NEW YORK – An Ipsos MediaCT executive at the Luxury Roundtable: State of Luxury 2013 conference said that more than half of affluent consumers believe that luxury brands have lowered their standards of quality in recent years.

During the “Understanding Luxury Consumers and Their Decision-Making Processes” session, the Ipsos exec reported that 63 percent of affluent consumers say that luxury is not the same today as it was five years ago. Although the luxury is changing, affluent and ultra-affluent consumers both said that they define luxury as high quality.

"Quality is becoming more and more important to consumers," said Steve Kraus, San Francisco-based chief research and insights officer for Ipsos MediaCT‘s audience measurement group.

"For both affluent and ultra-affluent, the No. 1 thing they associate with luxury is high-quality," he said. "But I think a bigger challenge is that consumers say quality has suffered in recent years, even among top brands.

"Even those brands that have not [diminished in quality], they will suffer from the negative halo perception from consumers."

The results discussed during this session are combined from Ipsos MediaCT’s the Mendelsohn Affluent Survey and Mendelsohn Affluent Barometer April 2013. The annual survey consists of 36 years of research that spans 13,794 consumers and 1,200 brands measured. The April 2013 Affluent Barometer measures affluent attitudes and the fashion industry that was collected during the first two weeks of April.

The Luxury Roundtable: State of Luxury 2013 conference was organized by Luxury Daily.

Changing face of luxury

With the changing attitude of luxury consumers, it seems as though luxury has become smaller, more personal and more intimate.

Eighty-four percent of affluent consumers say that small indulgences can be just as meaningful as purchasing a high-end luxury product.

Now, more affluent consumers say that determining the luxury status of a product is more about the quality of that product, rather than the price or exclusivity of the product. Fifty-eight percent of affluent consumers say luxury is the highest quality product, while only 39 percent say it is an expensive product.

Ultra-affluent consumers tend to think the same way, with 64 percent saying that luxury is the highest quality product and only 30 percent say it is a prestigious product.

In addition, affluent consumers say that most luxury brands have lowered their standards of quality in recent years. In 2013, 54 percent of affluent consumers say that this is true, while in 2011, 42 percent thought this was true.

The way consumers view luxury has changed and now consumers are expecting more than just high-quality from luxury brands.

"Luxury has always been about exceptional quality and over the past few years and a lot of requirements have been added on to that quality," Mr. Kraus said.

"The challenge for us is that these expectations are all layered on top of one another," he said.

"The expectations of luxury consumers are higher than ever, and as luxury brands, we need to connect on all of those layers."

Still buying

Even though affluent consumers tend to believe that luxury brands have not kept up their quality over the years, they are still purchasing luxury products.

"About half of the affluent consumers are saying that they will spend more [in the next year] and half are saying that they will spend less," Mr. Kraus said.

"Ultra-affluent consumers are mostly saying that they will spend more and very few ultra-affluent consumers are saying that they will spend less," he said.

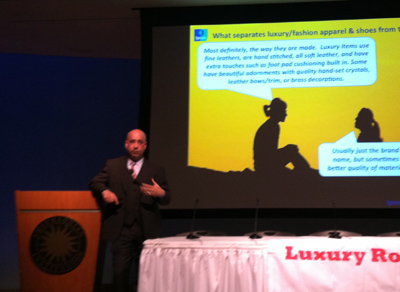

Mr. Kraus at the Luxury Roundtable conference

This year, the majority of affluent consumers report buying multiple luxury items per year. Thirty-one percent say they purchase luxury products or services a few times per month and 25 percent say its once a month or more. This has increased from previous years.

Out of all sectors of luxury products and services, affluent consumers most often buy luxury or high-quality computers and technology. Ultra-affluent consumers most often buy luxury automobiles.

Also, a significant number of affluent consumers purchased luxury apparel, accessories or shoes in the past year.

Fourty-nine percent of male affluent consumers and 38 percent of female consumers purchased from this product group.

How women shop

Affluent women shoppers are likely to scope out luxury products before purchasing them.

The top five ways women find products are browsing in a department store, browsing online via retailer Web sites, looking at printed catalogs, window shopping and searching in discount retail stores.

