As millennials continue to accrue more wealth as they age, that growth will likely drive more spending on experiential luxury, according to a new report from YouGov.

The second part of YouGov’s "Affluent Perspective 2017" global study looked into the ways that affluent consumers are spending their money. What the report found was that wealthy consumers are continuing to spend at a consistent rate, but that there may be a boost soon for luxury experience providers.

Affluent millennials

The movements of the luxury consumer base are an important metric to track. This is especially true when a demographic has so much spending power, meaning that even small changes can have large effects.

For its report, YouGov collected and analyzed data on all luxury buyers’ shopping habits so far for 2017.

In general, luxury spending is only set to increase by about 1 percent in 2017 as compared to last year, meaning that overall luxury spending is holding steady.

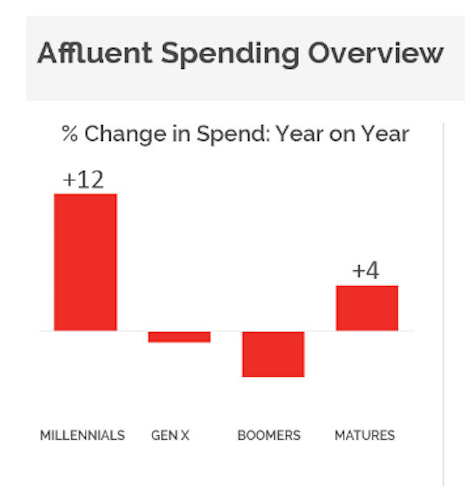

However, there are some changes to shopping behavior, if not in the overall amount spent. These changes can be tracked easily by age.

Overall luxury spending will increase by 1 percent this year

Currently, older consumers, Gen X and baby boomers, make up the majority of affluent households in the United States.

These older consumers are planning on reducing the amount of money spent on luxury goods in the next year, by 4 percent for baby boomers and 1 percent by Gen X.

However, this number is offset by changes in the millennial shopping habit. Millennials plan to increase their luxury shopping expenditure by 12 percent, handily making up for the losses of older generations.

The more spending from millennials also means that the luxury industry will see more spending on experiences rather than products, something that research has long shown that millennials prefer.

"Biggest takeaway for me is that the market for luxury goods is for the 2nd consecutive year showing minimal change (-1% was last year’s forecast, +1% is this year’s forecast) while the mood of the affluent is a mix between optimistic and not," said Chandler Mount, vice president of business development on the Affluent PErspective team at YouGov, London. "Emerging economies are more enthusiastic than developed; younger more enthusiastic than older; political right more than the political left."

Experiential luxury

The move toward experiential luxury for millennials consumers has opened the doors for new kinds of luxury spending experiences that did not exist before.

In the past, fine dining was an ostentatious, ornate and stuffy experience that attracted ill-informed diners who cared little about sustainability, ingredients and culinary innovation. But, dining trends have evolved from this “sad state of reality” to be experience-based where informed diners, armed with Instagram, are increasingly appreciative of culinary trends, exotic ingredients and talents in the kitchen (see story).

Millennials are planning on spending much more on luxury this year

Many luxury retailers have adjusted their strategies accordingly to take advantage of this new trend, such as a new in-store spa featured in Neiman Marcus.

The experiential addition comes by partnership with Hudson Blvd. Group (HBG), a holding company formed in 2015 that specializes in high-end beauty services. HBG’s beauty portfolio includes DreamDry, a salon concept that offers on-the-go women convenient and personalized hair services as well as Spruce & Bond, a brow and hair removal studio, and Pucker, a cosmetic and eyelash extension provider (see story).

With millennial luxury buyers’ influence growing, luxury brands will have to increasingly turn to experiential products to continue appeasing them.

"The watchword today is leave your divisions at the door," Mr. Mount said. "Now is the time to cater to your best clients, and not to let the machinations of the economic/political world interfere with delivering high quality experiences."

