The combined wealth of global ultra-high-net-worth individuals has grown to a record high, although the ultra-high-net-worth population has dropped in Brazil and China, according to a new report by Wealth-X and UBS.

The “Wealth-X and UBS World Ultra Wealth Report 2013” explores the global population of ultra-high-net-worth individuals and their income on both a global and local market scale. Examining the global wealth of individuals in specific markets is likely to benefit luxury brands looking to expand to developing markets.

“On the memorial of Sept.11 and as we look back at the last decade what we’ve seen across the landscape is that businesses have been focused on risk as a core issue whether from a geo-political or financial perspective," said David Friedman, president of wealth intelligence firm Wealth-X, New York.

“In contrast, the release of our report and the picture it paints underscores the view that the next decade will be about growth for those focused on ultra-high-net-worth individuals," he said.

“In particular, private wealth management, luxury brands and nonprofits will have a great opportunity for growth among the ultra wealthy.”

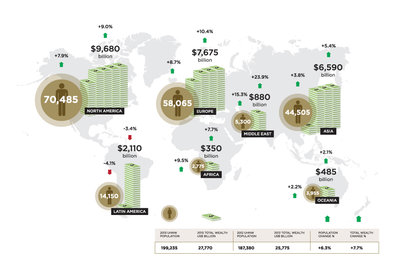

The Wealth-X and UBS World Ultra Wealth Report 2013 measured the wealth of 199,235 ultra-high-net-worth individuals with a combined net income of $27.8 trillion. The information in the report is reflective of Wealth-X’s World Ultra Wealth Report 2012 and its database of affluent consumers profiles based off market research of specific individuals.

Wealth-X and UBS’s report shows that 1 percent of the global population or 2,170 global billionaires, with net assets of $30 million or more, living in North America, Latin America, Europe, Africa, the Middle East, Asia and Oceania hold 23 percent of the world’s wealth, an aggregate net worth of $6.5 trillion.

Where the affluence is

The report discovered that the largest population of ultra-high-net-worth individuals live in North America and Europe, a number that eclipsed that of Asia.

North America has 70,485 ultra-high-net-worth individuals that account for $9,680 billion with an increase of 7.9 percent and 9 percent respectively.

Europe is ranked second with 58,065 ultra-high-net-worth individuals with a total wealth of $7,675 billion. Europe has seen an increase of 8.7 percent in ultra-high-net-worth populations with a 10.4 percent increase of total wealth.

In 2013, North America and Europe had a total net gain of 10,000 ultra-high-net-worth individuals, an increase of $1.5 trillion.

Ultra-high-net-worth population infographic

The report projects that in five years time the Asian market will outpace both North America and Europe in population and net worth even though Asia’s number of ultra-high-net-worth individuals has slowed slightly.

Asia rebounded from its 2012 contraction in which the region had only 43,000 ultra-high-net-worth individuals compared to this year’s data showing a 5.4 percent increase resulting in 44,505 with an aggregate net worth of approximately $6.5 trillion.

Asia infographic/video still

China, considered to be the "juggernaut" of the Asian market, saw a decrease in ultra-high-net-worth individuals with 10,675 individuals with a total wealth of $1,515 billion in 2013 as compared to 11,245 individuals with a total wealth of $1,580 billion in 2012.

Latin America is showing signs of slowing as well with a decline in the ultra-high-net-worth population. In 2012, Latin America had a population of 14,750 ultra-high-net-worth individuals compared to 14,150 individuals in 2013.

Latin America infographic/video still

Brazil has seen a drop in ultra-high-net-worth individuals residing in the country as a result of the global economy’s market. Brazil has seen an 11 percent decline from $865 billion in 2012 to $770 Billion in 2013.

The report also shows that 88 percent of men and 12 percent of women, or 23,000 ultra-high-net-worth individuals, control most of the world’s wealth. Of this population, 65 percent generated their own fortunes while 35 percent inherited their wealth.

Beyond your backyard

Even with the slowdown of the ultra-high-net-worth populations of emerging markets such as Brazil and China, luxury brands should continue to aggressively pursue these areas.

