By Pam Danziger

At a recent conference I ran into a colleague and friend who comes from the retailing side of the luxury market. As most conversations these days turns to this crazy election, my friend casually mentioned from a 20-plus year perspective that presidential election years are tough for luxury retailers.

This was followed closely by Bain & Company’s caution on the United States luxury market in its latest 2016 projections. It reported that in this election year, U.S. luxury consumers were taking a wait-and-see attitude and that personal luxury goods demand will lag in 2016.

YouGov seconded Bain’s assessment in its Affluent Perspective Global Study. It found that all but the United States’ 400,000 wealthiest households – $350,000-plus household income and assets of $10 million or more – plan to hold back luxury spending this year.

Luxury is a mindset, not a brand or a price point

Since the ups and downs of the luxury market are driven primarily by the mood, feeling and mindset of affluent consumers, it is reasonable to conclude that election years are bad for luxury retail.

After all, nobody strictly needs any of the things that luxury marketers sell, so affluent consumers hold onto their plentiful cash when the economy looks unstable.

Taking my cue from these anecdotes, I decided to look at the data. Here is what I found, best expressed by actress Bette Davis as Margo Channing in the movie, All About Eve:

“Fasten your seatbelts. It’s going to be a bumpy night.”

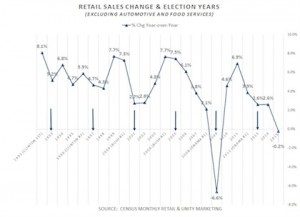

Last year was the worst in retail since 2009. Excluding the automobile sector and dining services, the retail industry dropped 0.2 percent from previous year.

Since affluent consumers ($100,000-plus) account for upwards of 50 percent of all U.S. consumer spending or more than $6 trillion, they overwhelmingly drive the trajectory of retail spending in the country.

Going into 2016, U.S. retail faces strong headwinds.

Yet looking back over the last six election years, retail actually does fairly well during election years.

But that changes in the first year of any presidential administration, with retail sales growth suppressed from the election year.

Retail does not necessarily decline – with exception of 2009 when the recession hit – but its growth is more restrained.

Election year sales change

Election year sales change

Take, for example, the last 2012 election year: election-year retail sales rose 3.9 percent, only to fall back to a more modest 2.6 percent growth in 2013 during the first year of President Obama’s second term.

This pattern holds at least since 1992 and challenges the conventional wisdom that presidential election years are bad for the retail business, in general, and luxury retail, in particular.

Rather, it is the first year of any president’s term when retail gets challenging.

We must start to market luxury in a brand new style

So if retail follows historical trends, and the predictions from Bain and YouGov are right, 2016 will be followed by an even more challenging 2017 for luxury retailers. What is a luxury marketer to do?

First, recognize that luxury in the minds of contemporary affluent consumers is shifting.

The old ideas of luxury are giving way to new perceptions and ways of interpreting and participating in a luxury lifestyle.

Old luxury has taken on negative connotations in the minds of affluent consumers, most especially the younger Gen X and millennial generation affluent base. For them, old luxury reeks of over-indulgence, conspicuous consumption, elitism, extravagance and, most especially, reflects income inequality and the excesses of the 1 percent.

We need to start marketing luxury in a brand new style that reflects the next generations’ new values.

Second, get a firm fix on the young HENRYs – high-earners-not-rich-yet – the demographic of the Gen-Xers and millennials on the road to affluence. Too many luxury brands call them aspirational, which implies their aspirations align with their old style of luxury.

Aspirational the young HENRYs may well be, but not necessarily for the old luxury that they are selling.

Rather, they are aspirational for a lifestyle that balances work and home life and sharing and giving, but not necessarily acquiring.

Most especially, they aspire for true happiness, which all academic research shows comes by what you do and experience, not that you have or own.

Finally, start telling new stories of luxury in keeping with the values of the next generation’s rising affluent base. They reject their parents’ and grandparents’ ideas of luxury in favor of concepts that are more practical, functional, inclusive, democratic and, ultimately, more affordable.

Surely they want exceptionally high quality, superb workmanship, and all the other quantifiable features that luxury brands promise.

But they also want to align their consumer behavior with their personal values.

TOO MANY people believe that luxury is just a marketers’ label that signifies something is over-priced and too expensive.

So calling a brand luxury does not necessarily make it so.

In fact, if you have to call it luxury, it probably is not.