{"ct":"0QeP319K3J8bJ4nZACBn3ILt\/\/t1GVriAkb2FwiVcfvB1vxKmRMEkWBPcjmuYO+vIhgf6Vvs2r6uldtBuSVF1hDhPLhFVJVuh9ARFksKX1yS+BuC+i\/VcM\/zQLXFsL7NTw24GwhMM2qyL8PZMgfMfIFfzvB56KlAQj8k88bGAUajUc1KuEIhAhqfWVGU95+x4wzyuchF1hCsllbZTsWu\/A\/IEN3LJxaNJyNHPz9Dp3n7rXLWov1hw1ZzWjZFuUDiboV9YWdus96X5\/x4IFsrh7xsvz\/4utF5iQxiC\/waqUxGLZhNEPGNwX11\/Z34ry7WZlnHSW1jwZRuxFbBBrCJy10fDiLWdPRdmbudlKuzmGXohS34V1NE+w28fbD3ap7GSX6fD1VbaCNHwLEbRV1KJFKJdibVr9G9aoz4Z0VIVHquMTfhf45SzvDHKF0MIxWl7L3MyRQboJY\/YO7BvusUtmI90WC1PbyjtV\/vAFggCF34D0pc1k7Wxy93ZnjrO+TvxqYqFBifWjb4XnPhdeqkynF+kBFl1Nrkv\/PrNymOZmA23zVUtrLfHUZE8\/t\/8TltqlNK4Ed\/Ai6uo\/fYXxYAwFMCwmkrUJLLJBgCz74BBWi8dAKpn3cOYEJI5wYn6O\/CeCuwvQdo9d+W2UscFp6yScAa1mJIBWoYDJBE7dQ2xiCXQ27\/JHKN3stARPov2e0px1yyUpOYZznALsz+nVmGrornqHiWMHs3wCc57F7wf3wJsmh9\/6b2xCvNN\/6AkrsiIcuT3kCda8pKZjwtXWbTLMDWcdVrp2O2eOXxgNEJfmqD5EXC3eSZJulwWaJ3ouCw5aHse+KcBZAPrOrWrPHhDBgvUBw47o8PJdBg9yZVi3uTYE2T87dTUw9crl74aONzj7Gt\/WIyKWPJGrON9OT5vuvfxdwRFBQ3r5P5EZQlepV\/ij6fuXyp6bd3bVILgS951xIebFpQUb8m8vGUaJUmitV7THqHzFOnU8pO2WChP5fGvblLs5hmitE2pe\/cE5u+A2dGXHkHrp138AVqE2xrBHwWwG7eOL7+vVjdXqgVkiqbmylKTn\/7IDrYrOrNhkTwnvdOO+TGubzLJ8lVubwj0ONgK3F1KAOCaXZnWPBgKapRDWDm1du+nhzNOdlklMA6GgsuJLaldQAVkhY9E66B5FyGRsosTAvXVyocMMYgOfXIe8Py5hCtmAlfrGvzqB6q4wz2DaUPzx\/2ajmLnjMpwm5CcIMIkid1LvUADespolCAaSa3sgL9Fqe\/Q1eEB6JbCTBzrHmXBBYM2FRmvfqenzkp3tiuein26+oU\/tGNaGnc7sR0np9\/ugyQino58huAxKuS6O5yHR2Za5paNhIQ7gbSDExN+oQE02mPV5WcOeJSn4ekiNYRhd8DDgjlGWkXW54WFJBJqSf8KM7keL52TpZmFMbx3zhwGvVRSX+JQkjntQOyi45D32v\/pwhfz0NWW+srmdDCHyIg8lN1uh9pfLz552VdvQEtxzP3VEF2x0As8jPkggy9zP3DJUXIDYTqJYbaOiJycA7rIX3wCQoxZsNvUJ7Zc5syr2FdNbeOJkd6jlFLop1YQ5tgDiNdyc1z75RkLL5Mg+RfWQWXXuq4TV+UKhCfUmLV+5xQQT0XcOgRwUgKNu+5iVx7DH9NM1nLL2UwMo5\/BIAWaXf\/4wwQqgGBY0uRanOREY7dWjD5uNhGkDCPgU8mVTYhiuLe7\/SjY9u4kEvGVV4Fhae\/EtiD2ycKuBntQn1TVVeAyM9K2cNunCFYxV8U\/WE6hSkToAsLVWTsyH1dLwtu1eZRh7tU4D7BhfJhRCPO7f5lgHLG4btL7W06UfY9