For example, Mandarin Oriental Hotel Group is expanding its presence in the brand’s most prolific continent with a property in Shenzhen, China slated to open in 2017.

The hotel will form part of the Shum Yips UpperHills mixed use project that will host commercial and residential buildings in Shenzhen. Finding a slot in a development with properties scheduled to open around the same time will allow Mandarin Oriental to benefit from the buzz surrounding each individual venture’s debut (see story).

In addition, British automaker Rolls-Royce Motor Cars fulfilled Brazilian consumers’ desire for more information about luxury products and services through a strategically-placed showroom in the emerging market which is its first in Latin America.

The automaker opened the new showroom in São Paulo, Brazil, in October 2012. In addition to developing a physical presence to better reach consumers in the emerging market, Rolls-Royce seems to be tapping the appeal of chauffeured and bullet-proof luxury vehicles among consumers in the region, experts said (see story).

Brands should be aware of current ultra-high-net-worth global demographics but not be deterred from expansion as these populations tend to fluctuate.

“High-end luxury brands have a long gestation period for their most expensive products so now is a good time to cultivate relationships in emerging markets, such as Asia and Latin America, because it is likely that these markets will bounce back," Mr. Friedman said.

“Even with some decline, there’s still a lot of wealth out there and there is little to indicate that they should continue to invest aggressively in accessing these markets," he said.