My advice: Use the L-Word with extreme caution and learn how to communicate true luxury in a brand new style.

Take a cue from such brands as Shinola, Warby Parker, Apple, FitBit, Everlane, Suit Supply, Canada Goose, Toms and many others that deliver a luxury experience to a new generation of affluent consumers.

Pam Danziger is president of Unity Marketing, Stevens, PA. Reach her at [email protected].

{"ct":"Hqq4IjHJvCYjaUkCAgGcBs7H4d8zwCprrkyowDQr6VdENmEUOBw\/nNzbR5pGQn+aEpua869ev+XZj02+ewapsX62pYJiL50LFCw44b6Ja+2sTDaBLJ0DHrlYcGFpmPQmS9Ni40GQIOvy3XzYXGWqYQ+G0CJN6TTFdohhdz+EKwfQq0JX9Q3P2lBCoOWQKdlQQS+bUEQ5tU\/JX1IZHZ1wOI1zv6fDS+mGFQtxNY1w3pl2Vh6UbVDsUqFZ4ZJDhbOoQBjvYCUQexO8zIaEmKHqnoo4YDKuKCZztw\/vEOq2GFOE9iqTwR+RjSQalaRseb8IM9ToTJ9Mzqp6ol8LHkVKbJTm9ePoyoCLUWlSc6Y6rMbTk6+xPiHMiJ0DYgV08kY63bTdWYwJJeim\/WdVrcC5EcjriWOq0aa2u4HTayfSp0BmP8yjjx\/YzW4FW\/tMtr9RCKMtUNOLhv5uTC0ZrocKOpDV1O39DELvrlF2V\/xE8X5zCpq5167M1Un9+BWHvoe+tLF36Ec2\/PSCP6CGLDE5iaXSJ28YRUOxR+ex72InMOPxaq1mhNFtlGPM4UYTbzZC58+rak+ajDXRHtFGUioWZFihiTpGWWKg4w\/At2a09Jso77e4TMFGQx3EUUDsKjDN1TGTXypwV3AgB3C6OQZM4htcZj+3MTqtCyUNWWlx6TXYaJmVsDa18lm7dpAP9GVD4OdMNelWA3u32WTEHWTwlLBCIIxTTKpdiymWc4UawZc9vJu+YCTR1ujPH9BavmpUb2MlKXsBi+x9ynAkXKmn+2JoZ4YygN8ixfJI1XGWjMiEIJZEbkaN+TZ4KXlrLVLH8DedPJU1ies+p3BTcXAhaLGmjffHjS0fhHdldY1drPtd7+vUiLV9LVhuSwRGUlfA7MbOqLW7PyOjIMCdfYbF3FMNvXflNJ+2iNc9TmHqtl7DCdKAOVG2Rg9SGMOqP8aLuLtTkD03JXJGFsSlWLILdMTQ+NWCnbq4N5y8tToDZ\/eyimKSxVIzcGmfv2jgKnicDHG9w0udzwi0HMJnp1jrv5J0AdMiw2GA7bvz73KyTAaCkPcbfwJifFdc7CoOpzTHQUntA\/NQOsNh7nSboCP6hDKX0JVhSiLWGABoriNT8qjW51DfhbfCkgfLcbKnRF7TPf59GujpQK1V+ImwrqFmuVyxH0OaeALOOlFy\/864gEe8ncPj+9zDBln05LwYYRE8\/AIrw\/N08A\/Bq+IJhlkBR8fiBP9t5egJxs6emV6C1fAq4NnOueXHYmtZ+AxM0wEzRuMbuvOW1DziCNmaegjN18KJko0I4zJOXLkJ78Vi9u+i8WzW8ZooujrcEL+kGMk5S3Jc\/tUuZi4iiwwPTxLB7XmLhesykHporrBMfmoHUvkg5f\/xZEbAj8vt8EQzTyKKS33b3HVDveZkU+9wdU2qWqN4fkXie0Y4SlALVuoGcg+JQ79EFIvHwJ1HIF4xWuJyiD9LR5g5+tQ0