By Jim Taylor, Stephen Kraus and Doug Harrison

By Jim Taylor, Stephen Kraus and Doug Harrison

Chapter Five: Theory into Practice: Thirteen Expressions of Passion in Selling

“An ounce of action is worth a ton of theory.”

—RALPH WALDO EMERSON

“In theory there is no difference between theory and practice. In practice there is.”

—YOGI BERRA

Expression 5: Understand their Ultimate Passion: Family

“A family is a place where minds come in contact with one another.”

—BUDDHA

We saw in Chapter 3 that family interests consistently top the lists of passions for the affluent.

Depending on your product category and your sales style, understanding customers’ family situations may be a powerful way of deepening your relationship with those customers and prospects.

But as it is the ultimate passion for these people, tread carefully on the subject of family. It is easy to invade a customer’s comfort zone when it comes to sharing information about family.

Understanding the family situation is obviously of particular importance for those in sales in the financial services industry.

Has a new baby changed the customer’s need for life insurance? Are there more kids on the way?

Has there been a financial switch from a dual-income household to a single-income breadwinner-homemaker household?

Is there a child heading to college soon, necessitating that some cash be freed up for tuition payments?

Is there a “boomerang kid”—one who has returned home after college, and may need some guidance in getting a job and becoming financially independent?

Is an aging parent putting a near-term financial burden on your customer, a burden that may soon paradoxically morph into a significant inheritance?

It is one thing to know the ages of your prospects and their family members, and to understand the likely changes in lifestyle and income.

But there’s another level of understanding: knowing the needs and attitudes of family members, their personalities and preferences, their ambitions and fears.

For the wealthy, for example, there is significant concern that money might undermine the tight family life they have tried to create.

Among 700,000 or so households with $500,000 or more in annual discretionary income, a group that averages over $12 million in assets, fully half express serious concerns about their children’s work ethic because they have grown up with money.

Abundance creates new fears and new expectations. More than two-thirds of these adults want their heirs to be “stewards of the family wealth,” managing it and passing it on to future generations.

In contrast, only 49 percent agree with the statement: “I do not care what my heirs do with the family wealth; I just want them to be happy.”

The wealthy reach out to their kids with guidance and information, particularly since the Great Recession has elevated everyone’sfinancial stress.

Three-fourths of them have taken specific steps to educate their kids about financial decision making (but most stop short of revealing the full value of their estate).

Other families have chosen to “outsource” the solution; instead of dealing with it “in-house,” they defer to a new cottage industry offering financial how-to seminars for children of the newly wealthy.

Either way, financial service providers are obviously well advised to be part of the family education process; they just have to understand the familial “lay of the land” to position themselves effectively.

One might expect that social media sites are great places to keep up with customers and their family members, and although there is potential there, tread carefully: In general, social networking sites such as Facebook aren’t great places for selling.

At least for the moment, the closest technological analogy to Facebook is the telephone. Consumers love it as a medium to communicate with friends and family but find it terribly intrusive when used for marketing.

Less than one in three affluent Facebook users is a friend or fan of a company or product, and less than 5 percent have made a purchase decision largely based on information and ideas found on Facebook.

Of course, the relative noncommercial focus of social media sites may change as they evolve, and they certainly evolve rapidly.

But today, a number of top sales performers tell us they use social media sites less as tools for broadcasting their offerings and more for listening to their customers.

They maintain a minimal presence, careful to avoid being too “salesy” or posting something they wouldn’t want a prospect to know about them.

Their posts tend to focus on their personal and professional passions. (For example, one salesman focuses his posts on his training for an upcoming marathon, implicitly illustrating his energy as well as his ability to set and achieve big goals.)

Instead, top-performing salespeople tend to use social media sites more for “listening” than for promoting themselves or explicitly selling.

And they find that information about their customers shows up on social networking sites long before it would typically filter to their financial adviser, real estate agent, travel agent, personal shopper, personal trainer, or any number of other service providers and salespeople.

Facebook isn’t just about keeping up with friends and family (or playing Farmville). It’s often the first venue for the dissemination of information about new jobs, new kids, new business ventures, job promotions, which kids are attending new schools, family travel plans, and so on.

In short, these sites are a valuable line of communication, although that communication is surprisingly more one-sided than social media are typically thought to be.

Of course, understanding the family dynamics of a customer doesn’t just help the provider of financial services.

Top salespeople in many categories keep detailed customer files and use them to mark occasions (such as by sending handwritten birthday cards) important to the customer and his or her family.

Ultimately, the details of gathering and using information are less important than is expressing a sincere interest in those closest to your customers.

Expression 6: Satisfy the passion du jour: Value

“Price is what you pay. Value is what you get.”

—WARREN BUFFETT

Family has been, and will continue to be, the ultimate passion for most people. But the newest and most pressing passion—one that extends through every financial strata—is value.

Among the affluent and wealthy, we first saw the seeds of this tremendous focus on value germinate in 2006.

The National Bureau of Economic Research, the private group of economists charged with dating recessions, put the start of our recent Great Recession at December 2007.

In fact, we saw an “emotional recession,” with declining optimism, spending cutbacks, and a growing focus on value, take root as much as eighteen months earlier.

The turmoil and uncertainty of the ensuing years only served to heighten this value orientation, and it required considerable experience to navigate the marketplace with a fundamentally different set of trade-offs.

According to our survey, among the affluent:

• 86 percent prefer to shop in stores with reputations for great pricing.

• 74 percent usually wait for something to go on sale before buying it.

• 64 percent shop regularly with coupons (that’s right, coupons).

It is important to recognize that the dynamic at work here is value orientation, not necessarily price sensitivity.

In fact, across a variety of product categories, the affluent have shown tremendous reluctance to buy the lowest-cost option or to trade down in quality.

When we asked how the economy was reshaping their personal travel plans, for example, one of the most common responses was: “Staying in the same quality of accommodations, but expecting a better deal.”

Similarly, they told us they were making fewer highend purchases, but ones that were more personally meaning-ful—again speaking to the unwillingness to trade down.

Nowhere is this dynamic better reflected than at Costco, which is extremely popular among the wealthy, with its unique treasure-hunt approach to asurprising range of products across price ranges.

Costco is among the world’s largest retailers of high-end wines and high-quality diamonds, for example.

Wal-Mart, however, with its low-cost/low-quality approach, garners much less enthusiasm (and share of wallet) among the financial elite.

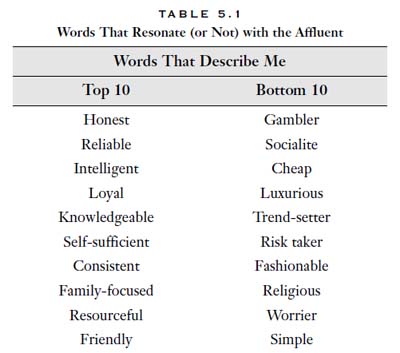

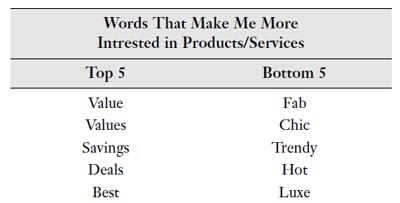

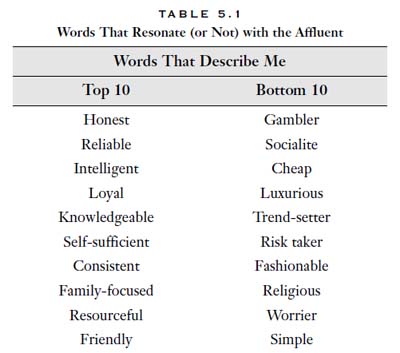

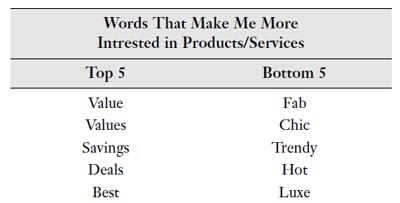

We saw similar dynamics when we asked affluent individuals what words they would use to describe themselves, and what words make them more or less interested in various marketplace offerings.

