By Abhay Gupta

What is it that the Indian luxury business can look forward to in 2019 with last year meeting a cold and wintry end, and as the political environment heats up, new alliances, mergers and acquisitions take shape in business and politics, and goods and services tax corrections and foreign direct investment norms in ecommerce tinkered with?

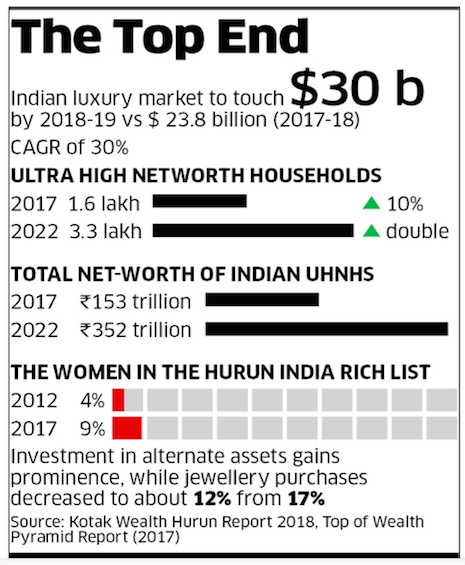

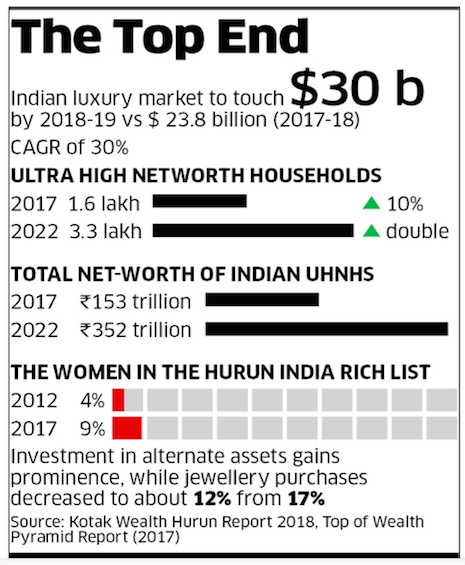

Leading Indian chamber of commerce Assocham figures continue to be optimistic and bullish. As per the last projection, not only was the luxury business expected to reach $30 billion by end of 2018, but it is also expected to continue its growth trajectory unhindered.

But alas, the seemingly stable political applecart has been rattled, not helped by a floundering rupee currency, growing market uncertainty and a potential global slowdown next year.

The ground reality for luxury could be different. Industry insiders, trade analysts and brands all alike seek the pot of gold at the end of the rainbow.

Source: Kotak Wealth Hurun Report 2018

Source: Kotak Wealth Hurun Report 2018

Here is where the Indian luxury business is likely heading this year:

1. Consolidation is the key: With Reliance Brands having taken over Genesis Retail in 2018, it has created the largest fashion and accessory conglomerate in the Indian luxury and premium space.

With almost no competition, the all-powerful group is set to be the only point of entry into India for foreign luxury brands. Surely, independent brands and smaller groups continue to offer their wares, but the sheer strength, negotiation powers and might of Reliance – India’s No. 1 industrial conglomerate – will perhaps be the single most driver in fashion and luxury.

2. Power of the common man: Someone wise enough once said, “Don’t underestimate the power of the common man.” Sure enough, luxury has slowly spread its wings to the hitherto sleepy Tier I and Tier II towns.

The fast-emerging Indian market is not only witnessing demand for luxury products from the metros but also Tier I and Tier II cities that have a sizable population of high-net-worth individuals.

Concurrently, an increase in wealth for the middle class coupled with Internet and mobile phone penetration has resulted in newer segments of first-time luxury buyers. This has given ample space for a whole lot of brands to set up shop in India and retail their brands through distribution networks, making it the next growth driver for luxury in India.

3. Travel, tourism and hospitality will drive further growth to the value pie: Domestic and foreign tourist inflow is likely to further increase with increased e-visa processing, faster on-the-ground arrival support and eye-catching “Incredible India” tourism campaigns.

A new report from the World Travel and Tourism Council (WTTC) reveals that India’s travel and tourism sector ranks seventh worldwide in terms of its total contribution to the country’s GDP.

During January-October 2018 revenue from tourism increased 8.3 per cent year-on-year to $23.54 billion.

4. The Great Big Fat Indian Wedding carnivals will drive luxury: The wedding industry and the wedding service industry set unprecedented benchmarks.

According to a 2017 KPMG report titled “Market Study of Online Matrimony and Marriage Services in India,” the wedding services industry is estimated to be worth approximately $53.77 billion.

This is one sector which adds incremental sales to all sectors of the luxury business – from beauty, fashion, accessories, photography, jewelry, travel and hospitality to gifting and cuisine.

High standards are being set by Indian movie stars Anushka Sharma (married cricketer Virat Kohli), Priyanka Chopra (wed singer Nick Jonas) and fellow actors Deepika Padukone and Ranveer Singh, as well as perhaps the most lavish wedding celebration of the daughter of India’s richest person, Mukesh Ambani. Not surprisingly, the aspiration of average Indian to splurge on weddings is reaching a new peak.

With Rolex watches as gifts to the entire wedding party to bespoke clothing from super luxury brands to not only the entire family but the whole guest list adds further fillip to the luxury trade.

5. Technology and luxury: From high-end home appliances such as Sub Zero Wolf to tech-controlled homes using Home Automat, luxury and technology seem to marry and create an inseparable union.