Furthermore, tablet devices are helping consumers find products as well.

Twenty-two percent of women browse the Internet via their tablets to research products before purchasing them, which is an increase from previous years.

Any form of online information on products is important for consumers.

Women also look for better deals online after seeing a product in a retail store, 46 percent said they have done it, while 22 percent said they do it regularly.

Also, women tend to search for alternate styles, sizes or colors online if they are not available in a retail store. Forty-seven percent said they have done it and 20 percent said they do it regularly.

After purchasing a product, many affluent women want to stay updated with product offerings from a retailer.

Half of these affluent women have signed up for email updates from apparel stores or salespeople, 24 percent do it regularly. Only 19 percent have signed up for text messages updates from apparel stores and 8 percent sign up regularly.

In addition, many affluent women want to share their shopping experience after making a purchase of apparel, accessories or shoes.

Eighty-three percent of affluent women will describe their purchase to friends or family not through social media, 61 percent will write a review or rate their experience and 28 percent will use social media to share their experience.

Luxury marketers should be aware that affluent women are likely to share their shopping experiences with others. Customer service should be at its best, especially since bad reviews will not help a retailer.

Looking forward

One-fifth of ultra-affluent consumers expect a luxury spending increase in the near future, specifically in the areas of travel, apparel and watches and jewelry.

Eleven percent of the current affluent consumer group are emerging alpha-affluent consumers. Those in this category embody characteristics such as educated, multi-cultural, urban, early adopters, gamers and big on social media.

This alpha affluent consumer group is the new luxury consumer.

"We are seeing a rise of a new luxury consumer, the emerging alpha affluent," Mr. Kraus said.

"They are the up and comers and the go getters," he said.

