As millennials grow into the dominant consumer base in the global market, their proclivity for digital platforms is changing the way luxury brands market to their demographic.

According to data from the Shullman Research Center, digital platforms are the most preferred ad channels for luxury buyers, and they are significantly more popular among the affluent than the wealthy.The Shullman Research Center attributes this to the presence of millennials in the affluent market segment.

"Digital platforms are becoming more important to luxury brands as the years go by," said Bob Shullman, founder and CEO of the Shullman Research Center, Greenwich, CT.

"Millennials who are the 'digital' natives and live with their smartphones are currently more predisposed to use digital platforms, even for consumption of TV programming, and are now becoming more important to luxury brands as they are currently tending to buy more 'affordable' luxuries," he said.

"As [millennials] mature and their disposable incomes grow, they will become even more important to luxury brands as the boomers who currently buy fewer luxuries grow older and continue to decrease in numbers and eventually no longer are buying much of anything."

Affluents and wealthy

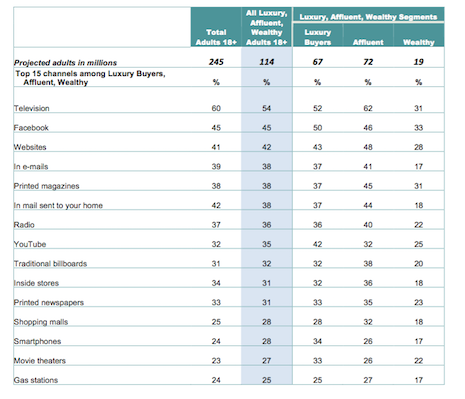

Even among the wealthiest consumers there exist divisions. For this report from the Shullman Research Center, affluents are defined as those with an income of more than $100,000 per year whereas wealthy are those with an income of more than $1 million.

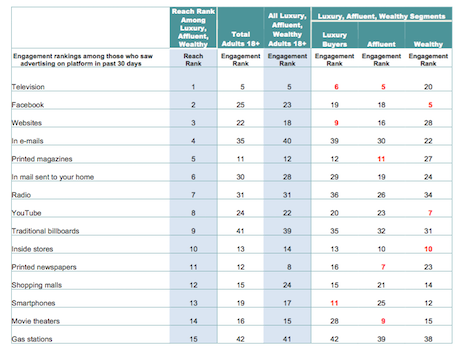

Among affluents, who tend to be younger and therefore have accrued less wealth, digital platforms are dominant in a way that they are not for the wealthy, which tends to have more older members.

As millennials have grown up with Facebook and digital life, they are more comfortable with those platforms as vehicles for engaging with luxury brands.

For example, 48 percent of affluents said they had engaged with a luxury brand’s Web site in the past 30 days, while only 28 percent of wealthy consumers did the same.

Top 15 channels among the affluent and wealthy. Image credit: Shullman Research Center

One of the most notable statistics of the report has to do with the average price of purchases between wealthy and affluent consumers.

Wealthy and affluent buyers tend to spend similar amounts on things, with an understandable preference for more affordable purchases from affluents and more expensive purchases from the wealthy.

But in the middle is where there is the most disparity, with only 25 percent of affluents buying something between $1,000 and $5,000 in the last 30 days and 47 percent of the wealthy doing the same. For comparison, all other price ranges have the two groups within a few percentage points of each other.

This can be attributed to the wealthy’s comfort with regularly making moderately expensive purchases in addition to large ones, while the affluent tend to either buy affordable or go all out and buy something ultra expensive, and saving money in the middle.

"The wealthy consumers with have at least $1 million or more in liquid assets are notably less 'cash' constrained than the affluent consumers," Mr. Shullman said.

"As such, they are conceptually able to buy and do buy more of the luxury categories that tend to be more expensive such as luxury cruises/vacations, fine watches or jewelry, designer clothing and accessories, home furnishings and luxury automobiles," he said.

"Plus when the wealthy actually buy luxuries, they can and do spend more on the actual luxury product or service they buy than the affluents typically do."

Generational divide

The difference between the two groups is also cultural as well as economic.