The list of top ten words that describe themselves (see Table 5.1) can be summarized as wise and nearly puritanical, while the bottom ten words largely reflect the superfluous and insubstantial kind of characterization they disdain.

The picture becomes even more telling when one examines the words that engage their interest in products and services: value, values, savings, deals, and best.

They reflect a value orientation, to be sure, but just as important is being consistent with their values and maintaining high quality.

The words that turn them off reflect those things that seem gimmicky and don’t stand the test of time.

The importance of value to this group is apparent, not just in their retail choices but across virtually every other category of goods and services.

Consider travel. Just a few years ago, very high-priced destination clubs and other vacation concepts were successful products among the wealthy, largely

Table 5.1

Some commanded initiation fees in the hundreds of thousands of dollars, with annual maintenance fees in the tens of thousands. These clubs typically offered little in the way of equity or investment potential, but customer interest was nevertheless reasonably strong.

The recession put a sudden and dramatic end to that entire business model, however. By mid-2010, interest in vacations was rising, especially a growing interest in high-quality vacation homes, fractional properties, and time-shares.

Whereas in 2006, these consumers wanted a fabulous vacation experience, by 2010 they were insisting on an investment-grade fabulous vacation experience.

And their standards for what constituted “fabulous” were no less demanding.

Investment-grade quality (figuratively speaking) and value continue to be the new “must-haves,” regardless of whether the offering is mainstream or luxury.

Expression 7: Use the language of passion

“The language of truth is simple.”

—EURIPIDES

“Think like a wise man but communicate in the language of the people.”

—WILLIAM BUTLER YEATS

In our interviews with the affluent and wealthy, we were struck by the characteristic ways they express themselves.

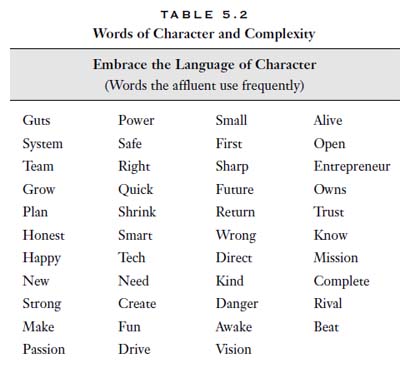

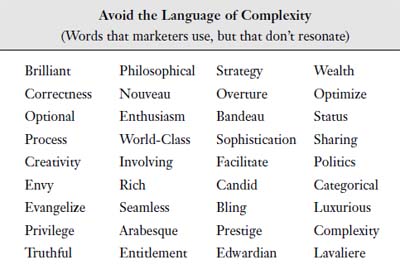

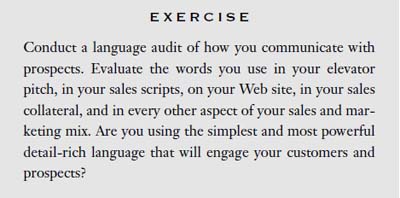

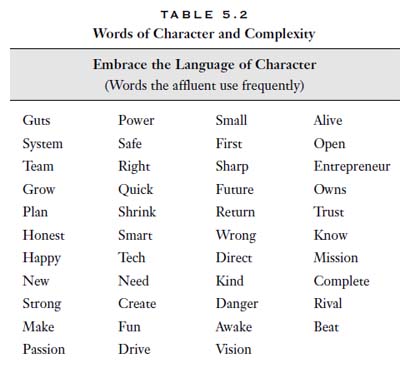

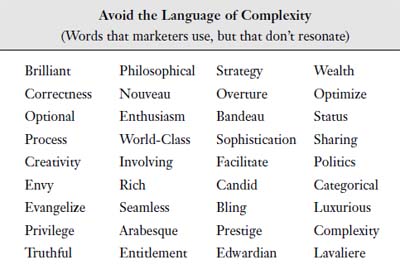

We analyzed these interviews and discovered that certain words and phrases were used with great regularity, and we noticed that other words and phrases were conspicuous by their absence (see Table 5.2).

The words these groups use might be characterized as “the language of passion”: mission, guts, future, vision, entrepreneur, right, wrong, happy.

Generally, they express their thoughts with a clear preference for short, simple words; active verbs; straightforward nouns; and resultsoriented terminology.

Table 5.2

In contrast, our research showed that they tend to be turned off by flowery language, anything that conveys faux sophistication, and an abundance of adjectives and adverbs.

In other words, they dislike the kind of language that untrained salespeople routinely use to try to impress the wealthy.

Their feeble communication strategies—both written and verbal—backfire, triggering the fine-tuned BS detectors of today’s wealthy.

Advertising copy for luxury products is often an example of this offense—filled with multisyllabic descriptors that obscure the message.

Theory into practice: Thirteen expressions of passion in selling

Selling to the New Elite: Discover the Secret to Winning Over Your Wealthiest Prospects

by Jim Taylor, Stephen Kraus and Doug Harrison

© 2011 Harrison Group

All rights reserved.