What was earlier restricted to high-end laptops and computers, demand has now invaded the mobile space, home entertainment and embellished kitchens. Phones such as the iPhone X models to Hanmac are hot items.

6. Technology and retail: Omni-presence now means beyond just available everywhere to also be “phygital.” A merger of physical and digital retail is quietly invading global retail. Amazon Go has already launched a number of cashierless and cash-less stores, and plans to ramp up to 3,000 by 2021. Can India be far behind?

In Bangalore, Decathlon launched a similar store by introducing a “phygital experience”— an innovative mix of physical retail and digital touch points.

From virtual reality to digital payments, the intent is to create a fun, unique and immersive user experience designed to engage consumers and add value to them at every step of the way while choosing their favorite sports gear.

On the other hand, another concept store called “Watasale” went further to create a cashierless store, which is its first store in Kochi in the southern state of Kerala, with plans to expand to other cities including Bangalore and New Delhi.

7. Predictive analysis to predictive selling: The Indian fashion industry proudly received its first futuristic analysis software called Stylumia.

Created by former Myntra founder Ganesh Subramanium, the software will assist in better buying to improve efficiencies and sellthrough ratios.

Most luxury brands dependent on the human predictions of the buyer can now resort to technology and manage their budgets better. This, coupled with predictive selling, could bring in the much-needed correction in stocks overload with luxury brands.

8. Experiential retail, virtual reality and artificial intelligence: These three aspects will come to the forefront: Local brands such Arvind have introduced Magic Mirrors through its brand Creyate Custom Clothing.

Also, Shoppers Stop has launched an innovative augmented reality-based dressing room called “The Magic Mirror.” It is an intelligent photo booth that gives customers the option to select and view apparel and accessories on themselves without having to physically try on the desired products.

Apart from this, ecommerce players such as Lenskart (eyewear) and Caratlane (jewelry) are already into a virtual trial of the products by customers.

9. Rent a luxury and reusable luxury are a reality: What started as a trickle two years back is now a stream with more ventures offering specialised product categories.

Web sites such as Confidential Couture offer usable luxury goods, while Ziniosa & Rent A Closet offer fashion on rent. Even affluent Indian women are renting high-end jewelry for their weddings.

The fashion rental market is becoming the biggest trend. A wedding dress or gown worth $1,500 can now be rented for as low as $29 to $36.

It is estimated that the online wedding rental business is worth $14 million, with existing brands claiming a 25 to 50 percent year-on-year surge in business, per Black Book.

10. Sustainable, authentic and responsible luxury is sought after: GrassRoot by Anita Dongre and Nicobar by Good Earth are a few names that are famous for their sustainable offerings.

Slowly but surely, better-informed Indian consumers seek value over mere brand name. Value definitions are shifting rapidly in line with global shifts. A brand that pays heed to such demands will perhaps go a long way.

11. SUVs take over the roads: The typical Indian, fond of big cars, is rapidly switching to SUVs.

Various variants have been introduced by automakers. From the local Mahindra XUV 500 to Lamborghini Urus and the Rolls-Royce Cullanin to Porsche Cayenne, almost all luxury brands have come up with their SUV variant.

The sale of SUVs grew seven times faster than that of passenger sedans. While small cars and sedans managed a growth of 3 percent in the last financial year, sales of SUVs grew 21 percent.

The share of SUVs in overall passenger vehicle sales rose to nearly 30 percent in 2017-18, compared to 14 percent during fiscal year 2017-18 ending last March.

According to data released by the Society of Indian Automobile Manufacturers (SIAM), 920,000 SUVs were sold in fiscal 2017-18 versus 760,000 units in the previous year.

Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School

Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School

Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School, Gurgaon, Haryana, India. Reach him at [email protected].