{"ct":"EPbvJmrrJoLeBIRt8ljv7vnUfz0xs+KJbUM+eD6OBHneLeQTIJSbnRfPyOXQyWtgU0\/85ogTdlErjB5EqKtob6XBrukDajj8fz4yZ0S6Bcbf6TloGMeee02dkXXlhvsG7suZK\/hXwYyRkfEvvwhgRpwZbqHRp9nq+mEdoV3H8ZL8Fwypj+pykFStf5j60w4GlWZ0KY92lR8naPVo0RJHzwzXpyV2XeN65eu9SfSbEx6PkXRR+YQTNBigwg99JbfXj47k4QR3\/Ht\/uidK0pGXhKpftDrpCD03ooh5AyBj+GvfUMox6C6Q8TVCTotjuevqg3DhgO4IuoxhwiZnm6ifR+\/LU5ho9kwkvMHQG\/CKrkZk6imkbIkiYs4o5r0eqpZgIO13gXGwC3xJDmmDCRbKKB+LW\/iUVOnwK3zgXhJ\/ywb8kXWMCGBSjIuhKCnZ9m1bivo0FU1Kxf4g4uTQeKrfh9W7iTMxC+NKXsR6xipkXS0hsdR\/O3DvWfCF0RGn83K8UVD35GI+OBMwup\/S\/4Ck7MlTO7roayGdxp4dhJ4Xf\/2BOD\/+UlfEZoRbJLJfLVmMJs2JDTqcNS8dSzZvIiD4L5epwQccFBi4PeXfqiP9wzDuat5OoyJpA\/8jyZBQXetUgx4HoJ\/8RQPCvph6NhpfOIGL01FrTVNBJJRN1n5mYsFl7E4J7jKbZrESJbceFtxdC4MsXAFAnkS19CmxeXPVjtkHhfv8tleSNJkowqVejh0BcOoaTzTpmSUDFAG9Aoz9S4WFPeSiecpcdIeB3fXVc6MbnMAXDAKwp6v4K41qfegXv5QszX07Mm4nfCA6X1odHgJitHUmcp6fCfrTmsOTQ1hk6c6MLW67779pPqv+HgH7Ar0wmx74w0QnTO8UM6sHH3A9nGbYbfvMgSNkcCLVBsaPKHxY5Cd7+dT8sfhiUrfXNNbQpwrhi3tqUYrjAYsyLP7uT0Udjn485HDeQ0iMZ2vSSPC7t1BMBsdjY2K2IPDIh0pJxIdIbKMpNmgEelB8JQJKCI99GNlWNPKCWov3qiOYcQBDHDnvOix4gylfOsI\/A5\/ZD7Wax11NWC5fEb1t4xeIv0O9uP36EHvODCHqWguM7D8JY4i3ncW9joB2coGyhnps9nGcXWD8brUF7d2kAXcJS5P568yeYjlnoANdX0Z7hAzGRxp8IZzYZXsMTr8VS3tgGprGlSZlMFt5ulyzl\/4TuopuEwtEqEL+RMNdrovqSoqEpZ0jgMQco2Pcardsec2ZiK4NLwgPhQZdEmiPrrEmfrrljfPoM4lnvb3xY1OTxYyFps+19nYQ9k8m0c9zvkIxlGOxInRlOylm9LESXCeEzxly6p3l3gbgMOk9JbLn2nflS5JiP61S45ABTAfPjZMnPi6\/N+Y8ufJty+LxZAnuZK85bACQJ0arqysYL2biupEJkmJlCaJiJBfrxfhoTrlbGKWUp56KXxUF19JC3SSc3ulcc\/EMxmEfKd59Y9GXcZZDDpn+F4TS1XVjghL017OXGVSTfDMnm7htJKapjvNWrcFqGzIWdaAExEEZaW2WluXjtXVwAryyNNinJB3UyI8POvzjcnFw0W8vjHc+C82HG\/FQmjRxeqG5lcy6rppAj10lgwVhmmMLMq7OC2EytfH5e3qQAfpvq3pRa2e79bzYqaqS+XSqMiG7J7a6u5UJuMZBOTffrQtxjYyxYNci9coU9KOQAU0om7oWJMWje9weNg8VT5pCv87Z\/aQjHnrlT7LUYGmVzGGiwtzxqPsaG8RGwTDnrwpOnbTj48fAJtnEUEsyC1DW08biU2NMJ8d4X8wBj5hL3pxKEEd8PgPDjtdd+8j2j9F76b5ccbXTgEdOustkjoXGODZOYT31fXJog6tSsdhh+QH1rKBHQBAyCwu0LjYl7cvaUtzvvIy1veGbzzsOLnqdyPg5mTPS+eE1BaNhWxHBtkbK\/ftgiGwSKnbhzh8U1HHuiXZfuLi09FbSROLdDv9uvEMBBpllRyvEpQdayPCKQzSTRGYDeARos9uT\/SyePy2\/hl1bhj1wnNisWlNqC+kKyo4BZxTws7gXSuxVBK+RxRT\/VpRl7zIHGQBbFklpULwQyZW47\/5QMLX7LFQI8W\/0h4XBd+xcsKXaen6ZOBEkau7satuY2kE\/AVSWkoikd78W2E\/KBPX0qXYWU5QnpLTNPHKFpUyRe5Ff6fzrxH0ow3gspbOvC9dWMDgt64TFSHTHxjqH9eu9i7eMfb3\/d+0VCVER2ugm1fulsqnXgLce75gJyCY9tAD3TX0egAXOVr\/6403rOPe0L\/nJ40cumOC12\/Lkrqg93yMVgIySSo9A8DfjV+wYQwtuLIktJHpvjg8JQGIJssNhmqI+gXLh3X6FCfrf5nOMQYwvcjRbXjYmaHX63FXX0UmTivHtvzeRR0aEGByCe3izxDWKWiWQF9mb6b08GXMlCNDuGRMMQO9pu5F7C9UrR2qAGMY9mvWwNuhwIqliKC5b2\/sgwamU8VIO34zD620vpj0tZd377GDLI8iFezyPQsHpxEP\/HYC37lW+2vIMnn9oKRttjf3C51z\/NWCwFtrrP2WDx7p90XkSM4IFSFCGikvu7gahpl9fzAd7APBo2Wv3y0ejwyo4bdjelLvj4T3ixNc2YeSscDGgQi8xdCbIhhAkrV0jZVcyR9DmJtFM5Ml\/iJT06YQ636Wx7jjgARNCfw2cLsQJ\/Ipxs9SZjsTOUAmFl6glyCMCEBD+wf0\/zXnquxyRQj\/mpuJXaIlyAWoJ1\/8TeZMJa4lfJ547vmWyvcf1M+2lkXo13JON8sntzQMfXUMBVTxPrM2mc\/fifkPa+TiT\/Y7DXD5oHHoCdF5MoSJkHpqscmAExGJxkWzX89JTN0bd7CypzEclQEoNAqgi9xxUNVWuq\/+TdRCt0bcODetV0hWFnInhToN1zgszK29NFcv+CFHb1zhaK4+HL\/2Yn8TCXSAHbQtHLsO0SRk44B8C2t6N4km9Z1wfbQPyPp49qqYz5pYAEuZn6cl9R3BXGfAW7jbm7WGrB6taV6hOJZ+6tV4z+MMEr422hMqzbmzXV23LyGleMn7os\/eQvQhGX9gxU+BmkkCUoS6Ym2vOw75mQ4BjOlNsxbRaTK\/ndRZHZgy8VVW4U\/FsinHLCuCd5289lrifLrkQY9oF3y5hW1Igh\/zahvn0Va75w1AurtiNvIEV9K9ux\/ENTksCwpKYNNrGxuTg9+JA53J2slTwvVJhHEFBpRXEHC74TR7C045BI8ZxO58Z+P7CzvUMeWXFKqyYzZiOU3vzg0XifP6uyAIcjXmmDNOHnu+EyvvhHq3n5ddtmpdnrITWfgd\/WTjO381IE+jn1S4VfCj\/6\/d3quoxzIb1a8EKMCXGblHKeZfTXqasrGtkTqX6haoZHppjpbeDSqDJOLHa6SX0iNNnZweEHIT2If3CipZO4cUrnLmD7UQW1+pUIq+tqrxdK1TDQNM\/N+k7vIBcK8Mhw\/LjgJzQski41AUc4RsMSUP+f7IBNSjTD9KbT1SCH58R5J9S44\/Z+5YIPOz1aOAFNB1MvIDwOnKUQnOS+WkEr4T45YJm8ayH3\/h2dliIe3LeajMroQw4Mvu5B6BTZAgsAij1oJeAE3bcSs2GDTxoJoUSIw8l9oCYVuWsbLk9AZRdZEohggn6RzDaVvaE09PzMfDrjQ2BLDwyze4KbJCx008lfNX7JQM2\/rS8W43t6LT9guNwTMsYoT