Sixty-two percent of ultra-high-net-worth Americans live in close proximity to department store chain Neiman Marcus, according to a new report from Wealth-X.

The “Neiman Marcus Ultra-High-Net-Worth Individual Breakdown” study finds that the retailer chooses its locations based on where affluent consumers reside. This insight will be useful for luxury retailers expanding into different markets through bricks-and-mortar locations.

“The Neiman Marcus study confirmed that the brand’s retail footprint is aligned with clusters of wealth,” said David Friedman, president of wealth intelligence firm Wealth-X, New York. “Neiman Marcus' position for success is based on the up-growth of the ultra-wealthy.

"Overall, this says that we’re going back to brick-and-mortar stores because the upper wealthy want a more physical experience," he said. "The key drive for luxury brands is to use digital to drive traffic to brick-and-mortar locations.

“Brand equity is created from a physical standpoint rather than just social media.”

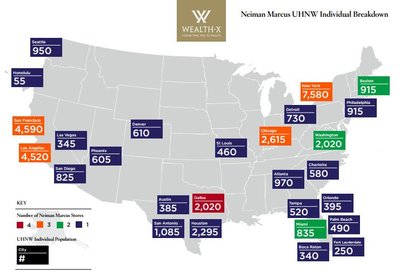

The Neiman Marcus Ultra-High-Net-Worth Individual Breakdown study measured the data of 37,900 consumers living in 27 cities in 19 states. The information was curated from Wealth-X’s database of affluent consumers profiles based off market research of specific individuals.

The study examined ultra-affluent populations of Texas, where Neiman Marcus has its headquarters, and the top affluent states in the country, California, New York and Florida.

Map of luxury

The Wealth-X study discovered that Neiman Marcus is located in most affluent neighborhoods in the United States. The retailer has 41 stores in 19 states and 27 different cities, all of which cater to 62 percent of the U.S.’ ultra-high-net-worth population.

Wealth-X's infographic for the Neiman Marcus study

The 19 states where Neiman Marcus is located accounts for more than 75 percent of the ultra-affluent consumers in the U.S.

The study first examined Neiman Marcus’s hometown, Dallas. In Dallas, there are four locations to cater to a population of 2,020 ultra-affluent consumers. Throughout Texas, there are seven Neiman Marcus retailers located in Austin, San Antonio and Houston.

In total, 5,785 of Texas residents are ultra-affluent individuals.

California, which is the wealthiest state in the U.S., has nearly 10,000 ultra-affluent residents living near Neiman Marcus’s seven locations in and near Los Angeles, San Diego and San Francisco.

Neiman Marcus on Stockton Street in San Francisco

San Francisco is home to the largest Neiman Marcus in the country on Stockton Street. The location is 251,000 square feet.

New York state is the second wealthiest state with a ultra-high-net-worth population of 7,580 consumers. Neiman Marcus has one location in Westchester and owns New York department store Bergdorf Goodman.

Florida rounds out the study with 2,830 ultra-affluent consumers living in six key cities. Neiman Marcus has locations in those six cities and two locations in Miami.

Luxury retailers will be able to garner increased brand exposure and generate lucrative sales by being in the ideal locale and nearby their competitors.

Location is key

When a luxury brand looking to expand into new markets, being aware of the area demographics makes scouting a location easier. Whether the brand is opening a new boutique or selecting a single boutique to carry a limited release item, knowing where affluent consumers reside or frequent is key.

For example, Swiss watchmaker Hublot is catering to a concentrated group of Ferrari owners with its new Big Bang Ferrari watch available exclusively at the Hublot Boutique Beverly Hills, CA.

Isolating the watch to a single location and grafting many Ferrari references onto it adds extra layers of exclusivity that may spur consumers to make the purchase. Partnerships such as this create occasions for unveiling new watches, since a new watch can accompany vehicles designed or events coordinated by the other party (see story).

In addition, Italian fashion house Gucci is opening two new boutiques in different terminals within the Charles de Gaulle Airport in Paris to target travelers with time for shopping.