BrbMvLa9SvZBgylUrTvlWNRdSa6ghIT2Tv8MkpDmbvkxGv+LCliN3Zlk4f0sCWhgD9WdyHPz3kdQE3SPPI1uPX\/bciqp5HNPU942ElNWr1c1Litdi1laPxp2mRNxiJWdPyYEEor3KMnVlXYOYXE+7tSGyxDpAuH4w2Vf90b7oGLpMHZhHjsRN8OQdf6XGhpta3CHMBuWVso2o39tNB0pJnycuPpo6pfLMKDOK5Qnve58the1ghaTZY7tDR8mihuSijNoi7RaC54qzKTcFK7TwDHfYz96cmZmLDPDxu6w5eBHGBsPsId5etKN7nyESPLlyOKbaHCzuIPFITPUC9iTDyOcwSAyAzfyr\/lr3B5Pu1xun5YuQ+t\/UbGipRBEsTs4v7nkuKydJVXh\/uEHBi88RntomUAXv3O1CsYXPEEN96ZAtTuZqmIuIpAqO9UlkDKWwaGo4qjL4t\/F+NCELJ8hao79fUIgoE1frM\/qDFdqVFy78wjRBKvvOuKfvJVNApkXKLNDVK3f1pVUIGlGd2GLxhwVz1vP+373dD1FAuW7NJPr7PE4pMEffrxE1R++eu05H8MuWzTm70virZDSvF3V9FjyMU7x6+zQe5FAaqPNgZVytCemonVklse0l2n\/Dv7vDUULT2uLHNYQJY8QIB9tKETITTy4v1MFlg162IS19jq36iSd4uS6PZ1O0sPiB\/YNFooYmmBkBZZkz73X54b\/\/kwMB+UDMWGl3dyFxkmaqFnk5838dPWykuqm\/5JtRfTeqK9FtZ2ko+9Zgq9LnKpzShTpzj4MV7vezB4FJOdBbT+25N+OZ72TOSWl8fKEaxyAi\/IzVEoiRGiEtYGnODdlbEELnvAraBzFiTJW6bnTfl\/8854+Dn6DCoF7rwPYed0WT4FyE2BrbA3Hv5HMik5gcLEvSFeDKmALwojENltSED59bnREeXy6LQCD+1lPBLWB0srNAjjFcdNH7OvR38+qH2LW6wQ1\/xdXQs7q89oP6BERW83RPI8AdCi1ui558Av3sN9JtdCLq+jgUmzNAVvmwqorKmrk+9o+eoNsTqPfOMhHMInkrePXQxX9emuAmVQFh7QcXbFlNBxYwuTeY7aGG2VfigCl3cE0OEMre9xEe5sSFr1KdAuYH0bhPJiiqzPztlftwUKgw4YbqkvhcYEZ5kaTU96hDj6ss4zyEUbBNd\/lDoXI9hsb\/qcR945oWxYTsfC7iVu0CdZrImDBipRU\/\/IdPlpNBJjhnj5vskAo2LdbSTy\/1EaSnflEa17\/Qj8vJP4NeXxhJCZMgi0e8zBb31faxWU1qpE0BXt5uMRwS2u2jU3UoOnPk3zeU5K9yxwDjxFSqpvP9WJv5EqYAF4fYxBxeKquVt+IdLaPV1XPYVJeSXzJIzlywV46tw2vs4IbcUp4lWSoOgEdIG0D216VsSC2eTwuqsXXprIjFMrG6QYZYihXDXUkpfF43AAjgRwd6K6GZBLu7jOt4S09tTU70WK9PCkxPxvLBtiOQS1J98WbUz3a\/UspLwHwIACN0Okjdzc8x+wxiiWit5XYvDwYBBe03\/2ZnZR31o5xvcdqemxZCiUucc\/m358B22Scs\/zDtvMu1asPrQYs8xH2OBlbu5lZ3UQbAR\/yY18DgqnYFcfYGTe6DOIjjSg6OayAtRaopNb2L0R7pRfYfsCASfJ1X8rLzDLGaat1m8CnYN5JpcCw\/tTJXhbyINlaJNpcCFndGwDdjQyTKbbw5TO1mWN8RprIryYRuG5ivMr0N8lherXgs0ELM7tgQSM6hRXrl4rKPp1kc9+IJntvPpStZOSYw0A48\/AJtkHTTo8x\/V5ZzE+pJ2\/MCia4Rm3tzs6BNy0\/