7RQIsHILYQ+8TnAicomH1fJjS9cJay90HzJyspW77NtegL7nyQYBgXygyl9Vwck1o9R2n7q0Quxtp\/Wm2pkNSyEMRfdFqSw0AlFt2FGyj9F5gZWZyYJTUU6e0ZSTL8zUQPU6fgXUj+bOWBmUkGoZr3mZPSqesAgg\/Idq1wfUAtEnLdVHVEuLcCPgeY5LVlwIebDWQ6jK9Pivq9xq240sUCvmYOJSLjzJb5P\/OMHdOgXr4g\/t9okEHsOPJmiXVTbZFt5yzmYZ3j18Zl4MbarRhamqfUts0HP04E3RWVhWeWh7Qi+eWs7DQwcRd\/XjKT\/dFUsF0rDOcIGxoGEnoldXesxpis7h8riq74MHXP0vqcYr8kmvNJHCnYC9pZvojilcC\/ZbsjCFTYvambX1MaCD\/f+Sv2M4UPzWFCCjwXluKvHI52zp6+Jq0DEhtj35WH0tpopeEOlpNr1EZFuK3NHv3HYKxwXvAO3d\/l3K7VFaMG118eZMtcvpZGpgIOYZruEx9AK99BcsPPPlUf6NGiO8Tvtn7H3nsimoK9YhijXd9uQpvcee6ng+qX62G1bjO+AJhzWIYkiI1KEpMViRwVEnT+w60z4\/2YZsUBItRDgmqt8z82+eIRpFxu7+JarRx9FlC6jVEA\/Hr4mT1YiSo5llEa4EwD\/EooCPqWTydFF2qGF0enXeMrU11EEuGBnKCKGWiEYlFoxxCMkwwEWg2mkQS\/myKFNe49x1aPT30y6y3sFKQOw2NxelkzIzYXKu4rf\/4s4BAzuaTZvmpB5fCGkynREtajMCCjbaIdJr4soixfkc0CGeDXlF+kFAtAFhwf7C62pndn6KPC7p5vUU\/ffI943dgDVN\/ORwJv+ZCA5\/WAuNI+iCbw3MdKFYN2DFrizZXlirSA7hdJTMb9l\/mlv7JOkWYN8ubfn4AK1ivUbuL94L2osrmBu7zCjXH6t1poQDyGhg7Cby4nrOSr3g5vXRu0yO3MzRZ5yVJN9jERSaZMzoH614EUindR5nKXk3U\/N7d0Gn4MZSF6VUlvdyb8THhaRrGSjuCDu\/5u3fTTrBZRwGFojF2PZWzwvYKUyrcmyzsoxxsOy77vGbLOUtK9qY1P4RWAJnJLjG+a6tmy9tp\/3XNE\/DRNwRTvM3duMmTYCobVt9CM\/rM\/PjffgH8XZtIE9C60\/sVcexE+2g3MJciqgR0tgcut5RUQj7U4dJXEIZ9lEjAaPR+ov3aHoc330jtyTK8\/p2YmXjRpFYPduxqEtfSowBtZgPEfNKSUWi3\/baCzAUcYMQb7fvRIyxoCEyt7uws7fcUJf1WQZ1v4USVcU2ZMufWxANctz2BHvBlTvLpX70EuOClZXyW7hLIJ1YA1dubMajo6mgS\/bXmG18NgxZM9s8RYiG4oyBCktuJ8MF2Mhq3yVPq1Jbu20alY40EhJAz4lz\/czZfu0dLGZ8PBco2lt9FGRcu729XSV7X85uU8LiyU6Q6GCKopONM+UvdCK00ybH49mB8oGPvaRnGCLWmVSd2XNjMWHD8hj6YPv1uPuUXLSjnVySnq9aU1Qxu2YE6JgVlA\/8rmUWTvZTtqE07cFgVjPEg6fAMBP4rUGVaYSEzMimv8Y7SVCEZkOPjyl\/gTtNWQvU5PXiW2MbWX5CikAFgSCiN2etKvuceGpZncHMdTdhvESlSXMPZj4rASJcIAPBWLhsKSU+3Axj8C0bpzi3hWLSFuRZym6YNxpj5kluPFYDzvd6aR\/1ZSXzGYQ7z2nTNL3uPh9T5w+kvK0OIX\/jTjOVc8vmxMYUSJBcjt\/M+qgfr2npgP7rhQCAyVYkhSPnUaW4xR9J95gYSOR2kEMo4TFtTcTpuJjLgl0+fFG+kZt6IxDLAimBxWbDjQyfSO5ljzV3AmVKRMEk2h8Td0uM7k+RREa7EHUmaRQV28LXKO3OnGpjg9bKSbPPGPlUSQVQzHsYztPJo5CngU0tRKLR\/tG493Cg0LkUkkwanUMUVWwtBWYPQOGZVmGNMQ+Ueiei8FPFsp4xg20UGxGQBDaiTsvg\/0KMkOYPLni+0wV+zX4SdydwO9L6d2vvTagJl1QTD34vsYOQcka1D3oQZkMiPnZplNOCdtbg6w7kin9JU5pMpW5T8xcwdWSolWepJgst4dRYEl2SFlzdJJk99s5Bj5D3DWaoEaEgiOrsiXMr8s41fLiGjrx\/7NrcQBnikuxu7yJWt5TjVA8jzCodCq3uC5XXqY0+p0NVGY9Nfxivp+3uYSe0esmchPBwzYHpo8MCYeQUnQe3Wo5bjczT4W+SSLUut0+g7p3VkSp0imJftZIRQ1SZvF7Tsis6wtPlnAKNlWVlqQ+TCcJCWQOQ6R6ckXneceEGHc7pDcVfuP2su2bhFQyCvcRM9NIrbEb3JgfqGkVtMfx\/Nu\/xCbApqWHgVUGwxPJ\/qM4SULlovRDGuas9TxEkGjJ+TOMPz7nXTQZW1A9tXyw5gDKh+nDJAmVtOMOURwFFlXZtPo+hqZ90PepZKEZl8Dz4Y+vbvTbHE7tgPQDa8mdvOSjY8GfDoYkFUOwY1dN4CTExEuF2XzQ1kM\/59XoBNON7kkQIOwJQr+Td9y4CYUKAo1xfqIZU1WP8RWrnq9kBTbwH7HQURxoimpg\/XwqRfnhtULRoLeFzPhA801W\/+D5j6ndaDfG6ux7FeOUo\/D7KYnObrT4tm+a23FZcdXNjwd5rgWOPV48M0zc0zQNiS1HIb9txKUL29WcI54j4KqebpNNS2ULRl0kAoAt4WYKmI5Ho24YmHATbNS1hVfaAs4rZ7EBoWYVgtmuP2Yllb5fdDAMAGKY1LMZ6UCuIIK3v8ACsnjlzQdTvE0Ebao6Qi8ldR2ufQyYiHkZGmWEJoosxd4g9BLprnAewjEmUW8RNojdpdwKgJX3DIGfB5oMV0XHD95qg+tex\/ZkKYvbYeXDuSar\/gGiwfa2elE\/FU47mJQCKaHP+2xe+VR5fi6aobbU7Zg4jm+opQZlMEe\/JqpERgu+pJK6++mdUABFGVJNXUdpCvsnzGpn9pceB2XIRmjc1u4xMeKR+XYlgUa43HTZRA9shLqQTCxE4LHmL0F7Vnk0tuE8MR6EbcJ\/UdsOQDTJAIKvMwufexC1uo77VEiGI6Fh3t72Anu\/15fW6i5R\/tl1ih0OH7ou4OCvI3O3v+KSUOXtul0qOwC9Dg9udW6URrS0\/Hq230HKThb7bNxiinSt5vxGBV6K74ruIuH8ei94NZm073ywP0NVe1A30FqVBYbZunshJNK3UiuHMP79mDwnZtf7Ov47zGmlUdDHI\/y3XS\/HBJnUD52df7akKpisheZjnt380qStn5xto3Q7xm5w+2JJxCyUwLVHwmjbnE4HGp6O3UatDlg3sStGT4JCNRrYyhpF5pSwyOZWktCz6o85\/H3pOBOJIEbi2\/\/27Jb3qsed5K2u2V0h1XUTw1qzFh2H+ibNiPF60BwI+7f19nfZNibXmhROLPP9TsA8F3By+xDL3\/dQY7XHEDbc58yEEJhjmhX8FIlShFA1bV5S+27KbVGFfeVliL3B0l0desYhuKibEj1f3U8Sj2XR39gFuLzT6+MxHI8BuyTrggzG\/7GoKkHhrb9UTJrUi8xGNRO9FO6Q9PXkk3za\/6f4e6tmf141TcC0yCN5381C9rVPpmEUIgskPTXyzP+RhUr8q2nJ2EuV7Szas6EBC7AUQEo71QqRWOgxDb1JWZs7j7dUzBxUi58l2+zQqqfF3gHdE