Published by AMACOM Books

www.amacombooks.org

Division of American Management Association

1601 Broadway, New York, NY 10019

{"ct":"3tK6AjYsfSASz5FJDPv8n8jjV20+6M9j99fo1T9AvCwZ3gb6i6eIk7\/x9CWFhEj6MCWC4wE50UKTrh8uYD4GOini8zLdb3XmzMFgXer6vX+Cacn1IcNI2QsYUqEEplC5W0GjFyzt9s9Ws0uzSuB6dJ8CLwAutMjj+tedL9nqkqRkhLkgznAurBmjGSIIlBT\/9NLeWT3vdLt4tEWiumrjL8sWBd9OygUFvNIyGr7RAyNRfCB10z1hz0zMdeq\/aMotFTQscEKTflFI\/KTc0bEWweEIh9OmTCs60VjfMD\/jpt65Nvz3u3+ErYUhCtVd6O+NX0aOk0uerZuupEyhsZCYPP\/aqkaSpKAR8AtXsF9VCJRnbJS6Vc7\/cKxldZisQ8bbe25eL5D5oTmPXiC+v\/3N5GT3NQYZWPKGnRJKYHOY+qCYWlp\/b74S0Lo7OhkV7rWvR3LnRgSkz5XWtv\/G0ApBAB23uzT\/MNYcMfCubQKGWIhYqiwhePsfX2RjZ\/H9YAvSyyQC5owheuj3oOUU\/oAF3mOmQ3kvdXmAXyEfpLXlMlvdgVdSQCBntcadbE8M+QJc5ic9XBH8GPUTVE6iG4atnyd\/1\/kNk34rj4NAvMZ3gzLAABrBxkISu\/PnjgOSj+VXVGEpYnn5VOJ1ETKun3bcyvRLEO6fD3UUpGd2LAsou6\/Iu+jskdufTQptVYtPCxTqSQixlxlO+jnNe7szQbg\/cwvbxjqBIkpeh5+tcTaM5K0ze5uxH+Mw2pBOicWX8EQwD7WqEQxOeQ+TL+Zo25umZpag05jGQ0R3AsCG6vTV3WaWhWd7oQgrNtX0jnU2+IG3zFKbegbC5B0\/pghK65jZ+QFlD\/RJilhnOJKNah2kar1YDshFBWPGXAFLOUoBE4mIKGZbHp2nna\/vy9QKpMAFY\/xOOsGpBsk\/mUN8n28iFp5HhsIMtUMFwbU7Mye1T6Yy\/JQjNRPhViJLllezZO4Skbj1PNL8p4+IZtuFclo\/QUV8msiQtJUJqTDsxOe9BWe66XjVJV0jxGmU2Cq1lLqxTr3SDPrSL7O2qM+38k0tvqreAGlSh\/LX22rDWxsrxVpzeTGICHiF+tKQx5KBv7\/\/qmxQcNt7\/Jo0zCUct3RZs\/WAJNei774BGdS2yub+x4HRK6AvWrX\/KaqhyEdFTRVr\/EhyFu8G684PBNG7sE7dVNy2fJb8HrrSV2FSKYzVvFj8jgDASOghLXs0CtiLmOvMTE0PT+OqbVwzmfgH6YqWBNBcHU5NpCpELKM7amG1HBlTqFNTsnb63crle33fgtguhRX2caN9j+\/JnpaRujbLTUq\/3H19obfCUGE+bvyrwpBfR3LU7riQAGbr4VXxMVEYwSV9yPATNCJ9fwunK7N5jc6\/uV4uMpWhLN8z51oFpStXls+2B5zurlYTAg+IX7RiDEGBIzPHz3mqI+Gpcm080Q9+fDRXnlIIOuOSv6bEHJUmP4PitTB5JuB4HAx5yMjjPQpKckPZWKP11zes7qTSSl6qPyxUXgRX2PV9ju1PDT+dQrjLF+BAWVqNeZi12+fZEiNdRQHbZRPxwJn3TTq\/yJZphBjzp9vf1R5GVOl8IyQPGdCBzdWYLnP6p3mNCUDSEAWvvF5fCy54zr2xblWVC3+pCOuhkhyftlLkB9hCJfzppzA6IMqg+pHiekfHTAZfHEAeT5RkBGP7t+TyXD+TmNcfEElwqyW2JQRXUcijO0yCjOIJHo13o50ck1yVs6vCwc8QuFKYeaog2TvgiB2tZOVkovtdhGHE6FZwhCWyK5sqasr4OzHPrTp3syWa6CY6SRknoUD7jfmc2BayR2VAqWDEWqXjQxd+R+4U41rtC0rLTgCBA1N8j43ICexXwI1AvB9yMozXgJAYmZpmEbJUHNvRzhQnGq630BOo8WUiCBzxEQSIpaJkJsPVNxyALUA7BNaWP9ytF4r49nBoreySf52kJdYsmV5NcqEkg7mBLgpXpRvKjgPjTMatK0Itc1oGuJlPMhALE9EaKboE+9ITOMwAvHUXyzorrEBkUrnQjZQ5+eeG5FcVfTRYi+EcqX0e3BdpK+MR3HrDkiGnHp5+Vq8lpsLWaJwpSrAsSRZfm1QZWtaE37HARNFal8ON+Iazd+3dNbjVf3wJdTm26Cx0kp4SPSYDRKdoKPcxYqpa\/6p9iXhamrW3ePL+epRCuA75Db5tAwKG12Or4uCLoN+Kr7g4gsf3E59dz5LcwrxdiJBaXc4h5uobUOtbikjVWW5ZU\/hdGPc3dswR15oVHb8Alw2TjS+rwUIM1yNJuQmBfMlCSuVK5HaMszgbWYuZSWOI\/l02gsVFFCHakXhd6TXu4zO3faBAyL7BV1njTLHXWAaPEnZyK6HCyqOZRW1O\/z8Lcl4A8UPo6\/O6trjyxyCPP\/Iu\/qbdSluIBcWyM1WrQOfDRaLsXoyPu1xYDHtXqSVVBvp7Qh1km3XjVKN\/WL5Rt92J21dnnyrVH3jLvnqEBxetX3tA3BrwduXs2P2PxTjqKOrxkaKBnlXo\/0Ae3S9fHrGuDkh+B0UhoHlxohyIWhclgsxO8saeVjj4yI9sq3\/L4pOncdpN4nY6r3b\/3gscgQ7iFRnZRP+HypNsixV7oxWZrE1JCEuPr0fBVyzWTJp6XebLypcB+zti5uzbCpW1NXbZeqDHVyMKqiCnTdOb1gWxWI3P+y4UdZ464v4\/+uwuG8TNXm7nzuYTRjajhYDoPLBiozFQ8sX530ALGvStTfS4u4LfcSPkRMq8A\/1XGBSbQ68REpLUHg1bhvLKutZ7uj\/GxDnNQc8zkUDx2F+qid8UUk0Y8fZr7BYkjlkujrZ66ngxnOYWMEsB8j22tWXIfAfqi0g9Yl3esCWpNbGt17W9vqSwsrfhQ\/InYp4yRuIYUuYN\/S8Lws3Gpynp2KTqcJC5UIUccxNI+3ZFs2nTeADKt8RIWAIUvChFekkjPObBz+dCFG1mRtdl9fnHDQslvJMs1EAcUNbmpyudVW9iHPcv2WjUxXL2TXfwpEnOzQmnfzuyYgSsDFxadFVuP9NE52XuLMg4cXrEOsVVTvcSY3PPW26EiX8065N2\/SPkAYrSxLX83W2tO8WF8RZYcFku7XKMRd6tAAlCDJMSCcmRTABuMMbeXr7E+kJuoae0lhzZaWAPEtwPkMT7H+AwEMQNPuqgKDKrtbfo1qTCzqfcMeqwaQOOSeglntO7rOyBthkUZTffKDMojcMPa0RYUkFTo6g+fsRdUqy0GjjbMafbTxYzOXWzGiMNMUwJvYgf7RQkAskKi4sJsx9rj53ogDVytl8CiQB61BHTjpTVxx\/UfDlAqprcfQ29uDjwkopy3hFiOWRhVhWPW4xmhd56v2vXLvVFFPnLrXrZhJMUy\/zdsfHkts3Y2yHfqoVQVcWsUKEoynn9+zy08zLcynnMquUKPSVVn\/tdGhrBJWsxIc4Uqb6CyZbUrOKAcplyWg9Q\