW53KW580hZedZ2bYbB\/DtYtpKOXUb\/3RDu0aYRJhskcyni943mIEJGZE44fcsowEgFYdg1NpQAqMgk5QOJYn4WyeVrVwbyYDEixwfij2DkRHVzghmIzqzQ8ewOq\/ijegkW3XeXKy7VrZGPp9HnkOt8S5y26cyAd1J4fTe+y6y3NU30k\/YvGhgx+I8jERVSqr7h74M4BEbMhnT2byUleAMi8Bv4E5O\/5rhzLE7\/72XpDWunnaFTQ0wMlF7FcC4lS5ZhRr\/A25N+XzbiuFlOUgDvBOVtR\/7XJ4qlgvyAOzcm40l66GDY4Ed0ISaGb8JQNfay2tdXrrrl0HH52janW4RvXQ3VV+ikz9SuygrOI0m3uGRo+bq0t\/I2A8mZgU7yCwwM0nQ4TM19UF4n\/E18Zfb\/WUp\/pp0uCl4tWGrCzsvUnCCOo1sFdh79QpcSEQJtOEJ5ff\/kfgKW8AnHlYZqqfNLQUYSDuSFmQaIEwXkGVXMx\/4MHL\/PO4EIVRfWoPXW+fxj8bEmnGcDUrldHefugZYyZ67FjlMDnxuQIyt3ft6VFfdx32fo7tV63VfTC9NiFUG3LQhzvlZDKQ\/+BLaHYk1vqM8D8wY6VE\/dZ1p5jupwmOM1hUSp0KDItqLLw92BTsQIvFQbGlbR1QgVl+Ehe\/OYtwm97qrGWyKBoS4AZUXkGw4JSStGKXZYZjn\/l4nNuHm01cDcoVXkof\/SfifXUJV4FqkW83pPXfvuan52nUPERd8jr570OE9LVeKmD12d3dPEeT\/7GioQ0FAIlx+XjE9edfcO3sSzExs82XrjaPM0mM68HEKJeQK9yPM\/zReFqvOD6Nogd7t2p3NfWhQ0Lzwr4RRRcHkaSZIvXCaSH+Qby+DJwTLQoGOYU425jR61XDYBEOafeNa1XAjdjooCQ8EKpVaT3bCMlF6xcfm3Qt\/bLnxwaBZd+XcnrmGFkB4YsKzHwktEp5SZKJXRA8IQoH+LTzCDtpWD2FdWPOKLKA5hzbpXDAjxIhKEqHAX+XO1r6S\/rIkJBCTGNdXVsX2Z\/fi5NP4C9sY+2cMEFh5wriCIy33hOru2uSMdwkOrqQGH\/OdXs5NFStT1qjTBZD\/Jqs51E2s7KL2QvcifcD18QBRrmKliGVb8r3h01Jt1eR+MLrfoGnawU7bbYGztB4Z3RBYlr4P5yXgjYf01DetVPGjufEpWvuh93RPPjxuVWbNZU8GyB2lXJaW7zni5njpCuAdWVVCOim\/gOdzudfKDSe8HYMgzS9yoIvFx8tB7ASAvd\/VMoqBcmir93Q5dKhW9jW+HJmNYcBQR\/JT6iSqxnCvqXByGGeoxgfL3UyOMkM\/naYJ3cns4Xs\/mZrTm+nNNTLGcKbok3yfapi0XJjtzVaqXUZid9zLrjkZFbnN+1WmM7PjVM6mJAl\/JAqyZNi6N0cvLY8ktS43JX38HcO77s\/QG7hhAv\/nqv9tdiw0ZfQ9bAtU66cPCWBT8eVUujrpiVxgWdSRJcBFPD9v8dBiCyyPENlwqJfyWaPQ5X4aG8NOM4I3JsyUxRlmpXy0HJC5b+SpvW\/h+LdpM\/+o\/jajCss921UNe4fKPJSMpjdN44TrYLmbZAzDlJmplOwb4A9kJHFScw90uluDVaqpay+ysqiFzovbLL9spCzExxzNaGZTHL+YyfkZte2qm5NG5iOgx5Fe9agc1ks\/F8BjyJUZecBVfCdk1b4J9ugwvUJRLM9JWguLYmOVQjvboaWQznaFz9aL+uR77TL1yrNQdlUVaguyTCRG31qf4Bghe1Fa3QsZXqHKro+FepAwljB7tZariZInlsNl6HUep\/0zPArxnbKIe\/wXg4UGZv9hpaw6hAHN3m4etlVHFrtT9uA+BnoeCUMsIOFy1cmhkAmaxXSvftTyyqNgxr07zNwKgYw3CARmAg7oUMziW+xK2\/jDtCojO5nTJr4DthFqlIBgWpJbO8K0L3BHG+\/jwUMDyDz3flyqrYhAth2W0bMsRnHs3pPgdtQ6FFpr8xuUw3pmeOBr7PgHUD4m+OjYn\/VWbnyFarM0uN0GJFx0ng8kGaicUtvVXolMScOgzCYVLMQek4LM6d4kjEO4oQyprX3ZSANwHPdG\/Lx+nAWFw6Eu\/i3tjEM7tt5KCZZuCzp1TBLQoCDhg1P5roBphLk+ctP+lXD3agt2epesTwKat4oOwF9Zr8hSg7oaZCtrmi53QoQIXm1ZWBcrMjf1+cBUDJ3MnKdBJiUelQe0fyefwPBK4OhgKXrVnkncM2VTzVzU7\/v31tsP5tKe2XY1BD9j5m85mw3g4iVyD9\/vyDB3BgOPXktJiaRhdrc6kCqBntNfxEbjqQ730SvqKWhKUc5QLV2iJlH3r1KhCGl1bExtbosH67eZ1vi+4YFsrsRTWVft3gP1GbPQVKivDJrUzUti5epMlvUKzZgAsVIBKf\/Xm6x+mnCX0Q8QlyrcIg\/EpjspHBXUVVd0uRJC+DxKZbrKhfmYOVAffGfmYQtAAd2HKb3\/hqYyWSQIzFIReUxy2bcCkDcBL5A3HCcCyVC7fMWmU2xbJtx3DNv1mq2Nad3Wspbe59nUwN6Q6OS2yMWx78yRH9DNUX\/9AeGo9OK1OXq+rgjAfzBqg+jsz+AUXXOMqspq9dWzSjjJFEOkXjifeZ4sZ2r0hYA96G2uzPn6\/Kk2S6zfptTC3YxKpcBnUh+WwUU\/HhoS9JJgIRX2FPUxoQ8DMoKpKBkgx6W6Y1y\/SBvdpIuRohuChuUc+TyACkRZGZl3ZCzlmHY+8ZK7A3mqGVT01ki7LxBmF39FEUxWe7+jAiBtMAcCwtKIFGvUHznUtW\/\/DtOTZq2O+aktyypgLil7l11h3jceC+YepslleTU04XjgPqS6JRMEYvRQT2t44UnT15SiOTiiDaAuSpewKzDy1SD4XPTMx\/ZOd2VPCCqlPj5hxfVbpEewUYUx48nUmWfBQdoPEhcaDh\/03ZCsSyGfNh+7mAEPPPe9A7c15Tu37yF9r9rAe1wLCKxtfw1QgevlxRhQud82ICR5rdmrNR\/5aJPIyfYvKwTBR57Fxge0toi5AhDfc\/aXTvKZ27m+1in5by4T2vwyPJsYKvRR+cW+6gk\/98+lBL8Q+x3Y9lx9xVkuS1djNZlIxFNh7lU9nzAwsywnFVc2SeX5RsCkh7AIFAAW5YmD1O5agedf8D2nYrjvbmtJAuyDpayt\/fjY1PKfQJNkP7mc8po5J8EmgC62nClLbnPIgs0JlhM7NnMwlL7eUkIBS9Qd05MET4bnGUCt1k\/NzErWNr9D7vNzGOjYfygOOYxwcwD3na94TEoi4bgn\/e3XrAA4oFe\/gF9bDSnRvsxHYhq7qZUTftHvMxQsw8dM13SyUyL2vmjrlqMjTbeFeIqq3g0XBYDhssXC3jxtuHtBHsY6OldrsWBhY0ZNwWnEQRuWUCIoJHgLWXg+ugPmhRwdz55lQKdAgWbx0DFjVy3kX0KBz26W2d+Glr87v1lks\/XOZFORkn2w6nOnyV6JZI9HfJjE6HMZ6liSL4N8GJI1FI1rrAhzL+A+UTIxH7HLQLel6zRWpHWSeM56ICaZRtn47ykrQYW9O65BB3rd7iir0scYDu0KWFS5I6EaR19uXQXDZ1qe0GU866rI38aubpX7uAxNZjVqIHcn2R+TZhMjFOdbSHZOiJSbxulPtk5zuefBSkzVc+86yd4JwWtSfd2yuLXPxc+WGJOG2eVftFuMxd+65rw\/\/jcZ\/Mjbin8RvI\/5DAoCOlYmQNgCueW\/2jw0rju0VkkYly2OisAKgziQ9KfvMUW7BqQh6v7Qsnx3kwB20TH+wwgKz3CuNdSko3ArgdZVwA2ievbP3gb15i0ScP03DbAlyQPlFkKOgRhXj5\/7R0sG8Id08G\/Kd+7cat1hYZaoDqZKFM+f3ZAtDAK0wqinweozAbmev2F3tyqGAnrvdmWi5LGM\/ZsXgOfnkOo1D\/m5+Ayw1RLbGY6Jomgi0gqDuZ5VJWuFTvI6IktDS1vwzna0KbgltP\/5rg0XHXDlxcTfnpQq0nMBrLDWPPeXh8vpm9chr0Dv15Rj21BlooldBeq6KEKDn7ZNgHXqLgxC5R+VkpkoDp7+S\/QY145h37RJSY5cRODRyzdqCmAivf3U2ypiN4RtU7pmuoiFV9R0cuMOo9l69vAfSGdQOlOWba2G55LmIB8oJb9\/o1Ib0Yd7QIRFGn2csldtiyKc1fH59hFpT6YfvfXpy7VTULZS89dC92PsZKSzsXWv70I2Y\/3eAuJePmMgj3zRdbflnu3JV5AEPnYhmyUJoo\/LjSku8oe7dV8NteQNvgnl++bULzkjvqo6lPViutN5Jl\/aJtDv0\/cEKejMDx\/cv4k9cuDsZZ\/o457vEWFw0tUJJRmy2uNU=","iv":"e37ecc72562f3262fd20b542613a0bf1","s":"d6a5c48300e6e8cc"}

With sweeping tax reform, luxury investors are feeling confident. Image credit: Cartier

With sweeping tax reform, luxury investors are feeling confident. Image credit: Cartier