Final Take

Jen King, editorial assistant on Luxury Daily, New York

{"ct":"hGcseTygKxGo70hZ\/kXB4z8xA6RU6TKA6hgd+AcQT26d9HSnz+zZMzZaacKa1AtQWk8uDNkxe9aVPhm5iujQBfOJfSzYJyCubjigDQejrwshRmU6PgBW1au4S8n5grsstEmq32WvzCAMF40gAjWj3602Qvs+xQyj\/S1htMCMPJPVVRtk2pm+D31PPlTMEeAQGXfsYPztcL1M2EaW9\/EqowN7tbulqh7ya6qAI6XU67VqBnqMTUoSuDW2V6PlHMbzpxu8eJOOcLeMVWavPPAfaFQLnuL\/VW+mO0Jt4KdgvgLQ2Sjz514HuSI06FEtFGoFZyG6nMRldvukMWXefiGgH0hvhk0l+99IbSyWGk1N\/IdRp\/G+\/sNBLrKStv2vZk8pvrDeJU4+tVBtO\/mfMrvJd2Lw1sAFGzkJwkztGUIq+lvdSf73HTmHIPtYbb7J2i21av1enHVcPENEUm\/ShIgO1scA7rvS6XuXCafYuU3htRWvZWQDW4Oc2oM8X0pJEe1qmWz2kJn02AdA5JLH3O5XF8wvWm9XmWD3pthnC6+oF8SjV+PCzx+7dit5KKFWqsnLmbcT6KsBor2tnwmm9\/n+anxiOZMZcWOjjg9Fpb1HqD7HlFGaO7b2SS229E5JkfTFuGL+i+t8ohA2AuVWbl0iNdNYNZtO92R1rHmGKfGD1h+epkC52VROG1s1gLGce2gOHq1xz5m4l1fFA2o7AJzVJh5Eunv46rh5qUj1rncvueLLGFFrI97UCE08Wk+x5buUd8MUiCUvWgT6YI6DAuIsa\/AmoGq09XftqoRaqSjOpi6gEf6NdxYYKh9WeTpu9zZIHGUgdrZ\/fJUVjCGLkXp4UpAJKzQHamvFBXQsOoVnJFVEmVT\/JMs7vQkvUR54VINUlXx4fsD\/apGB0j0oFQY5dPDNoMYfBj\/XlOzTUbQwZuqKVtEasjaFixpnOikGXewZk707scjO7LRObcQVlu5gBtiUZ3CHVNrhub7PYKY0sdyfmS+VjhpbYm952IX2kHSQh0DaxcWeLg7ycaF4pEtvW+dO6\/VFXRmWVBwSMkyTUo+FF72x\/cg4xyTf4lZZ0QJPpHqWyPJZQLqXT\/aGq9w5g33ayNom2TaKhNenr7S5hNZ+3HfFXT9+zWDTef1eTgZ\/aAG3+Lzk0GDW7LPiTLY3JUk103EDscgYRLrR\/rv2fcEgEVMsnH\/LB6vnIA57yd7\/Jd1nXwuwDmtv5dqhhvaUgWNkiFKoxVSG+YfEc6pQy6J+dYMJlGdTdM9JTNB1uH6GL7DIBMZtaLLqUoRvTtsCbyzccveMzvSPoorBAPKsRdkYdKDMmROGcY5P3550novtUQ8t\/fUi9a57nDap7eGm8hMrUpagtazuFGw9Cqd\/ajeMIKJiojnUGvKW9DJE0w4isB3oYHYFVamGceXy6qtxRfxtLwjDLcqHQu1RFUfcjprvCPJ+FUwm0VXuB27ATwydb6Z+RovcFvIY7uJOi4SMMSM0yk7DDiDG09omX1NLwYhl27Oqv759YZWKXvb+Ldi08OzKbF60A5a53lyAYNCEbH\/92Cmu3LW7S55OSZqC2pausvCo9ilJ4u1W5jukPBziFciv4hu53WbZDbEz9o3xcilV12b7TE\/sQ\/UMZnJdg5AK7oJK7VyAr1dreADi2yFgQRe9e\/L79\/4Frj26BMoJZKS31pYYgLwHLh18NxD7IQA4uQ2vy0zPxGEkj9z7sz1AD0jQqYxrhuVoKFzEMBwmv25HLXFs9sf+kbRyYvhsaO8wg2Yig8nWWwKMh7M3P+afSGF11MRxz1IkU3AaJ0HLruB1jLyF2il6CUA3BEncfwfRw2g6oqZklq1A7R2vK0ROJ2M5vaAWMoAKraeiAWErFyYGLhbi\/EBV5h6OOHqQX2jCRu4pGZpuJgk\/p2QVrENvwfAC+\/q0jowjkwTXZJPmJdiU8HFD+ZIxkjXKZMt+uukcbxS7CPX8cLbFS2rSqFzZdxZpVz2kcwD57Z9tmBQ97lvbmLKSOma6xgFj657UK6\/8S71noZHX1igusCtfe8IncKPgliKuWq2XB0YxToTPPsj2cZpF6Sp5ivEjcNkT6houClJWjfD2r4tStetHpVy3cfAy4w0mcLV2SJ8U\/vRJC06Yx5br\/gv3ZgKK3XD1DbBtlGWodrItl0Xs17nxWnyovYyyEtGgRAhrn6HheS6pkKrt\/T\/GCCKE593AarDaCi6RG+dDL21xtXRYVT1gL+sFZmdC9R0hlWxjNE2+7VpAxI2MIAMXWF0QbDpFzsQTYieHfYAlySa6OWT1p55youFqX6EgaHzSakliUrpAj4qosYFrdiDwjVGZg90TJ6OUInZAk1lf9L+PR3vRc2NP14PUJLdeJjAZcip8dR\/YtB9Wn3kXhjh54SrVckh25l0GqLzX3BztyBiPkjDyAKfEyzcvjJ0PuuM1Bqx3hN2WaPw3+vLRBFLMSjdaR0uHqo07slSgkFLSNL+nIy23dDhr+ngkn7tQRdG69agsmwAEmMHZRgQWZlRM+QVlU\/zy\/gnuAOxsbtd2bft7kx85WDWQbDNQ0GJUs3j+j87SjTqTZdlLMVU0NHmZZco3vcSc8GXwsWWASdY3HEFaySfC6zySLr\/bqCUC4Amc1bgeFsOYKxKj7pRtF9PmY8MQhd90LOisAEacmyaMi+Oqnvqrq2RQ3EakLAyFefPAttwgPlp4mjayX+ACU6hmYEHJQIN064YMKyB8ESyWzDtgUTF7hKtdV5P54RtYTi9nvv7zdjVe8tmEiOYfJj0B2+17DHrz7wEsUiKuWhtf396tyvlC1wWjhxvspTbxk440F3dv79cbRBAKSIN9zIqMbYH5e3oSr1z34p6L7WvsyzPjO\/2mbW+hM2Uqv3VzFCuSlNf4rzQHU6UOTkr\/X1i\/4svUubLehO3a70oiSLn\/83OetHdjPy1OonnC9wcNp5iUatXcIcn4P287SQmbgQrv9ddYePT3x7QLZb8HqoVOeG02\/soyYumAnZvGkfoI89YDk1Nzzv48NW1xhQ3EgjliSh3bgRG1xFZQ4SrofnFCCaAFnTeVAWL2IQ5nXkZN\/Yxgo9UITpSivrtZZSWEbS8miSU4GUkurqO4H9R0Dxp8oqV+RxK129PmoLYWrip64xcKvVRF7uoc+HCtt7wS1s8nZO2aSH+oyn3vaRrdHbSeriOZLB5uTn4zl98uKUVkpoF4XYxM4PViiOrJn1Cj3L94O\/g4euJJebi5l\/Ao67gWMDSALh7XrpdBbRWqYDkvCKP4xRT9AGQAqJ+r+XpMzBOxGrXYzbfd0jE\/BbY3WsKQ0rj5RoXZrfCipk7ocRuPtAHcT8s9gxQEZIP5fgu09voEbedw6gwbZWOmvLf5t3zXKjPEQsEK8ZJ34RlYe7RKDwvro7IfLTzpgrPxigkkQ2urAxB2ae8Lg3F+I3RiX5COLlqzK5dMBWSkKwAkzNF\/1Cwn8I5370eoXTZCi8\/43F6aatvf8f2eIN9zqUwoISQVlupn+HAOoaJkbZB\/eCQsuDROCWMoVMnmv2X58rWEy0n9hUgJRDvOp0iC54JEcAd4slYROkKLc\/GW+VU4kT\/jyQMxHmVDMm4T2blVrbTrMoh9BgskJzqZlldVKDfpdyYowQ3VyEW4GBkdfDXYaZrGsdov8tYY\/fdVTTH\/pXSr5WYp6OtQWIRi4gWrLxtRbY+jXa0dphJXX3S\/37OSmn9P24nBNTqJyTlvGU5N5OfjN2+zdApSy+6CsLKLQ39DFPRg3+VUiZzdMymTDOCnz8W40vRr5ND4GDRpWi0y9LtCQPmEDnH3VB1c8GOcVxy7GCkfj9fh7q4yLy7F5jsj4FhZmLzere4sE43njEos9d788IAl466x3vGpXJ1kBrcAmL4XA0sbMQgdG1L1JZFbeVop1rcVj1c\/fWBuC5K0KKPiLxmTnNJ6r7921AUdVWWIxDLde0A2T1654rC3etvduRVNb8+JTS6L5g+5OFKOtBPdT61oScGK6PAO+0aqg0YOu34HxWPmCjaZ8VvFL3UjWBoeJdP+1ejGRQwIRJ8EZ0KR47lVdlIlu+QyDDJMImlrX3jAr1V9ZCRzGEVdHVugnsttQ0a7+JIeOnvKIhsq3pGXCIFMLNsdXmO2Qh+X7DYnfyvPHBxl092qjTpdEMayBD1UED2uMGzZxAC1YM4IhpJ+NWIBkOEFh+WsOnilEamYf4ReZrs4eP5quojcKW1tVGxUlyR5g4iU\/KCzhdjkCdP+P++iFaR1XRVRkCa\/vWGbMV9ndttTmpTswXKT57VgDmLykEV9y3R1frgkBpnY3P3ijkqZJeEwlPeM7GUFfPQSubTa9OxxBiskdvuf3HpMAhYENsgIzBi1V+hYAJzFTXEjWBFdUn3fTuC0GFBA25nKBh7vc0IdZ8sRG0SACRv5rUr61GFOZRDxQWLzWrW467qOjUGxpDyvUoCo0m6iFyNgUizFeTT282PSwNPvspVQKN9IeqyfMvDbsDM3rx56HZ0QuuHqBBpkbzVYVGUBXJLHE66JSqH\/Z9q1G0YJkuv2eKczsM3Wp75QfixHaBPMLV4U1ckF0C72jLaxzC5IskF4gQfWT5AJFvZdb3S0650tEOEZoZyRc9J9eShAAiXNdvm1MCV1xC1hfeiT20UswgiMbqjzeR1KVoNPXlzVPhRl0iMCnbMvdwEzes+ou2DFtAW1KLv0srqmbmi8qNl1xlJNPtia2U3Oove39oeYoLgxxevM91I4FJVvXg8TZ0LnsUxf4MrYdTSOAmelzvMB9Z3mRAcBuvejgXeVU0RZPDyW2VLIssUGtQCgXA73PLgIE6VZLpfZ\/JCGpIV0GxBMna0vr2r1khO4MfRwqYC0vlx4g17LLJVBirbHHbueHoSGoaH5NfTmbLBvWp9KcCp0cBTFENaXHmVdMwZVEC0xk7pFMrRYuiCrYgKwtgaJrpJSIpjoH3O7I7JO0pvhX\/a7oh8BqoY+lZMeEih8uJTAh+CTKurSBIH0kDXWbVEpUUK5RPMtNRb85XoKb6o4WRkvb9piI9sOFD3hupjWlbJAnGFBpPsq4P\/ylhmGE90YtkMm\/BZFV7pnzReJXHLIBvxA52+lxi+hYwaDrKk12RjgvWRc6lYIvfbRg2CThLLvibWA27AooeUyIt9H53cDywcLY7n+t3X1PFjYHrqNcLu5uYEOoNfNo6lQCcwIcOACSGuzcTHhaCJL9TmfZcM\/tik8r2OVqpcqPjlKT\/awto1RtXaIv0R\/VJntqkRjvDFkpmaPbBSn9cLUvX7MNWY7ALEubFpIush157HqLODZX6t6sDGneEQ+bgVeo0ZgnIBY+AIpeKfC6S2m+Q2tJVIk1PWhKYR9TOv5AGiH5JVKnB8RnRfFHx0hRR6FKVbCkbCRCKoaeQWoHnH67R0PZxxboV6PYNVAp0FP6z8XtbYnkCQn0eZXKWOeN5SZUtiy6LdWjqgpOTceCumhC6PTsGYrrVPclKnN2zWj+AOdPmaq1vrBPATg5517