/N8ybs7XONxAE14IWL1nI7kDvQvAH62QxqWOYN4S6JaPRjeANebMG6moPtmBdAd00n2hfzpwgiOjV7GJcjPiTPRIehCLOxr+zMK\/QeCSYA8fzwUkl5NoC+zYAO\/Na9AmAR3KJxsf21VOQSznBJHjZZWlNGPIWlVHQPeVpuSE3c2taVgOYgc1wjMPbOdBRlDW4+eV4aZOvunvLCS9EcGJoi\/JTeX1ngGadhBAHJOKOq+6pMUeNf1cUp3A1LlaFlxmutQBLGl7K6bncGJEh4TM3d0ZEXkk\/olA7dqTbxwexS5Y0SijcZC6\/Dx+QKp90QaVtI0R6CavEPVqojLa3AiemPOCE+m05r7DkfRuwfQEK7oFvHIgPsyvFg5s4JtmlUwzvgJCUUD6AHmif7ZeOEdaIPE9IC8RrF25ouldEn5DhNJ7DFEy9lahty4E2S\/91MmyEmXIMm1jYFfcgMMQQWtOrf1kRTFzGjnmqbbdqagZEPJURlZbLLV9K4crx9e0h6Ln7LM6O3yfFyhWRZdHRO+jHfKSMHHaqlbcbRDLmjXzfkTHy2qyJMVPtB8bamfZjE73\/pYmgKC3i2fK2ntM87tMxL6FFd\/lCSWb3oILYGYc+0P+XST3Okd9ihBosw8EgqTgFDfzj6q0kJMm6w1XU\/aOmWw4hpCVKWA9wRIW\/fhlsxzrYG2EC72681G7EVS\/++RHbVUhvP1UCPlHlqzEIA1gXaezwJV8i9scAsbWSHCryny7xw0oT6B3OT2jbdevARD6wWQmtdf9EFHuud8lw69XFtZMVSYpxpCl2AR63tP2GPWJkfN0H92DaXKHHUGfhFtw5VeRY9yYPwmDdPkbaU6mELpFc0g2Bh\/C0wR3Bi\/T9f7SIdHtZANgxMxJmWRDCnSFWDT5ri3xwUV9G1xrPGGrhY1d9dMZYn+lgk4NM020JAThfkwDsrURtWLmvk4dBW8ZTlT28uB4PWQI8P+fW3lzS7Hcnm\/jKLXR2+ktXUZZAR\/zAyVTg791dE\/v20O0k63MNtnc8k3EWPnUxhgHWWiCNvHM8mfopMlNQa+Ivj7soPuHNo5zrdfl\/6U4wN0Z7\/PWCTgONT\/p9IyMegSTQI6rzE4TxY40SmhJQntPvaWSPbD9uGAY9GF6mue7K0lCHaJBBaUhLpgYtyqoCIqBb7YCfdXBiJm7wtVw5opgDQ3ZUQU\/7nclcFl2iJ9Ls5BiVG\/cirV0PTe89VKgN5W\/zqNuIrVUzqA7gWx2CvjSqv\/C9v4TSYtUexIxF1jOINrgNGrdh\/oud9gDCEktkvtzb0mB5EnLxFCHR5XQrlJPHC+wR7Hp5wkadccG64k5L5UDFzIaqM\/3US6ZzwybXnjfGF8xq3LZE+S2k7LWYwnGCwxLDT1vegNgAQ+V3NgTKq0DbkMm+Q2yXZtwgN0DdC6uQ1SLejW13cV+m3kg1mclZPsc90s+nRswZzfIe22+TfGxI7xL6SdhDahBVnqHI+X7Tw59z7j8dkBHCVrvb6KlBYTGXq06OBqwtERMuNhrk3MSpbKAsy+IhWkii69lroR3MjZ6FIScVGwes7DBFr792R4\/cpd2MjquQbsqcwDnX\/PPwE+WCKRzPFZODIr6yYXw4wxIAVtyR8qR81zP2YcqfVXE0Yv1hFXdHwWB5z6kIKAETbxByAssaqNCSDAl9BsNTVfQgClpm0VRM9msjdAPU\/G69LkpKvi90jp2\/cNNUN+g5dQzZ0IiccVDcm8JwuB8ny6WR706v0dv6AahHPY++\/AEZXP8ecVqfFLLxrxTUBKYcAgmW2GbL\/vpyrpk60IWgAy3aZa8+RDTtPjVBqZq8cSZgSYWoSsaxGFWcOY9wrxOVFgvBCKo5TdTWVzfZ0FDJsSQKwzSZk0uAbeYt+mS4V4jVHuKIK4xR48\/xNV8Z5T95NkJYVaNlVNwbzmilc6vx7NS8tm8u42vhYLaZH77Vty1ixOWc6r1XnrImFt0OgTBTOwhNXeXVAh3znbynqkgd5iAMdZZpvrpT8PMKVX4C41hyvRrffh9sIpPqepO3PEaRvMfly3Lu2GWBOD46MO9ilccG72WlSdrKh61HdXUmBQgboCFDWVlFqio6xNtajlIkNfrevM7Muypx8rjOJJpkCCUHNEuQWoBB1DrdlIUPcD08OAVDX0T6LSLKyniyjmM6en8js+W1Jc9Jr5xqsSbUIN1\/H0f9mkZbUh3R4FC5srhDKKmM0SK9WXursj+F8nJCJ4qocmzlIATF65\/j5vGV8dJWNwS60GC3RuakzikryDMdyG5tM0Bd8f5BhO23NOr2WOl7lyg0EOFWtM3tuL6fZxM+fwlimKcet3q5\/jNDgEyL3ZE1NAiqHG4G7mofr5Nk+wnZFBUSrGnuusvA4bnuPy3X68zuQuIOg8TjkhOS9tn5LTASiihcnv1wQj63p+NJrHPOg5s+wcjrn7jQBQNDiWIIwc9GDmrF8mFDK37nN4PwCj6whKrZ4wRV47AYBaeig2kZd1wpO01TCkMFRvzT0iFHejzkC2fBuu4PTi4lbOxtutWBmZW68LE\/4l89lNMz2\/K+JhWmkWAnGN+M0w\/7GjlWdec8HraepynqR5MNoPyncXhSbQYtfW+nrZh3hZCFGBwzuG93qgUXOAAptcFc1jfzFhdNxowAVShLubdoVKJo1aYBFO06XBJ\/pO9MCN9DqTLke8u4mHkPTnJ9D4MfPkZ3t7QfoMmMRkGW4oCDKaireO\/Hxns65PCioKc3PfR+cprQ8ItIYDfw2WMFPVkqjQCJV58PCHDCdEI3DnevOccAJxtqL+dhytfXeeMKlBaPbJ0wSd+ylMq5ULIjtDJJGZCLCVZUYvL6mO6yHFeEnhS7guK\/+l178H5NszW7mLWD0iyfUN9NIKWyiRkMZkVEnD4HQ9ZjTEUYEbG9NxPOBl0jCRf7M4eODJcoZF\/fFhIyBOyqn1Hg8oLIvGk5r4I1if5PPsMYzx8Ev1x0xwcsL0dUDMMPIfg\/ceBHoXzgixNo\/PoO6\/SDGbyXtjazQ7JPKPvDdokFx57FRlSd8hn9h0HwMj5Hx4MoQc81Uu3\/Jje3AB0FsSblfkWITExf2WpmBdQDbcoA3VZIsHuxyWBmYmbewfZMHe\/6\/zfYOSL5fJ\/XyPCsD9tt\/iAh2wmPxPn09APzWs4kLKT9zjg6UKAo5sxCaq8B5SVsGq+GFZHfh+5CoM\/W\/WPFeU5+65D4F8FYbMG9+ibhmvCI3DYWo+D1cOzq6RVr0+R9IGoITeKhODMytXOx\/qxgxEXSJUI3ygnMVMFuppR\/O1fhVrU1CVwsk5NHe7G\/s+w3yfJ2SnWsSr5YYeh63bh2vbzEB8EFEJEJteT2VpAxTdy5L1jcUBpbx4vHPyuxsuCNi4T5bYd8NxV1aT\/71uBPfJPzjeNJKsK7O5wztp5SN5csncgTmR4TWJ67ImKQTLS8Lu8WIvhhIHjAd+tz+EISV2Itn7iiFJO4Nk0xtl80lpwJneXhZTlOP3qgHWbsQBccRIEQ8t5LqvQabC3e3twbDJibA+L6GSxleXX79GVy22Rh77e0SNotMfudw\/utjZnO6owPqlQvNR7cnCggidyuBwtnv2VBFZXfHnts107