A recent study has shown that millennials are outperforming older generations in saving for their future, making the demographic a valuable future investment for luxury brands.

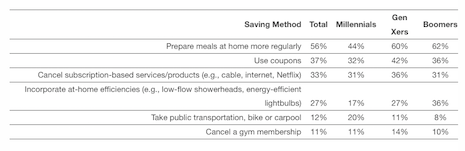

A report from credit line provider Discover has found that 81 percent of millennials are saving for the future compared to just 74 percent of Generation X and 77 percent of boomers. For luxury brands, this means that when millennials grow into their purchasing power, they will hopefully have more money to spend on luxury items.

Future savings

While millennials’ collective wealth is growing, they still trail far behind older generations in terms of overall purchasing power.

But this does not mean that luxury brands should ignore them. Instead, they should invest in millennials, engaging with them now so that in the future, when their careers are more established and they have more money saved up, they can be valuable customers.

Not only are millennials saving more than older generations, the rate at which they are saving up is increasing. Thirty-five percent of millennials said they saved more in 2017 than they did in 2016, compared to just 25 percent of Generation X and 22 percent of boomers.

Millennials prefer to be frugal in order to save up for big items. Image credit: Discover

Another notable trend for luxury brands is that millennials are not just saving for a vague notion of the future. Most of them are saving for specific items with 67 percent of millennials saying they are saving for something specifically.

Millennials are aspirational. They are more informed than any other consumers and have a better idea of what they want.

For now, as millennials still do not have the purchasing power to match older generations, this is the best way for luxury brands to target them. Until they have more money, many millennials will save up for a few luxury items in particular, rather than buying them at regular intervals the way older customers do.

Upcoming millennials

While there is no such thing as a typical millennial, just as there is no archetypal luxury consumer, decoding the next wave of high-end consumption can seem daunting for brand marketers.

While speaking at The New York Times’ International Luxury Conference Nov. 14, a McKinsey & Company partner summarized how millennials generally act and explained that the demographics’ behavior ripples through to older consumer segments. Born between 1981 and 2000, or ages 18 to 35, millennials make up 30 percent of the global population and primarily live in emerging markets, creating a enormous potential for luxury brands (see story).

Millennials are the most important segment for brands to connect with today, and doing so requires reengineering how brands think about their relationships with customers.

Fendi has embraced Instagram Stories, a millennial favorite. Image credit: Fendi

A panel moderated by Bob Shullman during the first Italian Luxury & Design Summit on Nov. 30 took a look at the path the luxury business is on at the current moment and where it is heading in the year ahead. The executives on the panel agreed that millennials are the future of luxury and it is paramount that brands evolve in the ways they connect with millennials (see story).

As brands look to the future of their customers, they need to understand that millennials will dictate the market in only a few more years. For that reason, luxury brands must begin engaging with them on their terms on a more serious level.