jmsv\/9R+ko+XjAC6ZcFX+xsj6+gW6I86pR1aUYtkdkJoLv+FzZb30aYvAixrsgBINga7MIC4EzniZVZgaZqQtZ794hxf2oLdfl1m63+U4o6PiF75Cd9rDTIrbexfloB\/fX0jwZxPH9VwI7oB5AyL+rVkMbxJ43t5iEBaqcTV2ub8R2xUf514CPMN\/9rQLfmQC3J96zCtGZS5WmYP1rWPq2P4gv\/1GIP\/tZ9Le57XRpPGp1pJ1agf9NFODqG5G7mABpIvtLPqIacKz1O4hoDX1RXI1V0HzJbWT3cJqYiZGbdCNrDlquQQuOQypNlNs8vgoInIKqxrg0Yc+qqQkzxgbNYLZfNXPmTKaMCY6eZ1vq302bU7YPaT3L4DWLkG0zLEIKq9dMQlp77JG5OfBu2ksrpqTeTpbBNBqQQrWotj8gbFmlojY87ehhGIi6q1ahXbEe6+0Z4wflgYLSEDeuYpPzSUZiZ+J2Mx8Hrf02b\/NM4TVfQD2HIYL49lLbqIxD3r1yMVmnNhg\/HIJQbkrVvyfepWQqzNpzHg+Yo0EZC85T3cciRJzDt70zPbHZWuMW8\/CKw8I7Ijr9mEK72m3IjhFgyN1PIanzlzAc09ksZ0vf5mburIZrQ1+ImMT20BbWmzoE00kBtZICXlx61aLK2G7FmD9EeuAQRHUhnon1XoNnyUBZA+PdzyH5GzWTn3neRVbtcmnwFT3r\/\/yfbMj0PXo8VbwGl6FLJppQOMxa8xeS+HbYiwN\/hQTwA\/2UApQOH4tvYLb5X\/btuY8qVfuK53DkWz7j+JhVJQbsTXeax2N97Pl1Tn73R3XQizmckkNi4QP9QF1o0Ii1KQJK1OKeERgnDueBbkRDm6HNBEOjeI3l\/YBfC7fjfEcL6w36r+3AlfQcCDiSTiUIWS6On9f4sLGn3CqU9TErFdmrC9LUAakcx0MKA19vHywhSRIFfwxd\/CTonViAneRtxdtWzNRHZcTcXpGDoCgS\/URyLcuoI3GAFA5qrBKSrvHz6gxHzVjrvsRR3dazKIwNWbrzVY4\/ojoYmQbykRnfQLI7PdzvM04z6aY6xM0x7VVXObWZnZnRnEQR6q3jZBw4VjxdG5pe0PXaSKfb63ZyCKIlyYfyMwTO6bWxquANPiEBfvkzWrtQEFqBdK9nIe4wtJDnf8jgcgRwp+uvK93cd9108vk6PP5MqFRq20EVvtAodDjCBtfvPafmzaljE0qGjloAOdhlfbCzkRZlgNKrLDMp7mKzTvOct6\/mYe02BcOheJf1ks4bUQn2eNmo9fT5oIcJj4kDfuO+l2kI44fTJKovBRqvS7u1\/VAbIl8SqkQJ+CvvdY94+MR3PFicn3gL2kHU0znkm7uLTiQUtZFfPMUymUVRFEV8PlBmbhkEDXr\/C4wINGR0e0Gu8mvtEAfS68OMONSHO0Wfiz0ybfXwfed28l+m1bU6lrkKCf39jWvcRGTqJQaoHMsebeIFJhgmVA+X2+NaXobwYn9ksKWD8TqSsrmnWyB+A3\/iiEW10wLdxIMqwBctqqbpbnvHReIUQjX61vkjSsvOWKdQIinZtevIFF\/r7XOqUv4JJW18It3q3iViZX+x9XM8Fzmw\/52D+JTlXZ4FDCU1fGddSCs6ppv6tC0VbqVIgcIJFoFYP29PtWokRxLgwN4LK94SPKuJKOXMTlpjSTiRCDS+x+\/7JMO3XRAvReo34yVfII0ZaFJw8leeim333isBv4yrs9bQjJdtAeMzJK45q82LHTKZFxuWfGrl7cuJv7mbaYLJ\/D5DvXkxw\/M0c6fp+3Y1GrsLmFb+ecSJz356G0DumxlCqmH3r9adlVI7YUWkXDKXhU8ANWHanmMT2Z