pQNwYRdzDjFytjgcwq\/ibEdorPRI+aoH35UNPBfuWl3Vxmm6rMYGZ0AEmG6jx8ItEFPHIcsgS5nfEKle0sYgLAqgzfDre9X\/vDgKZzXiQrlZVT+eg3DXeUmrqXod44R3ELavIzyb5tUeet5cHt4FXjGYO0LRaZ7Al+Pz\/2R8Z3E5wNgWR+h9T6lBge5MhFv\/a8Yutz6jH6bsSOwbeA50AIa6YxdiZoqx80Dge10QUlc6HF22ktBOwEMrucHU5On6JRN3AeJBF17ghOJw2zkJE0EjcMaH8GIzQzuxhcTkwjPuXq\/UE0w9fBxraIceKcgEeFANW\/4xBYE0y5d4pysvUxGwgZc2fAvmOCbTG+uddeyQTlBQu8UW\/kxU4FyKuR98SsIKWJnqRWX090bfxDXgw\/SDE85nsLkw+RrIrzw1lwlBMOjZi7JyzQ4dJk0QkRo2O0CbXQkEW4G94kk6l039zRqMReIY712xy\/0VRkjbq82zsrmOHHDzToeDOeE9HvJcQvLKgVu3qhvAajKgjLVEg\/d2YpwwOt8IImAaQR772OJOWj54uBDrM\/rbQx3NsLz+e31mFZpMdwqVQHBITnCz5RsxjrPWCys5KveN2G7sHVkEC8JjT3JA8dfhE\/5sNVOUXQnH1Ym1C3zRmjPWVU6nn+l\/LgcRDpc7VLg3\/b\/yRrAD9+ZFIKM5R0w9rawBhV5SWz8TpO0es7WUEpgR6jF1lCIaNvEuIvjkVaR6nY6ZnkSzarV1BPuZ\/m4o1PVPOaLPJwNf8MiAzVCx\/xP5in2RiBL\/A6obQyytPGsp96moq+Y7VM8ZXd9foKXXZnkwAdLHJJy8GYTUVpR7m9Bw19\/BTG+R9L3NMw\/d3JAR3QwxqI6Fxv2qqRjt44jBvXuOtF9UeFNtROnP82LS+JzW\/NK+kO3+CjJ+SXRfX5onRYEQa7YtGV\/ghrAAftfgW6ytfRU3O+y6r8HsHeaauedB2rXxl1iA\/tGWMU\/JEUkeWCgUxWcb1TenP8J6vlxe305AVvHqInBIlSf5z+Wege1kDfv1W1ppgcNPVSCwOSIFxPV1yhq7FJzrgSlps4GRr6hXtGqIykvSUHjk2f0G3TmPHsEzqzqM\/uEAyTMfCu+sV7uEtZuI6dkjQ7ueoClsv5\/AQdXOYB4ZcOJxc7CTPKDYok7RVHuYA5nv\/Wm6xeP3xbIDjAfNEvO+JNq3i6X1F6yUsHlIdmOAo+MTGldUWRaHluMaW6sKxpRg3igjhq\/zd2e94Ev4ogG3WaA2VxHq+\/OXFprA3AS4dzh305kqErG2Mdrb42y3BnFdVuVR9peSa\/17I\/bAYLqplrpXpsqnSn8n1pgxoRngU3ZVTMpsu2lzFHHZgMfaZaa+Q99IQl1UQjESoPPF7cRd3wn05zgDKydTPdiB7UDWPIruQm+w0GOYk\/uYQBnQMg3awK49OZtk\/VIaKuqvpf5LRmwbrgCqrWgv1G9ezlzR6thS\/XEYvrIvdHYAv08SFUZIx7Rq6rU8BsoNvIueoxrlM+NR+f3wYw75pE6etQFmOLSd+8uyZtAy9uSQ56BMNWzhpgEe5b8womA4A7P6HesbIf2+pjVWNXcWIzZrnSqywbU3SQnST3fegGtjdehY\/IqY6Qg4PFytIhR3n5yT\/wCWnfrDhf+S+25HDuUveGUw9P6OJx08vT\/CCER+p+FfLvzzS02gleP\/7nu2zUzgD7wxlghP+tyMWiZnft816PVfZ0hZMBRu\/Tzx3re7NyP30EiyWOIZ0w+oxps6tk3hFkLeRyLcJ+4Mt8adpHm65tyVJr1FAXEnvU8Brzpnoxjh5KdKgKo1wWczU4ZyGH3+dTrc76iooAIR+Mjx\/QZuBlEMsepvmYDYx0lUrI70