For example, between average consumers and affluent consumers, activities such as going to the movies, reading books, attending sports games and cooking for fun are all quite popular. These more mundane tasks still hold their appeal for affluents.

However, moving up to wealthy consumers, many of these familiar activities fall off. While an average 44 million affluent consumers regularly go to the movies, only 25 million wealthy customers do (see story).

Engagement rates by platform. Image credit: Shullman Research Center

Other disparities exist in behavior, such as preferences for American products, following business-related news and most notably, whether consumers buy the same brands their parents bought, which the wealthy overwhelmingly do.

"A good number of the current wealthy grew up in wealthy families and have been consuming the brands the parents bought for their entire lives," Mr. Shullman said. "For many of them buying what their parents bought clearly is a 'good' habit."

{"ct":"Q\/iMHnneMDarGktoDPLl8vSzQZNp4ImHwUr5FkIqN9s\/ksGMqPVBxMj33yjVdG\/rVhVcPTovok91trD+01Hov8Nfxy0\/Kl89KRPFueHYdvZW0du\/bVSVz85SqCYKQwNoFYcHLgL3W9JUA47nN8BFrOfQooFRVrGQP++2jB6l+UKg3qNadmZB\/QmyfiaxKxGH5qQ2zbGkob39\/1INZiH3WdNzSzJES51hFNOVK4OO1qbZPy1nEWyE3TkOv2G42yUM05CSNPNO2jwvrNHFNzz5ry8vru\/O1\/m\/V1gLYIKvZjbVRLub8q8KZUCuQ2WSXzyw6j8W8kHEcDQgI+Df5CEh\/ut\/Czf\/Rz2GYoZ6upxihqmFKfGxdbZIbebyxQepjHCScjoeZIKxtdiVw76cNg8BrMvFbXcIWwOnnP1WkwKRe83YOOnRhlkcorSy5xm5GCpjd+rUYBIlgo4\/km3GRamAWeNqhk9KJf6DYyVMZuDZtgUMJ3OeE9lk1ThTfxaDiK3Rt26cRXD0Ps+v2PDjcAYMhqHHdy1Qj1a0Pjkf33ykkchjCt9zAH2o0N2GGN7LIcNz\/Xx3a0Rn7wdpHchaQaVq1ZcPmc0SntqCXPEdFYUpc7X1I+1G4Q\/iblWbi3pyj6XhqfkYCw2\/8kxhzVKGwVW4GiI3jT0BUBD7hZYIWZx0pSgc9ErwgA\/dZlq\/w1INfkAn+5E7e1V\/1jZ3w4DcFejLOdxjIiT1Q7hlGE+UXzze86QsuhBy19Cr8gwhLqffCkZ38E9oI2O1ty1d9BGVWvYB1t5JTSQMbmCmclNpzUCYTJGiNHP33lvBXa278NmSriTG8fCmWBXHVLQYi1pmO2rwJfrnvup\/X2M2scs9I1YwMMHr38fvBq\/Q2kP\/Fyj6rnUNr0c0scy3VROH1TVxaoRets7YS8V8pqjf6g7UaIcNxQTKmO\/Cp8qij2yzh5ljtAJGPJqCwZlH9LcLQZqMM7OmhZxzS6Mqx7zvD+G0Dym\/w8TP5J5L9rar49ajbXJ944+df6Yk2jgXwb+BsI1wKTRAOy2DvARfk17qlGorRVle05wurEmelRX39YJiE\/jP1R6UySZtiLVcl0N\/10ZZDewLnGBwTnZ1VTsN24Fh\/TXoWzoUDUDaYnm90MzRgw37q2w\/u30azRMVPd6nzpN81bI5sJFQtlbCSjTX6Xq7ohPz4ajfGttdjaENklKNlkDMRtk+4TNYP\/t7MutIaf99cbpHM5Ym03vxlzxT2QqPe9+rcNHuftF5osrRWC7ilQk\/9CrDmXop49PaV1WsLUwLlG4iYA7lDJkxF4iNBTivNEXZV1vzvKzO+v00\/oaZc+5N223wwuOLsA6Lb5QXkATA4I6X+xZV35zJT877LObWWcO9Q6PnzjLt55hu9pHehT+Zoflw9pBunUj3nrhg5D5ln3nVs57ogx28ntFfYITagACYrds9eMaCihcaXXQtuW0JAQXtVxVkNnE6PLFVxW+8Vda5V\/4gDOcg4IZcKlqOaJYk0by7SFaBi9XlFQXqjvW9zd8hongq+9vPCTqw+tbQKoZeNlM69ry\/ZdoSC7jMvzRZRlS7p2R+K+uxW+rZfw1uhdtbzUtAgDU4XE3zokS3NAJssiLgdpgt1V8LYPJD4YJLoOuHai4ivTpj69Oo20w9wZ8XzhBTpSFAi1XeLTmEXXO1\/fAVESRSmMubhJPnfktFFYueV2PZMyJZF0cBOxNQ8oXr5Fx5xTy534bamMnjcOgzbDwiidfUVCXke0VnyFpL5XarrBH3ZWj+YpoR0PNJ216czaDU69nTC1HzVYQoKH0qTBDOMKDA5MPd9wdGzA5wEqvg\/Maixsw1UjhxEnFUJWFDBxxDaHAOwjirte07OkoAvBcyCfTrUoUoxeTzptWWSs501INKCC4ZpLRRVpLOHjYGXuj1VR+Z+efHfdopqBG5sSHcTygl9pEMbCum9Ygt8ICFt+AU+DfQQx7\/0kYVWFXZpE1nQ+Ua8nyPBQU6vK+LRzWvb9szHNN3tlPj3NsjZILbu+cehpXmqC0LuhlijcRoQEffjnepdBoVaTaMoDef1OpPk7TCn2ce2CS1HVsm2evUYGhZKDufz7Nuyoy7fnUzKDQIWK\/AOauGQ1GSz3vvrCu19UqlDTkOInxhYuk+XQN0Dkj9eQVwbFtHanNFMGqC478e55hX99z6\/49hRY3jegLaQ30gAf5tOXQJq3nNXX\/86hE7MBmxJUdDDv8kmSCWLI5PR1MnzZHvNBRsag1\/AzdN4kVjXsTc1QaIZlNEB0XdbTsRP8tS5xzp5uWwh1SFcmOPijyJgd8QxA2blPVpx9sCMMjbxqGN5msBFJij048MrTUi6FqCa\/AmDK9A5+ky03zRoFChGxy2S6VMTLnIbEpQ8px4FetbmEJgWMvvDCC8L8La7\/YtzLDLEtAyrZYq02CgcSpRuYL3qew2RCE0YhOlvlrUSXXzevXNqEqrqVvpXgyzTsmaPEkAgSNNsItAFNYixcFCNn8lWLLpFjhP2TFnIBcEiWhvH0DQN9YxX8lrUp4Oxpnue8yKrttxmojNcyflYS6c\/ZXRgzlRICuLf0A7RVu7SGNEFQsCUySMJlkkrTOEp5rIa5Nam4NITiiERas8XX86dXEtbTz9F5qfO3xjg5MdmxgjbOODla948cfpVgEEH2PuuJE3CQMycMeNTH7dXoSJVmvzU6MzEk+PM+wphJwzKVWklpWpuugtDa6KGhpa7lni4AMEbCVMHFW\/V3Rt09bQ45XD0qIs8ZhJow2zgUdJP32G385yuSn5Px6Kg60q0jMZEmdBzYorgBYS\/9oxovT\/+QuoWa1mnyFU8oxkIbNZUssXBJ2KCQSfYfUYT2SG2JrqPUOWNr\/1sEAkiTE8UtC0ZR75efNw\/KZKphtnCXYUG0Fq\/HjddChBacrbDxerwBkv7q3ht2eu5FbP8nx5HX1\/dBDgihgaUpdyLnRytoGLsjU7WCoZZjJ34cH7wc+b3aMuO6oF6yMj2jRVphyhY+CyXQzuwL58l0cE8scAxA8qSd2ZX72Z3Kjj6BiuODuxsht79LRB2+5ClbG7UborjorCVblEm0U3wN1L6+Do8kd+sH5GCyMLo9hCMmh+DcuFws8fhIO10H00arMZPa7Wt0D\/5Y\/FaSEPyPnwLPHh9Ef9P4j+c\/CbQ101xyXlcVmA7i3zCr8IwDBrJTFNa30LSDdq3pXN6z4eSthhNj2Pu24QjBOX\/0LCFmhplDxj9vMiIXtgT4yg9JL1LSdHUP5JnErCL0wm6KlY\/pxFvUHkydhKOVoS5E4+nfu0U+6lEnImLvXhU8JJshuTJ8h0F5Vxf\/Xh\/ZJBsJRyR6eJ3klYtA2LxIY6qYw9Rj\/O0g9A8BTGWaoptFJdxRL3kQI17+UJi4LNFBhJ340NAc2UA1tL6NP\/EYomCknFmGZ6iRKwzWSx4Tk4OQaASDttq3XQzPxL4pzYrADQzMCIDgfrpRKYUBvXisJfey0IV0QIOXK0KUIHbY7kMQbXIyET5EZz1RzlJaGOL5Y8IQZjvHLsxeuRIST9lc+BIOcPU5euzzILSDOEeDRon1IA5sZlZ3lvZobCE2BhKA8y\/DnBbbg6H7kas3HtT32XOTvAfGk2O5PPEDuj9h9T9hkUvwvWpIAA0u5Wy6m3X6ObkJmMj+hy1mACDOYs5+BO4LjVCKPexgB7bwxepUL9\/901jJPe9BVOTkQRqW9rep0sgMS39ssxT6GdLrYTjxLbxxJMnoishlNGwzQzIlZl66kzVAhiVHQwvT\/3I7b7geydEUNwLnWmrw05ttZ5Tm96KenEmXnMoyGuJ9sFejDqEPBCBgiPm3TTXzFnt2PngEhp0AJMrzuyOGWszZRG2x2es+2qdjxeKaOwAeH67dLVFx3DzyAlHj0+\/OTkdlAXVc0R8fY9yH1GISOs7ylELYHfGdo8LFytDcrpXY6NY4gcnONGr1Zm+MdaklVgMM7Z0Z+14Gtut7xAkiQUXxyJlu4u1SsrH7OQErZfabKuouiBVyxpt+4JdSaBkfZXuwbsRKYt1j4MWWXzL033acz9hBFoRnetJgxmreSPlAo2UdBukR4crTbmsQMfdzSgqUlSIgdM7fsQg5B+\/+J\/0SztosXAmQnVM\/rwUwS9+E4UKeWZfFjyXzmuKLy8MHtK+pNofozuasVlIMVVHEttq5sbRAaa71mvxCil7IrX4ndm2JB1Cu2JrAR13A3ox8FMt55y65mb3VMmgZ7wB1SlGAbDfd2dwkxG5V4pmkNJq\/Tz9P+NC4gdFX65Ic7LKVA\/4IonZcXIInuyJMoojBLfmCUc2aQwicvjpkkny+Gs\/a66Sab20Y8nufcNElx3440dxFSdSAwjIeUbt1D4wsHYuhHzBPS71m7AclGeOoe6eThxiiWxd73bQHKtS1pWZTkcFaAAO8KQ5RUMkAxpUsjH0p\/1pqIv\/WEHOCS7PLE6f3hM\/fuATjga3VehRZoWOAksPLRfk\/xHHbMLcHN3OWEQqKFg+QFEbGBnc5BylIi