8dL9yDG1kcKfqQp9Gt5oS0T6yC7N+4C85noi22PSwZcPl0PMEEhqbxgPpjHhwgUmQd0pvsDanitSfMQix5vNS+\/WqtkOfd3MdOFjyMu8wxHmPbf\/T\/qdzVicXVGYtTvNGtf\/5msUlRLeJdu+dQgqV0qUcFKZm51JVjgP0iMI3++KfdttKDSWP18\/Bm5BHix2LIYIA1rXjTOrMrhEtjWGGOPE0MK+NJfpRIN\/QaZNtZ29DcKeFiWZN3dVZs+YDX9F0pO9BSOgyrqHFUyWUHIzN7elOsQ1yAGp3n2i6gHi37Ar+URCgb0fjIyBpSI8jXjTU7WkWQE9g0ykpnxtmYYP37LKcx+wSGfZlB3j14jD6Qbh2aiCPzi3vE\/O+zmqhe\/+0Y\/nvwIE\/\/TbKw4X3gYLDsOHqy7m2mE9nWdgL7dz9+Zy\/nzOork0U1ngo6YjtFu\/2Ae4\/9pxb+iRORHYTWXKdWG2LS66xRKnop83uTtTkXCsY+sBxEaCTqDpmQibvQ8vObFbiNEB0L5A\/eGkFpNFwFFH+xygTAxXhGfMfz43wMXCWF\/D2vtV6zrVUhbi+JjrT4OCGs06RMY+RbP2EsvUSrRAMaMYly4swr5vY\/0LOwbAmu0piU28\/EBid74xQDtAUQjfa7u4i2VZuFDIwlbFgtCuobO6ChaBulQMkIFVN+mJVwtVj7ibkUeIyb2NrLCIJd8YE3b1S41mSXalSXdssE7irinXU9GHnT94QaOo3hs6J+xWdwEfilL7vexr2UyUWbdpSPsZ8lewi+0Xe3xcoVDSjH9FhDO4+mU1hc4PSUrCrNuiz9wmX+pNgqxzJ6uBBsuCrZ5CWJdwCrKUo6YDlKx+w8L0X+psJ69cGPo4a1SphSwFRXM0IqB5lrwaqY8X8ehehyGid1zqhpBRhFMobsq4RHZt4ipTcCmMWLBTbrCshI7y5D7z1WCGKRZY+xhtafE8oTdWa7N8XZ2Lac1RtyXJ81Pn6MUsU7sIBH76+3\/a6thU12us1EnaQYWjCUyzwUTBGxzpl8suwA2o2YOTsou1ZHRkigbCurMnTLHkNhuwMc\/Sd7bw+aNGGRlupBrZhoWc3UFolQujo8cSUWakqZyNdqIgNiVGWM0Wn7F2R8aHk8ybCjTsHUJkI4fxbzxTafsCwhnZDi37vz6\/q47Y8VXqM0icC4dYINhLH1cjA2a73q\/4FWr3rxrNKYLx0lR94qX4KpH9TVDOqCGH3bA3D5DVZCVos1zX8jVCtP1x7zOh5bMZJ9ZI6W+lGy1uIFgNBgXiWWJxkErSw1nIXWZ+kaWlcxmIibtEt8\/MFH4ft2ruKqaDKR3dZlLRq4eccWJi7wOFdVCjOo9ymlaKPMdnOKEUemlMj43cC6rsSzUarNPB7ufybE4qBeDOq1IxOIcIPsk8WeM\/Nrg3\/4tgs2Aceg4FE421qQeE0dTK33MezEWwayxAaheEAJh33m4z+RokZ8Ri0lT6DAoPKeXu3TYPkQzznzIx3zglaPcgFNXaj39saZsXlGZHxeQCTuRCjy\/+gf\/ari7+oc99SWNUor8CVssfrqF8\/UAgJyOYE4H6oYmMJPDLOMevqDMXa\/anBeRwlABd1JWfhyIRAcuAhvnvFA47ix9UsclnsWXiIYfTjKGRXRpIB0oUr0CAPqkuiwmUJgoG23bYywvLkOl7d6NJHVzoc71iuhSf0Qa+fZdZq3oCMtUYd7bmNLPFdLOhP7ezDlhzLvKb+v+1Ta0r2XPoLHLeM9kwVCNBwhCAPXw6XYnAmTzuyVqN3ZS9U8+23EgT\/QtyjujSNzpKfJat0on250SUhn5qFm1rEp5NW7A6NeW81acaoAro4sMxvIwiKfP13bN0gxIZJzMHkqc2D8aW2yLOeSWeNFdokF1Z+IK+xnIL5jPcsj6hUI+jqK7sNGLvF5r86xrvfzp2rizMh61T7A4L1mCXDDHwsKFKJxZTHLTZhANDWxwtVQ4LoKy8DIdmllwujCZbGhr\/EMpjykmPKRi58GhYPAXM8M8Tr94K6lgZgkNU3QC8Kx97MsoXTqA6Tunimf1EeD\/S0bFszTYUlkNiabB5RqzmHdoQi1I7GrGYAfL8VCFwXNG7\/dJ2DULM+y7j5WhoM8ZqaEArUcAbkANC1hE3Xw1HVR8\/zCuyfT3VUZeJjfkcWjsaEUB8Hi489c4DEkFEVa5bL3SE0h4M0QV\/KNsIW\/WiNnm4Rl8C9nMdHMHUg0G45SQIpx1ujlAdfK38vJGa5M+UFXs0dLXVwDKZobfSYIml3qqS7HvaZJ2iLNqNTTnOmRFeSo35MTxUNU0hDih9ecdjSfb6+FwcuiJeBD2Ypau6sWhvelucWwU72rdinHCZpx+IpYgdoqyE70EZtb53pN33WE4t8lEZU0SL\/38x\/mG8ldp+N2LpvFCkQqqUKAgqYY85Ygy5sfW9kP1rIeYTjT++pkKQ8QRewZf\/OEHQwK+jPh9FdlZyjbBWfFuPMzQFuLSci3khP9\/gE0+J7btDCjqiQIukRxFyMQ11079DARXJQpORrF7YlQuNbj3InFrIA+1o7RUy\/Ks8KwA\/iUxQNLBkfNLOxwBYNoGeCtWLJ5VTwgnnCGm40AozEvtmiSF0U+QfIhxlZE8GnFeDO4wNeEvj19bEHGSccZ8CAoWYQwt5ybTIsJOcqW1S4L3v4PYduAlutjx6ylMecgAY1TRWoQ2U0\/ibvvW1wnYKZokmscaT5aHL7QQMACiPczOTEMSBptZ\/Os4o5\/n7Q4MzT7x9AdYDyiLJVzhw8SFM8HfZfYa4wRbDwtygZYZp+OrTWm8PueZnn7bEwhCD0irzj7ODwELcAYdm54fTuPJzBJK6hN7fMFCwZ36VuXow\/sPqpskZnmn7kaIzMSfmtvEOEFZJ1vIDyt2d0CUIt526c+UrtL058qoD1l2VE+8XKpzYO8PGNnzzO43Zxjhf2r10OkraWvmCEu9Ae6xJ\/X\/5DgkJlSShzzJaflu1qTJkmExLUVKXjgtmueZ\/4MbQo\/CaWF3n6qrCG9hTd7Z8AgOc4mxyQsZjK+Gg\/eohpr5XZpC22H26498Msc0DWIriOyvECAjWOhaxv44DiEJ1jGZhNrUamCi+rySamXXH2xKYwlRh2P1IVrGYrojDOktQ33EV2E5O2A8q\/BLgXibG2Bw2ycKZXaDIhy+aWoNeAtf9bPH0hJyUB9zPUPglNIhfs3Zpl9uT6uk9X\/Nrp\/RSvoOWeu4CQya+mC1I4vBA7CSUcf+6qe+rvQzBVIrSEYEST70WFf\/YJUT5QTMNbgNMkgbwtCdjL6GY4AiDUWhegT3Q6\/F2IxfWgrAKiLXV6Ze+8f83UHWlwv3k5jFDJZN8Hy3VcoEp1ek+d6v+kv9AXkIzPvB5nYlSswn\/vojnldOXLJJkJJANfO0knxFbnVHj8xbP6jP31\/WLsYTrCxrN4z3uOgEfxbjshHzqEeUH+PGLEa5gAgqMwhDZQpwjMCFbqwt4c9n5+yYEGkzVWKauJAmSNC1GJDOiW6cSRDz36p7MGv9x124A2VpvmVDxxXvpGbsAhH4eMF8ni0nx9XU7M0pbKWxxXnJw\/tNYu6SYLaiyC09ne8jBudikeR+EvNV0EMZ9GaxPoRXnjUF9IWFTWB+62I6nOEAvdJg8wEQX","iv":"7117a172c0a8412d1ea835560b6b8c9d","s":"ab0e19eb38acdb4d"}