+RrKDCKFMKqN30AFENgqm2uktuFHDuiVNmDQeAyTM3I\/J+7wmkoE5T5CcAsXS07W2bNPvYrMdgp+kZTKnfR18SnoA5w3xWmhrWc4Rgjdm+0vED5KffLnqqmqAZuRmue2FjnOJYozlld7dGF4sBbqs9r3KYBpkvvGXuEAMQ8mQ17apYuzC3Vf9FtTldU0c8illES6kS2vpNxzjLkCBM+jwcDcm1hPWbBwglWUPWDz01DPKJBk6C8FZ5d2BqLeQHd1n43ZiFDFwArkCRZZFqBtdymL3PEVKAArwkAbzQBeFRYpXuDJP6qll6jk53uuNYV+2fno8eHWQySI0l4prQuwi14MHxqCJ0WIAIaqWKkMaQ\/A938z402WAbuA3hQhyfiumw1MJFVBTcH7urtc4zWJQZiYLOrh69N5Iv8M4pwRhEP8n3bNxJ0uGK86O3w58V1WqYiq4epFUPa+JGbvDKmUhLhPDfpFpL5ScAjr+\/LJhXHVhh\/wC5dYs18kEIEuIBq9TmIpHeBybF5mKLo0xQZSN\/N249hHFwTPOAhnMTEz2+CwK8cGazEQD6pXMzbJCaEw1\/bKCBBhHE4i23oAGXI1jeTMof\/Y6EiuFYk+oHTlqVKAFpLC9vYO5UI3xEhokAf+6ilyqJMwO5q9U\/sHc3p6Es0gbm6VAZPRbqxiliD\/+gN3Qspzj1BKCMPEqVru57SMXVgTobqFt0h4jlt1Tfhc\/QOu85L49iGLVMkPnWWq4mwWXPrfvysblD6iMttMi4TI13NPtHkNEM6T+p32BNpTfokav1NMjflBQI\/RFEk621wsgdDGhHKeJNetrv5Ef5wOEJKaYLA\/s9DeODsmNqwl27sfGdcWTEvcGFXzeK6kJ36kWydO2yADTN1fgXgdxmFvA2wqyXRuybCn\/gbznr4axJ5J6olmE2X3ZegUDXwbtWYK+3Xnc+VQbZ\/cvT\/1tqmvXMk4q67F\/NrMPUTInUxee3hkqWbS8BnX5BofiAQO4TzERl9E34GV5T8h98axXiBcEnbjxaVWOoeq2LpSRMpKbxs7Bv\/GdOLiFe10xekawNNjI6\/6tOCc5t9fL1Lod5AwzvSUicoXXbLYGD5+IPyHWxNA\/BclfFBK4b2HSogIYAuzWNH\/NQwsz8EPe9TAZquwIeIv7cbZdYM+kQtJvDP0XFdcjcNX4iBEBHJgZvmyFEazcasSN9KxT28+kp9nnWbTOYjkGQMp6QzNgqeBTZyqMio8cwDbBg2O78fIFmCMXL6FtY65f5v\/023N5c\/o2f80alPepppeXxXubK04tcSn1OfZ+ayJwQGSuanyQzNLKy4nWnnLaNasVSQVGgxtymGt2aZiEjITXVxpjSJ83sRD8AscnwczTsWjSgHZ4QOlwL5DOeWIS+jbn\/bEjiCWlGM5iNSqyMFVStnXDkNXB6\/bNOZ3IxuzDgWDW4dyRiGqcXKgnzh\/Y5ZU\/JtftI8bniQ4D4UYgS2TGQyj6FNRsqdKx5VDuyswe3Ax8wXes6xwHsSNch50u62Mt3jL9eCn6dFxGA6ss3SW7dlJpaglSsro92OL+d6UiGYIb5Vb4K6WO2m\/1pBV6qyRkYKuPJTk7RsIWFhXBSfcxi4P6uVh0PxFe11dJF1BYSNpwqdprO6oAcjcwYIKkTWwLR0WP30wSIPocKZBBZfgM5kFira+nRvcD\/miqCqMkEm17qXrXYrm+\/D2ZxL+yRzIj6+Ts51b\/kqVXet7Pld50K1\/QJzXOQf9llFwlXXZmxkKAkFOXoUS9selg8BhzcnMer88XlfoTP3Z22F2xYd9fcGaLI4kZShLm7G59XFrvmUsqbogExkUB84M6KkXMZLu1b3nAk4cW2qnAqLtkcCIUGQkz\/