- About

- Subscribe Now

- New York,

March 17, 2020

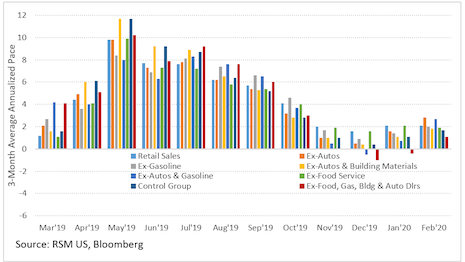

3-Month Average Annualized Pace. Source: RSM US, Bloomberg

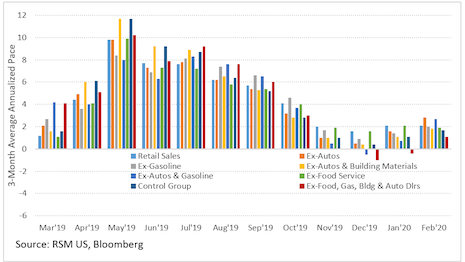

3-Month Average Annualized Pace. Source: RSM US, Bloomberg

What does Joe Brusuelas, chief economist to the middle market at RSM, have to say about the state of retail sales in the United States?

The conclusion is that U.S. retail sales foreshadow the “Great Reset.” Here is what Mr. Brusuelas had to say:

Consumers pulled back across the board on spending in February as the onset of the coronavirus began to shape household expectations about the economy and society.

Top-line sales declined by 0.5 percent while the control group that feeds into the estimation of gross domestic product was flat on the month.

Excluding auto sales, which declined by 0.4 percent, and excluding autos and gasoline, outlays fell by 0.2 percent.

This data, which will be one of many reports going forward that show the slowdown in the economy, is why the federal government needs to engage in bold and persistent action to put a floor under the American economy in general and for small and medium businesses in particular.

We expect that the U.S. Treasury will grant the Federal Reserve what is called 13(3) authority imminently. It is now necessary for the Federal Reserve to construct a Commercial Paper Funding Facility to permit firms to obtain bridge financing throughout the crisis.

The federal government needs to engage in bold and persistent action to put a floor under the American economy.

Overall sales excluding building materials, auto dealer sales and gasoline stations declined by 0.1 percent and excluding food service by 0.5 percent. This data also points to the need to get cash to individual households through a fiscal stimulus bill in the area of 2 percent of gross domestic product to fund basic outlays on rent, food and necessities.

In our estimation, the overall spending data in March will show a noticeable decline in outlays at eating and drinking establishments, as well as for luxuries, as households focus on necessities such as groceries and utilities.

Inside the data, outlays on motor vehicles and parts declined by 0.9 percent, furniture by 0.4 percent, electronics by 1.4 percent, building materials by 1.3 percent and clothing by 1.2 percent.

Spending at eating and drinking establishments fell by 0.5 percent, department stores by 0.1 percent and general merchandise stores by 0.1 percent.

The proxy for ecommerce increased by 0.7 percent, and we would expect that to hold up somewhat going forward.

Our preferred metric of retail sales, the three month average annualized pace, increased by 2.1 percent and the control group advanced by 1.7 percent. Those will be the peaks in spending during the first half of 2020, and investors and policymakers should anticipate profound declines over the next three to four months.

Share your thoughts. Click here