cWCNnZtH1M0xvMbNmvp5yJytTl+UvHqQwuNmlPz423ZuVGALH1yVCWZVaIi44DXmL9ZMxjev6XzTPHo6QJas0kJcwYKJMDNcCcYZLLDlGL81m6QOW0kXhN7RrXy3W\/CIjEPc+JwOaMTmby6x+3VRQgtJMwH+XDapmnC12ttMHCwa+D2b6YvKi18+L2qfkyRTT0BS\/AyvCY5U9Hh2dapD34zu6zw35jYJrpx16Uo5ZEvtRU9FvUkVRRrQX\/0wduPz32SIQpdrnEhcOK366duMAGh2\/tlhYeQ71QEQoXcOoVaEttvzdrxbJYTdlVp674AYJt3B75aqnT09wk8mC0VLm6wBBeUV6aPiTlOP55Yuf6AuhQf7W5CxF0trGxtqouJhbfeT2lL2muDa7Fphz1jBc3liZAAkf+1I1kxIiVX5EyjOfERwsehE\/uL66mIKUgPTR+yItb\/\/swz6ybNrZnsjZmJsuhiEH1ToP75xrlegpv4d3VDhdJD7ixIBm9uTkzdVCpZbca0ieXn0bgnaSEFEQMsfFWUe8eA6hPXbNOa4T5VpxTSHhPqosPu1jfNuMlzXQ\/ziwWb98ar68EjrP9EeIZ\/ft4thiHDfOqd3AYZG87lBCzfxqFBdJe0SO01GSCfToqZn0YEbBOxC+5ZZ0BUycDeEJ3Ah60mwYMa3G+X4WWAZKHlZyRwI4JpXBd+evsmT97gK7rxy85nAoQQWUbbZLQhxq9fOpDGvzdbwOqqJX9Qg3nn\/32KplQx1JsEBrkcSFMbc\/Ojr1K1b0miTyuG8DvHFIwoGltoHh+ZA3XwOul6FBPFqzSyxiqv2DrX011q+IwEPj0S6LLL77oqKCD3xOH+WEgVE1qF26JgrGdpqPdoFNfLq1wEsXsA\/24ez10\/HIz4m1COwdYJfm+elnJHD7\/GEtrwUZL2i6WzL\/tJQfQ4QRYezMKMJxGtC2iSpXNGSqGiyGVJsef9SLYn\/6PtsdBIjduBZ6K3aaewWH9yAVP4ib6LePQ8YKOFmWEUs7dXPem\/N\/V0HCIjlvBukg+jstbbgOp8g3fJYc7UBBvYideY+aEIOxLyVgZTkB+IUC8qGVmCPxfv5rbgHrGcevU6e1HpYBNDEmcB6iy7+D2s0y4HIINENCWLV+OsITImA2WQfxQzfGMxdR2Lu+WZRWGegHODRVZ7aW4zu2SOCpQ5gngM2KjrR+yKCv3QhAVcenIGz0uC\/D0DGe\/yYBHeOvLBNPQPj8M7j8RsUUTMxWAogHzjraQuIqYfpFrg+BXJkQ8s8nw8kD1CbF5EYQEpK8nOZBpQoLIMEmV0558F3oW9x3ISBx7Dt1HJsJ4v\/snvdaSUPvPsH3+df4M4QfuEtSXwJtteMcx0WLPhmFWNa11fxRMYZ1DuTuTaj0yS2l97ROcvH1j4jSQWoDffXLh11T65pqGOGgOGYSLUTsZc2myQ11VPOrO4sEh+VVRUZcYBrdPyORDSpA2\/oKtHGdUR75XOkgzr3PzyTKsbcXDWbRyIz6OID77j7FKYkgjMaT6\/jh7129d\/QC71rsPv6o6n9L03CGvSWjjZ0ZKqn9+i1n5LCYLlcLnz3P0H+vLL+kkXRL+nfeyihiu1uObwefMUKlYC\/9SrNb2wb2YPqs8QTwQqHFMsy2N6kl+u8IsrnEFafAFh9ROoKAfU1Ekb6UO6P\/iDtK00onNf68iPqox\/JtW0Qyyy94hdrm6qwoqiQhW0adIOHba3Cy990od4eMC3OpvHpJCH\/jYICwMt\/KzSZVWhlBswYFddz1hpD0vXko49I3pfLlorkU8Omufx1ioegWYd4gXP8BHo7gaeoyMWV7Cc1M3cdn35s\/O9Fo8USmZsWWqKvAgPDgqUODmXozdv9nd\/rhJIgaqY4gk6d6KqHyil8MxzQa0PzBib\/ZRT2thFgov40vghDtG+7AT1V2FVtvvorEoyo2bE\/NpwnvXdiR5KlBoyArArBcnLSZ83fqTjxcMFG1YVwIiOe1WaHXq\/4h3GVAGhKfqKewm89\/76RnuSfDKAYiR3bK8OeYt5LsdztNi3kIzs\/bh0QHNhBJYa+qCHX9c76TCug38JSqZ48W1KFz0WRUeXQnbkLlo5XQxAk4x3a\/E9pMzBrBmPo0AwP40eSBJxpH+XvlN3k5Rj57pXaBP6YLHbUaL78sXq3T\/HItofMG0Y7uJINKxl+MSL89wPk27ZxIC4cckv9+LUKt8wyO\/ummK\/FiL+gnyrMoNSX9g\/Lr78gxsMFCi8ASPrH3PTYajgYbTExjk0KtvQNVrjGvsmAjG1MxWwv2EomQQSBlUOr80gNTnlpJSA\/kEqhv1kaI1tMfblklCutlZVVz3D2ktDjQ46AibtDoZnDev7Onb9rRZ3eKx9+PipW5qd+Z1MiVbPuxNiQr8qQsS6EquhfYhZmEW+ienLgxS75V1ZC8G6MO45fXs7Z\/ze2c8tzMacEAIULY9GmrjyDNvU5WhA8s3vIILrqlwMzxQEUlnpa1n\/IUy9PxPgOnzg3bbaqlBCx3qLllTTGVYzwMglsTVr8heVLnYKlJAV8+oCtUoBbvzdKlpGYACgTonjXzmg68BxnGt+aOoLv9W2JVWG7hlS\/ICymUH2+OI3YQyQzMSzl69N3U8pQq\/pwOVSVQt00LqKnX1n7DS6dLbbS5\/C\/jIIoovxlsauDPZZC94qrl9rKi3AjLt+gWyrJURty\/ABuSVY18mySaOk9CEjRZqRdVKeV\/HH7Gdu2+aH5uBvug5crRTA\/yb1nOJ1S6L02iF+jAjweIOJ+SkdknY+2\/SxOHvsVfB1hPqhlr786Cmr3JTM1dOrbAvRAAxiJOm8HTz6fKNGCU0KLMszwf9qieXOUm0oZfnoUTFt+kUz6H2+fPdKyu8x1Hpvo0i0I5eYXDkpiAX7DcyzGqeOo40rXL\/JO4flkuwsuWuIswb9YRrSEjuZyJGRcRXiUN0neFCgw6Nt6BIYACLSvr3dXIHLT9juSd0irb6ZuPZZ4fahR87mXBeLE1FuPSK6Crpzrxn91\/HRFTy71olGxrKZA54STPlAgfm4lfKnUB7jsCx4Q\/mrWUK+R\/48Q6xI44l1cgY\/4qpCHYkrQyI1qZwu2PrdhrhfQkSkJbAZcIiSLvqDPM3tYu5uzcVOhYL6CvhIuQlUY0VB\/TIPPAeNOsRiZ1y2F6QCCItHylV\/NKJ\/PQKTLUxrQ+hi\/Tiwt9mGdQyK+G8CJyUObXnj7tURW1wydnLSvaQ5mI1CubaNzNOzEDe\/inZsfPt+Suc5R0BP08OZORSwCFtDDS5rR7jmrZMdE7TrCf+Y9qoXB3nkBh6svA6dkybfix93Go8KCJwRyPd\/6jjglw9jAWxoQql9byJYLVUKY3R8lgOV6Np\/HJV52eAdgszsPugZigOYHAe8Kd1m6ShELzRikHW5\/uILsh7cLXSU25uQh1F7ZnM63MzPNzzt0Rcijyjjdc4Ttw+mlVTk9SEb62HGwVyPzsHomAjD9JqThH5rTL66QXWxoTnqsOIUuGp59UTE83T45vP1suRhLX0AyYa6EO4tTOuEaUvTKfY953oyso++ZbdiRmEDHC6XgOTGHZ5Ec6fIco\/ngNUPWOUADXIw\/iaJ9iy8ELfjQpChEJyiPcE4UyJoUNFoAmBQKl3xmeqOb5xxXxTESM4MtE01T9Yvy3QPwhi0dv7Tt4zVqGxl2dfIG+BgWfwWsFos5vNjJgU7GjyR\/zgl12N1xiD9knFUL0RepPbQDSqcOAxhP44sqUGbDX0ry4I\/R65JFD64Bfev8AY2q\/DCoAsqXqltagzL3no6\/hOAC\/FaHfU7SeyzqPDSolCHH9Ptn8byrxJMqHUtgYmT1Sfc6p8cSdDFCDasp\/Hx\/YfRqdbDKiZkB7YuYB7lBn\/RWSY\/Zjsa05tlDbn3K+Dd1RwUbB2mUC029ZaqbS4s8VlJuqE3YujzM3sYadyaZoKuJ1upMFjW6CmfeUXL6GearZWZvGAE9SUztMNAMUbIYEG7RclZDm8BH8fKo1hr3zui4FWoBXicgfElaVXzkeYdDPuJdXLc3o5SekNtmKTdgHuhilbIKLXjjbpDloJcfgVTfjwxEdfIGAEPJh0OLRnv6oDSV2Q4n3pQjdehoAa9Ws6+LWqP4u6qltF7OIf6RQe8LF2BH3XyIwJLHuiyl58QiM1ZW7DN4BqzRs7j3KMmSK9ji8eOliThnO4S2b7nUisrWio0BHTOOuB5tICSEFkNjlheZDvNDMsT96Og4YCCQ2zKAioL6IxhVR1nPfiqp1IoisjijEQIJfjMELlncybcgC7bUtZofyFDPkqe8I361cZO+ILOZn4HmZdnMCJuNIFNDFx3NI03ulrsHxpf8rURPcFGkpLO1OmluG1ObpHrtcksU+DqpUeJa\/bm4g8Ql\/cr3ZJv9huK5SisJ2Pg+qkRAOkGRynCy35Ax8pciTjRokw\/UyiHk0eVUPuo6Q8ThqjjYNHnPv8gYmnu1qzo1ipJCWn3HXnwSipqQ6ZBPedawIFbGAFd4jPZJmoe\/8LuMQyCt7KaePoKdyqvpeYgVN5xQFZT5li7z\/HYSUnM6RBHtBSwZ5vjQaHL3RlAWbGDoOAT4EKkOVK9y\/eaZ1GjSaq9Jrs0aVkECMBgj4\/Yzl6uJrLBEsM0tchKWgsa5latLHQ8P0m7SECQYBQvRKR2QTYfm7paXuHRAbJvrSRbb5UfHBpH35n5ltUMOlZ4o6dZs9+vn5B8VNE4sWXwn+lMwfHPdcES8NqdGY54XI6T3c3S1zBWWEQMbtzx3rpeMxNed0\/ba5fll3nRIlc4LVUXhwUbNMqxJe5L9c1WyngUrO4ez\/gP+V\/+ivK2wxK1nh\/3qQT3YA7nHRt81zRmEa2immKTsUi5tk5igXBEXQSSo5VR2qh+UwHwjuTrY8kCOk0jmciEmkqWwfmLFudwPP8Pr7JehY5kv9CsFXHiPQqYOoo+vDJL8DgJxbFbm+Cf2y3IbOd2tYgdhtcgbz0P8mgBlG+G+GhNXl6c\/iG\/9zu1wiXNcY7jmItJjsPNIHd6doRO+l2TGXSA4Pf1qEsJBvA2kQsXP9ydceICkP078Vmj9Su02wltEyPMgdRfwPbuCOx+RgED+jqze\/emyYNQL2wCcXj\/OMdeeHdjD89nbmVFLwQC8MNrYy2EYEnZPaLaZEItzKTJAdfDHK\/+mLxqzUVFcTkpARSw+UOXdVJ8RD\/vrROUxPm0gcyXYyh1y0IZosfp\/nlCO\/98A3fYS6ZL2FHkh41I6fYP3WjjWdGxjSCp9\/nfx8TKH1XpdAjvE1yKSPd8Fs0EGqxaIaJB1H2Jwo1N0TqSdoTG+fi0mva7mDxHjP58e6RR4iBE1teW4HKJtd5cD3Th7E3PHsavTz92KPHUHa4IYvMrkyWa37k71VXFyrTAnyTNCZSvLLN3pi11PnS3o2xB6OPSAwWM70DeMiea6n5rEWhw3qzOAsRx0WrNX\/K\/oH1G2RQ1HuEZjd6+WhbAC69KYfmoK2p4r6gblAszY6TwhBxoi5Yr1J1aN1ifpklCGBJnbpYasnwnuTC2dKTfpu8ScFTd1ZAeWDbOM\/GLLxAY+WMLvEaDvOAuckbLkz1L5KGAb+t+a7+pvDNvVHKvx\/ueq2HGar\/jnrNj6w3NGVcgxyQsxq29yu2GakOESMmzgQ4RBtzuLpevAt3DskoJ6g8lO8mVL8mqZFjwRAk4DrXhoXCoLJk98mX1Ipa7x3TgVlGNryFyAiJBJRTx0Ikg9NsLNKsK5xB7TncHBaG20Wfjw7M3YkrMvHbjzCvhjBaEX2sidFEYDRiaTXKeVl176Kv+a6uBrPe7HNbOcI+W+Wd9VHHH6Ok+UkOZ65XpUhHhVLaxMx9EX0ACqwk6r7Ht6MtP5rMQ+bznT6q5WsxgwFu9WPVqZh0KOefC2jmxqLPTQws4RxVBWCyeRNbHFmQRPopumDKyTqQPhGJnbO3\/k\/SgIRLprld1Pers9L8\/D\/rj3LBkZKVmzkFDA3HqM\/oRBvMuDZn5f2mOPLDdWcw7W2UP\/SuLSIYQahiKV\/quRfRR9NbmSiQJvJC0ftbqpQtGD\/FGz+Uew2gbMAiIO2oHwOjuWG36NDqyGT2mVDjhFKVG6lpntEkZbY3IG2z8AQTBWz6fJBkdrKn5bn4UyQkGqM8KG7NUewrPLyIzHAymMNcsekrszn5kSv69pltcQzrtOLe7KiU1fGvZ0gP\/eTfj4SYTRrVju2NsAcDT15BJlNKin5jM80ApqH7+31RJGQ12Aya60hmWR\/Ihx\/WlapIY9AX0jf6kftutRMSPYn73Dxw4TfpSqyJjUWdKM\/kZLcCaFA8aesiz7MbE\/8iLjBjTMeDcr\/qjqtVS+ZV4YW+8NhfdaDLQJMSD4zAswFeNYm06fFA5GN0hwlXzsK1SUNnsiGfFs5vFjKPd6ViXNLt2muvTJwCdQZzpTyPea5n407vNjF6OrLHQp2drZZ4Tt8n8R1pK4DsWRJ57TzhAQO\/330MSRfhKJ5rjfdUURMifO\/NRXTaBdNsZazi6725\/8N97bKIEX5tsVngbkH4TsSxN0AwcU1c1xrqfMdsG9Kgav8j5fcvf\/Wys+3yqG+37IYeQNjCBWzxV5Rr8SlQRRxD2h\/U+Ss8WHAwB\/26VzhjEfq29CmxENKIbt5vFTg2PViHk7wbiFIj0rCCGnn7yKnysG2ag1tGfEpT41PEwfQHmnazBruVt6n\/FjHzBg7EMrHN35dHKQ9zO6Y+BCpBCXe0ef2rgm\/NuM9NS+UbaZyCRS5PI2zZ5a5yPrHTxWfF6bxXKNiKIMu5O0enVeIGRZxdxbhrSdKJ1fqL3KNNEdewCZMz429QXlBurPQ8o1hAFplEtRVZRIR3tPqiR8TrCtTTrpHhlfU7\/\/J0ZenOuX0bnvjbxkwz5ZytHhbkhax9Qyw+N9oxyJL\/OEwcamr2\/UnbWR58n\/85hUAbssFeoA9DZ8BC2zsYV9uR87dgV4UV2QhvI7zcdS7nJde8Zqb\/a+cdblyodtPUfqymTg381elAjB\/hUl5yVSAEVRjt3mBVTXSKycpYpDgHs\/vkws4K\/1EFkXqQ8g7D5TPPofYYA2BqWkct+9YZlnhmeoHMb5FYglTwgKsDNLCUuhFj4Xz8yOnNXSLMtB8nyc0iZ6RwV+8yRUEFWYkP7pP1Fl6JnJNocs6zzEgBaGGHNyaO4WwP75PCYljeknU66\/