{"ct":"eHTPHeKhIUtUT8ur17iVAWukQPvo6G8lPD\/LbbPBc4NL6fRKLJmFa6wRFm4ZQ87358PM2qiw+elghQK+ZLWaFOlHa4jEekd0cNDvdYsh6NRm1WKBMmIPlEBdBTSKvUwMgzK7qup25eOqRkAd7EbQS6q7AdOm0EYJxLa+L2fRiThIn0Hi5hTbjiMl2Gw+S+sX+Q7mZ3LVm0qMi5GZJsh+QtQbT7cCfcQ5FqD1yYDSj3so7r0UngjgXHDYePKgbQppJAtHgexe2uqSFSnemJxuqWcQ3TsauC1BVoeOQqvne14OwoAQkj2L1sum7A+wDAZQc4AQQbuH+TNCGNVgh4695FapbJ+54uccvdK0ycVsJAwWyMmwgxyFM5qTcmspn+1IxfAOgXkfGXZfDM0uh0Vs\/ZoIPRr7wMZxDJeshRhaRMkQOhdTOEBSwoKQoZyfjy2Q2cxo0qVB5dyjkiqOdGPoOicCur9jVuuokJdJrbGOZfse1OD6tHSOMqAih9F210m+7LFfZ\/WU+m3V\/Gs4UdhkKTJy6Yo5W4\/dzNJCwx\/PCJxrGwsTXBU4JfuHettizR8kpJOBcRsGoiMMU9MZRKZQbeiEEQ+iVaYLT9GiNH+D4qd0S3jsQNh+G9Ns\/Pv71\/tF\/5C1IIFDohVuvXxltrz5ciqrfzSPDNBAc+RllHqWCKiM4vl8MQdYUy2HzSIaO+1LuHWaYp5u81U+z1oXBQKZE1biuhBFCtM2mwASYqQDZ7yA9elEAsm\/32ASRb7MxcGJV48bW8cERclot4m+fcudGFHUhgqI6NkFd+1nw4xwhucM+F0BywYNsjj+qnE9XF8JNVEVESDdhpKs8q7BeoI35E6lugos5irJIQyY00ZdTNBDSj1HYsrsP8wx+ovv77ZwezCqiYM1M4VHS+SjBhYzizBRl6m\/wfdbMcg30frhR93C+4EYuyOo3en3T8MndlZsDwdaa\/H8uyMapwC5sgl0\/9Yi4W+9C8BocvGVb+Y8k0x6fHjx5vPwX9jVuvQ7796AeUwX3mppkeSmcJoymAREznMcb8tdrOFxdKjv0QYaJECOJx7hIh437eiXxNRKhCfNFXUst9ie31CScX7MnJv8ezJaSGfQ+vgnqaOetbkGx31vq8QFxsuIi9T\/gt30TXPM\/dlC\/+6bOQ\/6\/BurjsmQ\/3KltDd3xIKceY8t6AxY0JVjGkO2q20xgfefvPJLTVTuwrInNPwh3+PsG2A+Pkpx\/lhb4vktKPvsh4rBDp6AHmxFFUg4Bj0xuA+uQL5BPsRZYFxhDC8QMJxInEojHXc6pLlR5RxacVfRP8F4pb1UWtm1oFDpjzI10LZgCGj2+oX3dYLUhXgjJO2JN19MX6qkBr5Dq9cYMhP+1vIw1Z2sNiMhb52wJ6uQYtJuTHDX\/dnMVOmYq8vzeV8db0XPRObuy5gd2Qy7gvFOUjpNz2hu5B\/R14jpfftdX5flCLAocFdsikj\/xg1gp1wKxHCgdvjAorMMKuEIu7u\/DBGCjfUdA8C12H91LTo7JWz+zQfR77MKLhYmg1KhdzOz1yFKFwWq4Xzj1Xn80eBcf9ZeGBfA2qo8jh0FHfAplEOq9bDGH01Er6G4tX8n1vP5XS51KJPODw01z1U66MMmiRR5RmaWZFwwTo14JLd9BEl2hggyKVXqEvI3Eff3ffxrp+bR+GmrBjVBEYQV+GgcXKv4np5l3GJEUk22IMLma7Z438Ev6Cq2BLm5i0y+tCvpxmzML3VfI82M2Rn42NGay2XXj3yghnluUXTJoxQJF82WVhvdnLNsVdCCFeQOU5dI5GIIhuLms8bUGo7j24\/yG1+v0ZD8Aq5RLL75r0BPw\/tMP9nC0sPYJvkJ4FWRqcBN5pw8XcJWn4w4P7aSwCAnUq6im51NapgpMtGBqhcY7zDNchdBS42lDYrXHhFJpKQpv\/O835xlr2uE6kSxrQtZ6cneooLcShvmH6elO4mc5qR1YTd1E9HAdoiVnDawSblTp6f32J0xMMOmWIpiEEeL\/rrJO5P8npc4HU4VRACJzLBzupDbAXExFYeKh9XA0Zg7t1GLP5jVwvRBAHMkrzYVvdJsPGE7HWdOrKUQOJZwh7ECa8UAT2MXlT3ypCF8\/No4QJMLxUT5Goy1AfVlvHeLY01mbAn3lOtDwwe02X0AvIvJZHsiSPAg\/jEkqDAc9GH8XrAJamqvB8m+KmTh+UsMIUxWUyaNL1JBc\/ZoN8Lhe2Jex\/js9toWgGJX5CXDxqg63ba7qOGpOwal+U982EnETWleNGF7KpSVykyPaLc6d\/7Yad3+fadAF7mbGI8S88cPO+PDvSwryzX3IRpZ26RYVLvkah0Hpi5x5MKbvAMgcKY2TOss5t7tMnNF9WKoysp1hliE4luvwAjNIPkt6EW0yvcEp98s9Ngzc7o+JaGr529fCqhq4CHbJf38YYf7f6V6WCQ8vZ+6nP\/q0as++X4PFBV5h5+5mT5cWERzTmqgeuVBTgN84AMzoWKByWwQbVTvKtalk3pNTRD04+XLihZw\/tcwPkW0lnKP8N4\/tj4AqxVY7EaVeLvl0K\/U0wzTlXIXev07QrnfcZW7SfTb8JvQc+dVTwp5i5i8+fLnmpiPvK3V0omGbb4qe0dxFQzxADTcMoOmAV36rNkv+QOzz6Pu4MCbkBI8m+a5QXwumdIZxrkwramtfnN4zpJWLGf0eWB4OdKzqySHOYF915Zp1dFCxXZfzDFrrPxe6hiAZjkUsykKUgfNDqYtT+MGiXfNoblpT+DWl6xUGG9fiKr1rq7MmprKSgKlxeNbWQEQvcsSDcdytFsqUgWewQ2S4GRmKqEBwu5nfVePc67Ia+CgjoqV4wCWwh68v8PzgBx4U0dsrZXPLt+AbgEAnOGdrmeQ6ZJQDE3SHlJzF\/ft4Wk8DWE4plz5OjbNunEbh8k\/lKATuS52T0yf6CMVxssjK3gprTDNhKj5dap6lhmDYcYRZ4n0JnX9u8bGwlFbszIZnwyGv5SpY9XgpLtjnIuIIwKDSgYVWOnUN0nt1nkKk5oTIlxr1+eQaT2TkgeWt0zl+PpZXY6zchhM7kmnXRAiyjRQUM5m3R2Wqsub6pftbtZyx2SzQA0BwzVwiIXlOHlN28oGGxG6u5ZNAIg3azFA3AAAUrtavu0rmpzNoMa3ifhZAuGvDtvPySZFmBCIbBxnMJniDcUAln06pPC7woeapiSsxIfZnURCg18aQAGZtShabVLG9Yv62r0zJ7SalQou0WCndUZz8BmlHodxPFpDwwz5svJE845cInodBi8+hvJcwlKiJMSxbAenahqF2cF5b9plmNQKbC8P\/lawRQeBcr7aHng0s1nh39Ki5PVT2vf6toIGj7vxs2fYvY4Fb3\/AQ0aMlcDiUSZttjvaKIULxnMHtGlmG1N8p1tw9Rax36GkEKUPZS59D3sSGBjLXZLJFk4EDlq+E5IIrgVFizsDph7IXqt\/e5RGoXhLGLYiOl0UtOzyUDVGST3\/SKDLnRHAo9v1T2y6Hp58caHSEvEMIwoVQYwxYmAJm3acfBIeoQgk74SNlUcN0++M\/\/A+0o8VBEpB2n4kE0I+5xFRKkZAchIcqpe3A9WLzMx\/iMPx99SIOOUjYNj3BX6UvaDM2fO8jECnlSI\/c2QSRcuUZ6euxYjpivjBx+6KggMWAvD5JN2wjpG9eJ8NU3dSyLVJ2W5\/xL\/x++vhGDhNcTJ4DUKZSxuiq1xSX2vTqIae57aWiT4aWwUEM0l2oInDFp\/apezLWv96oFC1M06gx\/A+wiWz96LCcE7XXHftA\/LA8dEfoaP380MlcgWTC52pKRQhQENgYzmaj7iY14PTCyDAOe3e5+ES4N7zicMAJSVMocrffICn72VzTynggqblJzQGm4ph\/+QKM4wHfEH8ppkQC1rAhmKI6sKtIdomdMzXIY1xmmFwbPfosDNTLjM+Q\/tEKIzD0tzkfgeT60hHA2Q\/6\/\/JcqYthz1E0b7tV3qVeVmYC+z8UReoG+iHB9tVvBQAqTA7FXYtpivPty\/CEEQk1fNejLc\/FBkQXwK3BqJic0OxdgCr6mOYHAZ+Glni7n91LijNX96FI6qFG28C1Fz+lT5lUsWfE+nILKyH7C8SD8tvLcDeYMnxNC0ReQFby7V3v6UhWb2IpyP84wttp5cFsk0wpJblY3EsxgR9a3av8s+c2ot4RpA6LU42E7\/W7C7mKUpA01sXMzNVZBBqsXt9PJ0+1jctnAf87tn+Rd2DO5x4M70o\/QLVrv4dtkW7rg0g4UBvT6pfoynUqUBUTGBZxzGJoACXkbFhaZR2PIlXn1mLD+XrBA60LHoA2kMnDV0io\/htkO0WPV5EIH2Vq4Y17WOpIfd\/KH\/upW1yantRcbgGXx4gVpXfu4UuhmT+3Hw3cRs1PrZKWBhg8ERlwlGwi6N7De3ALkEe64q8ovIDqX+RpuzA0yiX6\/Eg2hoP5r1KuRJxpShFafmW7b83440PSktdXiZAOU6Jk9yxZc5xKIOFUVPMeRcfsYQsqmL+lVigEorhGlTPnJkMMce6X0\/rLu3IdgoRhNc1Mbyan4vOMXmFNe6bwlECWO75uQzFagaVd2UsL5cO4bLUroush22xt+CyPQY0qtgEx8YMDJfrtY8l5WfksI2C8HO5Edc9TKcV6nVn9VXiNntfskAcZVf+ogP\/MG54reujfT9umk1uuDi1krI7Kp6yD7LGooOAJClQs84FIs3GKI\/\/nd3fLQBmSNvHdB4gND7lqrhSqqrdufgDva\/b\/6sberphj\/aw8Qu3PHqy42iJCM5BVaSWzjjzrz1XkSiTUR80rx4scozID0QDZXc9xksOmuyxEahyTfAT9i8rZh