Both boutiques will focus on accessories and handbags instead of ready-to-wear pieces due to the limited time travelers will have to spend in duty-free shops and carry-on luggage space limits. Having two focused boutiques will help increase brand exposure, and a lesser price point is likely to create new brand enthusiasts (see story).

Bricks-and-mortar locations are increasingly important as digital and social media drives traffic back to stores to cater to affluent consumers looking for a more personal shopping experience in a physical location.

“The core aspect is the idea of leveraging social and digital to drive traffic to a physical location," Mr. Friedman said.

“This is especially true for high-point luxury goods," he said. "Brands want to control the experience a client has and can achieve this by understanding their existing and future clients’ passions, hobbies and interests.

“It is likely that in four to five years we’ll see a retrenchment and overhaul of the brick-and-mortar status through the use of bespoke marketing strategies that will help brands understand the deeper passions of their clients.”

Final Take

Jen King, editorial assistant for Luxury Daily, New York

{"ct":"UHC1uSHWMrXbhYbrlm2RdhqF3nnriv+k40TdzTbQh40AiUW6VspA0OxQUrGnOG6kbUzhU8FeHRS1dnn6X391Jmx3D1Y9LTUd1Vgr+oQLW744C8CgrI8ShvFEPrtHBxdHfJ0qVXspH92l6AvdNfCZwe67D1xF49pFoGaRaYKZmtD0SERt\/22oJnDGyUpXg\/hIzGnhvxvhwN14VbKXtV0ENaMcarLelZx1+QgY2k7FbduClPmciGL+uQSuCcvqquTRn9f4ffyG4tGpFTD4J0FohQdZFj2lRVDauffji37cfAHiJOluQM22djf9KCQHBabgJK2ZUgGEl2VbRq06M9CFj3eEgz4QxgbK+pnqqpuudXxVA2XRE430jwd0CeuL0rAXr+OvQyxdzoKI255hNbgh7jU+YyHwsYgTeveEbMh2SCVbcbk4zgcF\/syrlK64EyZqrHCs0PoReWHUhb6tbBoqWa72bjY6nbd5S8yqMCwoq9ap30rnuh0Qi9YlG4nyFJNiL5MMCXpZGjTahd8eVmBzSev9ebVWeP9aLxpKZ1OAq2l\/WRdKsY07JLz4qRDWARHfyojGEFJ941OtmVY17ptEprIctxvtoW7Txu4YbeEWMHbT7sZzNYFLYtXEqpnjsYz49xG3QVFrESC830xRKMKy9jCfvKWVmRPIvdcVjy5Ro3\/EkWFwIAcVor\/RDLHKFLnf4tMYW6Sr9fC\/IXoJCDkA7aPez9OqY3bni1gRvMZNQuZcVqzspH5D+cdwJGYcmUdW1dKyFrjagQtT8tJsFt8r9bi0PZGpr+XNHeyzTrclAnPUx8T1+BZefdxYHFuDJWSZf9uho\/AQscksv7PrZY9ru05n3mHQiuDWCrrhotrcDAxJei+yB+XuBVQrIvHuOOD+pnFBXec+uYXWELp+HudLe3l6Q28Otz7rAuE9KuR0tH9u3e1d2HRDQWv3RJ2hbeE08lIR\/5yanTef8v9B3Gq0p7+eMqxYyeTO86Se44NoQxTMxD0birIYSMMP73aA7ZcOG7Ycr92dDD2ImWVKCDHwqXVJFfVHHjVomGuMXMxEpUsuF5bAm1Tbsrk8pJn2gms02kznSvTUUoUamTRaNx8OSkktrfV22M9e4vIFgz2BWad3CLEi0prdaETvBHKYI+GoUSyGrb9UMfSm0wnAD3ACGkKQITshoEIoYyKFBlFaIOPiuNHu3uD4\/j3VQCHYuzQtPG3ZG0R\/ULzqNcZA6QQVOvTsfnAw4dyIOzNag7WTgXJpMTsjuSWC6rIoNKohzWgpDEFO+X\/GvrHlTPrssTdiyvS94dXLhDD2VtU47WHKAWGgUUGEqjde0TdarSDUPvrLrn2WtTHxzMhy6gPnU6FrGz2sYHwQQsHJX1YbG2\/7j8AbbXqloKyzh7Qa8YSSdmLPo3qq\/mHCsBqvellkUAlKgd1+C6V5z9NhSbamuTj0H0GaLRaEvSaH1NNa8b70bt3Uv1lcBZnwF5elC6OX\/Ph3kOWA2Ai\/JfFI27krswXmhXGQ1QjbR\/S2Hs+why98Ldr1LP6dSgaG55xPQMXmfWk4yVXcWwazF+rRLFdJge+C38BPhWB0LTo4JA58UAXOrJ7PNw98dTsSjZuFeZNYjeMrC\/VxOGHtb+0ZP4fvo+6D3bnP+bW0U8PcgPFRsi5aQUox04jd2DYqmaFh57uatRMdb6IFQbsqPI+nRuD7XMmIvVYxkMblJBl6zqs4sihuHJPyZJUMI5HTkglsIAFvixcp0cHmul5+KWaOYx6pNcnKhRUdAITAke1G07LG0V9nz9J0XJysMLAezMhvIm36Hp7tK6K44q9vVbApEwsla5n5kujAGSGREEy7VIWSKYHqkQfS7J40ydJ0afq0YHh4v6Jy95\/tPnQqZqzyKKXrcfWgUV6o6SLaHBWRxQ31\/TbYCOWlOuEH+g+ED6A7lR9kvGG2SlPG0XYzhU1r77UrQInl3nx2F\/kQnYOpfGO1QdYEoylC6zoyGLEA8DaVwJks4ZA98CJjp1c0Frvj1uoV1G586bPzMr\/32NfljdTnzJcrYaHnWoQajsiXBYtnI3IWJ1FJ8AQoZQyB63ptyrYU3sVwI7wAYp6HRU7rgUpl0aVLmv5exS1RommtlHtaca\/xekiG81fVUvkhqWjQ0mgEndI4q64UCaUB6P3bu3E9buwZ4ZUl0d0DwF\/h+e1Dq\/XrWc\/nAu2X68lgcNxZp1l31NsbX0JKeNbaXM3uW4ZA9WqaU08cKxlEmzEexZKnKVKLdM9mZ4FOg1O+\/F24SXWk1var\/47NUXEzCYE6jmXKofb8gPpWsKMNwEnHmWt1mOtDokHL9fgxSJ\/407muN87iyW43Bi46G5wrDSzugVFY4Tc+thxbV3gFy4Oz+8tVWIKz+9yppIWOZKL\/dWtwCv6h2P+8pyocQPMpisAE8rUOUav+06UYysOD7l9QJbpLEkfXrVTNOisSS3QoYp5G1OG6uany319ne5lA4wUtEBrSpTWr5PmqwcfGAT8A5iBqPLez18WF\/JmzwjfRnZ0naPREB4yKajuv0IAR9I\/gO11Rk3VX7SspJg6twLhmzNBZRHYxU9XikFY0ZZJoZRiyOXrwp7CKxE4Mkp\/+GK\/V6l6bewUl4SG2UAeUiuYQq46UdICZ\/l3RtLt1UKuIWaozG7o33GVWHSw+XHNrzynYKjtbOkpxEUGWo5W8iKI4FB7f5zsDSqD0wSjveqBU5ycAvA00XUoB2CnBY6+EGsrJK5Lx6rJSlOBPkGWejZi9BErLC2OX8CgFArimbJEZrZ7\/oSodTx7yCDkt6FFHl+IOXSeqoTGIOc+PvrnLdRfJToRZwZOIDqRj1NlU04VrNEDNubxRcMBIUUGjAvd2VrkK3Tehg9K6Ac\/BESOXFJcuj1\/R55qPwOh\/4UwPGduYz2xmQwZ5zRs\/hWiowZLxSiXKsclLlselKAJgX5n9LOu2iE5D2clomQOwQb0qZqwJvQ1hzOO+Rn97sYvroqktrbh11cFAGkX\/oOI8sYXriePdUf\/qTUl3snMmJOEYw+uUVjBajWLWht8Z2wF0beUi4MyJaljMUlQF5t5C0KMnIP2CUDLk2EBWsR+rCFJBbMkwlQdreR25xHboJ0QfXYrwFLpuh5EkoZ60WKcKkAbwnz7+4Hc55AHjLb6s2wDivV1h8fq1fO4zFgCxpaqUJN6PEIl25qZstxFExC2mRd09G0h8ZXqtHpt1qlqTeIXyKLcPh1ahLhNjEkuJUWa3T9z0JafIf+1vC1qMB73shL\/9Rq5Q5OJLNdJgydxsZdL2FMZEqCgNV\/U3mXB4k1qO7IbaPizyu66MQMZv8o7xcTb8LQP8Vwnm1Mt9ks44aTyObmK2xIImEb1EKnQyalShLMY6xP8m8QbIy1w1MmZLKXiFsRvj8vIlriDGHJyMIcfuD9rHb0WqQe6Gm8SKklVJPL\/bm+RxsnKNHhBmL8naZCZCgA\/4k5ialrM3QqczwLG5oCthru2vSwjtdrdxy\/ZcYqXK7bcRunKiWzWdBwzr1pvYyQ0fr8dkVNWYXtI140uyZCxojrXt6HohkgwzkTFcWGFIuLg1kvIHSoU8G4qUHoejbH3eTLnBZ+xXvYrPuRN5LwvCMrExEbb2+Z1EcJo\/YNWVkSHUsfTqWaEd0Sa5+dCVU3Yc+tXO5L8\/6+N9gitDi0yGsfTmgBeKIhg\/tAX8He3nudx82shGW5u\/+215OwqNR1g9XcqWCW0oua7gx42j2n3Ty+2lRc+jlnSEPM0zZKYc0Rv2YWr2tuR1ktCsdAbJkJ2kqwtBRXwYyiRCMUxfL0vKMKb1JRNIA5L5\/Y6cQRMsHg6GxYY\/AGFAMIEPfNhKoNDfj5Ac2xe5o\/Y+btdwz7rSdYg+rUFePpsQUzSpWnav\/nFIJQiJT66i1u8xGkudb2BAV5jPCZu5\/ovLHDKU8jT2UhhgX1wi61srFNb7K97+NXrRO6hPkKKwDyX0NJjpZYlSrm95loonSEyuHPeWKINUrZaHu5kSXYTMahQ66tRKbWy0J3++haI1bN7qT+9QRGYPuCKjgKzSHVyDBoxPCKothGIOYIrach5gvZxbNqDG0XO+zMYFAWAUZ8qRJbiQmvO7n5meNqwOxxxh2ebiWReRQhBZ4MrkpuQmLzPfmzT3HniVWl8TRQehYW5QU4jPDx1WFCkcQiw0mcgOR9lQxwL6DsM65+lkom9kFaTfpiGOiw