q3yRrA\/REGz5XCOlHQG1CJ\/C3tErul2s03ajRbMoqZwMppbZXAr4vTlXrXY14EmsLlfAtxhtboOPs3Zywc5A1PZp5ad6F3PMMvV3IGuVCVP7nUdb65WE1Wbgbn9kAcckFi9KqV1K1SBPTqw3jWSD6kp+oSs4sMyYMmhevREjLymbSyC8Ls1SfQONKRB296kgY1ZmY1V8e45DNgmuGNTdPamlmJdU0fvDkDY\/kzb2wC7pYbQJs71t3G+w3fhFgZXEuXVMmjzTwtS0FR3PNUS46Nh6mtIXr75A3cnWTKE\/zq0r0othKJ6wErDzIL\/HWHiW7crogI+uS7rk4CEN9NZE8CiXMDY9B1H1lqLrsha9inxBwUXMNvkPYI3ym5wk\/dvi+M9vQTHmvgQcsDJ1DoQD9M1aufKiOO5Cj8\/3WKdUfgpdcDvb0EjMBR1gJ5JaZXedrP9A+72FfL5EwLhhJL0PHJwbXq5uJOQlFT7LGCDatToGKn5fI1Xe9clZ6x0VZK6K2Hzkt7Y8j\/BIXQXloK9rg+r3w76Zd1Kz8tLBCjM1occWLopS1tGiwP7uwsf0JX+msPO43rsBdxE8SBtZk4JNJiT6UYXMGSbyEwYG9yquoJn8dyjBa3GMz2FZb2LvkLevyYBOJrgeynvacr3f6NPZqtubSCdhnNrWeuZtec2Kghift+xzPKB1xhLWS9eHLLOawvj4R8jwnBZBqGbw\/WpdsbMG3X41dqOAnDCFCi9HbNrcAFgo7fW2sQfEmn8TdVvFBxzievnkVW9VWF15u2qXvMNH+j\/9yJLhIUx547gMuyUjRXqDdMiNUqSAw9ozI6sAENtZKb4Tf5mGMU47zktOGVV2X3c8fT2sVf85WIrbjtfn+IhTTrMzRgFfEH2muTQJzylLqcxqzLVpoM6RRu+QDCc0cz0C+XPyZ4rWNzQqTw+UV+2bnYcA804\/SXUrCILAbwvGienmJeeu7ISYZhqNAUlkDto+Ux6gvWr+E5q0IPi\/YCk\/DUYepkecxjYAx2\/Qe8rlA5WS6cMEaNsP+\/QTDJyiPz4d8I4Ym+gHr8VFYWYvvZWpzh9SnZOQ33fEdk8MnMQigCL1jSAm+DUyePNDMSmeN+57SdyM26Ad3jL0UnlWFmGS81\/nMVMjzrJYsTs4LRX4f1gDXxrxmAdgFYgmeBmMCjgu+OjSg5b8exHl7WYwvQZ3PuIFVB2n5kCJ6g+qQelwfazVUAr9V8P5lJnjgcbwJKnsEJhYZKEsHOu523EAzlxnkgxjmS+uAUIE+VVqPa0BD5mr9FRgvpoYJr43e6DvaOLc65G9NjCEC1DzyJs+zGK6Iu2hx1S1w97AZF7aNDxhSIazCgciFX8HpxBeLccVmB1Aw560LJNg+\/\/2eGXO\/dJ1US+pybuRtYm6CBBG\/mRosLChThf2UXFnihGglGsuRMK6G0oTg4py9C88AmPPCyJ0Qfh8QC53rcMgOs0g8OjXg84vhs1ngIawFjYQ1zHTiG51HHNNzirJIPXjPvJc572aIG2DOF9H6UQVORLC88fg5wMnwO9sah5jgA\/JN4+8bYorH54VJhWJdFEokgBnM0su2a2OyrOGzf1uWDHlDpMDL7ahhUszFaIfmGcOdZdg4Wa6kDuTQ2JuLTt6QKkSQA+4itO+dljzkKdS+mi7EJVXG3y3xhPKKm55hGPjjnMLnc63KhbfOEzvmpHcWVEprdcCKB8VviIqrYeAMqzYXfgTIpJmDjpCF64w1jtRPp1nRThzKZt37qmtlfDp8aEEw43V8e1w03ST63+SU9ne3EvOnE0dY9R0Rw9Xba+SYNxp3uTpqMDoN26DxB4a8dz+OBGx2MyiYrlvVcUABUdudvkcN\/BEMrwPTovakEzCCzIKfDSt5HV19OTATKo6cpM6Cj0u+io9BDJ7fuu4cjJyhlnp0n6Lk1vfmvBlD2vSs5Jvr+YKnTu+yTCBNmrjdWtPiWK6mLuP+0BHh7SN9eUD4MyIeVW273toVDE1YDCzybkPgo3+6XTW9cxPvrRexEEUGNKZ\/Fb9RlZ7rRp+Uh8ccovYXKobaApBHhuXByrOE9BUe+eCMcPrbzoT25NXeyUeEdpP4Mg9OgOm0Oa8DsO4FV++DAF7TqZjsUo+VWT2Qf8hYwKCOl+Ajel3UhRRTuQxz5+67Y3UX8\/5Q4m3jE65O6FNuCSWJd6PUXCsSxRW5D9oJnjuK5KaGWpYY1ruamb2ezU+aO9wVwthMgzU8zlkZGkeaxsbjJR4xKk14aDYChvRxQllpeCXdoj3I7Zk5u9EACEMPUZpNBHIIYeKfPJy+i\/rhJ3zhpCq+F3ZJv\/5tVk64\/5pswd3E4XJ3IR+PY7MAlCpW8pI3WJbULdGZyKdvq2Yfma8yhdw+aVNN8V0nqR0nBlXjYaOysWMBDNOJTmVB9joDjdTUcT2tpcUf+BlL9xMgp5gSFGUVrY9kAYimeSiJrMhH3Bg8rgLm\/SBC3Cf9pUZTybm56QphkCa+sH5M6GyE2PdZUmhPm6yPnnoMc\/A9awLDPNCjcuZvFLRq+\/u4xpUaDC91wF8u5zQNZ+BQdlsOM2SIc0DXyZ18gqC+UU6WKFEHl\/lz8Zt+T8gpvNoHUy6+EtDUYxW1erAp1PPHh6d9J37Hco\/7Td3CHhwPbKkGnS306U+5pBHYcSSsZDmjhjLPGNKOb7VwXc0eAEhG6tEh65vhRdvZJmMEz8YXy07FxjBJ84DgKKDsBaCfXcv27ihPPW2zI\/Eok6qgILQk94vVWKehS3beNcDXHxMbm519UEhkKLHt4\/s8aNmuPnlHG2cxEXa6ezLMk9YrKsiBJCM7XYeG3VlpBND839DuA2FFjHlpgdq31M9mihGsokBiSoxwHsNKayxdyqK9WydjgyDTOnz3CO3uYos33qwYmnT2Px99KAaD2Pwmv00NkpS1AEhBzmYvPetfUXNvm06qiy\/ANVWizlnmO0RaCYLsfYROdUDek1hXO8PRGkSp60Ob+H5UnBM0eW9wdlgcBx0srqFxG+OYULwS3kZIrQZMSmb5hORTkbmSJTjMvL2x80IR1AcftUKqA4GI89us54oD0BCSgdEsNa8OWzaU18GrVvKaCYDp\/KQG\/k0F7yo+vcKyXnnh+k5hriu++ymWVuQWYF\/B2NibCRoRkPiANqFom235PhvwCS75vaPo0N7U6c9uciBC23f+D5FCOf8jJy5xF1vIiV2x69Y6YP0J2Y61U53uV\/4UYkbjnRzpieBFuW27u+n9VmqCzhmTv\/G4\/zf+Rm2rGdZKGhxO7RUhiZR+uKqvk12DSzJNWxr7knjfK\/0xQGB3unI324NdPRNgDo41Xzqxo3QrQ0C80IXbfEOs+ISAFDzGgUtyf\/hDrghINB3jAJ88grdIF+eFyfHa5SGjEUaxKq1oaDeesSiL8g8uoQGw3B1STLjz9Llt65cEgR92Wl9rbcX34LspiaW9MqBuNVH+cMjhLu+NyA615sDlyYrzdgtTylckVSzywolz1AZiEbvY8wQusDISD74+w\/QuvgtZCMWy9OZ3Yiq9RJjDeAlWUQV4i9qy1NKiB8Hzu\/IjDS9K1UQLglRrmQ0qLluMpYcAPToN6IP\/FQg6+QTMgXFTYAJHV3RE4