22RCTrhBKhWa5HeD17fJHVn6QptHMUibU5mDG8fxdmn5WkKh9KeiHlEX\/RfM5IrV4AOcWBh\/MvvZ116NVUuKpfC8ci\/qqOCFypVJeS6op5Fwt+Nh3hJ8N+4lkiCGhvJKzSPWmU+Ci5KcmXH77fMKWfHBHACdVZn2wETuisoP+FMEw0+KKrJKhxCiShxRZLq9clrs+WBpdACZhkk3BuMr8dDc9KWCicEvhO04JYHqHEOjNiirI65XhbKqJwtOvV6uff8tY2hrgiJClSHtolQDToUtQ8USHJXF64yQ+3Cz5H\/7uYepF9ilFEyUcVxsZcNg9u7j568CgBoMUHEq1fwXbBmY3rYOVc2jtqFfLp4qsZxP7Y9BZM3N2i82FtnLbEdiY4APSQNFrbp+m2OdYETkbJ+n\/VERgYnmVcbkq\/kuD3Pc+lxz0HLIw8WB4OTSW1u+m2R8xUhJjhH7H44LU3fcQf7edRJCaldqk4jIUJ9dlk1iz2oHwN\/XqtZTRuGNLGqdL9h5f1Ec7lHoFbKFFzhp\/rBisJNJ5NawwuQl1AWdWGpyFB4pVcXg+Hh5gPuLNsGQdOiKgiwcTPH7TJC049mO6zJ2t7Z0oGLgdotM4UeLbdTKxzovWdHpznfl4tB2rFxabwaDrohiRkU\/w8Be5A\/3vqxHLGNX0ftCCdFQBsMod6pY4+eMUpdUPF8VkJQ9387C5GpVCyTS5dtkaxHBWQKhahJedt9S\/z7qOsckWG+FPN584025tkOzDeB0MKscBp+mGgIQ+sOOyJ+JOlNW8clAAtWOx0i1fxK2HfxbXRENLXcGcPYeraFbc+AnkuizzbQJkXkyEuIFZlxppqwNyGfmhBpr5GqXtPDAxMVMs1nhaVwKnYukul2BjXMUuKIEr0rlez4nB5rfJcxfGAjqDERNBOEpnxzKLAeGK542ozUTm1GoaH0l9liEnecGtQluKLcGGqElUptonj+7\/EPR8SHxPa95e70r9T3BOlKHx2m8d5xbcJNfRnmUZtzpwLYrq2GYum4n5+2VmNIcSnqxTMTPVNA97v005bJjxBuLS9S3Aq0z3YlezZDIA6LrGGwcxZWcgPIsIh7Qw+HPl4VOOrB6ViX0L7VvmThzicMi9NNuGDskqq9P8z436KuatxHIuBXB3mOR2R9sXKt+ScQSIOEYItGVPboorezSLNjAI+VfDGZXZDKD+4Z8b6\/VQwgHiiE6uhP+gaD4zifclpOi8WFCn\/BR+YlBfk+nTZMTvjgxeAb81ilECu7ycNiI3h+b\/t31KYYvtWbtqXC31phmruQ8MRK4kyZgSanWrJmFrvj+mmdu3TwgFr\/4Njgl1LWK1ktV5CrnGuib3FimBp4s7zKYBPXcR6dinLWBDdmJCKG5Ad\/CmgHbU\/UbT27A7TqPCrBQXyuLtH1kvv5+hnnlIqUHGxk3O0X5wu\/gnKKjvuHC446IyN6m0lseu19sWVaNiBlx8uIu7NJXhB6US7vhOY+U\/kOINFBvtL+EbOkLq2r34C8HGvLsClaBKj80Q5ErvYfOFjzeMQPT4twxyUgjXj0vQt4lY8YvXHVhTZiAk5f0rEVgwv9Yl4F59LhxD8INgnISx1SUcdroCz\/ElwVTwqLBCaeJK8gq5MjYXLW48xrB3q\/gVu7kK4nQLGDXVpKCG+LhnxsIBlc4U6Iwdcigl4Ld5IOkwtllEKaZnzaLqIyoRWVdhhOx\/znMf2JUyK4qqlVVGKJXZ5mgarvj9Jq5\/OW+grGrSZW2w9tYvipeQQGHazdDU\/KFfeQ1pFfQL5sHAd6DReeeiM3m+0ipcij+p0bG6OX3dGnkpBEIX9fPwESOavti5b\/iX8GpB5IyBA30i3DdtM\/ySesfhGkgX4TnfTf1CSY7cIbR\/1yNYuAW4hbfGMEguOf2B5krDyBpswqP4hmh5F4uXGwhx9wQVtEzHAL4Vb+vn\/xFs+s8V9cDF37pjahioNIEwUtFPTB9xfj1\/7sQbD2LQztZMOz1k29iSZl3QpFowXJ73+OZAOnT+0vWU0+ipwtMH9tpnMA2njvxWBh8L0Ftp5iqbQG5r+CWPzmj\/P6+QsYG+pIsxGohE5w07aaNCbaejbUxGMKphSRC9YP8p4\/ItYR7bi\/l+vYK7nXFLic+CZ6ql5dD2\/FqSVEiw\/tNHRbp1JTWjFjeo\/zFiqVHzvH+VjKL4e\/MY0gEbgis5VfAJNNkDRpGhuiMOQx8a7qqcujkd4C+0I\/jmKVEqJjvV+ZlSHHtO3jA892XlKJ82LXL3i17tiYh9PFyhQIYICQEF+P8WWnQLeIGij2J18\/aKG62\/sPxIUHS\/JO4D75Rrex+t9K2GHevntzTcm\/dgNQVdDEMo3Al1YFuMDVBfqBaklQm3beRMTes8raL0H28Ah4U+Gv7tWVdj6Jca6mmD95bU9Me94V7rbBCN5WTz9H602yaFzxu+yi5Wc2Oc\/C\/gP1RMdG30tASdzUhj8JapM+jyRjaEuNk+11PE4CjxjQJ8bO6pxPOv6ChgGDlfgbvBGIvtjWohkhVLpGnKpIPXPY4tdA3mk3aX4P89mCQl5tiUEKC56+8DSHxEBlyXx3ohqF5I3k\/yfPMdncGWF\/Vru3XT14gwVhp8S9IH74tPquc7wFTRtT15yvbPS8PJBwh5GIJqYLSMGhnJORnTKfM532evFb05B5X5eHZb2AEqqGQ0XUpz84SvfSq0suX8rDkQjDABEpD1RZT4kq0lToCamvECpKyZVwp8fB55jM0cdvFJ02KycrZYnz+PcyQcoQifqGxfJigFyaQJniLnJIyufKaoG3REGvnMX6fxMq8Zx8SQbw2UpNeHTOH1gVl5CJdPOItIYqLw2\/QjAV89iSIwxKDcxt9f3yXWtBz8J+aPd15mLWQz411OaSEinrjxz4rvNhfDMKDGo4lnwmgk949bYaNAV2HAyFIM0dcNfGtmGuePUbHunDJPlWMv21mUVSvqOnAkH9puvXluksAJbCGvvowevV1B\/A7nx73O4zx\/R5q2UtVK8KQh15jY23A3aU\/+jfqHnDrmPAAN1KUS6mYYZp7aPk6jUq5zat358kAqxP1j0384roPRlkNguI3pLSivDUPXjVeT86ki5PpO9HKIajKaqbPDnk4NmkDzENYw3XM\/EGKHwIx0KTNp7ht5izTnkr4r6lf254j4MQBo4x770ycHEoSRyUaTQ5Ok3Uq6+Zsn6F8o0NakYRAFWc6vcyLOXmStI7XBIuNa52ucuO875UVFzdwNIP+ZBBvv5xjBsINlsCBy8vRY\/i8mKkcv+utSRSI4Et7UcDsHe5A8fMq56bN2KafYt2xOBGWw19OTPT\/QZnX05nOBYUyZEYZnBMPtTKeZWW8FwG0psAQkHltVF19BadHpjGaHo6aByXZlOpbIs2AFjtgIzT8CXt8S+ehhWXS4TKJnRPMc8MDGFTwGAmEykBtXITS8fmVmYg65KtVu1+JXovvDAy\/22DI5n659fCdxn6IsTXW8G9kMc\/v+Mt2\/ooR6Xmb+S7fPqCt5P6OZ7I5yLXssJIYSoVDUHIEKFHNiW4zotcROt140chCf3J4ZXFxh\/gGEndm2hgg9jhtCt+HOy5qRAgmQXmU27U1Gw1pV5+wCsRx8mKyUL7lLd10LGXWxZrWdxiMJC3O1pGFxyqdeaGovFhmbyAJpK64dUWEsIQkUTa+a7gPO1+tq0EhXAXUivRtnnCpuTkZ9+lC4gzDssTodzi4eisGx+MzDdbbdyM8OFPKMszrNtTt\/KwBTS7EmGfTjK8O5RnRXlaONZTByNGSHmyekhOhfqgWcliqux0RK0Q6+5lTyMDmrJ17Azwd+yPMS30b+X0ZF5gv3geD03dVy441bDDwxpk0rn4Z3iu6coi60dbEELIi\/3uQcGaMpWu17N1pOWeAHa0A6Ab+RkMKedzq\/TN5BJGrG0elX5raB65lZ6juZ4TdTYedF4foFWZglnyS486A7urnAcriozrPW32CDdyA5SkbLP9Z\/vvjVI7lTbtcub+C3hwjBjxRt6e5fKk5BX7fYuWghTFLQ3IwZOx84z5460KqXGqKTckSVv2YN4lL6DSyvMEE0yTsJSLxEuuqMQ8lOKU9g+IlbFCnQMcO5dU1yzj5DIjPjAdRL+es6rianNuzS1B5WhGRklJm9DNbwF+CuRqcdPBP9Gm\/75Gco\/B+hbF5nnM\/4C2i\/99i06DGDYDQYFQXxBZTWb4IH4ksRVau8El2+rcnxVnjRkTUCxk98zJYM3jrJoECJ96eBGoWcpJqS1vt2Genx9ua7wF4T+fGHOQnOtmt9NhXNDd3NMS3V7+KErXzbFpEirfcBgYbqv3IvX6WeGF2jW9mDD3iITrC7SxtEKmHaq2UXJ92z5jgaJOoqNTRm67WIeepKbpgyHEPYY4xKWc46569r4rJ7EvgEM5yQL\/IVdcwN191Zu82rsfMOHpHJk2JI3mhTyFItukPb3d48MukjrnSnJEwPJ23Dd4nZKFGX0LC2yIgc+ZRWqUHouiDECvoSw3lVoZT\/Xim7UpUdrYXUujgL0t2LtnLMmm1HJAKOKwov6GFZgF8x93B4AQtliM\/t2kXQeOsf3wZ+WAhNfWZFmzfObsxuXCb6FvEFkTEjgmqmsw19sZgBMbYbmA7Ha9NMq2Vzb8N8CEDpNNnN82wPyJYk783TcY5w7mck5\/\/LVn\/BKCp8X0ttJS8sE4JX2mnjnyaDp5epB6VVPborlf5caMxYJ673mUyjakv87865oot1fu4dkn\/ZW9Jhk7nw3kyLpIgwLCcyf4itXutg8wnpnDQ5WyS19vFx3uzwOhITDUheEQUFwIruiYCi+6tjX9HWQPr6WAVQ9j0pJ94BJLFKPRo5c\/NbAjAKw2pTAHY2PtKIyrcsaeNs+gGfyo2jyqGvfhohsyDbL6tQKIc3tyBJCdDxqt2iRmnOwDf1VN8TEd0J72IzTvknyealww1lkBniQSjSsek5y03YqHP7\/m+m8d+ztKEPDeFwlYITohjmXkDqaQPUTOzuw5wKdColmDwHdoj1JNfZZzy0VD\/AIAKmB1dR9rjo6KX1p3FtVIVONt09wizO\/jrFdeQ1jtpBoVkHoYgKi6BBwurNeRN+MSW6G11TgvOMVLyORxIsqswIxlfTg2Sooaabatl\/MEyFBCoVngBufe9VrQSdm74Nc9n00Ev3vgIfsC6SGwdP\/wFnaemeTXxh52wNn79R2lC3ihFYy1uR\/QOptCCDzAsrWHwnAfeCR2bALUgFsTZ+jFlIdcA0FKOTfkh5SdMfOoXdlYP75GfSm06bXVe5yc5t\/mxFflMkJfUuxF2ADNqnaHOQrAOh9pzuGiH8l11xhCpI5lPx5o4eBEamzDbp2NOjkTAQhMlQby29YFiiBOqp6yGCVtqtiMyYbdMDSv9OFcicTqEqnXp3MVWrMhVR6yHkwioa4DlpbO3SEXzTI7z+DKYeAxETCjKr0C0JLL77dn8bcx18ir5s4E2cVLXvAAy7JRUSs+wWl4UHuSaDmhKUSvDIfFmUWDVNh+A4PwQ0PBCmd3nsfB6RIeP6nCfuo84G7WKBmS8HaKRbsrIwuZ2GkEWWqU0+YMwpGznNSSoZ3kNU2f1WwvEXydXpUUwL6sStqDmutQB7u+hZuxLJzklK+9M88yX5E0y\/s53d\/fBrSUAr8XQBwTwDwmr+0mHsUCO7nN3tA0dHFwyAW6gk5yG7maE4i3JqWQu\/6PJNBz7WpMhMN0gRzpQf8KQ922\/6serZ5txtGCLWVndsltshWduUIT\/puVqoJka7Hg6osZAqx2km\/\/xf+N3q593Iq819zW7o9agv2JYuwxaL7JSH8rmkQ\/suk+uN\/bwf8odrYlO\/H3YVvGwRQQSt6FbGKFCa5U9PPcB1KXxpu020z7lJjJ6S2u4Jmf+4fimDkuqpLrP2oW+5clYFwqRdi\/ZGhnAPO3fP3FHFaZF\/Pl0DHjxCgtz36Lf3HFBKhtfdSohJZGfdL3cQJSn4Vmco1ApezsXbiloCmdIOQjrRlO5Zq5ccS\/klQBDZYdaT5zEc\/ltl9Wv0TjNtsjIAj955eAJPsFKB5EMNKRBhZjifV70elTcyhSxq8LeEh1DOshJDimtUZ94F+L3PYki0XT9Ak8223JyKoE5CyGLzJ8rWtdnJKsLAFj1AB4bM20a7EkQPbawInEfUkUigbdU9foBEMk\/liNTLFZO0CoZe27w9ZdZ1LRqcIGzwPo+EOGl5BYMAMp538mCwcOOmvZjc3lJErEWfH5864N+G3VpV0p0fFygPP1P2JBHA4Jrh5kIyex7QopVi3GNGlatBi4wKEuVJsgXUprn0hdm9zZ2Tz3f9pWfpAtNZR+jHRVtacMXbTTe9hO70VZgCKxp3uzC6hm4VjKdIcEbEwdcjNsdyVWnLmK\/Y7wWuyMC3LxeksHhjjGs9NwWMoT68zg+uRVUi\/zy\/QDuXBKbaSToLtsanumV3dfe0GachW6sQLcJdyTIAWkxnGU9MNH11VPH7aXcPCvmOKpQ1KVKsPIopRrMcooiSBZpSCk0DCTVT7WyFQgwrm1qXtXNZshnfz24vx3Gwnf0JwD9zJaulEG0jDIkLHs\/UnEbAhFj3FNOj+n1LbKbzojbRBw\/X5BPFypVF1fqqNWL+eHn7j+QXcSCAvnWXwxBui\/0Q65kCfA7EQ4Qmh3Kj4ssxl5A72\/siFu1rWYsTKRd8IuYjxYXqdMIE9wxNy9QcnRd6cEoBHZRRjJAltpfsNHOL22VXPpg65btSnrm7P6pqs6UkaPAqumV2R+ZoM1q\/bFiaW5YV\/MSBnCOXVXQOryW0Q60bzDUlPVAGn0Rc6P1WjIoAT5dt2M\/CVPqQNShSZKs3UnMkk\/6LnObnN4uRAyQ2Hlgt9\/12mI\/NInMpjkvlq7Nxp6ZSXKLan+WoatKOrkgCYl1ZLDW8pXAZsuYmCKZS\/IGKhFlk2xCE1QOnHE59ImtbRmTTSQQgE+b5uWnG\/5DV6PH5usit2NJlY3cFZUuuGt1LDcsVYjV2WDn9H5nPDIdic2FQ+lXxnt3V5xbhcs4NO0ocA6GegL7DXu3DLca0HEqHidbgskEyVKtTf0kPrrdBgu5cVNEl+JcZ6RKv8fj9KDGqgd8+yLumn99y4tgRsKCCD1chnDaUNdOx11tjJUrYU1x741UiglwdWndpbWPkbmI01pLsXk8FPwjWWI7+vTkz2vmudhZ5lLtWBklGiCtTtWALu\/wiQZ8iDM5gsJa3VhOlW+R7Usgjw77XXvntwGea7qMsT+xtPYl4cXL6fkFlmvOilNJvxD2o+zeb5x2aJ6MtUYLW40jclyUXHvlX5Tt140vtnU1oXB73irtLGN04SZNpsw9pnhXKRoOI8H3S6ZOj4KEDmpMqgNlWNAgzsJ+mnEI64KmIEJtBCaNN5tUC3qfMHWuBOm9pMnlbXWF6tcGcWuAWz7R8ULGiQ\/RCkZyGma\/dokpU\/nVll\/OLh97v8hzjkt4kRARFJEQcp+MzB\/raDYg9OdJpoJuJqKXseLYkwmkK3WIJvVkszJUFuadO3JA0425dpvkhWHye7JR6vaaJaYubmj2qoOqi4cBy3TgmW+VclDx8D6n2vURukW1FBIn5Z0WNed5EBACeuDOVkzLfavyWvUYnpUxocGGQOGFkq4XjKlVQjl6y2ndltcws8B+GDpBQTWU0j9eos\/viV3rlXTnMnudVGIlRCPQfhkCB0mgJoYKV5L2DL35RugcP46rw0mPyEKJdLJiO5loVQt\/oIcmVWxgXxY5npK7Uad5B6WyqQOyT2\/7sUmJxZa8CsJIoHyuJgKWxw82NutnRexdi\/zaZoqUr6NymjJdDJQuBJ3bNHae4yHPq3XaCQkYcEyaq+ZNJdjXrw0qd0wK9H5ZgMAkBGjo6g1XDJVWa\/lltVQUVbfQrjfeuKUFiAshQtXUkUlNFFXyKP5A9m+qmQBuhvokIE3dXjo9\/U4\/Edt+VlCGi2\/YgTFWpyVsaxkOnnWukF0rYloBdYsSp114azqhoQaPYUjEM0riIR5ankqq6rtmT2+mH13GxalMDbeeSvOM+8RrGuWu5ZYd+ISf4Io8PLUFnczddrbtY6UKaGrX9AYUX\/WCvr4BkEE+NpUJtrVTAwWaP7zYavlk17+QNA\/4api7HBWnNReQAr+faV++lANTqojkUxfSOKgR5hXhie5zA+yZQUPD3k2FctfQU2od8fIPXVNw8C0UQu8IamIByWw07jptPAMAoLJJa6RSHEhZnjpFpudvXGXpvNEerY9r65roqrZmdtH5bTXRqURBabsfPo6WzSNgXEJja15HvyX4z6keVjaRFFdx4y8CoMcxYDOpIK3cFvz+mApTej+sR76NShVpye7uVO2Jvy7O8wC9qHQAgdmbDmkrvj4Al+h68LGik3nVQE2GWq3VNuWV65i+RgThSNtMHm+HHL7eVFGnu1I7tOrd3P4SY6ES30cn4udbfwDAYgIps1oeSW5gJUEDggz+rYZV7bC6zjRqgJc2z0YhPg4MqoCGjRmxzqjQqqYsMTJjfVDl1QzJlOAu4D7cdR4MsqoIYSKjNCvNsrRBy4eohkXFY7XUIoGhyo\/3RfR0JEFQd7B3PhRg1mUv0owCcshL9+czdK3PJgnRenAxiRVqlkE\/YlXNm0MR92znwaquznOcFSA74wuiJs8CkSnkaCz\/kEMsHZ7layNte2h08WyG8Wx+lxqO\/LHjObHy4C2SYK8hhKkyv5a1plkUbfIB\/L33ZQx7CKMjmPNvR02AgXmSAe71Ql34DeeHETBMsfbFqMUj31n9dH+9M4N0UPU2RPWxuqjDzfk8rSzo9+GvpJyHIV5J9jbgaHhShgXfXLolry0BH7UehJDNlAu1zIVjrGaGYAtWZWkaB7naURKCAsfbB6zfthZyu\/t\/rYQTxbofESAivZ\/arQuEsvyDmfbKFNw+np9znF7h6\/amoEIsCnjyTUY4aKFG9d5Kg8A425geC+nvcT2hrIwkMqmESsCXY36\/hpN26YQVtcyuGSxIw845HkzIc\/bLIBrgmJxVVlVImPbJtVEoGLFB7nxi6Pg1YLaRmLZ\/RjPFKBWzquatP\/0Di5T9sLR+Q9vPu+ncSc6N29FsJqGFpGaSAHi3UWMRzAAvjFEuhFYXKV\/nrB+i0I0WDmfI5DupkT3AUMhKO1TG8MKYlK\/4dpa+7Mja4Z9YekIaeKsSJb0+OFgWNeD48kjmY3xydlwTDsVnM=","iv":"4ee2c710342a85d553e2913bc8b1278e","s":"1f114f7e174e0b9f"}

Isha Ambani tying the knot last month with Anand Piramal in a wedding that only Indian billionaire parents can pull off

Isha Ambani tying the knot last month with Anand Piramal in a wedding that only Indian billionaire parents can pull off

Source: Kotak Wealth Hurun Report 2018

Source: Kotak Wealth Hurun Report 2018 Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School

Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School