DrUmdORT6RHwBCWPlLIqB5NZZdzgu14r77Qvv\/Ydekjg5V6V6cWelVvtetb\/05m68mLc6+hHcGaV\/ZSvdYqAmYTI+GuOFM3SEgIgvE7NxwRf6LTWrKBtO1fpvCpJdz+bF9tOn9bmdk6hvEQFZHa1KbohzXWu6yiuiuj3jeBFu+ETdrX4EO1H3z1\/S+1k+gFzW\/QzN5tsUf5h57Cwp\/L11FjQSjK\/4U42YhTNTmi6NAkbNR+Cp\/1htCzuyZccwOl+mlySm7biZPjM+A4wBgCAFQI4\/Y5dxvCqh+rcRTS8HmGC9IBOPJ0Os+zkG\/XLj5k\/k5dlYxsSex6X53xtaTmf4ckM6oppKJnSvXoTN3qmz8XFGGgxplLVZMj2BH6dgwyEIEN77JqMcTnRGucSdrazluqFMe2pV6VFeCoPhysqo8fmbwwxQ+0grLbm623a56lXSJ9mnSdAnZxSbwBSEVdQ1R6SSmejnjtwBStlWgiOcpGcWz0oSkyK36Cv6OqBLqfKo9F3CgJQI\/5ApBFk8d\/petPWTjIYsVsPGH2nQBj1GsuYpiTWDCYSwk6ieqf7MNlvJSc+yXgv5oVVdDNtYoeAqOjOyHgh0DAArgKGTVoDgdAqCnAmmQRw4h5pvm1R6kCAK6q6GVqS1raSkpcVK8Q6HyPaJdIv\/y+Zltt9Eud96dqBrcnZDhYBRGUSoG\/CcujGxhmHUMzh7x2MVGGEgshxiCsshBIW9tmE+6VYA0XKQPQP3wEtIzhu632v0CNaoOnFx1Ae624g2RpM\/UJnGZkWTPXzXK72vQJKkCzXdb16yiYG0z6aFgaVGj\/3U74yQvAZRZnRVTQxxetn2u6TrbGdUh+Chpu5Tg2kDDIAguBMYh39mW+zYJOX+\/k1B4kllz9hCcIVtlmPmF40HNxn5Nt3RcwfK3asERz2ReP2JJxUgXXotn8dkhyzxkcsm+KWB7lXaQ6PTTSA6jXg1+VfAV30\/vtmf9SHmqiOW8cOXELe+iT2rbRVc2lUyZXYlNb\/uiVwMJHm4e58UXHWe6A\/LCSp7ubtk8cz7RTiGxi0LR80b0oPLVFscmQgwQMCfnIO962rq64htEAIuRgcztSk\/VzPbcywdDn+V39ou44ue\/QaAVe9gC2NfPXOfgiKrXRIf91F9tXPpRxzhfwU7vG6y13lyRggEUnXtUFJZYvYw5+Y4jI2RGMNRcFgU34aL758HtZ9JkBam0\/M2l7bEh3gaMDcdqyxyEmP8LFRa15ogmH3SEWGEid6cuNcfIfcLSVTz8J23+IgvSucNYS4ssIPkn5Qtwd6H5pdQ+F1WWq7pnP0szOXYQeDZTKKuXu6+t7z2pr9EaVPGIXZc9lOnguVZt6871D8z4nWxs0ylqbPWU3asB6mXNFqy6GfOzxkFjega\/ihZ9HphwuqSnk4MYMhJjDMH6uuki+WyYse9EHP3PxNl+\/xRzIGAgwy6GGAYT8o7JqDHgW6HkvyplGA+BiyYN8YDZwjCIL2eFFPg9S4p1lv2AW1f4YSIX4ka7KEDzs5JQfUaKOgzJ10gAF6ZKaYI64UfArkm6ygehk3vsW5DwL6Dy5Y94bPAbf6uDIu\/VL9PmgmcTun0QrsRM1\/qQWPHAZU5CWc6Xl5yPtrOrm9EClbz51VrY2347wXYlEQ8+oTSrLdWKTj3XcNvjgPtB4FnkFy4C5R5thze7hOr1A4EtvtKImCdck3cwgsiBHXnoAxJcsZvj5gaURjLtBSsXO+qSdn4QLBw\/oezmqzua3fNzDtNfs2yz2WCItQ9D4d7v41OVKSS9eyLhbf7GkEAA==","iv":"f9045e65c672bc0c877f3f96062f7357","s":"c87cd6c4047d3463"}