Janj6CFyh0wwamZCg2u9zU0EbJEXrhI1la95w8FelOoFqnK3SD7f7hIjuhRuCsEeEx41vtnqRou+WQ3j9aO6iEUw8bQX29ZzLkiGT9J7qDSNX02gCnAu5XkXBArgNKnx3CLOI0B\/DRKupOVBUIk1kIm0EiQ8M96l6VdN9gWfqXWqzHzDCdoDVS0A4KC9Gl8VJTTz3zCYGs4GnTvpDC7v79tLQCI86Trxj1+RCdQcvoTutu4zxXvkJ82RKqL575t17C6zTdichKZrMvfeNEDaP3DYUHPZDUGhFnEBwULFR6JEnnL4MU99c5gNVS7VcE1WevDrPsT2ZFTfnzP35Wkaa8qGqjBfM\/M1bMnuVEWiQWkmY+bXdqrZlbVzl0QpfZbhAQCxVShqptsA3cx9teeNfz3ccU3xSDnxqAqFGTjZZ50XMO60kDmR4zmdYREnAiORboWsp2+REY6a33RCbekKuDCx7A0jrH3oRKAOyXPf0+KFA+dt79YXaKbURGyzJQ6h2+wuEIvGkN3psJC2a5aadUTjGGDB6Rj+gjSI1kjhiJ4KMXPJbiYJbXfDIFBk9GuOekbEQIA6qsEY1\/c8KV9ggwa1F0c8tqbZccYl4IoNnquB7rJdIaM\/DTFQivgufKmctrmikSH1E7uEz4yDQqSfjnAszKNhzE\/vEgUyF+ZMBG\/QLWdqu\/TpitpGinMcLI3mwcQrIvhfjN8u4ovccf9il0WRxO3peAypFzNl8YPhw5hOj+Vaf6nzST5cr0Ul5rsbKJWNsnhgY5ycw\/caZ5RS0km0otybknUgkZ2cGhBuSkR\/t08T5uUuaOqqhk+K\/gJJL1cchR1\/GNnIvznx9lw7qB5Zz38tPzA+oqoUUOAPTADfLe\/+g\/xGkT4NXbO5ap6O\/z7j8vKvaJBPkI2DH4+49\/Jd7uH6n9p7rGNLUsmHxXB5iQsrrpuQr4RLvUboqKhGfK2STsv\/MNuQgsk8HX9WHWbUJYVGbIUtpB1GmE\/MPEdv5GWQWomkiZjAlrGYQEkmJrdX6Mrbdp4XqM6CGcD\/735cJJQJns748oGvDMO7xYTE7pTa4GBL8wU1tl0XD3B4K9fuIk+WLDxSOtHaQUPfL2vS4j9yZhw1wsu2Ut3wjKF1L5AyqfKH5+lc5qSwKj+Y76NzjTlwOa6bm6\/zUVaYkscBEc6iu9aqEXLOIF9scCFdNYT073b6Hdi94p1G6gbFmH1ruxWwuNFNCi9xBqiIQYECP0QwlH4b5i0YGCNnCB0E49i5huXiFonGMNgvuRt29HQHLtZsF5eiTKHV8IdgXvSJqDn61YgQgMxWYaNYLwerEXH3mtn8u+B998OOhuTfyvh0dwDerrfT9Mm\/GhWyp02dG82jxdivOSx+br4Z34KMJr2rKpq0GIAw9BpvZ09o1R5Hx7Aw4FBdW1ty3A5UruzP9zm0zd+feMdwzH2ax0riYY21E997Giz92B\/0npR9N2tZtl2VVzj9qc8+Tgzct71a8hSf1dRvfxc5H2wYZoYvSVcV7MFZCyJINt4EL+h\/CWTtiavKaxss9xpbO45oVC1mL5b71CC02hljuy9R0MqEw\/42kvTepW3csckVwy4c30+YAZVPYQ1Pj0FID9uzNqDD8LvFxIEiv+JZ5lXRaIiYQcvEEHfC5htluMCxEbBluqJVyAFsUZrK2tnp\/JHg6LpCFQCxnJjbltW\/OQdz99ZXKGELMvOzAdiUnxY3fZGRs\/VBk3L\/EBRGWmud656EZ0R2nmv86h1ZhTE8jpzg+Kv5pgtHg1Eg0UD5G5At1ban4diCnmu7hHEBtuJbOoODF4ayZ0ekrgRJWLtWpRTSFwYD\/uoHxrNnzz+3X7GpLOlpGX4hlLTbbIM\/K3MRmkKcC9iSXeyPk6Y5iA0zu9gKstwDELNs93hJqaYgtS+d0zt4DdV87u1gldJvczO3G9kFxBNzW2Ycrp4F6YUYgrdfXkXTPgE2XN\/lLv6VtFBxTNqkw7521UpCmKrc5ABFJlHIyPkbH388zdUHJ9wKcdJpipx0mVbuzPuyB\/KE\/CXAsKd7B\/TePsIfusuRKU4F1R\/I7OGS\/9+iwmLB6KsBkRjyrh5g\/CQhOJOousSdjSVvb76ZGZBzYqMrof4gD3PeLhzSFGVqUG17p5PGlfnAf+W8upWk4rEH\/Suo4QXcK6EKvJx\/5PMg3gV\/9jcrany77Sto7kHUYaquoiXLQiFoqdxxdyTViSIUchQyU7JlVVu8uI5CVS37vb2CaJE0TMz1iHVlrQXQWdg50crFEKLc9lj6SVd6oa7qOr6Y97tLjsG4+FVxEyhcaYPdpXyJICRVgqfTITf5tKhz6hosLpE6jbHV6R2QoVjsXNyRelWa2l0X+QjsRM\/l6EunXjoxkvLYbGlxdlC21avBFdmGHOzKPKDjXODV4qNd06ZM\/BzLDFxLiRIya9F4f2S2J32rb4HrCFguDmXDDbOgA9ffqxYPruaUBsLMK0xGa4z31X75lLK0Rcu1kOLBfqXXw89hh68lL\/pl\/0N76fmhyEPXdVcbcuXXhNsdC2uRegtE8mHeJlqc6GUUqqTrC7XOvEYCeSJCfJKM0Dcq5cVT6Bk0cSfJw75XMipK0w9FGSDeYTVr+1Z8l5horJuPdn8UDBQAXY60Csq+M5UBJSAZ1ky0uGt0nHRz6xRLC9T9EsxG8YQgDsaSKNOsuSzGEqMz4OI2bBJvOSjL1zBuLoPsAsivr6efLaOSTTbHz21jdvFaQJIuSlvoNBliDVsnBkR\/Ty6xQrxLv5JeSpq3oS\/czhUBtJJv8p9MJlY8qkGKCwvMO7W9pML85AmBITOnvN+127QPoBxxhIXYxBQqz97Zz0N6JtIU5uFju2U7RtZkWOUh41nO3x\/opCEVgpJavQYPIqgEhq4oxsU12wDFlAK28sLRQHy\/372Jadmpkilrf2JANBPQWZE2kavP3hlDrgoLoMNPGOtoWR3qvPaOQh+kEHJoCuUXXzjr1S77hBfxcIWoX360PvzeMOSJngDcA7FsewlhK9ndJLlt8ZZeGp\/i+2vMHxjHGGBEPGCWIyKwees05T5N0c7lMcnttIZuVtXkO0cJsWwxgSAx7uDHLtEdmWshGJ3bUqi62fp408O9IAY1ZJFldEAGzvyMMNKYfax6fOzRPIM\/6oHJcCpCYUj9YhVZbK3FiSujyhS1yU5dtSR6QDffDfWTEEW8r3wto7VEo9za3Tc3dd\/hOVy6XCZsDm88oqWvFVNUpzK\/RE0KgWJdibG5HniVexx52rYgiERHRTc59PyzXSzy275Nnjmue6G2Fb+0YcnAoVGNcxOyuyTipiQUyyGEwdyX3DY1c1oHliVQ6qeUc\/Qu\/E9uKaOb47naqhVucjUxGhRhAnIB\/RwhBvAhUh5d6L5rW9vIBwjar\/5VIc3kqv0RS7yCz92GT2FmlYx3NUYvzhjH\/g6gZ0rQ==","iv":"eb39c4ba9eb0930c5e2bbc485d730117","s":"2b580a7be23fd317"}

By Jim Taylor, Stephen Kraus and Doug Harrison

By Jim Taylor, Stephen Kraus and Doug Harrison