\/EnKcep3mQFPNXRvXY5whg7E+Dge0d44VX6b\/vj\/SXyyFpZJxm6+AVEn7nJG1uyPAwUI2b0ygvuWnNl\/RJWx+uvTGgGZ4k+jdU3cttFAnIfkrAcgWi8AxMKucFvdJK8mjqDKCxUU2pe5UplLN7wqquJqHwTgJ608GHE98XPzNd7THqkFXoUATvwOGjCCuruM8hDZIb3x6nSjovb9XACSu06fOf0jfplMQaftwe3W5zPa9BPAaznb3MyXkF8bSBLwx6MQxLL3yudH\/QHUk9eR6Wp+KF0wivgA4TghfEA9\/QYcTeVIWZpYei76Hcuga18iXS\/\/qcCkR7q7HGNa7djgFk5Xs7Sll\/B3wdYdOHPHjbxLX+eyrvPhAU1Dx4ndI2WSiKQ6fwgVa3lVJKzCBqhq3e1YWtY9ykvbyTehazwuT3Z6CyFHO961AOD98cCZYbNO1rpIGKhNauo+8EdLBfzVAkGg8zRLKViR3FaDOUyBDis6v7sqwREl5GMxLoiqE3DqdK+QAwN+NUcAAxxdEUMZz\/2takzPrhEOPv8CQC8kKDTb9hkt+XsnaNFyvu7MtmN3ku5cgr4KCRqHQWfFo9mP3rs5QgGhojL8PkY5XCDZ869m75L6NFaGyEWex1l+F\/pfWkDda\/h1fWE9PMPIwEmHbDf6HLmiiM47n+KNVUOm6neN+mVbn+ZOdNvJNMMhf3CxyXzd1YCHmRQ6XWLXH+9dNlcvfnl\/lGtveY+zQE8WniBOtB5qsgWDZV1joN0DMMRzfx8kOmi5MXzlJxiJBD7pyQtXE2y7tWPZ1mLHWEr6XdIBlWPJ7osC8V541p\/TSjd1Vd0XJwV6Ocvz4emUs51zp7HYqTRQW8lxoNWRHxwETOcdvsLlJSSETYKG\/s3CMoGO5WiPM1\/tzzeU7fny3a9SabM9s8wBZ11OT3GZPznCGA9KyP1QEacQRANaZRQhcJ5j5A7ySc7tVBcsYU+yuotAk5l\/JDdvUOj1jZrLERByZ9XMyKS4saGEv0hq7TMBnA2Jlb2Axi7U6fqJ5UvIXudficzw99f1nsOzJINwo9QzN5C3MCAdikT0r\/AdXbeWA\/yNwfmyO5CMAojAOiF6yKVySWcOLX87tq6SqY0bcsVPDurQl3E9DudOEZLr7oazKAnigH6xF1vl7LOx1LnLOrL84tFtbZJOzsiFZlvJYbxUW0Z5oMbAoz6sNtrWMgJcOwtaJh3SOvEI0cmBOkORU7bMP65bPb1CJem\/j6kA0YmSK\/SUmgmHdsloA0EWBI9ZZCoKLcT5EtP8AL0wDMUiRYrbbj7Tzs\/ZAZVJFxnLHsqg6t22sSo99yvKq0EsQf2IOwA\/6gCZps9pdkVxXAL4kGMtXm8hSF3YV0MXLn4ogEHDtgrM\/G\/5Qkmx55d69h4MOhKa0ntBYTnjLcJgD1NNPZHnbVTFVZGQpfby1cMaUiT2JIPCGQk+NERNVoQ68pgYgF\/7LMj2l9x8v8VRB5mInD3EtwCbJKp5DmmKLtwQmwPzmvDLnRwNMN6o+l7GQVfZleSEr6Vygj0xOdKPHLcrU45ab1UGVG4u+pFxLmrJzURlHyVVlCleUWXfhyJoue0RdQtU9RiPNM+MHH4IJbZngmvkqQJNjPeOY07Pv4h9KdCbiBTRWmJS04yTBl5GVEbS0VyxooAv48pBn\/m5FhzLE26rxY8LNrjYIGdIt\/wHpitJVMirox5ksGgEpVcxoVpQoW5lsn1kfcUwcQdMsX8W0qnsMLRbFlN6RUh1ROo4\/Yr1Pmgmzl+jfjfE0kB\/l+kRf7ZV49rxbFKYIrTccFomVfVn9nNusy+9znUz2oIqyXBrNcc2oOOeq9GaCAydkuk0VcQ7M2peDOnMNkXfTkI8zoD8+k\/wA4Y6FG1CYQyz4SAKhucX9IRrF\/MlrgUA\/n1RVCDO2WVTfHqqr+O+2pnt9n\/XxF082SKHJrEfbpDo\/sjLPEuIKcFG5i1ZkG2FxEcUK1N4xdIHu1kMhOfayinFMFzr3N5tfQmlBlDDD6T72F6LQgLj2QtFRgWi32LEgVEvUjDrCeijAd64gZrefySgqEXRZoxBYrOcnlLe0a6Wfgj8DWddukFms6+eacRb7FmOhBc1tMj6xr5JYkyVgLp6efF4dF4CHeixDeT7oF+LpQZW\/u59nSr5VfRiLzcmq\/FAuEiMSoeywNGzhKOfKTJl7nWqJf4uhqjwig8XHttqvlJAhixUEjq+3lkH8+aGtzV+fc8G4T0dHX9zDPEkChW0JiOvvKsR9rGFWY8xMnj2jMOLfE\/7++fTtiMMakjiJO+AzxkfwAPhJAFB9\/Du0wkrVOijmF\/tLARZXgEMdNH6QJdaZT0AH7bHmw3IA0HTTxhoUSSbpAgYoyJ5jMNMEavlJBN1nlXa6d+olYeO0NQOnuAdl2qojvBvy0iF2HoxAeUdH74NPVDKs6izpfkDrm9YcuVy\/RLokgUssHuksdWgBisbttz7uvO9OFDa+v2qKHkEJDo2ip9ZLrxFYY\/xf2VzWzJF6mkXrG7t3V4qOCMcTCd8UHYc7Pmr5VUdm+CgKxnj+Onc4MFwieL8JHZWstw3Jx32Z9xNTgKqYUKHfzkWpWgIGHZlUWfHbnoslZ1\/U67IwGliuxBNcTcGM+V6o55ERuAAMcQOFyQu+PtraezJkqkflJmHQHR8AYm7FnEILtNy7qaesRMA6IYl2AAus4sbnn+Nx3MTm56R1qU\/RlgTJBJxexj1rdF+jW13Xb+JCHclEAzvaGwtRkxT48yz9VzLnoeWvEghcBvYXIFLYvAyCL9pmcuOZwuMgfjvJo8A4DUjgSs+c2Qa747e+sP1sbgWvFVk8WWW54F7smVuEZutBuI992hZp+zvaXUkoCIKIDbIkW8zwnjuBmgIN2c2NFjfeExHyGanpaSS22bosDLx6ooh0vZ\/cppY5YooFh6z+4FblbpypHvQJUJ4LD06JMGHXON2kSa8Gk1kbk7KtHkYMSIR1Di2PAhSSEPQe6u5Kv4JjLxQkNpB\/vmFYkO3ybCqT3ABsNKTAMfjPwvgwsmuWPgf\/DxNs3JlipApvMfplHi09BJuM9DWPoT71FuA5HsXkTR8fDjsbfB0rjuoM3rXnJtifojJEP55Z9FX89FhMOt5TxaTCCV00gi\/BKEfzME904dY7Ip55cIYlGmIqXQcAYIX4H+hbGi82WxoAD14a73JSSytp3PftJ+ywB63a5tHXrJOdSVszucumnTA4bFAda48JvUgnfHhRML+p9XMrszfzc617N2tJRjn3jIgzRg5lyxgq\/jQeQuWwMb0+ODVe4WuZcnDgttc6jMyX+\/kuuwh3QngXg2rVpVs6e3CKrWXfaHIiU4yjibyizhzPIuWNd27z6\/7InDKDTewN\/UMyKxDt\/YFEZ0a3xoYEpY2ebz73KMnHtR5doLJrI+t\/rb7Knmkdo3U8KLC2cfhvx7jUFOf4kJ4=","iv":"158e3f28eadff85758df53e54d62547a","s":"520ce8344a049cbb"}

Affluents engage with digital much more than the wealthy. Image credit: Pixabay

Affluents engage with digital much more than the wealthy. Image credit: Pixabay