{"ct":"oPJ3Tsj+ZffL5dZKrmhmgVTFVhW6ZVHCwfabQdfOC9KFBLvoAsnpjuF2fhXC4wsuwIxxujYXhxvaHhpyMtoJDaKvDn44lsnsbAWEOdHPT0RhYl9IbxmMpqCJrSOsbbTsFy+zJsHKqWdsIA8GL6VL\/tgu7Mw1PnYIz++UON0Hz71fbBnM9kebvxiOYvtfQ7KjsGMwsaB\/PuGWbLG2g4Kuu\/zvzrnEGAewYPsjQhM42rhcWoWuwIUotxB3b+uJwD\/DcCWLZ9gGxWQnsjb8\/xUqlPDCjlvSHT9RW79z5d8Dl11ve93gsEOsQB\/lJ+dPBpeUZ8kFhkh7ua46H7q2ioDIB0NaPlMcf27mwpOBecl+hrjzRWkUs5CQg51XhuHeDRMW1t4E6qB6HmjicRLtNwPUJwC1ugverG0zZ7DkhPnpABSpebHliKu8CY50NQ5kdBYxV1ycLFtWMTtXiIQdZDypUORji\/p4N\/rSCrUP1DTP3\/dypvIx5v041C29vhV5REC9IBzwO6wDBiKftkm7YgcWHhPy+i8\/37xhHjM+WP\/vbFBDyqtPgWbQczma7nuVWPiAuYu17uxqYo4+5jHIEBuR6KrKkTGBXcC7dTGTj5Qz5RTNnCCoeH6rbk1nI5S2O3bIKKO+0H+mtJDlsJy3vlBdzcq1nZ4JF7A5fzm6mgy6DwP6l\/18GrxxN\/Z3wmQw\/g2OX4eEVyVUPAT01fqv9UuyH1ieFk8UxEHjQAikpe6ScPEhIQhJkxsOW5S1hKQaGEOwpAx+oDvy998oFJiMxvJvmyxagAI3\/DFnao9y4QK5vr30si8ClreLfpVFmMIuZm4zNOxjatvk7AvgdNgld8sNdAUHuY1cKJ1ZsceT45n0uB5BHMFK2n9g1wYNSoblwXWCHdymylJe1WiVlUzLtPK+F5u9rfftAChI53Yh1256uD7Mo51OnAm0NURJG+ZVlMjHFJNwYxjo1RXprhW2OhtdaqH\/yWbVHJvJU0EET27AS47wlGzLE\/oEM92\/OT12mBaD35FYrDHYrCQ0SNTvKIRvEK2YEOgh3CC6cdTuGl8k3XtWgANS9aCRASaFM4c2ovqNTb2xYhVZWz8+EcrFPt\/YdngAiNKlI7dFYzrD3dfdf4Ci\/bDIYXV0YgpVZSCYdz5W71LO5gtkB\/ptScMsoKvRhGnzcVFOckHwVGL\/UoJZcZvoAGyK+TvsRjlRQ0Po6Ag6ZzCnTlCA6NyXTuCtb4MIr9ofohF4GUhdt8jsdCPhP0+SXqKNBZfMWqhiax2SR7QvytCDop4QSZgFHK+a3IRBRkTw571dKrIAxv\/cET4InfbcfurroPojiIlZKjDvu6amGTqr5+PcuQkPJPJzIkcctOLfvE176jMby+VL5AFnnyJWQU6GPJ\/r\/ArnRAEjEK\/qddHZuqYK86wPzbJcHhWLGPwlJ3XWZHqGhvsTr8lVJq731XTeyfS5nwUo7w5Dp2qbNOJhJbCoqjH0Aofmvzhn204I7RuVSRuF7SIxThqsA5ixQis3Hdy51bdLy9tk\/SnCuyisgsykevkALjUHZPD+P7qSMkG4ZuIKSEUzZPhCvo4OBrfhLuDqledln5TTQMUyVY\/DuFICVNHwI0iZceCb6ZbabFWGomXKCURvlfkdM8wks9R1mfqJBnQJQOkaofDsqFWVlix7ICh3ECWjwm6Vg0ivtBJXXXfW8iwzXjd9k3F94yS8PLL7+sjhUOT\/loqtc3Y+y7\/WyI7DoXsEsuPGBhKgJjIR4u++E+y7xf3CDLtKgNqOaxXskJBBGUSeNBIPjpe7FJ8MfSOw11CD1yAErEXG4mhFvj7vbxdk\/QIAsUb1\/MLReRqFxvG3\/9J03p65s3\/1qkWM4TycjN95KV\/g\/iV93N06XoDBzohJqgQLtenCV2olCYFxYoY1B2mIMCFEuxMQ9VEnpfVtXJM2Ah30MC0A380X5tEJz\/txVWiS0yykXxzSrdmRQVcaQlev7Bygr4di\/w0YYtij53QfR99JI3Kp+7vVXp8XC6huDqzj4B\/dhjmH7+soxx1mRw28O2YifM3\/BkRL92nZ6qJdZfRbNnD+pBLkAH5pFifO5jck4gT0ROgY98O\/OlY53Lf+DdHBjctwUyc39Rt7DrtLr3A1HZ22VxLQUl9BDg\/HGqEbQ1\/Dr\/pqwJRW+1ykQVJ\/uJb2