bUCAGp5okcK+3bUA02oa5Hr3Ygfxoeje1PQxdbVX9MAcghxrgHFDrCEkzS9ziOmf3jkTguXIoBE9ZAJTuVhn\/KMKQEwzBVndHvE0\/LTJNjwatPhiYaalw9vV4QfLOVdtlkkVAwMvufI6llgROJN\/oBrn7jTg3KG7jXgSh+agDLkEE+D+80GbZB9C2pV7QbMYTvt+AhRhqRSsj11FKCB+\/wRsklbSU\/tDOTwsOyvp2OQxfGs2x+icZB3x45mvQBQnNRvGOOTCRWDJa0h0VJP2xIc6tdQ8HI948BG1yoFKYfTWprOb2fgeiuSVlUUOplgTw7avIWWqKQOEGFdDSsPkWcFcioyneE9sD11KFRD+en+sXYS9hJSr6CyVBqAWnNDbbDpX7RzSoX8r5vyu0W1qiEN+FYFxsccbZ4QWBKIfLMLGBspxcAwBDc91fb+J9Ph1uPGF6yRpDScf0CVDwdBAsTfIWK5UPBzPH6FQ9sIsnI\/Z6KNn1F8Y9c0ecD+x33i1LEqEE6qFAr7L2u1hEODZb2U\/FaqFMWQU2WuAzUjL7y3gudGgkRYtecmER3CVbyPTBPFNk6MI2IrU9nZu7E3kHJom2TXLxDH\/aKbLZ4fBBIn4XNOfFsVc\/S0nblDUSPtWyH0xAtJgoFVw\/hfZLmxBF2YacdWfQygS\/nj1UZKOTcLbBIgXlYlLu2tNhW\/TIrM2SABux0yJorCENjyOx8yAoV4rC5xfFF82ik3+yCj3rmuALlZpw+UL1wmbRVXQdLUgbxX5t1\/P1hF\/b+1yim8G+R2fvRmsz3uBGSeSZa8XLDk8p6D7w8aYLttMFnmfJK050IQWU2T6Kni+54YbCorxullN3Kig6bPqk9zM4Np7mKa9WkSJU3kmfmWz9154V\/z2F0MJsA0eT7IgVVY8skLdmLq2wdxXomT6HuQeEf9O3nHmBe5Qd6mEu1TnJIt7vqgtFLiCSVpgb1amRP7RuM1kkn4v7shF6R9lupJwq8E4aOTc2iJ\/F\/H6eVruaCA2AI5Y979P5K65uXRcbBtZHDtpt30GT5fmF1lnYhElBGwKt1HS78wE9K1Phlx2eXSE11U+tdY5kMEj8PvBhJr\/Yio5OG3QDIuD5ANFaFefkQL6K77Sn3t8RQKnkOSYFznwh3A+Y5jT5v6cZ\/ZjVW7VsTLiAf3rceTjVj3q8p4wuQde3WROQamq\/NUD+5FZFOHKjfNExMfU02I2vJhXoBIvlpcjSt9ahLrtEn4RtBDOuvyFW2NrhLiOhMQE7SnyBKKDLnlR1gd\/B0kj9ZhKTk6ghikMCPgBM9jq\/WbibwoXblRTcE+E0we6aGC9NA3XsH2bAcbCUDGCT0PEsmugc8HqtjrHwd94MmwInquwtAqij6Q9OgfXurgaTyLGjfmLTzSBUaLHeY1L9rV3gXS5Y7MGGCrRMd8UnBysfdCEvI\/M0h6d1jJjRr1Phmo484sDFeaElia\/GorkZITC2fooypXtgikhzlTN65evlq8SK62ns1F0wMOEkHXCeQtTdyFR7Arjd3CSX1oJ+yYOfgZuLnxugGPjsx2MmJhGK7Of8ZEdlFYss6PdSrIjOgTYf5ix1P2EZozwVOYk2Kt7weY2HnsfoQ2i\/7V474ycsumMt0TUlwQGNF6OuCqDotCgxJpA0zL0p2G8rXaqqsh1s3AYtly\/GeyaDj3wdJvPYwd\/IwBo6MRMFU\/GVxfEtcW31CAAIUk+o+Rrt8kwiWy5zNDq3Mn+9pxq4MOvW1gVvJxBMmZ95yyGT2C36Dy\/IvmsRwt2oRAjxZFX4kMgRTttArSXej\/DMQM7Ps9O7Sk5zcL9ywqnGleVRUJvf8vpDmrtPqL1XkE14\/2zc6qMxTQCs4jdHxiUiBepviUOAWxmP6RkyVUxVwxLcExLl5\/Q0Qo6nDewAVGreI5vlHeW3gPlsKzKWN97rpbKd8Ly+n40Wx+mIYinFW5BBtHIw7blJlMrt3kI9t\/T0gt6L98ASUhSG4ope4OxJQoawjoE5hXpFgCYAfxQ\/NaMw+vc46lzbg5CwvkoQt6ZnUQ1qzLAv97WOW2G++8LmlAxFJ6OjWDOvc6iTiXw\/rLTZGevFVUmGQhsOh1J7+aOJohzPvSdlk2MI3HWFxvxs2uuBoZ+Es10Ih+Z9TwxhLZ9rccNXfQcLSEjVr4Ti8QwBCrCdDURgfn9PM0xkweTfm3jgOXn\/cCpbAo\/jn9OhyRTdAMKFYd+pIMTUoAJ7J\/cmvbRnc\/tbY8LaH87jx7ePjY1tA3D1VDgFX5QQbVYABPQazeyV2fRghV5LWN78BJJD0WkzkTJdCv01rNuEh8BAGW4R3GtacljXPLd+cs6o\/Eh5LsvlUjxoMgFBy+N50tc6Pg7DDnaPd\/l5HPcA545jc9wcHqSS3vyFFsWmu0fcv+m4roglCtvds3zlQjxahSGA8DVnkd7nQUZup+dXfDyamVnnXLqldX6\/Imrv2zZ\/KSSJcKph0A1J2so3Z13RDSKBGCNcsKyNgQGYTWdPris\/\/wapJ3074Jnn0cmS8cyBv5X6WR83BZYKTBmZ5Sr9UGcasVUMnCvxz0ATvZSmnk+g\/S6CgkS7UT81B1W1C24L5KIlM3FrkA8twMENLCbabCfdxG0cFZNZ4Or5oKmPV2AnXe37ImU4Nf9rwy1gBD0LQc2UshEmr74S2U314KOwxlGpR7Ee0lFjMifIyvaxkX7IIK+HdJbgEQo3dU7ke6ZuQ0tqqgQPvTuFEnsi4Mnswe6dHWh5Jx\/LmOsAbk0gB+EhpyosojOTMut\/fVp+VjS8AwHazCLEoMtZUzq+xQSnb5YoFFCrJ+FPyYJWiNN8hOEqPpDuW2Db5yIF8aX2xFw2LaoS6MzOYhNQIVdB9JUO3SyZToRlHmdt38ZERyJaz4HReSRNIbXNLQJpE70oovnDWjOR6neI2ejWJZuYZQ1oRbnct7avX8zuWv29+VeZRWfMVZKDM\/1dziQrn\/D69Vg6yO7g5DNCyQgD57+Grt8eS9RX16o55URFokU5qkgG+a7AyB7z1+hV2wTKe94oEM3Fq\/mcvz+uJnwpT4fD4HBU4Vtd1Vh2Q\/yqyXzFzb+Iou2TEtO7ZsZBQu8e91X0Rm6paNPg\/Ijw028xTVnI1b8U5vUy92\/QCzVnrniP0dR2PSt9UDhZxoX4jY4e+lu4Gn5PGTnTJG65K6n0HUNH\/WcLG0GEtNdf1dxFaN\/pYckGiSWXh0afCzQolUobA6biUt0fKnuMgtdoM7z5776wNm3h6jMxlrCQ9Kzxz7wBNV+p78xNr3l9d6PG6p7ttjSOXGAv5JIxt\/B2hIL+Mhtpd4eyDhEyiTWEtW76nm2bNtHCrpKsehFm2zsQcJh0gSYEh2g6stJPaF3N8RcIsaNykmtuCtQGiNHwQ2P2eeGdq3JiyX+lpe8wPvJteEhkwW4C3bBBiiXyCzNSN4IlNR6bhxK8FT3\/A8WqYB88Ljx16uLVCwcSQpoDGSCqU+ardlBccZhTqKiGjiiqwttSdWA2Z+l7BVzg+7qTsMPBWJaF522","iv":"19df129e877f7deebd48273c9b85763b","s":"6df0815d2395e8f0"}

Millennials spend more money on experiences than products

Millennials spend more money on experiences than products