Young high-net-worth individuals differ from their older counterparts in key ways, from a greater emphasis on international holdings to placing less of an importance on financial education.

According to a new study from OppenheimerFunds, 50 percent of young investors hold international investments while older investors are far more biased towards their home countries, with only 38 percent having international investments. This data corresponds to the larger divide between the two generations, which the new study examines.

“The millennial generation spans from age 22-37," said Ned Dane, head of private client group at OppenheimerFund, New York. "This is a period of significant change for young adults.

"Younger millennials, 22 to 30, are just graduating from college or have recently entered the workforce, while older millennials by contrast 31 to 37 have been in the workforce for more than 10 years," he said. "Accordingly, the older ones are focused on different things, such as homeownership, starting families, etc.

"Older millennials entered the workforce just around the tech crisis and experienced the global financial crisis as independent adults whereas younger millennials were likely still in school for both.”

Shifting priorities

Over the next 10 years, a great transfer of wealth will occur from the older generation of investors, baby boomers and the silent generation as OppenheimerFunds refers to them, to younger investors, mainly millennials and Gen Z.

This transfer will see the majority of the world’s wealth in the hands of young investors with drastically different priorities than their older counterparts.

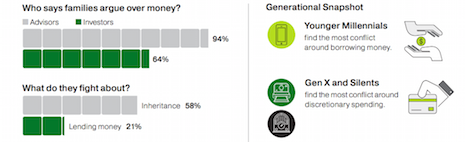

Millennial priorities. Image credit: OppenheimerFunds

For example, the report from OppenheimerFunds found that 37 percent of young investors make environmental and social issues a key part of their investing strategy. By contrast, only 21 percent of the silent generation makes their investments with those goals in mind.

Additionally, 32 percent of consumers with sustainable assets confessed to not being sure of their portfolio’s total impact on the environment. This statistic rises as an investor's age increases, meaning that younger investors tend to have a better idea of environmental issues and how their investments fit into them.

Finally, older investors overwhelmingly felt that a strong financial education was foundational to their continued success. Meanwhile, only 48 percent of them are planning on passing on that financial education to their heirs.

Changing guard

The stark difference in priorities and habits between older and younger affluents has been a recurring theme in the luxury business as brands continually seek to adjust to what young consumers want.

For instance, the lab-grown diamond industry is poised to explode in popularity in the near future, thanks to high interest from young consumers and millennials who are willing to spend big on created diamonds.

A report from MVI found that 70 percent of consumers said they would purchase a created or lab-grown diamond for their engagement rings. This represents a 13 percent increase in interest over last year’s survey that asked the same question (see story).

Generational snapshot.Image credit: OppenheimerFunds

Similarly, millennials’ value-driven sentiment has changed the retail landscape, which in turn has resulted in an increased interest in the secondhand market.

According to The Loan Companies, a network of upscale pawn brokerages in Beverly Hills, CA, Chicago and New York, millennial consumers have a deep appreciation for luxury brands, despite reports to the contrary. Deloitte, for example, conducted a 2017 study that found a significant decline in luxury goods spending by U.S. consumers ages 20-34, but The Loan Companies suggests this spend has just been repurposed to the consignment marketplace (see story).

This shift in priorities has seriously upended how luxury brands market to young consumers. For financial services companies, this shift is just as important for targeting the newly wealthy generation of environmentally conscious young people.

“Clients expect more and more from their financial advisors, and financial advisors accordingly need to broaden their role and relevance for today’s wealthy families," Mr. Dane said. "In doing so, however, they can’t lose sight of what is most important - that clients want to have an advisor who understands them, their goals and needs and most importantly, deliver performance that is aligned to that understanding.”