Q0SdYewZ0ESXtcbdmHJ6V1oQ1+dTcFBFF8crCGTT\/75yldbnKMTRIkOsC3w9gsxmgmSU4M6rihOI\/T67c1NKv+YucRiKSXOc2B8FdHDEIpVXXguP2SxTcEPVqKy+QEIOEndmGP444haiK\/MhIyY8YwUB7ULLbXSm9DoCjfnsxGLmWIMP7vnrRTKG1I2DtC5IyEC6kR\/llzap6WRWRKoW9ZI9RNfguWIhxujUv6yr36Dm2VXiq0rhXD3E4pivFj3B9PDRbvkVi2G2dFxp\/Of0LMhuOUzjxJdvOga9T+spOc9U9YMsS0ajm5\/azAPKvhBGln1FACdUf9QuB3GoaATAS3sfM0rhDISxsZRpB+xMK1tqd39IT8Qrz\/wibEr7IRrwaOwKCieoHdtK0+KsPy\/WCVPZRfKApZZ1X2svbn7dx87w13mIpgenDJMbvmYimjJha6V0RqNk78KzDO83NJq+30vpRCa4ifU9ieU5iyX3fqc3BGM1oJc+n\/rMpuzCr\/USQLeAd2m\/a8s078qCJPqUFIPqsc5InnqpbLa0LDATVugr6CvYEtXWr23a5kk5Srq0wx1XVQL23NsbZbumj7KagA7oL7sdf1E2Io402R3vZESIvalViJnR0EuRR4gEstrmj1wpN4geZ5LT9xHPgBmnKaGa4FtHeVsg8MpOh5j9KREPktM7xqqOVqIFyOMslcN4LaS0ZwmDENAtj5XBr3OQ6cKAK6yZDYVB9c+nTzkmT5bKKIqt1KQBfMaFO0BGQgjWr85msSesFWGIqqfxjPKM0iHxp4FfjOeZ\/SkeaTXaBsHfYVVDVRcnoJ1mVZ4+uOjyUEvRIBYELG6UYjnyg0H7d\/HGp86Ndot2ZfyY2n0\/aKmz5FTHYi4sQM7ZDDOertMETgTvtKA49yZhikKUJKruztzIyokULNc4Aqe6ScxJPi004P+\/mdRr3wk7YzgwQiG+\/lmR8OTZDzOGkKqeHiFsAOMvcO4Jz438SbPDr8Pf\/DboQhxpXcSzoIBXK97qS3wZpiiMr+atK83pzEa7NMLCcdV4XIs4Pm8Xt4UJLfyW8Ze3WfiDWKa4fdd0cRsM86tJ2E931YXySEgwpHmJBM6Ad6ASv+tiSEGqy3Q9VkWi0pgo5PpiARVzJiuGOjYkxQr6+EpjBbtZwfOrotDg6H8ONFY89y90EG2E+x83BH5qYKVkES6Cchcie1ZxwD4vuOEMIqnmLKt4hKwt+DcmbF9MM+cAF1vmjeP+1Di0kClGuT4ju3Wpnwj7DGqZLFColQHFmiIOakRgB89gICFykf0VBMTyPXHr0cnJ4LfUWhMMLGtH7MBD3YNXlbTKqO2TomS0Z+v5uvnI0456lQfccuQc3n5\/krpYRBp3zBSEv3qWy9Ofee4DCzcP5b\/uDNR5t8Roc7yvl7cXa0Up6B3lFItGJkWRXCzdQXe0JYLNQr6Qp797cWn53D9wjfxOavI4SCaX7uQ3PBl\/b9B+gf3Wi0QhjW0FqBKKD2FjGhfMDWg4Yt2AMHn5WXwwik1Z3Re7aG+QMAhH8iXTKkWFz3iSnrTRDSuePDp8tss+VFTNB9XB2HgeWwiKH84kNAyWp7nmhNFauAC8ttFqZpHYrSibBTE0Fq4AEdw8AGijS60YBjYQBMAewGWsghJjbsiQnJyeJmyR+IdjJPn\/aBnu2SPpvuI0VumvxM7OhMpkHja+43HRnCo6dQrEOUicVnWSSgppzKLjZOVXPwY81iN27Mdtc7XLho\/LrplY1o3HbHQLLQQCpPpslDUqNqj6ZFMQ9HwyPEzCSEZxhrd0aNr7Ek2XV3qOmyLKx7T\/xWYcATajG97ha8fk2WXiM2s+fH9Rm6PNn9i524FTuU3Oz48P0iw7AIt3pL98JjoZLnCftxqEAisbyNGZj42ndd+F+NdVwfOsdfG9UDVmYonB2Ja7laMT5Vvq7uLb3gF+3aXhCgMd7yN7ErZsvLhQQ4KTBz0R9ZlWDTtaRfOLc95DZwzRYkbIctZRUKk+XIPvSh+skgNQml\/1pCZ0khgNiPs8lXEFRR6OHnPfK2z2KBg0mZkBmUVvDbOD+3RLrpMWY2IMhMro8G\/3ZM3dbj0w0zdDcZ+tdqcEAmxac7w0H+3dOwjWqUCHwOXAXY1El7gWp5h4Cig\/K3v3\/VR4lQcn7w4OKktmZh+ZyJIP5G1CgGdRnu0eZQ8fJO7NJ6HQZCV7fa+Z32pPY6rDCZ0hzE2t+i8eO\/w50vSV5\/hePP+crbWn9EvYc7TyIY\/PMl4MCBxwPd9Sy1dYAeosfo4WJixHjq64VjOBhsE1j+EiPqz0mrNCoZKccqDdghoB4CX664ae5yP+TmM4\/QUCf9aV74b++w1+5XdvVPFGn\/Bsuf2lCrTmSR2AKRPLX+eFOYZnJPfAScfLaj1sYPI1pWnpMY2kC22sjDLDY2Rz6ek\/0wYS\/7S3b\/pK1yMdcDWagnNLI4bdptf0ZuPQwv3fvMYmfQlKGaPmxekc3kIfjgMlLMbFyxFleh2KS9BBgvXqwnTnxxzb5idYStAZa5Gimxf7LuZwwdXFEyUE2KZJrHLXzEy5ntEAg6WTJcjP+SxubkUXQOmyHcebimsHSIumBb624nLdMEbyl\/\/EIODc6WTr30Ug\/QIHQ+THg\/lHoF5tC+dwmlaGgIOpCDZKSL33VSwJDxD6dstrwhGJbwWgHs0XbttVSX156Ht9lLUEg5otqqRdayc4D7qJVMGs6QiOiG7Fnsm9wKQN2CTeAv\/OKWLP5wKq0vpyqSn\/GjVXePlUXUj+PoPdRXKTarWeL187qHLOByfWNln99NmafIXVm\/Q1cT\/55Lf1a2iy8Lw0jLuSI8KuXCKKAYCRAoOztFPstgKZRVtZmaLxPiOeu+eRAnz3rMIdRvpFYUPVuL+rsf7ffV9d4su3XqHdgWT0HuS8IevrrtMcuDT+d6tTJvd3zYCd8aGCsX7+CPX0SXBqFav4kL5YBd4rRb8HAfnQVoeMsThYysXFK9o9qpUMg5uGeYNUfNBBmRAXqUiIPbBdwvIpPwx6gk5IGC3vXQlHH2SWAcx+o2KWwfoNIeVaH0c0+BAZLVgLQjbK3\/NETvwd0V2XmVj8Hbp0AuALO\/GtwZffTk3zQOYdlZsJ6KZkm4N3epv\/r+d6ZOss6hkVTB+rh1U2uY7VubuXZi3AIXsSYlIQDzvE6NFlGLvbm3QlVuQdpALJy0GYUIcpdueSgcdvG1oB2iws9WLcoqYUhDp6U290MDYLJeERgY2NdNWWLSscsoBTSw5vH+Akrs19CmMAOGTULu92PFjAsPZip4+5pkslb\/qvzb1ahYMjp+c3iZMdEM8XoO5TODdFUQwzyPH2aZUBeevO\/SSZAEvanrCi7oOrtz7sU2iWVKNP+VJUOUS5e1iTSBdJNio9e+nzUgsu\/213sX38b4W01yxTAjIlWLdTxiHE6Lgf1LLL0Dsch4bsJ0G3ckNvXtVQa3VL05W+5Qmi8rc8VXh2aSkLtfD0iIn0JDPXd33VUrVal4Ie415dUEQcZ0ChJpNy04wcMWQKvt5yLBEGMnGA9MRHEsFqteirC1d33dB8Y5igPSF4MTn2iyXwakdKZ4VS76VS2gQsF7TNvt9U1U7gpz3LGmK6oNScUS4j5\/1wFXEOgo9qmCTDodvytaTQO0r0dFSqZ0P4P4M4UHA8+4hJCQ0JDiWNHSPAbh8QyePvY796B7MEPgc3ATlmF4rb6+Hb8BJ8M7HlU7+ah1wKcWSZThZ9vfDRwvYTBZ6QFysDO3+7MYimV4vkp+F+yN+ki