NhvOKQbIFGU8j2HKD2ChoDP3pPapzhkxr26pr0tPaK4nZ2R1tx8hb14ijv8k0d1V3ftNTf6zUcO\/5CPAKqEroXR7RcAjVBHsJwBK158N3EHkskiyzMAqgPovxGvarBIIx65ePTpJlIreqdM9MgmylRUSQOGyDBrJ+\/3HkerG98739PhOS9I6KbT5LdF8gljDSwaclSF3EXnFw7nw0crY9TS2mxVTBqwQjhhe\/Y7Wogd\/SvKo\/sbJPYrDjDN6OuOZPPukXUqCzTzNik5ZRh792SZAvMnNryk7cq6f12i9SaylZp\/qKB5sccKRWarrV7e7SEwEHpfBbhfHEY9BvFrZYaMc9KfrjV18RfZl2yu0emhxq0p4Wl6BGqbdRRKM6Xb09PGX+ZDO12lLcKrIVXg08hi9vF2rXAE\/0ki0VgYN3yacjQo3+TYShiGxDDTK4+1V5Y0weif7vs9kLHO+lFgDaInGKuOt56prNf5Byynz83ILiS6y+uKGQFhbIq8SHw3irStmSHWislo+l5RgwhZUJ8U5caq7ASbgiInN1jaSOJ2VEoOssOui3WMRGBsY6Xi4xPsL6W4oOYaJQ8NODdKlScX6V4mBEJCZyhjIR2CGhOcesBTkM\/UR\/H3GMTd0kH0gdh62mHsP17ShnleDweOEsPZ+FYUke3iip2oaHm3FV+dctjFD7YQ5sIPIxqnOnZCcKWeStjOwGag1LtnpRTgXudWuT3dPugTxVKquvfTfv8o5grsTWIOp4pd85\/Cok4PRmq7ATSfdLKCl2NAH3fvT21xscJCaNrzNchvPwqEqRMNywU+wRmu5wJ8fa\/ECExx0SpaNu07\/HUxM6HvT277Qw491QtYYBarQKjsPxl\/yRbVJSYu+PIJ9FF5wvJHQc+Zl\/90BIsN3aGb\/a18yHaCaP8AkvKVkTo2\/+zpYG\/lXWdjZrHIJvO6E9ZhyhGYo2+WAWC0DyUB73oGRZP1fWVnh\/eI8NTIBYpVyMkhXIM5lPDgDo91M437SHd1Pd0XQ1KLa7tXnyCGK6FPJSoAzZo1Uh7ARNbBAWyPXnxCRQDGpk3uUn\/Dylh\/Mwb1eWkYl8wtp10Ka0WxaTDUKOOLdAvn62NgrB6chYcEP1cNbwKiul7FAIv7D3dJi38D4uyYt0OmzUStiwhI5xdNGg5DL0GukX4iEjhiiBvNqbq+tkgCNVktQI8+iVzYs3+ZA18Bx4NFvy7KC4+wy0AUtB1OH0Pbg+1X\/irpbdpNAlcSEwu4ILNdeBiqBv7z3l5c0rIryseX9QX0qR3yVvEaf46Er4Qgjc3ivy5TxwDoikoZKd2Rtv7hnIZeiQDx44\/ezFeY4vLYsfLRAX\/Jh5ADz69nj+ycgjREbP1bATsTV3nCHYXRfTb7lhxl36TPCtwG8160xOmW318Q6xIWLkbJSvkzUyL\/HQFagoNqeho7bPr5iJjHvMbCxu1CyQaAI941fkoD\/oEOgfXaJSgLjtKrBulSILKiZL6lZFsYbALOctE+zc8s+\/HS4qLz\/HBuHfVQlgmXOyJYDNBE2Ys2yNhI92WYZWChssnBz+wkPazl8s3qsJ9Zx920KDd0A1Rv44nRGwS5EoABUawmfjDiOQZaF9g59qEBTevzq0nY7256+l8FylIQR9lsNrQdK2sXE0NXC6cyh\/4cQk4uej9dFBAhVgAYjUkn94HsOUs1skYMR2cq4OS4ywOzgkjbyy3WCLsUSDvdIViyEhe4g+ZAlYNRnpl9SJQ3QQxkNHoUTogpo7FCwjwIriiA8MMfEA3uIFL7k90K0Pf7YqVUiDCN3E+2+ejlTlrJRtHfMv8KZzUThozm0ik37mINFap10d+VxWs74UyeDNrnfFHBfQE8ZETNqJvuFlMBPKsv1bWppFZlYihnkxXK+ruoAQPSp\/kv4O0++tZGcAHsXtKtSd2+46wX5DBjfe4rDRBWPKtadLYHm2DI0oVPLI\/gJABXHWTcLYzm1u1JrYEGR4Fxm19f642tt3X22UYYXaaKgIVxbu3u2tHEkZ+NB1iKDzqYYEDbjXl2IyGwxoKO\/bWnI1+0QHen+r\/\/mgaffujuKe\/Gaxs4tq5fYleatD7ib1D+uufygaO8uMsLyeFS6akojDsk44kjZzcBuIFjLowmGX5rl0GKhqctYp2Vv3HOwNvoWdjUNHVUv+6tmwN6TJL\/l5xceAwIXKXwGPPjFGX19tKRUKsb0S6Q4UBUQLqXHUkrF4W7RZoY1g3GPD78IVeiSb4VFHpqA2Lf7M3G03gFWijOLlVOE\/tqdW9uS9SwVLCkptavdH7PdCwIzzAc1fyP3aKmIzL0me\/cFKdeTxNpGQ5nl\/v0mbmEmUN\/WDKjgr9tJZitamdpCgbNuFMPbU6qU9O9u2kYl0+Pw4wZg0rhEnn2Xa2T\/6gUYTNS8Q6PqpcnovUCAoNSx0g59iVu4saS8boTtG2Eo3uz5\/G0lSgDShJLwqIAEvsUb\/x5V258dP7M1\/vxW3au\/IZjzfs73YhOW+KD8oCOvt9bI2ooWGVeoG3XWl808dGrS66miv4x9Nxc\/Xb9risEW9tC22IiV1OGDJQLeXbBSiBhS0btoV4uJjuQjTcS+81SeDS2Stw8UWknQqnD6AcJFn+gMoEJShsr7UM5eVBpFklx9ofzi04r+xkQ\/AjQROcxftZ4M5WRrK2\/fGo2O2xYLixUrQUFitI5v9eySQsV9hE+rtZck8xjL1ynfYIG2Gkr3lXOw30K9n\/7SRaq6aH4yCziaXNlPg9Gose45gr8uaEPTTLwIofFoX\/CWm+JJBhpXnUYgjrznYjs2ydxBNL3PAupQ6GebGWBAUKddSValDdJT\/pPcE+OOOYBVVlViMwALUmkwAZ7dHgWzGdb3KTAEYfqUsatI6V6MXoPealSzFVkuFdN\/BmjAF\/dPamX2iHPhxdxaEMMYXC\/t+Rw0q7+xJMujlGlkA+rJ7W350kBz51\/igNakB3quFKCss1a8AhSbG+\/oVorrEeWJwXPHZP75Oc0zlHMvdgEmihaFU0F4PgtuYbEaiF6CeeED789mlHvwfYCsjgU27i3eOQbHICQW05IoxgzlkLtUdsWnFHAhPE7l3c2p6txd4Q0WrA\/GUtc4Nkoj1fql28nS+nPxWHtFS2xzrVe8fzg0LmEsPJ4t2hMVjYUX\/dMVcgJaWLPH1hdeQ4KnB\/GpCShhC4tMoA77d5q6kG1O9i8qcC6XfXwyrIiw2cdOhX5LwhlUwGxxn3x6L0Z\/JfIm9wfwpY35\/U4ENb9CCM5cntVZHvMHm07K6urJxajXqV5S\/LOfE4VPovfiuVy5QlR\/b4NSbe3hv1WkmVVr6KD6uT2SYpOJymDyKt+oq7GupGWOacH37VSthNlF4TwFiPyKvlcIC6Qzg+s2bW8fnhbEW0NcfmAx2c6VwuiaYKHqy8o7JSpb8gx8\/th3boo6b8XuSI9ABm2ucXqQ\/A4g+fYTpP5yr4rii4B+PvDoBEY+rHzE1q5xKOysnPdmDK+YYkFlirsoL1V\/UiZNG\/xAin348RBzFt\/mxLGC6Ntdnj7giMAk07k3v7gRXwlzKYpdDENfML4+JIR3A7iLxWIL0FnJiT076FMEgx0WIMxuiAkdOvnoso8ltaLX2yKbJP\/yTZnQrfEjmAWpGJgYmToZ9qZG\/b2NBsbcZ6bQKhheUvQRNqI38OtZEI5Wgk9gJz+6i486fp45Cfk1v3Tl1IUePSwBnOkP8jVzPibcBaI+T\/S6uj7+hSerFUd2rEXqSujvcZnQsfKe4Rb1u05MFPCoDwxVIwls\/ULlnMXcQzXKtVI4mnUEq9X7R4R1TubVQYdBeI1zs3CByOFVksaergAVmDfHSiFyYFo8g9rzxNlkZaIb\/R2hoxK0Ws28xmDnZ9DmkEzH7vu5SKjoF6lg4BCMo9Zv0EkUJfVcu1C8Ga5PfhJWqcLgvfC8P9ycD9AWiV4C9x6Qkij85knWDXtKId\/xwRK3dLQoYggC5PS0QEz3fBTXQ4OqMU4mdZapeAgBpiAv3Zb7lRYqcXCa5eE5qdkUFg3BO3GXrbn+1vvjbukpet7U4NAb0ovFYfCE\/B8sgzS0oyPrBB+zT5gZ8VMelE1JGEzZ","iv":"edbe4520283907b345a85ee973bd7596","s":"af98a84d28b33055"}

Chanel fall/winter 2017 features Gen Z's Lily-Rose Depp and millennial Cara Delevingne. Image credit: Chanel

Chanel fall/winter 2017 features Gen Z's Lily-Rose Depp and millennial Cara Delevingne. Image credit: Chanel