{"ct":"UDQ8tJTCnk8CJkpbLNPmU8kx+S4iuMgxKmOqokqieZCV4WLpWtscUDPh8APw1mXLiSmFaNM81yZ99zAuiE7Q2smjnlAGJ2uKfM3nL45ouLxk7aexFrjOOd0FZzgOFaFX5Se\/Uti+q94rkt4PQOd8WnXT79qMGGQBk8ziugUl1EPRDuGKmk49bTqc1kCwlvFbdfcDyHZ\/ZsHbNaCkk4SxGUo\/LAHE4rvK8vAbBBSNv1WjSAWZ6ZWGxs8vaJ0zExt8XFLxYFKo47q2Q43M1W4lv06KS0f48EE8a7GW7RIwuS2mdSg51rzWRv5WmAISO1l1yThn8mokoG2Bu9N\/3+dpQngaddKCim\/KMWA8fJq7QOb7vH26rE7CBFS5gbwJiEWH8PzNmSZ9VuEraOiIn3k+tfWoGIgpl0\/fyCskolzZYWl029lAwtbkKuroDPyq\/X7eoIfV8AiH1rRKVQMDtXrMNH1EzfB3CRHLFi1lbvRdcqIYIRhm7fVhS\/MnTKry9\/2XjVcPO8zjT4m0B1kiQyRWkBCMUFHV76K+6dIfY9t87Vi\/Qi4ehLqnSyq44bxrw66x\/MYKAmYL1fPkd+eetWCB0rKvul0Gbg0o\/cneL5OU5iWzg1F6Mtkx2KWQL0aBpBvuQ6FQHUY4RTzY23Z8mycresdgJt6DVu3KRkeFL7aP77ZmfsNK8rRCMwZ87QzgEBhWvuzQ6HKUtliU+4\/viT4Yju1HQSYkM44cJNzgrmSQ4luii1GMsOHMKO4YFCQtb8\/Y2Q60pVRCLW6xXsVfRAIwljs9kYh13RkZSOlxxHWthUqQgsTrZ8iYeGyj8+E55wTcI1mjRNJVuFRR\/dSjKeikgjm\/HZLXmI3Dx5VbrMc85ZZGTVPs9xEN6ai8eGAUFPBVwX3Z2qfaL9thlOdh2cc0Kx6SDSE2Ji6mYzw7j2o5md+AMlhDJiw4gHL\/f6jAhBCqJZ4RVdK1raWswTfTSLrNhO9osXaGtXAMTsFJN0eGDsUZeRKQPYAU6RI1ZNXkLFFoviEIMHH1AM0\/b8xpRetDMAGHRZg2rWpYNM\/T36IhZzsdip01zdzJlZy9Gr+Abwu6GXaTkNQFmPhC1hJdEFufcohtZnOYzYztlSRdwzce+XCjNZ4s4oI442lQJLQuQxjcKcMCSTwDflPODDm5JFXCk27xDV8Etsrgsez6R5EtnbMzWtOfxiyR5WRQsDKM\/vw8+P8NrTzjFCZX\/XYTr\/8KbUYpqcYF2PZ9fg0z6SsPmZPMwS\/82GYv8JW3uperB+p7haL7T1y5PARIpnxt3VAF3aGtCX8nX9Jpkhl2UDT6g\/fRjejLtf1aHqJXTRQM8yv3ZAxAmzyfRvzr7BEM2RsBlbXA80VZVmix65ybcyO\/5bRS1cNX7pHM9\/7dHbUSqfFtXwORTYo+w\/ifKQMO0kOLx1eV3fsBO5p4SCBFfXkDLh5Eudogs3x3Urgm\/+8DRij2aKZeWDgxEwfOsMtNG6lFjNyNS6Bv1qaOR1cciIubzzapkPj3cg0oFxDGJ9atHFg3+Y5IY60+DvBN97C3+myOJdVm9L3lGQ0S+eoRSSd0ljDJc7qPKi9\/bqmlfD6EbFQi4z5Iq+yTMWroAongnimeIpg\/QrqKQsB3A6Rxo0Z+1LeDgCyZ20nL3pp6sKTlvPqyjylzsBMAZT\/hkyMu6FkTagZTWvkE0yXjzAfSGmPoeiS2jyWi5BotQjLKwRqKUh7yKbhCqffLrYz2lOfHG0y9Hy4NMcPmXk+ApmTegnUB\/eMpwryd\/jkqe7Rc4Jb4m4KTG+8HKg5c0rtBp5+N0iqKt72PFqOIfuNX46Ra6ejxpAbQn0K+Y7wLOD9WNTi0WJ3NM1OO40Ct\/nfPl8JY5sKcz9XzF8XjA1Ad1c9F9ZQTB53+6w+fe7kCAl1OxnmgW5MZGvQi4AcdVTuqvwuFtAD\/5+1VWxzaIMGsZB1vxC\/KlQtn13U8RI\/G8CFygKs0WJRkjPSo+ysqGFYcToxm8Dj2J6WAXCSN6iQx5QKJjNPRTIashL0LOQys3RuIbdAO0U+HHt6UNuYBLDtPiiooJZpCthwKGYxAEEVcbnhdyBFEpCdbXha09gMRVbmeHzUAWfbfgfpYkS7O+G1JMnztQjUoyoll+NRCFaTXng2gOgYPNILV5N\/spXFZxOZFmO3ioGnTYFQnE40Sh1L+93rSm+4f6EJ\/Ywk3IozAT9JBKUCv9aI7IAvStYyAE22QKfzAd8OEOSAKmS+IL8Pn+61n8N9m0sy\/xRPQHrhSMc\/CpTpQPzYY0VbtFyAi4aFQNM37ZFvCHBB4Th397GGIdiZD8kYyjyCx\/M48DqIGHQZ0T620yw6rN8hem+l7WFliOuig\/mYu+3Jmo3l\/5QQyNacm9zM\/iXmwBlYIyAPeB3lsJiWj8VW\/hOadsFp0dZb+Z7XcO6VhYSI2iUrzut3WOSum4Qye+0x+IYRaQ+V3v9NsQw5KICrLAz0YVWuhP2yI7lEujd\/Dobf2r8HVH+CyYikbBJevIckyml5rs2xSCPEnp0uAVpRjbsuz+njtf2gi7RXbaIh2KMW7P5nd34y3SdC2wshHvSqWZ8+B8ScLx24BdpTvK9wuAanDetM83AoFx5VXXypChwvr1SBQbmgZ\/\/N5hf7cnv9Lwq981tpHg5HYtsGvrZ8R\/zeZq9+1KFOUfxdEyRHSNV8tMpzVp471LmC+wiBeTuG9Z+KSM\/\/hybXdu5XKhCP3QxQhKi5jBAyY\/PttszR+aZYkNtd1Bd0sWIAL4wyxcVKKNYkZE7OcwaipHqQk1aSxIGjewkofjBXEhZL5pNvU6Vqz8zWhBRfOk7rhw6GMOx0uZRkjNmoq7xhH2ExszixTPfputABFPPTLlgdF3QpJuFL2pjHxsttA9PuxJKo0d4rpZ2ne\/xtpAIDzO6mc1kUYZQlV3HdUWCJSo7i3sZYhKdY1gf8Jrp\/D\/XcPFiFXKvaPjlhLL1gRFzRIwKeXssLNRArlYCMVYdj6\/SogI+X0m0X7ZAcy52Hmk1GVyA4218nME9jWHwJOsQlZ6PjbiPsmmx83tx1T2ui9R\/212ozDVExGQ5m19CGcwUavG33m++nSytoTSO5m3wBQc6l57Bk5QgRRbcKAXl0OA6cESVonsbfbkQpw\/ntvuVcVjiSNgrTWnZKYS0XRPCZPxGBPcG4gttEZqFFb9u1J60XchUxiVFEXidZaWgz2E4Cc8PAAhWiD+\/zgGcCng2ztlVTeQB1OCP3zcs9iAS1yt0lLIGYuROAiWuuZSuElxvn2uxTIa4sqypNZAaMFHl6sCAQtn32WwSaL38xVHH8uOkgfC1+ZkphL0CZp5P7YEHZiQKAemPUngYhHT7duMqeiHgvT6I60togFySMaV\/eTkA46iuWfwDEBZgG6zUXtu1j9QTwoc3BQpRssAS0XfAzSkNA+wQenhYZHrXDiJvV4K+pISPlMjJKOdNiMXj9y\/XOiJxWZFl68HSxBweU67nGMVYwjN+bODI8Lf\/FJ05QP6d49nHM3\/RjyQIJCfI3YsIaVRW7clYFYL8dzHZ7EywiGsAdFiC9dnWnoaODHpDYdTIXQqJnCYSJ0YF5aT6nEMe7s66IURiCc1nAXasQaTXFKzKYQjodgYFGFFal4IZKmgjmtZjhB3bs6mkZgs1EJ8cBeWS2jYMjGsBPR\/Exzf1gKzKS+sglscehGwz8daMIu1M\/QFNePJyJ73YUU3qSHQjULMxdXh30v\/XVJQL9yNXZINwadVSbpjsEPM8FGe6xPvfV+5lpkb3e4V+tg7kOX+PHzDjhB0iTbc24nGYc0QK1d1OKsaHwxneal1P0sbFGxLzQtaEcisVqHgO2nn70XMUqdKbjGtVK5POXfccbH4jw1+yCSD373MYqUXTP0AqL1mRu6cmVptTnwcPupEuiTOF3oRGAPR2j065v1q35es8xSlrmG9UW1h3gM5b8LKsQm92O1F69aJ+4F8u4XpC+BzZwb0xP\/VcHr3Yi3AMrk6Vz95Pz5SSJUbQd2gLf5sxdnxo0INHavD\/nDlDWTkRmg5dT52LbzZFdWYnGog2AMvMuCv6gOXH79TDty3xt8XR\/0KNfHAzl2Xf75pXqxOyCldCexfIZ8Ob453yFdQCu0QKGK7hnKijedlFCyqRluNFhPHhE1EmfMt\/HH3lEyc7+aY1qXXe\/qqMoH5ZRiREZ6NhxnDZqEBDGoEt8mfBruHb99fRvLS6uuW7muh2Ljh0I2rh91We1XuMeS92yvbjIaeRFrkGinQR6TV3ojTw+I5lcdZQu4gKKXwi7GNRAgytyaFMfHAaFQGWENkWu3pJAOfZ0VqAxPnWhc2kYUrLC1F9RlFY\/wBB5VP162cgHnMCbrFBuQqCtddzPbIdMZuMVSkO5H74YUspcskb5dETfLTZvhLpSvjtuP17gcsHNP1d6NoORj79gDPM11XCLV61LQuZMUzuEVdpGPNHGdmHzmtuxLI+CmONuoPRKYX7NpcV\/4aHa0IMfGU3Iv19hyDgg\/IgYT1t2hd3ujZHv8T\/9re4vzsU7muQt0gWQG+0VX+Ho5RLeD0BjEztNgCHK+LtrwZQO6ohEcIrbHrwMh8nDzp8nwA9R2ESxrBD3JwWnNdy2Vi7Z2HXZGraSr\/R2EhSYnKVCP0MmFjh4f5XqvgVRksOJyg\/Le987S+5C+ns8cpFp8V6DkLpaDzY2UY9tk5H2pkxZSm5bz1gmeAf5NK+yCN7uxSHhhuRB2Dum5QnuvaMecPYF4Lkj2LfO9uA7WgnGEPwG5hNCJJN+TgQrHxPiPSz0b5TpoiyLcH5zONZrJWu6oAnL4ksn4FOSbo2oHmJV5JhiH9HTYl3EsC3KexZjRRev8yfIhZK7s0tS9v0qTpogalRW2y1xo2g3YWOQKCWr+nyMbSthqFN6RFAQLew0XT1VEuijmOILxUae73cPhtq68qJglf1DhRwTf5UyftO+IxdWJjI\/Zi8++QT9zZUAOkF55+hYf4joNLczWd3nen7nW\/\/0UNU2dgCeiQWfuVJfptW3UDr7vk2PPQoGgahJXvpagtw+lRdjDSf5dt\/x8BnppKgfD6kOskkClEZpbfVVGhnVB3wRwS1kCI7YimD3lCp4KvU7q9hu9NxjhykvFXRV3lVyEJ\/1btbEbbYr4W3CQzoTuuUOvSUdaHYvKM8Bq4fQD\/XcQ8\/2ONm7QdUnwGd1R7paNC+Xj1VJgX5jLjDnPRmA5e3ms9tQd5YwkZSeQjv0UBGoBOshWOFdLuGah7K2WKfDzQ999zZPIWHZtHjbHS0DRZxP8gWTQg\/X4IfpV7O0FhteVN8k7vGOmooDABtFEIIN9o0Wyh2ZsVxapRFc9au2pMUDLvNTv8YGjtoHtrFeRu6GVlI6bKMXfr5B3R0nm0MHIlxvXauZWWkKDHHigsn5Ks3Y+1DEn0xea268YwI4rH1DXmJYk+qj1In3cEHqqj8PbQt8I8URhOYHfEU0Ve7MnzT7TE\/Zk92QQZJlkOzMvAsvA77cPKIKWr5AP57j+5J7sV+4e9KO+lT5Gl18Cc03JykMEB8n8yDqYrErkx7qWF1AxfYsazLHe14U3JU0pZM3fEaGCTPMefxX9eyhgT+0h9hnXVzuZzXYNMsvW7YZgR6cvrRhWmAsFUVvS1ElzOLGAfYpZv3RuEFir7Va2WV0MzZhM3m9We3psWIdESVFBRsf7KZswkhPHwO5syxRb54NFSSsFib0CAfJy+iUV2hnRgUjSnrktjwkiSSprpMjNQ0KkpvsUXC\/yw\/2YrI1lpjt0MvHSaLOI8abO7tRh+dWbA7ixSbB8HM3ZNCfoFK2LXjYHbPRZ84SGRgHGRWFpNkHzOsU8wVmwXvdytJC0xZhMWNIMC3XnveTbjD7s50OXcemcIiXtklY0ga2UJnRj1Xt7ff7ZujPv\/\/rqpKYAEhEjqc0mHwNW4BjAoOoUsE8Ev9Xf0hDJ9g3wmfKBRqXdUhDlFHYxj1iXlInGZ7w3bpluZeUdJQb+0+RBesMgqHGnOeeHF2B5ulq3j0TgfYoIB0r10y5ETnhClOJ3uQRflrQKW\/YekyixvT1+IMULSz9R0ZBQ5z5\/UwHdIBTVyftF4G2+lGVPssuppHonfHrScYYa08+2A+IzBM8bWjKjZ+e+cu1WmXEhkuIL8KK4NJLfgwokq7P6LdkPSLsvZnsmOqglKqK5qCIN\/GOAzSN2wPVAtEsgkK+DtdJHMb5AZX1yVJN7FgQNLl0ysYu52yhKb1Q7DnD8ctbtSeU4IJQ8X8Fm6E2qcZXvy5tQ+ZJJXUJYXUhP0g+hdVzNanMGGdIRnvMr+TDVLbU731iVesrqDxxZLAQIZ9kJudfytVO2zcSpGGIaiR3YGIDYrRICUMVqczMFzJuBuWXw1HbviJNzoVZylDihTgpj2lQO2AqHNvKne2yDz+ThI3akaW5r47vEPkT7O00PO5rSDoGOiX20qQm1NiJpbQ4A9XNoHdL3a6cSANcTFIl4WL4vUSce6Bx7\/avtGSVMf\/zhmORRQfpHO6qFHfekF7DGdBTrgGb5uDi+mdboWyDN4VkvA0fndfEF2p28IzS5CnuP\/geVRy69VeRlQYoSbDO2YJ3VA1obl\/BL7Ov9N9boZvKrS9ri+fX5UNfhIeibbhFJRoongQX699xeItfjij9f+ynYVJ5HxzMoITB78WFUIdy6ybm\/WBiHRcNo\/G0Fmle\/W3RKgCDxQd9lHOInCv7IGylEMBzoXPUpG2179EUnsus14Mueu8QkkKddYnJH146UPGjtOE6iWeqGhErUQQ0LD3c35L+ER09JL0oAVZcUtSGy\/Qb6MMA9x4V\/OTjnUA6\/\/pP3MZQ4bBXJ1uCRhOdr\/\/b0xcsxG1B7n6jg41V9I5\/ydfPc27HmkgI3A0oUQ4h8rseOxZ\/XA4XHSmWJR5M6sA6vNxnfoa6oo0rJfDYhQB4v1kqgUQjhWIcUZUhxCfh8Ub1WBjC3vWfFMSfxKhpnju2\/ZTSelssRCxLcm87Y0dQ7fI41mqGEgya4e\/CsTdawycAiW0YFe5afbcM4JfA6of8d4RcbveNYxnKcybSALiNC3zpOEeRVuyRpBBZUhStdy707n02X\/DHD0W2Kzvj7iN4j8L+gYjrGu77cg4S847XZnyUc3H7DJ1lj9sFwbXL25pk+CW3PtIltTYLxamArCYWNVwoHG5b8wrh5TA3J8\/ZMfYHKili3uKIhVetQzw4XIybAh6+0FKoI6KgnbLwFQ\/b7jbj8ItQQw5Qp6+qU1\/awukBbJCut7RkdBdCmHFnwCzciK7RH4Sm384dCQQu6GjW4cxifrs3ZAoQzaJC1kZzevK1MI78PQ\/GtlqDZvXrdiYhTPPybzngihIx6mW0cr95Vl6mIC\/SdaZ3FQWZb7rOxlhEHUqJvkp8ce5N4\/vGbhYg18So\/3xzqbbi3PDgf6jLEVe4HKLJaOuDXeBZf2OPrT0PqB1qrEj1Lfb1+W71YrQ6PfzvlhmFSZ95\/VzinjeZ4lo9ApGr9kgybZUzAIMk9SZQ70t2OHLJUMG0P63tnASw2TTzxmtTK36RG2LQvBwj4N4op2oRIm+57BwH3oWSaweQpsbtfJWuzx3W+GWqN7XxTtBCJrGFsAotKmjOIjuAQsyKz4ix5OngsNl8zQpFTH1AMlj2bi6tZq0vRXBVrP+yXOjgth5cutLS0SRL3\/dPxdVAu1x\/FF63eHrJw7s8V5qAQU27nWzxWcCKeyQHYwdZkRx1MY7BKhz+TXtvQy3E4Cf8OzYG3HHS5Gzb4AUiyG0kRDSUwqOPtKcHNhBT+U\/CDGrKlTLljm2MucZySqGxd5JdntMNgNsIe8dA8kHkiYaBccL5kX6uNys6upXA9IzdJVfGgx6zdoNAYVM8Ok29t\/YeJvKyyoB8+29dnVSSeUzN44n6HS2swgjW+rVZLxSrZJvnbtVGvPf2YZwzPb2sKWZoY6\/M5\/z4YlodHfLHuMonFOrgqbnPE4TOMQabWMwrqE0uqtcv6DGcmhdcHyWz6LNACDWKyJu9Ng7pIyu8QS6riAhY3iJMR2yviMLO6k\/1iSJbwwgtltq9aR9KSlEk9lOqct2NWanzls18JSWzo9HdVr12jY0U5cwI\/Q3LTW1NOh8Wx+OQD5NzdXigkXsrQ0KxO\/jiYe32t1ezpd7t8liQkt00sdxnX2gzosIJwzrN7vGs6LgMcz1sHeTwYBn8jyRVoiS4m9pBDRYRV4i3ktI1MiNuqcWPWGdW7hzh1YK+ohT+ulaWY+DarDLqP","iv":"c75ba7500f1bf5468b4a88d36b74412b","s":"e66ac24b636ae7a8"}

The divide between older and younger consumers is critical for brands to understand. Image credit: The Loan Companies

The divide between older and younger consumers is critical for brands to understand. Image credit: The Loan Companies