- About

- Subscribe Now

- New York,

October 9, 2020

Retailers rethink holiday season strategy. Image credit: UKG

Retailers rethink holiday season strategy. Image credit: UKG

Ahead of the holiday season, retail stores are preparing by ramping up fulfillment options and implementing safety measures, according to a new study by Ultimate Kronos Group (UKG).

UKG’s “Retailers Rethink Holiday Season Strategy” examines what should be expected for both shoppers and store personnel this holiday season as health and safety remain a top priority. Retailers are hoping COVID-19 precautions will lure consumers back to bricks-and-mortar stores after months of lockdowns in the spring.

“Luxury retailers have created a unique, experience-based shopping model, particularly in their physical stores,” said Amanda Nichols, senior manager of retail, hospitality and food service at UKG, Boston. “And in the days of COVID-19, store associates are really having to take extra care to put the guest’s experience first.”

The report is based on a survey of 302 retailers across the United States.

What’s in store

The greatest question concerning holiday shopping is, “Will stores be open?”

According to the UKG survey, 91 percent of retail stores are fairly confident that they will be open and operational on Black Friday. However, confidence comes with caution as 53 percent of stores revealed that they would voluntarily close their stores in the event of a regional COVID-19 outbreak.

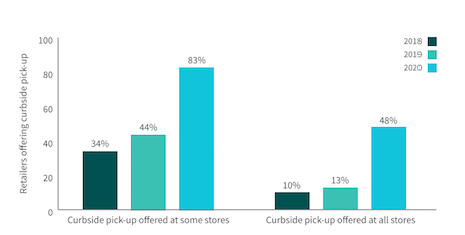

While stores have expanded their pick-up options over the past few years, curbside pick-up has nearly doubled since the 2019 holiday season with 83 percent of stores saying they will offer curbside options this year.

Percentage of retailers offering curbside pick-up year-over-year. Image credit: UKG

Percentage of retailers offering curbside pick-up year-over-year. Image credit: UKG

“Luxury retailers have put a lot of focus and attention into their digital channels and online shopping experience,” Ms. Nichols said. “The exploratory environments they’ve created online and the lavish experience shoppers get in stores can’t really be replicated with curbside pickup.

“I believe retailers have been experimenting with how to bring that element of luxury to curbside pickup, and certainly there are benefits to offering the option, but whether shoppers will be delighted by the experience is another question,” she said.

In order to adequately support the demand for pick up in-store, 47 percent of retailers say that staffing is a top priority this year.

The coronavirus pandemic has severely affected the retail workforce with 67 percent of stores reporting they had an employee test positive for COVID-19 and 86 percent expressing problems with understaffing due to the virus.

Even without a global pandemic, the holiday season is a stressful time for retail workers, so concerns have grown significantly for the well-being of employees this year. About 72 percent of retailers anticipate that their employees will feel anxious about COVID-19 at work.

Safety is the number one priority for the majority of stores as 83 percent of stores will require employees to wear masks and 82 percent will require customers to wear masks. An increase in cleaning frequency will also be adopted by 80 percent of retailers, while 67 percent will provide personal protective equipment to all staff members.

Shoppers and staff are required to wear face masks in Neiman Marcus stores. Image credit: Neiman Marcus

Shoppers and staff are required to wear face masks in Neiman Marcus stores. Image credit: Neiman Marcus

Retailers do not seem to be enforcing as strict safety precautions on shoppers considering only 11 percent say they will take temperatures at the door.

Flexibility and transparency will be more important than ever to ensure the health and safety of workers and shoppers.

Nearly 81 percent of retailers are prepared for staffing issues and are taking the necessary steps to maintain the well-being of their employees.

Almost half of stores, 46 percent, are making schedule accommodations for at-risk workers and more than a quarter, 28 percent, are willing to cover the cost of testing for employees experiencing symptoms. Fifty-eight percent of respondents will close stores on Thanksgiving Day.

COVID-19 meets the holidays

Despite safety precautions being made on behalf of retail stores this holiday shopping season, customers may not spend as much this year or simply revert to ecommerce in response to the pandemic.

According to Deloitte’s 2020 Holiday Retail Forecast, holiday sales will be dependent on customer confidence. A number of factors such as continued school closures, lack of a vaccine and an increasing unemployment rate could prevent customers from spending this year (see story).

On the contrary, presumably due to a decrease in experiential spending this year, such as travel, dining and entertainment, customers have more money to spend on holiday gifts this year. According to Tinuiti’s “2020 Holiday Trends Report,” more than 80 percent of customers are planning to spend the same or more on holiday gifts than last year (see story).

In response to customers’ reluctance to shop in-store this year, Kibo Commerce’s “2020 Guide to Holiday Commerce” suggests that retailers should incorporate consumer needs into their sales strategies such as ensuring websites are prepared for higher traffic volume. The guide also suggests that incorporating “buy online pick up in-store” options will help retailers if stores must shut down due to virus outbreaks (see story).

“One of the key findings from our research shows that 80 percent of U.S. retailers say flexibility is now more important than ever,” Ms. Nichols said. “It’s going to impact guest experience, and it’s going to make a difference in the holiday season.”

“If you also give staff the tools to develop and nurture their relationships with customers outside of the store, through digital channels and social media, this practice of being nimble and flexible can really come to life,” she said.

Share your thoughts. Click here