9XG9aFPMqUexGTfs6lP98jcNK6VrZYN4LhyL172EyG6kpAoy4fKIMqLmZDEICaclj4kPYURhVEmTiPH6z+uSFIqzQ2gKDYNkKSc0P8J3VajRg3uDKycq7ZqqDbYBXqAud0cGUvm2DXb575dPl7wZrxind8OcHrZ7qGlXMtlHM96NcfbvERiOf\/0RB6dvWOaRgeu5YlmRfJBPZlQy6qgETM7wiGmwTxrmdOspCrITItdLC27QagVhmBufoPpAZmHVcAufWR7p0yAwHCPmk3WGs7zzmigd1WJrKLormWkO2ZhSRsKOwqtECxK\/FpdAZHWuwMiz+6ZPqEI+Rzy7rojTpHJ8b5ZdIAYAkG9NJXYQtUb1yZaOJ7sHA9Usz3e55ipO8aMPJAkVQLfsjP\/Vnzkn\/gQiTKUuhVby5a1KyAQLkKwXJRgkLiM0wPgZ1yW4e5f9MHRJH9C\/Gf1EgiQJyrm\/FnJJI1dymR3QdQvA6WNU2Jc7EoQxYjSgFnmFG9BZJ5Fugz4B8ui25wTuLhTTvCWnIbtLkfyKtFN0vFLfkbyxlp2NsPROLlT\/64RdLvB\/j7gH+KOqZX7B1kSNHZt9SzGLvqq62qxbRct2I1spkZMGiKfgyPFqSvKh5n2TOElXBzS5TS2L1QhNlSRR2c0CTgyXtzSqAiKHiVekf4t1PyLQ\/5ABO+9iWsDURYTkVME6vl+Nfr6+iXxZjaiquBtdZr1YTN1uirfdgCIeiKHJRjsVZAhiUdmuhPb04cjeBp2hdifCs6f3OmLTlpQv548t3k4ZiSzvDZGeN6s+VQybJvlF9w3ER8oTpkH1ltmSo0DzIh\/PslOwfzF2Iv1gm7cRJ5xYgXDVkL5knyLg3WQN940VjOGlBk1wOtEIkbAa09d3GXJ1p\/J\/N\/x6kWiVdE\/wlQ2UwTKrV4CtjadLxhM4UFem+T2SArinuDot6JMiAQEKY5VJzrBVUp6MsmgH4J6kxIzWFQwM702ThwkZIUC5LDOyuFDOXqk2DOFkTO45dRwhu5aZifSWGPlpaRNYezBwJq2IksUiDH0g\/Wi9dcjxkjQ7xzHB\/BWjgZFB6wFSpJxZSIrvMs8nCF9Bei9H+WgShG4GXCuPvUNnJPDp\/tzNCzzR8uKUUuhbxO+S5WV3NrrKlvwovxj9SmdcCtfK84x\/NrhkXYUyAkaoRjm6BVVDMbY1g580w9po\/JioD0U3bcckKKbV+9s8B63c3+aYMxkighrYv1wkmbX2VKtZDVUKVqQV4KG5nqhN950597QhWAR\/533HxTARs7881NhLCEZ2vd1NvpSo7vO412Sxkb0xajcexQKjr\/BVqYm7w8B9nyn2wnW0Rcn4wtkogfCuKmWBq0Be3+SPQUN2\/7TMWUV88qi4QYFt2XX\/\/ID92A\/qp\/rugybTlePVAwVXrb0gClZTicqimI\/mZbnvgxtblahM6BFx5lcY4AeoTfsxAz9XYipV3\/PN448WmT2jKAgTXloC30+XL0ifP5O+O4fPBK3dRtxJAyuKIR8\/OiGV32hCTej1dlDH99fH5bY4cdQjoTVX5cmo0HFPbDgr+s5N3h8TcncRxDFBxYCnis6kBN81yY88Up1AS\/lC0wqfus+YkBhiSE54SIpKmefyizwVNgBtCBBF2QoMfGFUoBA6pEkdT3rlLyDhu1tpvU=","iv":"71af2c5394c1c5e831c67566f8286f6c","s":"9fa8bdb211ac1787"}

Pam Danziger is president of Unity Marketing

Pam Danziger is president of Unity Marketing

Election year sales change

Election year sales change