4cmB74PaXpulCROCVmUUyJFu7p7aJNOVwNrjeZWXlLzQhkla7Q1l4IE04SPAmraydVe9udS7u82Mr0hMhCze76cP\/lBj+KhtldNf5YCIebqv82AC2QlSnhAfiduzdu6JFHWq7jAOHCMwqzaqB3QClZ6VqtLqFc3Hv5805XA6W3IB3oqgwRHrEP66bNbc1ZHKj0\/XE4QW5\/sOFg2TG4kTK\/pWqjpLor6RBifexSWk33ph00h9aShaluuct0tbj47xs8Jkb+4MUxs5cBrNaj7bhclEwgFNkktJB84YanmkRos8PpqVk4aqJknEe7D6CSyIBzUm+nB\/cof3g8evQZHf7AYzERMtcC44Zx7mZ9ITQdnb4UX\/mHlnZV1lFNvInlAtDQLQg8TPQRgO5ZMX6M\/dV5+NIQng2367c+tz9+aqk6y4uWtJsX85g\/Kx0++4RWg4a9xH9Ogx31BpqYeUmeep2KNZzprasMVciQI10UZcSdbZZS\/K\/Ln4VlU4bZlCsT4WAQFUpCk4vluUI\/ht0gZom53UZ3T4PFIDd29W0q1xXvcB2aX0S1bv2nHMMBk8eIbX7k\/v6PJcxiKbA3nDKN8u3npE++H\/52CN2b9G0\/IeTobCpKfBclg7OsfaBrNGTk1icycGezkfdKXqi98jOxqmAnpkj8DuJkOMMGqQzTlrtFJcyy++fsgxNstS3xFWH0Srvj8Sg9A1T+sm+ULiUi0eg7ujEDz0WSYz\/jYe9ppMxMyjcKMOAVbskh\/0TseCkkVuJ6IoLOxqrJHGaFg\/g6AF2xMQ8SYC1LtqS18thhVoMwkDkP4Fic7IOvd8FbGvSm7qOOS7UZFpPQfPCF2h\/ALgehRPZMkDDapLa+zefGA7eB3UmohXZ15fG6jgk5dppwXKnojtZKXduc8XmtcXoZn1l0BOzffTWoOHD0e81mgWte7Q8LmcV9VcT7eCnfKLllmflhFhd8ewnXmJTXiiiCr0dMwBb\/GA9Ghw1qj25uHVwbfnzLV5N+kIrK9+mQhxgAsKCh1faZBr24mE0RTPOi8bbHInd3zImmmD6Z0UKXo+8DIAzFXYrV5Svfdu1LJCI4o9JGaMIwQx3y3pUcEmrmxoeWujVu1WUc8mEjcrsdl5BjWIdOQkRu7E8lbnak2k0Rfd2LUyr22CH0lpDFFynbCXkITocm1EI4qunYWqwEYop3C1\/yTo2xhgmMGRBKV7X+14PgjFHe5wfG+ppy3zW1A01dhX5wwVKuv9X5q8UheY5ULEeN+sUUSwbsL9CMYwP+NzLwqO0OZF2WXkV1UZO5Dwyew8jJPgGNQgxnm7KQxb2CLY8s+UsGYedEbcWzFbxGEPln+96dhYwC\/cLFHrxQyVi++qciz\/aAWoR7gdeBpqahKSBoqtRdsQ6Kced4ivJ64ROhZxpdUPMSprAgLOqs\/4+IHJwQXcKs5PSIHXu\/MuBBUPwtz0fRODxHIVA6gWQGHR+G4061ZF4MUYoomNRKAx87Z1kB1gLWclu1fAANi6s4ZMhNVD6KY+wxhw6easDgjKWqDvDGLozN95KTYRtmuae6xnHZ3K7jcToU2G+YSLRFo0SbmmJCCGJ2tM6n4gsG0H4vBhtUntrYqStNVUt9KdGLXXwSMOnNjROR1sWp3YWp057qDlkNYbWERy8\/4C6Tev\/y9+h2FBOR51V\/lML0ryb33v\/QRJsyVY5s037UN7vXUwhg7bhwws3ASV3aRw++83O0UR7B3oTBIHuQ19HjQyPzCONtY5gKbSiqvdtdrcbf3le4tF6VQktG0WKNlsnREl63PCjRRhUOdArrbSZSTPqpx8YS1VkCOsenM9ucSySb9N61fua4XWDxy0jim28iGtj9cg80gRwWi4DN4RmVNKck5bUiEEk7kttTmBPT\/EoK9n7yqOIXy0Dl4rszhze\/QvfKYR4NyIaSSisnF9PCDGJHbeX+BXvAca34xaavsWfAaodPYeEhK1zcclkolsq7lh7Vo5EqY3ZG7lVPbPp4GUNK3JcMc3E\/OC0iaGKLlR\/Meff\/OEkxqsedF5W3bM9Dnmy44CtofG18iVoiOJl+s2VvsJmugYSQc4cUj4X\/qYtEDEwUGbgpw7tLnYUYbsqWBk6R1fjQqCX6buPIe2oLKfg0HZnu2SZbvYJWoYnGGBnPI\/gKpEanmuIlhz73xsTXVzOAyMgG8d2MKfEcZasI0J2icqwG0hLqMjyWn81t3+3AUG3tIPlneHCJCnYbP4XMOf1Xr2bGkzZ7CfR8p271kUMWGdsVUSXs2\/v7ezK4\/HNLZlygpAmWnheGhKxWQ+g7VLvRraVDmnpT0iV3BXHdTBRIjS6kWOdCGCBMP2vvvb56TNdTd4tley7qqopzo+fB\/3CtEn5Hb7+mCDhn7FGuFfz2uIaFNch4UPrvz83628SGItoNBpXYNrrZq\/3M1UzjASbFLlMjVvN825HkVLNsBAyNSmUohA+y8cMoJxV\/FnOe\/Lq41FWS6vafWTOrc7LMapz7H08NAHmkOen9jTxV5PBjVa+bzgMGn5I0ur6vbc9V7jgaiSs8hn+uhoZxUEBhhuYiz+dB54GzF1wgMSGjzQIEOwrbnVzltyjeEZfgNc4rioxuslwh9beehbj7nAcuaI\/VUxYiyvYA9difCTwexAbxMz77Ss0j7ylb1cfvzYenAxJfyLqyUsCX7jV7GZaNvazOPkTazmm4oxb\/NYv2da7aMiLWr6vvj9ZVFXI4bS\/UNj67xIGDcOviKU4hSYe1pJrk1Ov5nomeDTb36CyBhXpV3KYvFFxlrQKRQTRFXJn\/YLvUcjq7jb1c8sX2rV3Et27bJU0rBPHgCbtz7LXm7bObWdaBQZsb6Cli0gn+A+XSqjGo4ZATO\/NrGOOiduck9nUpCdlBcWwm\/aqzeyp8OflcGYiud5MHK7NEf1J7rh4FcAuMHicWqOnQdtoA9zRT4fpvzYYA9Sc0sGowKQVMTEpfPtDfHMRadM+c5f90q35QcoyGjA8A9mco\/77kPRNAkSG5YopKPG1zKk4toyCZbfRWv0Cd29GI\/EsY+N9A+CqHmpr05HnYbx9kQV9AI2hFRKcrgKE8IAT9lDWunFm9UA0LTOEDpHVUrEAkOAptwC\/Ex0h9FiRs\/XO5Dhz4bHjMadEogKYtHV+CVuQtkw1yIXOzKBvBunbL+x7puv4DCI0cii333vD+ENsv5zsmGS6BEJ++r2vVnm5ImF+iPWNS9iSCSOk6AUaHOdSG4YHxzPvbY7lY1zmGyzzvkiw4HXy9heaeUJUuE4elay4FmdqS2q4x3eGrFOoCogVfcJYbXpU+oGgQcw8gvsaTfDMiVZifCKpz9zFrJZp6ntwsmJKn2dceuIRH5ydITkUY9ff6jBpGLcxtAf8XqfMCfKhhXSNywmvnBH6qzZzjB0Wim4K9ZHD53tNIyofOi1qN2b1YvdVMT6EoGFBwmTpfBBZ\/y2wF8SJaC9jG4BYMyCabY2ZCs8N\/Fh4FlVddsXSudEVL6f1T6Ztycu+DE1Dvf6JWvf0yo14OYZBZhmYBj\/VN\/DSBcY1eLhDX0h19LnAgi3s7QvJq2e8VfBdiVBOyn0qfbyjhT3rOrtXOjDyw0JQTUtk2Jns4tVzxfKdMCnmqSE0VTgZmHTx9MfJNBhxkm+uvUvg59ePgoZTqTv5pw3zb8I8hbScLRHVJfswqF168iG9L38qKQu60k8dzYT8oW0bU7aAIIYu3afT5S5yDykIZdyunONjX\/1YSRdgMq1phyNNXB0cyBALQcHfb\/BYEpIBOXnRJwUF3\/clcWGLDbzN+G0vhIC+09RQxTDskoogmUc1RUwTYEfacMT8bdiLh35qK\/hf9mrTBcf\/S06GzLAlhCKtYFrYPg4sTMpgVnvTt1TqbNRC0\/MxBM1SGvwl\/4MI23+EieotZEsSSJbzBgx309RYKCSAzDRQadqe6kf5xVOtcYGT9O4O2Smav\/Gk\/CgCyzKwsGJ\/ccifK5gIvi71YhfpnaM0tLTU\/pgawpGfTSzjnetkZAiIk4AvVF+dtphWTBMp0yGrue5aj4xPjo5\/g9m51P1nxXYchzpmPWubtIX50nl8k2o0utbtd4N1NWg78nfE1VOOTEnMMKNKTt4fgVCvKpfm\/zUWl7adrZiPnBBcw6cwtuA3kf6sQZcRYKpka3ibE6TzGMhAxTnY9QdMrXVEkxQo4dY87q18HITDfNJggsVjA0pDVpRh57n7i\/R1jRuqtknuWirbldkLB0vpv8Bmws2ZGQWfVlh4Rj0hkMqnqIcRbaVOTmvnhaos0objZSWIqXpN7WdczcHOE\/0C9ywBT6QU\/dP2AJC3HXPJeluV\/1B7GKmrRlyPG5ScUTL8fhzYxoa7Aib8yT6LuShXMZnab6\/htpFwBQYu0zo3ZzRZU7z0lvkH7onxoR18MJ9OnGhuUQBFRG1o7i6rblSLSu5vPvnG4EsrYpRhjsylX2OSgiz3wI2Zi07nMSppsus2w+UsQmpVCDJI4tQKr3EWqOF7XCG0S+thWFd9yHRFwePnBxSkj3NWAPiFW9DXlZMYPIPi51iW1oGkZZLs7lTiQM1vTv2fIGSOA4k8IbeO9v2gxd2vNZihGYBoMr9p1Domihdfj00XfFM4JYr\/lNMrzgmf6s2ifIhislK3ihUOiFBJiSsdosGaR\/ad1YTLzfBA0Z1WU5ixB1rtIhshMRLlYBBBzYC3o92x4FanfQlvh09AWIATwlsSLhOzZMn7TunBPFQtEi\/OZdZgephf05qIEFdqVbr3zAMEJ5hZH1uYHk5ChOIAFN3Qpoq2MHHTilTMCKGbszRdSxvabWTzGxZIXM6Ofwj0I7XrPVJLXlpKUBHSIKYG\/4n4av66HI4qbNUyRz+oSLPJFYbiVLXIfchewSXKZdpqGj1d\/E5JoMjWLVIw0DbUHu+xOGidporfbML8YyvFNKy2bTFpEHjI8DhW8tzvdnpVBKqNRfthmjNO4E+CwisxelD\/WkWnZyQ4lJvlpR5OeQkt1m3zFLM72GsGVJzPCLaDyt5\/Mif0KzzWVGDmCHQOKrbspDZaS4aqtFABXGIN+CKGe8cV67+S1Neot+vzjZYJMm5Q1TneiOQIz+fPq3uEzLHW\/W5UBfbWGi5OO31hRgl3ylJIWuFu93y0IurWaGzr4HwEfR\/ehqifujplr0PSptYkADs2gyd1LNjoc5FIy7Q\/4N58xXFTkB2VWK71iwCzjVNrY\/MyJETRWXLIauUxVhqXgbLwZBwWF3shfd84algsNSXB\/8YzRQRgSQQwAoRiUHhIFq3Z\/jVPMfiji8ajWhkSlUmgT5+r7Dq60rFs9Y9lDFZX3XpDUmqfO","iv":"a090a2f31c63d23119dd41f32ac51d5d","s":"d2f79fbbff537993"}